Subaru Corporation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Subaru Corporation Bundle

Subaru's unwavering commitment to All-Wheel Drive and its strong reputation for safety are significant strengths, attracting a loyal customer base. However, the company faces challenges in expanding its global market share and adapting to evolving automotive technologies like electrification.

Want the full story behind Subaru's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Subaru's brand reputation is exceptionally strong, consistently recognized for reliability and owner satisfaction. For instance, Subaru topped Consumer Reports' 2025 brand rankings, a testament to their enduring quality.

This commitment to dependability, exemplified by features like the advanced EyeSight driver assist system, fosters deep customer loyalty. Subaru owners often cite the vehicles' long-term performance and trustworthiness as key reasons for repeat purchases, creating a dedicated following.

Subaru's engineering prowess is anchored in its distinctive Boxer engine and Symmetrical All-Wheel Drive (AWD) system, a combination found in nearly all its vehicles. This unique setup delivers exceptional traction and stability, enhancing driving dynamics across diverse environments and weather, a significant differentiator in the automotive market.

This proprietary technology is a major draw for buyers prioritizing vehicle capability and reliability. For instance, Subaru's AWD system, standard on models like the 2024 Outback and Forester, continuously directs power to the wheels with the most grip, improving control on slippery surfaces. This engineering focus has contributed to Subaru's strong brand loyalty, with a reported 71% of Subaru owners trading in another Subaru as of 2023.

Subaru has a very strong foothold in the SUV and crossover market, which is a huge plus. Their models like the Crosstrek, Forester, and Outback are consistently top sellers, showing how well they meet what people are looking for right now in vehicles – versatility and durability.

This strong performance in key markets, especially the United States, is a major driver for Subaru's overall sales numbers and income. For instance, in 2023, Subaru of America reported over 600,000 vehicle sales, with SUVs and crossovers making up the vast majority of that figure, highlighting their market dominance.

Commitment to Safety and Reliability Excellence

Subaru's dedication to safety is a cornerstone of its brand identity, consistently earning accolades such as top safety picks from the Insurance Institute for Highway Safety (IIHS). For instance, in 2024, multiple Subaru models, including the Outback and Forester, achieved the IIHS's highest ratings, underscoring the brand's engineering prowess in occupant protection.

The widespread adoption of advanced safety features like the EyeSight driver assistance system is a key differentiator. This suite of technologies, which includes features like adaptive cruise control and pre-collision braking, actively works to prevent accidents and mitigate their severity, contributing to Subaru's reputation for reliability.

This unwavering commitment to safety cultivates significant consumer trust and loyalty. It reinforces Subaru's image as a manufacturer of secure and dependable vehicles, a crucial factor for buyers, particularly families. This trust translates into strong resale values and a dedicated customer base.

Key safety achievements include:

- Consistent IIHS Top Safety Pick+ awards across multiple models.

- Advanced EyeSight driver assistance technology as standard or widely available.

- High occupant protection scores in crash tests, reflecting robust structural integrity.

Efficient Manufacturing and Supply Chain Adaptability

Subaru has been actively enhancing its manufacturing efficiency, focusing on optimizing production lines to maximize output while minimizing resource utilization. This drive for efficiency is crucial in a competitive automotive market.

A key strategic move to bolster supply chain resilience and responsiveness was the decision to shift production of popular models like the Forester and Crosstrek to Subaru's U.S. facility. This localization aims to shorten delivery times and reduce vulnerability to global supply disruptions.

This manufacturing adaptability is a significant strength, allowing Subaru to better align production with fluctuating market demands and navigate external economic or logistical challenges. For instance, by producing more vehicles domestically, Subaru can potentially reduce shipping costs and lead times, which were exacerbated by global shipping issues in 2022-2023, impacting delivery schedules for many automakers.

- Manufacturing Efficiency: Subaru's focus on optimizing production processes is key to cost control and output maximization.

