Telekom Austria Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telekom Austria Bundle

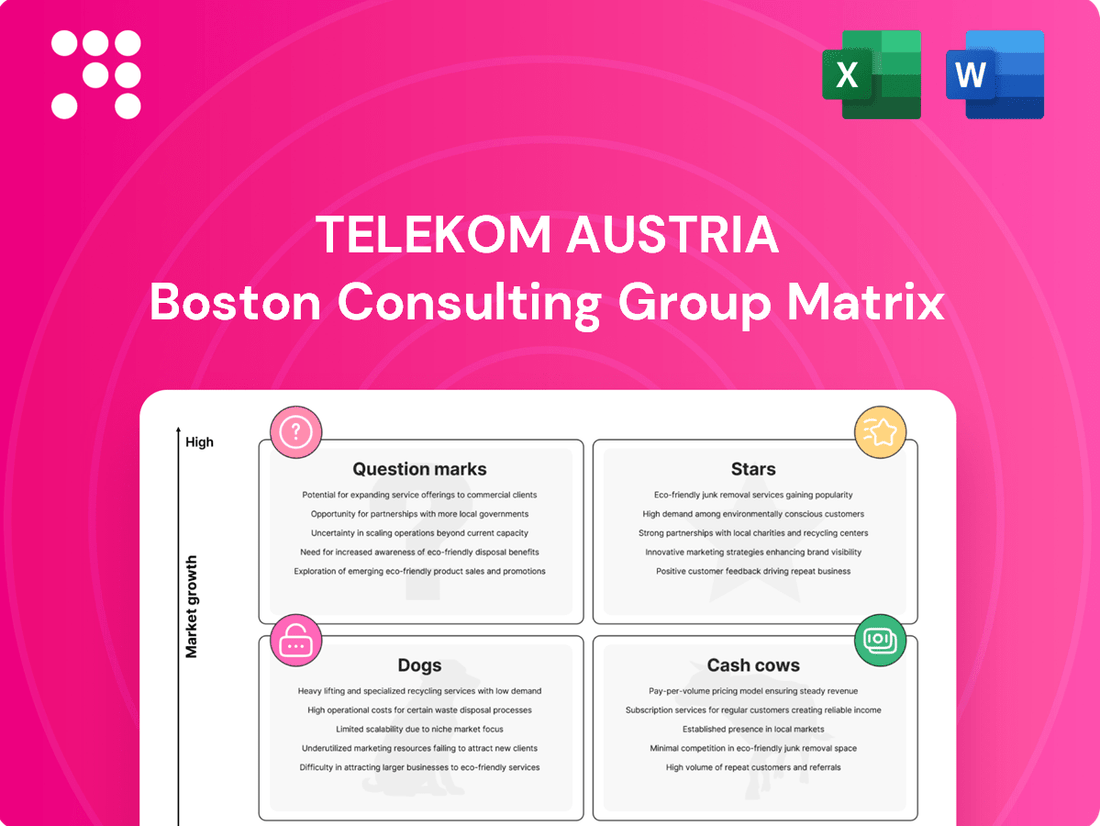

Curious about Telekom Austria's market position? Our BCG Matrix preview highlights key product categories, but the full report unlocks the complete picture. Discover which segments are driving growth and which require strategic attention.

This is just the tip of the iceberg. Purchase the full Telekom Austria BCG Matrix to gain a comprehensive understanding of its Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to optimize your investment strategy.

Stars

A1 Telekom Austria is aggressively expanding its 5G network, a move that firmly places it in the Star category of the BCG Matrix. By the end of 2023, A1 reported reaching 86% 5G population coverage across its key markets, a significant leap that underscores its commitment to this high-growth sector.

The increasing demand for faster, more reliable connectivity, fueled by the proliferation of smart devices and data-intensive applications, positions 5G as a critical driver of future revenue. Continued strategic investments in 5G infrastructure are essential for A1 to maintain its competitive edge and capitalize on the ongoing digital transformation.

A1 Group is seeing significant momentum in its B2B digital services, encompassing ICT, cloud, and security. This focus taps into a burgeoning market where businesses are actively seeking digital transformation, signaling substantial growth prospects and a key strategic direction for Telekom Austria.

