Tremor International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tremor International Bundle

Tremor International leverages its robust programmatic advertising platform and data analytics to capitalize on digital media trends, presenting significant strengths in a dynamic market. However, understanding the full scope of its competitive landscape, potential regulatory shifts, and emerging technological challenges is crucial for informed decision-making.

Want to fully grasp Tremor International's strategic advantages and potential vulnerabilities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your investment or strategic planning, revealing actionable insights and financial context.

Strengths

Nexxen, formerly Tremor International, boasts a comprehensive end-to-end advertising technology platform. This integrated stack includes a Demand-Side Platform (DSP), Supply-Side Platform (SSP), ad server, and Data Management Platform (DMP), offering a streamlined solution for the entire advertising lifecycle.

This unified approach provides a significant competitive edge by simplifying campaign management for advertisers and publishers alike. From initial planning and activation through to measurement and ongoing optimization, Nexxen’s platform ensures greater efficiency and control over advertising efforts.

Tremor International's significant strength lies in its deep expertise and strong focus on video and Connected TV (CTV) advertising. This is a particularly attractive area as programmatic video ad spending is expected to exceed $110 billion, representing almost 75% of new programmatic ad investments between 2024 and 2026.

The company's robust position in this high-growth market, bolstered by its proprietary data and advanced CTV solutions, serves as a crucial competitive advantage. This strategic focus allows Tremor to capitalize on the accelerating shift of advertising budgets towards digital video and streaming platforms.

Tremor International's strength lies in its sophisticated use of data and AI to refine video advertising. This technological edge allows for highly accurate audience targeting and boosts the effectiveness of ad campaigns. For instance, in Q1 2024, Tremor reported a 20% year-over-year increase in CTV revenue, showcasing the growing demand for their data-driven approach.

The company's AI capabilities enable real-time campaign optimization, dynamically adjusting ad placements and budgets based on live data and predictive analytics. This ensures maximum efficiency and impact for advertisers. Tremor's proprietary data, including ACR data from partners like VIDAA, further enhances their targeting and measurement accuracy, providing a competitive advantage in the digital advertising landscape.

Global Reach and Strategic Partnerships

Tremor International, now operating as Nexxen, boasts a significant global presence with offices strategically located across the United States, Canada, Europe, and the Asia-Pacific region. This widespread network allows the company to effectively serve a broad spectrum of clients, including ad buyers, advertisers, brands, agencies, and digital publishers worldwide.

Further strengthening its international reach, Tremor (Nexxen) has cultivated key strategic partnerships and made significant investments. A notable example is the extended agreement with VIDAA, which grants access to valuable ACR data and exclusive ad monetization opportunities. These collaborations are crucial for securing premium inventory and proprietary data, enhancing its competitive edge in diverse global markets.

The company's global operational footprint is underpinned by its ability to tap into varied advertising ecosystems. For instance, in 2023, Tremor reported that its international operations contributed a substantial portion of its revenue, demonstrating the effectiveness of its global strategy.

- Global Network: Offices in North America, Europe, and Asia-Pacific.

- Diverse Clientele: Serves ad buyers, brands, agencies, and publishers.

- Strategic Alliances: Partnerships like the one with VIDAA enhance data access and inventory.

- 2023 Revenue Contribution: International operations played a vital role in overall financial performance.

Robust Financial Position and Capital Allocation Strategy

Tremor International boasts a robust financial position, highlighted by its debt-free status achieved in April 2024 after repaying its credit agreement. The company also maintains substantial undrawn credit facilities, providing significant financial flexibility. This strong balance sheet underpins its strategic capital allocation, which focuses on internal growth, innovation, and share repurchases, signaling a clear commitment to enhancing shareholder value.

The company’s financial discipline is evident in its recent performance. For the first quarter of 2024, Tremor reported a 19% year-over-year increase in revenue, reaching $137.6 million. This growth was largely driven by its Connected TV (CTV) and data product segments, which saw significant expansion. Specifically, CTV revenue grew by 37% year-over-year to $54.8 million, and data product revenue surged by 51% to $24.4 million, demonstrating the successful execution of its strategic priorities.

- Debt-Free Status: Repaid outstanding credit agreement in April 2024.

- Financial Flexibility: Holds significant undrawn credit facilities.

- Capital Allocation: Prioritizes internal growth, innovation, and share repurchases.

- Revenue Growth: Q1 2024 revenue increased 19% YoY to $137.6 million.

- Segment Strength: CTV revenue up 37% YoY to $54.8 million; data product revenue up 51% YoY to $24.4 million in Q1 2024.

