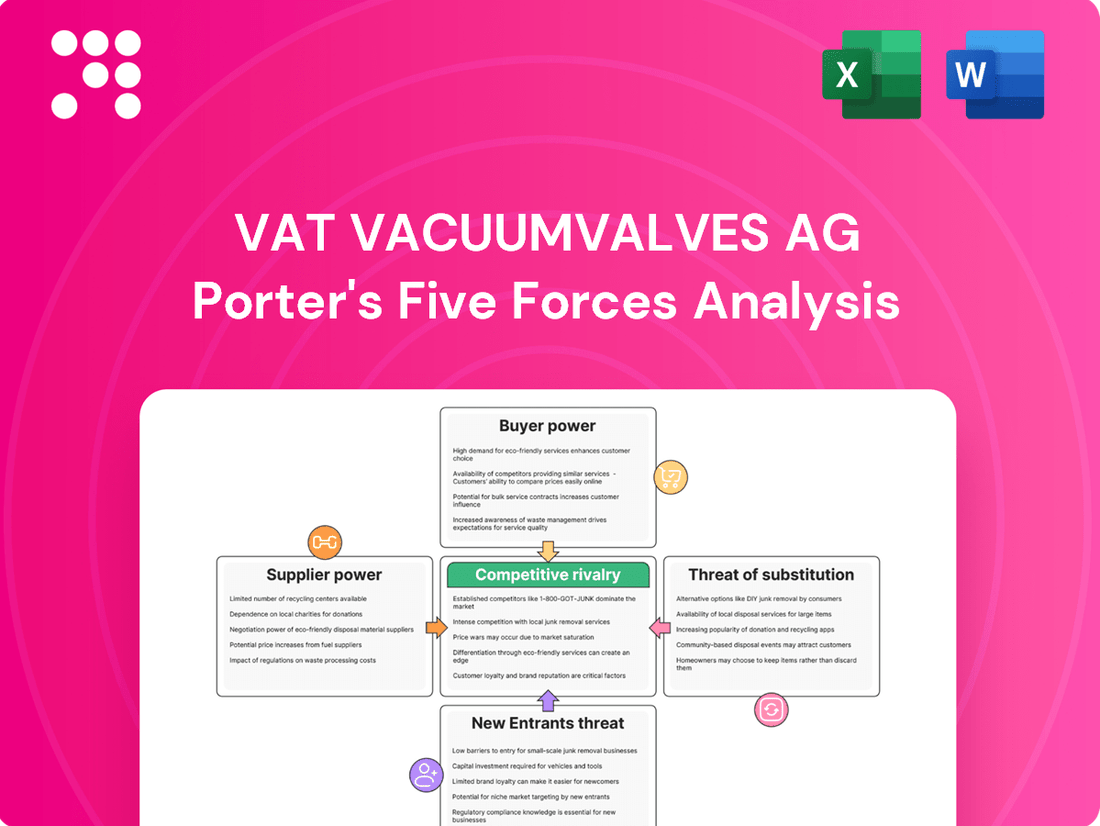

VAT Vacuumvalves AG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

VAT Vacuumvalves AG Bundle

VAT Vacuumvalves AG operates in a market characterized by significant barriers to entry and strong supplier power, impacting its profitability and strategic flexibility. Understanding these dynamics is crucial for anyone looking to grasp the competitive landscape.

The complete report reveals the real forces shaping VAT Vacuumvalves AG’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

VAT Vacuumvalves AG faces significant supplier bargaining power due to its reliance on a select group of highly specialized component and raw material providers. The demanding specifications for vacuum valves used in sectors like semiconductor manufacturing mean only a few suppliers can meet VAT's stringent quality and performance standards.

This limited supplier base, coupled with the critical nature of these components, grants these specialized vendors considerable leverage. For instance, the semiconductor industry, a key market for VAT, saw global fab utilization rates fluctuating, with some segments experiencing tight supply chains in early 2024, potentially increasing the cost of specialized inputs for valve manufacturers.

