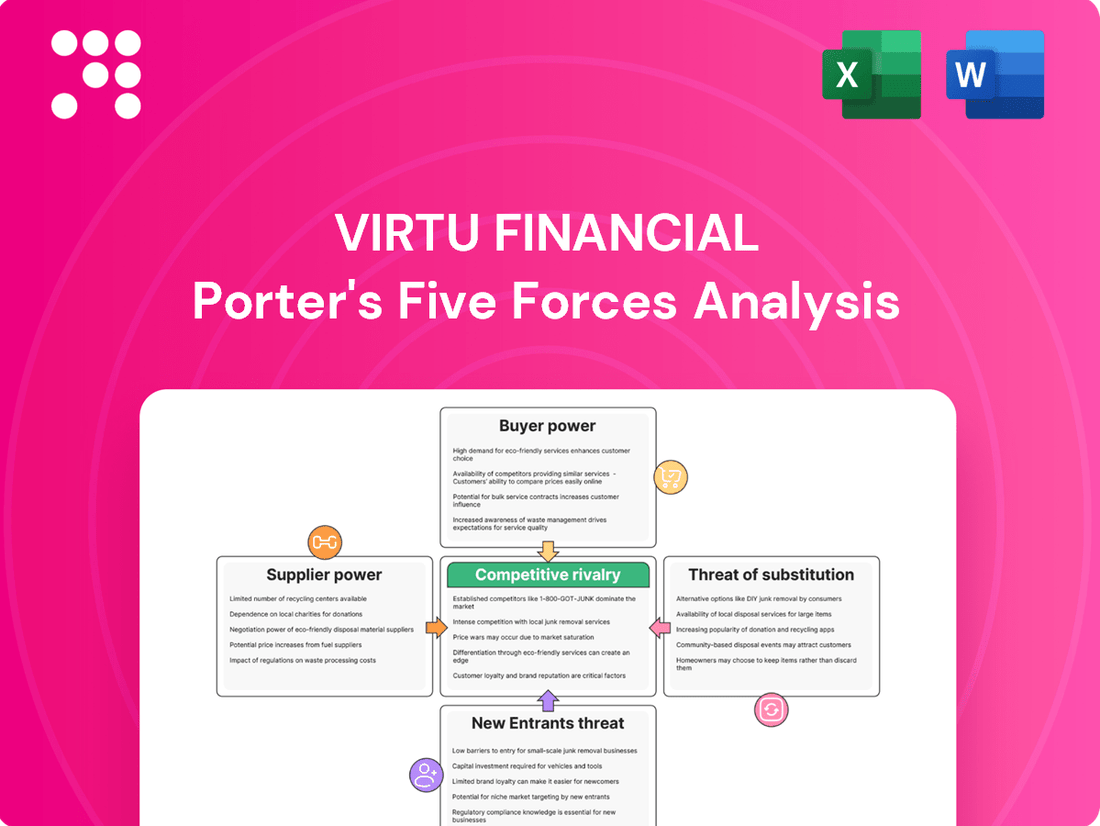

Virtu Financial Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Virtu Financial Bundle

Virtu Financial operates in a highly competitive landscape, with significant forces shaping its profitability. Understanding the intense rivalry among existing competitors and the substantial threat of new entrants is crucial for any strategic evaluation of the firm.

The full Porter's Five Forces Analysis delves into the intricate details of Virtu Financial's market, quantifying the impact of each force. Unlock this comprehensive report to gain actionable insights into their competitive dynamics and strategic positioning.

Suppliers Bargaining Power

Virtu Financial's reliance on exchanges and alternative trading systems for crucial market data and connectivity grants these entities considerable leverage. Exchanges often operate as monopolies or oligopolies for specific markets, making their data feeds and co-location services indispensable for Virtu's high-frequency trading operations.

The critical nature of these data streams and the infrastructure provided by exchanges means Virtu has limited alternatives. The cost and complexity of re-engineering systems and rebuilding relationships to switch primary trading venues would be substantial, further solidifying the bargaining power of these suppliers.

