Telekom Austria Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telekom Austria Bundle

Telekom Austria faces intense competition, particularly from agile mobile operators, impacting pricing power. The threat of new entrants is moderate due to high infrastructure costs, but digital disruptors pose a growing concern.

The full Porter's Five Forces Analysis reveals the real forces shaping Telekom Austria’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

A1 Telekom Austria's reliance on specialized technology providers for its network, especially for advancements like 5G, grants these suppliers considerable bargaining power. The cost and availability of cutting-edge equipment can be a significant factor, particularly when few alternative vendors exist or when switching providers incurs high costs.

This dependency highlights the strategic necessity for A1 to cultivate strong, long-term relationships with its key technology partners. Negotiating favorable terms and exploring potential long-term contracts are crucial steps in managing and mitigating the influence of these specialized suppliers.

The spin-off of A1's radio tower business into EuroTeleSites AG significantly alters the supplier landscape for Telekom Austria. EuroTeleSites now acts as a critical infrastructure provider, and while long-term contracts with termination waivers are in place, the terms within these agreements are paramount in defining EuroTeleSites' ongoing bargaining power as a key supplier.

Content and media providers hold significant bargaining power over Telekom Austria, now operating as A1, because A1 relies on them for its multimedia solutions and entertainment services, such as TV channels and streaming content. The appeal and uniqueness of specific content can really tip the scales in negotiations, allowing these suppliers to demand more favorable terms. For instance, A1's commitment to popular content through offerings like A1 Xplore TV and partnerships with providers like Canal+ underscores how crucial these relationships are for drawing in and keeping customers.

Skilled Workforce and Talent

The telecommunications industry, including A1 Telekom Austria, relies heavily on a specialized workforce. This includes highly skilled engineers, IT professionals, and customer service experts who are crucial for network maintenance, technological advancement, and customer satisfaction.

A significant factor impacting A1's bargaining power with its suppliers, particularly in the context of labor, is the availability of this talent. A scarcity of specialized skills can drive up wages and benefits, effectively increasing A1's operational costs and diminishing its leverage in workforce-related negotiations.

In 2024, A1 identified rising workforce costs as a key driver impacting its expenses. This trend highlights the direct influence that the availability and cost of skilled labor have on the company's financial performance and its overall bargaining power with suppliers, including those providing human capital solutions.

- Demand for Specialized Skills: The telecommunications sector necessitates a deep pool of talent, from network engineers to cybersecurity experts.

- Impact of Talent Shortages: A lack of readily available specialized workers can inflate labor expenses for A1.

- Rising Workforce Costs in 2024: A1 reported increasing workforce expenses as a significant cost factor during the 2024 fiscal year.

- Supplier Bargaining Power: When talent is scarce, suppliers of skilled labor gain increased bargaining power, influencing A1's costs.

Software and IT Solutions Vendors

A1 Telekom Austria's significant investment in digital services, IT solutions, and internal digital transformation naturally creates a dependency on a range of software and IT solution vendors. This reliance is particularly acute given the dynamic nature of the tech landscape and the need for cutting-edge capabilities to maintain a competitive edge.

The imperative to comply with stringent regulations, such as the EU NIS2 Directive, further amplifies the importance of specialized cybersecurity software suppliers. These vendors are crucial for safeguarding A1's infrastructure and customer data against evolving cyber threats, thereby increasing their leverage.

The escalating complexity of digital services offered by A1 can also empower specialized software and IT providers. As these solutions become more intricate and critical to service delivery, the bargaining power of the vendors capable of supplying and maintaining them tends to rise.

- Digital Transformation Investments: In 2024, the telecommunications sector, including companies like A1, continued to prioritize digital transformation, with significant capital allocated to cloud migration, AI integration, and network modernization. This drives demand for specialized software and IT services.

- Cybersecurity Spending: Global cybersecurity spending was projected to reach over $200 billion in 2024, a testament to the critical nature of these solutions for businesses, especially in regulated industries like telecommunications.

- Vendor Specialization: The market for IT solutions is characterized by a high degree of specialization, with niche providers often holding considerable sway due to their unique expertise and proprietary technologies, which are essential for advanced digital services.

