Aavas Financiers Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aavas Financiers Bundle

Aavas Financiers operates within a competitive landscape shaped by significant buyer bargaining power and the looming threat of substitutes in the housing finance sector. Understanding these dynamics is crucial for any stakeholder looking to navigate this market effectively.

The complete report reveals the real forces shaping Aavas Financiers’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Aavas Financiers benefits from a diverse funding base, lessening supplier power. This includes partnerships with public and private banks, alongside international entities like the Asian Development Bank (ADB) and the International Finance Corporation (IFC).

This broad access to capital, including significant commitments such as the ADB's USD 100 million facility announced in 2023, means Aavas is not overly reliant on any one source of funds, thereby strengthening its negotiating position with lenders.

The National Housing Bank (NHB) and the Reserve Bank of India (RBI) significantly shape the funding landscape for housing finance companies like Aavas Financiers. These regulators dictate the terms and availability of crucial funding sources, including refinance options.

Recent directives from the NHB, such as stricter refinancing conditions for under-construction properties, directly affect Aavas's ability to secure necessary capital. Furthermore, mandatory monthly Non-Performing Asset (NPA) data reporting for Housing Finance Companies (HFCs) adds an operational layer that can influence lender confidence and, consequently, funding costs.

Aavas Financiers' average borrowing cost nudged up from 7.5% in March 2024 to 7.7% by March 2025, reflecting broader market interest rate trends. This slight increase highlights the sensitivity of its funding costs to the overall economic climate and liquidity conditions. Ensuring access to funds at competitive rates remains a key factor for Aavas's continued expansion and profitability.

Technology and Service Providers

Aavas Financiers has significantly invested in technology, including a new loan management solution and a cloud ERP system, to boost efficiency and speed up processing times. These upgrades, completed in recent years, are crucial for their operations and digital transformation goals.

While these specialized technology and service providers are essential, their unique offerings can grant them a degree of bargaining power. However, Aavas's proactive approach to digital transformation aims to mitigate this by enhancing internal efficiencies and potentially reducing long-term reliance on specific vendors.

- Technology Investment: Aavas Financiers' commitment to technological advancement is evident in their implementation of a new loan management solution and cloud ERP system.

- Efficiency Gains: These technology upgrades are designed to improve operational efficiency and reduce loan processing turnaround times.

- Supplier Power: Reliance on specialized technology providers can give these suppliers leverage, although Aavas's digital strategy seeks to balance this.

- Digital Transformation Focus: The company's ongoing digital transformation efforts are key to optimizing operations and managing supplier relationships effectively.

Human Capital and Talent Acquisition

The bargaining power of suppliers, particularly concerning human capital, significantly impacts Aavas Financiers. The availability of experienced management and a skilled workforce is crucial, especially in the operationally demanding affordable housing sector. Aavas's ability to attract and retain talent adept at credit appraisal for informal income segments directly influences its operational costs and the quality of its loan portfolio.

In 2023, the Indian financial services sector experienced a notable increase in demand for skilled professionals, particularly in areas like credit risk assessment and digital lending. For instance, reports indicated a 15-20% rise in salary benchmarks for experienced credit analysts within the housing finance domain. This upward pressure on compensation for specialized skills strengthens the bargaining power of potential employees and recruitment agencies.

- Talent Scarcity: A shortage of professionals with proven experience in assessing creditworthiness for borrowers in the informal sector can drive up recruitment costs for Aavas.

- Competitive Landscape: Other financial institutions, especially those expanding into similar market segments, also compete for this specialized talent, further intensifying wage pressures.

- Training Investment: Aavas may need to invest heavily in training and development to upskill existing staff or attract new hires, impacting its overall operational expenditure.

- Retention Challenges: High demand for skilled personnel can lead to increased employee turnover, necessitating continuous efforts and resources for talent retention.

