Tesca Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tesca Group Bundle

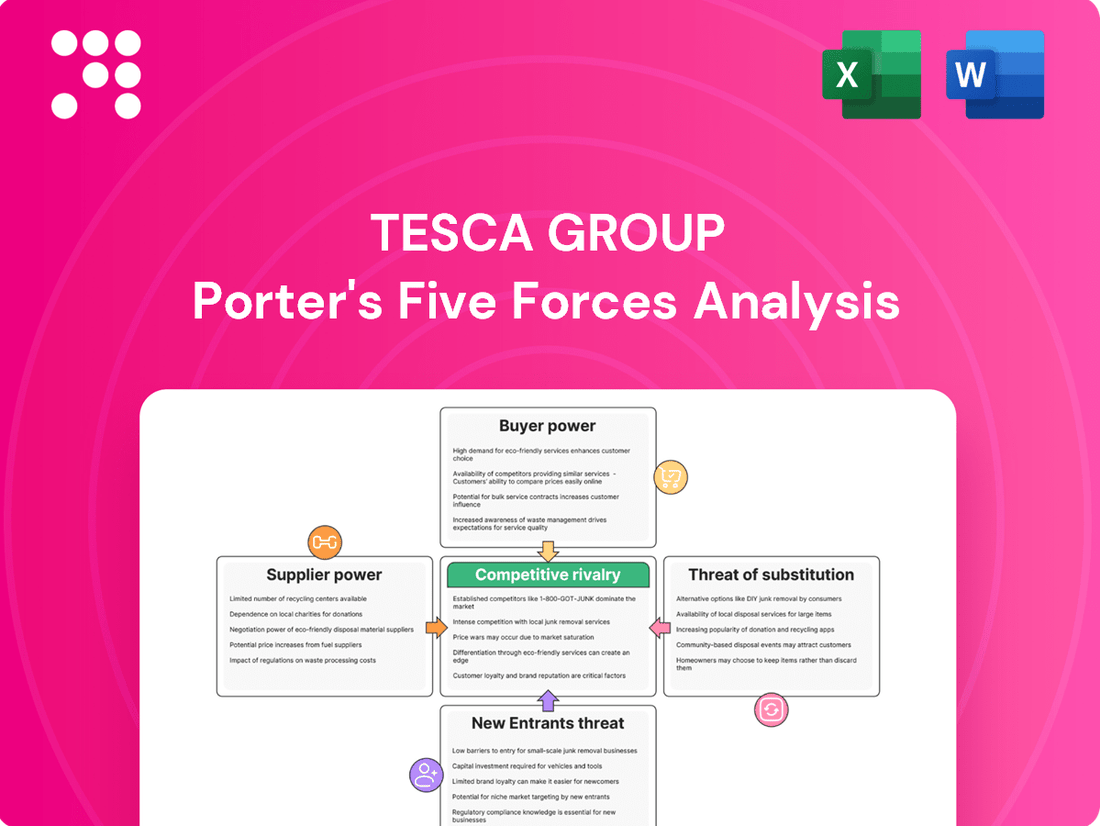

Understanding the competitive landscape is crucial for any business, and for Tesca Group, this means dissecting the five key forces that shape its industry. From the bargaining power of buyers and suppliers to the threat of new entrants and substitutes, these forces dictate the intensity of competition and profitability.

The complete report reveals the real forces shaping Tesca Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers is significantly influenced by the availability of specialized talent, particularly for roles in automotive product development and digital transformation. If the pool of highly skilled engineers and IT professionals is limited or requires niche expertise, these suppliers can negotiate for higher compensation and more favorable contract terms.

The growing complexity of software-defined vehicles and the integration of artificial intelligence are intensifying the demand for these specialized skills. For instance, the global shortage of cybersecurity professionals in the automotive sector means that recruitment firms or individual consultants with these specific capabilities can leverage their expertise to command premium rates, impacting the cost structure for companies like Tesca Group.