A1 Telekom Austria faces significant bargaining power from its suppliers, particularly in the realm of specialized technology and skilled labor. The increasing demand for 5G infrastructure and digital transformation initiatives in 2024 means that providers of cutting-edge network equipment and advanced IT solutions hold considerable sway, especially when alternatives are limited or switching costs are high.

Furthermore, the telecommunications sector's reliance on highly skilled professionals, such as network engineers and cybersecurity experts, means that talent shortages can escalate labor costs. A1's reported rise in workforce expenses in 2024 underscores this challenge, directly impacting its operational budget and negotiation leverage with human capital suppliers.

| Supplier Category | Key Factors Influencing Bargaining Power | Impact on A1 |

|---|---|---|

| Technology Providers (e.g., 5G equipment) | Specialization, limited vendors, high switching costs | Increased equipment costs, dependency on innovation |

| Content & Media Providers | Uniqueness and appeal of content, customer acquisition/retention | Higher content licensing fees, strategic partnerships |

| Skilled Labor (e.g., IT, network engineers) | Talent scarcity, demand for specialized skills | Rising wage and benefit costs, potential operational delays |

| Software & IT Solution Vendors | Complexity of digital services, cybersecurity needs (e.g., NIS2 compliance) | Higher software licensing and maintenance fees, vendor lock-in potential |

What is included in the product

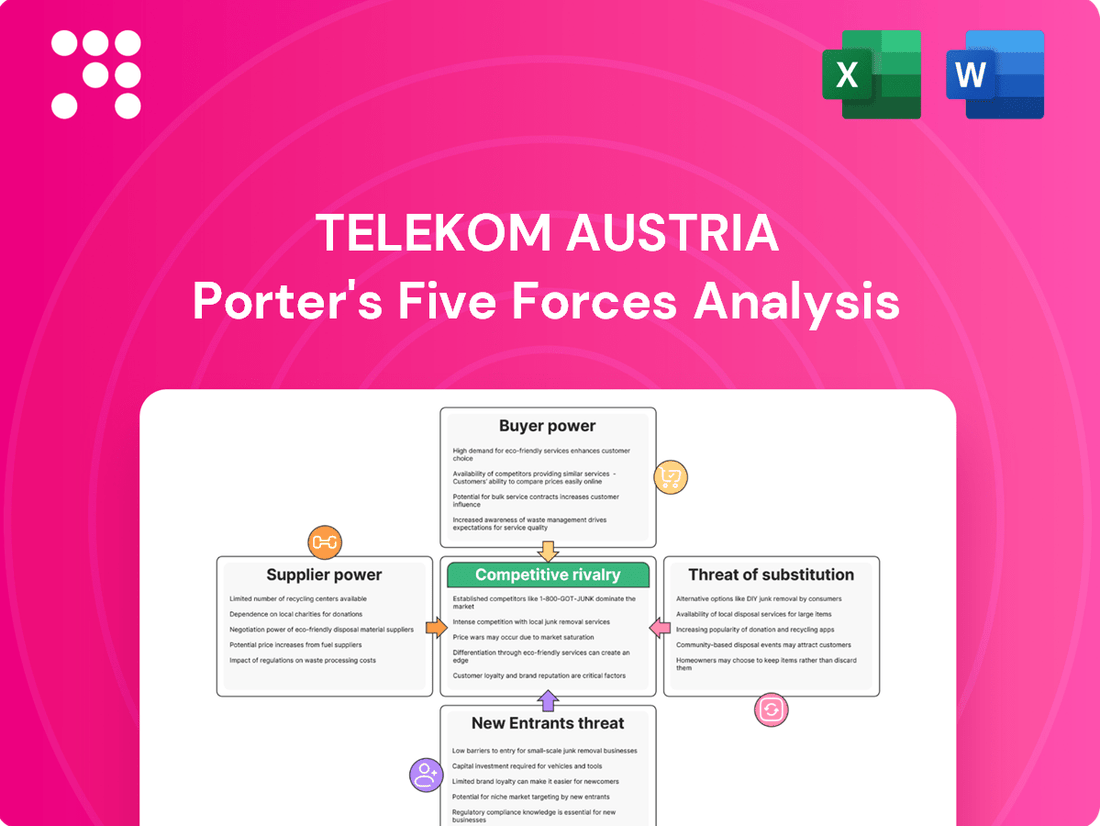

This Porter's Five Forces analysis for Telekom Austria thoroughly examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all within the dynamic telecommunications sector.

