Subaru Corporation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Subaru Corporation Bundle

Subaru Corporation navigates a dynamic automotive landscape shaped by intense rivalry, evolving buyer preferences, and the constant threat of new entrants. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Subaru Corporation’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The automotive sector, including Subaru, depends on a limited number of specialized suppliers for essential parts like semiconductors and advanced electronics. This concentration means suppliers often hold considerable sway, particularly when they control unique technologies or components in high demand.

Subaru, like its peers, has encountered difficulties with parts availability, notably semiconductors, which has amplified the bargaining power of these suppliers. For instance, the global semiconductor shortage significantly impacted automotive production throughout 2021 and 2022, leading to production cuts and price increases for automakers.

Switching suppliers in the automotive sector, especially for specialized components, involves significant investment in re-tooling, re-certification processes, and intricate integration into existing production lines. These factors contribute to high switching costs for automakers like Subaru.

For Subaru Corporation, the substantial switching costs associated with its specialized components and integrated systems directly bolster the bargaining power of its established suppliers. This reliance means suppliers can often command higher prices or dictate terms due to the difficulty and expense Subaru would incur by changing partners.

While Subaru is actively pursuing strategies to mitigate supply chain costs and diversify its supplier base, these efforts represent a long-term strategic objective. For instance, in 2024, Subaru continued to invest in developing more flexible manufacturing processes and exploring new supplier relationships to gradually reduce its dependence on a few key providers.

Subaru's reliance on suppliers for unique, patented technologies, like its signature boxer engine components, significantly influences supplier bargaining power. These specialized parts are difficult for Subaru to source elsewhere, giving those suppliers leverage. For instance, in 2024, the automotive industry saw continued consolidation among Tier 1 suppliers, particularly those with advanced powertrain technologies, further concentrating power.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while generally low in the automotive industry due to immense capital requirements for vehicle manufacturing, is a factor Subaru Corporation must consider. Established component makers could, in theory, move into producing their own vehicles, but this remains a significant barrier. For instance, in 2024, the average cost to establish a new automotive manufacturing plant can easily reach billions of dollars, making this a daunting prospect for most suppliers.

However, the landscape is shifting, particularly with the rise of electric vehicles (EVs) and advanced software. Suppliers of critical EV battery technology or sophisticated automotive software might represent a more plausible forward integration threat. These suppliers could potentially bypass traditional automakers by developing direct relationships with end-consumers or by supplying their technology to other burgeoning mobility sectors.

- High Capital Barrier: Establishing a new automotive manufacturing facility requires billions of dollars, making direct forward integration by component suppliers into vehicle production a significant hurdle.

- Emerging Threat in EVs and Software: Suppliers of advanced battery technology and critical automotive software face lower barriers to direct consumer engagement, posing a more realistic integration threat.

- Strategic Implications for Automakers: This potential threat necessitates that companies like Subaru maintain robust supplier relationships and consider strategic investments, such as joint ventures, to mitigate risks.

Impact of Tariffs and Global Supply Chain Disruptions

Ongoing global supply chain disruptions and geopolitical tensions have significantly amplified the bargaining power of suppliers for automotive manufacturers like Subaru. These factors limit alternative sourcing options and drive up costs, giving suppliers greater leverage. For instance, the semiconductor shortage experienced throughout 2021 and 2022 directly impacted Subaru's production, forcing temporary plant shutdowns and highlighting supplier control over critical components. This situation has persisted into 2024, with ongoing geopolitical events in Eastern Europe and Asia continuing to create uncertainty and potential bottlenecks.

Subaru Corporation, heavily reliant on importing vehicles and parts from Japan into key markets like the United States, faces a direct tariff burden. These tariffs, which can fluctuate based on trade policies, increase Subaru's cost of goods sold. This financial strain indirectly strengthens the hand of its suppliers, as Subaru may be less able to absorb rising component costs or negotiate favorable terms when faced with additional import duties. The impact of tariffs can lead to higher prices for consumers and reduced profitability for the company.

- Increased Component Costs: Tariffs and supply chain issues can directly inflate the price Subaru pays for essential parts imported from Japan.

- Limited Sourcing Flexibility: Disruptions reduce Subaru's ability to switch suppliers easily, giving existing suppliers more pricing power.

