Aavas Financiers Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aavas Financiers Bundle

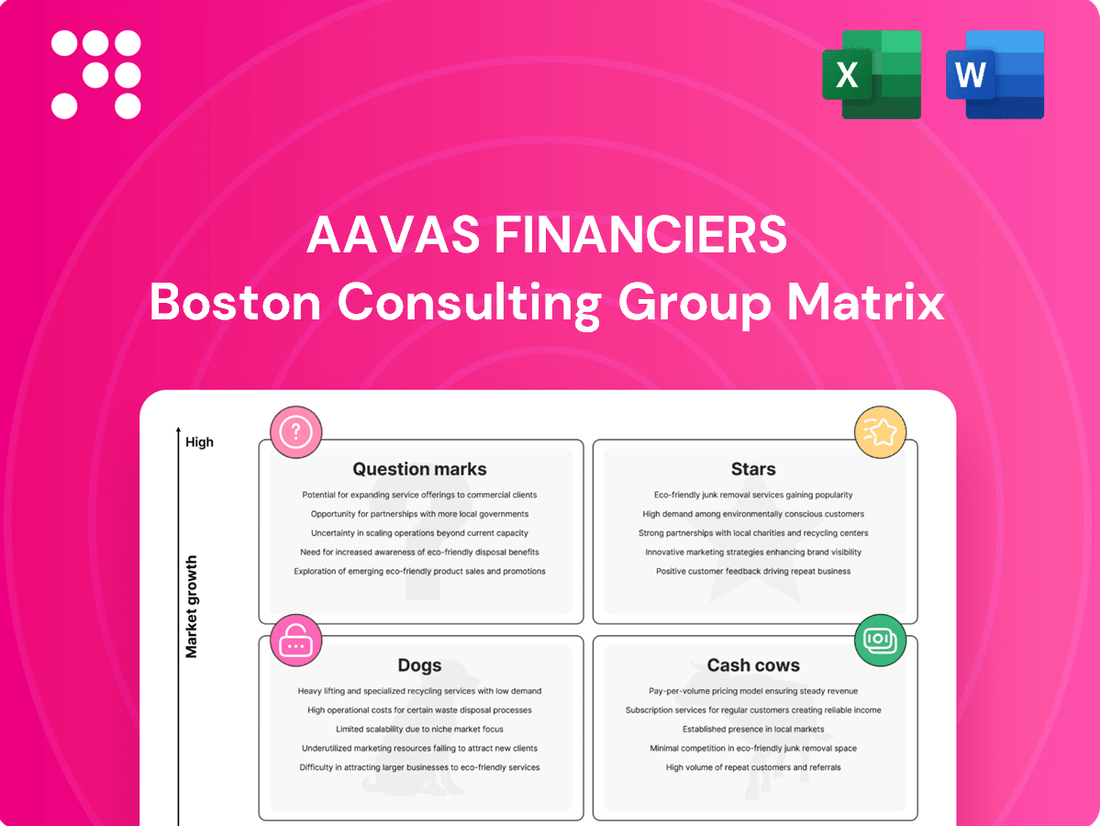

Unlock the strategic potential of Aavas Financiers by understanding its position within the BCG Matrix. This preview offers a glimpse into how their offerings are categorized as Stars, Cash Cows, Dogs, or Question Marks, guiding your initial assessment.

To truly grasp the nuances of Aavas Financiers' product portfolio and market standing, dive into the full BCG Matrix report. Gain actionable insights and a clear roadmap for optimizing investments and product development.

Don't miss out on the complete breakdown; purchase the full BCG Matrix today for a comprehensive analysis that empowers smarter, data-driven decisions for Aavas Financiers' future growth.

Stars

Aavas Financiers is strategically expanding its reach in rural and semi-urban areas, a segment experiencing robust growth in affordable housing. Their Assets Under Management (AUM) hit ₹204.2 billion in FY25, showcasing a significant presence in this expanding market. This penetration is bolstered by an increasing branch network, which stood at 397 branches across 14 states by Q1 FY25.

