Subaru Corporation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Subaru Corporation Bundle

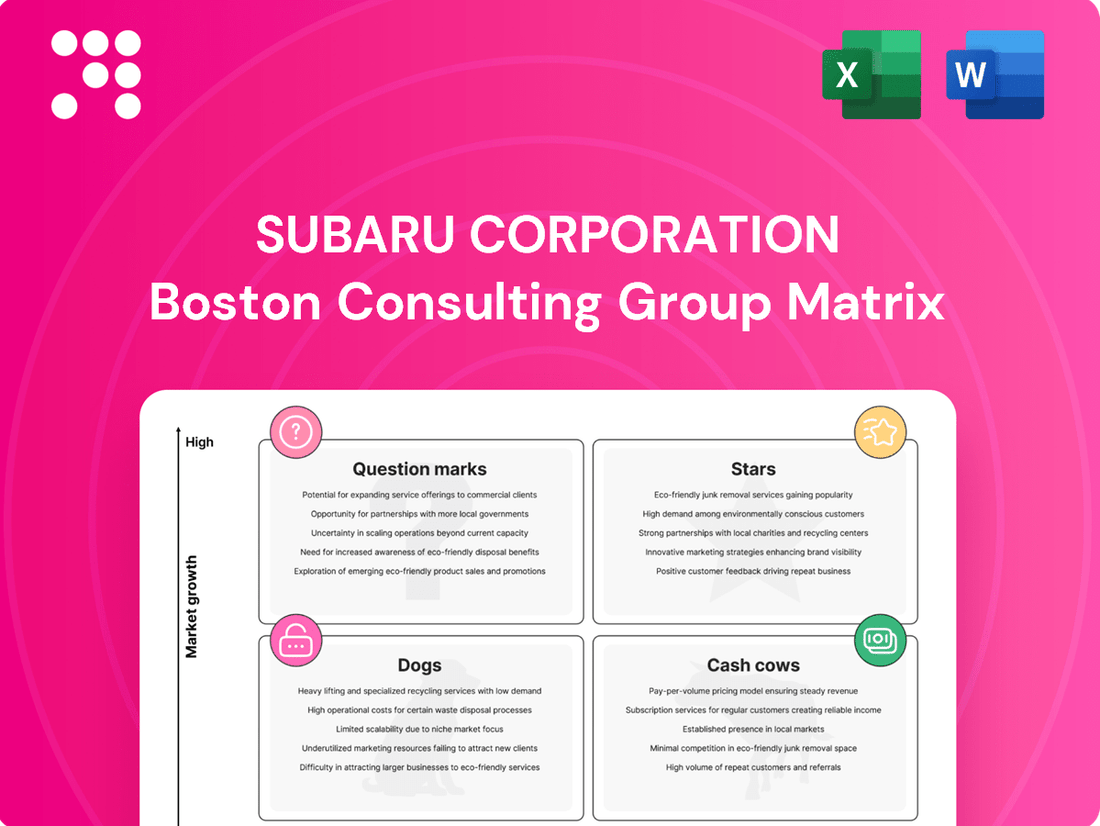

Curious about Subaru Corporation's product portfolio performance? Our BCG Matrix analysis reveals which vehicles are driving growth, which are generating steady profits, and which may require a strategic rethink. Don't miss out on the full picture; purchase the complete report for a detailed breakdown of their Stars, Cash Cows, Dogs, and Question Marks.

This preview offers a glimpse, but the full BCG Matrix report unlocks actionable insights into Subaru's market position. Discover precise quadrant placements and data-driven recommendations to optimize your investment and product strategies. Get the full report now and transform your understanding of Subaru's competitive landscape.

Stars

The Subaru Crosstrek is a clear star in Subaru Corporation's portfolio. In 2024, it not only maintained its status as Subaru's best-selling model but also demonstrated robust sales growth, significantly outpacing other vehicles in the lineup. This success is driven by its practical design, standard all-wheel drive, and ongoing updates that keep it highly relevant in the competitive compact SUV market.

