Sirius XM Holdings, Inc. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sirius XM Holdings, Inc. Bundle

Sirius XM Holdings, Inc. operates within a dynamic landscape shaped by political shifts, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for navigating the competitive audio entertainment market. Our PESTLE analysis dives deep into these factors, offering actionable intelligence to inform your strategy.

Gain a competitive edge by exploring how technological advancements and environmental considerations impact Sirius XM's future. This comprehensive PESTLE analysis provides the critical insights you need to anticipate challenges and capitalize on opportunities. Download the full version now for immediate access to expert-level market intelligence.

Political factors

Sirius XM operates under significant government regulation, primarily from the Federal Communications Commission (FCC) in the United States. These regulations cover crucial aspects like satellite licensing and spectrum allocation, directly influencing the company's ability to expand its services and maintain its broadcast infrastructure. For example, in late 2023 and early 2024, SiriusXM actively engaged with the FCC concerning regulatory fees for retired satellites, demonstrating the continuous impact of regulatory policy on its financial and operational planning.

Sirius XM Holdings, Inc. operates under a landscape of evolving consumer protection laws, with particular attention paid to subscription services and their associated cancellation policies. Regulatory bodies and state attorneys general are increasingly scrutinizing companies for potentially misleading practices in these areas.

For instance, the New York Attorney General's office has taken action against companies for opaque billing and difficult cancellation procedures, highlighting the critical need for transparency. Such legal challenges can result in significant fines and damage a company's reputation, making adherence to these laws a key operational consideration for Sirius XM.

Sirius XM's reliance on music content makes it highly susceptible to intellectual property and royalty regulations. These rules dictate how artists and rights holders are compensated, directly impacting Sirius XM's operating costs and content acquisition strategies.

The company has faced significant legal battles over royalty fees, exemplified by a class action lawsuit concerning the 'US Music Royalty Fee.' Such litigation highlights the substantial financial risks and the need for careful navigation of these complex regulatory landscapes.

Antitrust and Competition Policy

As a dominant force in satellite radio, Sirius XM Holdings, Inc. faces scrutiny under antitrust and competition policies designed to promote a fair audio entertainment market. While its satellite radio platform offers a distinct service, the burgeoning landscape of streaming services presents a competitive challenge, prompting regulatory bodies to observe Sirius XM's market conduct. For instance, in 2024, the Federal Communications Commission (FCC) continues to monitor the digital media landscape, ensuring that established players do not stifle emerging competitors. This oversight is crucial as Sirius XM's market share in satellite radio remains substantial, with subscriber numbers consistently reported in the tens of millions, highlighting its significant influence.

Data Privacy and Security Regulations

Sirius XM Holdings, Inc., through its streaming services like Pandora, handles substantial user data, placing it under the purview of increasingly stringent data privacy and security regulations. The company must navigate a complex web of global and regional laws, such as the GDPR and CCPA, to ensure lawful data processing and storage. Failure to comply can result in significant fines and reputational damage, impacting customer trust and potentially leading to data breaches.

Compliance is not merely a legal obligation but a strategic imperative for Sirius XM. In 2023, data privacy fines globally continued to rise, with significant penalties levied for non-compliance. For instance, the EU's GDPR has seen numerous large fines imposed on tech companies for data protection violations. Sirius XM's proactive approach to data security and privacy is therefore essential for maintaining its operational integrity and market standing.

- Regulatory Landscape: Sirius XM must adhere to evolving data privacy laws like GDPR and CCPA.

- User Trust: Robust data security is vital for maintaining customer confidence.

- Financial Risk: Non-compliance can lead to substantial fines, impacting profitability.

- Operational Impact: Data breaches pose significant operational and reputational threats.

Sirius XM operates under strict FCC regulations for satellite licensing and spectrum allocation, impacting service expansion and infrastructure. The company also faces scrutiny under antitrust policies, with the FCC monitoring the digital media landscape in 2024 to ensure fair competition, especially as Sirius XM maintains a significant subscriber base in satellite radio.

Intellectual property and royalty regulations directly influence Sirius XM's operating costs and content acquisition. The company has navigated legal challenges, such as class action lawsuits concerning music royalty fees, highlighting the financial risks associated with these complex rules.

Evolving consumer protection laws, particularly regarding subscription services and cancellation policies, are a key concern. Regulatory bodies are increasingly scrutinizing companies for opaque billing and difficult cancellation procedures, a trend underscored by actions from state attorneys general in late 2023 and early 2024.

Sirius XM's handling of user data falls under stringent data privacy and security regulations like GDPR and CCPA. Non-compliance, as evidenced by rising global fines in 2023, poses significant financial and reputational risks, making proactive data security a strategic imperative.