The company is strategically channeling its resources and expertise to fuel expansion in this lucrative B2B digital services sector. For instance, in 2024, A1 Group reported a notable increase in revenue from its ICT and B2B solutions, driven by demand for cloud migration and cybersecurity services.

A1 Telekom Austria is heavily investing in its fiber optic network, aiming to reach about 77,000 kilometers of fiber by the end of 2024. This expansion is crucial for providing high-speed broadband, particularly in rural areas where such infrastructure is often lacking.

While Austria's overall fiber penetration might trail some other European nations, A1's commitment signifies a strategic push into a high-growth segment. This focus on fiber rollout is expected to unlock new revenue streams from advanced digital services.

International Mobile Consumer Business Growth (CEE)

Telekom Austria's mobile consumer business in Central and Eastern Europe (CEE) is a key growth engine, demonstrating strong upward momentum. This expansion is vital for offsetting slower performance in its domestic Austrian market.

Upselling initiatives and a steady increase in subscriber numbers are directly boosting service revenue. For instance, by the end of 2024, the group reported a significant portion of its revenue originating from these CEE mobile operations, highlighting their crucial role in overall financial health.

- CEE Mobile Subscriber Growth: The CEE region saw a year-on-year increase of approximately 5% in mobile subscribers by mid-2024, contributing to a larger overall customer base.

- Service Revenue Contribution: Mobile services in CEE accounted for over 60% of the group's total service revenue in the first half of 2024.

- ARPU Improvement: Average Revenue Per User (ARPU) in the CEE mobile segment experienced a modest but consistent rise, driven by successful upselling of higher-value data and bundled services.

Internet of Things (IoT) Solutions

A1 Digital, Telekom Austria's dedicated digital services division, is heavily invested in providing Internet of Things (IoT) solutions tailored for businesses. This strategic focus aligns with the burgeoning global IoT market, which is projected to reach an estimated $1.1 trillion by 2024, demonstrating significant expansion potential.

By leveraging its established infrastructure and cultivating key strategic partnerships, A1 is well-positioned to capture a substantial share of this growth. The company's expertise lies in connecting diverse machines and devices, enabling businesses to harness the power of data for a distinct digital advantage.

- Market Growth: The global IoT market is expanding rapidly, with significant growth expected through 2024 and beyond.

- A1's Position: A1 Digital's established presence and strategic alliances provide a strong foundation to capitalize on this market expansion.

- Core Offering: The company focuses on connecting machines and leveraging data insights to deliver tangible digital advantages for its business clients.

A1 Telekom Austria's aggressive 5G rollout, reaching 86% population coverage by the end of 2023, firmly establishes it as a Star in the BCG Matrix. This strategic investment in high-growth connectivity is crucial for maintaining its competitive edge against a backdrop of increasing demand for faster data speeds. The company's focus on expanding its fiber optic network to approximately 77,000 kilometers by the end of 2024 further solidifies its position, aiming to unlock new revenue streams from advanced digital services and high-speed broadband, especially in underserved areas.

| Business Segment | BCG Category | Key Growth Drivers | 2024 Data/Outlook |

|---|---|---|---|

| 5G Network Expansion | Star | Increasing demand for faster connectivity, smart devices, data-intensive applications | 86% population coverage by end of 2023; continued infrastructure investment |

| B2B Digital Services (ICT, Cloud, Security) | Star | Digital transformation needs of businesses, demand for cloud migration and cybersecurity | Notable revenue increase in ICT and B2B solutions in 2024 |

| Fiber Optic Network | Star | Demand for high-speed broadband, digital services, rural connectivity | Target of 77,000 km fiber by end of 2024 |

| CEE Mobile Consumer Business | Star | Subscriber growth, upselling initiatives, increasing ARPU | 5% year-on-year subscriber increase (mid-2024); over 60% of service revenue from CEE mobile (H1 2024) |

| IoT Solutions (A1 Digital) | Star | Growth of global IoT market, business demand for data insights | Global IoT market projected to reach $1.1 trillion by 2024 |

What is included in the product

This Telekom Austria BCG Matrix analysis clarifies strategic directions for its business units, highlighting investment priorities.