The new generation Subaru Forester, especially with the anticipated 2025 hybrid variant, is positioned as a potential star in Subaru Corporation's lineup. Despite a temporary dip in sales during the late 2024 model transition, the Forester's strong historical performance and strategic redesign, including the hybrid option, are expected to drive renewed growth in the competitive compact SUV segment.

Subaru's Symmetrical All-Wheel Drive (AWD) system is a significant strength, underpinning its strong market position in the AWD vehicle segment. This technology is a primary reason for the popularity of Subaru's SUV lineup, appealing to consumers prioritizing safety and traction across various driving environments.

The consistent integration of Symmetrical AWD across Subaru's successful models reinforces its status as a high-market-share feature in a consistently sought-after vehicle attribute. For example, in 2023, Subaru reported that approximately 96% of its U.S. sales were equipped with Symmetrical AWD, highlighting its dominance within the brand's offerings and its appeal to a broad customer base.

Subaru's Commitment to Safety and Reliability

Subaru's dedication to safety is a cornerstone of its brand, directly impacting its market position. The company's EyeSight Driver Assist Technology consistently earns high marks, with the Insurance Institute for Highway Safety (IIHS) frequently awarding Subaru models with its top safety picks. This unwavering commitment to driver and passenger protection fosters strong customer loyalty, particularly within the family demographic, solidifying Subaru's presence in a competitive automotive landscape.

This focus on safety translates into a powerful value proposition, attracting consumers who prioritize secure transportation. For instance, in 2024, Subaru continued to see strong demand for models equipped with EyeSight, contributing to its overall market share. The brand's reputation for reliability further enhances this appeal, making it a preferred choice for buyers seeking long-term dependability and peace of mind.

- Safety Ratings: Subaru models frequently achieve top safety ratings from organizations like the IIHS.

- EyeSight Technology: This advanced driver-assist system is a key differentiator for Subaru.

- Customer Loyalty: The emphasis on safety and reliability cultivates a dedicated customer base.

- Market Appeal: Subaru's safety focus resonates strongly with family-oriented buyers.

Subaru Wilderness Sub-Brand

The Subaru Wilderness sub-brand is a prime example of a Star in the BCG Matrix for Subaru Corporation. Its expansion into models like the Crosstrek and Outback taps into a high-growth market for adventure-ready vehicles.

This strategic move allows Subaru to solidify its position in the lucrative outdoor lifestyle segment, attracting consumers specifically seeking enhanced off-road capabilities. The Wilderness trims leverage Subaru's core All-Wheel Drive strength, differentiating them in a competitive landscape.

- Market Share Growth: The Wilderness trims are designed to capture a larger share of the growing adventure vehicle market.

- Brand Differentiation: Subaru's AWD expertise is amplified, creating distinct offerings within popular model lines.

- Revenue Potential: These specialized trims often command higher price points, contributing to increased revenue.

- Consumer Demand: The sub-brand directly addresses the rising consumer interest in outdoor activities and capable SUVs.

The Subaru Crosstrek continues its reign as a Star, consistently leading Subaru's sales charts. In 2024, its strong performance, driven by its practical appeal and standard AWD, solidified its position as a high-growth, high-market-share product for Subaru Corporation.

The Subaru Forester, with its upcoming 2025 hybrid variant, is poised to reclaim its Star status. Despite a temporary sales lull during the model transition in late 2024, its historical success and strategic enhancements are expected to drive significant growth in the competitive compact SUV segment.

The Subaru Wilderness sub-brand exemplifies a Star product. By extending this adventure-focused branding to popular models like the Crosstrek and Outback, Subaru is effectively capturing a growing market segment, boosting revenue and brand differentiation.

| Model | BCG Category | 2024 Sales Trend | Market Position | Key Growth Driver |

| Crosstrek | Star | Strong Growth | Best-selling Model | Practicality, Standard AWD |

| Forester | Potential Star | Transitioning (Anticipated Growth) | Strong Historical Performance | New Hybrid Variant, Redesign |

| Wilderness Sub-brand | Star | Expanding Market Share | Adventure Vehicle Segment Leader | Targeted Consumer Demand, AWD Expertise |

What is included in the product

The Subaru Corporation BCG Matrix analyzes its product portfolio to identify Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

A clear BCG Matrix visualizes Subaru's business units, relieving the pain of strategic uncertainty by highlighting areas needing investment or divestment.