- Production Delays: Shortages of critical components, exacerbated by global events, can lead to production halts, further empowering suppliers who control scarce resources.

- Impact on Profit Margins: Higher costs due to tariffs and supplier leverage can squeeze Subaru's profit margins, affecting overall financial performance.

Subaru Corporation faces significant bargaining power from its suppliers due to the specialized nature of automotive components and the high costs associated with switching. This leverage is amplified by global supply chain volatility, as seen with the persistent semiconductor shortages impacting production throughout 2021-2024, forcing Subaru to accept supplier terms. For example, the average cost of a new vehicle in the US saw substantial increases during this period due to these component constraints.

The reliance on a concentrated base of suppliers for critical technologies, such as advanced engine parts and electronics, grants these suppliers considerable influence. Subaru's investment in 2024 to diversify its supplier network aims to mitigate this, but the inherent complexity and cost of re-tooling and re-certifying new partners remain substantial barriers, reinforcing the power of existing suppliers.

Suppliers of unique, patented technologies, like Subaru's boxer engine components, hold significant leverage because these parts are difficult to source elsewhere. The ongoing consolidation of Tier 1 automotive suppliers in 2024 has further concentrated this power, allowing them to dictate terms and pricing more effectively.

While direct forward integration by suppliers into vehicle manufacturing is limited by immense capital requirements, estimated in billions for new plants, the threat is evolving. Suppliers of critical EV batteries and advanced automotive software in 2024 represent a more plausible integration threat, potentially bypassing traditional automakers.

What is included in the product

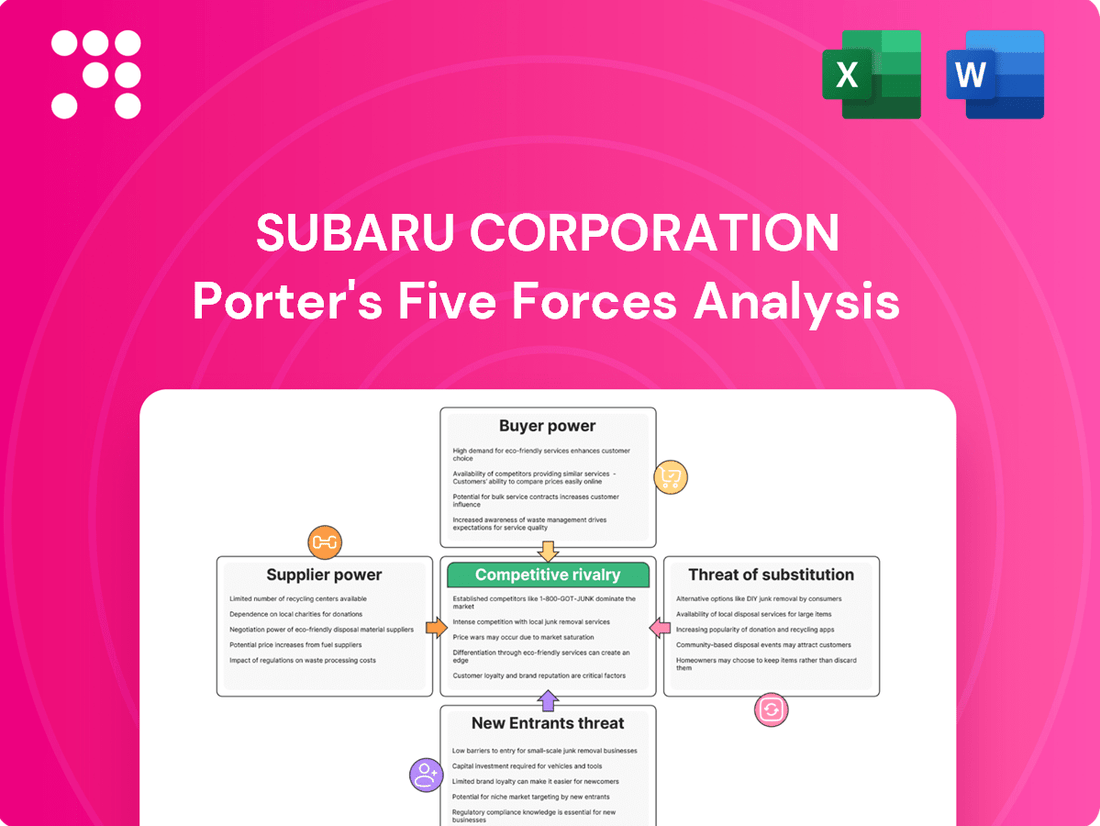

Examines how supplier power, buyer bargaining, new entrants, substitutes, and existing rivals shape Subaru Corporation's competitive environment and profitability.