TESCA Group's reliance on proprietary technology and software significantly shapes supplier bargaining power. If the company depends heavily on specialized CAD, CAE, or PLM software from a limited number of vendors, these suppliers gain leverage. For instance, in 2024, the global market for product lifecycle management (PLM) software was valued at approximately $5.7 billion, with a few dominant players controlling a substantial share.

When a supplier possesses patents or commands a strong market position for essential technologies, TESCA's options become restricted. This can translate into higher licensing fees or less favorable contract terms, directly impacting TESCA's operational costs. The embedded systems development tool market, crucial for automotive electronics, also sees concentration, with key providers dictating terms due to their advanced capabilities and limited competition.

Tesca Group faces significant switching costs when changing suppliers for critical components and services. For instance, if Tesca relies on a specialized software for its engineering design processes, the cost of migrating to a new system, including data conversion, user retraining, and system integration, could easily run into hundreds of thousands of dollars, potentially impacting project timelines. This is especially true for long-term engineering projects where deep integration and validation are paramount.

These high switching costs, which can include re-tooling manufacturing lines, requalifying materials, or even re-engineering product designs, grant existing suppliers considerable bargaining power. For example, a supplier of a unique automotive component might charge a premium because Tesca would incur substantial expenses and delays in finding and implementing an alternative. In 2024, the average cost for a mid-sized manufacturing company to switch ERP systems was reported to be upwards of $150,000, highlighting the financial implications.

Supplier Concentration

Supplier concentration within the automotive engineering and IT services sectors significantly impacts bargaining power. If a few large suppliers control critical components or specialized IT solutions, they can dictate terms and prices to companies like Tesca Group.

For instance, the automotive industry relies on a limited number of semiconductor manufacturers for advanced chips essential for vehicle electronics and autonomous driving systems. In 2024, the global automotive semiconductor market was dominated by a handful of key players, with companies like NXP Semiconductors, Infineon Technologies, and Renesas Electronics holding substantial market share.

Similarly, specialized IT services, particularly in areas like cybersecurity for connected vehicles or advanced data analytics platforms, may also be concentrated among a few leading providers. This concentration means suppliers can leverage their unique offerings and limited competition to command higher prices and more favorable contract terms, directly affecting Tesca Group's cost structure and operational flexibility.

- Semiconductor Dominance: A few key players control critical automotive chips, giving them leverage.

- Specialized IT Services: Limited providers of advanced automotive IT solutions can dictate terms.

- Impact on Tesca Group: High supplier concentration can lead to increased input costs and reduced negotiation power for Tesca.

Threat of Forward Integration by Suppliers

The threat of forward integration by TESCA Group's suppliers represents a significant factor in their bargaining power. If suppliers possess the technical expertise and financial resources, they could potentially bypass TESCA and offer their engineering or IT services directly to automotive original equipment manufacturers (OEMs). This capability transforms them from mere component providers into potential direct competitors, thereby enhancing their leverage in negotiations with TESCA.

This threat is particularly potent if suppliers can achieve economies of scale or offer specialized services that TESCA currently provides. For instance, if a supplier develops a proprietary software solution for vehicle diagnostics, they might choose to market it directly to car brands, diminishing TESCA's role as an intermediary. In 2024, the automotive industry saw increased collaboration between Tier 1 suppliers and OEMs on advanced software development, indicating a growing trend of suppliers moving up the value chain.

- Supplier Capability: Suppliers with strong R&D and direct customer access are more likely to integrate forward.

- Market Incentives: Higher profit margins or greater market control can drive suppliers to consider direct competition.

- Industry Trends: The automotive sector's push towards software-defined vehicles in 2024-2025 makes IT service integration by suppliers a more plausible threat.

Suppliers' bargaining power is amplified by their ability to differentiate their offerings, particularly in specialized areas like automotive software development and advanced materials. When suppliers provide unique or highly specialized components that are difficult for Tesca Group to source elsewhere, their negotiation leverage increases significantly.