The bargaining power of suppliers for Aavas Financiers is moderate, primarily influenced by its diverse funding sources and strategic investments in technology. While Aavas benefits from strong relationships with institutional lenders like the ADB and IFC, which limits reliance on any single provider, the need for specialized technology and skilled human capital presents some supplier leverage.

| Supplier Type | Impact on Aavas | Mitigation Strategies |

|---|---|---|

| Funding Institutions (Banks, ADB, IFC) | Moderate; diverse base reduces reliance. | Maintaining strong relationships, exploring new funding avenues. |

| Technology Providers (Loan Management, ERP) | Moderate; essential for efficiency. | Investing in internal capabilities, exploring multi-vendor strategies. |

| Human Capital (Skilled Professionals) | Moderate to High; critical for credit assessment in informal sectors. | Competitive compensation, robust training programs, employee retention initiatives. |

What is included in the product

This analysis of Aavas Financiers dissects the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes within the housing finance sector.

Navigate the competitive landscape of housing finance with an easy-to-understand breakdown of Aavas Financiers' Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Aavas Financiers' customer base, largely concentrated in low and middle-income, semi-urban, and rural areas, presents a unique dynamic regarding customer bargaining power. A significant portion, around 60% of its Assets Under Management (AUM) as of March 2025, comprises self-employed borrowers who often have limited formal income documentation.

This characteristic can, in some ways, temper their direct bargaining power on interest rates. Their reliance on Aavas for credit, due to limited access to traditional banking channels, means they may have less leverage to negotiate lower rates compared to borrowers with well-documented income streams and a wider array of financing options.

Even though Aavas Financiers focuses on less-served areas, customers still have other options. Housing finance companies, small finance banks, and public sector banks are all increasing their presence in smaller cities, providing borrowers with choices.

The Indian housing finance sector is quite competitive, with many companies vying for customers. This competition means borrowers have a degree of bargaining power because they can compare offerings from different lenders.

Customers in the affordable housing segment, like those served by Aavas Financiers, are particularly sensitive to changes in interest rates. Even small increases can significantly impact their monthly payments, making affordability a primary concern. For instance, a 0.50% increase in home loan interest rates could add several hundred rupees to a monthly EMI for a typical loan amount in this segment.

Government initiatives like the Pradhan Mantri Awas Yojana (PMAY) are crucial drivers of demand in this market. PMAY, which offers subsidies and other benefits, directly enhances affordability and accessibility for lower-income groups. In 2024, PMAY continued to be a significant factor, supporting demand for housing loans and influencing the bargaining power of customers who can leverage these schemes.

Switching Costs and Loyalty

Once a housing loan is disbursed by Aavas Financiers, customers face substantial switching costs. These include various fees, the complexity of legal procedures, and the inherent long-term commitment of a mortgage. For instance, pre-payment penalties or administrative charges can deter customers from moving their loans, especially in the initial years. This effectively dampens their bargaining power post-disbursement, encouraging a degree of loyalty to their current lender.

The high switching costs contribute to customer stickiness, meaning borrowers are less likely to seek out alternative lenders. This is particularly true for customers who have already navigated the initial disbursement process and are settled into their repayment schedule. Aavas Financiers benefits from this reduced price sensitivity, as it allows them to maintain more stable customer relationships.

- High Switching Costs: Fees for loan transfer, legal documentation, and administrative processes make changing lenders burdensome.

- Long-Term Commitment: The multi-year nature of housing loans reinforces customer inertia.

- Reduced Bargaining Power: Post-disbursement, customers have less leverage to negotiate better terms due to these barriers.

- Fostered Loyalty: The inconvenience of switching encourages customers to remain with their existing provider, Aavas Financiers.

Digitalization and Customer Empowerment

Increased digitalization in the lending process, including online applications and customer apps, empowers customers by providing easier access to information and more transparent comparisons of loan products. Aavas Financiers’ commitment to digital transformation, as seen in their FY24 results, aims to enhance customer experience and expand their reach.

Aavas Financiers' digital initiatives are designed to streamline operations and improve customer engagement, directly impacting the bargaining power of customers. As of March 2024, the company has been actively investing in technology to facilitate smoother loan application processes and provide better self-service options for its clientele.