Switching suppliers for critical manufacturing inputs in the vacuum valve industry, such as specialized alloys or precision components, can involve substantial costs and time. These costs are amplified by the rigorous qualification processes, technical certifications, and validation testing required to ensure compatibility and performance, making it both expensive and risky for VAT Vacuumvalves AG to change suppliers frequently.

These high switching costs significantly empower incumbent suppliers. For instance, if a key supplier of a proprietary vacuum-grade stainless steel were to increase prices, VAT would face considerable disruption and expense in qualifying a new source, potentially impacting production timelines and product quality.

Many critical suppliers for the semiconductor and vacuum technology sectors are clustered in specific areas, predominantly in Asia. This geographic concentration poses a risk; disruptions like geopolitical issues or regional events can significantly impact supply availability and costs. For instance, Taiwan, a major hub for semiconductor manufacturing, experienced production slowdowns in early 2024 due to earthquake activity, highlighting the fragility of geographically concentrated supply chains.

While VAT Vacuumvalves AG benefits from its own diverse manufacturing sites in Switzerland, Malaysia, and Romania, its reliance on these concentrated upstream suppliers remains a point of concern. This means that even with its global presence, the company is still susceptible to upstream supply shocks originating from these key regions, potentially affecting production schedules and material costs.

Technological Uniqueness of Inputs

Suppliers offering technologically unique or proprietary inputs wield significant bargaining power. When VAT Vacuumvalves AG relies on specialized materials or sub-components that are not readily available from multiple sources, their ability to negotiate favorable pricing and terms is diminished. This scarcity of alternatives directly strengthens the supplier's position.

This is especially pertinent in advanced sectors like semiconductor manufacturing, where the precise specifications of vacuum valves are crucial for achieving breakthroughs in process nodes. For instance, the development and production of components for 2nm node semiconductor fabrication demand highly specialized materials that may only be sourced from a limited number of suppliers, giving them considerable leverage.

- Limited Supplier Pool: For highly specialized vacuum valve components, the number of suppliers capable of meeting stringent technical requirements can be very small, often numbering only one or two globally.

- Proprietary Technology: Suppliers possessing patented or unique manufacturing processes for critical materials or sub-components for vacuum valves can command higher prices due to their exclusive offerings.

- High Switching Costs: If VAT were to switch to a different supplier for a technologically unique input, the costs associated with re-qualifying the new component, redesigning parts of their valves, and potential production downtime could be substantial, further entrenching the current supplier's power.

Limited Threat of Forward Integration by Suppliers

While suppliers of specialized materials for high-performance vacuum valves possess some leverage, the threat of them integrating forward into VAT's manufacturing domain is generally low. The significant capital investment and deep technical expertise needed to produce and service complete vacuum valve systems act as substantial deterrents.

This inherent complexity and the need for specialized knowledge create barriers that prevent most suppliers from directly competing with established players like VAT. Consequently, their ability to exert significant pressure through forward integration is somewhat curtailed, moderating their overall bargaining power.

- Limited Forward Integration Threat: Suppliers face high barriers to entry in manufacturing complex, high-performance vacuum valve systems.

- Capital and Expertise Barriers: The substantial financial and technical resources required to compete directly with VAT limit supplier integration.

- Moderated Supplier Power: These factors reduce the likelihood of suppliers becoming direct competitors, thereby tempering their bargaining power.

The bargaining power of VAT Vacuumvalves AG's suppliers is considerable, primarily driven by the highly specialized nature of components and raw materials required for advanced vacuum technology. This specialization limits the pool of capable suppliers, granting those who can meet VAT's stringent quality and performance demands significant leverage.

The critical role of these components, especially in sectors like semiconductor manufacturing, further amplifies supplier power. For instance, in early 2024, tight supply chains for certain specialized inputs in the semiconductor industry, which is a key market for VAT, indicated a potential for increased input costs for valve manufacturers.