Virtu Financial's bargaining power of suppliers is significantly influenced by advanced technology and infrastructure providers. Key suppliers include those offering ultra-low latency hardware, specialized networking equipment, and high-performance computing solutions essential for high-frequency trading (HFT).

While many vendors exist for standard IT, the highly specialized and often proprietary nature of HFT technology narrows the field of truly competitive suppliers. This reliance on cutting-edge, niche technology allows these suppliers to charge premium prices for their innovations and ongoing support, directly impacting Virtu's cost structure.

The talent pool for highly specialized roles like quantitative researchers, low-latency software engineers, and experienced high-frequency trading (HFT) professionals is exceptionally small and in high demand. These individuals possess the unique skills and deep knowledge that are fundamental to Virtu Financial's competitive advantage in the market.

This scarcity of specialized talent directly translates into significant bargaining power for these employees. They can command higher compensation packages, better benefits, and more favorable working conditions due to their critical contributions and the difficulty in replacing them.

Regulatory and Compliance Services

Virtu Financial operates within a tightly regulated financial landscape, making compliance with intricate rules across various global jurisdictions a constant necessity. This reliance on specialized expertise significantly amplifies the bargaining power of suppliers offering legal, compliance, and regulatory technology (RegTech) solutions. The high degree of specialization and the critical nature of regulatory adherence mean that established and reputable service providers hold considerable sway.

The bargaining power of suppliers in regulatory and compliance services stems from several key factors:

- High Switching Costs: Integrating new compliance systems or legal counsel involves substantial time, effort, and potential disruption, making it costly for Virtu to switch providers.

- Concentration of Expertise: The market for highly specialized financial regulatory knowledge and RegTech solutions is often concentrated among a limited number of firms, giving them pricing power.

- Critical Nature of Services: Failure to comply with regulations can result in severe penalties, reputational damage, and operational shutdowns, underscoring the indispensable nature of these suppliers.

- Demand for Innovation: As regulations evolve, there's a continuous demand for updated and innovative compliance tools, favoring suppliers who can consistently deliver cutting-edge solutions.

Capital Providers and Lending Institutions

Capital providers, such as banks and other lending institutions, are essential suppliers for Virtu Financial, providing the significant capital required for its market-making operations. This includes funding for collateralizing trading positions and general operational expenses. The bargaining power of these lenders is directly tied to factors like current interest rates and the overall health of credit markets. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, influencing the cost of borrowing for firms like Virtu.

Virtu's creditworthiness plays a pivotal role in shaping the negotiating leverage of these capital providers. A strong credit rating typically grants Virtu more favorable terms and lower borrowing costs. Conversely, any perceived weakening in its financial standing could empower lenders to demand higher interest rates or stricter collateral requirements, directly impacting Virtu’s cost of capital and, consequently, its profitability.

- Capital Requirement: Virtu needs substantial capital to act as a market maker, covering collateral and operational needs.

- Key Suppliers: Banks and lending institutions are critical suppliers of this necessary financing.

- Lender Bargaining Power: Influenced by interest rates (e.g., Fed funds rate around 5.25%-5.50% in early 2024), credit market conditions, and Virtu's creditworthiness.

- Impact on Virtu: Higher borrowing costs due to strong lender power can reduce Virtu's profit margins.

Virtu Financial's bargaining power of suppliers is influenced by exchanges and alternative trading systems, which are critical for market data and connectivity. These entities often act as monopolies or oligopolies, making their services indispensable for Virtu's high-frequency trading operations.

The specialized nature of technology and infrastructure providers for ultra-low latency trading also grants them significant leverage. Niche vendors for high-performance computing and networking equipment can command premium prices due to the limited competition and the critical role their innovations play in Virtu's performance.

Furthermore, the scarcity of highly skilled talent in areas like quantitative research and low-latency software engineering empowers these professionals to negotiate higher compensation and better terms, directly impacting Virtu's operational costs and competitive edge.