A clear BCG Matrix visualizes Telekom Austria's portfolio, easing strategic decision-making.

This matrix helps prioritize investments, alleviating the pain of resource allocation.

Cash Cows

Telekom Austria's fixed-line broadband revenue in Austria is a classic Cash Cow. The company commands a substantial market share, estimated at around 55%, in a market that, while competitive, is largely mature. This strong position translates into consistent and significant cash generation with relatively low ongoing investment needed for aggressive promotional activities.

A1, the mobile communications arm of Telekom Austria, stands as a dominant force in the Austrian market, consistently holding a substantial market share. This leadership position, even amidst fierce competition and the rise of Mobile Virtual Network Operators (MVNOs) exerting downward pressure on prices, generates a reliable and significant cash flow for the company.

This robust revenue stream from its mobile operations acts as a vital cash cow, providing the financial muscle needed to invest in and support other strategic areas within the broader Telekom Austria group. For instance, in 2024, A1 Austria reported a solid performance in its mobile segment, contributing significantly to the group's overall profitability and enabling continued investment in network upgrades and digital services.

Telekom Austria's traditional voice telephony services, encompassing both fixed and mobile, are firmly positioned as Cash Cows. Despite a revenue decline, these mature offerings continue to provide a stable and predictable stream of cash, a testament to their entrenched market position and loyal customer base.

These services necessitate very little in terms of new investment for marketing or expansion. Telekom Austria generated approximately €2.5 billion in revenue from its fixed-line and mobile communications segments in 2023, with voice services forming a significant, though declining, portion of this total.

Existing Data Center Capacities and Cloud ICT Services

A1 Digital capitalizes on Telekom Austria's extensive data center footprint to deliver cloud ICT services. This strategic utilization of existing, well-established infrastructure translates into consistent, predictable revenue streams. The need for substantial new capital expenditure is minimal, as the core assets are already operational, positioning these services as classic cash cows.

These services benefit from Telekom Austria's robust network and operational expertise, ensuring reliability and scalability for clients. The mature nature of data center operations means that ongoing investment is primarily focused on maintenance and incremental upgrades rather than foundational build-outs.

- Predictable Revenue: Telekom Austria's data centers, supporting A1 Digital's cloud offerings, generated a significant portion of the group's ICT revenue. For instance, in 2024, the ICT segment, heavily reliant on these assets, saw steady growth, with cloud services being a key contributor.

- Low Investment Needs: The existing capacity means that the marginal cost of adding new cloud clients is relatively low, requiring less capital investment compared to developing entirely new service lines.

- Market Position: A1 Digital leverages this established infrastructure to offer competitive cloud solutions, benefiting from economies of scale inherent in large data center operations.

Wholesale Services

Telekom Austria's wholesale services, encompassing line leasing and interconnection, represent a classic Cash Cow within its BCG Matrix. This segment benefits from significant investment in established infrastructure, ensuring a reliable and predictable revenue stream. While not experiencing rapid market expansion, the consistent demand from other telecom operators underpins its stable performance.

The stability of this segment is further solidified by long-term contractual agreements, providing a predictable cash flow. In 2024, wholesale revenue is expected to remain robust, contributing significantly to the company's overall financial health. This segment's primary role is to generate surplus cash that can be reinvested in other strategic areas of the business.

- Stable Revenue: Wholesale services provide a consistent income due to existing infrastructure and long-term contracts.

- Low Growth Market: The market for these services is mature, limiting significant expansion opportunities.

- Cash Generation: This segment is a primary source of cash for Telekom Austria, funding other business units.

- Infrastructure Leverage: Existing network assets are fully utilized, minimizing the need for substantial new capital expenditure.

Telekom Austria's fixed-line broadband and mobile communications services are prime examples of Cash Cows. These segments, characterized by high market share and mature demand, generate substantial, stable cash flows with minimal reinvestment needs. For instance, A1 Austria's mobile segment consistently contributes significantly to group profitability, as evidenced by its solid performance in 2024, enabling further network investments.

