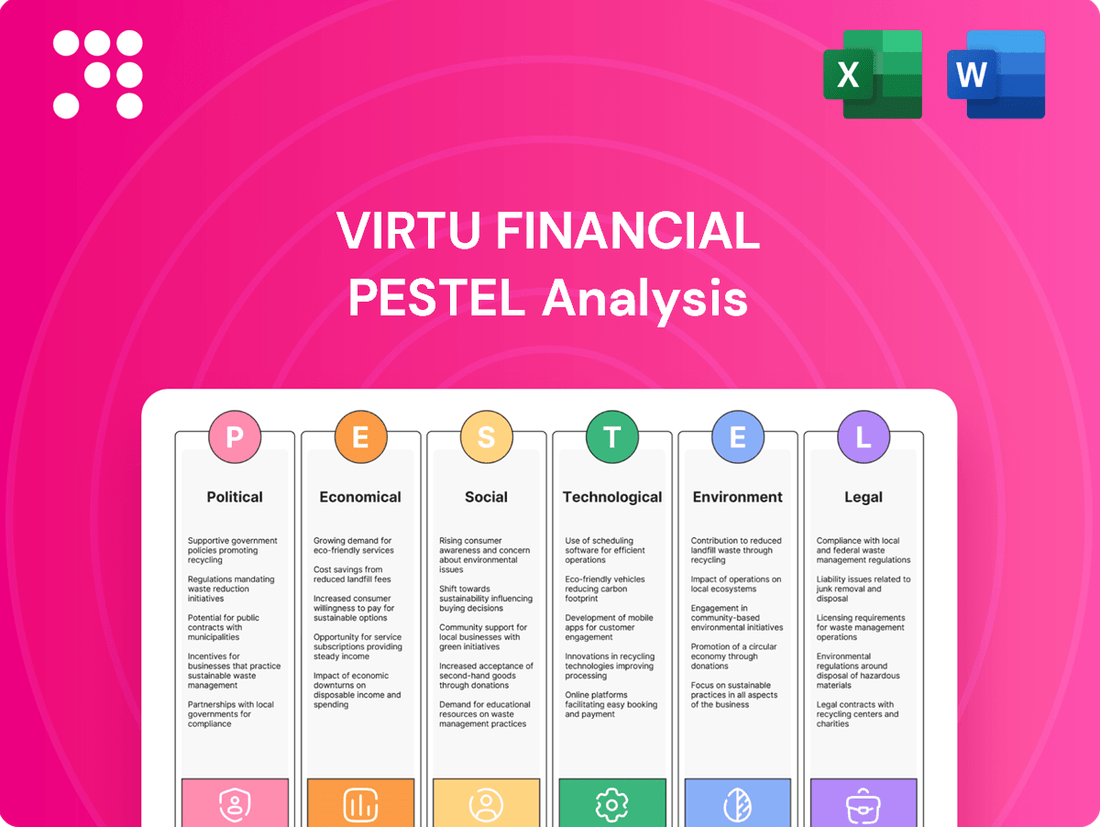

Virtu Financial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Virtu Financial Bundle

Gain a critical advantage with our comprehensive PESTLE analysis of Virtu Financial. Understand the intricate political, economic, social, technological, legal, and environmental factors shaping its trajectory. Equip yourself with actionable intelligence to navigate market complexities and identify strategic opportunities. Download the full analysis now to unlock deep insights and refine your own market strategy.

Political factors

The U.S. Securities and Exchange Commission (SEC) has been actively reshaping the regulatory environment, notably with Rules 3a5-4 and 3a44-2, which redefine what constitutes a 'dealer'. This redefinition could necessitate that firms heavily involved in market making and liquidity provision, such as Virtu Financial, register as broker-dealers. Such a change would bring increased regulatory scrutiny, stricter capital requirements, and more extensive reporting obligations, impacting operational costs and strategies.

While the SEC had initially planned an April 29, 2024, effective date with a grace period extending to April 29, 2025, recent legal maneuvers suggest a potential recalibration. The SEC's voluntary motions to dismiss appeals concerning these rules, particularly in relation to crypto firms, hint at a broader reassessment of their application and enforcement. This evolving stance creates a degree of uncertainty for market participants regarding the ultimate scope and timing of these new regulations.

Government scrutiny of high-frequency trading (HFT) remains a significant political factor for Virtu Financial. Following events like the 2010 Flash Crash, regulators, including the U.S. Securities and Exchange Commission (SEC), are intensely focused on market stability, transparency, and fairness. This scrutiny could lead to new regulations impacting HFT strategies.