Quickly identify and address the most impactful competitive pressures on Telekom Austria with a visually intuitive framework, simplifying complex market dynamics for strategic planning.

Customers Bargaining Power

Customers in the telecommunications sector, especially for mobile services, can switch providers with relative ease and minimal expense. This low barrier to switching means customers hold significant power, as they can readily move to a competitor offering better deals or services, a phenomenon known as customer churn.

A1 Group is keenly aware of this customer leverage, actively employing customer retention strategies and loyalty programs to mitigate churn. Despite overall group growth, A1 Austria faced a slight dip in fixed-line revenue generating units (RGUs) in 2024, underscoring the persistent challenge of keeping customers engaged in a dynamic market.

Customers in Austria demonstrated heightened price sensitivity throughout 2024, a trend amplified by persistent inflation. This economic climate compelled consumers to scrutinize their spending, making them more receptive to competitive pricing and value-added services from telecommunications providers.

This increased price sensitivity directly translates to a stronger bargaining power for customers. They are more likely to switch providers or demand concessions if they perceive that prices are not aligned with the value received, or if inflation erodes their purchasing power.

In response, A1 Telekom Austria has actively implemented measures to mitigate the impact of rising costs on its customer base. These initiatives aim to retain customers by offering price stability or enhanced value, thereby addressing the heightened price sensitivity observed in the market.

The digital age has dramatically increased customer access to information. For instance, by mid-2024, a significant portion of Austrian consumers actively used online comparison tools for telecommunications services, with many reporting that this research directly influenced their purchasing decisions, often leading them to switch providers for better deals.

This readily available data on service features, pricing structures, and ongoing promotions empowers customers. They can easily benchmark Telekom Austria's offerings against those of competitors like T-Mobile Austria or Drei, understanding the market landscape and identifying the most attractive options available to them.

Online comparison platforms and direct, targeted marketing from rival companies further amplify this transparency. Customers in 2024 are more informed than ever, making it easier for them to negotiate better terms or switch to a provider that offers superior value, thereby heightening their bargaining power against incumbent players like Telekom Austria.

Bundled Service Expectations

Customers are increasingly looking for a single provider to handle all their communication and entertainment needs. This means they expect seamless integration of services like mobile, broadband, television, and even smart home solutions. For Telekom Austria, known as A1, this translates into a significant bargaining power. If A1 can't offer attractive, well-integrated bundles that meet these expectations, customers have readily available alternatives from competitors.

The trend towards bundled services is a powerful driver in the telecommunications market. In 2024, the demand for converged offerings, which combine multiple services into one package, continued to grow. For instance, a significant portion of households in Austria sought triple-play (internet, TV, phone) or even quadruple-play (adding mobile) services from a single provider to simplify billing and potentially reduce costs. This consumer preference directly impacts A1's ability to retain customers and influences pricing strategies.

- Bundled Service Demand: Consumers increasingly prefer integrated packages for mobile, fixed-line, internet, and TV services.

- A1's Strategy: A1 aims to meet this demand by offering comprehensive household solutions.

- Competitive Pressure: Failure to provide competitive bundles can lead customers to switch to rivals.

- Market Trend: The telecommunications market shows a clear shift towards bundled offerings, impacting customer loyalty.

Regulatory Protections and Consumer Rights

Regulatory bodies play a crucial role in safeguarding consumer rights within the telecommunications sector. For instance, in 2024, court decisions mandated A1 Telekom Austria and Magenta Telekom to reimburse customers for unlawfully levied service charges, demonstrating the tangible impact of these protections.

These regulations empower customers by ensuring fair treatment and providing clear pathways for addressing grievances. This legal scaffolding significantly bolsters customer bargaining power, as it compels service providers to adhere to ethical practices and be accountable for their actions.

- Consumer rights are actively enforced by regulatory bodies.

- Court rulings in 2024 have forced companies like A1 and Magenta Telekom to refund illegal service fees.

- This legal framework ensures fair practices and provides recourse for customers.

- Enhanced customer bargaining power results from provider accountability.