Instantly visualize Subaru's competitive landscape with a clear, one-sheet Porter's Five Forces analysis, simplifying complex strategic pressures for decisive action.

Customers Bargaining Power

Customers in the automotive sector are quite sensitive to price, particularly since there are so many different brands and models to choose from. This broad selection means buyers can easily compare offerings and switch if they find a better deal elsewhere.

Subaru's decision to implement price increases on several of its models for the 2025 model year, a move aimed at covering increased production costs, could amplify this existing price sensitivity. For instance, the average transaction price for new vehicles in the US reached a record high of over $48,000 in early 2024, signaling a generally upward trend in pricing across the industry.

These price adjustments by Subaru might push consumers to more actively explore alternatives from competitors, especially if the perceived value proposition of Subaru vehicles doesn't keep pace with the higher costs. This dynamic directly impacts Subaru's bargaining power by making customers more inclined to seek out less expensive options.

Subaru enjoys a significant advantage through its dedicated customer base, especially for its popular SUV models. In 2024, the company consistently ranked high in customer satisfaction and loyalty surveys, underscoring the strength of its brand connection.

However, a growing trend of brand defection poses a challenge. The Deloitte 2025 Global Automotive Consumer Study highlights an increasing willingness among consumers worldwide to switch vehicle brands. This suggests that even Subaru's loyal customers might consider alternatives if their changing preferences, like the demand for electric vehicles or better affordability, aren't addressed.

The internet has dramatically shifted the balance of power towards customers. With readily available information on vehicle specs, pricing, and competitor offerings, buyers can easily compare options. This digital buying journey means consumers are more informed than ever, significantly increasing their ability to negotiate favorable terms with automakers like Subaru.

Influence of Economic Conditions and Incentives

Economic conditions significantly shape the bargaining power of Subaru's customers. For instance, during periods of high inflation and rising interest rates in 2024, consumers generally have less disposable income and are more sensitive to vehicle prices. This economic pressure can increase their willingness to negotiate or seek out lower-cost alternatives, thereby strengthening their bargaining position against Subaru.

Furthermore, the competitive landscape, particularly the prevalence of sales incentives, directly influences customer power. When competitors offer substantial discounts or attractive financing options, Subaru may feel compelled to match these offers to remain competitive. This dynamic can force Subaru to reduce its profit margins, as seen in their financial reports where increased sales incentives were noted in response to a competitive market. For example, in early 2024, several major automakers offered 0% APR financing for extended periods, putting pressure on brands like Subaru to offer comparable incentives.

- Economic Downturns: Periods of economic contraction or uncertainty, characterized by high inflation and interest rates, typically reduce consumer purchasing power, making them more price-sensitive and increasing their bargaining leverage.

- Competitor Incentives: Aggressive sales promotions and discounts offered by rival automotive manufacturers can compel Subaru to offer similar incentives, potentially impacting profitability and strengthening the customer's position.

- Price Sensitivity: As of mid-2024, the average transaction price for new vehicles remained elevated, making consumers more inclined to seek deals and negotiate, thus amplifying their bargaining power.

- Availability of Alternatives: The wide array of vehicle choices available to consumers means that if Subaru's pricing or offerings are not perceived as competitive, customers can easily switch to other brands, enhancing their bargaining strength.

Evolving Consumer Preferences (EVs, Hybrids, MaaS)

Consumer preferences are undergoing a significant transformation, with a growing inclination towards electric vehicles (EVs) and hybrids. While full battery electric vehicle adoption is still finding its footing in certain regions, hybrid models are experiencing a notable surge in popularity. For instance, in 2023, hybrid vehicle sales in the US saw a substantial increase, capturing a larger market share compared to previous years, indicating a strong consumer appetite for this technology.

