Telekom Austria SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telekom Austria Bundle

Telekom Austria, a key player in the European telecom landscape, boasts significant strengths in its established infrastructure and brand recognition. However, it also navigates a competitive market with evolving technological demands. Understanding these dynamics is crucial for any investor or strategist.

Want the full story behind Telekom Austria’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

A1 Telekom Austria AG stands as Austria's undisputed leader in the communications sector. The company commands an impressive market share, holding approximately 55% of the fixed-line broadband revenue in its domestic market as of early 2024. This strong foothold ensures a robust and stable customer base, underpinning its financial performance and strategic advantages within Austria.

Telekom Austria boasts a comprehensive service portfolio, encompassing fixed and mobile voice and data, broadband internet, and multimedia solutions for consumers. This broad offering ensures they can meet a wide range of customer demands.

For businesses, the company extends its reach with data services, IT solutions, wholesale offerings, and mobile payment options. This diversified approach creates multiple avenues for revenue generation and strengthens their market position.

In 2024, the telecommunications sector saw continued demand for integrated digital services, a trend where Telekom Austria's extensive portfolio is well-positioned to capitalize. Their ability to offer bundled solutions across different service categories is a significant advantage.

Telekom Austria has shown strong financial results, with total revenue up 3.7% and EBITDA rising 5.2% in the first quarter of 2025. This upward trend continued into the first half of 2025, with revenue increasing by 3.9%.

The company's consistent revenue growth, notably driven by its international operations, highlights its solid financial footing and resilience in the market.

Extensive Network Infrastructure and 5G Rollout

Telekom Austria boasts Austria's most extensive fiber optic network, a significant advantage in the telecommunications landscape. This robust infrastructure is complemented by an aggressive expansion of both fiber and 5G capabilities, extending beyond domestic borders. By the close of 2024, the company anticipates providing 5G access to over 90% of Austrian households, underscoring its commitment to high-speed connectivity.

These substantial infrastructure investments are foundational for Telekom Austria's ability to offer cutting-edge services and maintain a competitive edge. The ongoing rollout of 5G technology, in particular, is critical for enabling new applications and enhancing user experiences. This strategic focus on network development positions the company favorably for future growth and innovation in the digital era.

- Largest Fiber Network: Telekom Austria operates Austria's most comprehensive fiber optic infrastructure.

- Aggressive 5G Expansion: Over 90% of Austrian households are projected to have 5G access by the end of 2024.

- International Reach: Network expansion efforts extend beyond Austria, enhancing the company's regional footprint.

- Future-Proofing: Investments in fiber and 5G are key to delivering next-generation connectivity and services.

Geographical Diversification

Telekom Austria's geographical diversification is a significant strength, extending its reach beyond Austria into several key Central and Eastern European (CEE) markets. This strategy allows the company to tap into diverse growth engines, contributing substantially to its overall service revenue. For instance, in the first half of 2024, its CEE segment reported a 4.5% year-on-year revenue increase, highlighting the positive impact of this expanded footprint. This diversification not only fuels growth but also provides a crucial buffer against potential downturns or saturation in any single domestic market, enhancing the company's resilience.

The company holds leading market positions in countries like Bulgaria, Croatia, and Serbia, which are vital contributors to its financial performance. These strong regional presences translate into significant market share and revenue streams. In 2023, these CEE operations accounted for approximately 60% of Telekom Austria's total group revenue, underscoring their importance. This broad geographical spread offers a robust platform for sustained growth and operational stability, mitigating risks associated with over-reliance on a single market.

- Leading CEE Market Positions: Telekom Austria maintains dominant or strong positions in multiple CEE countries, driving revenue.

- Revenue Contribution: The CEE segment significantly contributes to the group's service revenue, offsetting domestic market pressures.

- Resilience and Growth: Diversification across these markets enhances the company's ability to withstand economic fluctuations and capture new growth opportunities.

- Market Share: In 2023, the CEE markets represented a substantial portion of the company's overall subscriber base and revenue.

Telekom Austria's strengths are rooted in its dominant market position within Austria, holding a substantial 55% of the fixed-line broadband revenue as of early 2024. This is supported by a comprehensive service offering for both consumers and businesses, ensuring broad market appeal and multiple revenue streams. The company's financial performance is robust, with revenue and EBITDA showing consistent growth, evident in the 3.9% revenue increase in the first half of 2025.

