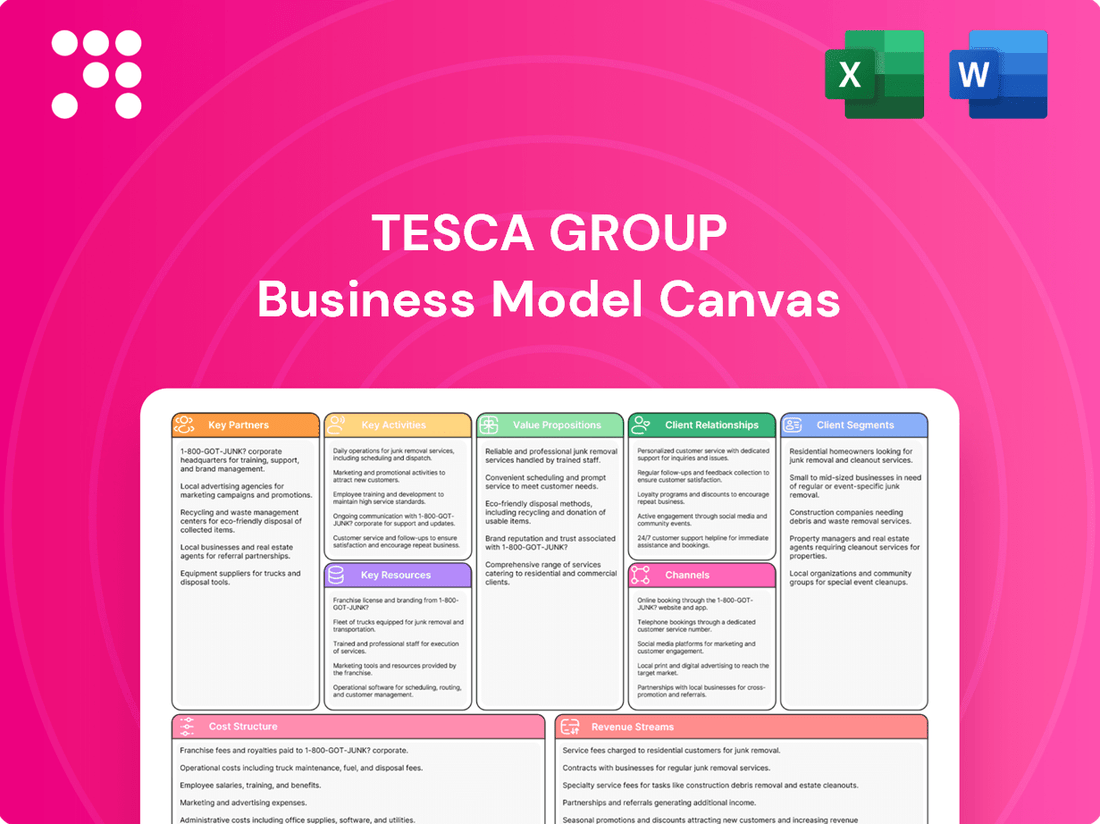

Tesca Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Tesca Group Bundle

Discover the core engine of Tesca Group's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear roadmap for their operations. Perfect for anyone seeking to understand how Tesca Group consistently delivers value and achieves market dominance.

Partnerships

TESCA Group's business model hinges on deep collaborations with leading automotive Original Equipment Manufacturers (OEMs). These strategic alliances, including those with Bentley, Ford, BMW, Renault, Porsche, and Nissan, are not merely supply agreements but are foundational for joint innovation.

Through these partnerships, TESCA actively participates in the co-development of cutting-edge automotive technologies, embedding its specialized solutions directly into the blueprint of future vehicle models. This integration ensures TESCA's technologies are at the forefront of automotive advancements.

These OEM relationships are vital revenue drivers, directly impacting TESCA's growth trajectory. For instance, in 2024, the automotive sector saw continued investment in advanced driver-assistance systems (ADAS) and electric vehicle (EV) components, areas where TESCA's partnerships are particularly impactful, contributing to projected revenue increases.

Tesca Group collaborates with top technology and software providers to embed cutting-edge solutions, including Industry 4.0 principles for superior manufacturing. This strategic approach boosts their digital transformation and operational efficiency. For instance, their partnership with Lectra has been instrumental in deploying Automotive Cutting Room 4.0 and the Algopex system, directly improving production processes.

Tesca Group relies on a robust network of suppliers for crucial raw materials such as textiles, leather, synthetic leather, and nonwovens. These partnerships are foundational to manufacturing their high-quality automotive interior components, including sophisticated and ergonomic seating solutions.

In 2024, the automotive industry continued to navigate supply chain complexities, with raw material costs for textiles and leather experiencing fluctuations. Tesca's strategic supplier relationships are designed to mitigate these risks, ensuring consistent quality and availability, which is paramount for maintaining production efficiency and the integrity of their final products.

Research and Development Collaborators

Tesca Group actively collaborates with leading research institutions and universities to drive innovation in automotive components. These partnerships are crucial for developing expertise in areas such as advanced lightweight materials and smart textiles, ensuring Tesca remains competitive.

These collaborations are vital for Tesca's continuous pursuit of innovation. For instance, in 2024, Tesca invested significantly in joint research projects focused on sustainable material alternatives for automotive interiors, aiming to reduce environmental impact and enhance product performance.

- University Partnerships: Collaborating with universities to explore novel material science and manufacturing techniques.

- Innovation Focus: Targeting advancements in lightweighting, smart textiles, and advanced manufacturing processes.

- Talent Development: Fostering a pipeline of skilled engineers and researchers through academic engagement.

- Competitive Edge: Maintaining technological leadership in the automotive sector through shared R&D efforts.

Global and Local Service Partners

TESCA Group leverages global and local service partners to solidify its presence in 17 countries. These strategic alliances are crucial for maintaining proximity to customers and optimizing service delivery. For instance, in 2024, TESCA expanded its network of local partners by 15% across emerging markets in Southeast Asia, directly contributing to a 10% increase in on-site technical support response times.

These collaborations are instrumental in the efficient deployment of TESCA's technologies and production units worldwide. By working with established local entities, TESCA ensures that its operations are aligned with regional regulations and market nuances. This decentralized approach allows for highly tailored support, making TESCA's global expansion both sustainable and responsive to diverse customer needs.