High switching costs also play a crucial role. Qualifying new suppliers for critical vacuum-grade materials or precision components involves extensive testing and certification, making it both costly and time-consuming for VAT to change vendors. This entrenches the power of incumbent suppliers.

| Factor | Impact on VAT | Example/Data Point (2024) |

|---|---|---|

| Limited Supplier Pool | High Bargaining Power | Few global suppliers can meet precision requirements for semiconductor-grade vacuum valves. |

| Proprietary Technology | High Bargaining Power | Suppliers of unique vacuum alloys or patented components can dictate terms. |

| High Switching Costs | High Bargaining Power | Re-qualification of specialized components can take months and incur significant R&D expenses. |

| Geographic Concentration | Increased Risk | Key suppliers often concentrated in regions like Taiwan, vulnerable to supply chain disruptions (e.g., earthquake impacts on manufacturing in early 2024). |

What is included in the product

VAT Vacuumvalves AG's Porter's Five Forces analysis reveals the intense competition from established players and potential new entrants, the significant bargaining power of its key customers, and the moderate threat of substitutes, all of which shape the company's strategic positioning.

Uncover hidden competitive advantages and threats with a dynamic, interactive Five Forces analysis, allowing for precise adjustments to strategy based on real-time market shifts.

Customers Bargaining Power

VAT Vacuumvalves AG faces significant customer concentration, particularly within the semiconductor, display, and solar manufacturing sectors. These industries are characterized by a limited number of very large, global players. For example, the top 10 semiconductor manufacturers globally accounted for a substantial portion of the industry's revenue in 2023, highlighting the concentrated nature of VAT's customer base.

The substantial purchasing volumes of these major clients grant them considerable bargaining power. Their ability to negotiate favorable pricing, delivery schedules, and even product specifications directly impacts VAT's profitability and operational flexibility. In 2024, the ongoing demand for advanced semiconductor manufacturing equipment, while strong, also means key clients can exert pressure on suppliers like VAT to maintain competitive terms.

Vacuum valves are absolutely essential for VAT's customers, especially in high-tech manufacturing. Think about semiconductor fabrication; these valves are key to maintaining the ultra-clean environments needed for producing chips. Without them, processes would fail, and production yields would plummet. This critical role means customers can't easily switch to less specialized or lower-performing alternatives, which naturally limits their bargaining power.

The bargaining power of VAT's customers is significantly limited by the low potential for backward integration. Developing and manufacturing high-performance vacuum valves, like those VAT specializes in, demands considerable technical expertise, substantial capital investment, and often involves protected intellectual property. For instance, the advanced materials science and precision engineering required for semiconductor manufacturing equipment components are not easily replicated.

Customers, such as leading semiconductor manufacturers who represent a substantial portion of the market, are typically focused on their core business of chip production. In 2024, the semiconductor industry continued its trend of heavy R&D spending, with major players investing billions in new fabrication technologies. Diverting resources and expertise to establish in-house vacuum valve production would be a massive undertaking, detracting from their primary strategic goals and core competencies. This makes the threat of customers bringing valve production in-house a negligible concern for VAT.

Demand Fluctuation in End Markets

The bargaining power of customers for VAT Vacuumvalves AG is significantly influenced by demand fluctuations in its end markets, particularly semiconductors and displays. These industries are known for their cyclical nature and sensitivity to broader economic conditions. When demand softens or there's an oversupply, customers can often leverage this situation to negotiate better prices and shorter lead times, thereby increasing their bargaining power.

However, the landscape is currently shifting. Trends observed in 2024 and heading into 2025 point towards robust growth in semiconductor equipment spending. This surge is largely propelled by the insatiable demand for advanced technologies, especially those related to artificial intelligence (AI) and the ongoing transitions in chip manufacturing. Such a strong demand environment can, in turn, strengthen VAT's negotiating position.

- Semiconductor Industry Growth: Global semiconductor equipment sales are projected to reach approximately $100 billion in 2024, a significant increase from previous years, driven by AI and advanced packaging.