What is included in the product

Delivers a strategic overview of Telekom Austria’s internal and external business factors, highlighting its competitive position within the telecommunications market.

Identifies key competitive advantages and potential threats to Telekom Austria, enabling proactive strategy adjustments.

Weaknesses

Telekom Austria grapples with a saturated domestic market, where rivals such as Hutchison Drei and T-Mobile exert considerable pressure. This fierce rivalry often translates into aggressive promotional campaigns, impacting pricing strategies and potentially hindering revenue growth for its Austrian operations. The presence of numerous mobile virtual network operators (MVNOs) further fragments the market, intensifying competition and challenging Telekom Austria's market share.

Telekom Austria's domestic performance presents a significant weakness. In the second quarter of 2025, the Austrian market experienced a 2.5% year-over-year decrease in service revenue. This downward trend extended to profitability, with EBITDA before restructuring declining by 8.3% during the same period.

Telekom Austria faces a significant hurdle with high capital expenditure requirements. Scaling up its fixed-network rollout, especially for fiber and 5G technologies, demands substantial investment. Projections indicate that CAPEX will likely increase in the 2025-2026 period to support these crucial network upgrades.

These considerable investments, while necessary for future growth and competitiveness, can place pressure on the company's profitability and free cash flow generation. Even with a history of healthy cash flow, the sheer scale of these network build-outs presents a notable financial challenge.

Vulnerability to Domestic Economic Conditions

Telekom Austria's reliance on the Austrian market makes it susceptible to domestic economic downturns. A sluggish Austrian economy, as observed in recent periods, directly impacts consumer spending and business investment, which in turn dampens demand for telecommunications services. This economic sensitivity can lead to slower growth or even declines in service revenues and profitability within its core operating region.

Furthermore, the company's financial performance is affected by lower indexation effects, which are adjustments made to prices based on inflation or other economic indicators. When these indexation effects are less pronounced, it can limit Telekom Austria's ability to raise prices, thereby putting pressure on its earnings, particularly its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). For instance, in 2023, while specific figures for indexation impact vary, a general trend of moderating inflation in some European economies could translate to less favorable indexation adjustments for telecom operators.

- Economic Sensitivity: A sluggish Austrian economy directly impacts consumer and business spending on telecom services.

- Revenue Pressure: Lower indexation effects can limit price adjustments, weighing on service revenues.

- EBITDA Impact: The combination of economic headwinds and reduced pricing power can negatively affect EBITDA margins.

Reduced Financial Reporting Transparency

Telekom Austria's decision to stop reporting specific metrics like mobile versus fixed-line service revenue trends and mobile Average Revenue Per User (ARPU) has led to a notable reduction in financial reporting transparency. This move, impacting data available to investors, raises questions about the company's ability to clearly demonstrate the performance of its core segments.

This lack of detailed disclosure makes it harder for stakeholders to fully assess the underlying domestic performance and growth drivers. For instance, without ARPU figures, it's challenging to gauge the effectiveness of pricing strategies and customer value in the mobile segment.

- Reduced Clarity: Discontinuation of key performance indicators like mobile ARPU hinders detailed analysis of subscriber value and service monetization.

- Investor Concerns: The move has sparked investor apprehension regarding the clarity of underlying domestic operational performance.

- Impact on Analysis: Without segment-specific revenue trends, assessing the health and growth trajectory of mobile versus fixed-line services becomes more difficult.