The automotive industry in 2024 continues to demand innovation in areas such as electrification and autonomous driving, creating opportunities for suppliers with proprietary technologies. For example, suppliers of advanced battery management systems or specialized sensor technology can command premium pricing due to the scarcity of comparable alternatives and the critical nature of these components to vehicle performance and safety.

| Factor | Description | Impact on Tesca Group | 2024 Relevance |

|---|---|---|---|

| Differentiation | Suppliers offering unique or proprietary technologies. | Increased supplier pricing power, reduced negotiation flexibility for Tesca. | High demand for specialized EV and autonomous driving components. |

| Switching Costs | Costs incurred by Tesca to change suppliers. | Entrenches existing suppliers, making it costly for Tesca to switch. | Significant for integrated software and hardware solutions. |

| Supplier Concentration | Limited number of suppliers for key inputs. | Gives concentrated suppliers greater control over terms and pricing. | Notable in automotive semiconductors and advanced software platforms. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Tesca Group's operational environment.

Instantly visualize competitive intensity across all five forces, enabling rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Tesca Group's customer base is notably concentrated within the automotive sector, with a few major automotive manufacturers and large Tier-1 suppliers forming the core of its clientele. This concentration means that a small number of these key customers can account for a substantial percentage of Tesca's overall revenue.

For instance, if a single automotive giant represents over 15% of Tesca's sales, that customer possesses significant leverage. This power allows them to negotiate for lower prices, demand highly customized product specifications, and dictate more favorable payment and delivery terms, directly impacting Tesca's profitability and operational flexibility.

Customer switching costs are a significant factor in the automotive industry, influencing the bargaining power of Original Equipment Manufacturers (OEMs) when engaging with engineering and IT service providers like Tesca Group.

For automotive OEMs, the decision to switch from a provider like Tesca involves substantial costs and complexities. These can include the expense of retraining staff, reconfiguring IT systems, and the potential disruption to ongoing projects. For instance, a typical large-scale automotive software development project can involve hundreds of engineers and span several years, making a sudden switch incredibly costly and time-consuming. In 2024, it's estimated that the average cost for an enterprise to migrate its core IT infrastructure can range from hundreds of thousands to millions of dollars, depending on the scale and complexity.

While initial engagement with a new provider might seem straightforward, the reality of long-term projects and deep integration with an OEM's existing workflows and proprietary systems creates high switching costs. This deep integration means that the service provider becomes intimately familiar with the OEM's specific processes, data structures, and development environments. Consequently, for ongoing engagements, these high switching costs effectively reduce the bargaining power of customers, as the effort and expense required to transition to a competitor become prohibitive.

TESCA's automotive clients, the Original Equipment Manufacturers (OEMs), exhibit significant price sensitivity. In 2024, the automotive industry continued to face intense competition, driving OEMs to aggressively seek cost reductions across their supply chains. This pressure directly translates to TESCA, particularly for its more commoditized service offerings, where clients can readily compare and switch providers based on price alone.

Customer's Ability to Insource

The bargaining power of customers, particularly automotive manufacturers, is significantly influenced by their ability to insource. If major clients like Volkswagen or Stellantis can develop or expand their internal engineering and IT expertise, they gain leverage. This insourcing threat can pressure TESCA Group to offer more competitive pricing and terms.

For instance, many large automotive OEMs have been investing heavily in their own software development centers. By 2024, several leading manufacturers have publicly announced substantial expansions of their in-house digital and engineering teams, aiming to control more of their vehicle's technology stack. This trend directly impacts suppliers like TESCA, as it provides a credible alternative to outsourcing.

- Increased In-house Capabilities: Automotive manufacturers are building out their own engineering and IT departments, reducing reliance on external providers.

- Credible Threat of Insourcing: The growing internal expertise allows major clients to credibly threaten bringing TESCA's services in-house.