Capital providers, such as banks, also hold considerable bargaining power, especially given Virtu's substantial capital requirements for market-making. Factors like prevailing interest rates, as seen with the Federal Reserve's benchmark rate hovering around 5.25%-5.50% in early 2024, and Virtu's creditworthiness directly influence the cost of capital for the firm.

| Supplier Category | Key Dependence | Supplier Bargaining Power Factors | Impact on Virtu Financial |

|---|---|---|---|

| Exchanges & ATS | Market Data, Connectivity | Monopolistic/Oligopolistic Nature, High Switching Costs | Increased operational costs, limited flexibility |

| Technology Providers | Ultra-Low Latency Hardware, Networking | Niche Markets, Proprietary Technology, High R&D Costs | Premium pricing for essential infrastructure |

| Specialized Talent | Quantitative Researchers, HFT Engineers | Scarcity of Skills, High Demand | Higher compensation and benefits costs |

| Capital Providers | Financing for Operations, Collateral | Interest Rates, Credit Market Conditions, Virtu's Creditworthiness | Cost of capital, profitability margins |

What is included in the product

Analyzes the competitive intensity within the electronic trading and market making industry, evaluating the bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes on Virtu Financial's profitability.

Quickly identify and mitigate competitive threats with a comprehensive overview of industry rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes.

Customers Bargaining Power

Virtu Financial serves a wide array of clients, from large institutional investors and brokers to various other market participants who all require efficient access to liquidity. This diversity means no single client typically holds significant sway over Virtu's operations.

While individual customers might not transact in massive volumes, the aggregate demand for Virtu's liquidity services is substantial. This broad client base, rather than a few large players, is key to Virtu's business model.

The fragmented nature of Virtu's customer base generally dilutes the bargaining power of any individual customer. Virtu can cater to a vast number of clients, reducing its dependency on any one entity and strengthening its position in the market.

In markets where liquidity is abundant, like many major equity and FX markets, the difference between buying and selling prices, known as the bid-ask spread, is incredibly narrow. Execution speed also becomes a critical factor for clients. This makes liquidity and efficient trade execution services feel like a commodity, meaning customers can readily find similar offerings elsewhere.

This commoditization grants customers significant bargaining power. If Virtu Financial's pricing isn't competitive or their execution speed falters, clients can easily shift their business to other market makers or choose to handle trades internally. For instance, Virtu's Q1 2024 results highlighted a focus on efficiency, indicating awareness of the need to maintain competitive execution in these commoditized areas.

Customers, especially institutional investors, benefit from access to a multitude of market makers and liquidity providers across diverse trading platforms. This widespread availability allows them to easily compare pricing and execution quality, directing their trades to the most advantageous source. For example, in 2024, the average bid-ask spread for highly liquid stocks remained exceptionally tight, reflecting intense competition among liquidity providers.

The ability to switch between these providers with relative ease significantly amplifies customer bargaining power. This dynamic forces Virtu Financial, like its competitors, to continuously offer competitive spreads and ensure superior execution quality to retain order flow. In Q1 2024, Virtu reported that its average realized spread on client orders was a key performance indicator, highlighting the pressure to remain competitive.

Internalization Capabilities of Large Institutions

Large institutional clients, like major banks and asset managers, possess the ability to internalize their order flow or route it through their own trading desks. This significantly diminishes their dependence on external liquidity providers such as Virtu Financial.

When customers can effectively become their own liquidity providers, their bargaining power naturally increases. This trend was evident in 2024 as many institutions continued to invest in their internal technological capabilities to manage trading execution more efficiently.

- Internalization Trend: Institutions are increasingly building out their own trading infrastructure, reducing the need for third-party market makers.

- Reduced Reliance: This capability empowers large customers to negotiate more favorable terms or seek alternative liquidity sources.

- Competitive Pressure: Virtu, like other market makers, faces pressure to offer competitive pricing and superior execution services to retain these sophisticated clients.

Regulatory Mandates for Best Execution

Regulatory mandates like 'best execution' significantly influence the bargaining power of customers in financial markets. These rules compel brokers to secure the most advantageous terms for client trades, indirectly strengthening customer leverage by pushing for better liquidity sourcing.