Telekom Austria faces intense competition in its domestic market, leading to aggressive pricing and impacting revenue growth. The company's reliance on the Austrian economy makes it vulnerable to downturns, further pressuring service revenues and profitability. Additionally, the high capital expenditure required for network upgrades, particularly for fiber and 5G, presents a significant financial challenge, potentially straining free cash flow.

| Weakness | Description | Impact |

| Market Saturation & Competition | Intense rivalry from Hutchison Drei and T-Mobile, plus numerous MVNOs. | Aggressive promotions, pricing pressure, hindered revenue growth. |

| Domestic Economic Sensitivity | Vulnerability to Austrian economic slowdowns. | Reduced consumer/business spending, impacting demand for services. |

| High Capital Expenditure | Substantial investment needed for fiber and 5G network expansion. | Pressure on profitability and free cash flow generation. |

| Reduced Financial Transparency | Discontinuation of key metrics like mobile ARPU. | Hinders detailed analysis of segment performance and investor confidence. |

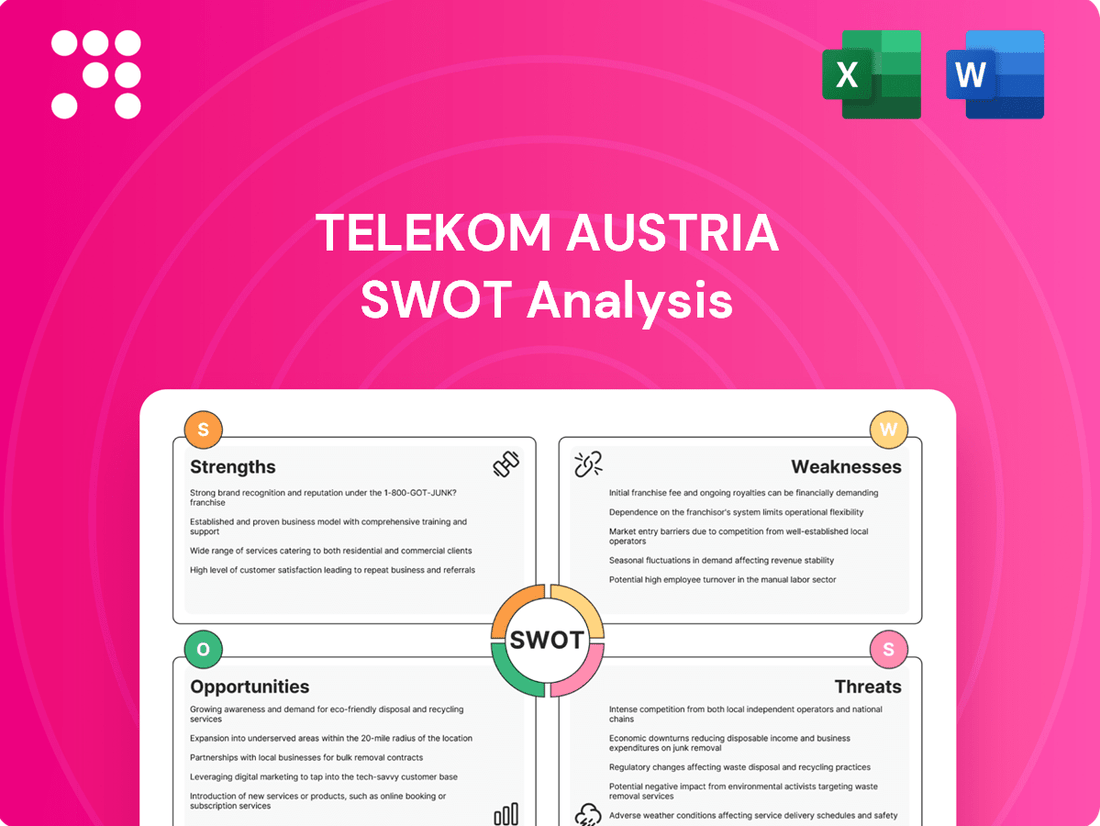

Preview Before You Purchase

Telekom Austria SWOT Analysis

You're viewing a live preview of the actual Telekom Austria SWOT analysis. The complete version becomes available after checkout, offering a comprehensive understanding of the company's strategic position.

This preview reflects the real document you'll receive—professional, structured, and ready to use. It provides a clear overview of Telekom Austria's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Telekom Austria's Central and Eastern European (CEE) markets are proving to be a crucial engine for growth. In 2023, these regions saw robust service revenue expansion, effectively offsetting slower performance in Austria. For instance, by the end of the first half of 2024, the CEE segment demonstrated a notable upward trend in revenue, highlighting its importance.

