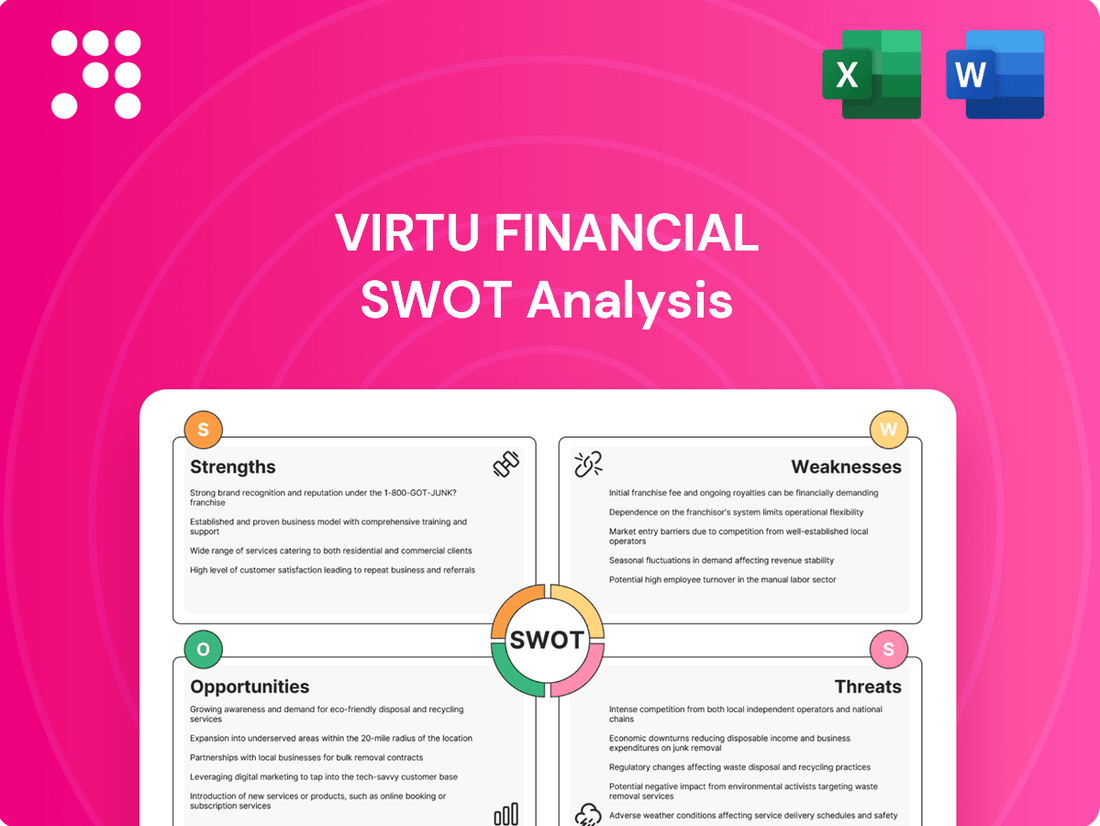

Virtu Financial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Virtu Financial Bundle

Virtu Financial leverages its technological prowess and global reach as significant strengths, but faces intense competition and regulatory scrutiny as key challenges. Understanding these dynamics is crucial for anyone looking to invest or strategize within the financial technology sector.

Want the full story behind Virtu Financial's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Virtu Financial's advanced technology infrastructure is a cornerstone of its success, enabling high-frequency trading and efficient market-making. This proprietary technology allows them to process millions of trades daily with minimal human oversight, a critical factor in maintaining speed and accuracy in global financial markets.

Their scalable and modular platform is directly integrated with exchanges and liquidity centers worldwide. In 2023, Virtu processed an average of 15.4 billion shares per day, showcasing the immense capacity and efficiency of their technological backbone. This integration is vital for their competitive edge.

Virtu Financial's strength lies in its extensive market making capabilities, operating across more than 50 countries and over 200 trading venues. This global reach, spanning equities, ETFs, FX, futures, fixed income, and even cryptocurrencies, provides a significant competitive advantage. For instance, in Q1 2024, Virtu reported record revenue of $778 million, partly driven by this broad market participation.

This diversification across numerous asset classes and geographies acts as a natural hedge, mitigating risks associated with any single market or instrument. It allows Virtu to consistently capture trading opportunities and generate revenue streams from a wide variety of global financial activities, as evidenced by their consistent profitability across different economic cycles.