Customers in Austria's telecommunications market wield considerable power due to the ease of switching providers and increasing price sensitivity, exacerbated by 2024 inflation. This allows them to readily seek better deals, putting pressure on A1 Telekom Austria to offer competitive pricing and value-added services to retain its customer base.

The digital age has further amplified customer bargaining power. By mid-2024, a substantial number of Austrian consumers actively used online comparison tools, directly influencing their decisions and often leading to provider switches. This transparency, fueled by readily available information on services and pricing from competitors like T-Mobile Austria and Drei, empowers customers to negotiate favorable terms.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Ease of Switching | High | Low switching costs and readily available alternatives |

| Price Sensitivity | High | Increased due to inflation, driving demand for competitive pricing |

| Information Access | High | Widespread use of online comparison tools influencing purchasing decisions |

| Bundled Service Demand | High | Growing preference for integrated mobile, internet, TV, and smart home solutions |

| Regulatory Oversight | Moderate | Enforcement of consumer rights, with 2024 court rulings mandating refunds for unfair charges |

What You See Is What You Get

Telekom Austria Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Telekom Austria, detailing the competitive landscape and strategic implications within the telecommunications industry. The document you see here is the exact, fully formatted analysis you'll receive immediately after purchase, providing actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The Austrian telecommunications sector is a mature and highly concentrated market. A1 Telekom Austria, Magenta Telekom, and 3 Austria are the dominant players, creating a landscape where intense competition for market share is the norm.

In the second quarter of 2024, A1 Telekom Austria held its position as the market leader. However, this leadership came with a slight decrease in market share, underscoring the persistent competitive pressures from its main rivals.

Competitors in the telecommunications sector, including Telekom Austria's A1, are locked in a fierce battle for market share driven by aggressive network expansion. This involves substantial ongoing investments in upgrading and extending 5G and fiber optic infrastructure. For instance, A1 reported capital expenditures of €700 million in 2023, a significant portion of which was dedicated to network modernization and expansion, aiming to enhance customer experience and attract new subscribers.

This relentless pursuit of technological superiority and broader coverage is a key differentiator. Companies are continuously investing to ensure they offer the latest advancements and the widest availability of high-speed internet. The high capital expenditure reflects the critical importance of maintaining a competitive edge in a market where network performance directly impacts customer acquisition and retention rates.

The competitive landscape for Telekom Austria is intensifying due to the growing presence of Mobile Virtual Network Operators (MVNOs). These companies, which leverage existing network infrastructure, are increasingly capturing market share by offering specialized or more affordable mobile plans. This trend directly impacts traditional operators like A1, compelling them to continually refine their pricing strategies and product portfolios to remain competitive.

By the second quarter of 2024, MVNOs had successfully expanded their collective market share to 17.0% within the Austrian mobile sector. This significant increase demonstrates their growing appeal to consumers seeking alternatives to incumbent providers, further intensifying rivalry and pressuring established players to innovate and offer more compelling value propositions.

Bundled Service and Pricing Strategies

Telekom Austria operates in a market where bundled services are increasingly the norm, combining mobile, fixed-line, internet, and TV offerings. This approach is designed to boost customer loyalty and increase average revenue per user (ARPU), shifting the competitive focus from individual service prices to the overall value proposition. For instance, in 2024, many European telecom providers reported that a significant portion of their customer base was subscribed to at least one bundled package, with ARPU for these customers often being 15-20% higher than for single-service users.

The competitive intensity is particularly high in the data and over-the-top (OTT) service segments, forcing operators to continuously adapt their pricing strategies. This dynamic environment means that pricing is not static; it's a fluid element influenced by new service introductions, competitor actions, and evolving consumer demand for digital content and connectivity.

- Bundling drives ARPU: Customers on bundled plans in 2024 typically saw ARPU figures 15-20% higher than single-service subscribers.

- Value over price: Competition increasingly centers on the comprehensive value of service packages rather than the cost of individual components.

- Dynamic pricing: The data and OTT service markets necessitate constant adjustments to pricing models due to rapid technological and consumer trend changes.

Regulatory Scrutiny and Compliance Costs

Telekom Austria, like other major telecommunications providers, operates within a landscape heavily influenced by regulatory scrutiny. This includes significant costs associated with spectrum auctions, which are crucial for network expansion and service provision. For instance, in 2023, mobile spectrum auctions in various European countries, including those where Telekom Austria operates, saw substantial investments from operators, directly impacting their capital expenditure and profitability.