- Supply Chain Localization: Shifting Forester and Crosstrek production to the U.S. plant directly addresses lead time reduction and risk mitigation.

- Market Responsiveness: The adaptable production model enables quicker reactions to shifts in consumer demand and supply chain volatility.

Subaru's robust engineering, particularly its standard Symmetrical All-Wheel Drive and Boxer engine, provides a distinct competitive advantage. This unique powertrain configuration, present in nearly all its models, offers superior traction and handling, appealing to consumers who value capability and performance in various driving conditions.

This engineering focus translates into strong brand loyalty, with a significant portion of Subaru owners trading in their existing Subaru vehicles. For example, data from 2023 indicated that around 71% of Subaru owners were repeat buyers, highlighting the enduring appeal of their core technologies.

Subaru's commitment to safety is a significant strength, consistently earning high marks from organizations like the Insurance Institute for Highway Safety (IIHS). In 2024, multiple Subaru models, including the Outback and Forester, received top safety ratings, reinforcing the brand's reputation for building secure vehicles.

The widespread integration of advanced driver-assistance systems, such as Subaru's EyeSight technology, further enhances this safety-focused image. These systems contribute to accident prevention and occupant protection, fostering consumer trust and driving repeat purchases.

Subaru commands a strong market position in the highly sought-after SUV and crossover segments. Models like the Crosstrek, Forester, and Outback are perennial best-sellers, demonstrating Subaru's ability to meet current consumer preferences for versatile and durable vehicles.

This market penetration is particularly evident in the United States, where Subaru of America reported over 600,000 vehicle sales in 2023, with SUVs and crossovers forming the bulk of these sales, underscoring their dominance in these key categories.

Subaru is actively improving its manufacturing efficiency and supply chain resilience. By shifting production of key models like the Forester and Crosstrek to its U.S. facility, the company aims to reduce lead times and mitigate risks associated with global supply chain disruptions.

This strategic localization enhances Subaru's ability to respond to market demand and navigate logistical challenges, a crucial advantage in the dynamic automotive industry. For instance, domestic production can help offset the increased shipping costs and delays experienced globally in recent years.

| Strength | Description | Supporting Data/Examples |

|---|---|---|

| Engineering Prowess | Standard Symmetrical AWD and Boxer Engine | Present in nearly all models; enhances traction and handling. 71% of Subaru owners were repeat buyers in 2023. |

| Safety Reputation | Advanced Safety Features and Accolades | Consistent IIHS Top Safety Pick+ awards (2024 models); widespread availability of EyeSight technology. |

| Market Position | Dominance in SUV/Crossover Segments | Crosstrek, Forester, Outback are top sellers; Subaru of America sold over 600,000 vehicles in 2023, largely SUVs/crossovers. |

| Manufacturing Efficiency | Supply Chain Localization and Production Optimization | Shift of Forester/Crosstrek production to U.S. plant to reduce lead times and supply chain risks. |