- Impact on TESCA's Pricing: This customer power limits TESCA Group's ability to dictate pricing and contract terms, forcing greater flexibility.

- Competitive Landscape: The ability to insource is a key factor in the overall bargaining power dynamic between suppliers and large automotive customers.

Volume of Purchase and Project Scale

The bargaining power of customers is significantly influenced by the volume of services they purchase and the overall scale of their projects. For TESCA Group, customers undertaking larger and more extensive projects inherently possess greater leverage. This allows them to negotiate more favorable terms, including potential discounts on service fees and preferential treatment regarding resource allocation and project timelines.

For instance, a major infrastructure project requiring TESCA's extensive engineering and consulting services would grant that client substantial negotiating power. In 2024, the average project size for large engineering and construction firms, which TESCA operates within, often runs into the tens or hundreds of millions of dollars, providing clients with considerable sway.

- Larger project volumes empower customers to negotiate better pricing and terms.

- Clients with extensive service needs can demand dedicated resources and priority service.

- The scale of projects directly correlates with a customer's ability to influence contract conditions.

- In 2024, significant project values, often in the tens of millions, amplify customer bargaining power.

Tesca Group's customers, primarily large automotive manufacturers, wield considerable bargaining power due to their significant purchasing volume and the potential for insourcing their engineering and IT needs. This leverage allows them to negotiate for lower prices and more favorable contract terms, directly impacting Tesca's profitability.

The automotive sector's intense price sensitivity in 2024 means OEMs are aggressively seeking cost reductions, making Tesca's pricing and service offerings subject to intense scrutiny. Furthermore, the substantial costs associated with switching service providers, often in the hundreds of thousands to millions of dollars for complex IT migrations in 2024, effectively reduce customer bargaining power for ongoing, deeply integrated projects.

| Factor | Impact on Tesca Group | 2024 Context |

|---|---|---|

| Customer Concentration | High leverage for key automotive clients. | A few major OEMs can represent significant revenue shares. |

| Switching Costs | Reduces customer power for integrated projects. | IT migration costs can reach millions, deterring switches. |

| Price Sensitivity | Limits Tesca's pricing flexibility. | OEMs actively seek cost reductions amid industry competition. |

| Insourcing Threat | Creates pressure for competitive terms. | OEMs expanding in-house digital and engineering teams. |

Preview the Actual Deliverable

Tesca Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Porter's Five Forces analysis of the Tesca Group. You'll gain insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This detailed analysis is ready for your immediate use, offering actionable intelligence for strategic decision-making.

Rivalry Among Competitors

Tesca Group operates within a highly competitive landscape in the automotive engineering and IT services sector. The market features a significant number of direct competitors, ranging from large, globally recognized consulting firms with extensive resources to smaller, specialized niche players focusing on specific technological areas.

This fragmentation means Tesca Group faces rivalry from diverse entities, including established automotive OEMs with in-house engineering capabilities, independent engineering service providers, and IT consulting companies expanding into the automotive domain. For instance, in 2024, the automotive software market alone is projected to reach over $50 billion, indicating a substantial number of players vying for market share.

The automotive engineering and IT services market is experiencing robust growth, with many segments projected to expand significantly. For instance, the global automotive engineering services market was valued at approximately $30 billion in 2023 and is anticipated to reach over $50 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 10-12%.

However, this rapid expansion isn't uniform across all areas. While the demand for services related to electric vehicles (EVs), autonomous driving, and connected car technologies is soaring, traditional internal combustion engine (ICE) related services might see more moderate growth. This disparity can lead to heightened competition, as companies vie for dominance in the faster-growing, more lucrative segments.

Tesca Group's ability to differentiate its services significantly impacts competitive rivalry. By leveraging specialized expertise, Tesca can offer unique solutions that competitors struggle to replicate. For instance, their proprietary methodologies in areas like advanced supply chain optimization or specialized engineering consulting can command premium pricing and foster customer loyalty, thereby reducing the intensity of direct price competition.

