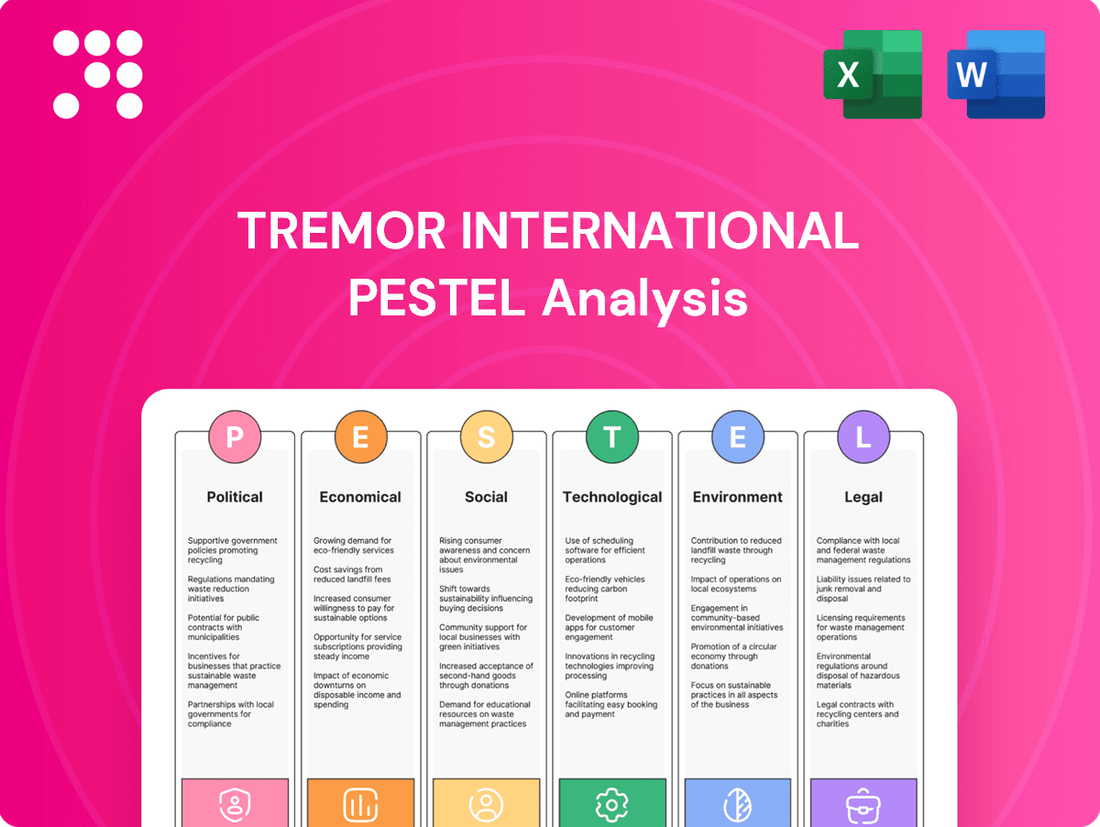

Tremor International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tremor International Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Tremor International's trajectory. Our expertly crafted PESTLE analysis reveals how these external forces present both opportunities and challenges for the company. Gain a competitive advantage by understanding these dynamics. Purchase the full PESTLE analysis now for actionable intelligence to inform your strategic decisions.

Political factors

New government regulations on digital advertising, particularly concerning data usage and transparency in key markets like the US and EU, could significantly affect Tremor International. For instance, the EU's Digital Services Act (DSA) and the upcoming Digital Markets Act (DMA) impose stricter rules on online platforms, potentially impacting how Tremor's programmatic advertising operates by limiting certain data collection and targeting methods. These changes might require substantial platform adjustments and increased compliance costs to navigate, impacting operational flexibility and potentially increasing legal oversight expenses.

International trade policies and the rise of digital services taxes (DSTs) pose significant challenges for Tremor International. For instance, the ongoing trade disputes between major economies could lead to increased tariffs or restrictions on digital advertising services, directly impacting Tremor's cross-border revenue. A 2024 report indicated that several countries were actively considering or implementing DSTs, which could increase Tremor's operational costs in those regions by an estimated 2-5%, potentially squeezing profit margins.

Political stability in Tremor International's key operational markets, particularly in regions like North America and Europe, is a significant factor. For instance, the 2024 US presidential election cycle could introduce policy shifts impacting digital advertising regulations and data privacy laws, which directly affect Tremor's business model.

Unforeseen changes in government or economic policy in major markets can disrupt advertising spend. A sudden increase in protectionist trade policies or changes to digital services taxes could negatively impact Tremor's revenue streams and operational costs, creating market uncertainty.

