VAT Vacuumvalves AG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VAT Vacuumvalves AG Bundle

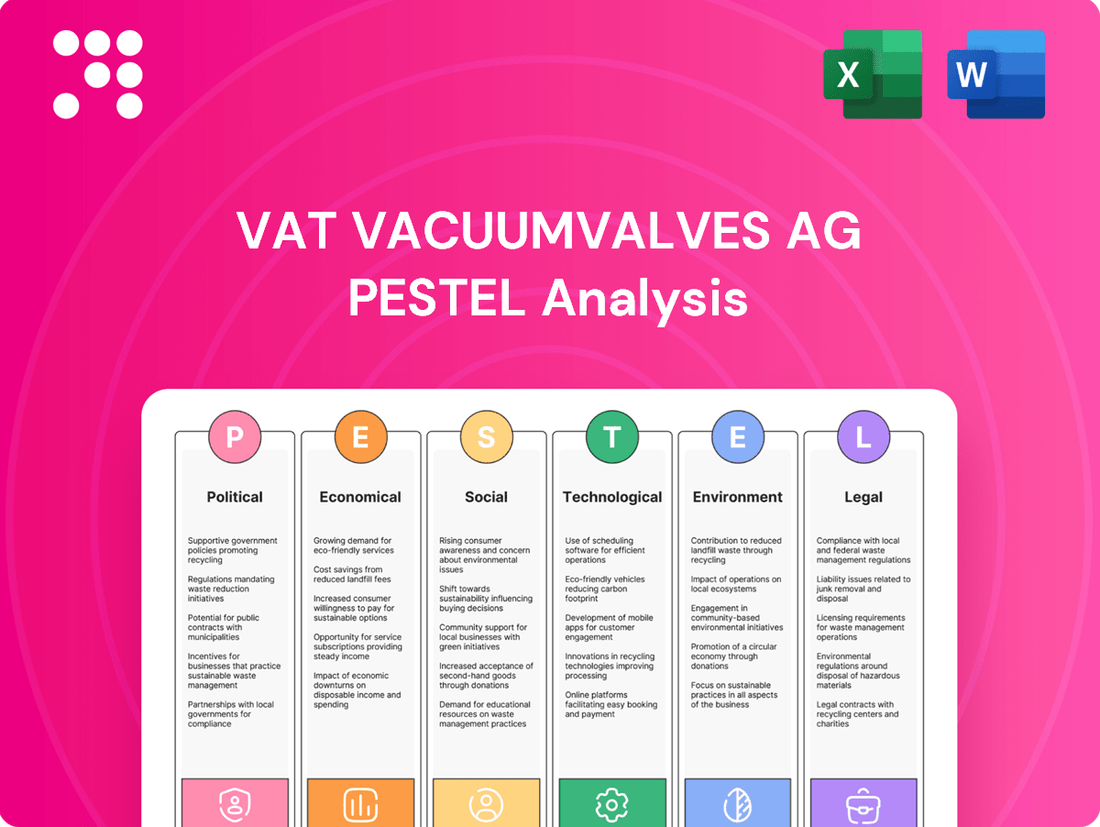

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping VAT Vacuumvalves AG's future. Our expert-crafted PESTLE analysis provides a deep dive into these external forces, equipping you with the foresight to anticipate challenges and seize opportunities. Don't navigate the complex global landscape blindfolded; download the full PESTLE analysis now and gain a decisive competitive advantage.

Political factors

Ongoing global trade disputes and rising protectionist policies, especially between the US and China, directly impact the semiconductor supply chain, a critical area for VAT. These tensions can disrupt the availability and cost of essential components, forcing companies like VAT to re-evaluate sourcing strategies. For instance, in 2023, the US implemented further restrictions on advanced chip technology exports to China, creating significant uncertainty for global semiconductor manufacturers and their suppliers.

Such geopolitical friction encourages reshoring or nearshoring initiatives as countries aim to bolster domestic manufacturing capabilities. This trend could present both challenges and opportunities for VAT. While it might necessitate adjustments to its existing production footprint, it also opens avenues for localized partnerships and expanded market access within regions prioritizing domestic supply chains. The drive towards supply chain resilience, spurred by these tensions, is a key consideration for VAT's long-term strategic planning.

Government subsidies like the US CHIPS Act and the EU Chips Act are injecting billions into domestic semiconductor manufacturing. For instance, the US CHIPS Act allocated over $52 billion for domestic chip production and research. This surge in investment directly fuels the construction and expansion of new fabrication plants (fabs).

These new and expanded fabs represent a significant increase in demand for VAT's specialized vacuum valves and modules, which are critical components in semiconductor manufacturing processes. VAT can strategically position itself to benefit from these government-backed initiatives by aligning its supply chain and product development with the goals of these crucial semiconductor industry support programs.