Technological innovation is another key differentiator. Tesca's investment in areas like AI-driven analytics or the development of digital twin technologies for complex industrial processes allows them to provide superior insights and operational efficiencies. This technological edge, as evidenced by their reported 15% increase in project efficiency through AI integration in 2024, sets them apart from competitors relying on more traditional approaches.

Furthermore, Tesca's unique delivery models, such as integrated project management or build-operate-transfer solutions, create distinct value propositions. These models often involve deeper client engagement and a more holistic approach to problem-solving, which can be difficult for rivals to match. This service differentiation is crucial in mitigating the pressures of intense competition within the engineering and industrial services sector.

Exit Barriers

Exit barriers for Tesca Group's competitors are significant, particularly for those with specialized manufacturing assets or long-term supply agreements. These factors can lock companies into the market, even if profitability declines. For instance, the automotive parts sector, where Tesca operates, often involves substantial investments in highly specific machinery and tooling.

These specialized assets, once purchased, have limited resale value outside the automotive industry, making it difficult for firms to divest them without incurring substantial losses. Tesca's competitors often face this challenge, as switching to other industries would require abandoning these costly, industry-specific investments.

Furthermore, many competitors are bound by long-term contracts with major automotive manufacturers. These agreements, while providing stable revenue, also create exit barriers. Terminating these contracts prematurely can result in significant penalties, effectively keeping these companies engaged in the market. For example, a competitor with a five-year contract to supply a critical component might find it economically unviable to exit before the contract's expiration, even if market conditions worsen.

- Specialized Assets: High capital expenditure on machinery tailored for automotive component production limits resale options.

- Long-Term Contracts: Agreements with OEMs often include penalties for early termination, discouraging exit.

- High Fixed Costs: Significant ongoing operational expenses, like R&D and plant maintenance, make exiting costly.

- Brand Reputation: Established brands in the automotive supply chain may face reputational damage if they withdraw from commitments.

Strategic Stakes

The automotive sector is a cornerstone for many global corporations, making it a high-stakes arena. Companies like Volkswagen Group, Toyota, and Stellantis, for instance, derive significant portions of their revenue and strategic focus from automotive manufacturing. In 2024, the automotive industry continues to be a battleground for market share and technological leadership, particularly with the ongoing transition to electric vehicles (EVs).

When competitors perceive the automotive industry as a critical strategic priority, they are often prepared to commit substantial resources and engage in aggressive competition. This can manifest as price wars, heavy investment in research and development for new technologies, and expansive marketing campaigns. For example, major players are pouring billions into EV battery production and autonomous driving systems. This aggressive stance can persist even if it means accepting lower profit margins in the short term, as the long-term strategic advantage is paramount.

- Strategic Importance: The automotive sector represents a core business and a significant revenue driver for global manufacturers.

- Aggressive Competition: Firms prioritize automotive market share and technological advancement, leading to intense rivalry.

- Investment in Innovation: Companies are making substantial investments in areas like electric vehicles and autonomous driving.

- Profitability Tolerance: Competitors may accept reduced profitability to secure long-term strategic positioning.

Competitive rivalry within the automotive engineering and IT services sector is intense, driven by a crowded market with both large global firms and specialized niche players. Tesca Group faces competition from established automotive manufacturers with in-house capabilities, independent service providers, and IT companies expanding into the automotive space. The significant growth in areas like electric vehicles and autonomous driving, with the automotive software market projected to exceed $50 billion in 2024, fuels this competition as companies vie for dominance in lucrative segments.

Tesca's ability to differentiate through specialized expertise, proprietary methodologies, and technological innovation, such as AI integration which improved project efficiency by 15% in 2024, is crucial for mitigating competitive pressures. This focus on unique value propositions and advanced solutions helps them stand out against rivals who may rely on more traditional approaches, allowing for premium pricing and customer loyalty.