Cash Cows

The Subaru Outback is a quintessential Cash Cow for Subaru Corporation. It consistently holds a significant market share within the mature mid-size SUV and wagon segment, demonstrating its enduring appeal and reliability. This model is a powerhouse for generating stable cash flow, requiring less aggressive promotional spending due to its well-established brand loyalty and proven utility.

In 2024, the Subaru Outback continued its strong sales performance, contributing significantly to Subaru's overall revenue. While specific profit figures are proprietary, its consistent demand and lower marketing costs compared to newer or less established models allow it to generate substantial, predictable profits that fund other business ventures. Its established reputation for durability and all-wheel-drive capability ensures a dependable revenue stream.

Subaru's Boxer engine technology represents a significant Cash Cow for Subaru Corporation. This unique horizontally opposed engine design is a core differentiator, powering the vast majority of their popular models and commanding a substantial portion of their vehicle sales.

The Boxer engine's established reputation for performance and reliability means it requires minimal new investment for ongoing development, allowing it to generate consistent profits. In 2023, Subaru reported global sales of approximately 870,000 vehicles, with the Boxer engine being a key factor in the appeal of models like the Outback and Forester, which continue to be strong performers in their respective segments.

Subaru's aftermarket parts and servicing division is a classic cash cow, fueled by a massive and loyal customer base. The company's popular models, like the Forester and Outback, have a significant presence on roads worldwide, creating a steady demand for replacement parts and routine maintenance. This segment benefits from the predictable nature of vehicle ownership, where regular servicing is a necessity.

In 2024, Subaru continued to leverage its extensive installed base, which represents a substantial opportunity for high-margin revenue. The aftermarket segment typically requires less investment in innovation compared to new vehicle development, allowing it to efficiently generate cash. This stability is crucial for funding other areas of the business.

Subaru's Core Dealership Network

Subaru's core dealership network, particularly strong in North America, acts as a significant cash cow for the corporation. This established network consistently generates stable revenue through vehicle sales and vital after-sales services, fostering strong customer loyalty.

The maturity of this network means it requires less capital for aggressive expansion, allowing it to efficiently generate consistent cash flow. In 2024, Subaru's US sales, a key indicator for this network's performance, remained robust, with the brand reporting over 600,000 units sold year-to-date, demonstrating the ongoing strength of its dealership operations.

- Stable Revenue Generation: Dealerships provide consistent income from new and used car sales, alongside lucrative service and parts departments.

- Customer Loyalty: Subaru's brand reputation and dealer service foster repeat business and referrals, reducing customer acquisition costs.

- Mature Market Presence: The established network in key markets like North America requires minimal new investment for growth, maximizing cash generation.

- Operational Efficiency: Experienced dealership management and optimized supply chains contribute to profitability and cash flow.

Existing Production Facilities (e.g., SIA)

Subaru's existing production facilities, exemplified by the Subaru of Indiana Automotive (SIA) plant, are key cash cows. These plants, including SIA which manufactures popular models like the Outback and Crosstrek, are in a mature stage of their lifecycle but operate with high efficiency. They consistently generate substantial vehicles for sale, contributing significantly to Subaru Corporation's operational cash flow through their well-amortized investments and high utilization rates.

The SIA plant, for instance, is a crucial asset. In 2023, Subaru reported a global production volume of approximately 912,000 vehicles, with a significant portion originating from its North American facilities like SIA. This high-volume output from established plants signifies their role as reliable cash generators for the company.

- High Utilization: Subaru's existing plants, like SIA, maintain high operational capacity, maximizing output from existing infrastructure.

- Amortized Investments: The capital expenditures for these facilities are largely depreciated, leading to lower ongoing fixed costs and higher profitability.