This regulatory environment means Virtu Financial, as a liquidity provider, faces pressure to consistently deliver superior pricing and execution quality. Failure to do so risks losing order flow to competitors who can better meet these mandated standards.

- Best Execution Requirements: Mandates such as MiFID II in Europe and SEC rules in the US require financial firms to take all sufficient steps to obtain, when executing orders, the best possible result for their clients.

- Impact on Liquidity Providers: This forces liquidity providers like Virtu to compete on execution speed, price, and reliability to attract and retain order flow from brokers acting on behalf of their clients.

- Customer Leverage: Customers, through these regulations, gain indirect bargaining power as brokers are obligated to seek out the most favorable execution, which often translates to better pricing and reduced slippage.

- Virtu's Competitive Imperative: Virtu Financial's success hinges on its ability to consistently offer competitive pricing and superior execution quality to meet these stringent regulatory demands and client expectations.

The bargaining power of Virtu Financial's customers is generally moderate to high, driven by market commoditization and the availability of alternative liquidity providers. In 2024, the intense competition among market makers, evidenced by persistently narrow bid-ask spreads in major markets, meant clients could easily switch providers if Virtu's pricing or execution quality wasn't optimal. This pressure is amplified by regulatory requirements like 'best execution', compelling brokers to seek the most advantageous trades, thereby increasing customer leverage.

| Factor | Impact on Virtu | 2024 Data/Context |

|---|---|---|

| Market Commoditization | High | Narrow bid-ask spreads in major equities and FX markets in 2024 made execution services a commodity, increasing customer ability to switch. |

| Availability of Alternatives | High | Customers have access to numerous liquidity providers, allowing for easy comparison and switching, thus amplifying bargaining power. |

| Regulatory 'Best Execution' | Moderate to High | Regulations compel brokers to seek the best possible outcome for clients, indirectly strengthening customer leverage by demanding competitive pricing and execution from providers like Virtu. |

| Customer Internalization | Moderate | Large institutions investing in their own trading infrastructure in 2024 reduced reliance on external liquidity, increasing their negotiating power. |

Same Document Delivered

Virtu Financial Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Virtu Financial, identical to the document you will receive immediately after purchase. You're viewing the actual, professionally crafted analysis, ensuring transparency and immediate usability. What you see here is precisely what you'll be able to download and leverage for your strategic insights, with no hidden surprises or placeholder content.

Rivalry Among Competitors

Virtu Financial operates in a highly concentrated market, dominated by a few sophisticated, well-capitalized firms. This intense rivalry comes from other independent high-frequency trading (HFT) and market-making specialists, such as Citadel Securities and Jump Trading, as well as the proprietary trading divisions of major investment banks.

Competitive rivalry in the financial technology sector, particularly for high-frequency trading firms like Virtu Financial, is intensely driven by technological superiority. This includes the development and deployment of ultra-low latency infrastructure, sophisticated trading algorithms, and advanced data analytics capabilities. Firms are locked in a continuous arms race, investing heavily in research and development to shave off microseconds of trading time, which translates directly into market advantage.

This relentless pursuit of speed and technological edge fuels a fierce rivalry. For instance, in 2024, the market continues to see significant capital expenditure on hardware upgrades and software optimization. Companies that fail to innovate and maintain a technological lead risk falling behind rapidly, making constant innovation not just a competitive advantage, but a prerequisite for survival in this dynamic landscape.

Virtu Financial's core business model hinges on capturing minuscule bid-ask spreads, the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. This is where the intense competition really bites.

The market making landscape is fiercely competitive, with numerous firms vying for the same order flow. This constant battle forces participants to narrow their bid-ask spreads to attract business, often pushing them to razor-thin margins. For instance, in highly liquid markets, spreads can be fractions of a cent, making volume the primary driver of profitability.

Firms like Virtu must excel at executing a massive number of trades to generate meaningful revenue from these tiny spreads. The pressure to offer the tightest spreads means that operational efficiency and technological superiority are paramount, as even milliseconds of speed advantage can translate into capturing more profitable trades and maintaining a competitive edge in a market where every fraction of a penny counts.