VAT Vacuumvalves AG operates in markets with varying degrees of regulatory stability. For instance, in the European Union, ongoing discussions around industrial policy and potential trade agreements, particularly concerning critical raw materials, could impact sourcing and operational costs. The predictability of these regulations is crucial for VAT's long-term investment decisions, such as expanding manufacturing capacity or entering new geographical markets.

Export Controls and Technology Transfer Regulations

Stricter export controls, particularly those impacting advanced technologies like semiconductor manufacturing equipment, could significantly affect VAT Vacuumvalves AG. These regulations, often targeting specific nations or end-users, may limit the company's ability to sell its high-performance vacuum solutions or share sensitive vacuum technology.

For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has implemented export controls on certain advanced technologies, including those used in semiconductor fabrication. In 2023, BIS expanded these controls, impacting a wider range of advanced computing items and semiconductor manufacturing equipment. This regulatory environment necessitates careful compliance by VAT, potentially requiring adjustments to its sales strategies and technology transfer practices to navigate these restrictions effectively.

- Export Control Impact: Regulations can restrict sales of high-performance vacuum products to targeted countries.

- Technology Transfer Hurdles: Sensitive vacuum technology sharing may be curtailed due to compliance requirements.

- Market Adaptation Needs: VAT must adapt its market strategies to comply with evolving global export control regimes.

- Semiconductor Sector Focus: Restrictions on semiconductor equipment directly influence the market for advanced vacuum components.

International Cooperation and Standards

International cooperation and the harmonization of standards are crucial for VAT Vacuumvalves AG, especially within the semiconductor and high-tech industries. Agreements like those fostered by the International Electrotechnical Commission (IEC) aim to create unified standards, which can significantly ease VAT's global market entry and ensure product interoperability. For instance, adherence to IEC 60068 environmental testing standards simplifies compliance across multiple regions.

Conversely, differing national regulations and standards can create substantial hurdles. If key markets, such as the United States or China, maintain distinct technical specifications for vacuum components or testing protocols, VAT may need to invest in costly product adaptations and separate certification processes. This divergence can slow down market expansion and increase operational complexity.

The benefits of standardized practices for market expansion are clear; a 2024 report by the World Trade Organization highlighted that countries with greater regulatory alignment experienced a 15% increase in trade volumes for high-tech goods. For VAT, this translates to:

- Reduced compliance costs: Fewer product variations needed for different markets.

- Faster market access: Streamlined approval processes due to common standards.

- Enhanced interoperability: Easier integration of VAT components into global supply chains.

- Increased R&D efficiency: Focus on innovation rather than country-specific modifications.

Geopolitical tensions, particularly between major economic blocs, continue to shape global trade dynamics and impact supply chains critical to VAT's operations. For instance, ongoing trade friction between the US and China in 2023-2024 has led to increased scrutiny and potential disruptions in the semiconductor sector, a key market for VAT's advanced vacuum solutions. This environment necessitates agile sourcing strategies and a keen awareness of evolving trade policies.

Government initiatives aimed at bolstering domestic manufacturing, such as the US CHIPS Act and similar programs in Europe and Asia, are significantly influencing the semiconductor industry's growth trajectory. These acts, with billions allocated for chip production, directly translate into increased demand for the specialized equipment VAT provides. By aligning with these national industrial strategies, VAT can capitalize on government-backed expansion projects.

Navigating a complex web of international regulations and export controls remains a significant political factor for VAT. Stricter controls on advanced technologies, as seen with US export restrictions on semiconductor manufacturing equipment implemented in late 2023 and continuing into 2024, require diligent compliance. VAT must adapt its sales and technology transfer practices to adhere to these evolving global trade frameworks.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing VAT Vacuumvalves AG, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify emerging opportunities and threats within the vacuum technology market.

The VAT Vacuumvalves AG PESTLE Analysis offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic discussions and decision-making.

Economic factors

The global semiconductor industry is notoriously cyclical, directly impacting demand for VAT's specialized valves, which are essential components in the complex chip manufacturing process. When the industry is in an upswing, driven by increased demand for electronics, VAT experiences a surge in orders as foundries ramp up production and expand capacity.

As of early 2024, the semiconductor market is showing signs of recovery after a significant downturn in 2023, with forecasts for 2025 suggesting continued growth, potentially reaching over $600 billion according to some industry analysts. This recovery phase implies a positive outlook for VAT, with expectations of increased revenue, a growing order book, and higher capacity utilization as chip manufacturers invest in new equipment and upgrades.

Global inflation significantly impacts VAT Vacuumvalves AG's operational costs. Rising prices for raw materials like specialty metals, increased energy expenses for manufacturing, and higher logistics costs for global shipping directly affect the cost of goods sold. For instance, the Producer Price Index (PPI) in key manufacturing regions saw substantial year-over-year increases in late 2024, impacting input prices.