What is included in the product

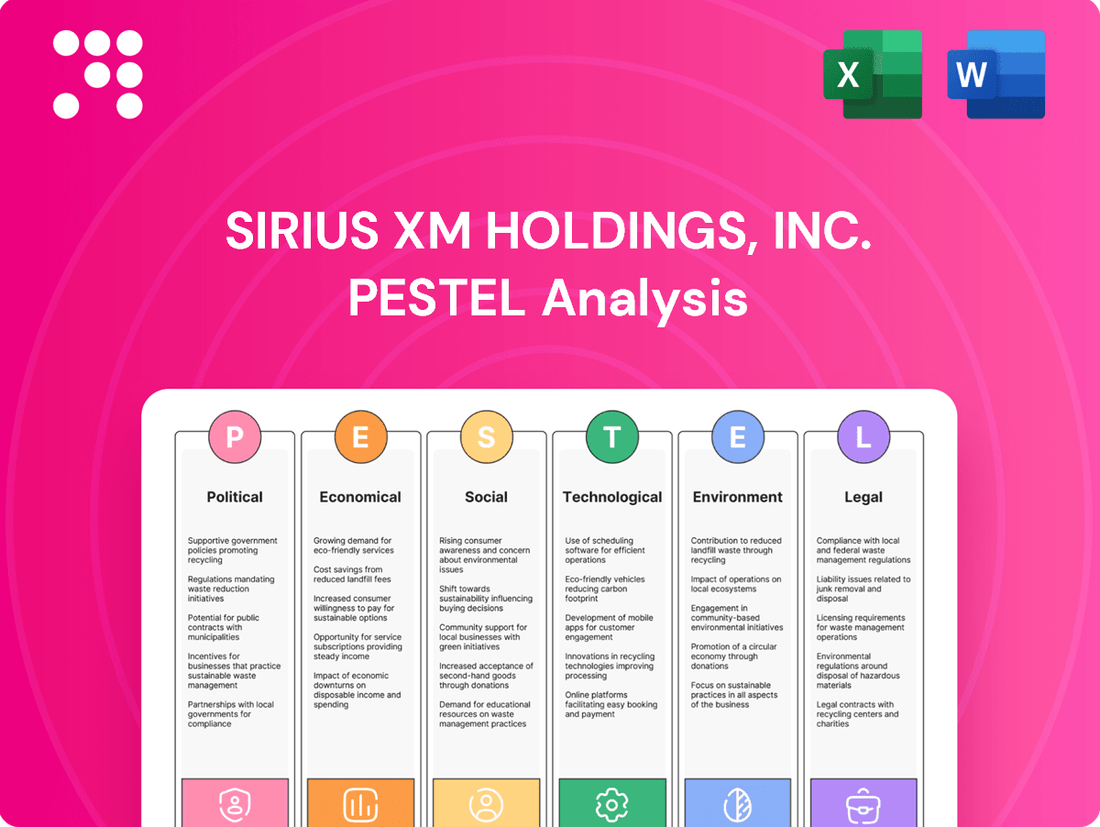

This PESTLE analysis of Sirius XM Holdings, Inc. examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its business, offering a comprehensive view of the external landscape.

It provides actionable insights into how these macro-environmental factors create both challenges and strategic advantages for Sirius XM.

This PESTLE analysis for Sirius XM Holdings, Inc. offers a pain point reliever by providing a clear, summarized version of external factors for easy referencing during strategic planning and decision-making.

It helps alleviate the pain of information overload by presenting complex external influences in a visually segmented, easily digestible format, facilitating quick interpretation and alignment across teams.

Economic factors

Sirius XM's subscription revenue, its main income source, is heavily influenced by subscriber numbers and average revenue per user (ARPU). These metrics are crucial for understanding the company's economic health.

In 2024, Sirius XM saw its self-pay subscriber revenue decline. This downturn was driven by a decrease in the average number of subscribers and a reduction in ARPU, signaling potential headwinds in their subscriber acquisition and retention efforts.

Advertising revenue, a key driver beyond subscriptions for Sirius XM, especially from Pandora and its growing podcast network, plays a vital role in its financial performance. In 2024, Pandora's ad revenue experienced a modest uptick, demonstrating resilience in a dynamic market.

However, this growth was tempered by a dip in overall streaming demand, influenced by heightened competition within the digital advertising space. This dynamic underscores the ongoing challenges and opportunities in capturing and retaining listener engagement for advertising monetization.

Sirius XM is prioritizing operational efficiency and cost savings to boost its financial health. The company successfully implemented initiatives that yielded around $350 million in savings across 2023 and 2024.