Compliance with evolving telecommunications acts and directives adds another layer of expense and operational complexity. These regulations often dictate service standards, data privacy, and fair competition practices, requiring continuous investment in systems and processes to ensure adherence. Legal challenges, such as those concerning past service fee structures or data handling, can also lead to unexpected costs and necessitate strategic adjustments.

- Spectrum Auction Costs: Operators face significant upfront investment in acquiring radio frequency spectrum, essential for 5G and future network upgrades.

- Compliance Burden: Adhering to a complex web of national and EU telecommunications laws requires ongoing investment in legal, technical, and administrative resources.

- Legal Challenges: Potential litigation over service fees, consumer rights, or regulatory interpretations can result in fines and impact financial performance.

- Strategic Impact: Regulatory pressures and compliance costs influence pricing strategies, network investment decisions, and overall competitive positioning.

Competitive rivalry within the Austrian telecom market is fierce, characterized by a concentrated player base and aggressive network expansion. A1 Telekom Austria, Magenta Telekom, and 3 Austria are locked in a continuous battle for market share, driven by substantial investments in 5G and fiber optic infrastructure, as evidenced by A1's €700 million capex in 2023 for network modernization.

The rise of MVNOs, which captured 17.0% of the mobile market by Q2 2024, further intensifies this rivalry, forcing incumbents to refine pricing and product offerings. Bundled services are now a key strategy to boost ARPU, with bundled customers seeing 15-20% higher ARPU than single-service users in 2024.

| Metric | Q2 2024 (Austrian Mobile Market) | 2023 (A1 Telekom Austria) |

|---|---|---|

| Market Share (MVNOs) | 17.0% | N/A |

| Capital Expenditures | N/A | €700 million |

| ARPU Premium (Bundled vs. Single) | 15-20% | N/A |

SSubstitutes Threaten

Over-the-top (OTT) communication services like WhatsApp and Zoom are significant substitutes for Telekom Austria's traditional voice and SMS offerings. These platforms leverage internet connectivity, allowing users to communicate globally at little to no cost, directly challenging A1's established revenue streams. In 2024, it's estimated that over 80% of global smartphone users actively utilize OTT messaging apps, a figure that continues to grow, underscoring the substantial threat to traditional telco services.

The increasing availability of free or low-cost Wi-Fi in public areas, offices, and residences significantly diminishes the need for mobile data plans. This widespread Wi-Fi access acts as a direct substitute for mobile data services, particularly for individuals who consume large amounts of data. For instance, in 2024, a substantial portion of smartphone users in Austria reported utilizing public Wi-Fi networks whenever available to conserve their mobile data allowances.

While Telekom Austria, operating as A1, offers robust broadband internet services, the pervasive nature of Wi-Fi can erode its mobile data revenue streams. As more consumers opt for Wi-Fi over cellular data for activities like streaming and browsing, A1's mobile segment faces pressure. Data from late 2023 indicated a growing trend of users prioritizing Wi-Fi connectivity, especially in urban centers where public hotspots are abundant, directly impacting the perceived value of mobile data plans.

Emerging satellite-based internet services, like Starlink, present a growing threat of substitution for Telekom Austria (A1). These providers offer an alternative, especially in rural or underserved regions where traditional broadband infrastructure is less developed. While still a developing market, the increasing reach of satellite internet could attract a segment of A1's broadband customers.

Self-Provisioned IT Solutions for Businesses

Businesses increasingly turn to self-provisioned IT solutions, bypassing traditional telecom offerings. This trend is fueled by the accessibility of cloud computing and edge computing, which provide agility and cost savings. For instance, by mid-2024, the global public cloud market was projected to reach over $600 billion, demonstrating a significant shift towards these alternatives.

These alternatives directly substitute for A1's data and IT services. Companies can build their own data centers or leverage non-telecom specific cloud providers, diminishing their dependence on A1's infrastructure. This allows for greater customization and potentially lower operational expenses.

- Cloud Computing Growth: The worldwide public cloud services market is expected to grow significantly, with projections indicating continued double-digit growth through 2025.