Furthermore, younger demographics are increasingly exploring mobility-as-a-service (MaaS) as an alternative to traditional car ownership. This shift suggests a potential recalibration of how consumers view personal transportation. Subaru's strategic response to these evolving demands, particularly with its all-electric Solterra and its developing hybrid technologies, will be a critical factor in its ability to retain and attract customers in this dynamic market. The company's investment in these areas directly impacts its bargaining power with customers.

- Hybrid Vehicle Sales Growth: Hybrid sales in the US market have shown consistent year-over-year increases, with 2023 data indicating a significant jump in market penetration.

- MaaS Adoption Trends: Surveys indicate a growing interest in subscription-based mobility services among millennials and Gen Z, potentially impacting future vehicle purchase decisions.

- Subaru's EV/Hybrid Strategy: The success of Subaru's Solterra EV and the introduction of new hybrid models are key determinants of its customer appeal in the face of shifting preferences.

Subaru's customers possess considerable bargaining power, largely due to the automotive industry's inherent price sensitivity and the wide array of available alternatives. As of early 2024, the average transaction price for new vehicles exceeded $48,000, making consumers more inclined to seek competitive pricing and incentives. This heightened price awareness, coupled with the ease of online research for specifications and pricing, empowers buyers to negotiate more effectively. Furthermore, evolving consumer preferences towards hybrids and electric vehicles, alongside the rise of mobility-as-a-service, present challenges that Subaru must address to maintain customer loyalty and mitigate their bargaining leverage.

| Factor | Impact on Subaru's Customer Bargaining Power | Supporting Data (as of mid-2024) |

|---|---|---|

| Price Sensitivity | High | Average new vehicle transaction price over $48,000 in early 2024. |

| Availability of Alternatives | High | Extensive choice of brands and models in the automotive market. |

| Information Accessibility | High | Online resources for easy comparison of vehicle specs, pricing, and reviews. |

| Economic Conditions | Moderate to High | Elevated inflation and interest rates in 2024 reduce disposable income. |

| Competitor Incentives | Moderate | Widespread 0% APR financing offers from competitors in early 2024. |

| Shifting Consumer Preferences | Growing | Significant increase in hybrid vehicle sales in 2023; growing interest in EVs and MaaS. |

Preview the Actual Deliverable

Subaru Corporation Porter's Five Forces Analysis

This preview showcases the complete Subaru Corporation Porter's Five Forces Analysis, detailing the competitive landscape including threats of new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry. The document you see here is precisely what you will receive instantly after completing your purchase, offering a professionally formatted and ready-to-use strategic overview.

Rivalry Among Competitors

The automotive sector is a crowded arena, with global behemoths like Toyota, Honda, and Volkswagen constantly vying for market share. Subaru, while a respected player, operates within this intensely competitive landscape, facing pressure from both established manufacturers and newer electric vehicle startups. In 2024, the automotive industry continues to see a high degree of consolidation and new entrants, making it challenging for any single brand to dominate.

While the automotive industry sees pockets of growth, particularly in SUVs and hybrid vehicles, the overall market is mature. This maturity, coupled with susceptibility to economic fluctuations, fuels intense competition for market share among established players like Subaru.

The period of 2024-2025 is marked by a return to more normalized inventory levels, a shift from the shortages experienced previously. This increase in available vehicles heightens the pressure on automakers to implement aggressive and competitive strategies to attract and retain customers, directly impacting rivalry.

Subaru has long distinguished itself with its Symmetrical All-Wheel Drive system and reliable, horizontally opposed "boxer" engines, coupled with a strong safety image. In 2023, Subaru vehicles received numerous safety accolades, including multiple IIHS Top Safety Picks, reinforcing this core strength.

However, the automotive landscape is evolving rapidly. Competitors are increasingly offering advanced all-wheel-drive capabilities and sophisticated safety technologies, narrowing Subaru's traditional advantages. For instance, many mainstream brands now feature advanced driver-assistance systems as standard or widely available options.

To counter this, Subaru is focusing on differentiating itself in the burgeoning electric vehicle (EV) market. Their strategy centers on rugged, adventure-oriented EVs, aiming to capture a niche that values capability and outdoor lifestyle. The upcoming electric SUV models are designed to carry this distinct brand ethos forward.