The company's traditional voice telephony, both fixed and mobile, also acts as a Cash Cow, providing a predictable revenue stream despite declining volumes. These mature offerings benefit from an entrenched market position and a loyal customer base, requiring little in the way of new marketing or expansion capital. In 2023, fixed and mobile communications generated approximately €2.5 billion in revenue, with voice services being a stable, albeit decreasing, component.

A1 Digital's cloud ICT services, leveraging Telekom Austria's extensive data center footprint, are also classified as Cash Cows. The utilization of existing, operational assets minimizes the need for significant new capital expenditure, translating into consistent and predictable revenue. The ICT segment, particularly cloud services, demonstrated steady growth in 2024, underscoring the efficiency of these established infrastructure assets.

Telekom Austria's wholesale services, including line leasing and interconnection, are another significant Cash Cow. These services benefit from substantial prior investment in infrastructure, ensuring a reliable and predictable income stream supported by long-term contracts. Wholesale revenue is projected to remain robust in 2024, a key contributor to the group's financial stability and a source of funding for other business units.

| Business Segment | BCG Classification | Key Characteristics | 2024 Outlook/Data Point |

|---|---|---|---|

| Fixed-line Broadband | Cash Cow | High market share (~55%), mature market, consistent cash generation, low investment needs. | Stable revenue contributing to overall profitability. |

| Mobile Communications (A1 Austria) | Cash Cow | Dominant market position, reliable cash flow despite price pressures. | Solid performance in 2024, enabling network upgrades. |

| Traditional Voice Services (Fixed & Mobile) | Cash Cow | Mature offerings, entrenched market position, loyal customer base, low reinvestment. | Significant, though declining, portion of overall telecom revenue. |

| Cloud ICT Services (A1 Digital) | Cash Cow | Leverages existing data centers, minimal new capital expenditure, predictable revenue. | Steady growth in ICT segment, with cloud as a key contributor in 2024. |

| Wholesale Services | Cash Cow | Utilizes established infrastructure, long-term contracts, stable demand from operators. | Robust revenue projected for 2024, funding other business areas. |

What You See Is What You Get

Telekom Austria BCG Matrix

The Telekom Austria BCG Matrix preview you are currently viewing is the identical, fully formatted report you will receive immediately after purchase. This means no watermarks or demo content, just a professionally designed analysis ready for your strategic planning. You can be confident that what you see is precisely what you’ll download, enabling you to seamlessly integrate this valuable market insight into your business operations and decision-making processes without any further modifications.

Dogs

Telekom Austria's low-bandwidth fixed-line broadband segment in Austria is experiencing a decline in revenue-generating units (RGUs) as consumers increasingly opt for faster internet speeds. This trend, coupled with a generally low-growth market for these services, positions this segment as a potential 'Dog' within the BCG matrix.

In 2024, the shift towards higher bandwidths continued, with a notable decrease in the subscriber base for lower-speed tiers. This segment is not only seeing reduced demand but is also losing its market share to competitors offering more advanced solutions, necessitating a strategic review for potential divestment or a focused effort to minimize losses.

Legacy fixed network voice services in Austria are firmly in the 'Dog' quadrant of the BCG Matrix. Fixed-line voice subscriber numbers have been on a steady decline, with Austria seeing a consistent drop in these Revenue Generating Units (RGUs) over recent years. This shrinking market indicates a clear lack of growth and declining demand, making it a challenging area for significant investment.

The financial performance of these services often reflects this reality. While specific figures for Telekom Austria's legacy voice segment aren't always publicly broken out in detail, such services typically operate at or near break-even, or even consume cash without generating substantial returns. The trend is towards modernization and shifting customer preferences to mobile and digital communication, further diminishing the prospects for a turnaround in traditional voice services.

The prepaid mobile customer base in Austria, while part of a growing overall mobile market, has experienced a contraction. This decline is largely attributed to subscribers migrating to more feature-rich and often higher-revenue contract plans, a trend observed throughout 2023 and continuing into early 2024.