- Digital Lending Platforms: Aavas Financiers is enhancing its digital platforms, allowing customers to access loan information and apply online more easily.

- Customer Apps: The development and improvement of customer-facing applications provide greater convenience and transparency in managing loan accounts and exploring new products.

- Information Accessibility: Digitalization grants customers better access to product details, interest rates, and comparison tools, thereby increasing their ability to negotiate or switch providers.

- Enhanced Reach: Aavas's digital strategy aims to reach a wider customer base, which can also lead to increased competition and customer choice, amplifying their bargaining power.

While Aavas Financiers serves a segment with potentially less formal documentation, their customers do possess bargaining power, particularly due to increasing competition and government support. The sensitivity to interest rates in the affordable housing segment means even minor rate changes can influence customer decisions, pushing them to explore alternatives if available. However, significant switching costs and the long-term nature of home loans generally dampen this power once a loan is secured.

| Factor | Impact on Customer Bargaining Power | Aavas Financiers Context (as of FY24/FY25) |

|---|---|---|

| Competition | Increases bargaining power as customers have more options. | Growing presence of other housing finance companies, small finance banks, and PSBs in semi-urban/rural areas. |

| Interest Rate Sensitivity | High sensitivity empowers customers to seek lower rates. | Customers in the affordable segment are highly sensitive to EMI increases. |

| Switching Costs | Reduces bargaining power due to fees and complexity. | Significant costs associated with loan transfer, legal processes, and administrative charges. |

| Government Schemes (PMAY) | Enhances affordability and potentially bargaining power. | PMAY subsidies and benefits continue to support demand and customer affordability in 2024. |

