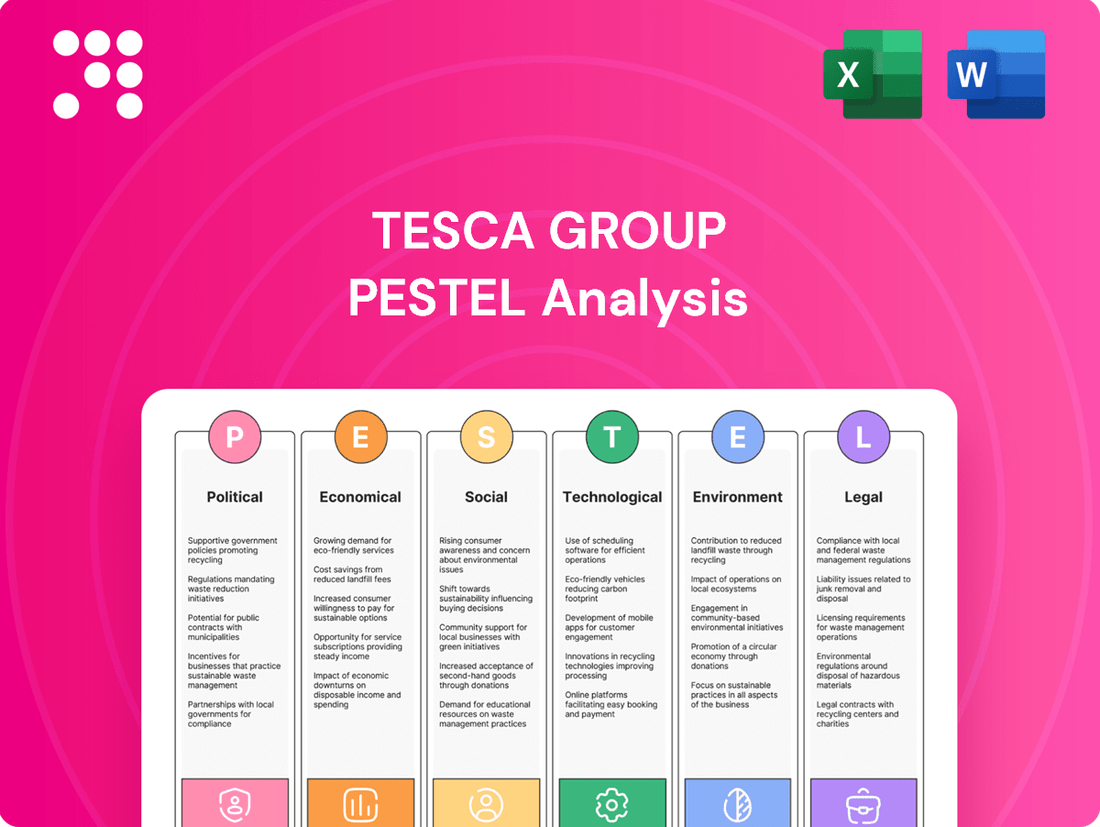

Tesca Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tesca Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Tesca Group's trajectory. Our expertly crafted PESTLE analysis provides the deep-dive insights you need to anticipate market shifts and capitalize on opportunities. Download the full version now to gain a strategic advantage.

Political factors

Government policies and incentives are a major driver for the automotive industry's pivot to electric vehicles (EVs). TESCA Group, as a service provider to this sector, is directly affected by these regulations, subsidies, and infrastructure investments designed to boost EV uptake.

For instance, the European Union's stringent CO2 emission standards, coupled with ambitious EV sales targets in various nations, are fueling demand for specialized engineering and IT services that TESCA Group offers. In 2024, the EU's CO2 targets are pushing manufacturers to accelerate EV production, creating opportunities for TESCA.

Global trade policies, including tariffs and trade agreements, significantly influence the automotive supply chain and manufacturing expenses. For instance, the ongoing discussions and potential shifts in trade agreements between major economies in 2024 and 2025 could alter import/export duties on automotive components.

Uncertainties surrounding tariffs, such as those that might be implemented by a new US administration in 2025, can disrupt international automotive trade flows. This disruption can lead to increased costs for components, directly impacting TESCA's clients in the automotive sector and subsequently affecting TESCA's own business operations.

The pace of autonomous vehicle (AV) development and deployment is directly tied to the evolving regulatory landscape. Governments worldwide are actively crafting legislation covering AV safety standards, operational testing protocols, and crucial liability frameworks. This regulatory evolution creates a significant demand for specialized engineering and software development expertise, a core competency that TESCA Group is well-positioned to address.