Aavas Financiers demonstrated robust Assets Under Management (AUM) growth, expanding by 18% year-over-year in FY25 to surpass ₹200 billion. This consistent upward trajectory across recent quarters highlights the company's strong performance in the affordable housing segment.

This sustained high growth rate, coupled with healthy disbursement figures, firmly positions Aavas Financiers as a leader in a market driven by strong demographic demand and supportive government policies. Their core business of offering long-term housing loans to low and middle-income groups is clearly a significant 'Star' in their portfolio.

Aavas Financiers' specialized credit assessment model is a key driver of its success, particularly in serving customers in semi-urban and rural areas who often lack formal income documentation. This innovative appraisal methodology allows them to tap into an underserved market, effectively building a competitive advantage and capturing significant market share in a high-growth niche. Their demonstrated ability to manage credit risk within this segment, reflected in robust asset quality, solidifies this as a 'Star' capability.

Strategic Branch Network Expansion

Aavas Financiers is strategically expanding its branch network, a key component of its growth strategy. As of March 2025, the company operates 397 branches, demonstrating a commitment to physical accessibility. This expansion is particularly vital for serving its target demographic in semi-urban and rural areas, where a strong branch presence facilitates deeper market penetration and allows Aavas to capitalize on the increasing demand for affordable housing finance.

The company's approach to network expansion is not random; it involves entering contiguous geographies. This calculated move aims to consolidate market share in regions identified as having high growth potential. By increasing its physical footprint in these areas, Aavas can better serve local communities and build stronger relationships, which is essential for sustained growth in the affordable housing segment.

- Branch Network Growth: Reached 397 branches by March 2025, indicating a significant physical presence.

- Target Demographic Focus: Expansion is geared towards semi-urban and rural areas to reach underserved populations.

- Market Penetration Strategy: Deepening reach in core markets to capture growing demand for affordable housing.

- Geographic Expansion: Entering contiguous regions to build market share and operational efficiency.

Digital Adoption and Operational Efficiency

Aavas Financiers is actively embracing digital transformation to boost its operational efficiency. This includes implementing a new loan management solution (LMS), cloud-based ERP systems, and leveraging GenAI for customer interactions, all geared towards achieving near paperless operations and enhancing customer service.

These technological advancements are designed to streamline processes, leading to reduced operating expenses and a better customer journey. This focus on efficiency is crucial for Aavas Financiers as it scales its business in a rapidly expanding market, ensuring profitability is maintained alongside growth.

The company's commitment to digital adoption is reflected in its financial performance. For instance, in the fiscal year 2023-24, Aavas Financiers reported a healthy Opex to Assets ratio, indicating efficient management of its growing asset base. Furthermore, strong Return on Assets (ROA) and Return on Equity (ROE) figures underscore the effectiveness of these operational improvements in driving profitability.

- Digital Investments: New LMS, cloud ERP, and GenAI bots are key components of Aavas Financiers' technology strategy.

- Efficiency Gains: These initiatives aim for near paperless processes, cost reduction, and improved customer service.

- Financial Impact: Strong Opex to Assets ratio and robust ROA/ROE in FY24 demonstrate the success of these digital efforts.

Aavas Financiers' core business of providing housing loans to low and middle-income groups in rural and semi-urban areas is a clear 'Star' in its BCG Matrix. This segment benefits from strong demographic tailwinds and government support, leading to high market growth. The company's extensive branch network, reaching 397 locations by March 2025, and its specialized credit assessment model further solidify its leading position in this high-growth, high-market-share category.

| Business Segment | Market Growth | Relative Market Share | BCG Category |

|---|---|---|---|

| Affordable Housing Loans (Rural/Semi-Urban) | High | High | Star |

What is included in the product

Aavas Financiers' BCG Matrix analysis categorizes its business units, guiding strategic decisions for growth and resource allocation.

Aavas Financiers BCG Matrix analysis provides clarity on strategic resource allocation, relieving the pain of uncertain investment decisions.

Cash Cows

Aavas Financiers' established home loan portfolio, primarily serving low and middle-income customers in semi-urban and rural regions, represents a significant portion of its Assets Under Management (AUM). This segment is a classic cash cow.