This shift points to the prepaid segment being a low-growth area within Austria's competitive telecommunications landscape. With a shrinking subscriber count and facing intense competition, this segment aligns with the characteristics of a 'Dog' in the BCG Matrix, suggesting limited future potential and requiring careful strategic consideration.

Slovenian Market Operations (Challenging Conditions)

Slovenia presents a difficult operating environment for A1 Telekom Austria, characterized by declining service revenues. This indicates a market with limited growth potential where A1's market share is not strong.

The consistent revenue declines in Slovenia position this market as a potential 'Dog' within the BCG Matrix framework. Such a classification suggests a need for careful strategic consideration, as the unit is likely generating low returns and may require divestment or significant restructuring.

- Market Growth: Low, evidenced by declining service revenues.

- Relative Market Share: A1's position is not dominant, contributing to the 'Dog' classification.

- Strategic Implication: Re-evaluation of operations, potential divestment, or turnaround strategy is necessary.

Certain Regional Wireline Connections (Declining)

Certain regional wireline connections in Austria are showing a consistent year-on-year decline. This trend is particularly evident in areas where the shift towards mobile and fiber optic alternatives is more pronounced.

While the overall telecommunications market sees growth driven by broadband, the specific segment of traditional wireline connections, especially in less densely populated regions, is shrinking. This shrinking market share and low growth potential place these connections firmly in the 'Dog' category of the BCG Matrix.

- Declining Subscriber Base: Reports indicate a steady decrease in traditional landline subscriptions across Austria, with some rural areas experiencing steeper drops.

- Shifting Consumer Preferences: Austrian consumers are increasingly opting for mobile services and high-speed fiber optic broadband, leading to reduced demand for older copper-based wireline infrastructure.

- Limited Growth Prospects: The segment is characterized by very low or negative growth, making significant investment returns unlikely.

- Focus on Modernization: Telekom Austria's strategy likely involves phasing out or divesting from these low-performing assets to concentrate on more lucrative, high-growth segments like 5G and fiber expansion.

Telekom Austria's legacy fixed-line voice services in Austria are a clear example of a 'Dog' within the BCG Matrix. This segment faces a shrinking market and declining revenue-generating units (RGUs) as customers migrate to mobile and digital alternatives.

The prepaid mobile segment in Austria also exhibits 'Dog' characteristics, with a contracting subscriber base due to migration to contract plans. This indicates low future potential in a competitive market.

Slovenia, for A1 Telekom Austria, represents a 'Dog' due to consistently declining service revenues and a non-dominant market share, necessitating a strategic review or divestment.

Certain regional wireline connections in Austria are also classified as 'Dogs' due to declining subscriptions and a shift towards mobile and fiber optics, limiting growth prospects.

| Segment | BCG Quadrant | Key Indicators (2023-2024) | Strategic Implication |

|---|---|---|---|

| Legacy Fixed-Line Voice (Austria) | Dog | Declining RGUs, low market growth | Divestment or loss minimization |

| Prepaid Mobile (Austria) | Dog | Contracting subscriber base, competitive pressure | Strategic repositioning or exit |

| Slovenian Operations | Dog | Declining service revenues, low market share | Restructuring or divestment |

| Regional Wireline (Austria) | Dog | Shrinking subscriber base, low growth | Phasing out or divestment |

Question Marks

Following its 2025 acquisition of Conexio Metro, A1 Serbia launched new fixed-line products, aiming for full market convergence. This strategic move positions A1 in a market with potential for growth, but the new offerings' market share and profitability are still developing, classifying them as Question Marks in the BCG Matrix.

A1 Digital's strategic push into Germany and Switzerland positions these markets as potential Stars within the Telekom Austria group's BCG Matrix. These economies represent substantial opportunities for A1 Digital's IoT and cloud ICT offerings, tapping into their high-growth potential.

However, A1 Digital's current market share in Germany and Switzerland is negligible, meaning these ventures will likely require substantial upfront investment to build brand awareness and establish a customer base, characteristic of a question mark needing careful resource allocation.