In 2024, the global political landscape remains dynamic. Tremor International must monitor potential geopolitical tensions and their spillover effects on consumer confidence and corporate marketing budgets. For example, ongoing conflicts or trade disputes in certain regions could lead to reduced advertising investment by businesses operating there.

Antitrust scrutiny in the ad tech industry

Global regulatory bodies are intensifying their focus on potential monopolistic practices within the ad tech sector. This heightened scrutiny could lead to investigations and restrictions for major players, including Tremor International, impacting their strategic growth and market operations.

The increasing antitrust attention translates into stricter mergers and acquisitions (M&A) rules, demands for enhanced transparency, and the potential for structural remedies. For Tremor, this means navigating a more complex regulatory landscape that could affect future expansion and integration plans.

- Increased Regulatory Scrutiny: Regulators worldwide, including the US Department of Justice and the European Commission, are actively examining the ad tech industry for anti-competitive behavior.

- Potential Impact on M&A: Antitrust concerns could lead to more rigorous review of Tremor's potential acquisitions, potentially blocking or imposing conditions on deals.

- Transparency Demands: Companies may face mandates to increase transparency in their data handling and advertising practices, affecting operational models.

- Compliance Costs: Adapting to evolving antitrust frameworks will require significant investment in legal counsel and compliance measures, impacting profitability.

Government spending on digital campaigns

Government spending on digital campaigns presents a growing opportunity for Tremor International. As public sector entities increasingly leverage digital channels for everything from public health announcements to civic engagement, their advertising budgets are shifting online. This trend directly aligns with Tremor's core business, offering a potential new revenue stream and a chance to diversify its client portfolio beyond commercial brands.

For instance, in 2024, governments worldwide are expected to continue increasing their digital ad spend. While specific figures for Tremor's direct government contracts are not publicly detailed, the broader trend is clear. The US federal government alone allocated billions to digital outreach and information dissemination in recent years, a significant portion of which would have flowed through digital advertising channels.

- Increased Digital Ad Spend: Governments are reallocating budgets towards digital platforms for information dissemination and public service announcements.

- New Client Base: This shift offers Tremor International access to a new segment of clients, reducing reliance on traditional commercial advertising.

- Platform Utility: Tremor's advanced programmatic advertising solutions are well-suited to help government agencies efficiently reach specific demographics and geographic areas.

- Policy Impact: Future government policies promoting digital literacy and online civic participation could further boost demand for such services.

New regulations in key markets like the US and EU, such as the Digital Services Act, are tightening data usage rules, potentially impacting Tremor's programmatic advertising operations and increasing compliance costs. International trade policies and the rise of digital services taxes (DSTs) also present challenges, with some countries considering DSTs that could increase Tremor's operational costs by an estimated 2-5% in those regions. Heightened antitrust scrutiny globally could lead to stricter M&A rules and demands for greater transparency, affecting Tremor's strategic growth and market operations.

What is included in the product

This PESTLE analysis examines how political, economic, social, technological, environmental, and legal factors influence Tremor International's global operations and strategic decision-making.

Provides a clear, actionable roadmap of external factors impacting Tremor International, streamlining strategic decision-making and mitigating potential risks.

Economic factors

Global economic growth directly impacts advertising spend, influencing the demand for Tremor International's video advertising solutions. When economies are strong and consumer confidence is high, businesses tend to increase their marketing budgets, leading to greater opportunities for Tremor. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023 but still indicating a generally positive economic environment that supports advertising investment.

Conversely, economic downturns often result in companies cutting advertising budgets as a primary cost-saving measure. This cyclical nature means that Tremor's revenue potential is closely tied to the broader macroeconomic environment. A slowdown in global growth, such as the 2.6% projected for 2025 by the IMF, could lead to reduced advertising investment across the board, directly affecting Tremor's top line.

Inflationary pressures in 2024 and early 2025 are likely to increase Tremor International's operational expenses. This includes higher costs for technology infrastructure, cloud services, and specialized talent in areas like programmatic advertising and data analytics. For instance, global inflation rates, which saw significant increases in 2022 and 2023, continue to impact the cost of essential business inputs.

These rising costs for resources directly affect Tremor's profit margins. If Tremor cannot effectively pass these increased expenses onto its clients through pricing adjustments or achieve significant operational efficiency gains, its profitability could be eroded. The company's ability to manage these cost increases is therefore a critical factor for its financial performance in the near term.