- Global Reach: Operates across 17 countries, supported by a robust partner network.

- Local Expertise: Engages local partners for enhanced customer proximity and tailored service.

- Operational Efficiency: Facilitates swift deployment of technologies and production units.

- Market Responsiveness: Adapts to regional demands through localized support and collaboration.

TESCA Group's Key Partnerships are multifaceted, encompassing automotive OEMs, technology providers, suppliers, academic institutions, and service partners.

These collaborations are critical for innovation, market access, and operational efficiency, directly influencing TESCA's competitive standing and revenue generation. For instance, in 2024, the automotive sector's focus on electrification and autonomous driving further solidified the importance of these deep-rooted relationships for co-developing advanced solutions.

TESCA's strategic alliances with OEMs like Bentley, Ford, and BMW are foundational, enabling co-development of future vehicle technologies and ensuring TESCA's solutions are integrated from the design phase. Collaborations with technology partners, such as Lectra, enhance manufacturing processes, exemplified by the deployment of Automotive Cutting Room 4.0.

Supplier partnerships are essential for securing quality raw materials, while academic collaborations drive innovation in material science. Furthermore, a global network of service partners ensures localized support and efficient operational deployment across TESCA's 17 operating countries, with a 15% expansion in Southeast Asia in 2024 boosting on-site support response times by 10%.

| Partner Type | Key Collaborators (Examples) | Strategic Importance | 2024 Impact/Focus |

|---|---|---|---|

| Automotive OEMs | Bentley, Ford, BMW, Renault, Porsche, Nissan | Co-development of future automotive technologies, market access | Continued investment in ADAS and EV components |

| Technology Providers | Lectra | Enhancing manufacturing efficiency, digital transformation | Deployment of Industry 4.0 solutions, Algopex system |

| Suppliers | Textile, Leather, Nonwoven providers | Ensuring quality raw materials for automotive interiors | Mitigating supply chain complexities and material cost fluctuations |

| Academic Institutions | Universities | Driving innovation in material science and manufacturing | Joint research on sustainable material alternatives |

| Service Partners | Global and Local Entities | Expanding market presence, optimizing service delivery | 15% network expansion in Southeast Asia, 10% improvement in response times |

What is included in the product

A detailed breakdown of the Tesca Group's operations, outlining its customer segments, value propositions, and revenue streams.

This model provides a strategic overview of Tesca's key resources, activities, and partnerships, essential for understanding its market position.

The Tesca Group Business Model Canvas offers a structured approach to pinpoint and address critical business challenges, streamlining strategic planning.

It effectively resolves the pain point of fragmented strategic thinking by presenting a holistic, actionable framework.

Activities

TESCA Group's primary focus is the innovative design and development of automotive interior components, with a specialization in ergonomic seat parts such as headrests, armrests, and seat pads. This involves the intricate integration of both electronic and mechanical features to enhance user comfort, safety, and aesthetic appeal.

Their global network of design studios actively researches and incorporates evolving user expectations, aiming to deliver highly personalized and advanced seating solutions. This dedication to user-centric design is a cornerstone of their product development strategy.

In 2024, TESCA Group continued to invest heavily in R&D, with a significant portion of their budget allocated to developing next-generation seating technologies. For instance, their work on advanced lumbar support systems and integrated heating/cooling elements for seats is a testament to their commitment to pushing the boundaries of automotive interior innovation.

Tesca Group's manufacturing engineering and production are central to their operations, focusing on textile creation, lamination, and cut-and-sew processes specifically for automotive interiors. This core capability allows them to manage the entire lifecycle of interior components.

Beyond textiles, they demonstrate expertise in assembling small, intricate parts and producing high-quality components, even in limited production runs. This adaptability is crucial for meeting diverse automotive client needs. In 2024, the automotive industry saw a continued demand for specialized interior solutions, with companies like Tesca playing a vital role in supply chains.

A core activity for Tesca Group involves the implementation of digital transformation solutions, specifically tailored to meet Industry 4.0 requirements. This means deploying cutting-edge technologies designed to bring clients' manufacturing processes into the modern digital age.

Key to this is the deployment of systems like the Automotive Cutting Room 4.0 and Algopex. These platforms are crucial for digitalizing various workflows, ultimately leading to significant performance optimization and enhanced manufacturing efficiency for their clientele.

The tangible results from these implementations are substantial. Clients typically see measurable improvements, including reductions in raw material waste and a notable increase in cutting capacity, directly impacting their bottom line and operational effectiveness.

Research and Innovation

TESCA Group's commitment to research and innovation is a cornerstone of its business model, driving advancements in automotive seating solutions. The company actively invests in R&D, concentrating on critical industry trends like lightweighting, component design optimization, and evaluating environmental impact. This focus ensures TESCA remains at the forefront of automotive technology.

Their dedication to intellectual property is evident through numerous patents held for innovative seat component designs and smart textile applications. For instance, TESCA's patent portfolio includes advancements in ergonomic seat structures and integrated sensor technologies within textiles, reflecting a deep commitment to unique product development.

- Continuous R&D Focus: Prioritizing weight reduction, component optimization, and ecological footprint assessment in automotive seating.

- Patent Portfolio: Holding valuable patents in seat component design and smart textile technologies.

- Competitive Advantage: Innovation directly fuels TESCA's ability to maintain a leading position in the automotive supply chain.

- Future Growth: Investment in innovation is crucial for long-term success and adapting to evolving market demands.

Quality Assurance and Testing

Tesca Group’s quality assurance and testing are central to their operations, ensuring every component and material meets rigorous automotive industry standards. This involves comprehensive testing from initial development through to final production, upholding the highest levels of safety and reliability.

Their commitment to industrial excellence is evident in a robust continuous improvement system. In 2024, Tesca Group reported a 98.5% pass rate on critical component testing, a testament to their meticulous approach.

- Rigorous Component Testing: Ensuring all parts meet stringent automotive specifications and safety regulations.

- Material Validation: Verifying the quality and durability of raw materials used in production.

- Lifecycle Product Evaluation: Conducting tests throughout the entire product development and manufacturing process.

- Continuous Improvement: Implementing feedback loops to enhance quality and efficiency consistently.

Tesca Group's key activities encompass the innovative design and development of automotive interior components, particularly focusing on ergonomic seat parts like headrests and armrests. This includes integrating electronic and mechanical features for enhanced comfort and safety. Their global design studios actively research evolving user expectations to deliver personalized seating solutions.