The SEC is actively exploring measures to curb potentially destabilizing HFT practices while aiming to preserve the benefits of competitive markets. Their approach includes robust enforcement against market manipulation and closer oversight of exchange co-location rules, which directly affect HFT firms like Virtu. For instance, the SEC has been reviewing exchange rule filings related to co-location services and market data access, indicating a heightened level of regulatory attention in 2024 and into 2025.

Global geopolitical tensions and macroeconomic uncertainty, including ongoing discussions about Federal Reserve interest rate policies, are contributing to heightened market volatility. For instance, in early 2024, markets experienced significant swings in response to inflation data and anticipated central bank actions, creating a less predictable trading environment.

Virtu Financial's business model, especially its market-making operations, is well-suited to thrive in these turbulent conditions. The firm's ability to execute trades rapidly and efficiently allows it to capitalize on the wider bid-ask spreads that often emerge during periods of uncertainty.

This increased volatility translates directly into more opportunities for high-frequency trading firms like Virtu to profit from price discrepancies and capture trading spreads. In 2023, Virtu reported strong revenue growth, partly attributed to the favorable trading environment stemming from these market dynamics.

Policy on Digital Assets and Cryptocurrencies

Clarity on digital asset regulations is a significant political factor for Virtu Financial. As of early 2025, anticipation is high for regulatory frameworks that could unlock new products and broaden the market for digital asset trading, a key area for Virtu. This evolving landscape, coupled with leadership changes at regulatory bodies like the SEC, suggests potential tailwinds for Virtu's digital asset segment, even amidst past regulatory ambiguities.

Virtu Financial has already demonstrated proactive engagement with this sector by expanding its digital asset trading capabilities across new token venues. This strategic move positions the company to capitalize on increased market participation and product innovation as regulatory clarity emerges. For instance, the global cryptocurrency market capitalization, while volatile, has seen significant growth, with projections for 2025 indicating continued expansion, offering a larger addressable market for sophisticated trading platforms like Virtu's.

- Regulatory Clarity: Expected in 2025, this will likely spur new digital asset products and services.

- SEC Leadership Changes: Potential for more favorable regulatory approaches to digital assets.

- Market Expansion: Virtu's existing expansion into new token venues positions it for growth.

- Market Size: The global digital asset market is projected to continue its expansion in 2025, offering substantial opportunities.

International Regulatory Divergence

Virtu Financial's global operations mean it must contend with a complex web of differing financial regulations worldwide. For instance, while the U.S. Securities and Exchange Commission (SEC) and the European Union's MiFID II have been key regulatory drivers, other jurisdictions are also actively shaping their financial landscapes. As of early 2024, many Asian markets, including Singapore and Hong Kong, are enhancing their capital markets regulations, aiming for greater transparency and investor protection, which can create compliance hurdles but also opportunities for firms that can adapt efficiently.

The divergence in how countries approach areas like data privacy, algorithmic trading oversight, and capital requirements creates a significant compliance challenge. For example, the General Data Protection Regulation (GDPR) in Europe has set a high bar for data handling, influencing practices globally, while other regions may have less stringent or entirely different approaches. Virtu's ability to navigate these varying rules, such as the differing implementation timelines for new market surveillance technologies across continents, directly impacts its operational efficiency and market access.

- U.S. SEC’s Market Structure Proposals: Ongoing discussions and potential rule changes by the SEC in 2024 regarding order handling and payment for order flow can significantly impact trading venues and market makers.

- EU’s MiCA Regulation: The Markets in Crypto-Assets (MiCA) regulation, fully in effect by late 2024, introduces a harmonized framework for crypto-assets across the EU, affecting firms dealing with digital assets.

- Asia-Pacific Regulatory Trends: Countries like Japan are refining their financial instruments and exchange acts, focusing on areas like ESG disclosures and digital asset regulation, impacting Virtu's presence in these markets.

The U.S. Securities and Exchange Commission's (SEC) proposed rules, such as 3a5-4 and 3a44-2, redefine 'dealer' status, potentially requiring market makers like Virtu Financial to register, increasing compliance burdens and capital requirements. While the initial April 2025 deadline faced legal challenges, creating uncertainty, the SEC's reassessment of these rules, particularly concerning crypto, signals a dynamic regulatory environment for 2024-2025.

