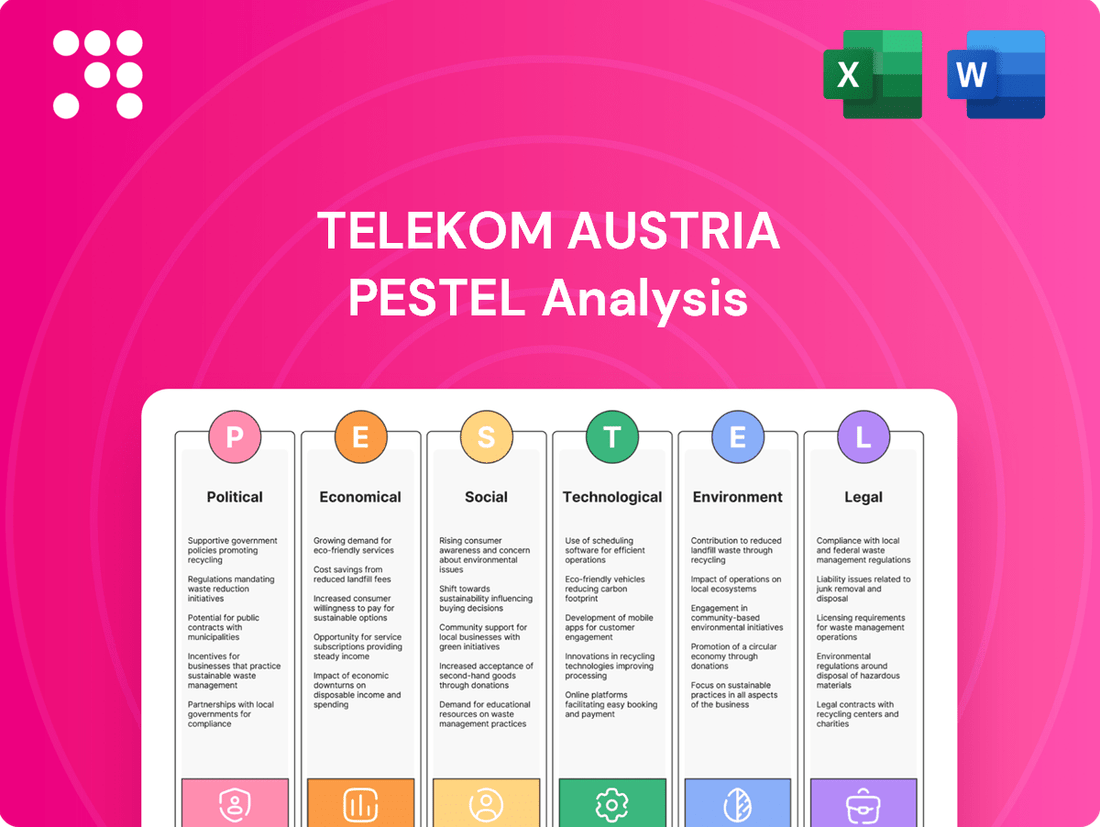

Telekom Austria PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Telekom Austria Bundle

Navigate the complex external landscape impacting Telekom Austria with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping the telecommunications sector and the company's strategic direction. Gain critical insights to inform your investment decisions and competitive strategies.

Political factors

The Austrian telecommunications sector is overseen by the Regulatory Authority for Broadcasting and Telecommunications (RTR) and the Telecommunications Competition Authority (TKK). These bodies are instrumental in managing spectrum licensing and defining market parameters, directly influencing companies like Telekom Austria (A1). Their decisions shape the competitive landscape and the availability of essential radio frequencies for network expansion and service innovation.

The TKK's strategic spectrum release plan for 2022–2026 included significant auctions. Notably, frequencies within the 3410–3470MHz range were auctioned in March 2024, a critical move for 5G expansion. Additionally, the 26GHz band was allocated specifically for private campus and industrial network use, opening new avenues for specialized enterprise solutions and further impacting A1's strategic deployment of advanced network technologies.

European policymakers are actively encouraging mergers, acquisitions, and innovation investments in the telecom sector to boost global competitiveness. This is highlighted in the European Commission's September 2024 report on 'The Future of European Competitiveness'.

The Digital Networks Act, slated for the Commission's 2025 Work Programme, is designed to foster an investment-friendly climate. This policy directly influences A1's strategic planning and investment decisions, shaping its approach to market development and technological advancement.