- Edge Computing Adoption: Edge computing offers localized processing, reducing latency and bandwidth needs, making it an attractive alternative for specific business applications.

- Cost Efficiency: Businesses are actively seeking ways to optimize IT spending, and self-provisioned or alternative cloud solutions often present a more cost-effective model than managed telecom services.

- Flexibility and Innovation: Non-telecom providers and in-house solutions can offer greater flexibility in adopting new technologies and adapting to rapidly changing business requirements.

Traditional Media and Entertainment Alternatives

For A1 Telekom Austria's multimedia and TV services, a significant threat of substitutes exists from various entertainment channels. Traditional broadcast television, while declining, still competes for consumer attention. More critically, the rapidly growing popularity of online gaming and a plethora of alternative streaming platforms, especially those not directly bundled with telecom packages, present strong substitutes.

The shift in consumer behavior towards over-the-top (OTT) streaming services and PayTV is a clear indicator of this competitive pressure. By 2024, the global OTT market is projected to continue its robust growth, with revenue expected to reach hundreds of billions of dollars, directly impacting traditional pay-TV subscriptions which have seen a steady decline in many developed markets.

- Alternative Entertainment: Gaming, social media, and other digital content compete for consumer leisure time.

- Streaming Dominance: Services like Netflix, Disney+, and Amazon Prime Video offer vast libraries, directly challenging bundled TV offerings.

- Cord-Cutting Trend: Consumers increasingly opt for flexible, on-demand streaming over traditional cable or satellite packages.

- Content Accessibility: The ease of accessing diverse content across multiple devices further strengthens the appeal of substitutes.

The threat of substitutes for Telekom Austria (A1) is substantial across its core services. Over-the-top (OTT) communication apps like WhatsApp and Zoom directly erode A1's traditional voice and SMS revenue, with over 80% of global smartphone users in 2024 actively using these platforms. Furthermore, widespread free Wi-Fi access reduces the reliance on mobile data plans, impacting A1's mobile segment, as users increasingly prioritize Wi-Fi, especially in urban areas.

| Service Area | Key Substitutes | 2024 Market Insight |

|---|---|---|

| Voice & Messaging | OTT Apps (WhatsApp, Zoom, Telegram) | Over 80% of global smartphone users utilize OTT messaging apps. |

| Mobile Data | Free/Low-Cost Wi-Fi | Increasing adoption of public Wi-Fi, particularly in urban centers. |

| Broadband | Satellite Internet (e.g., Starlink) | Growing reach in underserved regions, offering an alternative to fixed-line broadband. |

| IT & Data Services | Cloud Computing, Edge Computing, Self-Provisioned IT | Global public cloud market projected to exceed $600 billion in 2024. |

| Multimedia/TV | OTT Streaming Services (Netflix, Disney+), Online Gaming | Global OTT market revenue projected to reach hundreds of billions of dollars. |

Entrants Threaten

Entering the telecommunications sector, particularly for a comprehensive service provider like Telekom Austria (A1), demands immense upfront capital. This includes the costly deployment of advanced network infrastructure, such as extensive fiber optic networks and the rollout of 5G base stations. These significant financial requirements act as a formidable barrier, deterring many potential new competitors.

A1's ongoing commitment to network modernization underscores this point. In 2023, the company reported capital expenditure of approximately €761 million, with a substantial portion dedicated to expanding its broadband and 5G capabilities. This continuous investment by incumbents further solidifies the high entry cost for any new players aiming to compete on a similar scale.

The telecommunications sector in Austria is characterized by a complex and stringent regulatory framework. New entrants must navigate licensing requirements, adhere to national telecommunications acts, and often participate in expensive spectrum auctions to secure frequencies for mobile services. This regulatory burden, coupled with the substantial financial commitment needed for spectrum acquisition, acts as a significant barrier to entry.

The 2024 5G spectrum auctions in Austria exemplify this challenge. These auctions demand considerable capital investment and specialized regulatory knowledge, making it exceptionally difficult for new companies to establish a competitive presence. The high cost and complexity associated with obtaining essential operating licenses and spectrum rights effectively deter potential new entrants, thereby strengthening the position of incumbent players like Telekom Austria.