High Fixed Costs and Exit Barriers

The automotive sector, including Subaru Corporation, is characterized by substantial fixed costs. These include massive investments in manufacturing facilities, ongoing research and development for new technologies, and extensive distribution and dealership networks. For instance, establishing a new automotive production line can cost billions of dollars, creating a significant financial commitment that is difficult to divest from.

These high fixed costs act as significant exit barriers. Companies are often reluctant to cease operations, even in periods of low demand, to avoid abandoning their substantial capital investments. This pressure to continue production can lead to intensified competition, with firms engaging in aggressive pricing strategies and marketing campaigns to maintain market share and cover their overheads. Subaru's ongoing commitment to developing and producing electric vehicles, which requires substantial upfront investment in new platforms and battery technology, exemplifies these high fixed costs.

- Automotive Industry Fixed Costs: Billions of dollars are typically required for new manufacturing plants and R&D.

- Exit Barriers: High capital investments make it challenging for companies to leave the market, intensifying rivalry.

- Subaru's EV Investment: Significant capital is being allocated to electric vehicle production, underscoring the industry's fixed cost structure.

Marketing and Sales Intensity

Subaru Corporation's competitive rivalry is intensified by aggressive marketing and sales tactics. This includes competitive pricing, attractive incentives, and robust digital engagement strategies to capture market share. In 2024, the automotive industry saw continued pressure on incentives, particularly in key international markets where Subaru operates, directly impacting profit margins.

The need to boost sales volume means Subaru often faces pressure to increase sales incentives. This is especially true in competitive overseas markets where brand loyalty can be challenged by aggressive promotions from rivals. Such incentives, while driving short-term sales, can erode profitability if not carefully managed.

Effectively reaching target audiences in today's landscape relies heavily on digital marketing. Subaru's success is increasingly tied to its proficiency in search engine optimization (SEO) and strategic partnerships with influencers. These digital efforts are crucial for building brand awareness and driving customer interest in a crowded automotive market.

- Marketing Intensity: Subaru engages in aggressive marketing, including pricing strategies and incentives.

- Sales Pressure: The company faces pressure to increase sales incentives, particularly in competitive international markets, impacting profitability.

- Digital Engagement: Effective digital marketing, SEO, and influencer partnerships are critical for reaching Subaru's target demographics.

- Profitability Impact: Increased incentives, while boosting sales, can negatively affect Subaru's financial performance.

Subaru faces intense competition from global automakers and emerging EV players, with the automotive market in 2024 characterized by a return to normal inventory levels, increasing competitive pressure. This environment demands aggressive strategies to capture and retain customers, impacting Subaru's market position.

The high fixed costs inherent in automotive manufacturing, such as billions invested in R&D and production facilities, create significant exit barriers. This encourages companies to remain competitive even during downturns, leading to intensified rivalry through pricing and marketing efforts, as seen in Subaru's substantial EV investments.

Subaru's competitive rivalry is further fueled by aggressive marketing and sales tactics, including pricing and incentives, particularly in international markets. The company must effectively leverage digital marketing, SEO, and influencer partnerships to stand out in a crowded automotive landscape, balancing sales volume with profitability.

| Competitor | 2023 Global Sales (approx.) | Key Market Share Strategy |

|---|---|---|

| Toyota | 11.2 million | Diverse portfolio, hybrid leadership, strong brand loyalty |

| Honda | 3.9 million | Reliability, fuel efficiency, expanding SUV and EV offerings |

| Volkswagen Group | 9.2 million | Broad brand range, electrification push, strong European presence |

| Hyundai Motor Group | 7.3 million | Value proposition, design innovation, growing EV market share |

SSubstitutes Threaten

The increasing availability and sophistication of public transportation, particularly in major urban centers, pose a significant threat of substitutes for individual vehicle ownership. As of 2024, many cities are investing heavily in expanding and modernizing their transit networks, offering more frequent and reliable service.

For many consumers, especially those living in densely populated areas, public transit options like buses, light rail, and subway systems can offer a more cost-effective and convenient alternative to owning and maintaining a car. Factors such as rising fuel costs, parking expenses, and the hassle of navigating traffic congestion further bolster the appeal of these substitutes.

The rise of ride-sharing and car-sharing services presents a significant threat of substitutes for Subaru Corporation. Platforms like Uber and Lyft, and car-sharing options such as Zipcar, provide accessible and often cost-effective alternatives to personal vehicle ownership, particularly for urban dwellers or those with infrequent driving needs. This trend directly impacts the demand for new car sales, a core market for Subaru.