What is included in the product

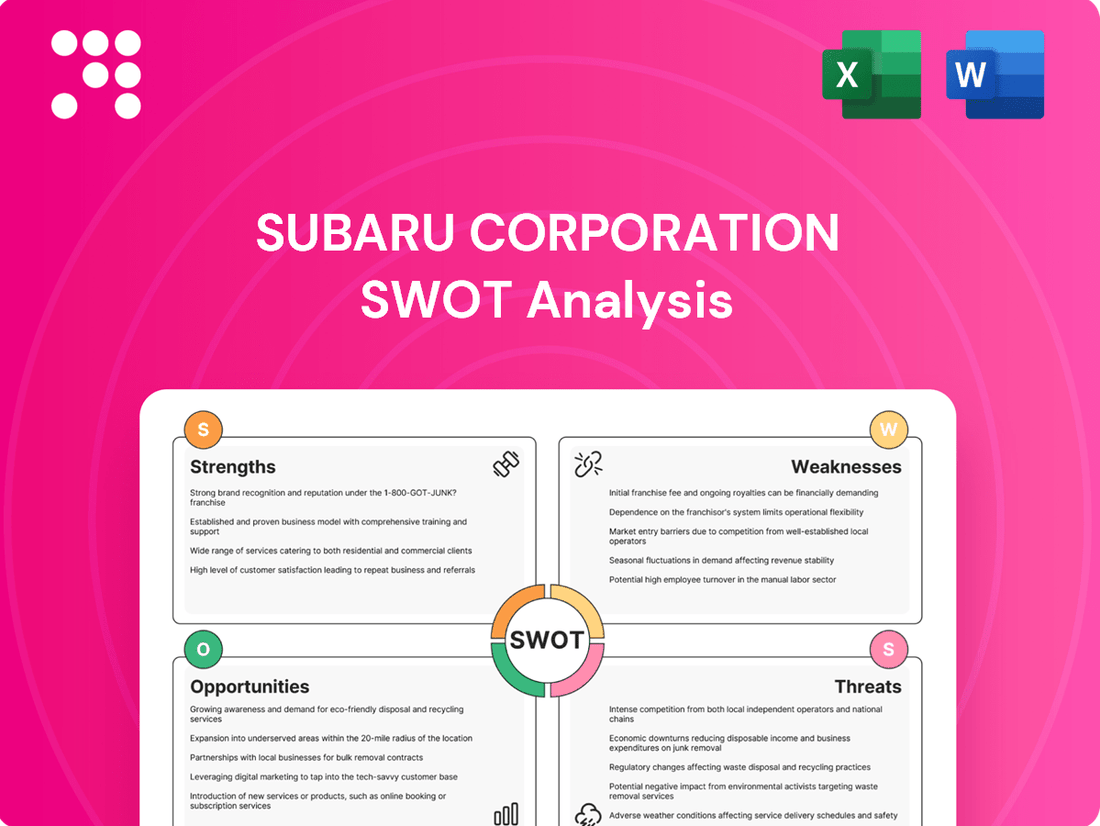

This SWOT analysis highlights Subaru Corporation's strong brand loyalty and all-wheel-drive expertise as key strengths, while also identifying potential weaknesses in production capacity and reliance on specific markets. It explores opportunities in expanding into new vehicle segments and leveraging technological advancements, alongside threats from increasing competition and evolving environmental regulations.

Offers a clear roadmap to navigate Subaru's competitive landscape, addressing challenges like supply chain disruptions and EV transition. This analysis provides actionable insights for strategic decision-making, alleviating the pain of uncertainty.

Weaknesses

Subaru's significant reliance on the U.S. market, which accounts for roughly 85% of its global business, presents a notable weakness. This heavy concentration makes the company particularly vulnerable to economic downturns, shifts in consumer preferences, or regulatory changes within the United States. For instance, a slowdown in U.S. auto sales, as seen during certain periods in 2023 due to inflation and interest rate concerns, directly impacts Subaru's revenue more than a more geographically diversified automaker.

Subaru's electric vehicle (EV) strategy is notably more measured than many rivals, with the company currently reassessing its approach. While new EV and hybrid models are planned, the timing and scale of investment are being adjusted in response to evolving market conditions and a slowdown in EV adoption. This cautious stance, though potentially prudent given market volatility, risks Subaru falling behind in market share as the automotive industry rapidly shifts towards electrification.

Subaru Corporation faced a notable dip in its operational scale during the fiscal year ending March 2025. Global production saw a reduction of 2.4%, while consolidated unit sales experienced a more significant decline of 4.1%.

Despite pockets of strength, such as positive U.S. retail sales in certain quarters, the company's overall overseas consolidated sales contracted. This downturn was attributed to necessary production adjustments and the intensifying competitive landscape in key international markets.

This persistent decrease in both production and sales volume signals a core weakness for Subaru, highlighting difficulties in expanding or even maintaining its market presence against prevailing industry challenges and strategic headwinds.