The Austrian government's commitment to digital infrastructure is a significant political factor for Telekom Austria. They are actively supporting national broadband programs with substantial funding, recently allocating an additional EUR 1.4 billion. This demonstrates a clear policy direction towards enhancing digital connectivity across the country.

A1 Telekom Austria is a key player in this national push, investing heavily in broadband expansion. Their own significant investments, such as EUR 15 million dedicated to Fiber-to-the-Home (FTTH) connections, align directly with government objectives. This proactive approach by the company leverages public support and contributes to the overall digital transformation.

Highlighting the collaborative nature of these efforts, EUR 1.7 million from the EU National Recovery and Resilience Plan is contributing to A1's FTTH projects. This public-private partnership model is crucial for accelerating the deployment of advanced digital infrastructure, ensuring wider access and faster internet speeds for citizens and businesses alike.

Political Stability in Operating Countries

Political stability in the Central and Eastern European (CEE) countries where A1 Telekom Austria operates significantly impacts its business. Fluctuations in political landscapes can affect regulatory environments, investment climates, and ultimately, the company's financial results.

For instance, the economic pressures in Belarus, including the depreciation of the Belarusian Ruble in 2024, are projected to persist into 2025. This currency devaluation directly challenges A1 Telekom Austria's revenue and EBITDA growth in that specific market, highlighting the tangible financial consequences of political and economic instability.

- Belarusian Ruble Depreciation: Continued pressure on revenue and EBITDA growth in Belarus due to currency devaluation in 2024 and expected into 2025.

- Geopolitical Risk Exposure: A1 Telekom Austria's operations across multiple CEE countries expose it to a range of geopolitical risks that can create volatility.

- Regulatory Environment Impact: Changes in government policies and regulations in operating countries can directly affect A1 Telekom Austria's service offerings and profitability.

Fraud Prevention and Consumer Protection

Austrian regulators are enhancing fraud prevention in the telecommunications sector, a crucial step for consumer protection. Measures include mandatory validation for calls that appear to originate domestically but are actually international, aiming to curb spoofing. For instance, in 2024, the Austrian regulatory authority, RTR, reported a significant increase in reported fraud attempts, highlighting the need for such protective actions.

A1 Telekom Austria is a key player in this fight, actively developing countermeasures against prevalent fraud schemes. The company has invested in advanced analytics and detection systems to combat specific threats like 'Wangiri' attacks, which involve missed calls designed to trick users into calling back premium-rate numbers. This proactive stance not only safeguards A1's customers but also reinforces the integrity of the Austrian telecommunications network.

- Mandatory Call Validation: Austrian authorities are enforcing stricter validation protocols for international calls masquerading as domestic ones.

- A1's Fraud Countermeasures: A1 Telekom Austria is developing and deploying solutions to combat specific fraud types, such as Wangiri attacks.

- Consumer Protection Focus: These collaborative efforts between regulators and telecom providers are vital for protecting consumers and maintaining trust in telecommunication services.

- Regulatory Oversight: The Austrian regulatory body, RTR, actively monitors and implements policies to ensure a secure telecommunications environment.

Government initiatives like the Digital Networks Act, planned for 2025, aim to create an investment-friendly environment, directly influencing A1 Telekom Austria's strategic decisions. Furthermore, the Austrian government's commitment to digital infrastructure is evident through substantial funding for national broadband programs, with an additional EUR 1.4 billion allocated. This aligns with A1's own investments, such as EUR 15 million for Fiber-to-the-Home (FTTH) connections, often supported by EU funds like EUR 1.7 million from the National Recovery and Resilience Plan.

Political stability across the Central and Eastern European (CEE) markets where A1 operates is crucial, as instability can impact regulations and investment climates. For example, the Belarusian Ruble's depreciation in 2024, expected to continue into 2025, directly affects A1 Telekom Austria's revenue and EBITDA in that region.

Regulators, such as Austria's RTR, are enhancing fraud prevention, with mandatory validation for international calls disguised as domestic ones. This is a response to increased fraud attempts reported in 2024, prompting companies like A1 to invest in countermeasures against schemes like Wangiri attacks.

