Tremor International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tremor International Bundle

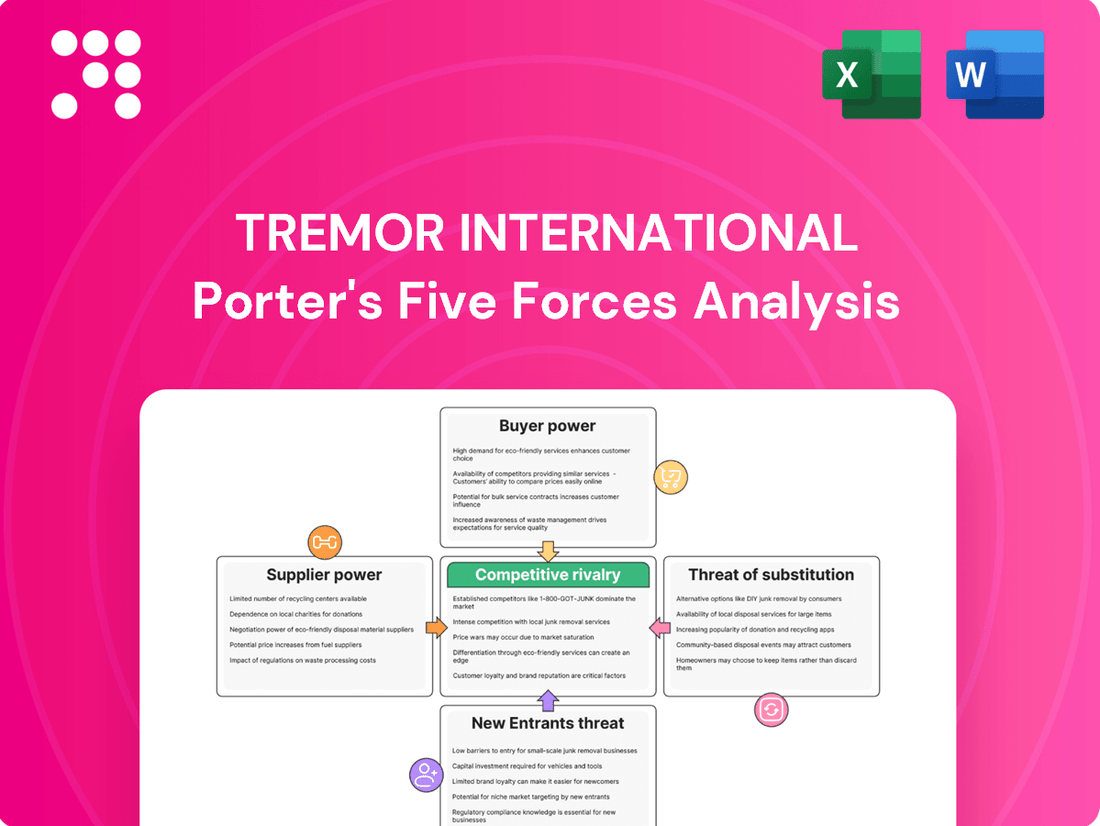

Tremor International navigates a dynamic digital advertising landscape where buyer power from large advertisers and the threat of new entrants significantly shape its competitive environment.

The complete report reveals the real forces shaping Tremor International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Publishers hold significant sway over Tremor International due to their control over valuable video ad inventory. When publishers offer highly desirable video content or access to niche, engaged audiences, they can negotiate premium pricing for their ad space. This directly impacts Tremor's cost of acquiring inventory and, consequently, its profitability.

Data providers hold significant sway over companies like Tremor International because they offer specialized audience insights crucial for effective video advertising. These insights allow advertisers to pinpoint specific demographics and interests, making campaigns more efficient and impactful. Without access to this unique data, Tremor's ability to deliver optimized campaigns would be severely hampered.

The unique nature of proprietary data sets significantly strengthens a data provider's bargaining position. If a data provider possesses information that is not readily available elsewhere and is essential for Tremor's targeting capabilities, they can command higher prices or more favorable terms. This is especially true in the digital advertising space where granular audience data is a key differentiator.