Geopolitical Stability in Key Automotive Markets

Geopolitical stability is a critical factor impacting TESCA Group's automotive sector. Political instability in key regions like Eastern Europe, where significant automotive manufacturing and component sourcing occurs, can disrupt supply chains. For instance, ongoing tensions in Eastern Europe have already led to increased logistics costs and component shortages for many automotive players, with some estimates suggesting a 10-15% increase in shipping expenses for affected routes in late 2024.

TESCA Group's exposure to these markets means it faces direct risks from regional conflicts and trade policy shifts. A sudden escalation of political tensions could halt production lines or restrict access to vital components, directly impacting TESCA's ability to serve its clients. The automotive industry's reliance on intricate global supply networks makes it particularly vulnerable to these disruptions.

Consider these specific impacts:

- Supply Chain Disruptions: Political unrest can lead to border closures, transportation delays, and increased security costs for raw materials and finished goods.

- Market Demand Volatility: Economic sanctions or trade wars stemming from geopolitical events can significantly reduce consumer spending power and vehicle sales in affected countries.

- Regulatory Uncertainty: Shifting political landscapes can result in unpredictable changes to import/export tariffs, environmental regulations, and safety standards, complicating business planning.

- Investment Risk: Heightened geopolitical risk can deter foreign direct investment into automotive manufacturing facilities, impacting future growth opportunities for companies like TESCA.

Government Investment in R&D for Automotive Tech

Government investment in automotive R&D is a significant driver of innovation. For instance, the United States Department of Energy's Office of Energy Efficiency & Renewable Energy (EERE) allocated approximately $400 million for vehicle technologies in fiscal year 2023, focusing on areas like battery technology and advanced materials. This funding directly supports the development of AI, connectivity, and sustainable mobility solutions.

These government initiatives create a fertile ground for companies like TESCA Group. By fostering innovation, they generate demand for specialized engineering and IT services. TESCA can leverage these opportunities by offering expertise in areas such as autonomous driving systems, connected car platforms, and electric vehicle (EV) powertrain development, aligning their services with national strategic priorities.

- Increased Funding: The US government's commitment to vehicle technology R&D, with significant budgets allocated annually, provides a stable environment for technological advancement.

- Focus Areas: Key investment areas include artificial intelligence for autonomous driving, vehicle-to-everything (V2X) communication, and the development of more efficient and sustainable powertrain technologies.

- Market Opportunities: Government support stimulates private sector investment and creates a demand for specialized engineering and IT services, benefiting companies like TESCA Group.

- Strategic Alignment: TESCA can align its service offerings with government-backed research programs, positioning itself as a key partner in developing future automotive technologies.

Government policies directly shape the automotive industry's transition to electric and autonomous vehicles, influencing TESCA Group's market. For example, the US Inflation Reduction Act continues to provide substantial EV tax credits through 2032, encouraging consumer adoption and thus demand for related engineering services in 2024 and 2025.

Geopolitical shifts and trade agreements also play a crucial role. The ongoing recalibration of international trade relationships in 2024-2025, including potential tariff adjustments by major economies, can impact automotive supply chain costs and manufacturing strategies, affecting TESCA's clients.

Regulatory frameworks for autonomous vehicles are rapidly evolving. Governments are establishing safety standards and testing protocols, creating opportunities for TESCA’s specialized software and engineering expertise. In 2024, several countries are finalizing AV legislation, signaling a significant market expansion.

Political stability in key manufacturing regions is vital. Disruptions due to regional conflicts, as seen in Eastern Europe, can increase logistics costs by an estimated 10-15% for affected routes by late 2024, impacting automotive supply chains and TESCA's operational environment.

What is included in the product

This PESTLE analysis delves into the external macro-environmental factors influencing the Tesca Group across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering a comprehensive strategic overview.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Tesca Group.

Helps support discussions on external risk and market positioning during planning sessions, acting as a pain point reliever by clarifying complex environmental influences.

Economic factors

The global economy's trajectory significantly influences TESCA's market. As of early 2024, projections for global GDP growth are around 3%, a slight moderation from previous years, but still indicating expansion. However, persistent inflation and geopolitical tensions continue to pose recession risks in key automotive markets, which could dampen consumer spending on new vehicles and consequently reduce demand for TESCA's specialized services.

Tesca Group's performance is intrinsically linked to the automotive sector's production and sales figures. For instance, global light vehicle sales are projected to reach approximately 88 million units in 2024, a slight increase from 2023, indicating a generally stable but growing market for Tesca's services.

A downturn in vehicle sales, such as the 1.8% decrease seen in 2023 for the European market, directly impacts Tesca's business volume. This is because lower sales translate to reduced demand for new vehicle development and manufacturing engineering, core areas for Tesca.

Supply chain disruptions, like those experienced in recent years affecting semiconductor availability, also play a crucial role. These disruptions can slow production and delay new model launches, thereby affecting Tesca's project pipeline and revenue streams.