Tremor International, now Nexxen, possesses a significant competitive advantage due to its integrated, end-to-end advertising technology platform. This unified stack, encompassing DSP, SSP, ad server, and DMP, simplifies the advertising process for both advertisers and publishers. The company's strategic focus on the high-growth video and Connected TV (CTV) markets, a sector projected to see programmatic ad spending exceed $110 billion by 2026, further solidifies its position.

Nexxen's sophisticated use of data and AI enhances campaign effectiveness through precise audience targeting and real-time optimization. This technological prowess is demonstrated by a 20% year-over-year increase in CTV revenue in Q1 2024. Furthermore, the company's global reach, supported by strategic partnerships like the one with VIDAA for ACR data, allows it to access valuable inventory and proprietary data across diverse international markets.

Financially, Nexxen is in a strong position, having achieved a debt-free status in April 2024 and maintaining substantial undrawn credit facilities. This financial flexibility supports its capital allocation strategy, prioritizing growth, innovation, and shareholder returns. The company's revenue growth, with a 19% year-over-year increase to $137.6 million in Q1 2024, driven by strong performance in its CTV (up 37%) and data product (up 51%) segments, underscores its operational success.

| Strength | Description | Supporting Data/Fact |

| Integrated Ad Tech Platform | Comprehensive DSP, SSP, ad server, DMP for streamlined advertising. | Simplifies campaign management for advertisers and publishers. |

| Video & CTV Focus | Deep expertise in a high-growth advertising segment. | Programmatic video ad spending projected to exceed $110 billion by 2026. |

| Data & AI Capabilities | Advanced targeting and real-time optimization for campaign effectiveness. | Q1 2024 CTV revenue increased 20% YoY; data product revenue up 51% YoY. |

| Global Presence & Partnerships | Strategic offices and alliances (e.g., VIDAA) enhance market access. | International operations contributed significantly to 2023 revenue. |

| Strong Financial Position | Debt-free status and significant credit facilities provide flexibility. | Q1 2024 revenue grew 19% YoY to $137.6 million; debt-free as of April 2024. |

What is included in the product

Delivers a strategic overview of Tremor International’s internal and external business factors, highlighting its competitive position within the ad tech industry.

Streamlines Tremor International's strategic planning by offering a clear, actionable overview of their competitive landscape.

Weaknesses

A key vulnerability for Tremor International is its heavy reliance on the video and Connected TV (CTV) markets. While these are indeed growth sectors, a substantial part of Tremor's income is directly linked to these advertising formats. A downturn in advertiser spending on video or CTV, perhaps due to economic instability or evolving market preferences, could significantly hurt the company's financial results.

This dependence was highlighted in early 2024, when Tremor reported declines in certain revenue segments during the first quarter, even as CTV revenue demonstrated growth in the second quarter of 2024. This fluctuation underscores the sensitivity of their performance to the health and direction of the video and CTV advertising landscape.

Tremor International operates in the ad tech sector, a space characterized by fierce competition. Giants like Google, Meta, and Amazon, alongside a multitude of other specialized firms, vie for market share. This crowded landscape puts pressure on pricing and necessitates constant innovation to maintain relevance, potentially impacting sustained revenue growth.

Tremor International's revenue is heavily reliant on advertising expenditure, a sector known for its cyclical nature and susceptibility to macroeconomic shifts. During economic slowdowns or periods of uncertainty, businesses often trim their advertising budgets, directly impacting the demand for Tremor's programmatic advertising solutions.

This vulnerability was evident in recent market conditions, where the company experienced an uneven recovery and saw a pronounced shift towards lower-cost advertising alternatives. For instance, in Q1 2024, while overall ad spending showed signs of recovery, the programmatic sector faced intense competition and pressure on pricing, which would have directly influenced Tremor's top line.

Challenges with Data Privacy Regulations and Signal Loss

Tremor International faces significant hurdles due to the increasingly strict global data privacy regulations like GDPR and CCPA, alongside evolving US state-specific laws. The ongoing phase-out of third-party cookies further complicates matters, forcing continuous adjustments to how they collect and target data.

These regulatory shifts and technological changes can potentially restrict audience targeting precision, impacting campaign effectiveness. Furthermore, ensuring compliance across various jurisdictions adds substantial operational costs and demands ongoing investment in privacy-preserving technologies and expertise.

- Regulatory Complexity: Navigating a patchwork of global and US state-level data privacy laws requires constant vigilance and adaptation.

- Cookie Deprecation Impact: The decline of third-party cookies directly affects Tremor's ability to track and target users across the web.

- Compliance Costs: Meeting diverse privacy standards necessitates significant investment in technology, legal counsel, and operational adjustments.