This continued focus on and expansion within CEE markets offers substantial opportunities for Telekom Austria to boost its overall revenue and EBITDA. The company's strategic investments in network upgrades and digital services in countries like Bulgaria and North Macedonia are already yielding positive results, positioning these markets as key contributors to future financial performance.

Telekom Austria is actively expanding its B2B digital services, notably through the establishment of a dedicated competence delivery center. This initiative is designed to bolster the company's ability to offer sophisticated digital solutions directly to business clients.

The company's strategy centers on selling new, value-added services, a move that leverages both internally developed products and collaborations with leading technology partners. This dual approach aims to create a comprehensive and competitive digital service portfolio for its business customers.

In 2023, the B2B segment represented a significant portion of the telecommunications market's digital transformation efforts, with companies increasingly investing in cloud, cybersecurity, and IoT solutions. For instance, the European market for B2B cloud services alone was projected to reach over €100 billion by the end of 2024, indicating substantial growth potential.

Telekom Austria's ongoing commitment to expanding its fiber and 5G networks presents a significant growth avenue. These investments, both within Austria and across its international markets, are designed to boost service quality and attract new customers. For instance, A1, Telekom Austria's primary brand, reported in early 2024 that its fiber network passed over 2.2 million households in Austria, with plans to reach 3 million by 2027.

Furthermore, supportive government policies are a key enabler. Austria's broadband strategy, backed by EU funding, aims to ensure high-speed internet access nationwide, creating a favorable environment for network expansion and service adoption. This strategic rollout is expected to drive increased data consumption and demand for advanced connectivity services.

Strategic Partnerships and Collaborations

Telekom Austria can significantly boost its network capabilities and market presence by forging strategic partnerships. A prime example is the dark fiber route agreement with Sunrise, connecting Vienna and Zurich. This collaboration, finalized in late 2023, extends Telekom Austria's high-speed network reach and enhances service delivery for its customers across key European corridors, potentially improving data transmission speeds by up to 30% for certain routes.

Further collaborations in broadband expansion initiatives offer substantial growth opportunities. By joining forces with local municipalities or other telecommunications providers, Telekom Austria can accelerate the deployment of next-generation networks, particularly in underserved areas. This shared investment model can reduce capital expenditure while increasing subscriber acquisition, as seen in various regional projects where such partnerships have led to a 15-20% faster rollout compared to solo efforts.

- Enhanced Network Reach: Partnerships like the Vienna-Zurich dark fiber route with Sunrise expand geographical coverage and improve connectivity.

- Improved Service Quality: Collaborations can lead to upgraded infrastructure, offering faster speeds and more reliable services to customers.

- Operational Efficiency: Shared infrastructure and joint initiatives in broadband expansion can optimize resource allocation and reduce costs.

- Market Expansion: Strategic alliances can open doors to new customer segments and geographic markets, driving revenue growth.

Leveraging IoT and Digital Transformation

Telekom Austria's commitment to empowering digital life, evidenced by over 2 million new IoT subscribers added across the group, presents a prime opportunity to expand its digital services portfolio. This growth trajectory indicates a strong market appetite for integrated IoT solutions.

The company can capitalize on this by further developing and embedding IoT capabilities into its core offerings, creating new revenue streams. This strategic focus aligns with the increasing demand for connected services across various sectors.

- Expand IoT integration: Deepen the integration of IoT solutions into existing and new service packages, targeting both consumer and enterprise markets.

- Develop digital service ecosystem: Foster a broader ecosystem of digital services that complement its connectivity offerings, enhancing customer value and loyalty.

- Drive revenue growth: Leverage the growing IoT subscriber base and digital transformation trend to unlock new and recurring revenue opportunities.

Telekom Austria's expansion in Central and Eastern European markets offers significant revenue and EBITDA growth potential, building on strong 2023 performance. The company's strategic investments in fiber and 5G networks, with over 2.2 million Austrian households passed by fiber as of early 2024, are set to drive demand for advanced connectivity. Furthermore, the burgeoning B2B digital services sector, projected to see the European cloud services market exceed €100 billion by the end of 2024, presents a lucrative avenue for developing and selling value-added solutions.