- Consistent Cash Flow: These mature facilities produce high-demand models, ensuring a steady stream of revenue and contributing to the company's cash reserves.

- Operational Efficiency: Well-established processes and experienced workforces at these plants contribute to efficient production and cost management.

Subaru's existing production facilities, like the Subaru of Indiana Automotive (SIA) plant, are significant cash cows. These plants are mature but highly efficient, consistently generating substantial vehicle sales and contributing significantly to operational cash flow. The SIA plant, a key asset, produced a considerable portion of Subaru's global vehicle output, which was approximately 912,000 units in 2023, underscoring their role as reliable cash generators.

| Facility | Key Models Produced | 2023 Global Production Contribution (Approx.) | Cash Cow Attributes |

|---|---|---|---|

| Subaru of Indiana Automotive (SIA) | Outback, Crosstrek, Ascent | Significant portion of 912,000 global units | High utilization, amortized investments, consistent cash flow, operational efficiency |

Full Transparency, Always

Subaru Corporation BCG Matrix

The Subaru Corporation BCG Matrix preview you see is the identical, fully formatted report you will receive upon purchase, ensuring no surprises and immediate usability. This comprehensive analysis, ready for strategic application, is designed to provide clear insights into Subaru's product portfolio without any watermarks or demo content. You can confidently use this preview as a direct representation of the professional-grade document that will be instantly downloadable after your transaction.

Dogs

The Subaru Legacy sedan, a product firmly categorized as a 'dog' in the BCG matrix, faces a challenging future. Its market share within the declining sedan segment has diminished, with sales experiencing notable downturns. For instance, in 2023, Subaru's overall sales saw an increase, but the Legacy's contribution was not a growth driver, reflecting the broader trend of decreasing demand for sedans.

Subaru Corporation has officially announced that the Legacy will be discontinued after the 2025 model year. This strategic decision signals a clear exit from this particular product line, aligning with the 'dog' classification where continued investment is minimized. The company is shifting resources towards more promising segments, such as SUVs, where it holds stronger market positions and sees greater growth potential.

The Subaru WRX, a symbol of rally-inspired performance, currently occupies a 'dog' position within Subaru Corporation's portfolio. Its presence is within a specialized, low-expansion market segment for performance vehicles.

Sales figures for the WRX have seen a notable downturn, with declines reported in both 2024 and projections for 2025. This trend suggests the model is facing challenges in maintaining its market footing and sales volume in the current automotive landscape.

Despite its dedicated fan base, the WRX's financial contribution to Subaru's overall earnings is on a downward trajectory. This situation necessitates a strategic approach to resource allocation, as its profitability is diminishing.

The Subaru BRZ, much like the WRX, occupies a specialized segment of the automotive market as a niche sports coupe. Its sales volume is characteristically low, reflecting a small market share within a mature, non-expanding category.

While the BRZ might see occasional, modest upticks in sales from its already low baseline, its overall impact on Subaru Corporation's financial results remains constrained. For instance, in 2023, Subaru sold approximately 3,000 BRZ units in the US, a small fraction of their total vehicle sales.

Consequently, the BRZ often operates at a break-even point or requires cash infusions without generating substantial returns. This financial profile firmly places it in the 'dog' category of the BCG Matrix, suggesting that further significant investment for growth is unlikely to be warranted.

Older, Less Competitive Industrial Products

While Subaru's automotive sector is its primary focus, the company's industrial products division may house older equipment or components facing declining demand. These offerings could be in low-growth or niche markets, potentially classifying them as 'dogs' in the BCG matrix. For instance, if Subaru still produces certain legacy power generation units or industrial parts that haven't kept pace with technological advancements or market shifts, they might generate minimal profits and require strategic review.

Assessing the profitability of these less competitive industrial products is crucial. Without specific 2024 financial disclosures detailing the performance of each segment, it's challenging to pinpoint exact figures. However, industry trends suggest that manufacturers of older, specialized industrial equipment often face shrinking order books and increased competition from more modern alternatives. Subaru's 2023 annual report, for example, indicated that while the overall company saw revenue growth, the industrial products segment's contribution, though stable, did not show the same dynamism as the automotive business. This suggests that some of its industrial offerings might be mature or in a mature stage.