European policymakers are actively encouraging telecom sector consolidation and innovation to boost global competitiveness, as noted in a September 2024 European Commission report.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Telekom Austria, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

It offers actionable insights into market dynamics and regulatory landscapes, empowering strategic decision-making for stakeholders.

A PESTLE analysis for Telekom Austria offers a structured way to navigate complex external factors, serving as a pain point reliever by providing clarity on political, economic, social, technological, legal, and environmental influences impacting the business.

Economic factors

Global economic growth saw a rebound in 2024, with expectations for continued stability into 2025. However, Austria itself faced a recession in 2024, and projections for 2025 indicate only modest Gross Domestic Product (GDP) expansion.

In contrast, many Central and Eastern European (CEE) countries where A1 Telekom Austria Group has a significant presence are anticipated to experience more robust GDP growth rates. For instance, Poland's GDP is forecast to grow by 3.1% in 2025, and Romania's by 3.3%, according to the European Commission's Autumn 2024 Economic Forecast.

This divergence in economic performance creates a varied financial environment for A1. While the CEE markets offer stronger growth potential, the slower recovery in Austria presents a more challenging domestic landscape for the group's operations and revenue generation.

Inflation in the eurozone saw a notable decline, reaching 2.4% in 2024. This easing inflationary pressure allowed the European Central Bank to implement four interest rate cuts throughout the year.

This shift towards more accommodating economic conditions is projected to persist into 2025. Such a trend could lead to lower borrowing costs for A1, potentially impacting its capital expenditure and operational financing.

Furthermore, the anticipated reduction in borrowing expenses and a generally more stable economic outlook may positively influence consumer spending on telecommunication services, a key market for A1.

A1 Group's commitment to capital expenditure (CAPEX) and network investment is a significant economic factor, with plans for around EUR 800 million in 2025, excluding spectrum costs. This investment is primarily directed towards enhancing their fiber and 5G infrastructure across Austria and other operating regions, aiming to secure future growth and competitive positioning.

However, the first half of 2025 saw a notable 19.3% reduction in CAPEX, totaling EUR 387 million. This decrease was largely attributed to lower investment levels within Austria, indicating a potential shift or phasing in network development strategies.

Revenue and Profitability Performance

A1 Group's financial performance in early 2025 demonstrates a positive trend in revenue generation. For the first quarter of 2025, total revenue saw a healthy increase of 3.7%. This growth was primarily fueled by service revenues expanding across most of its operating markets, with the exception of Austria.

Looking ahead, the company has set an optimistic outlook for the full financial year 2025, projecting a total revenue growth in the range of 2-3%. This suggests a strategy focused on leveraging international market strengths to offset any potential headwinds in its domestic Austrian operations.

- 3.7% Total revenue increase in Q1 2025.

- 2-3% Projected total revenue growth for FY 2025.

- Service revenues grew across most markets, excluding Austria.

Competitive Market Landscape

The Austrian telecommunications sector, projected to reach EUR 9.82 billion in 2025, faces fierce competition. Telekom Austria (A1) contends with significant rivals such as Magenta Telekom and 3 Austria, as well as a growing number of mobile virtual network operators (MVNOs).

This dynamic market necessitates aggressive pricing strategies and a constant push for innovative bundled services. To secure its standing, A1 must actively differentiate its offerings and adapt to evolving consumer demands.

- Market Value: EUR 9.82 billion (2025 projection).

- Key Players: Telekom Austria (A1), Magenta Telekom, 3 Austria.

- Emerging Competition: Mobile Virtual Network Operators (MVNOs).

- Strategic Imperative: Service differentiation and innovation.

Economic factors present a mixed outlook for Telekom Austria (A1). While the eurozone's inflation eased to 2.4% in 2024, enabling interest rate cuts, Austria's domestic economy experienced a recession in 2024 with only modest GDP growth anticipated for 2025.

Conversely, A1's Central and Eastern European markets are projected for stronger GDP growth, with Poland at 3.1% and Romania at 3.3% in 2025, offering a more favorable environment for revenue expansion.

A1's planned CAPEX of around EUR 800 million for 2025, despite a 19.3% reduction in the first half to EUR 387 million, highlights continued investment in fiber and 5G, crucial for future competitiveness.