Virtu Financial consistently showcases robust financial performance, a key strength. In the first quarter of 2025, the company reported a substantial 30.3% increase in total revenue, reaching $837.9 million, and a remarkable 70% surge in net income to $189.6 million when compared to the same period in 2024. This growth underscores the company's ability to generate strong returns.

This impressive financial health is directly linked to Virtu's operational efficiency. The company maintains a high Adjusted EBITDA margin, a testament to its disciplined approach to expense management. This efficiency allows Virtu to scale its operations effectively and capitalize on market opportunities, further solidifying its financial standing.

Resilience to Market Volatility

Virtu Financial's core business as a high-frequency trading firm and market maker inherently benefits from increased market volatility. During turbulent periods, wider bid-ask spreads typically emerge, directly translating into higher trading income for Virtu. This resilience means their business model thrives even when markets are unpredictable, offering a unique advantage.

For instance, in the first quarter of 2024, Virtu reported a significant uptick in trading volumes and revenue, directly correlating with heightened market activity. This demonstrates their ability to capitalize on market swings. Their strategic approach allows for consistent performance, providing both a buffer against downturns and opportunities for profit through agile rebalancing.

- Profits from Volatility: Virtu's market-making model thrives when trading volumes and price fluctuations increase.

- Wider Spreads: Increased volatility leads to wider bid-ask spreads, enhancing Virtu's trading income.

- Q1 2024 Performance: The firm saw a notable rise in revenue and trading activity during periods of market uncertainty in early 2024.

- Strategic Advantage: Virtu's business is structured to perform well, and often better, during chaotic market conditions.

Commitment to Shareholder Value

Virtu Financial demonstrates a strong commitment to its shareholders by consistently returning capital. This is evident through its regular dividend payments and active share repurchase programs. For instance, in the first quarter of 2025, Virtu announced a quarterly cash dividend of $0.24 per share, alongside repurchasing approximately $48.1 million worth of its Class A Common Stock. This ongoing buyback strategy, which has been in place since November 2020, underscores the company's confidence in its future prospects and its dedication to increasing shareholder value.

Virtu Financial's technological prowess is a significant strength, enabling its high-frequency trading and market-making operations. Their proprietary, scalable platform is integrated globally, processing billions of shares daily. This advanced infrastructure is key to their speed and efficiency in diverse markets.

The company's extensive market-making capabilities across over 50 countries and 200 trading venues, covering multiple asset classes, provide a substantial competitive advantage. This broad participation, exemplified by record Q1 2024 revenue of $778 million, allows Virtu to capture global trading opportunities.

Virtu's business model is inherently designed to profit from market volatility. Increased price fluctuations and trading volumes lead to wider bid-ask spreads, directly boosting Virtu's trading income. This resilience was evident in Q1 2024, where heightened market activity significantly drove revenue.

The firm demonstrates robust financial health and operational efficiency, consistently achieving high Adjusted EBITDA margins. This financial strength, highlighted by a 30.3% revenue increase to $837.9 million in Q1 2025, allows for effective scaling and capitalization on market opportunities.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Total Revenue | $778 million | $837.9 million | +7.7% |

| Net Income | $111.5 million | $189.6 million | +70.0% |

| Shares Processed Daily (Avg) | 15.4 billion | 16.2 billion (Est.) | +5.2% |

What is included in the product

Delivers a strategic overview of Virtu Financial’s internal and external business factors, highlighting its technological strengths and market opportunities alongside potential regulatory challenges and competitive pressures.

Identifies critical market vulnerabilities and competitive advantages for proactive risk mitigation.

Weaknesses

Virtu Financial's reliance on market volatility, while often a boon, presents a significant weakness. The cyclical nature of trading means that periods of low volatility directly impact Virtu's earnings. For instance, during calmer market periods, trading opportunities diminish, and the crucial bid-ask spreads, a key revenue driver, tend to compress.

This inherent dependence on market conditions creates a vulnerability to revenue fluctuations. Virtu's financial performance can become less predictable when markets are stable, as the scarcity of trading activity directly affects profitability. This makes long-term forecasting challenging and exposes the company to the inherent unpredictability of financial markets.

Virtu Financial operates within a heavily regulated financial services landscape, making it susceptible to intense scrutiny. The firm's high-frequency trading model, in particular, draws attention from regulators concerned with market structure and the impact of retail trading, including payment for order flow practices. For instance, in 2023, the SEC continued to examine payment for order flow, a key revenue source for many retail brokers and a practice Virtu engages with.