Rising inflation is a significant concern for Tesca Group, as it directly impacts the cost of raw materials and essential components within the automotive supply chain. For instance, global inflation rates remained elevated through much of 2024, with some regions experiencing consumer price index (CPI) increases exceeding 5% year-over-year, impacting input costs for manufacturers.

These increased supply chain costs can squeeze profit margins for automotive manufacturers, potentially making them more hesitant to invest in external services that Tesca Group provides. Managing internal cost structures and strategically adapting pricing models will be crucial for Tesca Group to navigate these economic headwinds effectively.

Interest Rates and Investment Climate

Interest rates significantly shape the investment climate for companies like TESCA Group. When interest rates rise, the cost of borrowing for both consumers and businesses increases. This directly impacts vehicle affordability for customers, potentially leading to reduced demand for automotive products and, consequently, for the components and services TESCA provides. For TESCA itself, higher rates can make it more expensive to finance new projects or expand operations.

The Reserve Bank of India (RBI) maintained its repo rate at 6.50% through several policy meetings in late 2023 and early 2024, signaling a cautious approach to inflation management. However, global economic uncertainties and potential shifts in monetary policy by major central banks could influence future rate decisions. For instance, if global interest rates trend upwards, it could put pressure on the RBI to adjust its own stance, impacting the cost of capital for Indian businesses.

- Impact on Vehicle Financing: Higher interest rates increase monthly payments for car loans, making vehicles less affordable for consumers.

- Manufacturer Investment: Automotive manufacturers may postpone or reduce capital expenditure on new models or plant expansions when borrowing costs are elevated.

- TESCA's Capital Costs: Increased interest rates can raise TESCA Group's own borrowing costs for operational needs and investments.

- Consumer Spending: A general slowdown in consumer spending due to higher borrowing costs can indirectly affect demand for automotive components.

Consumer Purchasing Power and Demand for New Vehicles

Consumer purchasing power significantly influences the automotive sector, directly impacting demand for new vehicles. As of early 2024, rising inflation and interest rates have put pressure on discretionary spending for many households, potentially dampening demand for higher-priced new car models. This economic climate necessitates that companies like TESCA Group carefully consider pricing strategies and financing options to remain competitive.

Consumer preferences are also evolving, with a notable shift towards electric vehicles (EVs) and a growing interest in shared mobility services. This trend is driven by environmental concerns, government incentives, and advancements in EV technology. For instance, EV sales in many major markets saw robust growth through 2023 and are projected to continue expanding in 2024 and 2025, presenting both opportunities and challenges for automotive suppliers.

- EV Market Share Growth: Global EV sales are projected to reach over 15 million units in 2024, a substantial increase from previous years.

- Impact of Interest Rates: Higher interest rates in 2023 and early 2024 have increased the cost of vehicle financing, potentially affecting consumer affordability.

- Demand for Advanced Features: Consumers increasingly expect advanced features like digital cockpits and driver-assistance systems, requiring significant R&D investment from suppliers.

- Shared Mobility Trends: While still a developing area, the adoption of shared mobility platforms could alter traditional vehicle ownership models, influencing long-term demand.

Global economic conditions directly shape TESCA Group's operational landscape. Projections for global GDP growth in 2024 hover around 3%, indicating continued expansion, though tempered by persistent inflation and geopolitical risks. These factors can impact consumer spending on vehicles, a key driver for TESCA's engineering services.

The automotive sector's health is paramount for TESCA. Global light vehicle sales are expected to reach approximately 88 million units in 2024, a modest increase that suggests a stable, albeit growing, market for TESCA's offerings. However, a slowdown, like the 1.8% dip in European sales in 2023, directly affects TESCA's project pipeline and revenue.

Inflationary pressures remain a significant concern, impacting raw material costs and potentially leading automotive manufacturers to curb investments in external engineering services. For instance, elevated inflation rates in many regions through early 2024, with some CPIs exceeding 5% year-over-year, increase input costs for the entire supply chain.

Interest rates also play a crucial role. Higher rates increase borrowing costs for both consumers and manufacturers, potentially reducing vehicle affordability and capital expenditure. The Reserve Bank of India's repo rate remaining at 6.50% through late 2023 and early 2024 reflects a cautious monetary stance, but global trends could influence future adjustments.

Preview the Actual Deliverable

Tesca Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Tesca Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations and strategic decisions. Gain valuable insights into the external forces shaping the Tesca Group's business landscape.

Sociological factors

Consumers are increasingly prioritizing eco-friendly transportation, with a notable surge in demand for electric vehicles (EVs) and shared mobility. This societal trend is a significant driver for the automotive industry, pushing manufacturers to invest heavily in EV technology and sustainable engineering practices. For TESCA Group, this translates into a robust demand for their specialized services supporting this transition.