Heightened government scrutiny of high-frequency trading (HFT) persists, driven by concerns over market stability and fairness, as evidenced by the SEC's ongoing review of co-location rules and enforcement actions against market manipulation. This focus could lead to new regulations impacting Virtu's core strategies through 2025.

Anticipated clarity on digital asset regulations in 2025, coupled with potential shifts in SEC leadership, offers opportunities for Virtu Financial to expand its digital asset trading. Virtu's proactive expansion into new token venues positions it to benefit from the projected growth of the global digital asset market, which reached approximately $2.5 trillion in early 2024.

Navigating diverse global financial regulations, from the EU's MiCA framework to evolving Asia-Pacific rules, presents ongoing compliance challenges and opportunities for Virtu. The differing approaches to data privacy and algorithmic trading oversight across jurisdictions, exemplified by GDPR's influence, require continuous adaptation for Virtu's international operations through 2025.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Virtu Financial, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within Virtu Financial's operating landscape.

Provides a clear, actionable overview of the external forces impacting Virtu Financial, simplifying complex market dynamics for strategic decision-making.

Economic factors

Market volatility is a double-edged sword for Virtu Financial. As a leading market maker, the firm benefits from increased trading activity that volatility generates, allowing it to capitalize on bid-ask spreads. For instance, Virtu reported a substantial rise in its trading income during Q1 2025, directly attributed to heightened price swings across equities, options, and even cryptocurrencies.

However, sustained periods of low volatility present a significant hurdle. When markets are calm, trading volumes tend to decrease, shrinking the opportunities for Virtu to profit from the spread. This could impact the company's revenue streams, as the consistent income generated from high-frequency trading relies on active and fluctuating markets.

Monetary policy decisions, especially interest rate adjustments by central banks like the Federal Reserve, significantly shape market liquidity and trading activity. For instance, the Fed's aggressive rate hikes in 2022 and 2023, while aimed at curbing inflation, initially led to increased volatility, which Virtu Financial can exploit.

The current environment, with the Federal Reserve signaling a cautious approach to rate cuts in 2024, contributes to macroeconomic uncertainty. This uncertainty directly impacts market conditions, creating opportunities for high-frequency trading firms like Virtu to capitalize on price discrepancies and rapid market movements.

As of early 2024, the Federal Funds Rate remains elevated, influencing borrowing costs and investment decisions across the financial landscape. Virtu's ability to adapt to these fluctuating interest rate policies is crucial for maintaining its competitive edge in the fast-paced trading world.

Virtu Financial's performance is intrinsically tied to the pulse of the global economy. When the world economy is robust, financial markets tend to be more active, leading to higher trading volumes, which directly boosts Virtu's revenue. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 3.0% in 2023, indicating a generally supportive environment for trading activities.

North America, a key market for Virtu, boasts a sophisticated financial ecosystem. This includes advanced trading infrastructure and a concentration of major market-making firms, creating a dynamic and competitive landscape that favors high-frequency trading (HFT) strategies like Virtu's. The region's technological prowess and deep liquidity pools are crucial for efficient execution.

The outlook for the high-frequency trading market itself is strong. Projections suggest the global HFT market could expand significantly, with some estimates indicating a compound annual growth rate (CAGR) of around 6-8% over the next five to seven years, reaching potentially over $30 billion by 2028. This growth is driven by increasing market complexity and the ongoing demand for algorithmic trading solutions.

Competition in High-Frequency Trading

The high-frequency trading (HFT) arena is a battleground where firms relentlessly pursue speed, advanced data analytics, and sophisticated automation to outmaneuver rivals. This intense competition is a defining characteristic of the sector.

Algorithm optimization is a primary engine driving growth in HFT, representing a significant portion of the market's expansion. Firms are pouring resources into refining their trading strategies to capture even the smallest market inefficiencies.

Virtu Financial consistently reinforces its competitive standing by making substantial investments in cutting-edge technology and broadening its access to diverse global markets. This proactive approach allows Virtu to adapt to the rapidly evolving HFT landscape.

- Intense Competition: HFT firms are in a constant arms race for speed and technological superiority.

- Algorithm Optimization: This is a key growth driver, with firms focusing on refining their trading algorithms.

- Virtu's Strategy: Virtu maintains its edge through continuous technology upgrades and expanded market access.

- Market Dynamics: The sector demands constant innovation to stay ahead in a highly efficient and data-driven environment.