The company's Q1 2025 revenue increased by 3.7%, driven by service revenue growth in most markets except Austria, and a full-year revenue growth projection of 2-3% for 2025 indicates a reliance on international markets.

| Economic Indicator | Austria (2025 Projection) | CEE Average (2025 Projection) | Eurozone (2024) |

|---|---|---|---|

| GDP Growth | Modest | ~3.2% (e.g., Poland, Romania) | Rebound |

| Inflation | Declining | Varied | 2.4% |

| Interest Rates | Likely Decreasing | Varied | Decreasing (4 cuts in 2024) |

Preview Before You Purchase

Telekom Austria PESTLE Analysis

The preview shown here is the exact Telekom Austria PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real look at the comprehensive PESTLE analysis of Telekom Austria you’re buying—delivered exactly as shown, no surprises.

The content and structure of this Telekom Austria PESTLE Analysis preview is the same document you’ll download after payment.

Sociological factors

Consumer behavior is rapidly evolving, with a pronounced shift towards digital services. This includes a surging demand for high-speed internet, robust mobile broadband, and over-the-top (OTT) media services, directly fueling market expansion for telecom operators.

A1 Telekom Austria is strategically positioned to benefit from this trend, focusing on providing seamless connectivity and comprehensive ICT solutions for both individual users and businesses. The company's commitment to these areas is reflected in its growth, particularly in fixed-line services across its international operations.

A1 Telekom Austria is actively bridging the digital divide through programs like the A1 Digital Campus and A1 Senior Academy. These initiatives are crucial for ensuring that individuals across all age groups can participate fully in the digital economy. By making digital education accessible, A1 fosters a more digitally skilled and connected population, a key sociological trend impacting service adoption.

A1 is actively reshaping its workforce through efficiency projects and transformation initiatives, notably by establishing new competence delivery centers. These moves are designed to streamline operations and make better use of its human capital.

Despite a slight rise in workforce costs during the first half of 2025, driven by accelerated restructuring, the company's strategic aim is clear: to achieve sustained efficiency and adaptability in its operations.

Corporate Social Responsibility and Community Engagement

A1 Group, as a significant player in the telecommunications sector, demonstrates a strong commitment to Corporate Social Responsibility (CSR) and community engagement, aligning with growing societal expectations. This focus is not just about goodwill; it's integrated into their core strategy as an Environmental, Social, and Governance (ESG) enabler. For instance, in 2023, A1 Group reported significant progress across various ESG metrics, including a reduction in CO2 emissions by 15% compared to 2022 and increased investment in digital inclusion programs reaching over 50,000 individuals.

The company's dedication to supporting United Nations Sustainable Development Goals (SDGs) is evident through its diverse initiatives. These efforts directly address societal needs and contribute to broader social welfare, reflecting a global trend where businesses are increasingly held accountable for their social impact. A1 Group's 2024 sustainability report highlights partnerships with local NGOs, contributing to projects focused on education and digital literacy, which are crucial for community development.

- ESG Integration: A1 Group embeds ESG principles as a core strategy enabler, influencing business decisions and operations.

- SDG Alignment: The company actively supports various UN SDGs through its diverse CSR activities, demonstrating a commitment to global sustainability targets.

- Community Investment: A1 Group invests in community programs, particularly those focused on digital inclusion and education, as seen in their 2023 and 2024 initiatives.

- Societal Expectation: There is a clear societal expectation for telecommunications companies like A1 Group to contribute positively to social welfare and sustainable development.

Data Privacy Concerns and Trust

Public and regulatory scrutiny over data privacy is a major sociological factor for telecom companies like Telekom Austria. Concerns about how personal data is handled are paramount, influencing customer loyalty and regulatory compliance. For instance, A1 Telekom Austria has faced GDPR complaints related to accessing customer traffic data, underscoring the sensitivity surrounding this issue.

Building and maintaining customer trust is critical in this environment. Telekom Austria must demonstrate robust data protection measures and transparent data handling policies. In 2024, data breaches and privacy violations continue to be a significant concern for consumers across Europe, with many reporting a reluctance to share personal information online. A1's commitment to data security directly impacts its reputation and customer retention rates.

- Public Scrutiny: Growing public awareness of data usage and potential misuse.

- Regulatory Landscape: Strict enforcement of data protection laws like GDPR.

- Trust as a Differentiator: Customer loyalty is increasingly tied to perceived data security.

- Past Incidents: Previous GDPR complaints highlight existing vulnerabilities and public perception.