Increased Sales Incentives and Profitability Pressure

Subaru faces a significant challenge from increased sales incentives in competitive overseas markets. These incentives, even with the benefit of favorable exchange rates and price adjustments, have put a strain on their financial performance, impacting both overall revenue and operating profit. For the fiscal year ending March 2025, the company reported a notable decline in operating profit, down 13.4%.

This situation suggests a potential reliance on discounts to sustain sales volumes, a strategy that can directly compress profit margins. The pressure to maintain market share in regions like North America, a key market for Subaru, often necessitates such promotional activities. This can create a difficult balancing act between achieving sales targets and preserving profitability.

- Increased Sales Incentives: Competitive pressures in overseas markets are forcing Subaru to offer higher incentives.

- Profitability Erosion: Despite favorable exchange rates and price revisions, these incentives have negatively impacted operating profit.

- FYE 2025 Performance: Operating profit saw a decline of 13.4% for the fiscal year ending March 2025.

- Margin Pressure: The strategy may indicate a need to use discounts to maintain sales volume, potentially hurting profit margins.

Limited Product Diversification Beyond Core SUVs/Crossovers

Subaru's strength in SUVs and crossovers is undeniable, but this specialization also presents a weakness. The company has a less significant footprint in other expanding automotive sectors, like the luxury market. Furthermore, Subaru has made decisions to discontinue certain sedan lines, such as the Legacy, which narrows its product appeal.

This limited product diversification could hinder Subaru's ability to capture a wider customer base and expand its market reach. An over-dependence on a few highly successful models, like the Outback and Forester, might leave the company exposed if consumer tastes or market demands shift unexpectedly. For instance, while Subaru's sales in 2023 remained robust, with a 5.7% increase year-over-year to 632,344 vehicles sold in the U.S., the majority of these sales were driven by their SUV and crossover lineup.

- Narrow Market Appeal: Limited presence in non-SUV segments like luxury vehicles restricts customer acquisition.

- Discontinuation of Sedans: Phasing out models like the Legacy reduces product variety.

- Vulnerability to Market Shifts: Over-reliance on popular SUV models poses a risk if consumer preferences change.

Subaru's heavy reliance on the U.S. market, accounting for approximately 85% of its global business, leaves it vulnerable to domestic economic fluctuations and shifting consumer preferences. This concentration was evident as U.S. auto sales faced headwinds in 2023 due to inflation and interest rates, directly impacting Subaru's performance more than diversified competitors. The company's cautious approach to electric vehicles (EVs) also poses a risk, as a slower-than-anticipated rollout could cause it to lose ground in the rapidly electrifying automotive industry. For the fiscal year ending March 2025, Subaru experienced a 2.4% decrease in global production and a 4.1% drop in consolidated unit sales, signaling challenges in maintaining market presence amidst industry shifts.

Increased sales incentives in competitive overseas markets have strained Subaru's financial performance, contributing to a 13.4% decline in operating profit for the fiscal year ending March 2025. This strategy, even with favorable exchange rates, suggests a potential pressure to use discounts to sustain sales volumes, which can erode profit margins. Furthermore, Subaru's product lineup, while strong in SUVs and crossovers, lacks diversification into other growing segments like luxury vehicles. The discontinuation of sedan models, such as the Legacy, further narrows its appeal and increases its dependence on a few key models, making it susceptible to shifts in consumer tastes.

| Weakness Category | Specific Issue | Impact/Data |

| Market Concentration | Heavy reliance on U.S. market (approx. 85% of global business) | Vulnerability to U.S. economic downturns and policy changes. |

| EV Strategy | Measured and reassessed EV/hybrid approach | Risk of falling behind competitors in market share as electrification accelerates. |

| Sales & Production | Declining volumes | Global production down 2.4%, consolidated unit sales down 4.1% (FYE March 2025). |

| Profitability | Increased sales incentives | Operating profit down 13.4% (FYE March 2025) due to competitive pressures and promotional activities. |

| Product Diversification | Limited presence outside SUVs/crossovers; discontinuation of sedans (e.g., Legacy) | Narrower customer base appeal and increased dependence on popular SUV models. |

Preview Before You Purchase

Subaru Corporation SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file. This comprehensive report delves into Subaru Corporation's Strengths, Weaknesses, Opportunities, and Threats. The complete version, offering detailed insights and actionable strategies, becomes available after checkout.