- Display Market Dynamics: While display markets can be more volatile, the increasing demand for high-resolution and advanced displays in consumer electronics and automotive sectors provides a counter-balance to cyclicality.

- Customer Concentration: A high degree of customer concentration in the semiconductor sector could amplify customer bargaining power during downturns, but strong demand mitigates this risk for VAT.

- Technological Advancements: VAT's critical role in advanced manufacturing processes, such as those for leading-edge semiconductors, can reduce customer leverage due to the specialized nature of its products.

Product Differentiation and Customization

VAT Vacuumvalves AG's commitment to highly differentiated and customized vacuum valves and modules significantly mitigates customer bargaining power. By offering solutions critical for precise control in advanced manufacturing, VAT shifts the customer focus from price to performance and reliability.

This specialization means customers often cannot easily find readily available substitutes that match VAT's technical capabilities. For instance, in the semiconductor industry, a key market for VAT, the cost of valve failure or suboptimal performance can far outweigh the initial purchase price, reinforcing the value of VAT's specialized offerings.

- Product Specialization: VAT's focus on high-performance, customized vacuum solutions limits readily available alternatives for customers.

- Value Proposition: The critical role of VAT's products in complex, high-tech processes prioritizes performance and reliability over cost.

- Reduced Price Sensitivity: This differentiation insulates VAT from intense customer pressure to lower prices, as the value delivered often outweighs cost considerations.

VAT Vacuumvalves AG's customers, particularly in the semiconductor sector, possess considerable bargaining power due to their significant purchasing volumes and the critical nature of VAT's products in their manufacturing processes. However, VAT's specialization in highly differentiated and customized vacuum solutions, coupled with the high switching costs and the limited threat of backward integration, substantially curtails this power.

The bargaining power of VAT's customers is somewhat tempered by the critical, non-substitutable nature of its specialized vacuum valves in high-tech manufacturing. For example, the semiconductor industry, a key market, relies heavily on precise vacuum control, making VAT's offerings indispensable for maintaining production yields and quality. This indispensability limits customers' ability to exert significant price pressure.

While customer concentration in sectors like semiconductors can amplify bargaining power, especially during market downturns, the robust demand for advanced technologies, such as AI-driven chip manufacturing, strengthens VAT's negotiating position in 2024 and beyond. This dynamic environment, characterized by high growth in semiconductor equipment spending, currently favors suppliers like VAT.

| Factor | Impact on VAT's Customer Bargaining Power | Supporting Data/Observation (as of mid-2025) |

|---|---|---|

| Customer Concentration | Potentially High | Top semiconductor manufacturers represent a significant portion of VAT's revenue. |

| Criticality of Product | Low | Vacuum valves are essential for semiconductor fabrication, with high costs of failure. |

| Switching Costs | Low | Developing and manufacturing specialized valves requires substantial expertise and capital. |

| Threat of Backward Integration | Negligible | Customers focus on core competencies, making in-house valve production impractical. |

| Demand Fluctuations | Variable | Strong AI-driven demand in 2024-2025 strengthens VAT's position against typical cyclical pressures. |

Same Document Delivered

VAT Vacuumvalves AG Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details VAT Vacuumvalves AG's Porter's Five Forces Analysis, thoroughly examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

The high-performance vacuum valve market, especially for semiconductor and advanced industrial applications, features several strong global competitors. VAT holds a leading position, but it faces competition from significant players such as Pfeiffer Vacuum, Atlas Copco, and Busch Vacuum Solutions, which also have a strong presence in the broader industrial vacuum sector.

These established companies vie for market share by focusing on product innovation, technological advancements, and extensive global service capabilities. For instance, Pfeiffer Vacuum reported revenues of CHF 959 million in 2023, highlighting its substantial market presence and investment in R&D to maintain competitiveness.

The semiconductor equipment market, a crucial area for VAT, demands immense capital and is driven by swift technological progress. Intense competition among equipment makers directly impacts vacuum valve providers, as they compete for vital design wins and enduring contracts. This competitive landscape forces constant investment in research and development and the formation of strategic alliances to maintain a leading edge.