- Potential for low market share in mature industrial sectors.

- Limited growth prospects for older product lines.

- Need for strategic evaluation regarding divestment or modernization.

- Impact on overall resource allocation within Subaru Corporation.

Subaru Impreza Sedan (pre-hatchback focus)

The Subaru Impreza sedan, prior to Subaru's emphasis on the hatchback and facing declining sales in 2024, likely falls into the 'dog' category of the BCG Matrix. This is because the sedan market itself is contracting, and the Impreza sedan's market share was notably lower when contrasted with Subaru's more popular SUV models.

While Subaru has invested in redesigning the Impreza hatchback, the sedan variant represents a segment with diminished growth potential for the brand. For instance, in the US market, sedan sales overall have been on a downward trend, with compact sedans like the Impreza facing increased competition from more versatile crossovers and SUVs.

- Declining Sedan Market: The overall market for sedans has been shrinking, impacting sales volumes for models like the Impreza sedan.

- Low Market Share: The Impreza sedan held a smaller market share compared to Subaru's highly successful SUV lineup, such as the Forester and Outback.

- Limited Growth Prospects: With a shrinking market and competition from other vehicle types, the sedan segment offers limited future growth opportunities for Subaru.

- Focus Shift: Subaru's strategic shift towards the redesigned Impreza hatchback indicates a move away from the sedan variant as a primary growth driver.

The Subaru Legacy sedan, a product firmly categorized as a 'dog' in the BCG matrix, faces a challenging future. Its market share within the declining sedan segment has diminished, with sales experiencing notable downturns. Subaru Corporation has officially announced that the Legacy will be discontinued after the 2025 model year, signaling a clear exit from this product line.

The Subaru WRX, a symbol of rally-inspired performance, currently occupies a 'dog' position within Subaru Corporation's portfolio, operating within a specialized, low-expansion market segment. Sales figures for the WRX have seen notable downturns, with declines reported in 2024, suggesting challenges in maintaining market footing. Despite its fan base, its financial contribution is on a downward trajectory, necessitating strategic resource allocation.

The Subaru BRZ, much like the WRX, occupies a niche sports coupe segment with characteristically low sales volume and a small market share. While it might see modest upticks, its overall financial impact remains constrained; in 2023, Subaru sold approximately 3,000 BRZ units in the US. This profile firmly places it in the 'dog' category, suggesting limited future investment is warranted.

The Subaru Impreza sedan, prior to Subaru's emphasis on the hatchback and facing declining sales in 2024, likely falls into the 'dog' category due to the contracting sedan market and its lower market share compared to Subaru's SUVs. The sedan variant represents a segment with diminished growth potential for the brand.

Question Marks

The Subaru Solterra, Subaru's inaugural all-electric SUV, is positioned within the rapidly expanding electric vehicle sector. While the EV market is a high-growth area, the Solterra currently commands a modest market share, contending with established players and new entrants alike. This places it squarely in the question mark category of the BCG matrix, demanding significant strategic investment to climb the market share ladder.

Despite experiencing substantial percentage sales increases from its initial low volume, the Solterra's overall sales figures remain relatively small. Reports from 2023 indicated challenges, including the need for aggressive discounting to move inventory and some lingering reliability concerns, further complicating its market penetration efforts. These factors underscore the considerable investment required to transform it into a future market leader.

Subaru plans to launch multiple new battery electric vehicle (BEV) models by 2028, with a goal of 50% of its sales being BEVs by 2030. These upcoming vehicles, like the anticipated 2026 Trailseeker, are entering a rapidly growing EV market where Subaru currently holds no share.

These future models are classified as question marks in the BCG matrix because they require substantial investment in research and development, alongside manufacturing capabilities. The significant upfront costs are balanced against the uncertainty of market adoption and the fierce competition within the dynamic electric vehicle sector.