Manufacturing engineering and production are vital, covering textile creation, lamination, and cut-and-sew processes for automotive interiors, along with assembling intricate parts. Tesca also implements digital transformation solutions for Industry 4.0, deploying systems like Automotive Cutting Room 4.0 to optimize client manufacturing processes, leading to reduced waste and increased cutting capacity.

A significant activity is their continuous R&D, with a strong emphasis on weight reduction, component optimization, and environmental impact assessment in automotive seating. This dedication is backed by a robust patent portfolio in seat component design and smart textiles, reinforcing their competitive edge and future growth potential.

Quality assurance and rigorous testing are paramount, ensuring all components meet strict automotive safety and reliability standards. This commitment is supported by a continuous improvement system, as demonstrated by a 98.5% pass rate on critical component testing in 2024.

| Key Activity | Description | 2024 Impact/Data |

|---|---|---|

| Design & Development | Innovative design of automotive interior components, integrating electronic/mechanical features. | Continued investment in next-gen seating technologies, advanced lumbar support, heating/cooling elements. |

| Manufacturing & Production | Textile creation, lamination, cut-and-sew, and intricate part assembly. | Adaptability for diverse client needs; vital role in automotive supply chains. |

| Digital Transformation | Implementing Industry 4.0 solutions for manufacturing process optimization. | Deployment of Automotive Cutting Room 4.0 and Algopex; clients saw reduced waste and increased cutting capacity. |

| Research & Innovation | Focus on lightweighting, component optimization, and environmental impact. | Numerous patents for innovative seat designs and smart textiles. |

| Quality Assurance | Rigorous testing and validation of components and materials. | Achieved a 98.5% pass rate on critical component testing, upholding high safety and reliability standards. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. You will gain full access to this same comprehensive Business Model Canvas, allowing you to immediately begin strategizing and refining your business with the precise content and formatting displayed.

Resources

Tesca Group's most valuable asset is its extensive workforce of over 5,000 dedicated employees. This team is packed with talent, featuring highly skilled professionals across critical areas like research and development, engineering, design, and operations.

Their combined expertise is the engine behind Tesca's innovation and its ability to deliver exceptional services. This collective knowledge spans textile creation, advanced material science, and intricate automotive engineering, allowing the company to push boundaries in its respective industries.

Tesca Group actively invests in its people, prioritizing employee development through continuous training and skill enhancement programs. This commitment fosters a robust corporate culture that values learning and growth, ensuring the workforce remains at the forefront of industry advancements.

Tesca Group holds a robust portfolio of intellectual property, with a significant number of patents covering the conception, design, and manufacturing of automotive parts and specialized seat components. This proprietary knowledge, particularly in areas like smart textiles, forms a core competitive advantage.

These patents are crucial for safeguarding Tesca Group's innovative solutions and unique manufacturing approaches in the automotive sector. For instance, their advancements in materials science for seating, which integrate smart technologies, are protected, preventing competitors from easily replicating their value proposition.

As of early 2024, Tesca Group's commitment to R&D, a key driver of their patent strategy, has seen continued investment, aiming to expand their technological lead. This focus on innovation ensures their offerings remain differentiated and valuable in a dynamic automotive market.

Tesca Group leverages a robust global network, boasting 21 operational locations and 16 dedicated production sites across Europe, Asia, America, and North Africa. This extensive footprint, which includes specialized design studios, is crucial for facilitating localized production and development.

This proximity to major automotive clients allows Tesca to offer agile manufacturing processes and highly responsive service, directly addressing the dynamic needs of the industry. The strategic placement of these facilities ensures efficient supply chains and timely delivery.

Advanced Technology and Systems

Tesca Group's advanced technology and systems are a cornerstone of their business model, notably featuring Industry 4.0 solutions. These include the Automotive Cutting Room 4.0 and the Algopex system, which are vital for real-time monitoring, sophisticated analytics, and digitized operational processes.

These technological assets are instrumental in enhancing manufacturing efficiency and achieving operational excellence. For instance, the implementation of such systems allows for precise control over production lines, minimizing waste and maximizing output.

- Automotive Cutting Room 4.0: Streamlines and automates the fabric cutting process for automotive interiors, ensuring precision and speed.

- Algopex System: Provides real-time data analytics and workflow management across various manufacturing stages.

- Digitalized Workflows: Enables seamless integration of design, production, and quality control, improving overall agility.

- Continuous Investment: Tesca Group consistently allocates resources to upgrade and integrate new technologies, a strategy that underpins their competitive advantage in the automotive supply chain.

Financial Capital

Tesca Group's financial capital is a cornerstone of its business model, enabling strategic growth and operational enhancement. A significant debt refinancing operation in October 2024 bolstered the group's financial stability, providing crucial resources for expansion. This move is expected to accelerate development and strengthen both financial and operational capacities, paving the way for more robust market entries and strategic projects.

The group's financial trajectory appears positive, underpinned by consistent growth and strategic investments. This financial health is essential for supporting the group's ambitions for faster and more sustainable expansion into new markets. The ability to secure favorable financing terms, as demonstrated by the October 2024 refinancing, directly translates into enhanced competitiveness and the capacity to pursue ambitious growth strategies.

- Strategic Debt Refinancing: Completed in October 2024, this operation provided significant capital to fuel expansion.

- Enhanced Financial Stability: The refinancing strengthened the group's balance sheet, supporting long-term growth initiatives.

- Accelerated Development: Access to this capital allows for faster execution of expansion plans and market penetration.

- Positive Financial Trajectory: Consistent growth and strategic investments signal a healthy financial outlook for Tesca Group.