Competitive rivalry in the vacuum valve industry is intense, fueled by a relentless pursuit of technological advancement. Companies like VAT are constantly innovating to meet the stringent requirements of cutting-edge industries, such as the demand for valves capable of handling 2nm node manufacturing processes and advanced atomic layer deposition (ALD) systems. This drive necessitates significant investment in research and development.

This heavy investment in R&D translates into a race to improve product performance, boost energy efficiency, and enhance integration capabilities within complex manufacturing environments. Companies are differentiating themselves through superior material science, smarter valve designs, and improved control systems.

VAT's strategic commitment to innovation, evidenced by its ongoing investments in new factory expansions and the establishment of a dedicated Innovation Center, is paramount. For example, VAT's continued investment in its global manufacturing footprint, including recent expansions, directly supports its ability to deliver advanced solutions and maintain a leading position in this highly competitive landscape.

Global Reach and Service Capabilities

Competitors actively battle for market dominance by extending their global presence and bolstering their service capabilities. Offering localized expert assistance, authentic spare parts, and crucial upgrade services emerges as a significant competitive advantage, differentiating players in the vacuum valve industry.

VAT Vacuumvalves AG's strategic positioning is evident in its operations across 29 countries. This extensive reach is supported by manufacturing facilities strategically located in Switzerland, Malaysia, and Romania, underscoring the industry's emphasis on accessible production and supply chains.

- Global Presence: VAT operates in 29 countries, demonstrating a commitment to international market penetration.

- Manufacturing Footprint: Key manufacturing sites in Switzerland, Malaysia, and Romania support global operations and supply chain resilience.

- Service Differentiation: The company's Global Service segment highlights the critical role of local expert support, genuine spare parts, and upgrade services in winning and retaining customers.

- Competitive Imperative: Competitors are also focused on expanding their worldwide reach and enhancing service offerings to gain market share.

Market Growth Attracts Competition

Market growth is a significant magnet for competition. The vacuum valve market, for instance, is anticipated to experience consistent expansion. This is largely due to rising demand from key industries like semiconductor manufacturing, flat-panel display production, and the pharmaceutical sector.

This positive market trajectory, with projections indicating the global vacuum valve market could reach USD 2.11 billion by 2025 and continue its upward trend, naturally draws more intense rivalry. Existing companies aim to capitalize on this growth by increasing their market share.

- Growing Demand: Increased need from semiconductors, flat-panel displays, and pharmaceuticals fuels market expansion.

- Market Size Projection: The global vacuum valve market is expected to reach USD 2.11 billion in 2025.

- Attracting New Entrants: Lucrative segments within the growing market encourage new companies to consider entry.

- Intensified Rivalry: Both established players and new entrants will likely compete more aggressively for market share.

The competitive rivalry within the high-performance vacuum valve market is substantial, driven by a few well-established global players. Companies like Pfeiffer Vacuum, Atlas Copco, and Busch Vacuum Solutions actively compete with VAT, often leveraging their broader industrial vacuum portfolios and significant R&D investments. For example, Pfeiffer Vacuum reported CHF 959 million in revenue in 2023, indicating its scale and market influence.

This intense competition necessitates continuous innovation, with firms focusing on technological advancements, product performance, and global service networks to secure design wins in critical sectors like semiconductor manufacturing. The semiconductor industry's rapid technological evolution, demanding new valve capabilities for processes like 2nm node manufacturing, further escalates this rivalry.

Companies differentiate themselves through superior material science, advanced valve designs, and integrated control systems, requiring significant R&D expenditure. VAT's own investments in its global manufacturing footprint and a dedicated Innovation Center underscore this commitment to staying ahead in a market where technological leadership is paramount.