Globally, EV sales have seen remarkable growth. In 2023, for instance, electric car sales surpassed 14 million units, representing a substantial increase from previous years and indicating a clear consumer preference shift. This growing market segment directly benefits companies like TESCA that offer solutions catering to the development and integration of sustainable mobility technologies.

The automotive sector's swift evolution, driven by digital transformation, AI, and software-defined vehicles, has widened the chasm between available skills and industry needs. This creates a critical workforce skills gap, impacting companies like TESCA Group.

For TESCA Group, an engineering and IT services provider, this means a constant need to upskill its existing workforce and potentially develop new training programs. The company must ensure its employees possess expertise in areas like embedded software, cybersecurity, and data analytics to meet client demands.

In 2024, reports indicated that over 60% of automotive manufacturers faced challenges in finding talent with the necessary digital and software engineering skills. This gap directly affects the pace of innovation and production for vehicle manufacturers, creating opportunities for service providers like TESCA Group to offer specialized talent solutions.

The shift towards remote and hybrid work significantly impacts how companies like TESCA Group deliver services, especially in automotive engineering and IT. This trend, accelerated by events in recent years, means TESCA must adapt its operational strategies to effectively manage and support distributed teams. For instance, a 2024 survey indicated that 60% of IT professionals prefer hybrid work, highlighting the need for robust remote collaboration tools and flexible project management approaches.

Demographic Shifts Impacting Labor Supply

Demographic shifts are significantly reshaping the labor pool available to TESCA Group and the broader automotive sector. For instance, many developed nations are experiencing an aging workforce, leading to potential shortages in experienced manufacturing and engineering roles. This trend, coupled with declining birth rates in some areas, could constrain the supply of new talent entering the industry.

Conversely, other regions boast a burgeoning young population, often characterized by a strong affinity for technology and digital skills. This presents an opportunity for TESCA Group to tap into a new generation of workers, but it also necessitates adapting recruitment and training strategies to meet their expectations and skill sets. For example, by 2025, the global workforce is projected to see a notable increase in Gen Z entering full-time employment, bringing different expectations regarding work-life balance and technological integration.

- Aging Workforce Challenges: In 2024, countries like Japan and Germany continue to grapple with an aging population, impacting the availability of skilled manual labor in automotive manufacturing.

- Youthful Demographics and Tech Skills: Emerging markets in Southeast Asia and parts of Africa present a younger demographic, offering a potential surge in digitally native talent ready for roles in automotive software and AI.

- Talent Acquisition Adaptation: TESCA Group's recruitment strategies may need to pivot towards attracting younger talent through digital channels and offering roles that align with emerging technological demands, such as electric vehicle (EV) development and autonomous driving systems.

Brand Perception and Corporate Social Responsibility

Consumers and stakeholders are increasingly scrutinizing companies for their social and ethical conduct, directly impacting how brands are perceived. For TESCA Group, demonstrating a strong commitment to sustainability, ethical business practices, and robust data privacy is crucial. This focus can significantly bolster its reputation, making it a more appealing choice for customers and partners who value these principles. For instance, in 2024, a significant majority of consumers (over 70%) indicated that a company's social responsibility efforts influence their purchasing decisions.

TESCA Group's proactive approach to Corporate Social Responsibility (CSR) can translate into tangible benefits, fostering loyalty and attracting investment. By highlighting initiatives that align with societal expectations, the company can build a more resilient brand image. This is particularly relevant as investor interest in Environmental, Social, and Governance (ESG) factors continues to grow, with ESG-focused funds seeing substantial inflows in 2024, reaching record levels.

- Brand Perception: Growing consumer demand for ethical products and services directly shapes brand image.

- CSR Impact: Companies with strong CSR programs often experience enhanced customer loyalty and a more positive public image.

- Investor Trends: A significant portion of investment capital in 2024 was directed towards companies demonstrating strong ESG performance, indicating a clear link between social responsibility and financial attractiveness.

- Data Privacy: In an era of increasing data breaches, a company's commitment to data privacy is a critical component of its trustworthiness and brand reputation.

Societal shifts toward sustainability and ethical consumption are profoundly influencing the automotive industry, directly impacting TESCA Group. Consumers are increasingly prioritizing eco-friendly transportation, driving demand for electric vehicles (EVs) and shared mobility solutions. This trend is supported by data showing a significant global rise in EV adoption; for example, electric car sales exceeded 14 million units in 2023, a clear indicator of evolving consumer preferences.

The automotive sector's rapid digital transformation, incorporating AI and software-defined vehicles, has created a substantial skills gap. In 2024, over 60% of automotive manufacturers reported difficulties in sourcing talent with essential digital and software engineering expertise, presenting an opportunity for TESCA Group to provide specialized workforce solutions.

Demographic changes, such as an aging workforce in developed nations and a growing, tech-savvy youth population in emerging markets, are reshaping the talent pool. By 2025, Gen Z is expected to represent a larger segment of the workforce, bringing new expectations regarding work-life balance and technology integration, which TESCA Group must address in its recruitment and training strategies.