Tremor International's extensive global presence means its reported financial results are susceptible to currency exchange rate fluctuations. When Tremor converts earnings from foreign markets back into U.S. dollars, unfavorable movements can reduce the reported value of those revenues and profits. For instance, a strengthening U.S. dollar can make earnings generated in currencies like the Euro or British Pound appear smaller.

This exposure necessitates proactive financial management. Companies like Tremor often employ hedging strategies, such as forward contracts or options, to lock in exchange rates and mitigate the impact of volatility on their financial statements. Global currency volatility directly influences the company's financial statements, affecting everything from top-line revenue to bottom-line profitability.

Interest rates and investment climate

Interest rates significantly shape the investment climate for companies like Tremor International. As of mid-2024, global central banks have maintained relatively high interest rates to combat inflation. This environment increases the cost of capital, making it more expensive for Tremor to finance potential acquisitions or invest in new technologies. For instance, if Tremor were considering a $100 million acquisition, a 1% increase in interest rates could add $1 million annually to its financing costs.

Higher interest rates also tend to dampen investor appetite for growth stocks, including those in the ad tech sector. Investors may shift towards safer, fixed-income investments that offer more attractive yields in a high-rate environment. This can lead to lower valuations for ad tech companies. For example, a higher discount rate applied in a Discounted Cash Flow (DCF) valuation model directly reduces the present value of future earnings, potentially making Tremor's stock appear less appealing to investors seeking immediate returns.

- Increased Cost of Capital: Higher benchmark interest rates, such as the US Federal Funds Rate which remained in the 5.25%-5.50% range through early 2024, directly inflate borrowing costs for Tremor's expansion and R&D initiatives.

- Reduced Investor Appetite for Growth Stocks: When yields on government bonds, like the US 10-year Treasury note hovering around 4.0%-4.5% in early 2024, become more competitive, investors often reallocate capital away from riskier, high-growth sectors like ad tech.

- Valuation Impact: Elevated interest rates lead to higher discount rates used in financial modeling, compressing the perceived present value of future cash flows for companies like Tremor, potentially impacting market capitalization.

Consumer discretionary spending patterns

Consumer discretionary spending patterns significantly influence Tremor International's business. When consumers tighten their belts, sectors like retail and travel often reduce their advertising budgets. This directly impacts the volume and value of ad campaigns that Tremor manages, as companies in these sectors scale back their marketing efforts.

For instance, a slowdown in consumer spending, like the one observed in early 2024 with a slight dip in retail sales growth compared to the previous year, can lead to a ripple effect. Advertisers in these discretionary sectors might then decrease their spending on digital advertising platforms, which are Tremor's core business. This reduction in demand for advertising services can directly affect Tremor's revenue streams.

- Reduced discretionary spending by consumers, particularly in sectors like retail and travel, can lead to lower advertising budgets from companies in those industries.

- This directly impacts Tremor International, as a decrease in client advertising spend translates to reduced demand for its ad campaign management services.

- For example, if consumer confidence wanes, leading to less spending on non-essential goods and services, Tremor may see a decline in the volume and value of advertising campaigns it facilitates.

- Understanding these consumer spending shifts is crucial for Tremor to forecast market demand and adapt its strategies accordingly.

Global economic growth directly influences advertising spend, with the IMF projecting 3.2% global growth in 2024, supporting ad investment. However, a projected slowdown to 2.6% in 2025 could temper this. Inflationary pressures in 2024-2025 increase Tremor's operational costs, impacting profit margins if not passed on.

Currency fluctuations also affect Tremor's reported financials, with a strong U.S. dollar potentially reducing foreign earnings. High interest rates, exemplified by the US Federal Funds Rate range of 5.25%-5.50% in early 2024, increase capital costs and can deter investor interest in growth stocks like Tremor, impacting valuations through higher discount rates (e.g., US 10-year Treasury yields around 4.0%-4.5%). Consumer discretionary spending shifts also directly impact Tremor, as reduced consumer confidence can lead to lower ad budgets from affected industries.

| Economic Factor | Impact on Tremor International | Supporting Data/Trend (2024-2025) |

| Global Economic Growth | Influences advertising spend; higher growth supports increased budgets. | IMF projects 3.2% global growth in 2024, slowing to 2.6% in 2025. |

| Inflation | Increases operational expenses (tech, talent), potentially reducing profit margins. | Persistent inflationary pressures impacting input costs globally. |

| Currency Exchange Rates | Affects reported financials when converting foreign earnings to USD. | Volatility in major currencies like EUR, GBP against USD. |

| Interest Rates | Raises cost of capital for expansion/R&D; can reduce investor appetite for growth stocks. | US Federal Funds Rate 5.25%-5.50% (early 2024); US 10-year Treasury yields ~4.0%-4.5% (early 2024). |

| Consumer Discretionary Spending | Reduced spending leads to lower advertising budgets from affected sectors (retail, travel). | Consumer confidence shifts impacting non-essential goods and services spending. |

Full Version Awaits

Tremor International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Tremor International delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You will gain a deep understanding of the external forces shaping Tremor International's business landscape, enabling informed decision-making.