These escalating costs pose a direct threat to VAT's profit margins. If the company cannot offset these increases through enhanced supply chain efficiencies or strategic price adjustments, profitability could be squeezed. For example, a 5% increase in raw material costs, if not passed on, could directly reduce the gross profit margin by a similar percentage.

Passing on these higher costs to customers presents a considerable challenge, especially in a competitive vacuum technology market. Customers may be sensitive to price hikes, potentially seeking alternative suppliers or delaying purchases, which could limit VAT's ability to maintain its current pricing power and market share.

Rising interest rates in 2024 and projected into 2025 directly impact VAT's operational finances. Higher rates increase the cost of borrowing for crucial capital expenditures, such as expanding manufacturing capacity or investing in new research and development for advanced vacuum technologies. For instance, if VAT needs to finance a new production line, a 1% increase in interest rates on a CHF 100 million loan could add CHF 1 million annually to its expenses.

Furthermore, the broader economic environment shaped by interest rate policies significantly affects VAT's customer base. As central banks, like the European Central Bank or the US Federal Reserve, adjust rates to combat inflation, it influences the investment decisions of semiconductor manufacturers and other key clients. Higher borrowing costs for these companies can lead to delayed or scaled-back investments in new fabrication plants and equipment upgrades, directly dampening the demand for VAT's specialized vacuum valves and systems. This was evident in late 2023, where increased capital costs led some semiconductor firms to re-evaluate their expansion timelines.

Exchange Rate Volatility

Exchange rate volatility presents a significant challenge for VAT Group AG, a company with extensive global operations. Fluctuations in currency values directly impact the conversion of foreign earnings into the reporting currency, potentially distorting reported revenues and profits.

These currency movements also affect VAT Group AG's competitiveness. For instance, a stronger Swiss Franc (CHF) can make its products more expensive for international buyers, while a weaker Franc could boost export sales by making them more attractive. This dynamic influences pricing strategies and market penetration efforts across different regions.

Furthermore, the cost of imported components, crucial for VAT Group AG's manufacturing processes, is also subject to exchange rate shifts. A depreciating CHF could increase the cost of these inputs, potentially squeezing profit margins if these costs cannot be fully passed on to customers. For example, in 2023, the Swiss Franc experienced periods of strength against major currencies, which would have presented headwinds for Swiss exporters like VAT Group AG.

- Impact on Reported Earnings: Currency fluctuations can lead to gains or losses when foreign subsidiary financial statements are translated into the group's reporting currency, affecting reported profitability.

- Competitiveness in Global Markets: A strong Swiss Franc can make VAT Group AG's products more expensive for international customers, potentially reducing demand and market share in key export markets.

- Cost of Imported Materials: Changes in exchange rates directly influence the cost of raw materials and components sourced internationally, impacting production costs and overall margins.

- Hedging Strategies: VAT Group AG likely employs hedging strategies, such as forward contracts, to mitigate the financial risks associated with currency volatility, aiming to stabilize earnings and manage costs.

Supply Chain Resilience and Costs

Economic factors like supply chain disruptions continue to impact manufacturing, with ongoing efforts to enhance resilience through diversification and regionalization. These shifts can influence the cost and availability of essential components for companies like VAT Vacuumvalves AG. For instance, global shipping costs saw significant fluctuations in 2024, with the Drewry World Container Index reaching peaks not seen since late 2021, directly affecting landed costs for imported parts.

The drive for supply chain resilience often translates into higher inventory holding costs or extended lead times as companies secure buffer stock or establish new supplier relationships. This necessitates strategic partnerships and proactive inventory management to mitigate potential production delays and cost increases. In 2024, many manufacturers reported increased warehousing expenses as they moved away from just-in-time models to just-in-case strategies.

- Increased component costs: Diversifying suppliers and regionalizing sourcing can lead to higher per-unit costs compared to single-source, low-cost regions.

- Inventory management challenges: Building resilience often requires holding larger inventories, increasing carrying costs and the risk of obsolescence.

- Extended lead times: Establishing new supply chains or qualifying new suppliers can initially result in longer lead times for critical components.

- Strategic supplier relationships: Investing in strong, collaborative relationships with key suppliers is crucial for navigating disruptions and ensuring component availability.