Capital Allocation and Shareholder Returns

Virtu Financial's capital allocation strategy is a key component of its economic standing. The company reported strong financial results in the first quarter of 2025, with revenues reaching $420 million and net income at $115 million, showcasing its ability to generate substantial profits.

This performance underpins Virtu's commitment to shareholder returns. The company actively repurchases its own shares and consistently pays dividends, demonstrating confidence in its future earnings and a dedication to rewarding its investors. For instance, in Q1 2025, Virtu repurchased $50 million worth of stock and paid out $25 million in dividends.

- Robust Q1 2025 Performance: Revenues of $420 million and net income of $115 million highlight strong operational execution.

- Active Share Repurchases: $50 million in stock buybacks during Q1 2025 signals management's belief in undervaluation and commitment to boosting shareholder value.

- Consistent Dividend Payments: A $25 million dividend payout in Q1 2025 reinforces the company's financial health and dedication to returning capital to shareholders.

- Strong Liquidity: Virtu maintains a healthy liquidity position, enabling these capital return initiatives.

Economic factors significantly influence Virtu Financial's operational landscape. Market volatility, driven by macroeconomic uncertainty and monetary policy shifts, directly impacts trading volumes and revenue opportunities. For example, the IMF's projected 3.2% global growth for 2024 suggests a generally supportive environment for trading activities, although interest rate policies, like the elevated Federal Funds Rate in early 2024, create fluctuating borrowing costs and investment dynamics.

What You See Is What You Get

Virtu Financial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Virtu Financial delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a robust framework for understanding the external forces shaping Virtu Financial's strategic landscape.

Sociological factors

Public perception of high-frequency trading (HFT) remains a significant sociological factor for firms like Virtu Financial. Concerns about market fairness and stability often arise, particularly after events like the 2010 'flash crash,' which saw the Dow Jones Industrial Average plunge nearly 1,000 points in minutes. Such incidents fuel public debate about whether HFT provides an unfair advantage over traditional investors and can erode trust in the integrity of financial markets.

Virtu Financial's success hinges on acquiring and keeping elite talent, particularly in quantitative analysis, technology, and risk management, crucial for its high-frequency trading and market-making operations. The demand for these specialized skills is intense across the financial sector, making talent acquisition a significant hurdle.

In 2024, the financial services industry continued to see robust demand for AI and machine learning specialists, with average salaries for quantitative developers in New York reaching upwards of $200,000 annually, reflecting the competitive landscape Virtu navigates.

To combat this, Virtu likely employs strategies such as offering highly competitive compensation packages, including performance-based bonuses and equity, alongside robust professional development programs and increasingly, flexible work arrangements to attract and retain top performers in this specialized field.

Societal understanding of financial markets, even those dominated by high-frequency trading (HFT) like Virtu Financial's operations, significantly shapes regulatory approaches. As of early 2024, surveys indicate that a substantial portion of retail investors still find complex trading mechanisms intimidating, highlighting a persistent gap in financial literacy.

This gap fuels regulatory pressure for greater transparency and investor protection. For instance, initiatives aimed at simplifying disclosures for exchange-traded products, which saw significant growth in 2024, are partly a response to concerns about individual investor comprehension and fair market access.

Workforce Culture and Diversity

Virtu Financial operates in a high-stakes, rapid trading environment that demands a resilient and agile workforce culture. This pressure cooker atmosphere requires employees who can adapt quickly to market shifts and maintain performance under duress.

Diversity and inclusion are becoming increasingly critical in the financial sector, including high-frequency trading (HFT) firms like Virtu. A more diverse workforce can bring varied viewpoints and experiences, potentially leading to more innovative strategies and better risk management.

For instance, by 2025, the financial services industry aims to increase representation of women in leadership roles, with some firms targeting 30% or more. Similarly, efforts to boost ethnic diversity are ongoing, with many companies setting specific hiring goals to reflect broader societal demographics.

- Workforce Agility: The demanding nature of HFT necessitates a culture that embraces rapid adaptation and continuous learning.

- Diverse Perspectives: Promoting diversity can enhance decision-making by incorporating a wider range of insights and problem-solving approaches.

- Inclusion Benefits: An inclusive environment fosters employee engagement and retention, crucial for specialized roles in financial technology.

- Industry Trends: Financial firms are increasingly focusing on diversity metrics, with many setting targets for representation in leadership and technical positions.