Opportunities

Subaru has a prime opportunity to bolster its hybrid and battery electric vehicle (BEV) lineup. The upcoming releases of a hybrid Forester and the Trailseeker EV are key steps, further supported by their ongoing EV development partnership with Toyota. This strategic expansion into electrified models is crucial for capturing environmentally aware consumers and staying ahead of stringent emissions standards and the growing market demand for sustainable transportation solutions.

Subaru has a significant opportunity to boost its U.S. production capacity utilization at its Indiana plant. This move can directly address potential U.S. tariffs and ongoing supply chain disruptions, offering a more stable operational environment.

By increasing production locally, Subaru can effectively lower import-related costs and potentially shorten delivery lead times for its most popular models in the crucial North American market. For instance, the Indiana plant has demonstrated flexibility in scaling operations to meet demand.

This strategic localization enhances overall operational efficiency and builds greater resilience against unpredictable shifts in global trade policies. This proactive approach ensures Subaru can better navigate market volatilities.

Subaru's consistent top rankings in reliability and safety, as recognized by Consumer Reports, alongside exceptional brand loyalty, create a significant opportunity to implement premium pricing strategies. This strong reputation allows Subaru to command higher prices compared to competitors, directly translating into improved profitability per vehicle.

The company has already demonstrated its capacity to leverage this brand strength through successful price increases, indicating a market acceptance of their value proposition. This ability to maintain strong residual values further bolsters their premium pricing power, ensuring customers perceive lasting worth in their vehicles.

Technological Advancements in Driver Assistance and Connected Cars

Subaru can leverage its established leadership in advanced driver-assistance systems (ADAS), such as its EyeSight technology, to further enhance its competitive edge. The company has a strong foundation in safety, a key differentiator for many consumers. By continuing to invest in and refine these systems, Subaru can attract a growing segment of the market that prioritizes cutting-edge safety and convenience features.

Expanding into connected car technologies presents another significant opportunity. This includes integrating advanced infotainment, over-the-air updates, and vehicle-to-everything (V2X) communication capabilities. For instance, by fiscal year ending March 2025, Subaru aims to equip more vehicles with its latest infotainment systems, responding to consumer demand for seamless digital integration. This move will not only appeal to tech-savvy buyers but also create new revenue streams through subscription services.

Strategic partnerships are crucial for staying ahead in automotive innovation. Collaborations focused on developing artificial intelligence (AI) for autonomous driving and securing advanced chip integration will be vital. For example, in 2024, Subaru announced a deepened collaboration with a leading AI technology provider to accelerate the development of its next-generation ADAS. These alliances can help Subaru maintain its position at the forefront of automotive technology, ensuring its vehicles remain competitive and desirable.

- ADAS Leadership: Subaru's EyeSight system, a benchmark in driver assistance, offers a strong platform for further development and market penetration.

- Connected Car Expansion: Integrating advanced infotainment and V2X capabilities can enhance user experience and open new service opportunities.

- AI and Chip Partnerships: Collaborations with tech firms in 2024-2025 are key to advancing autonomous driving features and ensuring access to critical semiconductor technology.

Growth in Aerospace and Industrial Divisions

Subaru Corporation's aerospace division offers a significant avenue for expansion beyond its automotive core. This sector, which includes manufacturing aircraft components and fulfilling helicopter contracts, provides a crucial opportunity for diversification. By actively pursuing new contracts and broadening its footprint in aerospace, Subaru can establish alternative revenue streams, thereby lessening its dependence on the automotive market.