Sociological factors

Consumers are increasingly shifting their media consumption from traditional channels like television and print to digital video platforms, particularly connected TV (CTV) and mobile devices. This evolution directly fuels the demand for Tremor International's core advertising technologies, as it mirrors where audiences are spending their time and attention.

As more people embrace streaming services and mobile content, advertisers are naturally following these engaged audiences, leading to a significant rise in programmatic video ad spend. This trend represents a powerful tailwind for Tremor International, as the company is well-positioned to facilitate these growing digital advertising investments.

In 2024, digital ad spending is projected to reach over $600 billion globally, with video advertising accounting for a substantial and growing portion of this. This surge in digital video consumption and ad expenditure underscores the favorable market conditions for companies like Tremor International that specialize in programmatic video advertising solutions.

Consumers increasingly expect ads that feel relevant and don't disrupt their experience. This shift is fueling a demand for sophisticated targeting and optimization, areas where Tremor International's technology excels. For instance, a 2024 survey indicated that over 70% of consumers are more likely to engage with ads that are tailored to their interests.

Advertisers are responding by seeking platforms that can deliver precise audience segmentation and personalized messaging to meet these evolving consumer preferences. Tremor's solutions are designed to help them achieve this, ensuring their campaigns resonate more effectively and drive better engagement. This focus on relevance is crucial for capturing consumer attention in today's crowded digital landscape.

Public awareness of data privacy is growing significantly, impacting how companies like Tremor International collect and use audience data for advertising. This heightened concern means advertisers and platforms must be more transparent about their data practices. For instance, a 2024 survey indicated that over 70% of consumers are more worried about their online privacy than they were a year prior, directly influencing how data-driven targeting strategies are perceived and implemented.

These evolving societal expectations necessitate stricter consent mechanisms and continuous adaptation of data handling protocols by Tremor. The company must ensure compliance with regulations like GDPR and CCPA, which are increasingly being mirrored by new legislation globally. Failure to adapt can lead to reputational damage and regulatory penalties, affecting Tremor's ability to leverage data for effective ad targeting.

Influence of social media and influencer marketing

The pervasive influence of social media and influencer marketing significantly reshapes the digital advertising landscape, presenting both challenges and opportunities for Tremor International. These platforms, with their massive user bases and direct engagement capabilities, compete for a share of digital ad spend that might otherwise flow into programmatic channels. For instance, global social media ad spending was projected to reach approximately $207 billion in 2024, highlighting the sheer scale of this segment. This trend necessitates that Tremor continually adapts its strategies to demonstrate the value proposition of programmatic video advertising across a wider ecosystem of premium publishers, rather than solely focusing on direct social media placements.

Understanding how these evolving consumer behaviors and advertiser preferences impact overall ad budgets is crucial for Tremor. Clients are increasingly allocating significant portions of their marketing budgets to influencer collaborations and social media campaigns, seeking authenticity and direct consumer connection. In 2024, influencer marketing alone was expected to grow to over $21 billion globally. Tremor must articulate how its programmatic video solutions can complement these efforts by offering broader reach, sophisticated targeting, and measurable outcomes across premium inventory, thereby ensuring its continued relevance in a dynamic market.

- Social media platforms command a substantial portion of digital ad budgets, projected to exceed $207 billion globally in 2024.

- Influencer marketing is a rapidly growing segment, anticipated to reach over $21 billion worldwide in 2024.

- Tremor's strategy must emphasize its ability to integrate with and enhance social media and influencer campaigns through programmatic video.

- Client demand for authenticity and direct engagement on social platforms requires Tremor to showcase the added value of its programmatic video offerings.

Demographic shifts and audience targeting

Demographic shifts are a critical consideration for Tremor International. As populations age in many developed markets, advertisers need sophisticated tools to reach older, often affluent, consumer segments. Conversely, the rapid growth of younger demographics, particularly Gen Z, demands platforms capable of engaging them through newer, interactive formats and channels. Tremor's ability to adapt its targeting capabilities to these evolving audience profiles is paramount for its continued relevance and success in the digital advertising ecosystem.