Tremor International's strategic moves, such as its investment in VIDAA for ACR (Automatic Content Recognition) data, highlight the importance of securing exclusive data access. By investing in data acquisition, Tremor aims to reduce its reliance on third-party providers and gain a competitive edge. This proactive approach underscores the substantial bargaining power that exclusive data providers can wield in the market.

Specialized technology vendors can indeed hold significant bargaining power, especially when they provide critical infrastructure that is difficult to replace. Tremor International, while boasting its own programmatic platforms like a DSP, SSP, ad server, and DMP, likely depends on external providers for essential services such as cloud computing and specialized software. If these vendors offer unique or highly proprietary technologies, their ability to influence pricing and contract terms increases substantially.

For instance, a vendor providing a unique data processing solution or a highly efficient cloud infrastructure could command higher prices if switching to an alternative would incur significant costs or operational disruptions for Tremor. This is particularly relevant in the fast-evolving ad-tech landscape where specialized solutions are often key differentiators. While Tremor's integrated platform aims to reduce reliance on any single external component, the fundamental need for robust underlying technology means these specialized vendors remain a factor in the company's cost structure and operational flexibility.

High demand for skilled ad-tech talent

The advertising technology sector, particularly for companies like Tremor International, relies heavily on specialized skills. This includes expertise in data science, AI and machine learning, sophisticated software engineering, and programmatic trading. The demand for these professionals often outstrips supply, giving them significant leverage.

This scarcity of talent directly impacts labor costs. When skilled individuals are in high demand, they can command higher salaries and better benefits, increasing the operational expenses for companies. Tremor International's strategic emphasis on AI and machine learning, particularly as we look towards 2025, underscores the ongoing and critical need for this specialized workforce, further strengthening supplier power in the labor market.

- High Demand for Specialized Skills: The ad-tech industry requires professionals in data science, AI/ML, software engineering, and programmatic trading.

- Talent Shortage Impact: A limited pool of qualified candidates increases employee bargaining power and drives up labor costs for companies like Tremor International.

- Tremor's AI Focus: The company's continued investment in AI and machine learning through 2025 highlights the persistent need for highly specialized talent.

Potential for publishers to consolidate ad inventory

The potential for major publishers to consolidate their ad inventory presents a significant shift in the bargaining power of suppliers within the ad-tech ecosystem. If large media groups unite their digital ad space, they can create more formidable direct sales channels.

This consolidation could diminish the necessity for intermediaries like Tremor International. By pooling resources and offering unified platforms, these publishers gain leverage, potentially dictating terms and increasing the cost of access for ad-tech companies.

- Publisher Consolidation: Major publishers are increasingly exploring alliances and unified platforms to manage their ad inventory more effectively.

- Direct Sales Channels: A move towards stronger direct sales reduces reliance on third-party ad-tech providers.

- Increased Bargaining Power: Consolidated inventory gives publishers greater control over pricing and terms, impacting ad-tech platform margins.

- Impact on Intermediaries: Platforms like Tremor International may face pressure to adapt to a landscape where suppliers hold more sway.

The bargaining power of suppliers for Tremor International is influenced by publishers' control over ad inventory and data providers' unique insights. Publishers offering premium video content or niche audiences can command higher prices, impacting Tremor's acquisition costs. Similarly, specialized data providers with proprietary information crucial for targeted advertising hold significant leverage, as seen in Tremor's VIDAA investment to secure exclusive data and reduce third-party reliance.

Specialized technology vendors providing critical, hard-to-replace infrastructure, such as cloud computing or unique data processing solutions, also wield considerable power. Tremor's reliance on robust underlying technology means these vendors can influence pricing and terms, especially if switching incurs significant costs or disruptions. The ad-tech sector's demand for specialized skills in data science, AI/ML, and engineering, coupled with a talent shortage, further amplifies labor costs and supplier power, a trend expected to continue through 2025.

| Supplier Type | Impact on Tremor International | Key Factors |

|---|---|---|

| Publishers | High bargaining power due to control over valuable video ad inventory. | Desirability of content, audience engagement, niche access. |

| Data Providers | Significant leverage due to specialized audience insights. | Proprietary data sets, targeting capabilities, market differentiation. |

| Technology Vendors | Influence pricing and terms for critical infrastructure. | Uniqueness of technology, switching costs, operational disruption. |

| Skilled Labor | Drives up operational expenses through higher wages. | Demand for specialized skills (AI/ML, data science), talent shortage. |

What is included in the product

Analyzes the competitive intensity, buyer and supplier power, and threat of new entrants and substitutes specifically for Tremor International's digital advertising operations.