- Targeting Limitations: Stricter regulations and the loss of traditional tracking methods may reduce the granularity and reach of audience targeting capabilities.

Integration Challenges Post-Acquisition

Tremor International's growth strategy heavily relies on acquisitions, a model that has brought in entities like Amobee. However, integrating these acquired businesses presents significant hurdles. The process of merging disparate technologies, aligning different organizational cultures, and consolidating customer bases can be intricate and time-consuming.

These integration challenges can lead to operational inefficiencies and hinder the timely realization of expected synergies. For instance, the successful integration of Amobee, acquired in 2022 for $239 million, is crucial for Tremor to fully leverage its expanded programmatic capabilities and market reach. Delays or complications in this process could impact overall performance and the achievement of strategic objectives.

- Integration Complexity: Merging diverse technological stacks and operational processes from acquired companies like Amobee can be a significant undertaking.

- Synergy Realization: Achieving the anticipated cost savings and revenue enhancements from acquisitions can be delayed if integration is not smooth.

- Operational Disruption: The immediate aftermath of an acquisition can bring about temporary disruptions in day-to-day operations and client service.

Tremor International's dependence on video and Connected TV (CTV) advertising makes it susceptible to shifts in advertiser spending within these specific channels. The company's financial performance can be significantly impacted by economic downturns or changes in consumer viewing habits that reduce ad budgets in these areas. This was evident in early 2024, where Tremor reported revenue fluctuations, although CTV revenue showed growth in Q2 2024, highlighting the segment's volatility.

Same Document Delivered

Tremor International SWOT Analysis

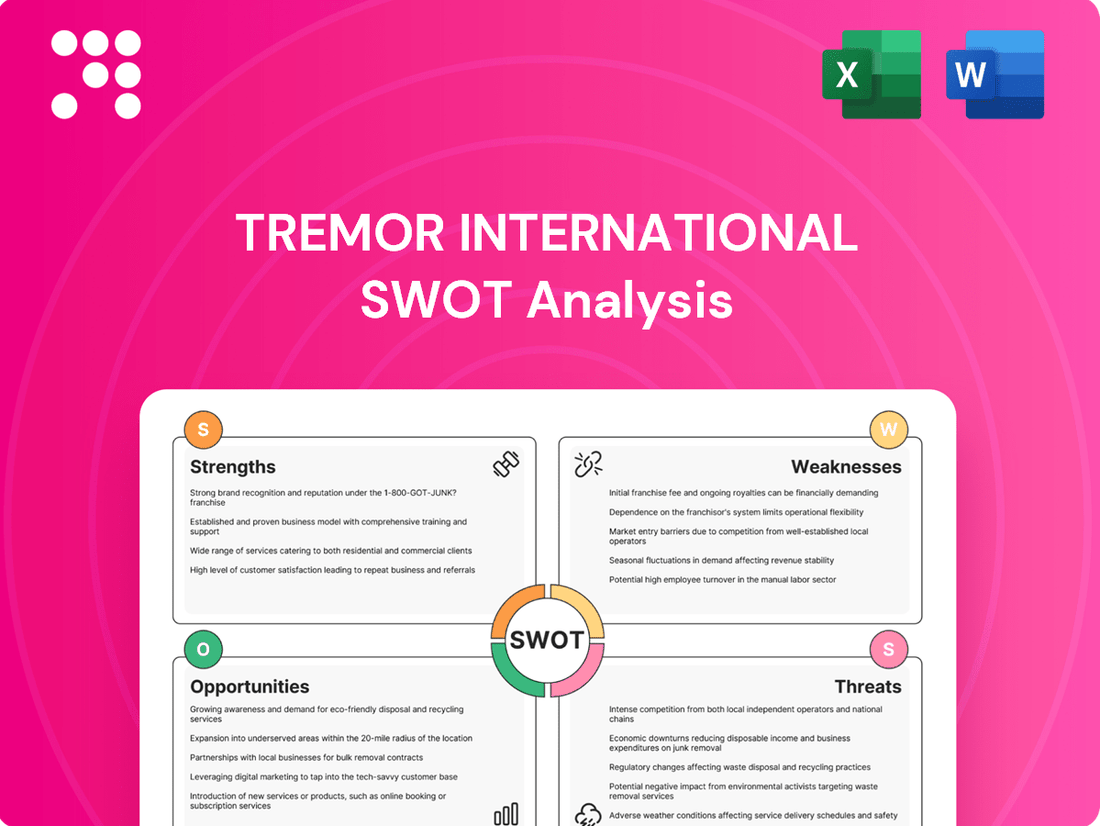

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details Tremor International's Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive strategic overview.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into Tremor International's market position and future potential.