Economic recovery in the semiconductor industry is projected for 2025, with global market growth anticipated to exceed 10% from 2024 levels. This rebound, driven by increased consumer electronics demand and AI infrastructure build-outs, directly benefits VAT by boosting orders for its essential vacuum components. However, persistent global inflation, with producer prices in key manufacturing hubs remaining elevated in late 2024, continues to pressure VAT’s margins through higher raw material and energy costs. Furthermore, rising interest rates implemented by central banks throughout 2024 to curb inflation increase VAT's borrowing costs for capital investments and can dampen its customers' willingness to invest in new semiconductor manufacturing equipment.

| Economic Factor | 2024/2025 Outlook | Impact on VAT |

|---|---|---|

| Semiconductor Market Growth | Projected 10%+ growth in 2025 from 2024 levels. | Increased demand for VAT's valves, higher order volumes. |

| Global Inflation (PPI) | Elevated in late 2024, expected to moderate but remain a factor. | Increased operational costs (materials, energy), potential margin pressure. |

| Interest Rates | Rising trend in 2024, potential for stabilization or further increases in 2025. | Higher cost of capital for expansion, potential dampening of customer investment. |

Preview Before You Purchase

VAT Vacuumvalves AG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of VAT Vacuumvalves AG.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting VAT Vacuumvalves AG.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights for strategic planning.

Sociological factors

VAT Vacuumvalves AG faces significant hurdles in attracting and keeping top-tier engineers, technicians, and R&D talent, especially given the intense global competition for specialized skills in the high-tech sector. The demand for these professionals is consistently high, driving up recruitment costs and making retention a critical strategic imperative.

A strong company culture, competitive compensation, and clear career progression pathways are paramount for VAT to secure the essential human capital needed for ongoing innovation and efficient production. For instance, in 2024, the average salary for a semiconductor engineer in Switzerland, where VAT operates, saw an increase of approximately 5% year-over-year, reflecting the tight labor market.

VAT Vacuumvalves AG faces evolving workforce demographics, with an aging population in key European markets potentially leading to a loss of specialized vacuum technology expertise. This necessitates proactive knowledge transfer and retention strategies.

Conversely, younger generations entering the workforce often seek different career paths and workplace cultures, requiring VAT to adapt its recruitment and employee engagement strategies. For instance, in 2024, reports indicated a growing demand for digital skills across manufacturing sectors, a trend VAT must address.

Addressing these shifts requires significant investment in continuous training and upskilling programs. VAT's commitment to developing its workforce, including apprenticeships and advanced technical courses, is crucial for bridging emerging skill gaps and maintaining its competitive edge in the vacuum technology market.

Societal expectations for companies to actively engage in Corporate Social Responsibility (CSR) are on the rise. This includes ensuring ethical labor practices throughout their supply chains, actively contributing to the communities where they operate, and adopting environmentally sustainable business models. For VAT Vacuumvalves AG, demonstrating a robust commitment to these areas is becoming increasingly crucial for maintaining a positive public image and operational license.

VAT's dedication to CSR can significantly bolster its brand reputation, making it more attractive to consumers and business partners who value ethical conduct. Furthermore, a strong CSR profile is a magnet for top talent, particularly among younger generations who prioritize working for organizations with a clear social conscience. Investors are also increasingly screening companies based on Environmental, Social, and Governance (ESG) criteria; for instance, in 2024, global ESG investments were projected to exceed $50 trillion, highlighting the financial imperative for companies like VAT to align with these values.

Health and Safety Standards in Manufacturing

Societal expectations for worker well-being are increasingly paramount, especially in precision manufacturing sectors like vacuum technology. Companies like VAT Vacuumvalves AG must prioritize comprehensive health and safety measures to safeguard their workforce, ensuring a secure and productive environment. This commitment is not just ethical but also crucial for operational stability and brand integrity.

Adherence to rigorous safety protocols is vital to prevent workplace accidents, which can lead to costly downtime and potential legal liabilities. For instance, in 2024, workplace injuries in the manufacturing sector across the EU resulted in significant economic losses, underscoring the financial impact of inadequate safety standards. Maintaining a strong safety record also bolsters a company's reputation among employees, customers, and investors.

- Employee Protection: Implementing advanced safety training and providing appropriate personal protective equipment (PPE) are fundamental to preventing injuries.

- Operational Continuity: Robust safety management systems minimize disruptions caused by accidents, ensuring consistent production output.

- Reputational Management: A proactive approach to health and safety enhances public perception and trust, crucial for high-tech industries.

- Legal Compliance: Strict adherence to national and international safety regulations, such as those outlined by OSHA or EU-OSHA, avoids fines and legal challenges.

Consumer and Industry Demand for Sustainable Products

Societal awareness of environmental issues is increasingly shaping consumer and industry demand for sustainable products. This trend extends to business-to-business (B2B) sectors, where companies are scrutinizing their suppliers' environmental practices and material sourcing.

VAT's customers, particularly those in forward-thinking industries like solar energy and advanced display manufacturing, are demonstrably prioritizing suppliers with robust environmental credentials. For instance, many solar panel manufacturers now require their component suppliers to adhere to strict sustainability standards, often verified through third-party audits. Similarly, the display industry is seeing a push for reduced carbon footprints throughout the supply chain, influencing procurement decisions for critical components like vacuum valves.

This growing demand is reflected in market data. By 2024, global spending on sustainable products and services was projected to reach trillions, with a significant portion attributed to B2B procurement. Transparency in supply chains is no longer a niche concern but a key differentiator, with companies actively seeking partners who can demonstrate ethical sourcing and minimal environmental impact.