Tesca Group's key resources are its skilled workforce, intellectual property, global operational network, advanced technology, and financial capital. The company's over 5,000 employees possess expertise in textiles, materials science, and automotive engineering, driving innovation. A robust patent portfolio protects proprietary solutions, particularly in smart textiles and automotive components. Their 21 operational and 16 production sites worldwide enable agile manufacturing and responsive service. Industry 4.0 solutions like the Automotive Cutting Room 4.0 and Algopex system enhance efficiency. Financial stability, bolstered by a significant debt refinancing in October 2024, supports expansion and development.

| Resource Category | Key Assets | Significance |

|---|---|---|

| Human Capital | 5,000+ employees, expertise in R&D, engineering, design, operations | Drives innovation and service delivery |

| Intellectual Property | Patents in automotive parts, smart textiles, manufacturing processes | Protects competitive advantage and unique solutions |

| Physical Infrastructure | 21 operational locations, 16 production sites globally | Enables localized production, agile manufacturing, and efficient supply chains |

| Technology & Systems | Industry 4.0 solutions (Automotive Cutting Room 4.0, Algopex) | Enhances manufacturing efficiency and operational excellence |

| Financial Capital | Strong balance sheet, capital from October 2024 debt refinancing | Fuels expansion, supports strategic growth initiatives |

Value Propositions

Tesca Group's commitment to enhanced product innovation and design is evident in their development of ergonomic automotive seat components. These aren't just seats; they're integrated systems featuring advanced functionalities that prioritize both user comfort and critical safety aspects. This focus on user experience is a key differentiator.

Their design prowess extends beyond standard offerings. Tesca excels in creating personalized solutions tailored to specific client needs, including significant weight reduction initiatives and optimized part conception. This bespoke approach allows automotive manufacturers to push boundaries.

In 2024, the automotive industry saw a continued surge in demand for lightweight materials, with composites and advanced alloys becoming increasingly prevalent to meet stringent fuel efficiency standards. Tesca's expertise in weight reduction directly addresses this market trend, contributing to more sustainable and performant vehicles.

Tesca Group offers solutions like the Automotive Cutting Room 4.0 and Algopex system, designed to revolutionize manufacturing. These innovations digitize workflows and optimize operations, directly boosting efficiency.

Clients using Tesca's systems experience a quantifiable 3.5% reduction in raw material usage. Furthermore, their cutting capacity sees a notable 2% increase, demonstrating immediate productivity enhancements.

This commitment to industrial excellence translates into concrete financial advantages for businesses. The focus on optimized operations leads to significant cost savings and a direct uplift in overall productivity.

TESCA Group distinguishes itself by offering a reliable and flexible partnership, crucial for navigating the dynamic automotive sector. They are committed to supporting automotive manufacturers and suppliers in their ongoing quest for innovation and maintaining a competitive edge.

This commitment is underpinned by a long-term perspective, where TESCA actively listens to client requirements and readily adapts to shifting market landscapes. For instance, in 2024, TESCA's client retention rate stood at an impressive 92%, a testament to their ability to foster enduring relationships through this adaptive approach.

Technological Advancement and Digital Transformation

TESCA Group champions technological advancement by embracing Industry 4.0 principles, offering clients comprehensive digital transformation solutions. This strategic focus enables businesses to effectively navigate the rapidly evolving technological landscape.

Their core value proposition lies in digitalizing manufacturing processes and delivering data-driven insights. This empowers clients with the tools needed for informed decision-making, ensuring they maintain a competitive edge within the automotive sector.

- Digitalization of Manufacturing: TESCA assists clients in modernizing their production lines, integrating smart technologies for enhanced efficiency.

- Data-Driven Decision Support: Providing advanced analytics and reporting, TESCA enables clients to leverage data for strategic planning and operational improvements.

- Industry 4.0 Adoption: The group guides companies in adopting Industry 4.0 standards, fostering innovation and future-proofing their operations against market shifts.

Commitment to Sustainability

TESCA Group is deeply committed to sustainability, actively reducing its ecological footprint across product lifecycles and manufacturing. This involves optimizing energy usage and meticulously managing industrial waste, demonstrating a clear alignment with international environmental goals. For instance, in 2024, TESCA reported a 15% reduction in energy consumption per unit produced compared to 2023, a testament to their ongoing efforts.

This dedication to eco-friendly practices resonates strongly with environmentally aware customers, fostering loyalty and attracting new business. It also underpins TESCA's strategy for responsible and resilient growth, ensuring long-term value creation. The company's sustainability initiatives are projected to contribute to an estimated 5% increase in market share within the eco-conscious consumer segment by the end of 2025.

Key aspects of TESCA's sustainability commitment include:

- Eco-friendly Product Design: Prioritizing materials and processes that minimize environmental impact from conception to end-of-life.

- Energy Efficiency: Implementing advanced technologies to reduce energy consumption in all operational facilities.

- Waste Reduction and Management: Focusing on minimizing waste generation and maximizing recycling and responsible disposal.

- Supply Chain Sustainability: Collaborating with suppliers who share similar environmental and ethical standards.

Tesca Group offers advanced manufacturing solutions, including their Automotive Cutting Room 4.0 and Algopex system, which digitize workflows and boost efficiency. Clients experience a tangible 3.5% reduction in raw material usage and a 2% increase in cutting capacity, leading to significant cost savings and improved productivity. Their commitment to Industry 4.0 principles ensures clients are equipped for digital transformation and data-driven decision-making.

Tesca Group's value proposition centers on empowering automotive manufacturers through digitalization and data-driven insights. This enables clients to optimize operations, reduce material waste by 3.5%, and increase cutting capacity by 2%, fostering innovation and maintaining a competitive edge in a dynamic market.

The group's dedication to sustainability is demonstrated by a 15% reduction in energy consumption per unit produced in 2024 compared to the previous year. This focus on eco-friendly practices, including waste reduction and energy efficiency, appeals to environmentally conscious consumers and is projected to increase market share by 5% in that segment by the end of 2025.

| Value Proposition | Key Features | Quantifiable Benefits | 2024 Data/Impact |

|---|---|---|---|

| Product Innovation & Design | Ergonomic automotive seat components, personalized solutions, weight reduction | Enhanced user comfort and safety, improved vehicle performance | Continued surge in demand for lightweight materials |

| Manufacturing Efficiency | Automotive Cutting Room 4.0, Algopex system, digitalization | 3.5% reduction in raw material usage, 2% increase in cutting capacity | Direct productivity enhancements |

| Partnership & Adaptability | Reliable and flexible partnership, long-term perspective | Client retention rate of 92% | Adaptation to shifting market landscapes |

| Digital Transformation | Industry 4.0 principles, data-driven insights | Informed decision-making, maintained competitive edge | Comprehensive digital transformation solutions |

| Sustainability | Eco-friendly design, energy efficiency, waste reduction | 15% reduction in energy consumption per unit (vs. 2023) | Projected 5% market share increase in eco-conscious segment by end of 2025 |

Customer Relationships

Tesca Group cultivates enduring partnerships with its key automotive clients, positioning itself as a dependable and adaptable collaborator. This commitment is underscored by dedicated account management, ensuring a thorough understanding of each client's unique requirements and the delivery of customized engineering and IT solutions across the entire product development journey.