Instantly visualize Tremor International's competitive landscape with a dynamic, interactive Porter's Five Forces model, allowing for rapid assessment of industry attractiveness.

Customers Bargaining Power

Advertisers and agencies, Tremor International's key customers, face a vast landscape of video advertising options. They can choose from numerous programmatic platforms, major social media networks, and even strike direct advertising deals with publishers. This abundance of alternatives significantly enhances their bargaining power.

With so many channels available, advertisers can readily shift their spending if Tremor International's pricing or performance metrics are not competitive. In 2024, the digital advertising market continued to see robust growth, with video advertising being a major driver. For instance, global digital ad spending was projected to reach over $600 billion in 2024, with video accounting for a substantial and growing portion of this, giving advertisers more leverage across the board.

Major brands and advertising agencies wield significant influence over ad-tech platforms like Tremor International due to their substantial ad spend. This leverage allows them to negotiate more favorable pricing, request tailored solutions, and secure robust performance guarantees. In 2023, Tremor's revenue was $384.7 million, highlighting the scale of operations where such negotiations are common.

Advertisers face low switching costs when moving between ad-tech platforms. While initial integration requires some effort, the ability to easily shift campaigns to more cost-effective or higher-performing solutions significantly enhances their bargaining power. This dynamic intensifies competitive pressure on companies like Tremor International.

Performance-driven nature of advertising spend

The advertising industry's increasing focus on measurable results and a direct return on investment (ROI) significantly amplifies customer bargaining power. Advertisers, now more than ever, scrutinize ad spend, demanding clear evidence of effectiveness. This performance-driven nature means clients can readily divert budgets to platforms that consistently deliver superior campaign outcomes, placing continuous pressure on Tremor International to not only optimize performance but also offer sophisticated measurement tools.

For instance, in 2024, the digital advertising market saw a substantial shift towards performance-based models. Advertisers are actively seeking channels that can demonstrate tangible business impact, such as customer acquisition cost (CAC) and lifetime value (LTV). Tremor International, as a player in this space, must therefore showcase its ability to drive these key metrics to retain and attract clients.

- Advertisers demand clear ROI: Budgets are increasingly tied to demonstrable campaign success.

- Shift to performance-based models: Platforms showing better results gain favor.

- Pressure on optimization: Tremor International must continuously improve campaign efficiency.

- Need for robust measurement: Providing transparent and actionable data is crucial for client retention.

Increased in-housing of ad operations by brands

Brands increasingly bringing ad operations in-house directly impacts Tremor International by reducing the pool of potential clients. This shift allows large advertisers to gain greater control over their programmatic advertising spend and data, thereby strengthening their bargaining power.

For instance, in 2024, a significant number of major consumer packaged goods (CPG) companies, which are key advertising spenders, have publicly announced plans or already executed the move to internalize their digital media buying. This trend directly reduces the reliance on third-party ad-tech providers and agencies, including platforms like Tremor International.

This in-housing trend signifies a direct transfer of power to the customer. As brands manage more of their ad operations internally:

- Reduced dependency on external vendors: Brands can negotiate more favorable terms or even bypass ad-tech providers for certain services.

- Enhanced data ownership and control: In-housing allows brands to directly manage and leverage their first-party data, diminishing the need for external platforms to facilitate data activation.

- Potential for lower costs: By eliminating agency fees and ad-tech markups, brands aim to achieve greater efficiency and cost savings in their advertising efforts.