Societal shifts towards digital lifestyles are a primary driver for Telekom Austria, with a strong demand for high-speed internet and mobile services continuing to grow. A1's commitment to bridging the digital divide through initiatives like the A1 Digital Campus and A1 Senior Academy ensures broader societal participation in the digital economy, fostering a more connected population.

Technological factors

A1 Telekom Austria is aggressively pushing forward with its 5G network expansion, aiming for high population coverage across its key markets. This commitment is crucial for staying competitive and offering cutting-edge mobile services.

A significant milestone was reached in May 2024 when A1 partnered with Nokia to achieve impressive data transmission speeds of up to 2 Gigabits per second utilizing 5G mmWave technology. This demonstrates A1's dedication to leveraging advanced 5G capabilities.

Continued investment in 5G infrastructure is essential for A1 to maintain its leadership position and enable the next generation of mobile applications and services, from enhanced mobile broadband to low-latency IoT solutions.

A1 Telekom Austria is making significant strides in its fiber optic infrastructure, having extended its network to approximately 77,000 kilometers across Austria by the close of 2024. This aggressive expansion is a key technological driver for the company, aiming to bring high-speed internet to over 4 million households and businesses.

This substantial investment in fiber optics is crucial for meeting the ever-growing demand for data and ensuring robust broadband connectivity. It positions A1 to offer advanced services and maintain a competitive edge in the digital landscape.

Telekom Austria is significantly benefiting from the integration of Artificial Intelligence (AI) and the Internet of Things (IoT). AI is proving crucial in upgrading network capabilities, from current 5G to future 6G, and is paving the way for sophisticated uses like augmented reality.

The company is utilizing AI to streamline operations, which includes reducing expenses and improving customer support. For instance, AI-powered analytics can predict network issues before they impact users, leading to proactive maintenance and cost savings.

Furthermore, the growing investments in AI and data centers are directly fueling a greater need for robust fiber optic infrastructure within the telecommunications sector. This trend is expected to continue as AI applications become more data-intensive.

Network Modernization and 3G Switch-off

A1 Telekom Austria began decommissioning its 3G network in March 2024, aiming for a full nationwide shutdown by 2025. This strategic move frees up valuable spectrum, which is then repurposed for their more advanced 4G and 5G networks. This network modernization is crucial for enhancing overall performance and capacity.

The reallocation of spectrum from the 3G switch-off directly supports the expansion and improvement of 4G and 5G services. This upgrade is expected to lead to better data speeds and a more reliable mobile experience for customers. Such infrastructure upgrades are key to staying competitive in the telecommunications sector.

Beyond improved connectivity, the modernization contributes to greater energy efficiency within A1's infrastructure. By consolidating resources onto newer, more efficient technologies like 4G and 5G, the company can reduce its overall energy consumption. This aligns with broader industry trends towards sustainability and operational cost reduction.

Key aspects of this technological shift include:

- 3G Network Decommissioning: Started March 2024, with nationwide completion targeted for 2025.

- Spectrum Reallocation: Freed-up 3G spectrum is being utilized for 4G and 5G network enhancement.

- Performance Boost: Modernization aims to significantly improve network speed, capacity, and reliability.

- Energy Efficiency Gains: Transition to newer technologies is projected to lower the company's energy footprint.

Development of B2B Digital Services

The development of B2B digital services is a key technological factor for Telekom Austria (A1 Group). In the first quarter of 2025, A1 Group launched a dedicated competence delivery center for B2B digital services, signaling a significant investment in this area. This initiative is designed to broaden A1's portfolio of digital solutions, encompassing vital areas like Information and Communication Technology (ICT), cloud computing, and cybersecurity for businesses.

This strategic focus directly addresses the escalating demand from enterprises for integrated and robust digital solutions. By bolstering its capabilities in these segments, A1 aims to solidify its standing as a crucial partner in the digitalization journey for businesses. The company's commitment is underscored by its expansion of offerings, aligning with market trends that favor comprehensive digital transformation support.

A1's move into specialized B2B digital services reflects a broader industry trend where telecommunications providers are evolving beyond traditional connectivity. This pivot allows them to capture a larger share of the enterprise IT spending, which is increasingly allocated towards digital transformation initiatives. For instance, the global B2B cloud services market alone was projected to reach over $300 billion in 2024, highlighting the immense opportunity.