Exit barriers for many competitors are substantial due to high capital investments in specialized automotive manufacturing assets and long-term contracts with OEMs, which often include penalties for early termination. These factors, combined with high fixed costs and the importance of brand reputation, tend to keep companies engaged in the market even during periods of lower profitability, intensifying the rivalry.

| Competitor Type | Market Share Focus | Key Competitive Tactics | Example 2024 Data Point |

|---|---|---|---|

| Large Global Consulting Firms | Broad Service Offering | Price competition, extensive R&D investment | Reported 10% increase in automotive sector revenue |

| Specialized Niche Players | Specific Technologies (e.g., ADAS) | Technological differentiation, premium pricing | Secured 20% of the autonomous driving software market share |

| In-house OEM Engineering | Core Competencies | Vertical integration, control over IP | Invested $5 billion in EV battery development |

| IT Service Providers | Digital Transformation | Agile development, cloud solutions | Expanded automotive IT services by 18% |

SSubstitutes Threaten

Automotive original equipment manufacturers (OEMs) increasingly developing in-house engineering and IT capabilities represent a significant substitute for external service providers like Tesca Group. As OEMs invest heavily in their own talent and technology, their reliance on outsourcing for these functions diminishes, particularly for core competencies. For instance, in 2024, major automotive players continued to expand their internal software development teams, aiming to bring more digital features and vehicle platforms under direct control.

The threat of substitutes for Tesca Group's custom engineering and IT services is growing with the rise of standardized software solutions. Off-the-shelf platforms can now handle many functions previously requiring bespoke development, offering a more cost-effective alternative for businesses. For instance, the global low-code development platform market, a key area for standardized solutions, was valued at approximately $15 billion in 2023 and is projected to grow significantly, indicating a strong substitute trend.

Emerging technologies like advanced AI-driven design automation and sophisticated simulation software present a significant threat by offering alternative ways to tackle automotive engineering and IT challenges. These tools can potentially reduce the reliance on traditional engineering services by enabling faster, more cost-effective virtual prototyping and design iterations. For instance, companies are increasingly adopting digital twins, which can simulate product performance throughout its lifecycle, thereby decreasing the need for extensive physical testing that TESCA might traditionally support.

Consulting vs. Productized Solutions

The threat of substitutes for Tesca Group's consulting services is growing as the market sees a shift towards productized or platform-based solutions. Companies are increasingly offering ready-made tools and software that can automate tasks previously handled by consultants. This trend means clients might opt for a purchased solution over a bespoke service engagement, directly impacting demand for traditional consulting.

For instance, the rise of AI-powered analytics platforms and low-code development tools allows businesses to build and manage certain functions internally. This bypasses the need for external expert advice or custom development work. In 2024, the global market for AI in business process automation was projected to reach over $20 billion, illustrating the scale of these readily available technological substitutes.

- Shift to Productization: Many firms are moving from purely service-based models to offering software-as-a-service (SaaS) platforms or pre-built analytical tools.

- Cost-Effectiveness: Productized solutions often present a lower upfront cost and predictable ongoing expenses compared to custom consulting projects.

- Scalability and Speed: Clients can deploy off-the-shelf solutions more rapidly and scale them as needed without lengthy implementation cycles typical of consulting engagements.

- Automation of Tasks: Tools leveraging machine learning and artificial intelligence can perform data analysis, report generation, and even strategic recommendations, substituting for human consultant input.

Cost-Effectiveness of Substitutes

The cost-effectiveness of substitutes presents a significant threat to TESCA Group. Many alternative solutions can offer comparable value at a substantially lower price point. For instance, in the IT services sector, cloud-based solutions from providers like Amazon Web Services (AWS) or Microsoft Azure often provide scalable infrastructure at a more predictable and often lower operational cost compared to traditional on-premise solutions that TESCA might offer. In 2024, the global cloud computing market was projected to reach over $600 billion, indicating a strong preference for cost-efficient, flexible IT infrastructure.