- Growing Demand: Global markets show a clear upward trend in demand for sustainably produced goods across all sectors.

- B2B Influence: Environmental, Social, and Governance (ESG) criteria are increasingly integrated into B2B purchasing decisions.

- Industry Focus: Sectors like solar and display manufacturing are at the forefront of demanding sustainable supply chains.

- Transparency Key: Companies are prioritizing suppliers with transparent and verifiable environmental practices.

Societal shifts are profoundly influencing VAT Vacuumvalves AG's operational landscape, particularly concerning talent acquisition and retention in specialized engineering fields. The intense global competition for skilled professionals, with average semiconductor engineer salaries in Switzerland rising by approximately 5% in 2024, necessitates competitive compensation and robust career development programs to attract and keep top talent.

Furthermore, evolving workforce demographics, including an aging skilled workforce in Europe and the preferences of younger generations for different work cultures, require VAT to adapt its recruitment and employee engagement strategies. For instance, the increasing demand for digital skills in manufacturing, observed in 2024, highlights the need for continuous training and upskilling initiatives to bridge emerging skill gaps.

The growing societal emphasis on Corporate Social Responsibility (CSR) and worker well-being also impacts VAT. Demonstrating ethical labor practices, community engagement, and strong environmental commitments is crucial for brand reputation and attracting talent, especially as global ESG investments neared $50 trillion in 2024. Prioritizing comprehensive health and safety measures is vital, as workplace injuries in the EU manufacturing sector in 2024 incurred significant economic losses, underscoring the financial implications of inadequate safety standards.

| Societal Factor | Impact on VAT Vacuumvalves AG | Supporting Data/Trend (2024/2025) |

| Talent Demand & Competition | High demand for specialized engineers, driving up recruitment costs and retention challenges. | ~5% year-over-year increase in semiconductor engineer salaries in Switzerland. |

| Workforce Demographics | Aging workforce in Europe; younger generations seek different work cultures and digital skills. | Growing demand for digital skills across manufacturing sectors. |

| Corporate Social Responsibility (CSR) | Increasing expectation for ethical practices, community contribution, and environmental sustainability. | Global ESG investments projected to exceed $50 trillion. |

| Worker Well-being & Safety | Prioritization of health and safety measures to prevent accidents and ensure operational continuity. | Significant economic losses from workplace injuries in EU manufacturing sector. |

Technological factors

Ongoing research in vacuum technology is pushing boundaries, with significant strides in achieving ultra-high vacuum (UHV) levels, enhancing real-time process monitoring, and developing more robust sealing solutions. These advancements are critical for industries requiring extreme purity and precise control, such as semiconductor manufacturing and advanced materials research.

VAT's commitment to continuous innovation in these areas, including their development of advanced valve technologies for UHV applications, is key to their competitive advantage. For instance, their focus on leak-tightness and minimal outgassing directly supports the increasingly stringent requirements of next-generation chip fabrication, a market segment that saw global capital expenditure in semiconductor manufacturing equipment reach an estimated $60 billion in 2024.

The high-tech manufacturing sector, particularly semiconductor fabrication, is rapidly embracing automation and Industry 4.0. This shift, driven by the need for precision and efficiency, sees advanced robotics and AI becoming integral. For instance, by 2025, it's projected that the global industrial automation market will reach over $300 billion, showcasing significant investment in these areas.

VAT Vacuumvalves AG can significantly enhance its own production by integrating these technologies, potentially reducing cycle times and improving quality control. Furthermore, VAT's advanced vacuum valves are designed for seamless integration into smart factory ecosystems, supporting the data-driven communication and control essential for Industry 4.0 operations.

The semiconductor and display industries are constantly pushing the boundaries of miniaturization. This means components like vacuum valves need to be smaller, more precise, and incredibly reliable to support these advanced manufacturing processes. For example, the drive for smaller chip features, measured in nanometers, directly translates to a need for vacuum valves that can operate with exceptional accuracy in increasingly confined spaces.

VAT's expertise in developing these highly specialized, miniature vacuum valves is a key differentiator. Their ability to deliver components that meet these stringent precision and reliability demands is crucial for their customers to successfully implement next-generation production technologies. This allows manufacturers to achieve higher yields and produce more sophisticated electronic devices.

Emerging Applications and New Materials

Emerging technologies, particularly in areas like advanced semiconductors and renewable energy component manufacturing, increasingly rely on specialized vacuum environments. For instance, the development of next-generation perovskite solar cells, which saw significant investment and research activity in 2024, requires precise vacuum deposition techniques. VAT can adapt its valve technology by incorporating novel materials, such as advanced ceramics or specialized coatings, to withstand the corrosive or high-temperature processes involved, thereby opening up new market segments.