Looking ahead, Sirius XM has set a target to achieve an additional $200 million in annualized cost savings by the close of 2025. These efforts are vital for improving profitability and strengthening cash flow generation.

Capital Expenditures and Debt Management

Sirius XM's capital expenditures, particularly its investments in satellite technology and streaming infrastructure, directly impact its financial health. These investments are crucial for maintaining and expanding its service offerings in a competitive media landscape.

The company is actively managing its debt obligations, with a stated plan to reduce debt by around $700 million in 2025. This focus on deleveraging is a key economic strategy aimed at strengthening its balance sheet and improving financial flexibility.

Sirius XM's commitment to optimizing free cash flow is evident in its target of achieving $1.5 billion in free cash flow by 2027. This financial objective underscores the importance of efficient operations and strategic capital allocation in driving shareholder value.

- Capital Expenditures: Ongoing investments in satellite technology and streaming platforms.

- Debt Reduction: Planned reduction of approximately $700 million in debt during 2025.

- Financial Targets: Aiming for $1.5 billion in free cash flow by 2027.

- Balance Sheet Strength: Focus on maintaining a robust financial position through debt management.

Overall Market Competition and Consumer Spending

The overall economic environment, particularly consumer spending patterns, significantly impacts Sirius XM's performance. As discretionary income tightens, consumers may cut back on subscription services, affecting subscriber growth and revenue. This is compounded by fierce competition from streaming giants like Spotify and Apple Music, which offer vast on-demand libraries and personalized playlists, often at competitive price points.

These market dynamics are already showing in financial forecasts. For instance, Sirius XM's projected revenue for 2025 did not meet analyst expectations, signaling the challenges posed by both the broader economic climate and the intense competition within the audio entertainment sector. This suggests a need for strategic adjustments to maintain market share and financial health.

- Subscriber Acquisition Costs: Increased competition likely drives up the cost of acquiring new subscribers.

- Pricing Sensitivity: Consumers may be more sensitive to pricing changes due to economic pressures and competitive offerings.

- Market Share Erosion: Competitors with more flexible or lower-cost models could capture market share from Sirius XM.

- Innovation Pressure: The need to continuously innovate and differentiate its content and features becomes critical.

Economic factors significantly shape Sirius XM's financial landscape, with subscriber revenue and ARPU being key indicators of its health. The company experienced a decline in self-pay subscriber revenue in 2024 due to fewer subscribers and lower ARPU, highlighting challenges in customer acquisition and retention. Pandora's advertising revenue saw a modest increase in 2024, demonstrating some resilience, though overall streaming demand and intense digital ad competition present ongoing hurdles.

Sirius XM is actively pursuing cost efficiencies, having achieved approximately $350 million in savings across 2023 and 2024, with a further target of $200 million in annualized savings by the end of 2025 to bolster profitability and cash flow.

Strategic financial management includes planned debt reduction of around $700 million in 2025 and capital expenditures focused on satellite and streaming infrastructure. The company aims to generate $1.5 billion in free cash flow by 2027, underscoring its commitment to financial strength and shareholder value.

| Metric | 2023/2024 Data | Outlook/Target |

|---|---|---|

| Cost Savings Achieved | ~$350 million (2023-2024) | $200 million annualized savings by end of 2025 |

| Debt Reduction Plan | N/A | ~$700 million in 2025 |

| Free Cash Flow Target | N/A | $1.5 billion by 2027 |

Preview the Actual Deliverable

Sirius XM Holdings, Inc. PESTLE Analysis

The preview shown here is the exact Sirius XM Holdings, Inc. PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to the full PESTLE analysis for Sirius XM Holdings, Inc. upon completing your purchase.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a deep dive into the external forces shaping Sirius XM's operations and strategic direction.

Sociological factors

Consumer listening habits are rapidly shifting, with a growing preference for on-demand streaming services and podcasts. This presents a significant sociological challenge for Sirius XM Holdings, Inc. as it navigates a landscape where listeners increasingly expect to control their content and listen anytime, anywhere.

While Sirius XM's satellite radio remains a strong contender in the automotive sector, with over 34 million subscribers reported in early 2024, the company must actively adapt its strategy. This involves catering to these evolving behaviors across diverse platforms to not only retain its existing subscriber base but also to attract new listeners who are accustomed to more flexible audio consumption models.

Sirius XM's ability to connect with a broad range of age groups is vital. While they've invested in digital platforms and content to draw in younger listeners, balancing this with the needs of their established subscriber base remains a key challenge. For instance, in Q1 2024, Sirius XM reported a slight dip in total subscribers, underscoring the need to continually adapt content and delivery to appeal to evolving consumer preferences across different generations.