Opportunities

The Connected TV (CTV) advertising market is experiencing robust expansion, with projections indicating continued strong growth through 2025. CTV is increasingly dominating programmatic ad inventory, presenting a significant opportunity for platforms like Tremor International (operating as Nexxen). Nexxen is well-positioned to leverage this trend by further refining its CTV offerings, building on exclusive data collaborations such as the one with VIDAA, and broadening its footprint within this rapidly expanding sector.

Tremor International has a significant opportunity to deepen its investment in AI and machine learning to refine its programmatic advertising offerings. These advancements can lead to more dynamic content generation, improved contextual targeting, and the ability to make real-time campaign adjustments, ultimately boosting ad effectiveness and efficiency for advertisers.

By further developing its AI capabilities, Tremor can provide advertisers with increasingly sophisticated solutions. For instance, in 2024, the digital advertising market is projected to reach over $600 billion globally, with programmatic advertising accounting for a substantial portion, highlighting the immense potential for growth and innovation in this space.

The programmatic retail media sector is booming, with projections indicating it could reach over $50 billion globally by 2025. Retailers are leveraging their vast customer data, forming crucial alliances with ad tech providers to unlock new advertising revenue streams. Tremor International is well-positioned to capitalize on this trend.

Beyond retail, emerging programmatic channels like audio and Digital Out-of-Home (DOOH) advertising offer significant growth potential. The programmatic audio market alone is expected to exceed $15 billion by 2026. By strategically investing in and integrating these expanding programmatic avenues, Tremor can effectively diversify its revenue base and tap into new audience segments.

Strategic Partnerships and Market Consolidation

Tremor International can significantly boost its market position by forging new strategic alliances. Collaborating with major retailers, content creators, or even other ad technology firms offers a pathway to broader data access, a wider selection of advertising inventory, and an expanded customer base. For instance, a partnership with a large e-commerce platform could provide Tremor with valuable first-party data, enhancing its targeting capabilities.

The ad tech landscape is quite fragmented, creating fertile ground for strategic acquisitions. Tremor has the opportunity to consolidate its position by acquiring companies that offer complementary technologies or that hold significant market share in specific verticals. This could allow Tremor to integrate new solutions, like advanced AI-driven analytics or specialized video advertising platforms, thereby strengthening its overall offering and competitive edge.

- Expanded Data Pools: Partnerships can unlock access to richer, more diverse datasets, improving audience segmentation and campaign effectiveness.

- Inventory Access: Collaborations with content providers can secure premium ad inventory, crucial for engaging consumers.

- Market Share Growth: Acquisitions in the fragmented ad tech space can rapidly increase Tremor's market presence and revenue.

- Technological Advancement: Acquiring innovative ad tech solutions can enhance Tremor's product suite and competitive differentiation.

Global Market Penetration and Geographic Expansion

Tremor International has a solid global footprint, but there's significant room to grow deeper into the markets where it already operates. Think of it like this: even if you're in a city, you can still become a much bigger part of that city's fabric. This means increasing market share and brand recognition in established territories.

Furthermore, the company can strategically target new, rapidly expanding international markets. With digital ad spending continuing its upward trajectory globally, especially in emerging economies, Tremor is well-positioned to capitalize on these shifts. For instance, the global digital advertising market was projected to reach over $600 billion in 2024, with significant growth anticipated in regions like Asia-Pacific and Latin America.

- Deepen penetration in existing markets: Increase market share and brand presence in North America and Europe.

- Expand into high-growth emerging markets: Target regions like Southeast Asia and Latin America where digital ad spend is rapidly increasing.

- Leverage global digital ad spend shifts: Capitalize on the ongoing migration of advertising budgets to digital platforms worldwide.

- Capture new revenue streams: Strategically enter and grow within untapped or underserved geographic areas to diversify and expand income.

Tremor International has a prime opportunity to capitalize on the booming Connected TV (CTV) advertising market, which is projected for continued strong growth through 2025. By enhancing its CTV offerings and leveraging exclusive data partnerships, the company can solidify its position in this expanding sector. Furthermore, the company can significantly boost its market standing by forging new strategic alliances and pursuing acquisitions to consolidate its position in the fragmented ad tech landscape.

Threats

Tremor International, like many in the ad tech sector, is navigating a landscape of intensifying global regulatory scrutiny. New state-level privacy laws emerging in the United States, alongside significant European regulations such as the Digital Markets Act (DMA) and Digital Services Act (DSA), are reshaping data handling practices.