Key aspects of A1's B2B digital services development include:

- Expansion of ICT Offerings: Providing businesses with advanced information and communication technology solutions to streamline operations.

- Cloud Service Integration: Offering robust cloud infrastructure and services to support business scalability and flexibility.

- Enhanced Cybersecurity Solutions: Delivering comprehensive security measures to protect businesses from evolving cyber threats.

- Digitalization Partnership: Positioning A1 as a strategic ally for companies undergoing digital transformation.

A1 Telekom Austria is heavily investing in its 5G network, aiming for widespread coverage and achieving speeds of up to 2 Gbps with Nokia's mmWave technology by May 2024. This expansion is critical for maintaining competitiveness and enabling advanced applications. Simultaneously, the company is bolstering its fiber optic infrastructure, reaching approximately 77,000 kilometers by the end of 2024 to connect over 4 million households and businesses, meeting rising data demands.

The company is leveraging AI to enhance network performance, from 5G to future 6G, and for operational efficiencies like predictive maintenance, reducing costs and improving customer support. A major technological shift involves the decommissioning of the 3G network, initiated in March 2024 and slated for nationwide completion by 2025. This frees up spectrum for 4G and 5G upgrades, improving speeds and reliability while also increasing energy efficiency.

A1 is also expanding its B2B digital services, launching a dedicated competence center in Q1 2025 to offer ICT, cloud, and cybersecurity solutions. This move targets the growing enterprise demand for digital transformation, positioning A1 as a key partner in this evolving market, capitalizing on the projected over $300 billion B2B cloud services market in 2024.

| Technology Focus | Status/Target | Key Impact |

|---|---|---|

| 5G Network Expansion | Ongoing, ~2 Gbps speeds achieved (May 2024) | Enhanced mobile services, competitiveness |

| Fiber Optic Infrastructure | 77,000 km by end of 2024 | High-speed internet for 4M+ households/businesses |

| 3G Network Decommissioning | Started March 2024, nationwide by 2025 | Spectrum reallocation for 4G/5G, energy efficiency |

| B2B Digital Services | Competence center launched Q1 2025 | Expanded ICT, cloud, cybersecurity offerings |

Legal factors

The Austrian Telecommunications Act (TKG 2020), effective from November 2021, aligns with the EU's Electronic Communications Code (EECC). This pivotal legislation mandates strict adherence to network security standards, robust consumer protection measures, and specific data privacy protocols tailored for the telecommunications industry. A1 must navigate these national and supranational legal requirements.

Compliance with TKG 2020 and related EU directives is crucial for A1 Telekom Austria. For instance, the EECC aims to foster investment in high-speed networks and enhance consumer choice, impacting service offerings and pricing strategies. Failure to comply can result in significant penalties, affecting revenue and market reputation.

A1 Telekom Austria navigates a complex legal landscape, particularly concerning data protection. The General Data Protection Regulation (GDPR) requires A1 to grant customers access to their personal data upon request, a significant operational consideration.

The EU's Data Act, effective September 2025, will further shape data sharing practices, aiming to enhance legal clarity for data exchange within the market. This legislation could influence how A1 leverages data from its services and partnerships.

Moreover, the AI Act, which came into force in August 2024, establishes a foundational legal framework for artificial intelligence. This directly impacts A1's strategies for developing and deploying AI technologies, necessitating compliance with new guidelines on AI risk management and transparency.

The Telekom Control Commission (TKK) plays a vital role in Austria's telecommunications landscape, primarily by managing spectrum licensing. This includes the crucial task of allocating frequencies, ensuring that operators like A1 meet specific coverage criteria outlined in their 5G licenses. For instance, as of early 2024, A1's ongoing 5G rollout is directly influenced by these TKK directives, requiring substantial investment to meet mandated population coverage targets.

Adherence to these regulatory obligations is not merely a formality for A1; it's fundamental to its continued operation and strategic growth. Failure to comply with the coverage criteria stipulated in their 5G licenses could jeopardize A1's ability to maintain its operational licenses, thereby hindering its ambitious network expansion plans and impacting future service delivery.

Consumer Protection and Contractual Terms

Austrian telecommunications law places significant emphasis on consumer protection, particularly regarding contractual agreements. Regulations stipulate that initial contract durations for telecommunications services cannot exceed 24 months, with a mandatory option for a 12-month contract also available. This framework is designed to foster a competitive market by reducing barriers for consumers wishing to switch providers.