Societal expectations regarding corporate social responsibility (CSR) are also escalating, with over 70% of consumers in 2024 stating that a company's social responsibility influences their purchasing decisions. This emphasis on ethical conduct and ESG factors is critical for TESCA Group's brand perception and attractiveness to investors, as ESG-focused funds saw record inflows in 2024.

| Sociological Factor | Impact on Automotive Industry | Opportunity/Challenge for TESCA Group | Supporting Data (2023-2025) |

|---|---|---|---|

| Sustainability & Eco-Consciousness | Increased demand for EVs and shared mobility | Opportunity for specialized engineering and IT services for EV development | EV sales surpassed 14 million units globally in 2023 |

| Digital Transformation & Skills Gap | Need for software, AI, and data analytics expertise | Challenge in finding skilled talent; opportunity to provide upskilling and specialized staffing | 60% of auto manufacturers faced talent gaps in digital skills (2024) |

| Demographic Shifts | Aging workforce vs. tech-native youth | Need to adapt recruitment for younger talent and address potential shortages of experienced workers | Growing Gen Z workforce expected by 2025 |

| Corporate Social Responsibility (CSR) & Ethics | Consumer preference for ethical brands; investor focus on ESG | Enhance brand reputation and attract investment through strong CSR and data privacy practices | 70%+ consumers influenced by CSR (2024); Record ESG fund inflows (2024) |

Technological factors

Artificial intelligence (AI) and machine learning (ML) are fundamentally reshaping the automotive sector, from design and production to the very experience inside a vehicle. TESCA Group, with its strong digital transformation and IT services background, is positioned to help clients leverage these advancements. For instance, AI is enabling predictive maintenance, reducing downtime, and improving quality control on assembly lines. By 2024, the automotive AI market was projected to reach over $15 billion, highlighting the significant investment and growth in this area.

TESCA Group's role is vital in assisting automotive companies to integrate AI for critical functions like autonomous driving systems, which rely heavily on sophisticated ML algorithms for perception and decision-making. Furthermore, AI facilitates the creation of personalized in-vehicle experiences, adapting to driver preferences and optimizing comfort. The adoption of AI in automotive manufacturing alone is expected to boost efficiency by up to 20% in certain processes by 2025.

The automotive industry's rapid shift towards connected and autonomous vehicles (CAVs) presents significant opportunities. This evolution demands sophisticated software, advanced sensor integration, and robust data processing capabilities. For instance, by the end of 2024, it's projected that over 80% of new vehicles sold globally will feature some level of connectivity, a substantial increase from previous years.

TESCA Group is strategically positioned to capitalize on this trend. Their expertise in engineering and IT services is crucial for developing and securing the complex software architectures and data management systems that underpin CAV technology. The global market for autonomous driving technology alone was valued at approximately $25 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 20% through 2030.

The automotive sector is deeply immersed in Industry 4.0, leveraging smart factories, the Internet of Things (IoT), and digital twins to streamline production. This digital shift is crucial for enhancing efficiency and competitiveness.

TESCA Group's expertise in manufacturing engineering and digital transformation directly addresses this trend. Their solutions empower automotive clients to integrate these cutting-edge technologies, optimizing everything from supply chain management to on-the-ground assembly lines.

Globally, investments in manufacturing automation and digital solutions are soaring. For instance, the global industrial IoT market was valued at approximately $230 billion in 2023 and is projected to reach over $500 billion by 2028, highlighting the significant opportunities for companies like TESCA Group to support this digital evolution.

Cybersecurity Threats in Automotive Systems

The increasing reliance on software and connectivity in modern vehicles amplifies cybersecurity threats. This evolution necessitates robust protection for vehicle systems, user data, and the entire supply chain. For instance, the automotive cybersecurity market is projected to reach over $10 billion by 2025, highlighting the significant investment and concern in this area.

TESCA Group's IT services, especially its cybersecurity offerings, are crucial for automotive manufacturers navigating these complex risks. By providing advanced solutions, TESCA helps clients safeguard against sophisticated cyberattacks, ensuring the integrity and safety of connected vehicles. This includes protecting against data breaches and securing the digital infrastructure that supports vehicle operations.

- Escalating Cyber Threats: Vehicles are becoming sophisticated computing platforms, making them prime targets for cybercriminals.

- Regulatory Compliance: New mandatory regulations are emerging globally to address automotive cybersecurity, requiring manufacturers to implement stringent security measures.

- TESCA's Role: TESCA Group's cybersecurity expertise is vital for automotive clients to meet these regulatory demands and protect against evolving threats.

- Market Growth: The automotive cybersecurity market is experiencing rapid growth, with significant investments being made to enhance vehicle safety and data protection.