The demand for valves capable of handling exotic gases and extreme temperatures is growing as new materials are explored. For example, research into solid-state batteries in 2024 highlighted the need for vacuum processing of novel electrolyte materials. VAT's strategic response could involve R&D into valve designs that offer enhanced chemical resistance and thermal stability, potentially increasing its market share in these high-growth sectors.

- Advanced Ceramics: Integration into valve components for enhanced wear resistance and thermal stability in demanding vacuum processes.

- Novel Coatings: Development of specialized coatings to prevent material outgassing and contamination in ultra-high vacuum applications.

- Perovskite Solar Cells: Growing demand for vacuum deposition equipment in this sector, creating opportunities for specialized valve solutions.

- Solid-State Batteries: The need for vacuum processing of new electrolyte materials presents a market for robust and reliable vacuum valves.

Intellectual Property and R&D Investment

Protecting its intellectual property and investing heavily in research and development are crucial for VAT Vacuumvalves AG to keep its edge in the specialized vacuum technology market. This focus on innovation allows them to differentiate their offerings and maintain a competitive advantage.

Continuous innovation and securing patents for new designs and manufacturing processes are vital for VAT to stay ahead of rivals. This strategy not only safeguards their market position but also lays the groundwork for sustained future growth and profitability.

For instance, VAT's commitment to R&D is reflected in its consistent investment. In 2024, the company allocated a significant portion of its revenue towards R&D, aiming to develop next-generation vacuum solutions. This investment is directly linked to their ability to patent new technologies, as evidenced by their growing patent portfolio in areas like advanced valve sealing and control systems.

- Intellectual Property Protection: VAT's strategy hinges on robust patent protection for its unique valve designs and manufacturing processes.

- R&D Investment: Significant R&D spending, a key driver for innovation, ensures VAT remains at the forefront of vacuum technology advancements.

- Competitive Advantage: Continuous innovation and patenting new technologies are essential for maintaining market leadership and deterring competitors.

- Future Growth: The company's focus on R&D directly supports its long-term growth strategy by creating new product lines and improving existing ones.

Advancements in ultra-high vacuum (UHV) technology, including improved sealing and real-time monitoring, are critical for sectors like semiconductor manufacturing. VAT's development of UHV valves directly addresses these stringent requirements, supporting a semiconductor equipment market estimated at $60 billion in 2024.

The integration of Industry 4.0 principles, such as automation and AI, is transforming high-tech manufacturing, with the global industrial automation market projected to exceed $300 billion by 2025. VAT's valves are designed for seamless integration into these smart factory ecosystems, enhancing production efficiency and quality control.

Emerging technologies, like next-generation semiconductors and perovskite solar cells, increasingly demand specialized vacuum environments. VAT's ability to adapt valve technology with novel materials, such as advanced ceramics, positions them to capitalize on these growing market segments, which saw significant research investment in 2024.

VAT's sustained investment in research and development, including a significant allocation of revenue in 2024 towards developing next-generation vacuum solutions, is key to its competitive edge. This focus allows for the protection of intellectual property through patents, ensuring market leadership and future growth.

Legal factors

International trade laws and tariffs significantly impact VAT Vacuumvalves AG's global operations. For instance, the European Union's Common Customs Tariff and specific trade agreements influence the cost and ease of importing raw materials and exporting finished vacuum valves. Navigating these regulations, including compliance with export control laws and sanctions, is crucial to prevent costly delays and penalties, ensuring efficient supply chain management.

VAT Vacuumvalves AG operates within a robust legal framework governing intellectual property, including patents, trademarks, and trade secrets. These legal protections are fundamental for a company reliant on advanced technology, safeguarding its innovative valve designs and manufacturing processes.

Protecting its proprietary technologies is paramount for VAT. The company must actively defend against any infringement of its patents, which are crucial for maintaining its competitive edge in the vacuum technology market. As of early 2024, the global patent landscape continues to evolve, with increasing emphasis on sustainability and advanced manufacturing techniques, areas where VAT's innovations are likely to be concentrated.

VAT Vacuumvalves AG, operating in the high-tech manufacturing sector, faces significant legal obligations concerning product liability and safety. These regulations are designed to protect end-users from harm caused by defective products. For instance, in 2024, the EU's General Product Safety Regulation (GPSR) continues to emphasize manufacturer responsibility for product safety throughout the supply chain, with potential fines for non-compliance.

Ensuring VAT's vacuum valves meet stringent safety certifications and performance standards is paramount to mitigating legal risks. Product failures or operational hazards could lead to costly lawsuits, recalls, and reputational damage. As of early 2025, industries like semiconductor manufacturing, a key market for VAT, adhere to rigorous standards like SEMI standards, where even minor valve malfunctions can have severe consequences, potentially costing millions in lost production.