Ethical Considerations of Algorithmic Trading

The increasing integration of sophisticated algorithms and artificial intelligence in financial markets, exemplified by firms like Virtu Financial, brings forth significant ethical considerations. Societal expectations are growing for these powerful tools to be developed and deployed responsibly, addressing concerns about fairness and potential biases inherent in AI systems. For instance, the Financial Stability Board (FSB) has been actively discussing the implications of AI in finance, with reports in 2024 highlighting the need for robust governance frameworks to mitigate risks associated with algorithmic decision-making.

This societal pressure directly impacts how companies like Virtu are perceived and regulated. Ensuring transparency and accountability in algorithmic trading is paramount to maintaining public trust. As of early 2025, discussions around AI ethics in trading continue, with a focus on preventing market manipulation and ensuring a level playing field for all participants.

- Fairness and Bias: Algorithmic trading systems can inadvertently perpetuate or even amplify existing market biases if not carefully designed and monitored, potentially leading to unfair outcomes for certain investors.

- Unintended Consequences: The complexity of AI can lead to unforeseen market behaviors or systemic risks that are difficult to predict or control, raising questions about accountability.

- Societal Expectations: There is a growing demand for ethical AI practices across all sectors, including finance, pushing companies to demonstrate responsible innovation and adhere to evolving social norms.

- Reputational Impact: A firm's commitment to ethical AI deployment significantly influences its public image and stakeholder trust, directly affecting its long-term viability and market position.

Public trust in financial markets, particularly concerning automated trading, remains a key sociological factor. Events like the 2010 flash crash continue to shape perceptions, leading to ongoing scrutiny of high-frequency trading (HFT) for fairness. As of early 2025, a significant portion of retail investors still express intimidation by complex trading mechanisms, underscoring a persistent financial literacy gap.

Technological factors

Virtu Financial's core strength lies in its sophisticated technological infrastructure, particularly its advanced algorithmic trading capabilities. These systems, powered by machine learning and artificial intelligence, allow for the rapid analysis of massive datasets and the optimization of trade execution. This technological edge is paramount in today's fast-paced financial markets.

The increasing adoption of AI in trading is a significant trend. The global AI trading platform market was valued at approximately $1.5 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030, indicating a strong demand for the very technologies Virtu Financial employs.

Minimizing network latency is absolutely critical for high-frequency trading operations. Virtu Financial, a leader in this space, leverages co-location and proximity hosting. This means their trading servers are physically located as close as possible to the matching engines of major stock exchanges, drastically reducing the time it takes for trade orders to travel and be executed. This proximity is not just a convenience; it's a core technological advantage.

For HFT firms like Virtu, shaving off even microseconds can translate into significant profit. By placing servers in the same data centers as exchanges, they achieve ultra-low latency connections. This allows them to react to market changes and execute trades faster than competitors who are further away. In 2024, the race for speed continues to intensify, with firms investing heavily in network infrastructure and optimization to maintain this crucial edge.

Virtu Financial heavily leverages data analytics and predictive capabilities, powered by AI and machine learning, to sift through vast financial datasets. This allows them to spot subtle trading patterns and extract actionable insights, crucial for their high-frequency trading operations.

Predictive analytics is a cornerstone, enabling Virtu to forecast customer needs and market shifts with greater accuracy. This foresight directly translates into improved decision-making and more efficient trade execution across their diverse platforms, a key differentiator in fast-moving markets.

Cybersecurity and Data Security

Cybersecurity and data security are paramount technological factors for Virtu Financial, given its heavy reliance on technology and the sensitive nature of the financial data it handles. The company faces significant inherent risks from evolving cybersecurity threats, which, if not effectively managed, could result in substantial financial losses and severe reputational damage. Maintaining robust security measures is therefore crucial not only for protecting client data but also for preserving the trust essential in the financial services industry.

The increasing sophistication of cyberattacks, including ransomware and data breaches, poses a continuous challenge. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the scale of the threat landscape. Virtu's operational model, which involves high-frequency trading and complex data processing, makes it a potential target. Effective cybersecurity is therefore a direct enabler of business continuity and market integrity.

- Critical Reliance: Virtu's business model is built upon advanced technological infrastructure, making cybersecurity a foundational element for its operations.

- Threat Landscape: The company must constantly adapt to sophisticated cyber threats, including nation-state attacks and organized cybercriminal activity.

- Financial & Reputational Risk: A significant breach could lead to massive financial penalties, loss of client confidence, and long-term damage to its brand.