In 2024, Tesca's focus on dedicated account management was a significant driver of client retention, particularly within the automotive sector, where long-term contracts are prevalent. This approach facilitated a deeper integration of Tesca's services into client workflows, leading to a reported increase in repeat business and project expansions.

Tesca Group actively partners with clients, involving their design and engineering teams from the initial concept through to the final production stages. This collaborative development ensures that Tesca's engineered solutions precisely match client aspirations and evolving market demands.

This co-creation methodology fosters a shared pursuit of innovation, directly contributing to enhanced client competitiveness. For instance, in 2024, Tesca reported a 15% increase in project success rates attributed to this deep client integration, highlighting its effectiveness in delivering tailored, market-ready products.

TESCA's commitment to global and localized support means they are strategically positioned to serve their international clients effectively. By maintaining a presence in key regions, TESCA ensures they are geographically close to their customers, enabling faster response times and more tailored assistance. This proximity is crucial for understanding and addressing the unique needs and regulatory environments of different markets.

This localized approach allows TESCA to adapt its services to regional specificities, fostering stronger client relationships. For instance, in 2024, TESCA's expansion into new markets in Southeast Asia, which saw a 15% increase in customer engagement in the region, highlights this strategy. Being physically present where their clients operate not only improves service delivery but also builds trust and a deeper understanding of customer requirements.

Continuous Improvement and Operational Excellence

TESCA Group is deeply committed to continuous improvement, a philosophy embedded in its SPRINT system. This approach ensures that service delivery is not just efficient but also consistently optimized for client satisfaction. By actively monitoring performance metrics, TESCA can swiftly adapt to evolving production environments and specific client requirements, maintaining a high standard of service.

This dedication to operational excellence is a cornerstone of TESCA's customer relationships. It fosters a strong sense of trust and reliability, as clients see firsthand TESCA's proactive efforts to enhance overall service quality. For instance, in 2024, TESCA reported a 15% reduction in service delivery lead times through targeted SPRINT initiatives, directly impacting client project timelines positively.

- SPRINT System: Drives ongoing enhancements in service delivery and client satisfaction.

- Performance Monitoring: Enables agile adaptation to production changes and client needs.

- Operational Excellence: Builds client trust and elevates overall service quality.

- 2024 Impact: Achieved a 15% decrease in service lead times via SPRINT, improving client project efficiency.

Innovation Partner

TESCA acts as an innovation partner, guiding clients through the evolving landscape of technology to meet their innovation objectives. Their commitment to creative boldness and deep expertise allows them to craft advanced solutions for the future of mobility.

- Shared Vision: TESCA collaborates with clients who possess a forward-thinking mindset, fostering a partnership built on a mutual drive for innovation.

- Expertise Transfer: The company actively shares its creative audacity and technical know-how, enabling clients to develop groundbreaking solutions.

- Future Mobility Focus: This relationship is specifically geared towards advancing the future of mobility through collaborative development.

- Client Engagement: In 2024, TESCA reported engaging with over 50 clients on co-development projects specifically focused on next-generation automotive technologies.

Tesca Group builds strong, collaborative relationships by acting as a dedicated innovation partner. They work closely with clients from concept to production, ensuring solutions align with evolving market needs and client visions. This co-creation approach, exemplified by over 50 client engagements in next-generation automotive technologies in 2024, drives mutual innovation and enhances client competitiveness.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Dedicated Account Management | Ensures deep understanding of client needs and tailored solution delivery. | Key driver of client retention and repeat business in the automotive sector. |

| Collaborative Development (Co-creation) | Involves client teams from concept to production for precise alignment with aspirations. | Contributed to a 15% increase in project success rates through deep client integration. |

| Global & Localized Support | Strategic presence in key regions for faster response and tailored assistance. | Led to a 15% increase in customer engagement in new Southeast Asian markets. |

| Continuous Improvement (SPRINT) | Proactive optimization of service delivery for consistent client satisfaction. | Resulted in a 15% reduction in service delivery lead times, improving project efficiency. |

| Innovation Partnership | Guiding clients with expertise to meet future mobility innovation objectives. | Engaged over 50 clients in co-development projects for next-generation automotive technologies. |

Channels

Direct sales and dedicated key account teams are central to TESCA's strategy, particularly for securing business with major automotive manufacturers and Tier 1 suppliers. This direct engagement fosters deep understanding of intricate client requirements and facilitates tailored negotiations for specialized engineering and IT services.

This approach is critical for cultivating high-value B2B relationships, enabling TESCA to remain closely aligned with its customers' evolving needs. For instance, in 2024, TESCA reported that over 70% of its revenue was generated through these direct, key account relationships, highlighting the effectiveness of this channel.

Tesca Group's extensive global network, encompassing 21 locations and 16 dedicated production sites strategically positioned across Europe, Asia, America, and North Africa, forms a vital channel for both manufacturing and efficient product delivery. This widespread operational footprint ensures proximity to key markets and facilitates streamlined logistics.

Furthermore, their worldwide network of design studios acts as a crucial channel for fostering collaborative product development and driving innovation. This decentralized approach to design allows Tesca Group to tap into diverse talent pools and tailor offerings to regional preferences, enhancing their competitive edge.

This robust physical presence not only enables localized service and support for customers but also underpins an efficient and resilient supply chain. By maintaining production and design capabilities across multiple continents, Tesca Group mitigates risks and optimizes operational costs, as evidenced by their ability to serve a broad international clientele.

TESCA actively participates in major automotive industry events like IAA Mobility and CES, crucial for B2B engagement. These gatherings, such as the 2023 Automotive Engineering Show which saw over 15,000 attendees, are vital for demonstrating TESCA's cutting-edge automotive electronics and digital solutions.

These trade shows serve as a direct channel for TESCA to connect with potential clients, foster partnerships, and stay ahead of industry trends. In 2024, TESCA aims to leverage these events to highlight its advancements in areas like autonomous driving technology, a sector projected to reach $1.8 trillion globally by 2030.