Tremor International's customers, primarily advertisers and agencies, possess considerable bargaining power due to the highly fragmented and competitive nature of the digital advertising market. The ease with which they can switch between platforms, coupled with the industry's growing emphasis on demonstrable ROI, forces Tremor to remain highly competitive on pricing and performance. Furthermore, the trend of major brands bringing ad operations in-house in 2024, as seen with significant CPG companies, directly reduces their reliance on ad-tech providers, amplifying their leverage.

| Customer Type | Leverage Factor | Impact on Tremor International |

|---|---|---|

| Advertisers & Agencies | Abundance of Alternatives, Low Switching Costs | Forces competitive pricing and continuous performance optimization. |

| Major Brands (e.g., CPG) | Significant Ad Spend, In-housing Trend | Increased negotiation power for favorable terms and reduced dependency on third-party platforms. |

| Performance-Focused Clients | Demand for Measurable ROI, Shift to Performance Models | Necessitates transparent data and proven campaign effectiveness to retain business. |

Full Version Awaits

Tremor International Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Tremor International, detailing the competitive landscape and strategic implications. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, providing actionable insights into industry attractiveness and competitive positioning.

Rivalry Among Competitors

The ad-tech landscape is fiercely competitive, with Tremor International navigating a crowded market. Established players like Google, Meta, and Amazon wield significant influence, leveraging their vast user bases and integrated ecosystems to offer comprehensive advertising solutions.

These tech giants, often referred to as 'walled gardens,' control significant portions of the digital advertising supply chain, making it challenging for independent ad-tech companies to compete on reach and data access.

In 2024, the digital advertising market is projected to reach over $600 billion globally, underscoring the immense scale of competition and the need for differentiation.

The ad-tech industry, including companies like Tremor International, is characterized by intense competition driven by rapid innovation. The constant evolution of technologies such as artificial intelligence, machine learning, and sophisticated data analytics demands continuous investment in new features and capabilities. This relentless pace of development creates a highly dynamic and rivalrous market where staying ahead requires significant R&D expenditure.

Tremor International, for instance, is strategically prioritizing the integration of generative AI and machine learning into its operations in 2025. This focus underscores the industry's imperative to leverage cutting-edge technology to enhance ad targeting, campaign performance, and overall platform efficiency. Companies failing to adapt and innovate risk falling behind competitors who are quicker to adopt and deploy these transformative technologies.

Tremor International operates in a highly competitive ad-tech landscape, where companies fiercely vie for both advertiser budgets and publisher ad space. This intense rivalry means Tremor must constantly innovate and offer superior solutions to attract and keep clients on both sides of the marketplace.

The battle for advertiser spend is driven by the need for precise targeting, engaging ad formats, transparent reporting, and competitive pricing. Similarly, securing valuable publisher inventory requires ad-tech firms to demonstrate strong demand from advertisers and offer attractive revenue shares. In 2023, the global digital advertising market reached an estimated $600 billion, highlighting the significant stakes involved in capturing even a small fraction of this spending.

Price pressure due to commoditization of some ad-tech services

The ad-tech industry is experiencing growing price pressure as some services become commoditized. This means that features and functionalities are becoming so similar across different providers that buyers often choose based primarily on price, rather than unique value. This trend directly impacts companies like Tremor International, forcing them to constantly re-evaluate their pricing strategies to remain competitive.

To combat this commoditization and the resulting price pressure, companies must focus on differentiation. Tremor International, for example, can leverage its proprietary data sets, invest in advanced artificial intelligence for more sophisticated targeting and optimization, and develop integrated solutions that offer a more holistic approach to advertising. This moves them away from being a simple service provider to offering unique, high-value solutions.

- Commoditization Risk: Certain ad-tech functionalities are becoming standardized, leading to increased price competition and potentially lower profit margins for providers.

- Differentiation is Key: Companies like Tremor International need to highlight unique selling propositions such as proprietary data, advanced AI capabilities, and integrated platform offerings.

- Impact on Margins: As services become more commoditized, the ability to command premium pricing diminishes, putting pressure on profitability if differentiation strategies are not effectively implemented.