These seasoned loans, having navigated their initial risk phases, now provide a steady stream of interest income and predictable cash flow. The need for substantial new investment to acquire customers or expand market share in this established segment is minimal, allowing for robust profitability.

For the fiscal year ending March 31, 2024, Aavas Financiers reported a Net Interest Income of ₹1,653.3 crore, a testament to the consistent earnings generated by such portfolios.

Aavas Financiers demonstrates exceptional asset quality, a hallmark of its Cash Cows. For instance, its 1+ Days Past Due (DPD) consistently stayed below 4% in recent periods, showcasing robust credit risk management.

The company's Gross Stage 3 and Net Stage 3 Non-Performing Assets (NPAs) remained impressively low, with figures like 1.08% and 0.73% respectively reported in Q4 FY25. This signifies a well-seasoned portfolio that demands minimal provisioning.

This strong asset quality directly translates into high profit margins and a reliable stream of cash generation. Coupled with significantly low credit costs, this segment contributes substantially to Aavas Financiers' overall profitability and stability.

Aavas Financiers boasts a diversified borrowing mix, a key strength supporting its Cash Cow status. Significant funding comes from term loans, assignments, and NHB refinancing, alongside development finance institutions such as IFC, CDC, and ADB.

This broad liability franchise translates into a stable and predictable cost of funds. For instance, in the fiscal year ending March 31, 2024, Aavas Financiers reported a Net Interest Margin (NIM) of 4.43%, showcasing the benefit of its well-managed funding costs.

The consistent and manageable cost of borrowing directly fuels healthy spreads and robust net interest margins. This reliable funding structure underpins the strong and consistent cash flow generated from its core housing finance operations.

MSME Business Loans and Loan Against Property (LAP)

Aavas Financiers' MSME business loans and Loans Against Property (LAP) are key components of their diversified lending strategy. These products are particularly significant as they represent a substantial part of their non-housing loan book, demonstrating Aavas's reach beyond traditional home financing.

As of December 2024, MSME business loans and LAP accounted for approximately 31.4% of Aavas Financiers' Assets Under Management (AUM). This indicates a strong market presence and customer trust in these offerings.

- Diversified Portfolio: MSME and LAP products showcase Aavas's ability to cater to a broader customer base, including small businesses and property owners needing liquidity.

- Higher Yields: These loans typically offer higher interest rates compared to standard housing loans, contributing to improved profitability.

- Steady Income: Targeting established businesses and individuals with collateral ensures a more predictable and stable income stream for the company.

- Strategic Growth: The focus on these segments suggests a strategic approach to growth, potentially requiring less capital investment for expansion compared to developing new housing markets.

Operational Leverage from Mature Branches

Aavas Financiers boasts a robust network of mature branches, with many having operated for several years across 14 states. This extensive presence allows for significant operational leverage. As the loan book grows within these established branches, fixed costs like rent and administrative salaries are spread more thinly, leading to improved operational efficiency.

This leverage directly translates to a better Opex to Asset ratio. For instance, in FY24, Aavas Financiers reported a Gross Loan Portfolio of INR 21,892 crore. The operational efficiency gained from mature branches means that a larger portion of revenue generated from this portfolio contributes to profitability after covering the relatively stable fixed operating costs.

These mature branches are effectively cash cows for Aavas. They generate substantial cash flow with reduced incremental operational expenditure.

- Mature Branch Network: Aavas operates a substantial network of mature branches across 14 states, many with years of operational history.

- Operational Leverage: Established branches benefit from operational leverage, spreading fixed costs over a growing loan book.

- Efficiency Gains: This leverage improves operational efficiency and leads to a better Opex to Asset ratio.

- Cash Flow Generation: Mature branches generate significant cash flow with lower incremental operational costs, acting as cash cows.

The established housing loan portfolio, particularly in semi-urban and rural areas, forms Aavas Financiers' core cash cow. These seasoned loans generate consistent interest income with minimal need for new investment, contributing significantly to profitability. For FY24, Net Interest Income stood at ₹1,653.3 crore, reflecting the stable earnings from this segment.