These evolving regulations impose stricter requirements on how data is collected, processed, and utilized, directly impacting Tremor's ability to offer personalized advertising solutions. Non-compliance could result in substantial fines, potentially impacting financial performance and operational agility.

Tremor International faces significant competitive pressure from tech giants like Google and Meta, which control substantial portions of the digital advertising market. These 'gatekeepers' are currently under antitrust scrutiny, and any regulatory changes could alter the competitive dynamics, potentially benefiting or challenging Tremor's position.

The ad tech industry is also characterized by a constant influx of new startups and innovative solutions. This continuous emergence of new players and technologies can disrupt the market, increasing competition and potentially eroding market share for established companies like Tremor if they cannot adapt quickly.

Economic downturns present a significant threat to Tremor International. During periods of economic contraction, businesses often slash their marketing and advertising budgets as a cost-saving measure. This directly impacts Tremor's revenue streams, as advertisers may shift to less expensive channels or simply reduce their overall spend.

The cyclical nature of the advertising industry means Tremor is particularly vulnerable to these macroeconomic shifts. For instance, in 2023, while the broader digital advertising market showed resilience, some segments experienced slower growth due to inflation and recessionary fears, impacting companies reliant on ad spend. Tremor's reliance on programmatic advertising means it's directly exposed to these fluctuations.

Technological Shifts and Platform Policy Changes

Tremor International faces significant threats from rapid technological shifts in ad tech, particularly the ongoing deprecation of third-party cookies. This transition demands continuous adaptation and investment in new data strategies, as platforms like Google are phasing out cookie support. For instance, Google's Privacy Sandbox initiative aims to replace cookies with new privacy-preserving technologies, impacting how ad targeting and measurement are conducted.

Changes in major platform policies, such as Apple's App Tracking Transparency (ATT) framework, also pose a considerable threat. ATT, implemented in 2021, requires apps to obtain user consent for tracking across other companies' apps and websites, significantly reducing the availability of unique device identifiers for advertising. This has led to a substantial impact on the digital advertising ecosystem, forcing companies like Tremor to pivot towards alternative measurement and targeting solutions.

- Third-Party Cookie Deprecation: Google's Chrome is phasing out third-party cookies, with full deprecation expected by late 2024, fundamentally altering programmatic advertising.

- Privacy-Focused Platforms: Apple's ATT framework, adopted by millions of iOS users, has drastically reduced the effectiveness of device-level tracking for ad personalization and measurement.

- Regulatory Scrutiny: Increasing data privacy regulations globally, such as GDPR and CCPA, impose stricter rules on data collection and usage, requiring ongoing compliance efforts.

- Ad Fraud and Brand Safety: Evolving ad fraud schemes and the need for robust brand safety solutions necessitate continuous investment in technology to maintain advertiser trust and campaign integrity.

Brand Safety and Ad Fraud Concerns

Advertisers are increasingly focused on brand safety and transparency, making it harder for companies like Tremor to guarantee suitable ad environments. The rise of AI-generated content and made-for-advertising (MFA) sites presents a significant challenge in this regard. For instance, in 2023, the Interactive Advertising Bureau (IAB) reported that brand safety concerns were a top priority for a substantial percentage of advertisers, impacting media spend decisions.

Tremor International must actively combat ad fraud and ensure robust brand safety protocols to maintain advertiser confidence and secure continued investment. Failure to do so could lead to a decline in advertiser trust and a reduction in ad spending on their platforms. Reports from industry watchdogs in late 2024 indicated that ad fraud continues to cost the digital advertising industry billions annually, underscoring the critical need for vigilance.

- Brand Safety Imperative: Advertisers are prioritizing brand safety, with a significant portion of their budgets contingent on ensuring ads appear in appropriate contexts.

- Content Quality Challenges: The proliferation of AI-generated and MFA content complicates Tremor's ability to guarantee brand-safe inventory.

- Ad Fraud Threat: Ongoing issues with ad fraud necessitate continuous investment in detection and prevention measures to protect advertiser spend and maintain platform integrity.

Tremor International faces significant threats from the ongoing deprecation of third-party cookies, a transition expected to be largely completed by late 2024, fundamentally altering programmatic advertising. Apple's App Tracking Transparency (ATT) framework has also drastically reduced device-level tracking effectiveness, impacting ad personalization and measurement. Furthermore, increasing global data privacy regulations, such as GDPR and CCPA, impose stricter data handling rules, demanding continuous compliance efforts and potentially limiting data utilization.

SWOT Analysis Data Sources

This Tremor International SWOT analysis is informed by a comprehensive review of publicly available financial statements, investor relations materials, and reputable industry publications. We also incorporate insights from market research reports and expert analyses of the digital advertising landscape.