What You See Is What You Get

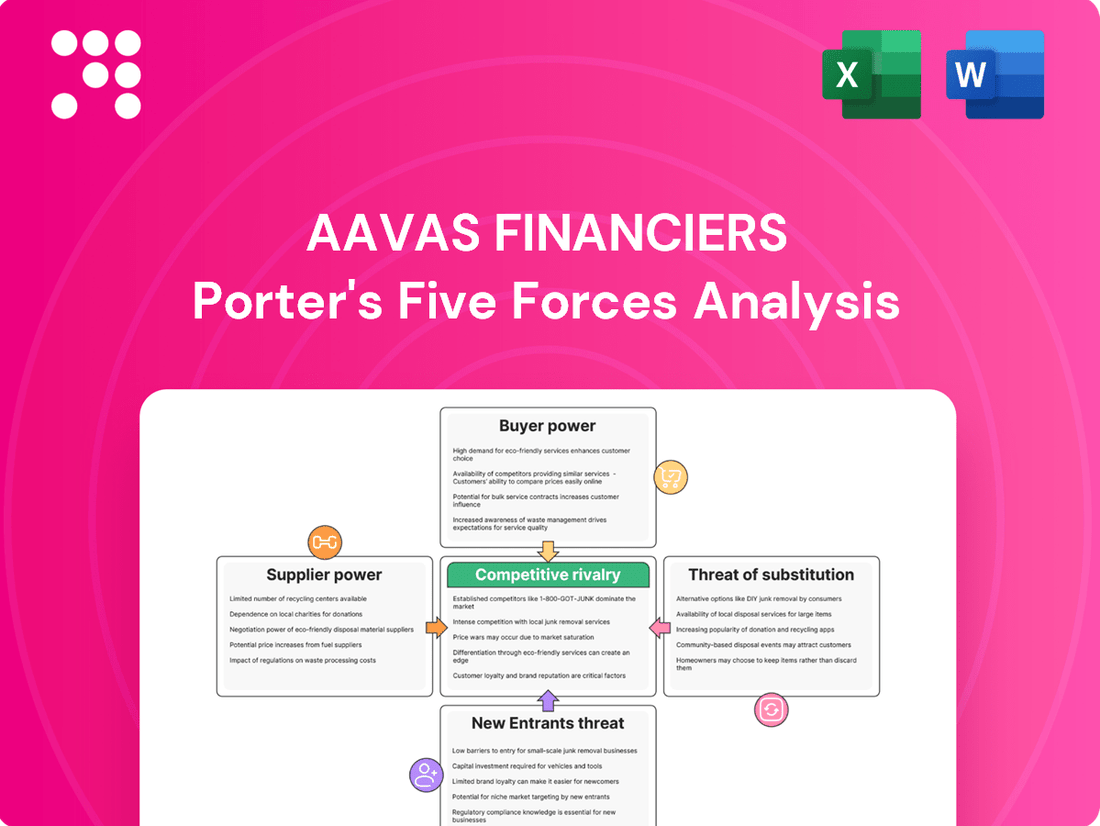

Aavas Financiers Porter's Five Forces Analysis

This preview showcases the comprehensive Aavas Financiers Porter's Five Forces Analysis, offering critical insights into the competitive landscape of the housing finance sector. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning. This detailed report covers the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products, providing a robust framework for understanding Aavas Financiers' market position.

Rivalry Among Competitors

The Indian housing finance landscape is indeed a bustling arena, featuring a wide array of participants. Banks, Housing Finance Companies (HFCs) like Aavas Financiers, Non-Banking Financial Companies (NBFCs), and increasingly, nimble fintech startups are all actively competing for a slice of this growing market. This diversity in players intensifies the rivalry, pushing each entity to innovate and differentiate.

While banks hold a significant portion of the overall housing finance market, HFCs have carved out a resilient position by strategically targeting specific, often underserved, customer segments. Aavas Financiers, for instance, has built its strength by focusing on the affordable housing segment, particularly in Tier II and Tier III cities, where its specialized approach allows it to maintain a stable market share despite the broader competition.

Aavas Financiers strategically targets the underserved affordable housing segment, focusing on low and middle-income, self-employed individuals in semi-urban and rural locales. This niche approach shields them from intense competition in prime housing markets dominated by larger banks.

While this focus reduces direct rivalry with major banks, other Housing Finance Companies (HFCs) and even some banks are increasingly recognizing the potential in this segment. For instance, in FY 2024, Aavas reported a net profit of ₹5.15 billion, indicating strong performance in its chosen market, which naturally attracts other players.

Aavas Financiers stands out in a competitive landscape through a distinct operational model. They focus on smaller loan amounts, typically serving individuals in smaller towns (tier 3 to tier 5) who are building their own homes. This niche focus, combined with robust credit assessment tailored for informal income earners, sets them apart from larger institutions.

Their commitment to these underserved markets is evident in their business strategy, which is inherently operationally intensive. For instance, in the fiscal year ending March 31, 2024, Aavas reported a loan portfolio of INR 22,086 crore, with a significant portion directed towards these specific customer segments.

Geographical Concentration and Expansion

Aavas Financiers' competitive rivalry is influenced by its geographical footprint. While the company is making strides to expand, its operations are still heavily weighted in specific regions.

As of March 2025, a significant portion of Aavas's Assets Under Management (AUM) was concentrated in Rajasthan, Maharashtra, and Gujarat, collectively representing around 65%. This geographical concentration can intensify rivalry within these core markets, as competitors may also have a strong presence there.

However, Aavas is actively working to mitigate this risk and foster growth through expansion. The company has outlined plans to increase disbursements in new states, including Karnataka, Odisha, and Uttar Pradesh. This strategic move signals an effort to broaden its market reach and diversify its geographical exposure, thereby engaging with a wider competitive landscape.

- Geographical Concentration: Approximately 65% of Aavas's AUM was concentrated in Rajasthan, Maharashtra, and Gujarat as of March 2025.

- Expansion Plans: Aavas aims to grow disbursements in new states like Karnataka, Odisha, and Uttar Pradesh.

- Competitive Impact: This concentration can heighten rivalry in existing strongholds, while expansion efforts introduce new competitive dynamics.