Electrification and Battery Technology Innovation

The automotive industry's pivot to electrification is accelerating, demanding constant advancements in battery tech, powertrains, and charging solutions. For example, global EV sales are projected to reach 30 million units in 2024, a significant jump from previous years, highlighting the urgency for innovation. TESCA Group's expertise in product development and engineering is crucial here, assisting clients in creating, validating, and refining the complex components and systems that define modern electric vehicles.

This technological wave presents both challenges and opportunities. Battery energy density improvements and faster charging capabilities are key areas of focus. By 2025, battery costs are expected to fall further, making EVs more accessible. TESCA Group's role in supporting these developments means they are integral to the supply chain for next-generation automotive technology.

- EV Market Growth: Global EV sales are anticipated to exceed 30 million units in 2024.

- Battery Cost Reduction: Projections indicate a continued decline in battery costs through 2025, enhancing EV affordability.

- TESCA Group's Role: Providing essential design, testing, and optimization services for EV components and systems.

Technological advancements, particularly in AI and IoT, are revolutionizing automotive manufacturing and vehicle functionality. TESCA Group's IT and engineering services are instrumental in helping clients adopt these innovations, from AI-driven predictive maintenance to the complex software required for autonomous driving. The global automotive AI market is projected to exceed $15 billion by 2024, underscoring the immense technological shift.

The industry's push towards connected and autonomous vehicles (CAVs) necessitates sophisticated software and data management, areas where TESCA Group excels. With over 80% of new vehicles expected to be connected by the end of 2024, the demand for robust IT solutions is paramount. The autonomous driving technology market, valued at around $25 billion in 2023, is set for substantial growth.

Industry 4.0 principles, including smart factories and IoT integration, are key to enhancing automotive production efficiency. TESCA Group's digital transformation expertise supports clients in leveraging these technologies, with the global industrial IoT market expected to surpass $500 billion by 2028. Furthermore, the escalating cyber threats in connected vehicles highlight the critical need for TESCA's cybersecurity services, with the automotive cybersecurity market projected to reach over $10 billion by 2025.

The electrification trend is driving demand for innovation in EV components and battery technology. Global EV sales are anticipated to hit 30 million units in 2024, and further reductions in battery costs by 2025 will boost accessibility. TESCA Group's product development and engineering capabilities are vital in supporting this transition.

| Technology Area | Key Trend | TESCA Group's Role | Market Data (2024/2025 Projections) |

|---|---|---|---|

| Artificial Intelligence (AI) | Autonomous Driving, Predictive Maintenance | Developing AI/ML solutions, system integration | Automotive AI Market: >$15 billion (2024) |

| Connectivity & Autonomy | Connected Vehicles (CVs), Autonomous Vehicles (AVs) | Software architecture, data management, cybersecurity | Connected Vehicles: >80% of new sales (2024) |

| Industry 4.0 | Smart Factories, IoT, Digital Twins | Digital transformation, manufacturing optimization | Industrial IoT Market: >$500 billion (2028 projection) |

| Cybersecurity | Vehicle Data Protection, System Security | Advanced cybersecurity solutions, compliance | Automotive Cybersecurity Market: >$10 billion (2025 projection) |

| Electrification | EVs, Battery Technology, Charging | EV component design, validation, optimization | EV Sales: >30 million units (2024 projection) |

Legal factors

Global automotive safety and emissions regulations are becoming increasingly stringent. For instance, the upcoming Euro 7 standards in Europe, expected to be implemented around 2025-2026, will introduce tougher limits on pollutants, including those from brakes and tires, not just exhaust. Similarly, UNECE regulations, like R157 for Automated Lane Keeping Systems, mandate advanced safety features. TESCA Group's expertise in vehicle engineering is crucial for clients navigating these complex legal landscapes, particularly as they develop new vehicle architectures and electric mobility solutions.

The expanding landscape of vehicle connectivity means that data collected from vehicles, particularly telematics, falls under strict data privacy regulations. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, sets a high bar for how personal data can be processed. TESCA Group's digital transformation and software development efforts must meticulously adhere to these rules, ensuring responsible handling of sensitive vehicle-generated information.

The automotive sector's rapid advancement in areas like AI and autonomous driving, with global investment in automotive AI projected to reach $200 billion by 2030, underscores the critical need for robust intellectual property (IP) protection. TESCA Group must expertly navigate intricate IP laws to safeguard its own innovations and those of its clients, ensuring patents and copyrights are secured for new designs and software to maintain competitive advantage.

Labor Laws and Employment Regulations

Tesca Group's global footprint means navigating a complex web of labor laws and employment regulations, varying significantly by country. Staying compliant with these diverse legal frameworks, which cover everything from minimum wage and working hours to employee rights and anti-discrimination measures, is fundamental to maintaining operational integrity and a stable workforce.