High Fixed Costs and Exit Barriers

The financial technology and high-frequency trading industry, where Virtu Financial operates, is characterized by exceptionally high fixed costs. These stem from continuous, significant investments in cutting-edge technology, robust data infrastructure, and highly skilled personnel. For instance, maintaining and upgrading sophisticated trading algorithms and low-latency networks requires millions in annual expenditure.

These substantial fixed costs, combined with the specialized nature of the assets and human capital involved, erect considerable exit barriers. Companies find it difficult to divest or redeploy their specialized technology and talent, making it economically challenging to leave the market. This situation strongly encourages existing firms to stay and compete intensely to recover their initial and ongoing investments.

- High Technology Investment: Virtu Financial, like its peers, invests heavily in proprietary trading platforms and data analytics, often running into tens or hundreds of millions of dollars annually to maintain a competitive edge.

- Specialized Workforce: The need for elite quantitative analysts, software engineers, and network specialists creates a unique and often immobile talent pool, further increasing exit barriers.

- Infrastructure Lock-in: Significant capital is tied up in data centers, network connectivity, and specialized hardware, making it costly and time-consuming to transition away from these assets.

Global Market Presence and Diverse Asset Classes

Competitive rivalry for Virtu Financial is intense and spans the globe, touching a wide array of financial instruments. Firms are not just competing in one arena, but across equities, fixed income, foreign exchange, and commodities. This broad competition means Virtu must constantly adapt to a dynamic landscape where strategies effective in one market might not work in another.

Virtu's extensive global presence means it encounters a diverse set of competitors. On one hand, it faces specialized regional players who possess deep knowledge and established relationships within their specific geographic markets. On the other hand, Virtu also contends with other large, multi-asset firms that operate on a similar global scale, offering a comparable breadth of services and products. This dual threat necessitates a robust and adaptable competitive strategy.

In 2024, the financial services industry continued to see significant consolidation and technological advancement, further intensifying rivalry. For instance, Virtu's core business of market making, particularly in equities and FX, involves competing with firms like Citadel Securities, Jump Trading, and XTX Markets, all of which have significant technological capabilities and global reach. The sheer volume of transactions processed by these entities underscores the high stakes and the need for continuous innovation to maintain market share.

- Global Reach: Virtu competes across numerous financial markets worldwide, from North America to Europe and Asia.

- Asset Class Diversity: Rivalry exists in equities, fixed income, foreign exchange, commodities, and other derivatives.

- Competitor Types: Virtu faces competition from both specialized regional firms and other large, global multi-asset trading houses.

- Market Dynamics: The industry is characterized by rapid technological change and ongoing consolidation, driving intense competition.

The competitive rivalry Virtu Financial faces is exceptionally fierce, driven by a concentrated market where a few sophisticated, well-capitalized firms dominate. This includes other independent high-frequency trading specialists and proprietary trading divisions of major investment banks.

The primary battleground is technological superiority, with firms constantly investing in ultra-low latency infrastructure and advanced algorithms. For example, in 2024, significant capital expenditure continues to be directed towards hardware upgrades and software optimization to shave off microseconds of trading time.

This relentless pursuit of speed and efficiency is crucial for capturing minuscule bid-ask spreads, the core of Virtu's profitability. Firms must execute massive volumes of trades, making operational efficiency and technological advancement prerequisites for survival.

The market is characterized by high fixed costs due to continuous technology investment and specialized talent, creating substantial exit barriers. This encourages existing firms to compete intensely to recoup their investments, leading to razor-thin margins where every fraction of a penny counts.

| Competitor Type | Key Differentiator | Example Firms |

| HFT Specialists | Speed, Algorithm Sophistication | Citadel Securities, Jump Trading, XTX Markets |

| Proprietary Trading Desks | Capital, Broad Market Access | Goldman Sachs, JPMorgan Chase |

| Regional Market Makers | Local Market Knowledge, Relationships | Various firms specific to European or Asian markets |

SSubstitutes Threaten

Large institutional investors and brokers increasingly leverage Direct Market Access (DMA) and their own proprietary trading desks. This allows them to bypass external market makers for certain execution needs, directly interacting with exchanges. For instance, in 2024, many hedge funds and asset managers expanded their internal trading capabilities to reduce latency and gain more control over liquidity provision, a trend that continues to grow.