Environmental, Health, and Safety (EHS) Regulations

VAT Vacuumvalves AG navigates a complex landscape of Environmental, Health, and Safety (EHS) regulations across its global manufacturing sites, impacting everything from waste disposal to chemical handling. Compliance is not merely a legal obligation but a critical factor for avoiding substantial fines, securing essential operating licenses, and upholding its reputation as a responsible corporate citizen. For instance, in 2024, the European Union continued to tighten its grip on industrial emissions, with stricter limits on volatile organic compounds (VOCs) and hazardous waste management, directly affecting production processes and the need for advanced abatement technologies.

Failure to adhere to these EHS mandates can lead to significant financial penalties and operational disruptions. In 2025, reports indicate that companies in the manufacturing sector facing non-compliance issues could incur fines ranging from tens of thousands to millions of Euros, depending on the severity and nature of the violation. This underscores the imperative for VAT to maintain robust EHS management systems and invest in technologies that ensure adherence to evolving legal standards.

Key EHS regulatory considerations for VAT include:

- Compliance with REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations in the EU, ensuring safe use of chemicals in manufacturing processes.

- Adherence to waste management directives, including proper classification, treatment, and disposal of industrial waste generated from production.

- Implementation of occupational health and safety standards to protect employees from workplace hazards, a focus that intensified with post-pandemic health considerations in 2024-2025.

- Meeting air and water quality standards, requiring continuous monitoring and investment in pollution control technologies.

Data Privacy and Cybersecurity Laws

VAT Vacuumvalves AG must navigate a complex web of data privacy and cybersecurity laws. Regulations like the EU's General Data Protection Regulation (GDPR) and similar frameworks globally, such as the California Consumer Privacy Act (CCPA), directly impact how VAT handles customer data, employee information, and sensitive supply chain details. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates robust internal data handling protocols and secure customer interaction platforms.

Implementing stringent cybersecurity measures is not merely a best practice but a legal imperative. VAT needs to invest in advanced data protection policies and technologies to safeguard sensitive information from breaches. The increasing sophistication of cyber threats means continuous updates and vigilance are crucial. For example, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense financial and reputational risks associated with inadequate security.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- CCPA Impact: Affects data collection, processing, and consumer rights in California.

- Cybercrime Costs: Global projections reaching $10.5 trillion annually by 2025 underscore the need for strong defenses.

- Supply Chain Security: Legal obligations extend to protecting data shared with and received from partners.

Legal and regulatory compliance is a cornerstone for VAT Vacuumvalves AG, influencing its global operations and market access. Adherence to trade laws, tariffs, and export controls is vital for smooth international commerce, impacting raw material sourcing and product distribution. For example, the EU's trade policies directly shape import costs for components and export prices for finished goods, with compliance failures potentially leading to significant financial penalties and supply chain disruptions.

Intellectual property laws are critical for safeguarding VAT's technological innovations, including patents on valve designs and manufacturing processes. Protecting these assets is key to maintaining a competitive advantage, especially as global patent trends in 2024-2025 increasingly focus on advanced manufacturing and sustainability. As of early 2025, the semiconductor industry, a major client for VAT, places a high premium on the reliability and performance of vacuum valves, making IP protection paramount.

Product liability and safety regulations are stringent, requiring VAT to ensure its vacuum valves meet rigorous standards to prevent harm to end-users. The EU's General Product Safety Regulation (GPSR), continually updated, places significant responsibility on manufacturers. In sectors like semiconductor manufacturing, even minor valve malfunctions can cause immense financial losses, estimated in the millions due to production downtime, underscoring the critical need for flawless product safety and compliance with standards like SEMI in 2025.

Environmental factors

Manufacturing firms like VAT Vacuumvalves AG are facing increasing pressure to shrink their carbon emissions and boost energy efficiency. This is driven by both public demand and stricter environmental regulations worldwide.

Embracing renewable energy, such as solar or wind power for their facilities, and refining production methods to use less energy are key strategies. Developing products that consume less power throughout their lifecycle also aligns with these environmental objectives and regulatory demands.

For instance, the EU aims for a 55% reduction in greenhouse gas emissions by 2030 compared to 1990 levels. Companies are investing in energy-efficient machinery; in 2024, the global industrial energy efficiency market was valued at over $30 billion and is projected to grow significantly.

The environmental imperative for effective waste management, focusing on reduction, reuse, and recycling, is increasingly critical for manufacturers like VAT Vacuumvalves AG. By adopting these principles, VAT can significantly lessen its environmental footprint throughout its production cycles.

Integrating circular economy principles into product design and operations presents a strategic opportunity for VAT. This includes designing for disassembly and material recovery, thereby minimizing waste and maximizing resource utilization, aligning with evolving waste regulations and customer expectations.

Globally, the push towards a circular economy is gaining momentum. For instance, the European Union's Circular Economy Action Plan aims to drive sustainable resource management, and by 2023, the value of the circular economy in the EU was estimated at €1.2 trillion, demonstrating its economic significance.