Consolidation and M&A activity within the ad-tech sector

The ad-tech landscape is witnessing a surge in consolidation, with mergers and acquisitions becoming a dominant theme. This is largely fueled by companies seeking greater scale, operational efficiencies, and the ability to offer more comprehensive, end-to-end solutions. For instance, in 2023, the digital advertising sector saw substantial M&A activity, with major players acquiring smaller, specialized firms to bolster their offerings and market reach.

This wave of consolidation is reshaping the competitive intensity. As fewer, larger entities emerge, the rivalry among them intensifies, particularly for those independent ad-tech companies that remain. These larger players often possess greater resources and can leverage integrated platforms, creating significant competitive pressure on smaller, less integrated rivals. The trend points towards the formation of powerful ecosystems that can dictate terms and capture a larger share of the market.

- Increased Bargaining Power: Larger, consolidated ad-tech firms can negotiate better terms with publishers and advertisers due to their increased volume and market share.

- Technological Integration: Mergers often aim to integrate disparate technologies, creating more seamless and efficient advertising workflows, which can be a competitive advantage.

- Market Dominance: The ongoing consolidation raises concerns about potential market dominance by a few key players, impacting innovation and pricing for smaller participants.

- Acquisition Targets: Smaller, innovative ad-tech companies may become attractive acquisition targets for larger players looking to expand their capabilities or market presence.

The competitive rivalry within the ad-tech sector is exceptionally high, with Tremor International facing formidable opposition from established giants and a multitude of nimble innovators. This intense competition is driven by the rapid evolution of digital advertising technologies, necessitating continuous investment in areas like AI and machine learning to maintain relevance and performance.

The global digital advertising market's substantial size, projected to exceed $600 billion in 2024, amplifies the stakes, forcing companies to differentiate through unique data, advanced AI, and integrated solutions to avoid commoditization and price wars.

Consolidation trends further intensify this rivalry, as larger, merged entities gain scale and technological integration, creating significant pressure on independent players like Tremor International to secure market share and maintain profitability.

SSubstitutes Threaten

Advertisers have a wide array of channels beyond programmatic video to meet their marketing goals. Social media platforms like Meta and TikTok, along with search engines such as Google Ads, offer robust advertising solutions. Influencer marketing also presents a viable alternative for reaching target audiences.

These diverse advertising options can siphon marketing budgets away from dedicated programmatic video platforms. For instance, in 2024, digital advertising spend on social media globally was projected to exceed $250 billion, demonstrating its significant draw for advertisers seeking reach and engagement.

This availability of alternative channels represents a substantial threat of substitutes for programmatic video advertising. Advertisers can achieve similar brand awareness and customer acquisition objectives through these other digital avenues, potentially reducing demand for programmatic video solutions.

Large advertisers and agencies are increasingly exploring direct deals with premium publishers, bypassing programmatic platforms. This trend offers them more control over ad placements and a perceived increase in transparency, presenting a viable substitute for the automated buying process. For instance, in 2024, major brands continued to allocate significant portions of their budgets to direct buys for premium inventory, seeking guaranteed reach and brand safety.

The rapid evolution of media consumption habits, including the rise of short-form video and interactive content, presents a significant threat of substitutes for Tremor International. Advertisers may divert budgets towards these new formats if they demonstrate superior reach or engagement, potentially bypassing traditional programmatic video platforms. For instance, platforms like TikTok saw a substantial increase in advertising spend in 2024, reflecting a shift in advertiser priorities.

Brand-owned media and content marketing strategies

Brand-owned media and content marketing represent a significant threat of substitutes for traditional paid advertising platforms like Tremor International. Brands are increasingly investing in their own digital properties, such as websites, blogs, and apps, to directly engage with consumers.

This shift allows companies to build brand loyalty and drive conversions through valuable content, bypassing the need for constant paid media spend. For instance, in 2024, many companies reported higher engagement rates and improved customer acquisition costs through robust content marketing initiatives compared to solely relying on programmatic advertising.

- Direct Audience Engagement: Owned media allows brands to control the narrative and build direct relationships with their audience, reducing reliance on third-party platforms.

- Cost-Effectiveness: While requiring initial investment, content marketing can yield long-term benefits and a lower cost per acquisition over time compared to continuous paid media.