The rise of alternative trading venues like dark pools and broker internalization facilities presents a significant threat of substitutes for Virtu Financial. These platforms allow large institutional investors to execute trades anonymously, away from the public eye, often without impacting the market price. This can divert substantial trading volume from traditional exchanges where Virtu operates.

In 2023, dark pools and internalizers accounted for a notable portion of U.S. equity trading volume, with some estimates suggesting over 15% of total market share. While Virtu may leverage some of these venues, their overall existence fragments liquidity and offers an alternative execution pathway that can reduce the demand for Virtu's market-making services on public exchanges.

The rise of blockchain-based Decentralized Exchanges (DEXs) presents a developing threat to traditional market makers like Virtu Financial, especially within the digital asset space. While DEXs are still in their early stages for broader financial markets, they facilitate direct peer-to-peer trading, potentially diminishing the reliance on centralized intermediaries.

By 2024, the total value locked (TVL) in DEXs reached hundreds of billions of dollars, indicating growing adoption. This trend suggests that as DEX technology matures and regulatory clarity emerges, they could increasingly offer a viable alternative for trading, particularly for crypto-native assets, thereby impacting the volume and revenue streams for established market makers.

Over-the-Counter (OTC) Bilateral Trading

The threat of substitutes for Virtu Financial's core business, particularly its high-frequency trading (HFT) operations on centralized exchanges, is amplified by over-the-counter (OTC) bilateral trading. For large or less frequently traded securities, major market participants might bypass traditional exchanges and directly negotiate deals with counterparties. This can reduce the volume of trades executed through the more transparent, exchange-based HFT model that Virtu excels in.

While Virtu does participate in OTC market making, this direct negotiation between parties represents a significant substitute. For instance, a large institutional investor looking to offload a substantial block of shares might find it more efficient to find a single buyer through a private agreement rather than breaking it up across multiple exchange orders. This direct approach can bypass the need for the sophisticated algorithmic execution that Virtu provides on exchanges, thereby impacting its market share and revenue potential in those specific segments.

The existence of OTC bilateral trading means that the total addressable market for exchange-based HFT is not absolute. Consider the global equity markets, where a significant portion of trading volume, especially for large blocks, can occur off-exchange. For example, in 2023, while precise figures for OTC HFT substitution are difficult to isolate, the broader OTC derivatives market alone was valued in the trillions, indicating the scale of activity that can occur outside of regulated exchanges.

- Reduced Exchange Volume: Direct bilateral trades reduce the liquidity and volume available on regulated exchanges, which are Virtu's primary operational arenas.

- Bypassing HFT: Large block trades negotiated privately may not require the speed and algorithmic precision that Virtu's HFT services offer.

- Market Fragmentation: The prevalence of OTC trading means that liquidity is not always consolidated on exchanges, presenting a challenge for HFT firms seeking maximum order flow.

- Alternative Execution Methods: For specific trade types, direct negotiation can be a more cost-effective or efficient substitute than relying on exchange-based HFT.

Passive Investment Strategies and Index Funds

The increasing popularity of passive investment strategies, particularly index funds, presents a nuanced threat to Virtu Financial. These strategies typically involve less active trading and more systematic rebalancing, which can indirectly decrease the demand for the high-frequency liquidity provision Virtu specializes in. For instance, assets under management in passively managed funds globally reached an estimated $12.9 trillion by the end of 2023, a significant increase from previous years.

While index funds aren't direct substitutes for Virtu's market-making services, a broader market shift towards passive investing can alter overall trading volumes and the necessity for constant, low-latency execution. This trend means fewer opportunities for Virtu to profit from the bid-ask spread in certain less actively managed segments of the market.