The company's strong asset quality, with 1+ DPD below 4% and low NPAs (Gross Stage 3 at 1.08% in Q4 FY25), ensures high profit margins and reliable cash generation, further solidifying its cash cow status.

Aavas Financiers' diversified borrowing, including term loans and refinancing from institutions like NHB, provides a stable and predictable cost of funds. This is evident in the Net Interest Margin (NIM) of 4.43% reported for FY24, directly supporting robust cash flow from its core operations.

The MSME and Loans Against Property (LAP) segments, representing 31.4% of AUM as of December 2024, also act as cash cows due to higher yields and steady income streams. Furthermore, a mature branch network across 14 states offers operational leverage, reducing the Opex to Asset ratio and boosting cash flow generation.

| Metric | FY24 Data | Significance for Cash Cow Status |

| Net Interest Income (₹ crore) | 1,653.3 | Demonstrates consistent earnings from core assets. |

| 1+ Days Past Due (DPD) | < 4% | Indicates strong credit quality and low risk in seasoned loans. |

| Net Stage 3 NPAs | 0.73% (Q4 FY25) | Low NPAs mean minimal provisioning, enhancing profitability. |

| Net Interest Margin (NIM) | 4.43% | Reflects healthy spreads due to stable funding costs. |

| MSME & LAP AUM Share | 31.4% (Dec 2024) | Higher yields and predictable income from these segments. |

What You’re Viewing Is Included

Aavas Financiers BCG Matrix

The Aavas Financiers BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally crafted strategic tool ready for your immediate use in business planning and analysis.

Dogs

While Aavas Financiers demonstrates robust overall growth, certain micro-markets or recently established branches might experience a slower start in gaining market share and reaching profitability. These specific areas could become "cash cows" in reverse, where invested capital generates low returns and limited customer acquisition.

For example, in the fiscal year ending March 2024, Aavas Financiers reported a net profit of ₹5,071 million. However, a deep dive into regional performance could reveal specific branches or micro-markets that did not contribute proportionally to this overall success, potentially indicating underperformance.

Proactive management is essential to either implement targeted strategies to boost performance in these lagging areas or to make timely decisions about divesting from them to prevent inefficient allocation of financial resources and maintain optimal portfolio health.

Legacy loan products with declining demand at Aavas Financiers, such as certain older housing finance schemes or specialized loan types that haven't adapted to current market needs, could be classified as Dogs in their BCG Matrix. For instance, if a particular loan product offered in 2023 saw a 15% year-over-year drop in new origination volume and its contribution to the overall loan book fell to below 2% by early 2024, it would likely fit this category. These products often represent a drain on resources, tying up capital and management attention without yielding significant returns or growth potential.

Even with Aavas Financiers' drive towards digital transformation, certain operational areas might still rely on manual, paper-heavy processes. These are considered 'Dogs' in the BCG matrix because they drain resources and significantly slow down business, leading to reduced productivity and increased costs. For instance, if loan origination or customer onboarding still involves substantial manual data entry and physical document handling, it directly impacts efficiency.

Non-Strategic or Underutilized Assets

Non-strategic or underutilized assets within Aavas Financiers, such as older office spaces or legacy IT systems not contributing to core business, fall into the 'Dogs' category of the BCG Matrix.

These assets often represent a drain on resources, incurring maintenance and depreciation costs without generating sufficient returns or supporting strategic objectives. For instance, if Aavas had an underperforming branch office that was no longer strategically located or generating significant business, it would be considered a Dog.

Aavas Financiers should actively assess these assets for potential divestment, sale, or repurposing to optimize capital allocation and improve overall financial efficiency. By shedding these underperforming assets, the company can unlock capital for more promising ventures.

- Underutilized Assets: Older office spaces or legacy IT systems not contributing to core business.

- Financial Impact: Incur maintenance costs and depreciation without adequate revenue generation.

- Strategic Recommendation: Evaluate for divestment or repurposing to free up capital.