For shorter commutes, particularly in urban and suburban settings, alternatives like walking, biking, and micromobility services such as electric scooters and e-bikes present a significant threat of substitution for traditional car use. These modes are frequently more budget-friendly, better for the environment, and encourage physical activity.

In 2024, the micromobility market continued its expansion, with global revenue projected to reach over $150 billion, indicating a growing preference for these alternatives, especially among younger demographics. This trend directly impacts the demand for personal vehicles, including those produced by Subaru, for shorter trips.

Subscription-Based Mobility Services

The growing popularity of subscription-based mobility services presents a significant threat to traditional car manufacturers like Subaru. These services, where customers pay a monthly fee for vehicle access, bypass the need for outright ownership, appealing to those prioritizing flexibility and lower upfront costs. For instance, companies like Porsche Drive and Mercedes-Benz Collection offer curated access to luxury vehicles on a subscription basis, demonstrating a shift in consumer preference away from long-term commitment.

This trend is particularly relevant as it caters to a segment of the market that might otherwise consider purchasing a Subaru. The convenience and reduced financial burden associated with subscriptions can be a compelling alternative, especially in urban areas or for individuals whose driving needs are variable. As of early 2024, the car subscription market continues to expand, with more manufacturers and third-party providers entering the space, intensifying the competitive pressure.

- Growing Subscription Adoption: Consumers are increasingly drawn to mobility-as-a-service models, valuing flexibility over ownership.

- Reduced Financial Commitment: Subscription services offer a lower barrier to entry compared to purchasing a vehicle outright.

- Competitive Landscape: Major automotive players are launching their own subscription programs, directly competing for potential Subaru customers.

Telecommuting and Online Services

The growing trend of telecommuting and the expansion of online services significantly impact the demand for personal vehicles, a key market for Subaru Corporation. As more individuals work from home and access services digitally, the need for daily commutes decreases. This shift directly challenges the traditional automotive market by offering viable alternatives to car ownership and usage.

The increasing prevalence of telecommuting and online services acts as a potent substitute threat. For instance, a significant portion of the workforce has adopted hybrid or fully remote models. Data from 2024 indicates that approximately 30% of US workers are now working remotely at least part of the time, a substantial increase from pre-pandemic levels. This reduces the necessity for daily commutes, directly impacting the demand for new and used vehicles.

- Reduced Commuting Needs: With more people working from home, the daily need for personal transportation declines, lessening reliance on vehicles like those Subaru offers.

- Online Service Accessibility: The ease of online shopping, entertainment streaming, and virtual appointments further diminishes the reasons for frequent travel, making car usage less essential.

- Cost Savings: Opting for remote work and online services can lead to significant savings on fuel, maintenance, and insurance, making these alternatives more attractive than car ownership.

- Environmental Concerns: Growing environmental awareness also encourages reduced vehicle use, pushing consumers towards more sustainable transportation methods or fewer car trips.

The threat of substitutes for Subaru Corporation is multifaceted, encompassing public transit, ride-sharing, micromobility, subscription services, and the broader trend of remote work. These alternatives directly reduce the necessity and appeal of personal vehicle ownership, particularly for urban commuting and shorter trips.

Public transportation networks are expanding, and ride-sharing platforms offer convenient on-demand mobility. Micromobility options like e-scooters and e-bikes are gaining traction, especially among younger demographics, with the global market projected to exceed $150 billion in 2024. Furthermore, car subscription services provide flexible, lower-commitment alternatives to purchasing a vehicle, a trend that is growing as more manufacturers enter the space.

The increasing adoption of telecommuting, with roughly 30% of US workers working remotely at least part-time in 2024, significantly curtails the need for daily commutes. This shift, coupled with the convenience of online services, directly diminishes the demand for personal vehicles, impacting Subaru's core market.

Entrants Threaten

The automotive sector, including companies like Subaru Corporation, demands enormous capital outlays. This includes substantial investments in research and development, setting up advanced manufacturing facilities, procuring specialized tooling, and building extensive distribution and service networks. These high upfront costs create a formidable barrier, deterring potential new entrants from easily entering the market.