This strategic diversification into aerospace is poised to bolster Subaru's overall corporate stability and enhance its profitability. For instance, in fiscal year 2023, Subaru's aerospace segment reported sales of ¥114.3 billion, demonstrating its established presence and potential for further growth. The company's involvement in projects like the Bell 412 helicopter and components for various aircraft highlights its capabilities and market position.

- Diversification: Reduces reliance on the automotive sector by tapping into the aerospace market.

- Revenue Growth: Securing new contracts in aerospace can create significant alternative income.

- Market Expansion: Broadening presence in aircraft components and helicopter services offers new opportunities.

- Corporate Stability: A stronger aerospace segment contributes to overall financial resilience.

Subaru has a prime opportunity to bolster its hybrid and battery electric vehicle (BEV) lineup. The upcoming releases of a hybrid Forester and the Trailseeker EV are key steps, further supported by their ongoing EV development partnership with Toyota. This strategic expansion into electrified models is crucial for capturing environmentally aware consumers and staying ahead of stringent emissions standards and the growing market demand for sustainable transportation solutions.

Subaru's consistent top rankings in reliability and safety, as recognized by Consumer Reports, alongside exceptional brand loyalty, create a significant opportunity to implement premium pricing strategies. This strong reputation allows Subaru to command higher prices compared to competitors, directly translating into improved profitability per vehicle. The company has already demonstrated its capacity to leverage this brand strength through successful price increases, indicating a market acceptance of their value proposition.

Subaru can leverage its established leadership in advanced driver-assistance systems (ADAS), such as its EyeSight technology, to further enhance its competitive edge. The company has a strong foundation in safety, a key differentiator for many consumers. By continuing to invest in and refine these systems, Subaru can attract a growing segment of the market that prioritizes cutting-edge safety and convenience features.

Subaru Corporation's aerospace division offers a significant avenue for expansion beyond its automotive core. This sector, which includes manufacturing aircraft components and fulfilling helicopter contracts, provides a crucial opportunity for diversification. By actively pursuing new contracts and broadening its footprint in aerospace, Subaru can establish alternative revenue streams, thereby lessening its dependence on the automotive market.

Threats

Subaru faces formidable competition in the global automotive sector, contending with established giants like Toyota and Honda, as well as emerging threats from Chinese brands rapidly expanding their electric and hybrid vehicle offerings. This intensified rivalry pressures Subaru's market share and necessitates ongoing investment in research and development to maintain a competitive edge.

The influx of budget-friendly manufacturers further complicates Subaru's strategic landscape, potentially eroding its appeal among price-sensitive consumers. For instance, in the first quarter of 2024, Chinese EV manufacturers like BYD saw significant global sales growth, impacting market dynamics across various segments.

The specter of potential U.S. import tariffs presents a substantial financial risk for Subaru Corporation. With approximately half of its U.S.-bound vehicles originating from Japan, these tariffs could translate to an estimated $2.5 billion impact in fiscal year 2026, directly affecting profitability.

Furthermore, the ongoing uncertainty surrounding U.S. trade policies, including the fluctuating landscape of electric vehicle tax credits, creates a challenging environment for Subaru's long-term strategic planning. This unpredictability complicates decisions regarding investment in production facilities and the development of future vehicle lineups, potentially leading to increased operational costs and a dampening of revenue streams.

Subaru, like other automakers, faces significant threats from escalating raw material costs. For instance, the price of steel, a key component, saw considerable volatility in 2023 and early 2024, directly impacting production expenses. These rising costs can force price adjustments, potentially affecting consumer demand for Subaru vehicles.

Global supply chain disruptions remain a persistent challenge. Shortages of critical components, such as semiconductors, continued to affect automotive production throughout 2023 and into 2024. Such disruptions can lead to reduced output and extended delivery times for Subaru, impacting sales volume and market share.