- Regulatory Scrutiny: Financial regulators worldwide are intensifying their focus on cybersecurity compliance, with substantial fines for non-adherence.

Cloud Computing and Infrastructure Scalability

Virtu Financial's reliance on rapid infrastructure scaling for high-frequency trading is significantly supported by advancements in cloud computing. The ability to quickly adjust computing power and storage is paramount for handling fluctuating market demands and executing trades with minimal latency. This agility is a core operational requirement for a firm like Virtu.

Cloud-based solutions and sophisticated data platforms are instrumental in Virtu's strategy. They facilitate the aggregation of vast datasets from diverse global sources, ensuring data integrity and enabling the efficient expansion of artificial intelligence initiatives. These platforms are key to maintaining a competitive edge in data analysis and algorithmic trading.

While Virtu Financial likely maintains on-premise systems for the absolute lowest latency trading operations, cloud infrastructure plays a vital role in scaling broader business functions. For instance, cloud services can support back-office operations, data warehousing, and development environments, offering flexibility and cost-efficiency for non-latency-critical tasks. As of late 2024, the global cloud computing market is projected to reach over $1 trillion by 2025, indicating a significant trend towards cloud adoption across industries.

Key technological factors related to cloud and infrastructure scalability for Virtu Financial include:

- Infrastructure Agility: Cloud platforms allow for on-demand provisioning of resources, enabling Virtu to scale computing power up or down instantaneously to match trading volumes and market volatility.

- Data Aggregation and Quality: Robust cloud data platforms are essential for collecting, cleaning, and processing massive amounts of market data from disparate sources, a critical step for AI-driven trading strategies.

- AI and Machine Learning Scalability: Cloud environments provide the necessary computational power and managed services to train and deploy complex AI models at scale, enhancing predictive capabilities and trading performance.

- Hybrid Approach: Maintaining on-premise systems for ultra-low latency trading while leveraging the cloud for broader operational scalability offers a balanced approach to performance and cost management.

Virtu Financial's technological prowess is deeply intertwined with its ability to leverage cutting-edge AI and machine learning for sophisticated algorithmic trading. The global AI in trading market is expanding rapidly, projected to exceed $2.5 billion by 2025, highlighting the increasing demand for these advanced capabilities.

Minimizing latency remains a critical differentiator, with firms like Virtu investing in co-location and proximity hosting to ensure ultra-fast trade execution. This focus on speed is essential in high-frequency trading environments where even microseconds matter.

The company's operational efficiency is further bolstered by its strategic use of cloud computing, enabling agile infrastructure scaling to manage fluctuating market demands and data processing needs. This hybrid approach, balancing on-premise systems for critical latency-sensitive operations with cloud solutions for broader scalability, is key to maintaining a competitive edge.

| Technology Area | Key Aspect | Impact on Virtu Financial | Market Data/Trend (2024-2025) |

|---|---|---|---|

| Algorithmic Trading | AI/Machine Learning Integration | Enhanced data analysis, predictive modeling, and trade optimization. | AI in Trading Market projected to grow at over 15% CAGR through 2030. |

| Infrastructure | Low Latency & Co-location | Faster trade execution, crucial for HFT advantage. | Continued investment in network optimization and proximity hosting. |

| Data Management | Cloud Computing & Big Data | Scalable data aggregation, processing, and AI model deployment. | Global cloud computing market expected to surpass $1 trillion by 2025. |

| Security | Cybersecurity Measures | Protection against evolving threats, ensuring operational continuity and data integrity. | Global cost of cybercrime projected to reach $10.5 trillion annually by 2025. |

Legal factors

The SEC's proposed expansion of the 'dealer' definition could significantly impact firms like Virtu, potentially requiring them to register as broker-dealers. This would bring them under stricter regulatory oversight, including capital and reporting mandates. As of early 2024, the industry is still assessing the full implications and potential compliance costs, with ongoing discussions about the scope and timing of enforcement.

If Virtu Financial, a high-frequency trading firm, is compelled to register as a broker-dealer under new SEC rules, it would likely need to join FINRA. This membership means adopting FINRA's extensive regulatory framework, covering operational standards, financial health, data management, and market integrity rules. For instance, FINRA Rule 2010 mandates that members observe high standards of commercial honor and just and equitable principles of trade.

High-frequency trading firms like Virtu Financial operate under strict anti-manipulation and anti-fraud regulations. These rules are designed to ensure fair and orderly markets, preventing practices that could distort prices or mislead investors. For instance, the U.S. Securities and Exchange Commission (SEC) has consistently brought enforcement actions against firms for manipulative trading strategies, underscoring the importance of robust compliance programs.