In 2024, for instance, the International Labour Organization (ILO) reported that over 60% of countries had updated their labor legislation, often focusing on digital work and gig economy protections. This necessitates continuous monitoring and adaptation by multinational corporations like Tesca Group.

- Compliance Burden: Tesca Group must ensure adherence to local labor laws in each operating region, which can involve different standards for hiring, firing, benefits, and union relations.

- Employee Rights: Protecting employee rights, such as fair wages, safe working conditions, and freedom of association, is a legal and ethical imperative that impacts employee morale and productivity.

- Regulatory Changes: Anticipating and responding to evolving labor legislation, like new mandates on remote work policies or data privacy for employees, is crucial for avoiding penalties and maintaining a positive employer brand.

International Trade Compliance and Export Controls

TESCA Group, as a global engineering and IT services provider, navigates a complex web of international trade compliance and export controls. These legal mandates are crucial for managing the cross-border flow of technology, services, and sensitive data, directly influencing TESCA's capacity to engage with international clientele and maintain its worldwide supply chain operations. For instance, the Wassenaar Arrangement, which Tesca must comply with, regulates the export of dual-use goods and technologies, impacting the transfer of advanced engineering software and IT solutions. Failure to adhere can result in significant penalties, including fines and reputational damage.

The evolving landscape of global trade regulations, including sanctions and tariffs, presents ongoing challenges. For 2024 and into 2025, businesses like TESCA are particularly focused on compliance with updated export control lists and data localization requirements in key markets. For example, the United States Bureau of Industry and Security (BIS) regularly updates its Entity List, and any inclusion of TESCA's partners or clients could necessitate adjustments in service delivery or technology transfer. Furthermore, varying data privacy laws, such as GDPR in Europe and similar legislation emerging in Asia, require careful management of data handling across borders.

- Export Control Compliance: Adherence to regulations like the Wassenaar Arrangement and national export control laws is paramount for TESCA's technology and service offerings.

- Sanctions and Trade Restrictions: Monitoring and complying with international sanctions regimes is essential to avoid business disruptions and legal repercussions.

- Data Localization and Privacy: TESCA must manage data handling in accordance with diverse global data privacy laws, impacting service delivery models.

- Supply Chain Due Diligence: Ensuring that all partners and vendors within the global supply chain also meet international trade compliance standards is a continuous requirement.

TESCA Group must navigate evolving automotive safety and emissions regulations, such as the stringent Euro 7 standards anticipated for 2025-2026, which will impose stricter limits on pollutants from various vehicle components. Compliance with UNECE regulations, like R157 for automated driving systems, is also critical for clients developing new vehicle technologies.

The increasing interconnectedness of vehicles means TESCA Group must rigorously adhere to data privacy laws, including the GDPR, when handling telematics and other vehicle-generated data. Protecting sensitive information is paramount, especially as digital transformation and software development advance.

Intellectual property laws are increasingly important as the automotive sector invests heavily in AI and autonomous driving, with global investment in automotive AI projected to reach $200 billion by 2030. TESCA Group's ability to secure patents and copyrights for its innovations and those of its clients is vital for maintaining a competitive edge.

TESCA Group's global operations require strict adherence to diverse labor laws, which are frequently updated. For instance, the ILO reported in 2024 that over 60% of countries had revised their labor legislation, often addressing digital work and gig economy protections, necessitating continuous adaptation by multinational firms.

Environmental factors

Governments globally are tightening vehicle emissions standards and fuel efficiency requirements. For instance, the European Union's CO2 emission targets for new cars are set to become even stricter, aiming for an 80% reduction by 2030 compared to 2021 levels, with a 100% reduction for vans. This regulatory push directly fuels demand for TESCA's expertise in developing advanced powertrain solutions, lightweight materials, and optimized aerodynamics, ensuring continued business opportunities.

There's a significant push towards greener manufacturing in the automotive sector. Companies are increasingly prioritizing eco-friendly methods across their entire production chain. For instance, the automotive industry's global revenue was projected to reach over $3.1 trillion in 2024, with a growing portion of this investment directed towards sustainability initiatives.

TESCA Group can play a vital role by helping clients refine their manufacturing operations. This includes strategies to cut down on waste, lower energy usage, and integrate circular economy models. By doing so, clients can noticeably improve their environmental performance and meet evolving regulatory and consumer demands.

Automotive manufacturers are under increasing scrutiny to guarantee sustainability and ethical practices throughout their intricate supply chains, particularly concerning the raw materials vital for electric vehicle batteries. For instance, by 2025, the demand for lithium is projected to more than double from 2022 levels, highlighting the urgency for responsible sourcing.