The threat of new entrants for Telekom Austria is significantly mitigated by the deeply entrenched brand loyalty and market dominance enjoyed by established players like A1, Magenta Telekom, and 3 Austria. These incumbents have cultivated strong customer relationships over many years, making it challenging for newcomers to gain traction. A1, as Austria's leading provider, boasts a substantial customer base, further solidifying its position and creating a formidable barrier to entry for any aspiring competitors looking to build trust and acquire market share.

Wholesale Access and Regulatory Facilitation

Regulatory changes, such as the deregulation of wholesale broadband access, can significantly lower the barriers to entry for new telecommunications companies. For instance, the implementation of VULA 2.0 and VHCN contracts allows smaller players and Mobile Virtual Network Operators (MVNOs) to leverage existing infrastructure. This reduces the substantial capital expenditure typically required for network build-out, making market entry more feasible.

While the threat of new entrants isn't entirely eliminated, these regulatory facilitators enable a different kind of competition. Instead of needing to build their own extensive physical networks, new companies can focus on service innovation and customer acquisition by utilizing the infrastructure of incumbents like Telekom Austria. This shift is crucial in a market that historically demands massive upfront investment.

- Lowered Capital Intensity: Facilitation of wholesale access, like VULA 2.0, reduces the need for new entrants to invest heavily in physical infrastructure.

- Increased MVNO Activity: Regulatory frameworks can empower Mobile Virtual Network Operators to enter the market by reselling services on existing networks.

- Focus on Service Innovation: With infrastructure access granted, new entrants can differentiate themselves through unique service offerings rather than network superiority.

Technological Expertise and Innovation Pace

New entrants in the telecommunications sector, like Telekom Austria, face a significant hurdle due to the high level of technological expertise required. Staying competitive means understanding and implementing cutting-edge technologies such as artificial intelligence for network optimization and advanced real-time data analytics for customer insights. For instance, the rollout of 5G technology across Europe, a key area for telecom operators, necessitates substantial investment in new infrastructure and skilled personnel.

The rapid pace of technological advancement presents another formidable barrier. Companies must continuously innovate and invest heavily in research and development to keep up. Telekom Austria, for example, has been investing in areas like fiber optic expansion and cloud services. New entrants without established R&D departments and the financial capacity for ongoing technological upgrades will find it extremely difficult to match the capabilities of incumbents.

- High Capital Investment: Deploying advanced network infrastructure, such as 5G, requires billions in capital expenditure, a significant barrier for new players.

- Intellectual Property & Patents: Established firms often hold key patents for critical technologies, making it harder for newcomers to operate without licensing agreements.

- Skilled Workforce Demand: The need for specialized engineers and technicians in areas like AI, cybersecurity, and network management creates a talent acquisition challenge for new entrants.

While significant capital investment and regulatory hurdles present substantial barriers, the threat of new entrants for Telekom Austria is somewhat moderated by regulatory frameworks that facilitate market entry for niche players. The availability of wholesale access agreements, for example, allows Mobile Virtual Network Operators (MVNOs) to leverage existing infrastructure, reducing the need for extensive network build-out. This enables competition based on service innovation rather than solely on network capabilities.

In 2024, the Austrian telecommunications market continues to see the influence of these factors. While major network operators like Telekom Austria (A1), Magenta Telekom, and 3 Austria maintain strong positions due to their established infrastructure and brand recognition, the MVNO segment offers a more accessible entry point. These smaller operators, while not building their own physical networks, can still capture market share by offering specialized plans and targeting specific customer segments, thus posing a differentiated threat.

| Factor | Impact on New Entrants | Example for Telekom Austria (2024 Context) |

|---|---|---|

| Wholesale Access Agreements | Reduces capital expenditure for network build-out | MVNOs can utilize A1's network to offer services, lowering their entry cost. |

| Service Innovation Focus | Allows differentiation without network superiority | New entrants can compete on unique pricing, customer service, or bundled digital services. |

| MVNO Market Presence | Provides a viable alternative entry strategy | The continued growth of MVNOs demonstrates that market entry is possible without massive infrastructure investment. |

Porter's Five Forces Analysis Data Sources

Our Telekom Austria Porter's Five Forces analysis is built upon a foundation of comprehensive data, including annual reports, investor presentations, and regulatory filings. We also incorporate insights from reputable industry analysis firms and market research reports to capture the competitive landscape.