Segments with High Default Rates or Collection Challenges

While Aavas Financiers generally boasts strong asset quality, certain borrower segments or geographic clusters might present higher default rates or collection difficulties. Even if these represent a small portion of the overall portfolio, they can demand significant resources for monitoring and recovery, impacting profitability. For instance, in its fiscal year 2023-24, Aavas reported a Gross Non-Performing Asset (GNPA) ratio of 0.87%, indicating overall good performance. However, a deeper dive into specific micro-markets or borrower profiles could reveal pockets of stress.

- Identifying High-Risk Segments: Aavas must rigorously analyze its loan book to pinpoint any specific borrower groups or geographic areas that consistently show elevated default rates, even if they are a minority.

- Resource Allocation: These identified segments may require disproportionately higher resources for credit monitoring and recovery efforts, potentially impacting the overall profitability of lending operations.

- Strategic Re-evaluation: If the risk-reward profile for these challenging segments is unfavorable, Aavas should consider de-emphasizing lending in these areas or to these specific groups to optimize its portfolio.

- Data-Driven Decisions: Continuous data analysis, focusing on delinquency trends and recovery success rates across different borrower demographics and locations, is crucial for informed strategic adjustments.

Certain legacy loan products at Aavas Financiers, those with declining demand or that haven't kept pace with market needs, could be categorized as Dogs. For instance, if a specific housing finance scheme introduced in 2022 saw its new origination volume drop by over 10% year-on-year by early 2024, it might be considered a Dog. These products often tie up capital and management attention without generating substantial returns.

Operational inefficiencies, such as those relying heavily on manual processes for loan origination or customer onboarding, also fall into the 'Dog' category. If Aavas Financiers still processes a significant portion of its new applications through extensive manual data entry and physical document handling, it directly impacts productivity and increases costs.

Underutilized assets, like older office spaces or legacy IT systems not aligned with current business strategies, are also 'Dogs'. These assets incur ongoing maintenance and depreciation costs without contributing meaningfully to revenue or strategic goals, potentially representing a drain on financial resources.

Question Marks

Aavas Financiers is strategically broadening its reach by opening new branches in adjacent states and intensifying its presence within existing ones. This expansion targets markets identified as having substantial growth prospects but currently holding a minimal market share.

These new geographic areas are considered question marks in the BCG matrix, signifying their high potential but uncertain future success. For instance, Aavas's expansion into Uttar Pradesh, a state with a large unbanked population, exemplifies this strategy.

Converting these question marks into stars will necessitate considerable investment. This includes establishing a robust branch network, cultivating strong customer relationships, and developing financial products specifically suited to the local demographics and economic conditions.

Aavas Rooftop Solar Finance represents a strategic foray into the burgeoning renewable energy sector, aligning with India's ambitious sustainability targets. This initiative is categorized as a Question Mark within the BCG Matrix due to its nascent stage and the significant investment required to capture market share in a rapidly evolving segment.

The company's commitment to financing rooftop solar systems targets a high-growth area, but it necessitates substantial upfront investment in marketing, operational infrastructure, and risk assessment capabilities. As of early 2024, India's rooftop solar capacity was rapidly expanding, with the government aiming for substantial additions, creating a favorable backdrop for such financing products.

Aavas Financiers is actively investing in its digital ecosystem, focusing on customer app adoption and GenAI bot integration to streamline service. These efforts aim to boost customer experience and operational efficiency, reflecting a high-growth potential for digital channels.

While the potential is significant, the current market share for digital loan origination and overall customer engagement through these platforms may still be relatively low. This positions these digital initiatives as question marks within the BCG matrix, requiring further development and market penetration.

For instance, a 2024 report indicated that while fintech adoption is rising, traditional players like Aavas are still building their digital footprint; achieving substantial digital loan origination volumes is key to moving these initiatives towards 'Star' status.

Significant investment in technology infrastructure and robust user adoption strategies are therefore critical. Success hinges on Aavas's ability to drive meaningful engagement and transaction volumes through its digital channels, transforming them into key growth drivers.

Partnerships for New Customer Segments

Aavas Financiers could forge strategic alliances with fintech firms or other lenders to access previously untapped customer bases or enhance distribution. These collaborations present significant growth opportunities by broadening Aavas's market presence, though its initial market share within these new segments might be modest. For instance, as of Q4 FY24, Aavas reported a Assets Under Management (AUM) of INR 20,820 crore, indicating a solid foundation for expanding its reach through partnerships.