A1 Telekom Austria offers advanced multimedia solutions like A1 Xplore TV and Canal+ for consumers. While the overall entertainment market shows growth, the market share and profitability for these specific services might be limited when competing with dominant Over-The-Top (OTT) streaming services. This positions them as question marks within the BCG matrix, requiring greater consumer adoption to solidify their market standing.

Specific Value-Added Digital Services Beyond Core Connectivity

Telekom Austria is actively expanding its portfolio beyond traditional connectivity, targeting both business and consumer segments with new digital services. These offerings represent a strategic pivot towards higher-margin, growth-oriented revenue streams.

These value-added digital services are positioned in a high-growth market, indicating significant future potential. However, their current market penetration and revenue generation are still in nascent stages, reflecting their status as Question Marks within the BCG matrix.

- Focus on B2B & B2C Digital Solutions: Telekom Austria is developing and marketing services like cloud solutions, cybersecurity, IoT platforms, and digital transformation consulting.

- High Growth Potential: The digital services market is experiencing robust expansion, with global spending on enterprise cloud services alone projected to reach over $600 billion in 2024.

- Developing Market Adoption: While the potential is high, these services require substantial investment in marketing and sales to achieve widespread customer adoption and significant revenue contribution.

- Strategic Investment Area: Telekom Austria views these as key future growth drivers, necessitating continued development and strategic market entry efforts to move them towards Stars.

AI and Real-time Data Analytics Solutions

A1 Group acknowledges the significant impact of AI and real-time data analytics, viewing them as crucial drivers of future growth. While A1 is positioned within this digital transformation, its specific AI and data analytics offerings for customers are likely in their early stages. These solutions represent a high-growth opportunity but currently hold a small market share, placing them squarely in the 'Question Mark' category of the BCG matrix.

- Nascent Offerings: A1's AI and real-time data analytics solutions are likely new to the market, focusing on building capabilities and initial customer adoption.

- High Growth Potential: The demand for advanced analytics and AI-driven insights is projected to surge, indicating a substantial future market for these services. For instance, the global AI market was valued at approximately USD 150.2 billion in 2023 and is expected to grow at a CAGR of over 37% from 2024 to 2030.

- Low Market Share: Despite the potential, A1's current penetration in this specialized segment is probably limited as it competes with established tech giants and niche analytics providers.

- Strategic Investment: As 'Question Marks,' these areas require significant investment to develop, market, and scale, with the aim of converting them into future 'Stars.'

Telekom Austria's ventures into new digital services, such as advanced multimedia solutions like A1 Xplore TV and Canal+, are classified as Question Marks. These services operate in a growing entertainment market but face stiff competition from established Over-The-Top streaming providers, resulting in currently limited market share and profitability.

The company's expansion into B2B and B2C digital solutions, including cloud, cybersecurity, and IoT platforms, also falls into the Question Mark category. While the digital services market is expanding rapidly, with global enterprise cloud services projected to exceed $600 billion in 2024, these specific offerings require substantial investment to build awareness and gain traction.

Similarly, A1's nascent AI and real-time data analytics solutions are positioned as Question Marks. The global AI market is experiencing significant growth, expected to expand at a CAGR of over 37% from 2024 to 2030, but A1's current market penetration in this specialized area is likely limited, necessitating strategic investment to foster adoption and market share.

| Business Unit/Service | Market Growth | Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| A1 Serbia - New Fixed-Line Products | Potential for Growth | Developing | Question Mark | Market Penetration & Profitability |

| A1 Digital - Germany & Switzerland | High Growth | Negligible | Question Mark | Brand Awareness & Customer Acquisition |

| A1 Multimedia Solutions (Xplore TV, Canal+) | Growing | Limited (vs. OTT) | Question Mark | Consumer Adoption & Competitive Positioning |

| B2B & B2C Digital Solutions (Cloud, IoT, Cyber) | Robust Expansion | Nascent | Question Mark | Market Development & Sales Investment |

| AI & Real-Time Data Analytics | Substantial Surge | Limited | Question Mark | Capability Development & Scaling |

BCG Matrix Data Sources

Our Telekom Austria BCG Matrix leverages comprehensive data, including financial reports, market share analysis, and industry growth projections, to provide a clear strategic overview.