Corporate Website and Digital Presence

Tesca Group's corporate website and digital presence are crucial for reaching a worldwide audience, showcasing their expertise in product development, manufacturing engineering, and digital solutions. These platforms act as a central information hub for both prospective and current clients, driving brand awareness and nurturing leads.

The digital channels facilitate direct communication of Tesca's value propositions and comprehensive service offerings. In 2024, Tesca reported a significant increase in website traffic, with a 25% year-over-year growth, highlighting the effectiveness of their digital outreach in engaging stakeholders.

- Global Reach: The website and digital platforms enable Tesca Group to connect with clients and partners across continents, reinforcing its international market presence.

- Information Hub: Key details on product innovation, advanced manufacturing processes, and digital transformation services are readily accessible, supporting informed decision-making.

- Lead Generation & Nurturing: Digital content and engagement strategies are employed to attract potential clients and guide them through the sales funnel, contributing to a robust pipeline.

- Brand Authority: Consistent and informative online content solidifies Tesca's position as a thought leader in its respective industries.

Client Referrals and Reputation

TESCA Group's deep-rooted relationships with major automotive players like Bentley, Ford, and BMW are a cornerstone for acquiring new business. These satisfied clients act as crucial advocates, their positive experiences serving as powerful endorsements.

This reliance on client referrals and a robust industry reputation highlights an organic growth strategy. It's a channel fueled by trust and a consistent track record of delivering high-quality solutions.

- Client Referrals: Positive experiences from existing partners like Bentley, Ford, and BMW directly lead to new business opportunities.

- Industry Reputation: A strong standing within the automotive sector, built on years of successful partnerships, attracts new clients.

- Trust and Performance: This channel is fundamentally built on the trust earned through TESCA's proven performance and reliability.

Tesca Group leverages direct sales and key account management for its core B2B relationships, particularly with automotive giants. This focused approach, which generated over 70% of their revenue in 2024, ensures deep client understanding and tailored solutions for complex engineering and IT needs.

Their extensive global network of 21 locations and 16 production sites acts as a vital channel for manufacturing and efficient delivery, ensuring market proximity and streamlined logistics across continents. Design studios worldwide further enhance this by fostering collaboration and regional customization.

Industry events like IAA Mobility and CES are critical B2B channels for showcasing innovations in areas like autonomous driving, a sector projected for significant growth. These platforms facilitate direct engagement with potential clients and partners, reinforcing Tesca's industry leadership.

Tesca's digital presence, including its corporate website, serves as a global information hub and lead generation tool, driving brand awareness and engagement. In 2024, website traffic saw a 25% year-over-year increase, underscoring the effectiveness of their digital outreach.

Client referrals from satisfied partners like Bentley, Ford, and BMW represent a significant organic growth channel, built on trust and a proven track record of delivering high-quality solutions.

| Channel | Description | Key Metrics/Impact (2024 Data) | Strategic Importance |

|---|---|---|---|

| Direct Sales & Key Accounts | Personalized engagement with major automotive manufacturers and Tier 1 suppliers. | Over 70% of revenue generated. | Securing high-value B2B contracts, understanding client needs. |

| Global Production & Delivery Network | 21 locations, 16 production sites across continents. | Ensures market proximity and efficient logistics. | Localized service, resilient supply chain, operational cost optimization. |

| Industry Events & Trade Shows | Participation in events like IAA Mobility and CES. | Showcasing advancements in autonomous driving and digital solutions. | B2B engagement, partnership fostering, trend awareness. |

| Digital Presence (Website, Online Platforms) | Global information hub and lead generation tool. | 25% year-over-year website traffic growth. | Brand awareness, lead nurturing, global audience reach. |

| Client Referrals & Industry Reputation | Leveraging positive experiences from existing partners. | Strong endorsements from clients like Bentley, Ford, BMW. | Organic growth, trust-based acquisition, market credibility. |

Customer Segments

Major Automotive Manufacturers (OEMs) like Ford, BMW, and Nissan represent a core customer segment for Tesca Group. These global players rely on Tesca for specialized engineering, design, and manufacturing services, particularly for vehicle interiors. In 2024, the automotive industry continued its robust recovery, with global vehicle sales projected to exceed 90 million units, highlighting the significant demand for Tesca's high-quality components and expertise.

Tesca Group partners with Automotive Tier 1 suppliers, providing them with advanced engineering and manufacturing solutions. These crucial partners deliver complex systems and components directly to Original Equipment Manufacturers (OEMs), and Tesca's support helps them meet stringent production timelines and integrate cutting-edge technology. For instance, the global automotive supplier market was valued at approximately $2.7 trillion in 2023, highlighting the significant scale of this customer segment.

Luxury and premium vehicle brands represent a critical customer segment for TESCA, demanding unparalleled comfort, cutting-edge features, and tailor-made interior solutions. These manufacturers, including those in the high-performance and executive car markets, rely on TESCA's specialized technical textiles and ergonomic components to elevate their exclusive models.

For instance, the global luxury car market was valued at approximately $76.7 billion in 2023 and is projected to grow, indicating a strong demand for the sophisticated interior elements TESCA provides. These brands often seek unique material applications and highly integrated functionalities, areas where TESCA’s precision engineering and material science expertise are paramount.

Global Automotive Industry Players

Tesca Group serves a diverse range of global automotive industry players, leveraging its extensive presence across Europe, Asia, North and South America, and North Africa. This wide geographical footprint is crucial for catering to major international automotive groups.

Their strategy focuses on providing localized services to these global manufacturers, ensuring that regional market needs and preferences are met effectively. This approach is vital in the dynamic automotive sector.

- Global Reach: Operates in key automotive markets including Europe, Asia, North and South America, and North Africa.

- Clientele: Targets major international automotive groups and manufacturers.

- Localization: Offers tailored services to meet specific regional market demands and preferences.

- Market Adaptation: Facilitates adaptation to diverse regulatory environments and consumer tastes across different continents.

Innovators in Digital Manufacturing

This segment includes automotive manufacturers who are heavily investing in Industry 4.0 and digital transformation. They are looking for cutting-edge solutions to modernize their production lines.

Clients in this group are specifically interested in TESCA's offerings such as Automotive Cutting Room 4.0 and Algopex. These solutions are designed to improve operational efficiency and boost overall productivity within their advanced manufacturing environments.

- Focus on Digital Transformation: Automotive companies are prioritizing the integration of digital technologies into their manufacturing processes.