Asset Quality and Profitability Pressures

Competitive rivalry, especially from banks and other Housing Finance Companies (HFCs), can put pressure on Aavas Financiers' profitability. Rising borrowing costs directly impact Net Interest Margins (NIMs), potentially squeezing profitability. For instance, in FY24, Aavas reported a Net Interest Margin of 4.10%, which, while strong, remains susceptible to these cost pressures.

The inherent nature of Aavas's target borrower profile, often characterized by lower income levels and potentially less stable employment, requires exceptionally stringent risk management. This focus on asset quality is crucial to avoid higher non-performing assets (NPAs) when facing intense competition. Aavas's Gross NPA stood at a healthy 0.77% as of March 31, 2024, demonstrating effective control, but maintaining this amidst competitive pressures remains a key challenge.

- NIM Sensitivity: Aavas's NIM of 4.10% in FY24 is a key indicator of profitability, but it's vulnerable to fluctuations in borrowing costs driven by competition.

- Risk Management Imperative: The company's focus on managing credit costs and maintaining asset quality is paramount given its target borrower segment.

- Asset Quality Benchmark: A Gross NPA of 0.77% as of March 31, 2024, highlights Aavas's current success in asset quality, a metric to watch closely against competitive threats.

Competitive rivalry is a significant factor for Aavas Financiers, particularly from banks and other Housing Finance Companies (HFCs). This competition can impact profitability by putting pressure on Net Interest Margins (NIMs), as seen with Aavas's NIM of 4.10% in FY24, which is susceptible to borrowing cost fluctuations. Maintaining asset quality is also crucial, especially given Aavas's focus on the affordable housing segment, where a Gross NPA of 0.77% as of March 31, 2024, demonstrates current success but requires continuous vigilance against competitive pressures.

| Metric | FY24 Value | Significance |

|---|---|---|

| Net Interest Margin (NIM) | 4.10% | Key profitability indicator, susceptible to competition-driven borrowing costs. |

| Gross NPA | 0.77% (as of March 31, 2024) | Indicates asset quality; crucial for managing risk in the target segment amidst competition. |

SSubstitutes Threaten

Informal lending channels, such as local moneylenders or personal loans from family and friends, present a viable substitute for Aavas Financiers. These alternatives are particularly attractive to Aavas's core customer base in semi-urban and rural areas, especially for smaller loan amounts or when formal documentation for credit is a hurdle. For instance, in 2024, a significant portion of the Indian population, particularly in these regions, still relies on informal credit sources for immediate financial needs, often due to quicker accessibility and less stringent documentation requirements compared to formal institutions.

The threat of substitutes for Aavas Financiers is present in the self-financing of housing needs, especially in rural and semi-urban areas. Many individuals can tap into personal savings, agricultural income, or other non-loan sources to fund their home construction or renovation projects. This reduces their reliance on formal housing finance institutions like Aavas Financiers.

While many in India aspire to own a home, renting continues to be a significant alternative, particularly in bustling urban centers where property costs can be a major barrier. Aavas Financiers strategically targets this segment by offering affordable housing solutions, aiming to facilitate the transition from renting to owning for its customer base.

In 2023, rental yields in major Indian cities like Mumbai and Delhi hovered around 2-3%, making outright purchase less attractive for some compared to the flexibility renting offers. However, Aavas's business model directly addresses this by making homeownership accessible, thereby mitigating the threat of substitutes by converting potential renters into customers.

Government Housing Schemes and Direct Subsidies

Government housing schemes, such as the Pradhan Mantri Awas Yojana (PMAY), offer direct subsidies and financial assistance to eligible beneficiaries. This can significantly reduce the out-of-pocket expenses for homebuyers, potentially lessening their reliance on formal housing finance. For instance, PMAY-Urban aimed to provide housing for all by 2022, with significant central assistance.

These subsidies can act as a partial substitute for the loans provided by housing finance companies like Aavas Financiers. By lowering the overall cost of homeownership, these government programs can attract customers who might otherwise seek traditional financing. The effectiveness of these schemes in 2024 and beyond will continue to influence the demand for retail housing loans.