Tremor must ensure its technology can effectively identify and reach diverse demographic groups across various digital channels. For instance, as of early 2024, global internet penetration continues to rise, with a significant portion of new users being younger and from emerging markets. This necessitates granular targeting options that go beyond basic age and location, allowing advertisers to connect with specific lifestyle, interest, and behavioral segments within these growing populations. Tremor's platforms need to be agile enough to incorporate new data sources and analytical methods to meet these demands.

- Aging Populations: In regions like Europe and Japan, the median age is increasing, creating opportunities for advertisers targeting healthcare, retirement planning, and leisure services.

- Youth Segments: Gen Z and younger Millennials represent a significant portion of digital consumption, driving demand for video-on-demand, social media, and gaming advertising.

- Emerging Markets: The expansion of digital access in Asia, Africa, and Latin America presents a growing base of new consumers with diverse demographic characteristics that require tailored advertising approaches.

- Platform Adaptability: Tremor's success hinges on its technology's capacity to segment audiences accurately and deliver campaigns across channels frequented by these varied demographic groups.

Societal trends highlight a growing demand for personalized and non-intrusive advertising experiences. Consumers are increasingly wary of privacy violations, with over 70% expressing greater concern in 2024 compared to the previous year. This necessitates greater transparency and robust consent mechanisms from companies like Tremor International.

The rise of social media and influencer marketing presents both competition and opportunities, with global social media ad spend projected to exceed $207 billion in 2024. Tremor must demonstrate how its programmatic video solutions can complement these trends by offering broader reach and sophisticated targeting.

Demographic shifts, including aging populations in developed markets and the growing digital native Gen Z, require adaptable targeting strategies. Tremor's ability to reach diverse age groups and emerging market consumers, where internet penetration is rapidly expanding, is crucial for its sustained success.

| Societal Factor | Impact on Tremor International | Supporting Data (2024/2025 Estimates) |

|---|---|---|

| Demand for Personalization & Privacy | Need for transparent data handling and consent-driven targeting. | 70%+ consumers more privacy-conscious (2024 survey). |

| Social Media & Influencer Dominance | Opportunity to integrate programmatic video with these channels. | Social media ad spend > $207 billion (Global, 2024). Influencer marketing > $21 billion (Global, 2024). |

| Demographic Shifts | Requirement for granular targeting across age groups and markets. | Increasing internet penetration in emerging markets. Growing affluent older consumer segments. |

Technological factors

Tremor International's reliance on advanced AI and machine learning is paramount for refining its advertising strategies. These technologies are instrumental in optimizing campaign performance, sharpening audience segmentation, and bolstering predictive analytics capabilities. By leveraging AI, Tremor can achieve more effective real-time bidding, ensure greater ad relevance, and allocate budgets with increased efficiency, ultimately boosting client return on investment and solidifying its market position.

The surge in Connected TV (CTV) and streaming advertising offers Tremor International a substantial growth avenue. This expansion necessitates advanced technological infrastructure to effectively deliver and measure video advertisements across these evolving platforms. Tremor's capacity to monetize CTV inventory and provide sophisticated targeting and measurement capabilities is crucial for its continued success in this dynamic market.

The digital advertising industry's rapid pivot away from third-party cookies, a trend accelerating through 2024 and into 2025, directly impacts Tremor International. This necessitates significant investment in and adoption of privacy-preserving identity solutions and data collaboration technologies.

Tremor must integrate with or develop advanced solutions like data clean rooms and universal IDs. These technologies are crucial for enabling effective audience targeting and robust measurement in an increasingly privacy-centric digital landscape, underpinning Tremor's core value proposition.

Development of new ad formats and interactive experiences

The evolution of video advertising, particularly with the rise of shoppable ads and interactive elements, directly impacts Tremor International's platform. To remain competitive, Tremor must continuously adapt its technology to support these richer, more engaging ad experiences for advertisers. This innovation is crucial for offering effective solutions that differentiate Tremor and attract premium campaigns.

Staying ahead in developing new creative ad units allows Tremor to provide advertisers with more engaging and impactful campaigns. For instance, interactive video ads can significantly boost user engagement metrics. Tremor's platform flexibility is key to seamlessly integrating these emerging formats, ensuring advertisers can leverage the latest advancements in digital advertising.

Tremor's commitment to supporting new ad formats is evident in its platform capabilities. In 2024, the demand for interactive video advertising solutions continued to grow, with many brands seeking ways to directly drive conversions within the ad itself. Tremor's ability to facilitate these advanced formats is a significant technological factor influencing its market position.

- Innovation in Video Ad Formats: Tremor's platform must support advancements like shoppable video ads and interactive overlays to meet advertiser demand.

- Enhanced Engagement: New ad formats offer advertisers more compelling ways to connect with audiences, driving better campaign performance.