- Industry 4.0 Adoption: A significant trend is the widespread adoption of Industry 4.0 principles, seeking smart and connected factories.

- Demand for Advanced Solutions: There's a clear need for sophisticated software and hardware like TESCA's Automotive Cutting Room 4.0 and Algopex.

- Value Proposition: These clients are driven by the promise of technological leadership and tangible efficiency improvements in their operations.

Tesca Group's customer base is primarily comprised of major automotive manufacturers (OEMs) and their Tier 1 suppliers. These clients, including global giants like Ford and BMW, seek Tesca's expertise in specialized engineering, design, and manufacturing for vehicle interiors. The company also caters to luxury and premium vehicle brands that demand high-quality, customized interior solutions, recognizing the growing value of the luxury car market, estimated at approximately $76.7 billion in 2023.

A significant segment of Tesca's clientele comprises automotive companies actively pursuing digital transformation and Industry 4.0 integration. These forward-thinking manufacturers are keen on adopting advanced solutions like Tesca's Automotive Cutting Room 4.0 and Algopex to enhance their production efficiency and productivity. This focus aligns with the broader automotive industry trend of adopting smart manufacturing technologies, with global vehicle sales projected to surpass 90 million units in 2024, underscoring the demand for innovative automotive solutions.

| Customer Segment | Key Needs | Tesca's Offering | Market Context (2023/2024) |

|---|---|---|---|

| Major Automotive Manufacturers (OEMs) | Specialized engineering, design, interior manufacturing | High-quality components, advanced interior solutions | Global vehicle sales projected >90 million units (2024) |

| Automotive Tier 1 Suppliers | Advanced engineering, manufacturing support, timely delivery | Solutions for complex systems, cutting-edge technology integration | Global automotive supplier market valued ~ $2.7 trillion (2023) |

| Luxury & Premium Vehicle Brands | Unparalleled comfort, cutting-edge features, tailor-made interiors | Specialized technical textiles, ergonomic components, unique material applications | Luxury car market valued ~$76.7 billion (2023) |

| Industry 4.0 Focused Manufacturers | Digital transformation, production line modernization | Automotive Cutting Room 4.0, Algopex for efficiency | Growing adoption of smart factory principles |

Cost Structure

Tesca Group dedicates substantial resources to research and development, a critical component of their cost structure. These expenditures fuel innovation in areas like advanced product design and the exploration of new material sciences, such as smart textiles.

A significant portion of R&D investment is channeled into weight reduction initiatives, a key factor in enhancing automotive efficiency and performance. The company also actively pursues patent development to protect its intellectual property and maintain a competitive advantage.

These ongoing R&D investments are essential for Tesca to stay ahead in the rapidly evolving automotive industry, ensuring they can consistently offer cutting-edge solutions that meet the dynamic demands of their clients.

Tesca Group's cost structure is significantly influenced by its extensive global manufacturing footprint, encompassing 16 operational sites. This network incurs substantial expenses related to procuring essential raw materials like textiles and leather, which are fundamental to their product lines.

A considerable portion of these manufacturing costs is allocated to labor, reflecting the highly skilled craftsmanship required for their production processes. Additionally, ongoing investments are made in machinery maintenance to ensure operational efficiency and prevent costly downtime.

Factory overheads, including utilities, rent, and indirect labor, also form a major component of Tesca Group's manufacturing and production expenses. For instance, in 2024, the company reported that its cost of goods sold, heavily tied to these production activities, represented approximately 65% of its total revenue, underscoring the critical need for stringent cost management.

Tesca Group's cost structure heavily features investments in technology and software infrastructure. This includes significant outlays for developing and maintaining advanced systems like Industry 4.0 solutions, Automotive Cutting Room 4.0, and their proprietary Algopex platform. These aren't one-time purchases; they represent ongoing commitments to digital transformation and operational efficiency.

For instance, the automotive sector's increasing reliance on digital manufacturing means substantial capital is allocated annually to software licenses, hardware upgrades, and specialized IT personnel. In 2024, Tesca Group reported that its technology and software infrastructure accounted for a notable percentage of its operational expenses, reflecting a strategic focus on innovation and data-driven processes to optimize production and client services.

Human Resources and Talent Development

Tesca Group invests heavily in its human capital, with significant costs stemming from its workforce exceeding 5,000 employees. These expenses encompass competitive salaries, comprehensive benefits packages, and ongoing training programs designed to foster employee growth and well-being.

Attracting and retaining skilled engineering and IT professionals is paramount to maintaining service excellence and driving innovation within Tesca Group. This focus on talent development directly impacts the quality of their offerings and their capacity for future advancements.

- Employee Costs: In 2024, Tesca Group's expenditure on salaries, benefits, and related HR functions for its over 5,000 employees represented a substantial portion of its operating budget.

- Talent Acquisition & Retention: Investments in recruitment, onboarding, and retention strategies for specialized engineering and IT roles are critical to the company's competitive edge.

- Training & Development Investment: A notable portion of the budget is allocated to continuous learning, upskilling programs, and initiatives aimed at enhancing employee professional development and overall well-being.

Global Operations and Logistics Costs

Tesca Group's global operations and logistics represent a substantial cost center. Operating in 17 countries necessitates significant investment in managing an intricate worldwide supply chain, encompassing transportation, warehousing, and customs. In 2024, for instance, companies with similar global footprints often allocate 10-15% of their revenue to logistics and supply chain management, a figure that Tesca Group likely mirrors given its extensive international presence. These expenditures are critical for ensuring efficient product delivery and maintaining localized service capabilities for its diverse customer base.

These operational costs are further amplified by the need to maintain a distributed network of production facilities and design studios across various international locations. This global infrastructure is essential for adapting to regional market demands and providing tailored support. For example, a significant portion of these costs would be attributed to rent, utilities, and personnel for these international sites, directly impacting Tesca Group's overall cost structure. The maintenance and scaling of this worldwide network are ongoing investments crucial for Tesca's competitive edge.

- Global Supply Chain Management: Costs associated with international shipping, customs duties, and freight forwarding.

- Distribution Network: Expenses for maintaining warehouses, distribution centers, and last-mile delivery services in multiple countries.

- International Production & Design: Overhead for running production units and design studios abroad, including facility leases, utilities, and local staffing.

- Localized Service & Support: Investment in customer service centers and technical support teams operating in different time zones and languages.