- Direct subsidies reduce the need for external financing.

- PMAY is a key example of government intervention.

- Lowering upfront costs makes homeownership more accessible.

- Government initiatives can divert potential customers.

Microfinance for Housing-Related Needs

The threat of substitutes for Aavas Financiers' housing loans, particularly for lower-income segments, can emerge from microfinance institutions. These entities sometimes provide smaller credit facilities for home improvements or land acquisition. While not a direct replacement for a comprehensive home loan, these micro-loans can serve as an alternative for very low-income households seeking incremental housing solutions. For instance, in India, microfinance institutions have been expanding their reach, with the sector's total loan portfolio growing significantly, indicating a potential overlap in customer base for basic housing needs.

These smaller, often more accessible loans from microfinance providers can cater to immediate, smaller-scale housing needs, presenting a substitute for a portion of Aavas Financiers' market.

- Microfinance institutions offer loans for home improvements and land purchase, acting as partial substitutes for full housing loans.

- These alternatives are particularly relevant for very low-income households with modest housing finance requirements.

- The expanding microfinance sector in India, with a substantial loan portfolio, signifies a growing presence in addressing basic housing finance needs.

The threat of substitutes for Aavas Financiers is multifaceted, encompassing informal lending, self-financing, renting, government schemes, and microfinance. Informal channels offer quick access, while self-financing leverages personal savings. Renting provides flexibility, and government subsidies like PMAY can reduce the need for external financing. Microfinance institutions cater to smaller housing needs for low-income groups.

In 2023, India's microfinance sector saw substantial growth, with its total loan portfolio reaching approximately ₹3.4 lakh crore, indicating a significant presence in addressing basic financial needs, including those related to housing. This growth highlights the increasing accessibility of alternative funding for housing solutions, especially for lower-income segments.

| Substitute Type | Key Characteristics | Impact on Aavas Financiers | 2024 Relevance/Data Point |

|---|---|---|---|

| Informal Lending | Quick access, less documentation | Attracts customers seeking immediate, smaller loans | Significant reliance in rural/semi-urban areas for immediate needs. |

| Self-Financing | Utilizes personal savings, agricultural income | Reduces reliance on formal housing loans | Common for home construction/renovation projects. |

| Renting | Flexibility, lower upfront cost | Competes with homeownership aspirations | Rental yields in major cities around 2-3% in 2023. |

| Government Schemes (e.g., PMAY) | Subsidies, financial assistance | Lowers out-of-pocket expenses, reduces loan need | PMAY-Urban aimed for housing for all by 2022. |

| Microfinance Institutions | Smaller credit facilities, home improvements | Partial substitute for low-income households | Microfinance loan portfolio ~₹3.4 lakh crore in 2023. |

Entrants Threaten

The housing finance sector faces substantial barriers due to stringent regulations and capital mandates. Entities like Aavas Financiers must comply with directives from the National Housing Bank (NHB) and the Reserve Bank of India (RBI), which include rigorous licensing procedures and demanding capital adequacy ratios.

These regulations, such as the requirement for Housing Finance Companies (HFCs) to maintain minimum investment-grade credit ratings and adhere to prudential norms, significantly escalate the cost and complexity for potential new entrants. This regulatory environment effectively limits the number of new players that can realistically enter the market.

New entrants would need substantial and varied funding sources to effectively challenge established entities like Aavas Financiers. Aavas benefits from deep-rooted relationships with a diverse range of banks and international financial institutions, providing it with significant financial flexibility.

Developing a comparable liability franchise requires considerable time and the cultivation of trust within the financial ecosystem. For instance, in 2023, Aavas Financiers reported a healthy Capital Adequacy Ratio of 21.7%, demonstrating its strong financial foundation and ability to access capital, a benchmark new entrants would struggle to match quickly.

Aavas Financiers boasts a substantial distribution network with 397 branches, strategically positioned to serve semi-urban and rural populations across 13 states. This extensive physical and digital reach is a formidable barrier to entry for new players aiming to tap into the underserved low and middle-income housing finance market.