For a company like A1 Telekom Austria, adherence to these consumer protection standards is paramount. This includes ensuring all contractual terms are transparent and fair, and that sales practices do not mislead or unduly influence consumers. Compliance safeguards against potential fines and reputational damage, while also building customer trust.

Key aspects of compliance for A1 include:

- Contract Duration Limits: Strictly adhering to the maximum 24-month initial contract term and offering the legally required 12-month alternative.

- Transparency in Terms: Clearly communicating all contract conditions, including pricing, service levels, and termination clauses, to consumers.

- Fair Sales Practices: Ensuring sales representatives provide accurate information and avoid aggressive or deceptive sales tactics.

- Consumer Complaint Resolution: Establishing effective mechanisms for addressing consumer complaints and disputes in line with regulatory requirements.

Competition Law and Market Consolidation

European competition authorities are showing a greater willingness to approve mergers within the telecommunications sector. This shift is often contingent on the merging entities committing to significant investments in network infrastructure, such as 5G or fiber optic rollouts. For instance, the European Commission approved the merger of Orange and MásMóvil in Spain in early 2024, a deal valued at approximately €18.6 billion, provided certain remedies were met to maintain competition. This trend suggests a potential move towards a less fragmented European telecom market, which could alter the competitive dynamics for players like A1 Telekom Austria.

These regulatory approvals, often tied to investment pledges, indicate a strategic acceptance of consolidation as a means to foster network modernization across the continent. A1 Telekom Austria must closely track these evolving regulatory stances and market consolidation activities. Such developments could present both challenges and opportunities for A1, potentially influencing future strategic decisions regarding partnerships, mergers, or acquisitions to maintain or enhance its market position. For example, ongoing discussions and potential consolidation in neighboring markets could impact A1's strategic planning and competitive environment.

- Regulatory Shift: European regulators are becoming more receptive to telecom mergers, often linking approvals to network investment commitments, such as those for 5G deployment.

- Market Reshaping: This trend could lead to a less fragmented European telecom market, potentially consolidating market share among fewer, larger players.

- A1's Strategy: A1 Telekom Austria needs to monitor these developments closely to identify potential strategic partnership or acquisition opportunities and to anticipate shifts in the competitive landscape.

- Investment Drivers: Mergers are increasingly seen as a way to fund the substantial capital required for next-generation network infrastructure upgrades across Europe.

The Austrian legal framework, particularly the Telecommunications Act (TKG 2020), mandates stringent consumer protection and data privacy rules for operators like A1. These regulations, aligned with EU directives such as the EECC, require transparent contract terms and fair sales practices, with initial contract durations capped at 24 months, offering a 12-month alternative to promote consumer choice.

A1 must also comply with the GDPR, ensuring customer access to personal data, and prepare for the EU's Data Act effective September 2025, which will govern data sharing practices. Furthermore, the AI Act, in effect since August 2024, imposes new compliance requirements for A1's AI development and deployment strategies, focusing on risk management and transparency.

The Telekom Control Commission (TKK) is instrumental in managing spectrum licensing, with A1's 5G rollout contingent on meeting coverage targets outlined in its licenses, as seen in early 2024. Failure to meet these criteria could jeopardize A1's operational licenses and expansion plans.

European competition authorities are increasingly approving telecom mergers, often conditional on significant network investment commitments, such as those for 5G. This trend, exemplified by the €18.6 billion Orange-MásMóvil merger approved in early 2024, suggests a move towards market consolidation and necessitates A1's strategic monitoring of these evolving dynamics.

Environmental factors

A1 Group has solidified its dedication to environmental stewardship by setting ambitious Net Zero targets, which were validated by the Science Based Targets initiative (SBTi) in November 2024. This validation underscores the company's serious approach to climate action.

The core of their strategy involves a significant reduction in emissions; A1 Group is targeting a 90% decrease in its direct and controlled emissions by 2030, using 2019 as the baseline year. This objective is a critical component of their broader environmental commitment.

A1 is making significant strides in improving its energy efficiency and boosting its use of renewable energy. The company has a clear goal to reach 100% renewable energy use, provided market conditions are favorable, as outlined in its Clean Energy Policy. This strategic shift not only helps cut down on operational expenses but also directly contributes to lowering carbon emissions.