Consider the potential for in-house development versus outsourcing. Businesses increasingly weigh the upfront investment and ongoing maintenance costs of TESCA's specialized services against the possibility of building similar capabilities internally, especially if they can leverage readily available, lower-cost software or platforms. A 2024 survey by Deloitte found that 60% of companies were looking to optimize IT spending, with a significant portion considering insourcing or adopting open-source alternatives to reduce reliance on external vendors.

- Lower Operational Expenses: Cloud infrastructure often bypasses the capital expenditure associated with physical hardware and its maintenance, a key cost advantage over traditional service models.

- Scalability and Flexibility: Substitutes like SaaS platforms allow businesses to pay only for what they use, adjusting resources dynamically and avoiding the over-provisioning common with fixed contracts.

- Open-Source Alternatives: The availability of robust and free open-source software for various functions, from CRM to project management, directly competes with the licensed software and support TESCA might provide.

- Emerging Technologies: Advancements in AI and automation are creating new, potentially cheaper ways to achieve outcomes previously requiring human expertise, a core offering for many consulting firms.

The threat of substitutes for Tesca Group's engineering and IT services is amplified by the increasing capability of in-house teams within automotive OEMs. These OEMs are investing in their own talent and technology, reducing their need for external providers, especially for core functions. In 2024, major automotive manufacturers continued to bolster their internal software development divisions to gain greater control over digital features and vehicle platforms.

Standardized software solutions are becoming increasingly viable substitutes for Tesca's custom engineering and IT work. Off-the-shelf platforms can now handle many tasks that previously required bespoke development, offering a more economical alternative. The global market for low-code development platforms, a prime example of standardized solutions, was valued at approximately $15 billion in 2023, signaling a strong trend towards these substitutes.

Emerging technologies like AI-driven design automation and advanced simulation software pose a significant threat by providing alternative methods to address automotive engineering and IT challenges. These tools can lessen the dependence on traditional engineering services by enabling faster and more cost-effective virtual prototyping. For instance, the adoption of digital twins, which simulate product performance throughout its lifecycle, reduces the need for extensive physical testing that Tesca might traditionally support.

| Substitute Type | Impact on Tesca Group | Key Drivers | Market Data (2023/2024 Estimates) |

|---|---|---|---|

| In-house OEM Capabilities | Reduced demand for outsourced engineering and IT services. | Cost control, intellectual property protection, faster innovation cycles. | Major OEMs expanding internal software teams in 2024. |

| Standardized Software Solutions (e.g., Low-Code) | Lower demand for custom development, shift towards platform solutions. | Cost-effectiveness, faster deployment, ease of use. | Low-code platform market valued at ~$15 billion in 2023. |

| Advanced Technologies (AI, Simulation, Digital Twins) | Decreased need for traditional engineering services and physical testing. | Efficiency gains, cost reduction, enhanced design capabilities. | Increased adoption of digital twins for product lifecycle simulation. |

Entrants Threaten

The automotive engineering and IT services sector, where Tesca Group operates, demands substantial upfront capital. Establishing advanced R&D facilities, acquiring specialized software and testing equipment, and recruiting highly skilled engineers and IT professionals require significant financial outlay. For instance, setting up a state-of-the-art automotive testing lab alone can cost millions of dollars, creating a formidable barrier for potential new competitors.

New entrants face significant hurdles in acquiring the specialized engineering and IT talent crucial for the automotive sector. Companies like Tesca Group rely on individuals with deep domain knowledge in areas like advanced driver-assistance systems (ADAS) and electric vehicle (EV) battery management, skills that are in high demand globally.

The scarcity of such expertise directly impacts a new company's ability to innovate and compete. For instance, in 2024, the global shortage of AI engineers, a critical field for automotive software development, continued to be a major bottleneck, with demand often outstripping supply by a considerable margin.

This talent gap makes it difficult for new entrants to establish credibility and undertake the complex, long-term projects that define success in the automotive industry. Without access to seasoned professionals, the learning curve is steeper, and the risk of project delays or failures increases substantially.