Subaru Corporation's renewed focus on next-generation hybrid technologies, exemplified by the anticipated Forester Hybrid and Outback Hybrid, positions these vehicles within the question mark quadrant of the BCG Matrix. This strategic move acknowledges the expanding hybrid market, but Subaru faces the challenge of catching up to rivals who have already established a strong presence with their hybrid offerings. The development and refinement of these new hybrid systems demand significant capital expenditure to achieve competitive fuel efficiency and performance benchmarks, crucial for capturing substantial market share.

Expansion into New International Markets for EVs

Subaru's strategic push into new international markets for its electric vehicle (EV) range would be classified as a question mark within the BCG Matrix. This is because such ventures demand substantial capital for establishing sales networks, charging solutions, and brand awareness in unfamiliar territories. The potential for high growth exists, but the market share and profitability are initially uncertain, contingent on factors like local EV adoption rates and competitive landscapes.

For instance, Subaru's 2024 EV sales targets in emerging markets like Southeast Asia, where EV penetration is still developing, represent a classic question mark scenario. The company must invest heavily in building out its charging infrastructure and educating consumers about EV benefits. Success hinges on navigating diverse regulatory environments and tailoring products to local preferences, with early sales figures being a key indicator of future performance.

- High Investment: New market entry requires significant upfront capital for distribution, marketing, and charging infrastructure development.

- Uncertain Returns: Initial market share and profitability are not guaranteed, depending heavily on consumer acceptance and competitive pressures.

- Growth Potential: These markets offer the possibility of substantial future growth as EV adoption increases globally.

- Strategic Importance: Expanding into new territories is crucial for Subaru's long-term global EV strategy and market diversification.

Advanced Autonomous Driving Systems (beyond EyeSight)

Subaru's exploration beyond its established EyeSight driver assistance system into Level 3 and higher autonomous driving capabilities places these advanced systems squarely in the question mark category of the BCG matrix. While the autonomous driving market is experiencing robust growth, Subaru's current penetration in this highly advanced segment is minimal.

Significant research and development expenditures are a necessity for Subaru to compete in this evolving technology. The path forward is fraught with uncertainty, including unpredictable market adoption rates, complex regulatory approvals, and intense competition from established and emerging players in the autonomous vehicle space.

For instance, the global market for advanced driver-assistance systems (ADAS), which includes precursors to full autonomy, was valued at approximately $35 billion in 2023 and is projected to grow significantly. However, the specific market share for Level 3 and above systems, where Subaru is still investing heavily, remains nascent, underscoring the question mark status.

- High R&D Investment: Subaru is committing substantial resources to developing its next-generation autonomous driving technologies.

- Low Current Market Share: Penetration in the Level 3+ autonomous driving market is currently very low for Subaru.

- Market and Regulatory Uncertainty: Future adoption and regulatory frameworks for advanced autonomous systems present significant unknowns.

- Competitive Landscape: Many automakers and tech companies are aggressively pursuing autonomous driving, creating a challenging environment.

Subaru's foray into new international markets with its electric vehicle (EV) range, such as targeting Southeast Asia in 2024, represents a clear question mark. These ventures demand substantial capital for establishing sales networks and charging solutions in unfamiliar territories.

The potential for high growth exists, but initial market share and profitability are uncertain, contingent on local EV adoption rates and competitive landscapes. Subaru's 2024 EV sales targets in these developing markets highlight the significant investment required for infrastructure and consumer education.

| Initiative | Market Status | Investment Need | Potential |

| EV Expansion in Southeast Asia (2024 targets) | Question Mark | High (infrastructure, marketing) | High Growth Potential |

| New BEV Models (by 2028) | Question Mark | High (R&D, manufacturing) | High Growth Potential |

| Next-Gen Hybrids (Forester, Outback) | Question Mark | High (technology development) | Growing Market Share Potential |

| Level 3+ Autonomous Driving | Question Mark | Very High (R&D, regulatory navigation) | Significant Future Market |

BCG Matrix Data Sources

Our Subaru Corporation BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.