- Brand Building: High-quality content fosters brand authority and trust, acting as a powerful substitute for brand awareness campaigns run on paid channels.

- Data Ownership: Brands gain direct access to valuable customer data through their owned platforms, enabling more personalized marketing efforts.

Traditional media advertising still holds relevance for some campaigns

Despite the undeniable surge in digital advertising, traditional media like linear television, radio, and print continue to capture substantial ad spending. This is particularly true for campaigns targeting specific demographics or aiming for broad, widespread awareness. For instance, in 2024, linear TV advertising is projected to remain a significant portion of overall ad spend, with global revenues expected to reach hundreds of billions of dollars, demonstrating its persistent appeal.

These established channels can effectively function as substitutes for digital video advertising in certain scenarios. Advertisers seeking to reach a vast audience, especially older demographics less engaged with digital platforms, may find traditional media to be a more efficient or impactful choice. The tangible nature of print or the pervasive reach of broadcast television offers a different, sometimes complementary, engagement compared to digital alternatives.

Consider these points regarding the threat of substitutes:

- Broad Reach Capabilities: Traditional media, particularly linear TV, excels at delivering massive reach quickly, a factor still highly valued by many brands for major product launches or awareness campaigns.

- Demographic Targeting: Certain older or less digitally-native demographics are still best reached through traditional channels, making them relevant substitutes for digital-only strategies.

- Brand Perception: For some luxury or legacy brands, association with premium traditional media can still enhance brand image and perceived value.

- Regulatory Environments: In markets with strict digital advertising regulations or concerns about ad fraud, traditional media can offer a more perceived secure and transparent advertising environment.

The availability of numerous advertising channels beyond programmatic video poses a significant threat of substitutes for Tremor International. Advertisers can effectively reach their target audiences through social media platforms, search engines, and influencer marketing, potentially diverting budgets from programmatic video. For instance, global digital ad spend on social media was projected to surpass $250 billion in 2024, highlighting its substantial appeal.

Direct deals with premium publishers also offer a substitute, giving advertisers more control and transparency than automated programmatic buying. This trend saw major brands continuing to invest in direct buys in 2024 to secure premium inventory and ensure brand safety.

The shift towards new media formats like short-form video and interactive content, exemplified by TikTok's growing ad spend in 2024, further diversifies the advertising landscape, presenting alternative avenues for engagement and potentially reducing reliance on traditional programmatic video.

Furthermore, brand-owned media and content marketing offer a cost-effective, long-term strategy for direct audience engagement and brand building, often yielding better customer acquisition costs compared to continuous paid media spend. In 2024, many companies reported improved engagement through these initiatives.

Entrants Threaten

Building and maintaining a sophisticated end-to-end ad-tech platform, similar to what Tremor International operates, demands a significant upfront capital outlay. This includes substantial investments in cutting-edge technology, robust data infrastructure, and specialized engineering talent.

This high capital requirement acts as a considerable barrier, effectively deterring many smaller or less-funded entities from entering the competitive ad-tech landscape. For instance, developing proprietary algorithms and ensuring compliance with evolving data privacy regulations in 2024 necessitates continuous, large-scale R&D spending.

Ad-tech platforms like Tremor International depend heavily on network effects, meaning they need a large number of advertisers and publishers to be valuable to each other. New companies entering this space struggle because they must attract both sides of the market simultaneously. Without this critical mass, the platform simply doesn't function effectively, making it a substantial barrier.

The ad-tech sector faces a growing web of data privacy laws like GDPR, CCPA, and the Digital Markets Act, alongside increasing antitrust investigations. New companies entering this space must invest heavily in legal counsel and compliance infrastructure, creating a significant hurdle. For instance, the fines for GDPR violations can reach up to 4% of global annual revenue, a substantial deterrent for startups.

Difficulty in acquiring proprietary data and advanced AI capabilities

Established players like Tremor International have a significant hurdle for new entrants due to their accumulated proprietary data and substantial investments in advanced AI and machine learning. These capabilities are critical for optimizing programmatic advertising campaigns, giving incumbents a distinct advantage. For instance, as of early 2024, the programmatic advertising market is projected to reach hundreds of billions of dollars, with companies like Tremor leveraging sophisticated data analytics to capture market share.