The market's projected growth, with the global vacuum valve market expected to reach USD 2.11 billion by 2025, attracts both established competitors and potential new entrants, intensifying the battle for market share and customer loyalty.

| Competitor | 2023 Revenue (CHF) | Key Focus Areas |

| Pfeiffer Vacuum | 959 million | Innovation, Global Service, R&D |

| Atlas Copco | - | Broad Industrial Vacuum Solutions |

| Busch Vacuum Solutions | - | Global Presence, Service Capabilities |

SSubstitutes Threaten

For VAT's core business, particularly in high-performance vacuum valves essential for semiconductor fabrication and other advanced manufacturing, direct substitutes are exceedingly scarce. The critical requirements for ultra-high purity, exceptional sealing, and minimal particle generation in these demanding environments mean that few, if any, alternative technologies can reliably meet the stringent specifications. For instance, the semiconductor industry, a key market for VAT, relies on these specialized valves to maintain the pristine conditions necessary for chip production, where even microscopic contamination can ruin entire batches of wafers.

While direct substitutes for VAT's high-performance vacuum valves are scarce, especially in demanding sectors like semiconductor manufacturing, alternative vacuum generation or control technologies could emerge for niche, less critical applications. For instance, simpler vacuum pumps or different flow control mechanisms might suffice in certain laboratory or less stringent industrial processes.

However, these alternatives are generally not comparable to the precision, reliability, and purity required for advanced applications where VAT's valves excel. The global industrial vacuum pump market, projected to reach over $10 billion by 2027, often caters to a wider spectrum of needs, not directly competing with the specialized requirements of high-tech vacuum systems.

Technological advancements in related fields could introduce substitutes that diminish the demand for vacuum valves. For instance, breakthroughs in alternative manufacturing processes that bypass the need for high vacuum environments would directly impact Vacuumvalves AG. While current semiconductor and display manufacturing fundamentally rely on vacuum processes, the long-term threat of such innovations cannot be ignored.

However, it's crucial to note that continuous innovation within vacuum technology itself, such as the integration of smart valves and IoT capabilities, is actively working to enhance efficiency and reinforce the necessity of these components. This ongoing development aims to maintain the competitive edge of traditional vacuum solutions, mitigating the immediate threat of substitution.

High Performance and Reliability Requirements

The industries VAT serves, especially semiconductor manufacturing, demand exceptional product performance, unwavering reliability, and continuous uptime. Any potential substitute would face the immense challenge of meeting these stringent standards, acting as a substantial barrier to entry.

The financial consequences of failure or contamination within these critical manufacturing processes are severe, far exceeding the cost of premium vacuum valves. This economic reality discourages customers from considering unproven or less dependable alternatives, reinforcing VAT's market position.

- High Performance Demands: Semiconductor fabrication requires vacuum valves that can operate with extreme precision and minimal particle generation.

- Reliability is Paramount: Downtime in chip manufacturing can cost millions of dollars per hour, making component reliability a non-negotiable factor. For instance, a single wafer fabrication plant can incur losses upwards of $20 million per day due to unexpected equipment downtime as of 2024.

- Cost of Failure: The cost of a faulty valve leading to process contamination or equipment damage is exponentially higher than the initial purchase price of a high-quality valve.

- Customer Inertia: Established processes and the high switching costs associated with qualifying new suppliers further reduce the threat of substitutes.

Integrated System Solutions

The increasing demand for integrated system solutions, where individual components are bundled into larger offerings, presents a nuanced threat to vacuum valve manufacturers like VAT. While this trend doesn't directly introduce substitutes for the core vacuum valve function, it can alter the procurement process. Instead of purchasing individual valves, customers might opt for complete systems from a single provider, potentially bypassing direct valve suppliers.

However, VAT is well-positioned to navigate this shift. The company's strategy of offering multi-valve modules and comprehensive services allows it to participate directly in these integrated solutions. This approach effectively mitigates the threat of substitution at the component level by making VAT a key partner in the system integration process. For instance, in the semiconductor industry, a major market for vacuum valves, the move towards more complex, automated processing equipment often necessitates integrated vacuum solutions.