The growth of passive investing is a long-term structural shift. By 2024, it's projected that passive funds will account for over half of all assets managed in the US, further emphasizing this potential impact on Virtu's core business model.

- Growing Passive Assets: Global passive AUM surpassed $12.9 trillion by year-end 2023.

- Reduced Trading Frequency: Passive strategies inherently trade less often than active ones.

- Market Share Shift: Passive funds are expected to hold over 50% of US managed assets by 2024.

- Impact on Liquidity Demand: A move to passive investing can lower the overall need for high-frequency liquidity provision.

The increasing use of Direct Market Access (DMA) by large investors and brokers allows them to bypass market makers like Virtu, directly accessing exchanges. This trend was evident in 2024 as many hedge funds enhanced their internal trading capabilities for better control and reduced latency.

Alternative trading venues, such as dark pools and internalizers, offer a substitute by enabling anonymous, off-exchange trades, diverting volume from public exchanges where Virtu operates. In 2023, these venues captured over 15% of U.S. equity trading volume.

Decentralized Exchanges (DEXs), particularly in the digital asset space, represent an emerging substitute. With total value locked (TVL) in DEXs reaching hundreds of billions by 2024, they offer peer-to-peer trading, potentially reducing reliance on intermediaries.

Over-the-counter (OTC) bilateral trading also serves as a substitute, especially for large block trades. These direct negotiations can bypass the need for Virtu's high-frequency trading services on exchanges, impacting its market share in specific segments.

The shift towards passive investing strategies, like index funds, indirectly substitutes Virtu's services. With global passive assets under management exceeding $12.9 trillion by the end of 2023 and projected to hold over 50% of U.S. managed assets by 2024, this trend can reduce overall trading volume and the demand for high-frequency liquidity.

| Substitute | Description | Impact on Virtu | 2023/2024 Data Point |

|---|---|---|---|

| Direct Market Access (DMA) | Investors trading directly on exchanges. | Reduces reliance on Virtu for execution. | Growing adoption by hedge funds in 2024. |

| Dark Pools & Internalizers | Off-exchange trading venues. | Fragments liquidity, diverts volume. | Over 15% of U.S. equity volume in 2023. |

| Decentralized Exchanges (DEXs) | Peer-to-peer trading platforms. | Potential to bypass intermediaries. | Hundreds of billions in TVL by 2024. |

| OTC Bilateral Trading | Direct negotiation between parties. | Bypasses HFT services for block trades. | Significant volume in global markets. |

| Passive Investing | Index funds and similar strategies. | Reduces overall trading frequency. | $12.9 trillion AUM (end of 2023). |

Entrants Threaten

Establishing a high-frequency trading and market-making firm like Virtu Financial demands substantial upfront capital. Think millions, if not billions, for cutting-edge technology, servers, and low-latency network connections. For instance, in 2024, the cost of developing and maintaining proprietary trading algorithms and the necessary hardware infrastructure can easily run into tens of millions of dollars.

Beyond technology, significant trading capital is essential to take and hold positions, a core function of market making. Regulatory capital requirements, mandated by bodies like the SEC, also add another layer of financial burden, ensuring firms can absorb potential losses. These combined financial hurdles create a formidable barrier, making it incredibly difficult for new players to enter and compete effectively in this space.

The immense cost and complexity of building and maintaining the ultra-low latency technology infrastructure, including proprietary algorithms and specialized network connectivity, present a significant barrier to entry for new high-frequency trading (HFT) firms. This technological moat requires substantial capital investment, estimated in the tens of millions of dollars for cutting-edge systems. Furthermore, acquiring and retaining the highly specialized engineering and quantitative talent needed to operate and innovate within this environment is exceptionally challenging and costly, effectively deterring many potential entrants.