Replicating the depth of data and the technological sophistication that seasoned companies possess is extremely challenging and costly for newcomers. This data advantage, coupled with AI-driven optimization, directly impacts a company's ability to deliver effective and efficient advertising solutions. Without comparable resources, new entrants would find it difficult to compete on performance metrics, a key differentiator in this industry.

- Proprietary Data Accumulation: Established firms have years of user behavior, campaign performance, and market trend data, which is difficult for new entrants to acquire.

- AI/ML Investment: Tremor International and similar companies invest heavily in AI for audience targeting, bid optimization, and fraud detection, creating a high technological barrier.

- Competitive Performance: The ability to leverage data and AI directly translates to superior campaign performance, making it hard for less-resourced new entrants to gain traction.

- Market Entry Costs: The combined cost of data acquisition and advanced technology development presents a significant financial barrier, limiting the threat of new entrants.

Established brand reputation and trust are crucial in advertising

Established brand reputation and trust are crucial in advertising, acting as significant barriers to entry. Advertisers and publishers gravitate towards platforms with a demonstrated history of delivering results, maintaining transparency, and ensuring reliability. For instance, in 2023, major advertising platforms like Google and Meta continued to command substantial market share due to decades of building consumer and advertiser trust.

New entrants must overcome the considerable hurdle of establishing credibility in a market where established players already hold deep-seated relationships and proven performance metrics. This often requires substantial investment in marketing, customer service, and demonstrating tangible value to both advertisers and publishers. The advertising technology space, in particular, sees new companies struggling to gain traction against incumbents who benefit from network effects and existing data advantages.

- Brand Loyalty: Advertisers often stick with platforms they trust, making it difficult for newcomers to win them over.

- Proven Track Record: A history of successful campaigns and transparent reporting builds confidence, which new entrants lack.

- Data Advantages: Established platforms possess vast amounts of user data, enabling more effective targeting and optimization, a hard gap for new entrants to bridge.

- Market Saturation: The advertising landscape is crowded, making it challenging for new brands to capture attention and market share.

The threat of new entrants in the ad-tech space, particularly for platforms like Tremor International, is significantly low. This is primarily due to the immense capital required for building and maintaining sophisticated technology, including AI and data infrastructure, which can easily run into millions of dollars. For example, continuous R&D spending in 2024 to comply with evolving data privacy laws is a substantial ongoing cost.

Furthermore, the network effects inherent in ad-tech platforms mean that new entrants must attract both advertisers and publishers simultaneously, a difficult feat without existing scale. Established players also benefit from accumulated proprietary data and advanced AI capabilities, which are costly to replicate. As of early 2024, the programmatic advertising market is valued in the hundreds of billions, with incumbents leveraging data analytics for competitive advantage.

The need for extensive legal and compliance infrastructure to navigate complex data privacy regulations, such as GDPR and CCPA, adds another significant barrier. Fines for non-compliance can be substantial, deterring startups. Finally, building brand reputation and trust in a market dominated by established players with proven track records and deep relationships requires considerable time and investment, further limiting the threat of new entrants.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront investment in technology, data infrastructure, and talent. | Deters smaller, less-funded entities. |

| Network Effects | Need to attract both advertisers and publishers simultaneously for platform value. | Challenging to achieve critical mass. |

| Data & AI Advantage | Accumulated proprietary data and advanced AI/ML capabilities for optimization. | Difficult and costly for newcomers to replicate. |

| Regulatory Compliance | Significant investment in legal counsel and compliance for data privacy laws. | High ongoing costs and risk of substantial fines. |

| Brand Reputation & Trust | Established players have proven track records and deep relationships. | New entrants struggle to build credibility and gain traction. |

Porter's Five Forces Analysis Data Sources

Our Tremor International Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Tremor's annual reports and SEC filings, alongside industry-specific research from leading market intelligence firms.

We leverage insights from financial news outlets, competitor investor relations pages, and macroeconomic data providers to meticulously assess the competitive landscape, supplier power, and buyer dynamics within the digital advertising industry.