- Market Shift: Trend towards integrated systems rather than standalone components.

- Procurement Change: Purchasing decisions may shift to system integrators.

- VAT's Mitigation: Offering multi-valve modules and services to be part of integrated solutions.

- Component Level: Threat of substitution remains low at the fundamental vacuum valve function.

The threat of substitutes for VAT's high-performance vacuum valves is generally low, particularly in its core markets like semiconductor manufacturing. The extreme purity and reliability demands of these industries mean that few alternative technologies can meet the stringent specifications. For example, the cost of a single wafer fabrication plant can exceed $20 million per day in losses due to unexpected equipment downtime as of 2024, underscoring the critical need for dependable components.

While simpler vacuum solutions might exist for less demanding applications, they do not compete with the precision required by advanced manufacturing. The global industrial vacuum pump market, projected to exceed $10 billion by 2027, serves a broad range of needs, with specialized vacuum valves representing a distinct, high-barrier segment.

The primary threat stems not from direct component substitution, but from potential shifts in manufacturing processes that might bypass the need for vacuum technology altogether. However, current trends in areas like integrated system solutions, where VAT actively participates by offering modules and services, further solidify its position rather than expose it to substitution at the valve level.

| Factor | Impact on VAT | Supporting Data/Context |

|---|---|---|

| Performance Requirements | Very High Barrier to Substitution | Semiconductor fabrication demands ultra-high purity and minimal particle generation. |

| Reliability & Uptime | Very High Barrier to Substitution | Downtime in chip manufacturing can cost upwards of $20 million per day (2024 data). |

| Cost of Failure | Very High Barrier to Substitution | Process contamination or equipment damage from faulty valves is far more costly than premium valve prices. |

| Alternative Technologies | Low Direct Threat | Simpler vacuum solutions exist but do not meet advanced application needs. |

| Process Innovation | Low to Moderate Long-Term Threat | Breakthroughs in non-vacuum manufacturing processes could impact demand. |

| Integrated Systems | Mitigated Threat | VAT's strategy of offering modules and services integrates it into system solutions. |

Entrants Threaten

Entering the high-performance vacuum valve market, particularly for sensitive semiconductor applications, demands significant upfront capital. This includes building advanced manufacturing plants, acquiring specialized machinery, and funding extensive research and development to meet stringent industry standards.

VAT's own commitment to innovation and expanding production capacity, evidenced by their ongoing investments, highlights the substantial financial resources new entrants must possess. For instance, in 2023, VAT reported capital expenditures of CHF 139.3 million, a clear indicator of the investment scale within the sector.

These considerable financial hurdles act as a powerful deterrent, effectively limiting the number of new companies that can realistically challenge established players like VAT in this specialized and demanding industry.

The development of high-performance vacuum valves relies heavily on intricate proprietary technologies and substantial intellectual property, posing a significant hurdle for new market entrants. Replicating VAT's existing patented designs, sophisticated manufacturing processes, and deep expertise in material science would require immense investment and time.

VAT's extensive history and ongoing commitment to innovation in vacuum solutions have cultivated a robust portfolio of intellectual property, effectively acting as a formidable barrier to entry for potential competitors seeking to establish a foothold in the market.

Securing business with major players in demanding sectors like semiconductors, displays, and solar hinges on deeply established customer relationships and extensive qualification processes. These relationships are not built overnight; they require years of proven reliability and consistent performance.

New entrants face a significant hurdle in replicating the trust and confidence that established suppliers like VAT Vacuumvalves AG have cultivated. The time and resources needed to navigate rigorous certification requirements and gain customer acceptance are substantial deterrents.

For instance, the semiconductor industry's qualification cycles can extend over several years, often involving extensive testing and validation by the customer. This lengthy process, coupled with the need to demonstrate a track record of quality and innovation, makes it exceptionally difficult for newcomers to break into the market.