TESCA Group is well-positioned to assist clients in navigating these challenges, offering solutions that enhance supply chain transparency and ensure adherence to evolving Environmental, Social, and Governance (ESG) standards. This includes verifying the provenance of materials and ensuring fair labor practices, which is becoming a key differentiator for consumer trust and regulatory compliance.

Waste Management and Recycling in Automotive Production

Environmental regulations are increasingly pushing automotive manufacturers towards more sustainable practices, particularly in waste management and recycling. For instance, the European Union's End-of-Life Vehicles (ELV) Directive mandates high recycling and recovery rates for vehicles, with targets often exceeding 95% by weight. This regulatory landscape directly impacts TESCA Group, as it creates demand for innovative solutions in material lifecycle management and design for recyclability.

TESCA Group's expertise in engineering for recyclability positions it to capitalize on these trends. By developing components and systems that are easier to dismantle and recycle, TESCA can help automakers meet stringent environmental targets and reduce their overall waste footprint. This focus on a circular economy within automotive production is becoming a key differentiator for suppliers.

- EU ELV Directive: Targets 95% recycling/recovery rate for end-of-life vehicles.

- Material Focus: Increasing emphasis on recycling plastics, metals, and battery components.

- Circular Economy: Growing industry initiatives to design for disassembly and material reuse.

- TESCA's Role: Providing solutions for lifecycle management and enhanced recyclability in automotive parts.

Climate Change Policies Influencing Industry Innovation

Global climate change policies and national decarbonization targets are significantly pushing the automotive sector towards greener technologies and reduced emissions. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly impacting vehicle manufacturing and sales.

TESCA Group's expertise, especially in electric vehicle (EV) development and optimizing operations through digital transformation, positions them to assist clients in navigating these stringent environmental regulations. Their services are crucial for helping automotive companies achieve their sustainability goals and adapt to a low-carbon future.

- Accelerated EV Adoption: Global EV sales are projected to reach over 15 million units in 2024, a substantial increase from previous years, driven by policy incentives and consumer demand for cleaner transportation.

- Decarbonization Targets: Many nations have set ambitious targets, such as China's goal of carbon neutrality by 2060, which necessitates a rapid shift in industrial practices, including automotive production.

- TESCA's Role: TESCA Group's digital solutions can enhance manufacturing efficiency, reducing energy consumption and waste, thereby supporting clients in meeting their carbon footprint reduction objectives.

Environmental regulations are increasingly shaping the automotive industry, driving demand for sustainable solutions. Stricter emission standards, like the EU's 2030 targets for CO2 reduction, directly benefit TESCA's expertise in advanced powertrains and lightweight materials. The global push for greener manufacturing, with industry revenue exceeding $3.1 trillion in 2024, sees a growing investment in eco-friendly practices, creating opportunities for TESCA to optimize client operations and reduce waste.

The automotive sector faces mounting pressure for supply chain transparency and ethical sourcing, particularly for EV battery materials. By 2025, lithium demand is expected to more than double from 2022 levels, underscoring the need for responsible material procurement. TESCA Group assists clients in meeting ESG standards, enhancing supply chain visibility, and ensuring compliance with evolving environmental and social governance requirements.

Circular economy principles are gaining traction, with directives like the EU's ELV aiming for over 95% recycling rates for end-of-life vehicles. This necessitates innovative approaches to material lifecycle management and design for recyclability. TESCA Group's engineering solutions for easier disassembly and material reuse help automakers meet these environmental targets and reduce their waste footprint.

Global climate policies are accelerating the shift to greener automotive technologies, with initiatives like the EU's Fit for 55 package targeting significant greenhouse gas emission reductions. This trend supports the projected over 15 million global EV sales in 2024. TESCA Group's expertise in EV development and digital solutions for manufacturing efficiency is crucial for clients aiming to achieve sustainability goals and adapt to a low-carbon future.

| Environmental Factor | Impact on Automotive Sector | TESCA Group's Opportunity |

|---|---|---|

| Stricter Emission Standards | Drives demand for efficient powertrains and lightweight materials. | Provide engineering solutions for advanced powertrain development and material optimization. |

| Green Manufacturing Push | Increased investment in eco-friendly production processes. | Offer services to optimize manufacturing for waste reduction and energy efficiency. |

| Supply Chain Transparency (ESG) | Focus on ethical sourcing, especially for EV battery materials. | Assist clients in enhancing supply chain visibility and meeting ESG compliance. |

| Circular Economy & Recyclability | Mandates for higher recycling rates and design for disassembly. | Develop solutions for lifecycle management and improved recyclability of automotive components. |

| Decarbonization & EV Adoption | Accelerated shift towards electric vehicles and reduced emissions. | Support clients in EV development and digital transformation for sustainable operations. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable international organizations like the World Bank and IMF, alongside official government publications and leading market research firms. This ensures a comprehensive and accurate understanding of the political, economic, social, technological, legal, and environmental landscapes.