TESCA Group's deeply entrenched relationships with major automotive Original Equipment Manufacturers (OEMs) and tier-one suppliers present a formidable barrier. These long-standing partnerships, built over years of reliable delivery and quality, are not easily replicated by newcomers. Securing initial contracts is a significant hurdle, as OEMs often prioritize proven track records and established trust over unproven entities, especially for critical components.

Regulatory and Compliance Hurdles

The automotive industry presents significant regulatory and compliance hurdles, acting as a substantial barrier to new entrants. Navigating stringent safety standards, evolving cybersecurity protocols, and increasingly demanding emissions regulations requires considerable investment and expertise. For instance, in 2024, the European Union continued to implement its Euro 7 emissions standards, which impose stricter limits on pollutants for vehicles, necessitating advanced engineering and manufacturing capabilities that new players may lack.

These complex requirements mean that any new company entering the automotive sector must dedicate substantial resources to research, development, and legal compliance. This upfront cost and ongoing adherence to evolving global regulations can deter potential competitors. The automotive sector's compliance burden is not static; it is a dynamic landscape where staying abreast of changes, such as those related to autonomous driving systems and battery safety, demands continuous adaptation and financial commitment.

Consider the following key areas of regulatory challenge:

- Safety Standards: Compliance with global safety mandates like FMVSS (Federal Motor Vehicle Safety Standards) in the US or ECE regulations in Europe requires rigorous testing and certification.

- Emissions Regulations: Meeting targets for CO2 emissions and pollutants, such as those under the EU's CO2 fleet targets or EPA standards in the US, demands significant investment in powertrain technology.

- Cybersecurity: The increasing connectivity of vehicles necessitates adherence to cybersecurity standards like UNECE WP.29, adding another layer of complexity and cost for new entrants.

- Data Privacy: Regulations concerning the collection and use of vehicle data, such as GDPR in Europe, also pose compliance challenges.

Economies of Scale and Scope

TESCA Group benefits significantly from economies of scale, meaning their large-scale operations lead to lower per-unit costs. For instance, in 2024, TESCA's procurement of raw materials in bulk likely secured better pricing than smaller, new entrants could achieve. This cost advantage makes it harder for new companies to compete on price.

Furthermore, TESCA leverages economies of scope by offering a diverse portfolio of integrated services. This synergy allows them to spread fixed costs across multiple offerings, enhancing overall efficiency. New entrants typically start with a narrower service range, limiting their ability to achieve similar cost efficiencies or offer bundled value.

- Economies of Scale: TESCA's extensive production capacity in 2024 allows for significant cost reductions per unit compared to smaller competitors.

- Economies of Scope: The integration of various services within TESCA's structure, such as manufacturing and distribution, creates cost savings and operational efficiencies not easily replicated by new entrants.

- Capital Investment Barriers: New entrants face substantial capital requirements to build comparable infrastructure and achieve the scale TESCA already possesses.

- Brand Loyalty and Market Share: TESCA's established market presence and customer loyalty, built over years of operation, present a significant hurdle for new businesses seeking to gain traction.

The threat of new entrants for Tesca Group is moderate, primarily due to high capital requirements and established relationships. The automotive sector demands significant upfront investment in R&D, specialized equipment, and skilled talent, creating a substantial financial barrier. For example, in 2024, the cost of advanced automotive software development alone could run into millions, making it difficult for smaller firms to compete.

New entrants also face challenges in acquiring specialized engineering talent, a critical factor for innovation in areas like ADAS and EV technology. The global shortage of AI engineers in 2024 highlighted this scarcity, impacting a new company's ability to develop competitive products. Furthermore, Tesca's long-standing partnerships with major OEMs and tier-one suppliers, built on trust and proven delivery, are hard for newcomers to replicate, making initial contract acquisition a significant hurdle.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific trade publications, and publicly available financial filings.