Navigating these evolving regulatory requirements presents a significant challenge. Compliance with new rules and potential policy shifts can directly impact Virtu's operational costs, potentially requiring substantial investments in technology and personnel to ensure adherence. Failure to comply can also result in considerable financial penalties, as seen with fines levied against other firms in the sector for compliance lapses.

Virtu Financial's business model is primarily centered around market making and electronic trading. This specialization allows them to excel in their core competencies, leveraging advanced technology and efficient execution. However, this narrow focus inherently carries concentration risk, making the company particularly susceptible to shifts in these specific market segments.

Compared to more diversified financial institutions, Virtu's limited range of services can restrict its avenues for growth. For instance, while Virtu generated approximately $6.1 billion in revenue in 2023, a significant portion of this is tied to its trading operations. A downturn in market making activity or stricter regulations on high-frequency trading could disproportionately impact their financial performance.

Rising Operating Costs

Virtu Financial, despite its impressive revenue expansion, is grappling with escalating operating costs. These increases are largely driven by higher brokerage and clearance fees, alongside rising employee compensation. For instance, operating expenses saw a significant jump of 22.1% in the first quarter of 2025 when compared to the same period in 2024.

This trend poses a potential threat to the company's profitability. If these rising expenses are not effectively managed or offset by proportional revenue growth, they could negatively impact Virtu's overall financial performance and bottom line.

- Rising Brokerage and Clearance Fees: Direct costs associated with executing trades are increasing.

- Increased Employee Compensation: Investments in talent and potential wage inflation are contributing factors.

- Q1 2025 vs. Q1 2024 Expense Growth: A 22.1% increase highlights the magnitude of the challenge.

- Profitability Risk: Failure to align expense growth with revenue could erode margins.

High Debt Levels

Virtu Financial's substantial long-term debt, standing at $1,768.3 million as of March 31, 2025, presents inherent risks related to interest rate fluctuations and the obligation of repayment. This elevated debt load can potentially strain the company's liquidity, particularly if its earnings experience a downturn. Furthermore, high debt levels may restrict the capital available for crucial strategic investments or potential acquisitions that could drive future growth.

Virtu's business model, while efficient, is highly concentrated in market making and electronic trading. This specialization leaves the company vulnerable to significant downturns in these specific areas, unlike more diversified financial firms. For example, while Virtu achieved substantial revenues in 2023, a large portion was directly tied to its trading operations, highlighting the concentration risk if market making activity slows or faces stricter regulations.

What You See Is What You Get

Virtu Financial SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Virtu Financial. The complete version, offering in-depth insights into its Strengths, Weaknesses, Opportunities, and Threats, becomes available immediately after purchase. This ensures you receive the full, professionally structured report you expect.

Opportunities

Virtu Financial has a significant opportunity to broaden its market-making services by venturing into new and developing asset classes. This includes capitalizing on the increasing electronification of fixed income markets and the burgeoning digital assets sector. By embracing these evolving financial landscapes, Virtu can tap into new revenue streams and solidify its market position.

The company is actively pursuing global expansion, exemplified by its recent moves to offer listed options coverage in key Asian markets like India and Japan. Furthermore, Virtu is enhancing its digital asset trading capabilities through partnerships with new token venues. These strategic geographic and technological expansions are crucial for diversifying revenue and capturing incremental market share in a dynamic global financial environment.

Virtu's Execution Services (VES) division is a key growth area, demonstrating impressive momentum. In the first quarter of 2025, this segment generated $115 million in adjusted net trading income, extending its growth streak to seven consecutive quarters.

This sustained expansion highlights the significant opportunity to further scale the institutional execution business. Such scaling can provide a robust stream of recurring revenue, effectively diversifying Virtu's income beyond its traditional market-making activities.

Virtu's continued investment in AI and advanced analytics is a significant opportunity. By sharpening its technological edge, Virtu can develop more sophisticated trading strategies and improve risk management. For instance, in 2023, the company reported that its technology and data analytics investments were crucial to its performance, enabling it to navigate market volatility effectively.

Leveraging AI can also unlock new trading opportunities and refine existing algorithms, giving Virtu a distinct competitive advantage. This focus on innovation is vital in a market that is constantly changing. Virtu's ability to adapt and integrate cutting-edge technology ensures it remains at the forefront of electronic trading.

Increased Retail Participation in Markets

The significant increase in retail investor activity, a trend that has persisted since 2020, continues to be a strong positive for Virtu Financial. This heightened engagement means more trading volume, which directly benefits Virtu's market-making operations.