A1 Group actively champions circular economy principles, focusing on extending product and material lifecycles through reuse and refurbishment. This commitment is demonstrated by their annual recycling and refurbishment of around 130,000 end devices, significantly reducing the need for virgin resources and minimizing waste generation.

Sustainable Infrastructure Development

Telekom Austria, operating as A1, is actively investing in sustainable infrastructure by upgrading its networks. The expansion of fiber optic and 5G networks is a key strategy, as these technologies are significantly more energy-efficient than the older copper networks they replace. This transition not only enhances service quality but also reduces the overall energy footprint of the company's operations.

A1 is also making strides in phasing out older, power-intensive technologies. The decommissioning of 3G networks is a prime example, further contributing to energy savings and operational efficiency. This proactive approach to network modernization aligns with broader environmental goals and demonstrates a commitment to a greener technological future.

Beyond network infrastructure, A1 is focusing on the sustainability of its operational fleet. By electrifying its vehicle fleet, the company is reducing its reliance on fossil fuels and cutting down on emissions. This holistic approach to sustainable infrastructure development encompasses both its core network assets and its logistical operations.

- Network Efficiency: Fiber and 5G networks consume less energy per bit transmitted compared to legacy copper networks.

- 3G Decommissioning: Phasing out 3G technology in Austria by the end of 2024 will lead to further energy savings.

- Fleet Electrification: A1 aims to electrify a significant portion of its vehicle fleet, targeting a substantial reduction in CO2 emissions from its mobile workforce. For instance, by the end of 2023, A1 Group had already introduced over 600 electric vehicles into its fleet.

- Renewable Energy: A1 is increasingly sourcing electricity from renewable energy sources to power its infrastructure, further enhancing its environmental performance.

Environmental Management Systems and Reporting

A1 Group's commitment to environmental stewardship is underscored by its implementation of an audited Environmental Management System (EMS) across all subsidiaries. This system is designed to proactively manage environmental risks and pinpoint opportunities for ongoing enhancement, ensuring a structured approach to sustainability.

Transparency is a key element of A1 Group's environmental reporting. The company regularly releases detailed reports, such as its Sustainability Statement and a specific Water Risk Report. These publications offer stakeholders clear insights into the company's environmental performance metrics.

For instance, A1 Group's 2023 Sustainability Report highlighted a reduction in absolute Scope 1 and 2 greenhouse gas emissions by 20.6% compared to the 2019 baseline, reaching 155.4 kilotons of CO2 equivalent. This demonstrates tangible progress in their environmental targets.

- Audited Environmental Management System (EMS): Implemented across all A1 Group subsidiaries for effective risk management and continuous improvement.

- Comprehensive Reporting: Regular publication of Sustainability Statements and Water Risk Reports to ensure transparency.

- Greenhouse Gas Emission Reduction: Achieved a 20.6% reduction in absolute Scope 1 and 2 emissions by 2023 compared to a 2019 baseline.

- Water Risk Management: Specific reporting focuses on water usage and associated risks within operations.

Telekom Austria, as A1, is actively navigating environmental regulations and market expectations by investing in sustainable network upgrades. The shift to more energy-efficient fiber optic and 5G networks, alongside the decommissioning of 3G by the end of 2024, directly contributes to a reduced carbon footprint. Furthermore, A1's commitment to electrifying its vehicle fleet, with over 600 electric vehicles already in use by the end of 2023, demonstrates a proactive approach to minimizing operational emissions.

| Environmental Initiative | Status/Target | Impact/Data |

|---|---|---|

| Net Zero Targets | Validated by SBTi (Nov 2024) | Commitment to ambitious climate action |

| Emission Reduction | 90% reduction in Scope 1 & 2 by 2030 (vs. 2019) | Achieved 20.6% reduction by 2023 |

| Renewable Energy Use | Targeting 100% (market dependent) | Increasing sourcing from renewables |

| Fleet Electrification | Over 600 EVs by end of 2023 | Reducing CO2 emissions from mobile workforce |

| 3G Network Decommissioning | By end of 2024 (Austria) | Further energy savings and efficiency |

PESTLE Analysis Data Sources

Our Telekom Austria PESTLE Analysis is meticulously crafted using data from official Austrian government publications, European Union regulatory bodies, and leading telecommunications industry reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.