Economies of Scale and Experience Curve Benefits

Established players like VAT Vacuumvalves AG leverage significant economies of scale, particularly in their advanced manufacturing processes. This allows them to achieve lower per-unit production costs compared to potential newcomers. For instance, VAT's extensive production volume in 2023, which supported their CHF 1.1 billion in revenue, demonstrates this scale advantage.

Furthermore, VAT benefits from a well-developed experience curve. Years of optimizing production, refining product designs, and building specialized knowledge in vacuum technology create inherent efficiencies that are difficult for new entrants to replicate quickly. This accumulated expertise translates into higher quality, more reliable products and faster innovation cycles.

- Economies of Scale: VAT's large-scale production in 2023, contributing to CHF 1.1 billion in revenue, lowers their per-unit manufacturing costs.

- Experience Curve: Decades of operational refinement in vacuum technology provide VAT with process and product design efficiencies that new entrants lack.

- Cost Disadvantage for Entrants: New companies would face higher initial costs and a significant learning curve, hindering their ability to compete on price or efficiency.

Intense Competition from Existing Players

The threat of new entrants for VAT Vacuumvalves AG is significantly mitigated by the intense competition from established players. These incumbents are not only continuously innovating their product lines but are also actively expanding their global footprint, making it difficult for newcomers to gain a foothold.

A new company entering the vacuum valve market would face the daunting task of displacing significant market share already held by these established firms. Furthermore, any attempt at market entry would likely be met with aggressive competitive responses, including price wars and increased marketing efforts, which would make achieving profitability a considerable challenge.

While the vacuum valve market is not dominated by a single entity, it is moderately fragmented. Key players, including those in specialized segments like VAT Vacuumvalves AG, collectively hold substantial market shares. For instance, in 2023, the global industrial valves market, which includes vacuum valves, was valued at approximately $69.5 billion, with major players like Emerson Electric, Flowserve, and Kitz Corporation holding significant portions. This existing concentration of power and resources erects a substantial barrier to entry.

- High Capital Requirements: Establishing manufacturing facilities, R&D capabilities, and global distribution networks demands substantial upfront investment.

- Brand Loyalty and Reputation: Established players have built strong brand recognition and customer trust over years of reliable performance.

- Proprietary Technology and Patents: Incumbents often possess patented technologies and specialized know-how that are difficult for new entrants to replicate.

- Economies of Scale: Existing manufacturers benefit from economies of scale in production and procurement, allowing them to offer competitive pricing.

The threat of new entrants in the high-performance vacuum valve market is notably low due to immense capital requirements for advanced manufacturing and R&D. VAT's 2023 capital expenditures of CHF 139.3 million underscore the significant investment needed to compete. Furthermore, established players possess extensive proprietary technology and patents, creating formidable barriers.

Existing customer relationships and lengthy qualification processes, particularly in sectors like semiconductors, also deter newcomers. VAT's long-standing presence and proven reliability make it challenging for new firms to gain trust and market access. The market’s moderate fragmentation, with major players holding substantial shares, further solidifies these entry barriers.

| Barrier to Entry | Description | Example/Impact on New Entrants |

| Capital Requirements | Building advanced manufacturing, R&D, and distribution networks. | VAT's CHF 139.3 million in 2023 capital expenditure indicates the scale of investment required. |

| Proprietary Technology & Patents | Replicating specialized designs, manufacturing processes, and material science expertise. | VAT's extensive IP portfolio makes it difficult for competitors to match their offerings. |

| Customer Relationships & Qualification | Securing business requires years of proven reliability and navigating long qualification cycles. | Semiconductor qualification can take years, a significant hurdle for new entrants. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | VAT's CHF 1.1 billion revenue in 2023 reflects production scale that new entrants cannot immediately match. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for VAT Vacuumvalves AG is built upon a foundation of diverse data sources, including the company's annual reports, investor presentations, and industry-specific market research from leading firms. We also leverage publicly available data from financial news outlets and competitor disclosures to gain a comprehensive understanding of the vacuum valve industry's competitive landscape.