Virtu's business model is well-aligned to capitalize on this. By providing price improvement on a massive scale, estimated to save retail traders billions of dollars annually, Virtu effectively captures a substantial portion of this growing retail order flow.

- Sustained Retail Engagement: Retail participation remains elevated, providing a consistent source of trading volume.

- Price Improvement Value: Virtu's provision of price improvement translates to billions in savings for retail investors, enhancing its appeal for order flow.

- Secular Trend: The shift towards greater retail involvement in markets is seen as a long-term, structural change benefiting Virtu.

Strategic Acquisitions and Partnerships

Virtu Financial's history is marked by successful strategic acquisitions, such as the KCG Holdings and ITG deals, which have been instrumental in its expansion and market position. These moves demonstrate a clear strategy for growth through consolidation and integration of complementary businesses. The company's continued pursuit of opportunistic acquisitions and strategic partnerships presents a significant opportunity to further solidify its market leadership and broaden its service portfolio.

By integrating new technologies and expanding its client reach through these strategic alliances, Virtu can unlock new revenue streams and operational efficiencies. For instance, the KCG acquisition in 2017, valued at approximately $1.4 billion, significantly boosted Virtu's scale and capabilities in market making and electronic trading. Looking ahead, such strategic moves in 2024 and 2025 could focus on areas like digital asset infrastructure or advanced data analytics to stay ahead of market trends.

- Acquisition of KCG Holdings (2017): Approximately $1.4 billion, enhancing market-making and trading capabilities.

- Acquisition of ITG (2019): Approximately $1 billion, expanding electronic trading and data analytics.

- Potential for 2024/2025: Focus on digital assets, AI-driven trading, or expanding into new geographic markets.

Virtu Financial has a substantial opportunity to expand its market-making services into emerging asset classes like digital assets and the increasingly electronic fixed-income markets. This strategic diversification can unlock new revenue streams and strengthen its competitive standing.

The company's ongoing global expansion, including its recent entry into Indian and Japanese listed options markets, alongside enhancements to its digital asset trading capabilities, positions it well to capture incremental market share. Virtu's Execution Services (VES) also presents a significant growth avenue, with its adjusted net trading income reaching $115 million in Q1 2025, offering a chance to build a robust recurring revenue stream.

Continued investment in AI and advanced analytics provides Virtu with the opportunity to refine trading strategies and risk management, as demonstrated by its crucial role in performance during 2023 market volatility. This technological edge is vital for adapting to evolving market dynamics and identifying new trading opportunities.

The persistent increase in retail investor activity since 2020 offers Virtu a continuous stream of trading volume, directly benefiting its market-making operations. Virtu's model, which provides billions in annual savings to retail traders through price improvement, is ideally suited to capture this growing order flow.

Threats

Virtu Financial operates in a highly competitive landscape, facing formidable rivals such as Citadel Securities, Two Sigma Securities, and Jane Street, all of whom are sophisticated players in high-frequency trading and market-making.

This intense rivalry directly impacts Virtu by compressing bid-ask spreads, which in turn erodes profit margins on individual trades.

To counter this, Virtu must consistently invest heavily in cutting-edge technology and infrastructure to maintain its speed and efficiency advantage, a crucial factor for success in this fast-paced environment.

Evolving regulations in the U.S. equity market and the burgeoning crypto space present a significant threat to Virtu Financial. Increased scrutiny on high-frequency trading and payment for order flow could directly impact their operational models and profitability.

New rules or shifts in market structure, especially concerning off-exchange trading, could force Virtu to adapt its strategies, potentially increasing compliance costs and limiting current business practices. For instance, the SEC's proposed changes to order handling rules in 2024 aim to increase transparency and competition, which could affect market makers like Virtu.

Virtu Financial's extensive reliance on technology and its management of sensitive financial data expose it to significant cybersecurity risks. The growing complexity of cyberattacks, such as AI-driven scams and social engineering tactics, poses a threat to trading platform stability, client data integrity, and could lead to considerable financial and reputational harm. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of this challenge.

Technological Obsolescence and Disruption

The relentless speed of technological advancement presents a significant threat to Virtu Financial. To stay ahead, the company must consistently pour resources into upgrading and adapting its technological infrastructure. A failure to keep pace with emerging innovations or disruptive technologies could quickly diminish its competitive edge, impacting operational efficiency and ultimately, profitability. This is particularly true with new entrants possessing considerable financial backing.

For instance, the increasing sophistication of AI and machine learning algorithms in trading could render existing proprietary systems less effective if Virtu doesn't maintain a leading position in their adoption and development. The market capitalization of companies heavily invested in AI research and development, like NVIDIA, which saw its stock surge significantly in 2023 and early 2024, highlights the premium placed on technological leadership. Virtu's ability to integrate and innovate with these technologies is paramount.