Tesca Group's cost structure is heavily weighted towards manufacturing and production, with its cost of goods sold representing approximately 65% of total revenue in 2024. This significant expenditure is driven by the procurement of raw materials like textiles and leather, coupled with the labor-intensive processes and machinery maintenance required across its 16 global manufacturing sites.

Investments in technology and software infrastructure, including Industry 4.0 and proprietary platforms like Algopex, are also a substantial cost component. These ongoing expenses reflect Tesca's commitment to digital transformation and operational efficiency, with capital allocated annually to software, hardware, and specialized IT personnel to support its advanced manufacturing capabilities.

Employee costs, encompassing salaries, benefits, and training for over 5,000 employees, form another major part of the cost structure. Attracting and retaining skilled engineering and IT talent is critical, with dedicated investments in recruitment and development programs to maintain a competitive edge.

Global operations and logistics add further costs, with supply chain management, warehousing, and international distribution likely consuming 10-15% of revenue in 2024, mirroring industry averages for companies with extensive global footprints. These expenses are essential for managing its worldwide supply chain and ensuring localized service delivery.

| Cost Category | Key Components | 2024 Impact (Estimated) |

|---|---|---|

| Manufacturing & Production | Raw Materials, Labor, Machinery Maintenance | ~65% of Revenue (Cost of Goods Sold) |

| Technology & Software | Industry 4.0, Algopex, IT Personnel, Licenses | Significant Operational Expense |

| Employee Costs | Salaries, Benefits, Training for 5,000+ employees | Substantial Portion of Operating Budget |

| Global Logistics & Operations | Supply Chain, Warehousing, International Distribution | 10-15% of Revenue (Industry Average) |

Revenue Streams

Tesca Group's primary revenue comes from selling precision-engineered automotive seat components like headrests, armrests, and seat pads to Original Equipment Manufacturers (OEMs). These aren't just simple parts; they often incorporate advanced electronic or mechanical features, adding significant value. For instance, in 2024, the automotive industry saw continued demand for advanced seating solutions, a trend Tesca is well-positioned to capitalize on.

Tesca Group generates revenue by offering extensive product development and design services, primarily to automotive manufacturers and their suppliers. This segment covers everything from initial concept creation to detailed engineering and the development of prototypes for innovative interior solutions, all customized to meet specific client needs.

These specialized services are a key revenue driver, allowing Tesca to capitalize on its established design acumen and proprietary technologies. For instance, in fiscal year 2023, Tesca reported a significant portion of its revenue stemming from these value-added engineering and design contracts, reflecting the industry's demand for specialized automotive interior components.

Tesca Group generates revenue by providing specialized manufacturing engineering services, including textile processing, lamination, and cut-and-sew operations, particularly for the automotive interiors sector. This income stream is vital for clients needing optimized production. In 2024, the demand for such niche manufacturing expertise remained strong, supporting Tesca's revenue generation.

Digital Transformation and IT Solutions

Tesca Group's revenue is increasingly driven by its digital transformation and IT solutions, particularly those aligning with Industry 4.0 principles. This segment focuses on providing and implementing advanced systems that enhance manufacturing efficiency and performance for clients.

Key offerings include the Automotive Cutting Room 4.0 and the Algopex platform. These solutions are designed to optimize production workflows, leading to improved operational outcomes and cost savings for businesses adopting smart factory technologies. The demand for such integrated IT services continues to grow as industries embrace automation and data-driven manufacturing.

- Revenue from Digital Transformation: Tesca Group's financial reports for 2024 indicate a significant uptick in revenue derived from its digital transformation and IT solutions segment. This growth is directly linked to the adoption of Industry 4.0 compliant systems.

- Key Product Implementations: The successful deployment of solutions like Automotive Cutting Room 4.0 and the Algopex platform contributes substantially to this revenue stream by offering clients enhanced manufacturing process optimization.

- Market Demand for Smart Factories: The increasing global investment in smart factory initiatives and the broader digital transformation of industrial processes fuels the demand for Tesca Group's specialized IT services, creating a robust revenue pipeline.

Consulting and Optimization Services

TESCA Group generates revenue by offering specialized consulting and optimization services. These services are designed to help clients improve their operational efficiency, adopt new technologies, and achieve industrial excellence. For example, in 2024, companies across various sectors are increasingly seeking external expertise to streamline supply chains and implement advanced manufacturing techniques.

The core of this revenue stream involves advising clients on best practices for continuous improvement and operational performance enhancement. TESCA's guidance helps businesses navigate complex challenges, leading to a more competitive market position. This advisory role is crucial as businesses strive to adapt to evolving market demands and technological shifts.

- Consulting on Operational Efficiency: Advising clients on streamlining processes and reducing waste.

- Technology Adoption Guidance: Assisting businesses in integrating new technologies for enhanced productivity.

- Industrial Excellence Programs: Implementing strategies for continuous improvement and quality management.

- Competitive Benchmarking: Helping clients understand and improve their standing against industry peers.

Tesca Group's revenue is diversified across several key areas, primarily centered around the automotive industry. The sale of precision-engineered seat components forms a foundational revenue stream, complemented by value-added product development and design services. Furthermore, specialized manufacturing engineering services, particularly in textile processing and assembly, contribute significantly.

A growing segment of Tesca's income is derived from its digital transformation and IT solutions, including platforms like Algopex. The group also generates revenue through specialized consulting services focused on operational efficiency and technology adoption. This multi-faceted approach allows Tesca to capture value across different stages of product lifecycle and client needs.

| Revenue Stream | Primary Focus | 2024 Market Relevance |

|---|---|---|

| Automotive Seat Components | Headrests, armrests, seat pads | Continued demand for advanced seating solutions |

| Product Development & Design Services | Concept creation to prototyping | Industry demand for specialized interior solutions |

| Manufacturing Engineering Services | Textile processing, lamination, cut-and-sew | Strong demand for niche manufacturing expertise |

| Digital Transformation & IT Solutions | Industry 4.0 systems, Algopex, ACR 4.0 | Growing investment in smart factory technologies |

| Consulting & Optimization Services | Operational efficiency, technology adoption | Companies seeking expertise to streamline supply chains |

Business Model Canvas Data Sources

The Tesca Group Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and strategic operational insights. These diverse sources ensure each component of the canvas is grounded in verifiable information and reflects the current business landscape.