For instance, the transition to electric vehicles (EVs) necessitates further significant R&D spending and investments in new production lines. In 2024, the global automotive industry's capital expenditure on R&D for new technologies, particularly EVs and autonomous driving, reached hundreds of billions of dollars, underscoring the financial hurdle for newcomers.

Existing automakers, including Subaru, benefit from substantial economies of scale in production, purchasing, and marketing. This allows them to achieve lower per-unit costs, creating a significant barrier for new entrants who cannot immediately match these efficiencies. For instance, in 2024, Subaru's global production volume contributed to its ability to negotiate favorable terms with suppliers and spread its fixed costs over a larger output.

Subaru Corporation benefits significantly from its strong brand identity and deeply ingrained customer loyalty, posing a considerable barrier to new entrants. For instance, Subaru's reputation for reliability and all-wheel-drive capability has fostered a dedicated following. In 2024, Subaru reported a strong performance, with continued positive sales trends in key markets, underscoring the enduring appeal of its brand.

Regulatory Hurdles and Safety Standards

The automotive sector, including Subaru Corporation's market, is burdened by significant regulatory hurdles. New entrants must contend with rigorous safety, emissions, and environmental standards, which are constantly evolving, especially with the push towards electric vehicles (EVs) and their battery technology. For instance, by 2024, many regions have implemented or are strengthening regulations around battery recycling and material sourcing, adding complexity and cost.

Meeting these stringent requirements necessitates substantial investment in research, development, and compliance infrastructure. Obtaining the necessary certifications and approvals can be a lengthy and resource-intensive process, effectively deterring potential new competitors from entering the market. This high barrier to entry is a critical factor in shaping the competitive landscape for established players like Subaru.

- Stringent Safety Standards: Compliance with global NCAP, IIHS, and NHTSA safety ratings requires advanced engineering and testing.

- Emissions Regulations: Meeting Euro 7 standards or equivalent mandates significant investment in cleaner powertrain technologies.

- EV and Battery Regulations: New rules on battery lifecycle management and material sourcing add complexity for EV startups.

- Certification Costs: Obtaining type approval in major markets can cost millions of dollars per model.

Access to Distribution Channels and Supply Chains

New entrants into the automotive industry, including Subaru's segment, grapple with the significant hurdle of establishing widespread distribution channels and securing robust supply chains. Building an extensive dealer network requires substantial capital investment and time to cultivate customer trust and brand loyalty. For instance, in 2023, the automotive industry continued to face supply chain disruptions, particularly for critical components like semiconductors, impacting production volumes for both established manufacturers and potential new entrants.

Established automakers like Subaru benefit from decades of experience in forging strong, long-standing relationships with key suppliers. These relationships often translate into preferential access to essential components and more favorable terms, creating a barrier for newcomers who are just beginning to negotiate with these same suppliers.

- Dealer Network Development: Newcomers must invest heavily to replicate Subaru's established global network of dealerships, which is crucial for sales, service, and customer support.

- Supply Chain Integration: Securing reliable and cost-effective access to specialized automotive parts, such as advanced engine components or electronic systems, is a major challenge for new entrants compared to incumbents with established supplier contracts.

- Subaru's Advantage: Subaru's existing global production and sales infrastructure, built over many years, provides a significant competitive edge in managing its supply chain and distribution efficiently.

The threat of new entrants for Subaru Corporation is generally low due to the immense capital required for automotive manufacturing, including R&D and production facilities. For example, the global automotive industry's R&D spending on EVs and autonomous driving in 2024 reached hundreds of billions of dollars, a significant barrier for newcomers.

Established brand loyalty and economies of scale also deter new players. Subaru's strong reputation for reliability, evident in its continued positive sales trends in 2024, creates a loyal customer base that is difficult for new entrants to capture.

Furthermore, stringent regulatory requirements concerning safety, emissions, and EV battery technology, such as evolving battery recycling rules by 2024, add substantial compliance costs and complexity. These factors collectively create a high barrier to entry in the automotive sector.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Subaru Corporation is built upon a foundation of comprehensive data, including Subaru's annual reports and SEC filings, alongside industry-specific market research reports from firms like IHS Markit and JD Power. We also incorporate macroeconomic data from sources like the World Bank and government automotive statistics to capture the broader industry landscape.