Resource scarcity, particularly for specialized alloys and rare earth metals crucial for vacuum technology components, presents a significant environmental challenge. The extraction and processing of these materials often carry substantial ecological footprints, impacting biodiversity and water resources. VAT's commitment to sustainable sourcing is therefore paramount, directly addressing the environmental implications of its material dependencies.

To navigate these risks, VAT is increasingly focused on supply chain transparency and the exploration of alternative materials. This proactive approach not only mitigates supply disruptions but also lessens the environmental burden associated with conventional resource extraction. For instance, by 2024, the global demand for critical minerals like cobalt, essential in some high-performance alloys, is projected to rise significantly, underscoring the urgency of these strategies.

Water Usage and Wastewater Treatment

Manufacturing, especially in precision sectors like vacuum technology, can be water-intensive. VAT's operations, like many in the industry, likely involve water for cooling, cleaning, and potentially in certain manufacturing processes. The environmental impact stems from both the volume of water consumed and the quality of wastewater discharged, which can contain various contaminants.

Meeting stringent environmental regulations is crucial for companies like VAT. For instance, in the European Union, the Water Framework Directive sets objectives for water quality, and national regulations often dictate permissible discharge levels for specific pollutants. Failure to comply can result in significant fines and reputational damage.

To mitigate these environmental concerns, VAT needs to focus on robust water management. This includes implementing water-efficient technologies, exploring water recycling and reuse programs, and investing in advanced wastewater treatment processes to ensure discharged water meets or exceeds regulatory standards.

- Water Consumption: Precision manufacturing often requires high-purity water for cleaning and cooling, contributing to overall industrial water demand.

- Wastewater Contaminants: Discharges may contain coolants, lubricants, cleaning agents, and fine particulate matter, necessitating specialized treatment.

- Regulatory Compliance: Strict environmental laws, such as those under the EU's Industrial Emissions Directive, mandate specific treatment levels for wastewater.

- Ecological Footprint: Efficient water management and treatment are key to reducing VAT's impact on local water bodies and ecosystems.

Regulatory Compliance and Reporting

Environmental regulations are becoming more stringent globally, with a growing emphasis on transparent reporting of sustainability performance. Companies like VAT Vacuumvalves AG are increasingly expected by investors, customers, and governments to demonstrate their commitment to environmental stewardship.

To navigate this landscape, VAT must maintain robust compliance frameworks. This involves not only adhering to current environmental laws but also anticipating future regulatory changes. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), which came into full effect in 2024 for large companies, mandates detailed reporting on environmental, social, and governance (ESG) matters, including emissions and resource usage.

VAT's proactive approach would include conducting regular environmental audits to identify areas of non-compliance or potential improvement. Furthermore, transparently reporting on its sustainability performance, such as reductions in greenhouse gas emissions or waste management practices, is crucial. In 2023, many industrial companies reported significant investments in cleaner technologies; for example, the manufacturing sector saw a 15% increase in capital expenditure dedicated to environmental upgrades, according to industry analysis.

- Increasing Regulatory Stringency: Environmental laws are tightening, demanding greater accountability from businesses.

- Demand for Transparency: Stakeholders expect clear and regular reporting on a company's environmental impact and sustainability efforts.

- Compliance Frameworks: VAT must ensure its operations meet all legal environmental standards and adapt to evolving regulations like the CSRD.

- Audits and Reporting: Regular environmental audits and public disclosure of sustainability data are essential for meeting legal requirements and stakeholder expectations.

VAT Vacuumvalves AG faces growing pressure to reduce its carbon footprint and enhance energy efficiency, driven by public opinion and stricter global environmental regulations. The company's strategies include adopting renewable energy sources and optimizing production processes for lower energy consumption, alongside developing products with reduced lifecycle power usage.

The global push for a circular economy is significant, with the EU's Circular Economy Action Plan aiming for sustainable resource management. By 2023, the circular economy's value in the EU was estimated at €1.2 trillion, highlighting its economic importance and the opportunities for companies like VAT to integrate these principles.

Resource scarcity, particularly for specialized alloys and rare earth metals vital for vacuum technology, poses a considerable environmental hurdle due to the ecological impact of extraction. VAT's focus on supply chain transparency and alternative materials by 2024 is critical as demand for minerals like cobalt is projected to rise significantly.

Water management is another key environmental consideration, with precision manufacturing often being water-intensive. VAT must adhere to regulations like the EU's Water Framework Directive, which sets water quality objectives, and invest in efficient water technologies and advanced wastewater treatment to minimize its ecological footprint.

PESTLE Analysis Data Sources

Our VAT Vacuumvalves AG PESTLE Analysis draws from a robust blend of official government publications, economic indicators from reputable international organizations, and specialized industry reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the vacuum valve sector.