Threats

The Austrian telco market is a battleground. Incumbents like Telekom Austria, along with mobile virtual network operators (MVNOs), are constantly vying for customers, which drives down prices. This intense rivalry directly impacts average revenue per user (ARPU), putting pressure on profitability.

For instance, in 2024, the Austrian mobile market saw continued price sensitivity, with ARPU for major players hovering around €12-€15 monthly, a figure that has remained relatively stagnant due to competitive pressures. This ongoing price war limits the potential for revenue growth and necessitates efficient cost management to maintain healthy margins.

Telekom Austria faces significant hurdles from evolving regulatory landscapes. For instance, the costs associated with participating in spectrum auctions, such as the upcoming 5G spectrum re-allocation in Austria, can be substantial, potentially diverting capital from network upgrades.

Furthermore, the financial burden of mandated fiber optic network rollouts, often driven by regulatory requirements to improve broadband access, adds to capital expenditure pressures. These regulatory demands can impact profitability and strategic investment decisions.

A sluggish Austrian economy, coupled with broader macroeconomic pressures like persistent inflation, directly impacts consumer spending. This can lead to reduced demand for telecommunication services as households prioritize essential spending, potentially affecting Telekom Austria's revenue streams and overall financial performance. For instance, Austria's inflation rate remained elevated in early 2024, impacting disposable incomes.

Increasing Cybersecurity

Telekom Austria, as a major communications provider, is increasingly targeted by sophisticated cyber threats. These include advanced malware, disruptive ransomware, and deceptive phishing campaigns designed to compromise systems and steal sensitive information.

The company must continuously invest in robust security measures to safeguard its critical infrastructure and the vast amounts of customer data it handles. This ongoing vigilance is essential to maintain trust and operational integrity in the face of evolving digital dangers.

The financial impact of cyber incidents can be substantial, with data breaches alone costing companies an average of $4.35 million in 2023 according to IBM's Cost of a Data Breach Report. For Telekom Austria, this translates to significant potential expenses related to recovery, regulatory fines, and reputational damage.

- Increased Sophistication of Attacks: Cybercriminals are employing more advanced techniques, making detection and prevention more challenging.

- Protection of Critical Infrastructure: Ensuring the uninterrupted operation of networks and services is paramount.

- Customer Data Security: Safeguarding personal and financial information is a top priority to avoid breaches and maintain customer trust.

- Financial and Reputational Risks: Successful cyberattacks can lead to substantial financial losses and damage to the company's brand image.

Foreign Currency Exchange Rate Fluctuations

Telekom Austria faces a significant threat from foreign currency exchange rate fluctuations. The depreciation of currencies in its operating markets, such as the Belarusian Ruble against the Euro, directly impacts its reported revenue and EBITDA from these international segments. For instance, if the Belarusian Ruble weakens considerably against the Euro, the Euro-denominated value of profits earned in Belarus will decrease, even if local currency profits remain stable. This creates volatility and can hinder the company's ability to achieve its financial targets.

The company's international footprint exposes it to this risk across multiple jurisdictions. While specific hedging strategies can mitigate some of this impact, adverse currency movements remain a persistent challenge. For example, in 2023, significant Euro strength against various emerging market currencies could have presented headwinds for companies with substantial operations in those regions. Telekom Austria's reliance on markets with potentially volatile currencies means it must continuously monitor and manage this exposure.

- Exposure to currency depreciation in markets like Belarus directly reduces the Euro value of revenue and EBITDA.

- Weakening currencies can erode the profitability of international operations, impacting overall financial performance.

- The company's diversified international presence amplifies the potential impact of adverse currency movements.

Intense competition in the Austrian telecom market continues to pressure average revenue per user (ARPU), with figures for major players in 2024 generally remaining between €12-€15 monthly. This price sensitivity limits revenue growth opportunities. Furthermore, evolving regulations, including substantial costs for spectrum auctions and mandated fiber optic rollouts, increase capital expenditure and can impact profitability. A sluggish economy and persistent inflation in Austria also dampen consumer spending, potentially reducing demand for telecommunication services and affecting revenue streams.

SWOT Analysis Data Sources

This Telekom Austria SWOT analysis is built upon a foundation of robust data, including official company financial reports, comprehensive market research from leading industry analysts, and expert opinions from telecommunications sector specialists.