- Continuous Investment: Virtu needs substantial ongoing capital expenditure to maintain its technological edge against rapid innovation cycles.

- Disruptive Technologies: The emergence of entirely new trading paradigms or platforms could bypass Virtu's current infrastructure, posing an existential threat.

- New Entrants: Well-funded startups or established tech giants entering the high-frequency trading space could leverage cutting-edge technology to challenge Virtu's market share.

Macroeconomic Instability and Geopolitical Tensions

Broader macroeconomic uncertainties, such as ongoing debates around interest rates and persistent inflation, alongside escalating geopolitical tensions, can significantly impact market volumes and volatility in ways that are difficult to predict. For Virtu Financial, a key player in market making, these factors directly influence the trading environment they operate within. For instance, the Federal Reserve's interest rate decisions throughout 2024, aiming to curb inflation, have led to fluctuating market liquidity, directly affecting Virtu's revenue streams which are often tied to trading volumes.

While periods of heightened volatility can present lucrative opportunities for Virtu due to increased trading activity, extreme or prolonged instability poses a considerable threat. Such conditions can lead to a general reduction in trading across markets, as investors become more cautious. This reduced activity can negatively impact Virtu's financial performance, as seen in periods of market calm where bid-ask spreads narrow, compressing profitability.

The geopolitical landscape in 2024 and projected into 2025, with ongoing conflicts and trade disputes, adds another layer of complexity. These events can trigger sudden, unexpected market movements, potentially leading to significant risk exposure for Virtu if not managed effectively. The interconnectedness of global markets means that instability in one region can quickly ripple through others, impacting Virtu's ability to execute trades efficiently and profitably.

- Interest Rate Uncertainty: Continued adjustments to interest rates by central banks globally in 2024-2025 create unpredictable shifts in market liquidity and trading volumes.

- Inflationary Pressures: Persistent inflation can lead to reduced consumer spending and business investment, indirectly dampening overall market activity.

- Geopolitical Risk: Escalating global conflicts and trade tensions in 2024-2025 introduce volatility and potential disruptions to international financial markets, impacting Virtu's trading operations.

- Market Volatility Impact: While volatility can create opportunities, extreme or sustained periods of instability can reduce trading activity, negatively affecting Virtu's revenue.

Virtu Financial faces significant threats from intense competition, evolving regulations, cybersecurity vulnerabilities, rapid technological advancement, and macroeconomic and geopolitical uncertainties. These factors collectively challenge its market position, profitability, and operational stability.

The firm must continuously invest in technology to maintain its edge against rivals and adapt to new regulatory frameworks, such as those proposed by the SEC in 2024 impacting order handling. Cybersecurity risks are amplified by the projected global cost of cybercrime reaching $10.5 trillion annually by 2025, threatening data integrity and platform stability.

Macroeconomic shifts, including interest rate debates and inflation, alongside geopolitical tensions in 2024-2025, create unpredictable market conditions that can reduce trading volumes and increase operational risk for Virtu.

| Threat Category | Specific Challenge | Impact on Virtu | Data Point/Example |

|---|---|---|---|

| Competition | Rival firms' advanced trading capabilities | Compressed bid-ask spreads, reduced profit margins | Rivals include Citadel Securities, Two Sigma Securities, Jane Street |

| Regulatory Changes | Increased scrutiny on HFT and PFOF, new market structure rules | Potential impact on operational models, increased compliance costs | SEC proposed order handling rule changes in 2024 |

| Cybersecurity | Sophistication of cyberattacks (AI-driven, social engineering) | Risk to platform stability, data integrity, financial/reputational damage | Global cybercrime cost projected to reach $10.5 trillion annually by 2025 |

| Technological Advancement | Rapid innovation cycles, emergence of disruptive technologies | Diminished competitive edge if not keeping pace, need for constant upgrades | AI/ML advancements in trading; NVIDIA's stock surge in 2023-2024 |

| Macroeconomic/Geopolitical | Interest rate uncertainty, inflation, global conflicts | Fluctuating market liquidity, reduced trading volumes, increased risk exposure | Federal Reserve interest rate decisions in 2024; ongoing global conflicts |

SWOT Analysis Data Sources

This Virtu Financial SWOT analysis is built upon a foundation of comprehensive data, including publicly available financial statements, real-time market data feeds, and insights from reputable financial news outlets.