- Platform Adaptability: Tremor's technological infrastructure needs to be flexible enough to integrate and serve a wide range of emerging ad unit types.

- Market Differentiation: By leading in the adoption of new ad experiences, Tremor can carve out a distinct advantage in the competitive ad tech landscape.

Cloud computing and scalable infrastructure

Tremor International's reliance on scalable cloud computing and infrastructure is fundamental to its operations in the ad tech sector. This allows the company to efficiently process the immense volume of data generated by its global marketplace, handle millions of ad requests per second, and ensure low latency for advertisers and publishers. For instance, Tremor's data processing capabilities are crucial for real-time bidding (RTB) auctions, where split-second decisions impact campaign performance and revenue. The ability to scale resources dynamically is a competitive necessity, enabling Tremor to manage peak loads without performance degradation and optimize costs during quieter periods.

The ad tech industry is characterized by rapid growth and fluctuating demand, making robust and scalable infrastructure a non-negotiable requirement. Tremor International leverages cloud platforms to achieve this agility, ensuring high availability and reliable service delivery. This technological foundation supports their ability to innovate and adapt to market changes, which is critical for maintaining a competitive edge. In 2023, the global cloud computing market continued its upward trajectory, with significant investments in infrastructure that directly benefit companies like Tremor.

Key aspects of Tremor's infrastructure strategy include:

- Data Processing Power: Utilizing cloud services to manage and analyze vast datasets for audience targeting and campaign optimization.

- Scalability and Elasticity: Dynamically adjusting computing resources to meet fluctuating ad request volumes and traffic demands.

- Low Latency Delivery: Ensuring rapid ad serving across global networks to enhance user experience and campaign effectiveness.

- Cost-Effectiveness: Optimizing infrastructure spending through pay-as-you-go models and efficient resource utilization.

Tremor International's technological edge hinges on its sophisticated AI and machine learning capabilities, crucial for optimizing advertising campaigns and enhancing audience segmentation. The company's investment in these areas directly impacts its ability to deliver personalized ad experiences and improve client ROI, a key differentiator in the competitive ad tech landscape.

The accelerating shift away from third-party cookies by 2024 and 2025 necessitates Tremor's adoption of privacy-centric technologies like data clean rooms and universal IDs. These solutions are vital for maintaining effective targeting and measurement in a privacy-first digital environment, directly supporting Tremor's core value proposition.

Tremor's platform must continuously evolve to support new video ad formats, such as shoppable and interactive ads, which saw growing demand in 2024. This adaptability is essential for providing advertisers with engaging experiences that drive conversions and maintain Tremor's competitive advantage.

Tremor's operational efficiency is underpinned by its reliance on scalable cloud computing, enabling it to process massive data volumes and handle millions of ad requests per second. This robust infrastructure ensures low latency and high availability, critical for real-time bidding and overall service reliability.

Legal factors

Global data privacy regulations, such as the EU's GDPR and California's CCPA, significantly influence how Tremor International collects, processes, and uses user data. These laws mandate strict consent requirements and data protection measures, impacting Tremor's programmatic advertising operations. Failure to comply can result in substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

National and international advertising standards significantly shape the ads Tremor International can deliver. These rules, covering everything from preventing misleading claims to restricting harmful content and protecting children, mean Tremor must have strong systems for checking and approving ad content.

For instance, the Digital Advertising Alliance (DAA) in the US and the UK's Advertising Standards Authority (ASA) set strict guidelines on data privacy and ad transparency. Failure to comply can lead to fines and reputational damage, impacting Tremor's ability to serve ads effectively across different markets.

Tremor's commitment to these evolving regulations, which often tighten around issues like AI-generated content and data usage, is vital for maintaining trust with both users and advertisers. In 2024, regulatory bodies globally continued to scrutinize ad tech practices, with a particular focus on consumer protection.

Intellectual property rights are a significant legal factor for Tremor International, particularly concerning patents in the ad tech space. This includes innovations in ad serving, targeting algorithms, and measurement technologies.

The company must navigate a complex legal landscape, ensuring its proprietary technologies do not infringe upon existing patents held by competitors. In 2023, patent litigation in the technology sector remained a substantial cost for many companies, with significant sums awarded in infringement cases.

Conversely, Tremor International must also actively protect its own innovations. This might involve securing new patents or entering into licensing agreements for technologies it utilizes. Effective intellectual property management is therefore crucial for maintaining a competitive edge and mitigating legal risks in this rapidly evolving industry.