Expertise in Underwriting Informal Income Segments

Aavas Financiers has cultivated significant expertise in underwriting loans for individuals with informal income documentation. This specialized capability requires an operationally intensive credit appraisal process, a hurdle that new entrants would find difficult to replicate quickly. Building the necessary systems and deep understanding of these nuanced segments takes time and considerable investment.

The threat of new entrants is therefore moderated by the steep learning curve and the operational complexity involved. For instance, Aavas's focus on the affordable housing segment, where informal income is prevalent, means they have developed proprietary methods for assessing creditworthiness. This specialized knowledge acts as a significant barrier.

- Specialized Underwriting: Aavas excels at assessing credit risk for borrowers without formal payslips or audited financial statements, a niche requiring unique skills.

- Operational Intensity: The credit appraisal process for informal income segments is inherently more labor-intensive and requires specialized training for staff.

- Risk Management Systems: Developing robust risk management frameworks tailored to informal income borrowers is a significant challenge for potential competitors.

- Market Entry Barrier: Replicating Aavas's established expertise and operational infrastructure presents a substantial barrier to entry for new players in this specific market segment.

Brand Reputation and Customer Trust

Established players like Aavas Financiers have cultivated significant brand reputation and customer trust over their operational history. This deep-seated credibility acts as a formidable barrier, as new entrants would face substantial challenges in replicating the established relationships and confidence Aavas enjoys. For instance, in the affordable housing finance sector, where Aavas operates, trust is paramount, often built through years of consistent service and local engagement.

Newcomers would need to undertake extensive and costly marketing campaigns to build brand recognition and establish a reliable image. This is particularly true in segments like affordable housing finance, where customers often rely on personal recommendations and a proven track record. Aavas Financiers, as of March 31, 2024, reported a robust Assets Under Management (AUM) of ₹54,808 crore, reflecting its established market presence and customer base.

The threat of new entrants is therefore moderated by the significant investment required to overcome the established brand loyalty and trust. Aavas's strong customer retention, a direct result of its reputation, means that new companies must offer demonstrably superior value propositions or niche solutions to attract customers away.

- Brand Reputation: Aavas has built strong brand recognition in the affordable housing finance segment.

- Customer Trust: Years of operation have fostered significant trust among its target demographic.

- Investment Barrier: New entrants require substantial investment to build similar credibility.

- Local Understanding: Success in this sector often hinges on personal relationships and local market knowledge, which new players lack initially.

The threat of new entrants for Aavas Financiers is significantly mitigated by high regulatory hurdles and substantial capital requirements. Strict licensing and capital adequacy norms, enforced by bodies like the NHB and RBI, make market entry costly and complex. For instance, maintaining a minimum investment-grade credit rating is a prerequisite that deters many potential new players.

Furthermore, Aavas's established distribution network, comprising 397 branches as of March 31, 2024, and its specialized expertise in underwriting loans for individuals with informal income documentation, create significant operational and knowledge-based barriers. Replicating Aavas's deep understanding of niche markets and its robust risk management systems for these segments requires considerable time and investment, effectively limiting new competition.

| Factor | Impact on New Entrants | Aavas Financiers' Advantage |

|---|---|---|

| Regulatory Compliance | High barrier due to licensing and capital adequacy ratios | Established compliance framework |

| Capital Requirements | Significant funding needed to match Aavas's financial strength | Strong access to diverse funding sources; CAR of 21.7% (FY23) |

| Distribution Network | Challenging to build a comparable reach, especially in semi-urban/rural areas | 397 branches across 13 states |

| Specialized Expertise | Difficult to replicate underwriting skills for informal income borrowers | Proprietary methods for credit assessment |

| Brand Reputation & Trust | Requires extensive marketing to build credibility | Deep-rooted trust in the affordable housing segment; AUM of ₹54,808 crore (Mar 2024) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aavas Financiers is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We supplement this with insights from industry-specific research reports and news articles to capture current market dynamics and competitive pressures.