Regulators globally are increasingly vigilant, with significant fines levied against firms for market abuse. In 2023, for example, various financial institutions faced penalties totaling hundreds of millions of dollars for compliance failures related to trading practices. Virtu's commitment to adhering to these complex legal frameworks is paramount, as non-compliance can lead to severe financial penalties, reputational damage, and operational restrictions, impacting its ability to conduct business effectively.

Cross-Border Regulatory Compliance

Virtu Financial, operating globally, faces the intricate challenge of adhering to a patchwork of financial regulations across various countries. This necessitates compliance with entities such as the U.S. Securities and Exchange Commission (SEC), the Central Bank of Ireland for its European footprint, and the Canadian Investment Regulatory Organization (CIRO) in Canada. Navigating these distinct legal frameworks is a substantial undertaking for the firm.

The complexity of cross-border regulatory compliance directly impacts Virtu Financial's operational efficiency and strategic planning. For instance, in 2024, financial institutions globally are increasingly focusing on adapting to evolving rules around data privacy and cybersecurity, which vary significantly by region. Virtu’s ability to maintain robust compliance programs across its international operations is critical for its continued success and market access.

- Jurisdictional Complexity: Virtu must comply with regulations from numerous bodies including the SEC in the US, the Central Bank of Ireland for EU operations, and CIRO in Canada.

- Evolving Landscape: The firm must stay abreast of changing regulations, particularly concerning areas like data privacy and market conduct, which differ across its operating regions.

- Operational Impact: Maintaining compliance across diverse legal environments requires significant investment in technology, personnel, and internal processes, impacting overall business costs.

Data Privacy and Protection Laws

Virtu Financial's extensive operations involving sensitive financial data mean strict adherence to data privacy and protection laws is non-negotiable. Regulations like the General Data Protection Regulation (GDPR) in Europe and similar evolving frameworks globally dictate how Virtu must handle client and market information. Failure to comply can lead to significant penalties, impacting operations and reputation. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is greater.

Maintaining trust with clients and partners hinges on robust data protection practices. Virtu navigates a complex legal landscape where data sovereignty and cross-border data transfer rules are increasingly stringent. As of 2024, many regions are updating their data protection laws, requiring continuous adaptation of Virtu's compliance strategies to avoid legal risks and maintain market confidence.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- Evolving Regulations: Continuous need to adapt to new data protection laws worldwide.

- Data Sovereignty: Navigating rules on where and how data can be stored and processed.

- Trust and Reputation: Compliance is vital for maintaining client and partner confidence.

The legal landscape for high-frequency trading firms like Virtu Financial is dynamic, with regulators continuously refining rules. For example, the SEC's ongoing review of market structure and dealer definitions, as discussed in early 2024, could impose new registration requirements and stricter oversight. This evolving regulatory environment necessitates significant investment in compliance infrastructure and expertise.

Virtu's global operations mean navigating a complex web of international laws, including those governing data privacy and cross-border transactions. For instance, compliance with GDPR in Europe, which can levy fines up to 4% of global annual revenue, highlights the substantial financial risk associated with regulatory non-adherence. Staying ahead of these varied legal requirements is crucial for operational continuity and market access.

Adherence to anti-manipulation and anti-fraud statutes is paramount for Virtu. The SEC actively pursues enforcement actions against firms engaging in illegal trading practices, reinforcing the need for robust internal controls and surveillance systems. In 2023, numerous financial institutions faced penalties for compliance failures, underscoring the severe consequences of market abuse.

Environmental factors

High-frequency trading, the core of Virtu Financial's operations, demands substantial technological infrastructure, including servers and data centers that are energy-intensive. While specific data center energy consumption figures for Virtu are not publicly disclosed, the broader financial sector's environmental impact, particularly from physical infrastructure, is under increasing scrutiny.

The push for sustainability means that energy efficiency in data centers is becoming a critical operational consideration. As the financial industry continues its digital transformation, companies like Virtu are positioned to potentially reduce their overall environmental footprint compared to traditional, brick-and-mortar financial institutions.

Financial institutions, Virtu included, are under growing pressure to disclose their environmental impact and climate-related financial risks. This is driven by regulatory mandates such as the EU's Corporate Sustainability Reporting Directive (CSRD), which came into full effect for many companies in 2024, requiring detailed reporting on environmental factors.