Consumer protection laws and transparency requirements

Consumer protection laws are increasingly shaping the digital advertising landscape, demanding greater transparency. Regulations like the Digital Services Act (DSA) in Europe, which came into full effect in February 2024, impose stricter rules on online platforms regarding advertising, including clear labeling of sponsored content and disclosures about how user data is used for ad targeting. Tremor International, as a player in this space, must ensure its platforms enable advertisers to meet these transparency mandates, which is crucial for fostering consumer trust and sidestepping potential penalties. For instance, the EU's GDPR, in effect since 2018 and continuously refined, mandates clear consent for data processing, impacting how personalized advertising is delivered.

These legal frameworks are designed to shield consumers from deceptive or opaque advertising practices. For Tremor International, this means actively supporting advertisers in adhering to these requirements. By providing tools and guidance that facilitate clear disclosure of sponsored content and the use of tracking technologies, Tremor can help its partners build stronger relationships with their audiences and mitigate the risk of regulatory action. For example, the US Federal Trade Commission (FTC) has also been active in enforcing truth-in-advertising standards, with guidance on influencer marketing disclosures being a key area of focus.

- Increased Scrutiny: Regulatory bodies globally are enhancing oversight of online advertising practices, with a particular focus on transparency.

- Data Privacy Compliance: Laws like GDPR and CCPA necessitate clear user consent for data collection and usage in advertising, impacting platform design.

- Disclosure Requirements: Clear identification of sponsored content and the use of data for ad targeting are becoming standard legal expectations.

- Platform Responsibility: Digital advertising platforms like those operated by Tremor International are increasingly held accountable for facilitating advertiser compliance with consumer protection laws.

Antitrust and competition laws

Antitrust and competition laws pose significant legal hurdles for Tremor International. The ad tech industry, characterized by rapid consolidation and data-driven strategies, is under increasing scrutiny from regulators globally. For instance, the European Commission has been actively investigating major tech players for potential anti-competitive practices, impacting the broader digital advertising landscape. Tremor must ensure its market strategies, including potential mergers and acquisitions, do not create undue market dominance or engage in practices that could be construed as stifling competition.

Regulatory bodies like the U.S. Federal Trade Commission (FTC) and the UK's Competition and Markets Authority (CMA) are proactively examining the ad tech ecosystem. Their focus on data privacy and the control of digital advertising infrastructure means that Tremor's business model and any expansion efforts will be closely monitored. Failing to comply could result in substantial fines, operational restrictions, or forced divestitures, as seen in past antitrust cases within the tech sector.

- Regulatory Scrutiny: Global antitrust regulators are increasingly examining ad tech practices, with a focus on market power and data utilization.

- Merger Control: Tremor's acquisition strategies will face stringent review to prevent the creation of anti-competitive market structures.

- Compliance Burden: Adherence to evolving antitrust regulations requires ongoing legal and operational diligence to avoid penalties.

- Market Impact: Practices that limit consumer choice or unfairly disadvantage competitors could trigger investigations and sanctions.

Tremor International operates within a complex legal framework that heavily influences its advertising operations. Data privacy regulations, such as the EU's GDPR and California's CCPA, mandate strict consent for data usage, impacting personalized advertising. For example, GDPR fines can reach up to 4% of global annual revenue. Advertising standards, enforced by bodies like the Digital Advertising Alliance, require transparency and prohibit misleading content, with non-compliance risking penalties.

Environmental factors

Data centers and cloud infrastructure, essential for Tremor International's digital advertising operations, are facing increased scrutiny regarding their environmental impact. The significant energy consumption required for data processing and storage directly contributes to carbon emissions, placing pressure on companies like Tremor to adopt greener practices.

Tremor International is therefore incentivized to explore and implement more energy-efficient technologies within its own infrastructure and to partner with cloud providers who demonstrate a strong commitment to renewable energy sources. For instance, major cloud providers like Microsoft Azure and Amazon Web Services have set ambitious goals for carbon neutrality, with AWS aiming for 100% renewable energy usage by 2025, a target that aligns with Tremor's potential sustainability efforts.

Addressing this carbon footprint is not just an operational consideration but also a crucial aspect of corporate social responsibility. As global awareness of climate change grows, demonstrating a commitment to reducing environmental impact can enhance Tremor's brand reputation and appeal to increasingly eco-conscious clients and investors.

The push for sustainability is now reaching the digital advertising world, creating a growing demand for environmentally friendly programmatic advertising. This means companies like Tremor International need to think about how their operations impact the environment.

Tremor International might need to actively encourage greener practices among its partners, like publishers and advertisers. This could involve choosing ad delivery methods that use less energy or supporting industry-wide environmental standards. Evaluating the entire digital ad ecosystem is key to this effort.