The effectiveness of such ventures hinges on seamless integration and positive market reception. Aavas’s focus on affordable housing, a segment with substantial unmet demand, makes partnerships particularly attractive for reaching underserved populations. In 2024, the demand for housing finance in Tier 2 and Tier 3 cities continued to rise, presenting a fertile ground for partner-driven expansion.

- Access to New Customer Segments: Partnerships can open doors to demographics or geographic areas Aavas currently has limited penetration in, potentially increasing its customer acquisition rate.

- Enhanced Distribution Channels: Collaborating with fintech platforms or other financial entities can provide Aavas with alternative, digital-first channels to reach potential borrowers, complementing its existing branch network.

- Shared Risk and Resource Optimization: Joint ventures or strategic alliances can allow Aavas to share the costs and risks associated with entering new markets or developing new products, improving capital efficiency.

- Leveraging Partner Expertise: Partnering with fintechs, for example, can bring technological innovation and data analytics capabilities that Aavas might not possess internally, leading to more efficient customer onboarding and risk assessment.

Pilot Programs for Innovative Financial Products

Aavas Financiers may be exploring pilot programs for novel financial products, such as micro-mortgages or digital lending platforms tailored to underserved rural and semi-urban populations. These initiatives are characteristic of question marks in a BCG matrix, representing potential high-growth ventures with minimal current market penetration.

These experimental offerings, by their nature, are question marks – they operate in potentially high-growth areas but currently have very low market share and require significant investment and successful execution to prove their viability and scale. Their future depends on early market feedback and successful scaling.

- Potential for High Growth: Pilot programs target emerging customer needs in areas like affordable housing finance, aiming to capture future market share.

- Low Market Share: As new ventures, these products have negligible current market share, reflecting their experimental stage.

- High Investment Required: Significant capital is needed for development, testing, and initial rollout, impacting profitability in the short term.

- Uncertain Future: Success hinges on customer adoption, regulatory approvals, and the ability to scale efficiently, making their long-term viability a key question.

Question Marks represent new ventures or markets with high growth potential but low current market share. Aavas Financiers is strategically investing in these areas, such as expanding into new states like Uttar Pradesh and developing its digital platforms. Success in these segments requires significant investment in infrastructure, marketing, and product development to convert them into Stars.

The company's foray into rooftop solar finance and pilot programs for novel financial products also fall under this category. These initiatives are crucial for future growth but demand substantial capital and careful execution to gain traction. Aavas's focus on affordable housing in Tier 2 and Tier 3 cities, often pursued through strategic partnerships, also highlights its approach to nurturing potential Question Marks.

As of early 2024, India's renewable energy sector was seeing rapid expansion, and demand for housing finance in smaller cities was on the rise, creating a favorable environment for these ventures. Aavas's Assets Under Management (AUM) stood at INR 20,820 crore in Q4 FY24, providing a solid base to fund these growth opportunities.

| Initiative | BCG Category | Key Characteristics | Investment Focus | Potential Outcome |

| Expansion into Uttar Pradesh | Question Mark | High growth potential, low current market share | Branch network, customer relationships, localized products | Star |

| Rooftop Solar Finance | Question Mark | Nascent stage, high growth potential in renewables | Marketing, operational infrastructure, risk assessment | Star |

| Digital Initiatives (App, GenAI) | Question Mark | High growth potential for digital channels, currently low penetration | Technology infrastructure, user adoption strategies | Star |

| Strategic Alliances/Partnerships | Question Mark | Access to new customer segments, enhanced distribution | Integration, market reception, leveraging partner expertise | Star |

| Pilot Programs (Micro-mortgages) | Question Mark | Emerging customer needs, low market share, high investment | Development, testing, scaling | Star |

BCG Matrix Data Sources

Our Aavas Financiers BCG Matrix is built on comprehensive data, including company financial statements, industry growth reports, and market share analysis from reputable research firms.