The financial services industry, particularly for high-frequency trading firms like Virtu Financial, is characterized by exceptionally stringent regulatory hurdles. New entrants must navigate a complex web of licensing requirements, capital adequacy rules, and ongoing compliance obligations. For instance, in 2024, firms operating in major markets like the US and EU face continuous updates to regulations such as MiFID II and SEC rules, demanding significant investment in legal and compliance teams. These substantial upfront and ongoing costs act as a powerful barrier, making it exceedingly difficult for smaller, less-resourced entities to establish a foothold and compete effectively.

Established Network Effects and Relationships

Established market makers like Virtu Financial have cultivated deep-seated relationships with exchanges, brokers, and institutional clients over many years. These existing connections foster trust and ensure optimized connectivity, crucial for high-frequency trading operations. For instance, Virtu's proprietary technology and direct market access agreements are built on these foundational relationships.

New entrants would struggle to replicate Virtu's established network effects. Building the necessary trust and gaining access to critical order flow presents a substantial hurdle. This lack of pre-existing connectivity means new players face longer onboarding times and potentially less favorable execution terms compared to incumbents.

- Established Relationships: Virtu's long-standing partnerships with major exchanges and financial institutions are a significant barrier.

- Network Effects: The value of Virtu's services increases with the number of participants already connected, a difficult advantage for newcomers to overcome.

- Connectivity Optimization: Years of refinement have led to highly efficient data transmission and execution pathways for Virtu, which are not easily replicated.

Talent Scarcity and Retention Challenges

The threat of new entrants for Virtu Financial is significantly heightened by the intense competition for specialized talent. High-frequency trading (HFT) and quantitative finance demand highly skilled professionals, including quants, low-latency developers, and seasoned traders. These individuals are in short supply and command premium salaries, making it difficult for newcomers to compete.

Established firms like Virtu Financial possess strong brand recognition and substantial financial resources, enabling them to attract and retain top-tier talent. This creates a considerable barrier for new companies aiming to enter the market, as they would face immense challenges in building a competitive team. For instance, in 2024, the average salary for a quantitative trader in the US could easily exceed $200,000, with bonuses often doubling that figure, a cost that can be prohibitive for startups.

- Talent Scarcity: The pool of qualified quants and low-latency developers is limited.

- High Compensation Demands: Specialized talent commands significant salary and bonus packages.

- Retention Challenges: New entrants struggle to retain talent against established, reputable firms.

- Competitive Barrier: The war for talent acts as a substantial barrier to entry for new HFT firms.

The threat of new entrants in the high-frequency trading (HFT) space, where Virtu Financial operates, is considerably low due to several formidable barriers. The sheer capital required for cutting-edge technology, robust infrastructure, and regulatory compliance presents a significant hurdle. For example, in 2024, the ongoing investment in proprietary algorithms and low-latency networks alone can easily reach tens of millions of dollars.

Furthermore, established firms like Virtu benefit from deep-rooted relationships with exchanges and a strong network effect, making it difficult for newcomers to gain comparable access to order flow and optimized connectivity. Building this level of trust and infrastructure from scratch is a monumental task, both in terms of time and financial outlay.

The intense competition for highly specialized talent, such as quantitative analysts and low-latency developers, also acts as a deterrent. These professionals command premium salaries, often exceeding $200,000 annually in 2024, plus substantial bonuses, which can be prohibitive for startups.

| Barrier Type | Description | Estimated Cost/Challenge (2024) |

|---|---|---|

| Capital Requirements | Technology, infrastructure, trading capital, regulatory capital | Tens to hundreds of millions of dollars |

| Technology & Infrastructure | Proprietary algorithms, low-latency networks, servers | Tens of millions of dollars for development and maintenance |

| Talent Acquisition & Retention | Quants, low-latency developers, experienced traders | Salaries exceeding $200,000 annually, plus significant bonuses |

| Regulatory Compliance | Licensing, capital adequacy, ongoing compliance | Substantial investment in legal and compliance teams |

| Established Relationships | Exchange access, broker relationships, client trust | Years to cultivate, difficult for new entrants to replicate |

Porter's Five Forces Analysis Data Sources

Our Virtu Financial Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company financial statements, investor relations materials, and industry-specific market research reports to capture competitive dynamics.