By 2024, the digital advertising industry is facing increased scrutiny over its carbon footprint. For instance, studies in 2023 indicated that digital advertising's emissions are comparable to those of the aviation industry, highlighting the urgency for change.

The increasing emphasis on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting is a significant environmental factor for Tremor International. Investors and top talent are actively seeking companies that demonstrate a genuine commitment to sustainability, making robust ESG disclosures crucial for attracting capital and skilled employees. For instance, in 2024, over 80% of institutional investors surveyed by PwC indicated that ESG factors are important in their investment decisions.

Tremor International faces growing expectations to showcase its dedication to environmental stewardship through formal reporting and tangible initiatives. This commitment is no longer just about meeting regulatory requirements; it's about building trust and enhancing brand reputation. Companies with strong ESG performance, like those recognized by the Dow Jones Sustainability Index, often experience a lower cost of capital and improved employee engagement.

Regulatory pressure for environmental disclosures

Regulatory pressure for environmental disclosures is a growing concern for technology companies, including those in the ad tech sector like Tremor International. While direct mandates for ad tech firms are less common than for heavy industries, this landscape is evolving. Future regulations could require companies to report on their environmental footprint, such as energy usage in data centers and carbon emissions from operations.

As of early 2024, the push for Environmental, Social, and Governance (ESG) reporting is intensifying globally. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD) is expanding disclosure requirements to a wider range of companies, setting a precedent. This means Tremor International might soon need to track and report metrics like:

- Energy consumption of servers and data centers.

- Waste management practices, including e-waste.

- Carbon emissions across its value chain.

Proactively preparing for these potential future requirements by establishing robust data collection and reporting mechanisms can help Tremor International mitigate future compliance burdens and enhance its stakeholder relations.

Impact of climate change on infrastructure resilience

Climate change presents a significant environmental challenge for Tremor International, particularly concerning its reliance on physical infrastructure. Extreme weather events, such as intensified storms or prolonged heatwaves, can directly threaten the data centers and network infrastructure that support global internet connectivity. For instance, the World Economic Forum's 2024 Global Risks Report highlighted that extreme weather events are perceived as the most severe short-term risk, impacting critical infrastructure globally.

Disruptions to energy grids, a direct consequence of climate-related events, could indirectly affect Tremor International's service reliability and availability. A study by the U.S. Department of Energy in 2024 noted that climate change is increasing the vulnerability of the nation's power infrastructure to disruptions, with potential cascading effects on digital services. This underscores the need for robust contingency planning.

To mitigate these risks, Tremor International must prioritize geographical diversification of its server locations and implement comprehensive disaster recovery plans. This strategy aims to ensure service continuity even if one location is compromised by climate-related incidents. The increasing frequency of climate-related disruptions makes such proactive measures essential for maintaining operational resilience and customer trust.

- Increased Frequency of Extreme Weather: Events like hurricanes and floods, which are projected to become more intense and frequent due to climate change, pose direct threats to data center facilities and network cables.

- Energy Grid Vulnerability: Climate-induced stresses on power infrastructure can lead to outages, impacting the continuous operation of data centers and internet services globally.

- Supply Chain Disruptions: Extreme weather can also disrupt the supply chains for essential hardware and maintenance, further complicating infrastructure resilience efforts.

- Regulatory and Compliance Pressures: Growing awareness of climate risks may lead to stricter regulations regarding environmental impact and infrastructure resilience, requiring proactive adaptation.

Tremor International faces growing pressure to address its environmental footprint, particularly concerning the energy consumption of its digital advertising operations. Studies in 2023 indicated that digital advertising's emissions rival those of the aviation industry, underscoring the urgency for sustainable practices.

The company is incentivized to adopt energy-efficient technologies and partner with cloud providers committed to renewable energy, such as AWS aiming for 100% renewable energy by 2025. This focus on sustainability is crucial for enhancing brand reputation and appealing to eco-conscious stakeholders, as over 80% of institutional investors in a 2024 PwC survey cited ESG factors as important in their decisions.

Proactive preparation for evolving environmental disclosure regulations, like the EU's CSRD, is essential, requiring Tremor to track metrics such as server energy consumption and carbon emissions across its value chain.

Climate change poses direct risks to Tremor's infrastructure through extreme weather events, with the World Economic Forum's 2024 Global Risks Report highlighting these as severe short-term threats to critical infrastructure globally.

PESTLE Analysis Data Sources

Our PESTLE analysis for Tremor International is built upon a comprehensive review of data from leading financial news outlets, industry-specific market research reports, and official regulatory filings. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the digital advertising landscape.