Slowing EV Adoption Rates and Market Volatility

While the long-term trend favors electric vehicles, a noticeable slowdown in global EV adoption rates and ongoing market volatility presents a significant challenge for Subaru's electrification plans. This uncertainty is causing the company to reassess the timing of its investments and its dedicated EV production schedules.

The fluctuating demand for EVs directly impacts the sales potential of Subaru's upcoming electric models, potentially delaying the expected return on its substantial investments in EV technology and manufacturing. For instance, in 2023, global EV sales growth, while still positive, moderated compared to previous years, with some markets experiencing slower-than-anticipated uptake, creating a less predictable sales environment.

- Slower EV Growth: Global EV sales growth rates have shown signs of deceleration in key markets during 2023-2024, impacting initial sales projections for new electric models.

- Investment Uncertainty: Volatility in consumer demand and charging infrastructure development creates risk for Subaru's planned capital expenditures on dedicated EV platforms and battery production.

- Profitability Concerns: Lower-than-expected EV sales volumes could strain the profitability of Subaru's new electric vehicles, potentially affecting the company's overall financial performance and its ability to recoup R&D costs.

Impact of Changing Consumer Preferences and Economic Conditions

Subaru faces a significant threat from evolving consumer tastes, particularly the ongoing shift from traditional sedans to SUVs and crossovers. This trend has already prompted Subaru to discontinue models like the Legacy in key markets, impacting their product portfolio and sales strategy. For instance, in North America, the Legacy's sales have been on a downward trajectory, making its discontinuation a strategic response to market demand.

Broader economic conditions also pose a substantial risk. Rising fuel costs, for example, can directly dampen demand for vehicles, especially for brands that have historically relied on a loyal customer base for larger, less fuel-efficient models. Furthermore, economic downturns and shifts in consumer spending habits can lead to reduced sales volumes across the board. This often necessitates increased use of sales incentives and discounts, which can negatively impact Subaru's profitability and financial performance.

- Shifting Consumer Preferences: Continued move towards SUVs/crossovers impacting demand for sedans, leading to model discontinuations.

- Economic Downturns: Reduced consumer spending power can decrease vehicle sales volume.

- Rising Fuel Costs: Potential to deter consumers from purchasing vehicles, impacting demand for certain Subaru models.

- Increased Sales Incentives: Economic pressures may force higher reliance on discounts, eroding profit margins.

Subaru confronts intense competition from established automakers and rapidly growing Chinese EV brands, necessitating continuous R&D investment. The company is also vulnerable to potential U.S. import tariffs, which could significantly impact its profitability, with an estimated $2.5 billion effect projected for fiscal year 2026 on vehicles shipped from Japan.

Persistent global supply chain disruptions, particularly semiconductor shortages that continued into early 2024, limit production output and extend delivery times. Furthermore, a slowdown in global EV adoption rates and market volatility creates uncertainty for Subaru's electrification strategy and the profitability of its new electric models, as evidenced by moderated EV sales growth in 2023 compared to prior years.

| Threat Category | Specific Threat | Impact/Data Point |

|---|---|---|

| Competition | Intensified rivalry from established brands and emerging Chinese EV manufacturers | Pressures market share; requires ongoing R&D investment. |

| Trade Policy | Potential U.S. import tariffs | Estimated $2.5 billion impact in FY2026 on Japan-sourced vehicles. |

| Supply Chain | Semiconductor shortages and component availability | Continued disruption into early 2024, affecting production and delivery. |

| EV Market | Slower EV adoption and market volatility | Moderated global EV sales growth in 2023; impacts EV model profitability. |

SWOT Analysis Data Sources

This Subaru Corporation SWOT analysis is built upon a robust foundation of publicly available financial statements, comprehensive market research reports, and expert automotive industry analyses to ensure a thorough and accurate assessment.