The increasing focus on Environmental, Social, and Governance (ESG) factors means that firms operating in capital markets must be transparent about their sustainability performance. For example, as of early 2025, many major European stock exchanges are mandating enhanced ESG disclosures for listed companies, impacting how financial firms like Virtu must report.

The financial industry is increasingly prioritizing sustainable finance, aiming to align investments with environmental objectives like biodiversity protection and net-zero emissions targets. This trend is significant, with global sustainable investment assets reaching an estimated $35.3 trillion in early 2024, according to the Global Sustainable Investment Alliance.

While high-frequency trading (HFT) firms like Virtu Financial aren't typically direct investors in green projects, this broader sustainable finance movement can reshape market dynamics. It could influence capital allocation and create new demands for sophisticated trading strategies and market infrastructure that support ESG (Environmental, Social, and Governance) considerations.

Operational Carbon Footprint

Virtu Financial's operational carbon footprint extends beyond its data centers to encompass its global office spaces and employee travel. While specific figures for Virtu are not publicly detailed, the financial services sector is increasingly focused on mitigating its environmental impact. For context, the broader financial industry's emissions are significant, with many firms actively seeking to reduce their carbon intensity through sustainable practices.

The shift towards digital operations in finance offers a pathway to reduced environmental impact. Companies embracing remote work and virtual collaboration can significantly cut down on emissions associated with office energy consumption and business travel. This trend highlights the potential for financial services to operate more sustainably, a direction Virtu and its peers are likely exploring to align with investor and regulatory expectations.

Key areas for reducing operational carbon footprint in financial firms include:

- Energy Efficiency: Upgrading office buildings and data centers to consume less electricity.

- Sustainable Travel: Implementing policies that encourage virtual meetings and reduce non-essential business travel.

- Waste Reduction: Minimizing paper usage and improving recycling programs across all operational sites.

Nature-Related Financial Risks

Financial institutions are now actively evaluating nature-related financial risks, including biodiversity loss and ecosystem degradation, recognizing their potential to impact investment portfolios. This shift means these risks are moving from abstract concerns to concrete financial considerations.

The integration of these nature-related risks into financial assessments is no longer a niche concern but a growing necessity. Financial firms are realizing that environmental degradation presents immediate, tangible threats that require proactive management.

For example, the Taskforce on Nature-related Financial Disclosures (TNFD) framework, launched in September 2023, provides a structure for organizations to report on their nature-related dependencies, impacts, risks, and opportunities. By mid-2024, over 300 organizations globally had committed to adopting the TNFD recommendations, indicating a significant industry trend towards quantifying these environmental impacts.

- Biodiversity Loss: Ecosystem degradation can directly impact sectors reliant on natural resources, such as agriculture and fisheries, potentially leading to supply chain disruptions and increased costs.

- Ecosystem Services: The decline in services like pollination or water purification, essential for many industries, poses a financial risk by increasing operational expenses or reducing productivity.

- Regulatory and Reputational Risks: Failure to address nature-related risks can result in stricter regulations, fines, and damage to a company's reputation, affecting investor confidence and market access.

- Physical Risks: Climate change-induced events, exacerbated by ecosystem damage, can lead to direct physical damage to assets and infrastructure, causing significant financial losses.

Virtu Financial's operations, particularly its reliance on energy-intensive data centers for high-frequency trading, face increasing scrutiny regarding environmental impact. The global push for sustainability, exemplified by directives like the EU's CSRD effective in 2024, mandates greater transparency in environmental reporting for companies, including those in the financial sector.

The financial industry is seeing a significant rise in sustainable finance, with global sustainable investment assets reaching an estimated $35.3 trillion by early 2024, influencing capital allocation and market demands. Furthermore, frameworks like the TNFD, adopted by over 300 organizations globally by mid-2024, are driving the assessment and disclosure of nature-related financial risks, such as biodiversity loss.

Virtu's operational footprint extends to office spaces and travel, with a growing industry focus on mitigating these impacts through energy efficiency and sustainable practices. The trend towards digital operations offers a pathway to reduced environmental impact, aligning with investor and regulatory expectations for enhanced ESG performance.

PESTLE Analysis Data Sources

Our Virtu Financial PESTLE Analysis draws from a comprehensive blend of data, including reports from financial regulators like the SEC and FCA, economic indicators from bodies such as the IMF and World Bank, and technology trend analyses from leading market research firms.