Listener preferences are a huge driver for Sirius XM. They see demand for everything from music and sports to talk radio and news. This means Sirius XM has to be smart about what they offer.

To stand out, Sirius XM focuses on what they call premium, exclusive, and live content. Think unique music channels you can't get anywhere else, live sports broadcasts, and a growing selection of podcasts. This strategy aims to capture a wide range of listener tastes.

In 2023, Sirius XM continued to invest heavily in its content, particularly in areas like exclusive music artist channels and live sports rights, recognizing these as key differentiators in a competitive audio landscape.

Brand Perception and Customer Loyalty

Public perception of Sirius XM's brand, especially regarding customer service and pricing clarity, directly influences subscriber retention and churn. Negative experiences can erode trust, pushing customers to seek alternatives.

Recent legal challenges, such as those concerning cancellation policies and royalty fees, underscore the critical need for a positive customer experience and transparent communication to safeguard Sirius XM's brand reputation.

- Brand Perception: Customer sentiment towards Sirius XM's service quality and value proposition.

- Customer Loyalty: The degree to which subscribers remain with the service despite competitive offerings.

- Churn Rates: The percentage of subscribers who discontinue their service, often influenced by brand perception and pricing.

- Legal Scrutiny: Lawsuits related to cancellation policies and royalty fees can negatively impact public image and customer trust.

Influence of In-Car Technology and Connectivity

The growing presence of in-car technology like Apple CarPlay and Android Auto significantly shapes how people consume audio. This shift means Sirius XM must evolve its strategy to remain relevant in the automotive space.

Sirius XM is actively responding by embedding its streaming services within vehicle operating systems that utilize internet protocol. This move is crucial for broadening its audience and securing its position in the evolving automotive entertainment landscape.

- Consumer Preference Shift: A significant portion of new vehicles now feature integrated smartphone mirroring systems, impacting traditional radio listening habits.

- Sirius XM's Adaptation: The company is focusing on its streaming app, which is increasingly available through these connected car platforms.

- Market Penetration: By 2024, it's estimated that over 80% of new vehicles sold in major markets will come equipped with advanced infotainment systems, presenting both a challenge and an opportunity for Sirius XM.

Consumer listening habits are rapidly shifting, favoring on-demand streaming and podcasts, which challenges Sirius XM's traditional model. While satellite radio remains strong in cars, with over 34 million subscribers in early 2024, the company must adapt its content and delivery across platforms to retain existing users and attract new ones accustomed to flexible audio consumption.

Sirius XM's success hinges on appealing to diverse age groups and tastes, from music and sports to talk radio and news. Their strategy of offering premium, exclusive, and live content, including unique music channels and sports broadcasts, aims to capture a broad audience, a focus that saw continued investment in 2023.

Public perception, particularly regarding customer service and pricing clarity, directly impacts subscriber loyalty and churn. Recent legal scrutiny over cancellation policies and royalty fees highlights the importance of transparent communication and a positive customer experience to maintain brand trust.

The increasing prevalence of in-car technologies like Apple CarPlay and Android Auto necessitates Sirius XM's evolution. By embedding its streaming services into connected car platforms, Sirius XM aims to broaden its reach, capitalizing on the fact that over 80% of new vehicles sold in major markets by 2024 feature advanced infotainment systems.

Technological factors

Sirius XM's core satellite radio offering is fundamentally dependent on its sophisticated satellite technology and the robust infrastructure supporting it. The company's commitment to maintaining and enhancing this foundation is evident in its continuous investment strategy.

For instance, Sirius XM has historically allocated substantial capital towards satellite launches and upgrades to ensure uninterrupted service and broaden its reach. Projections indicate that capital expenditures related to these satellite assets will remain a significant component of their financial planning in the 2024-2025 period, underscoring the ongoing need for technological advancement in this area.

SiriusXM's digital streaming platforms, like Pandora and its own SiriusXM app, are in constant need of technological upgrades to stay ahead. This means ongoing investment in innovation to keep users engaged.

Key improvements focus on making the user experience smoother, offering better personalized music selections, and enhancing search capabilities. Seamless integration with smart home devices and other connected technologies is also crucial for attracting and holding onto streaming subscribers in the competitive market.

For instance, as of Q1 2024, SiriusXM reported 73.9 million total subscribers, with a significant portion engaging through its digital platforms, highlighting the importance of these technological advancements for subscriber growth and retention.

Sirius XM's ability to effectively monetize its ad-supported content hinges on advancements in advertising technology (AdTech). These technologies are crucial for growing advertising revenue by enabling more targeted and efficient ad delivery.

The company is actively investing in AdTech and developing innovative in-car advertising experiences. This strategic focus aims to streamline campaign planning and enhance measurement capabilities for advertisers, making Sirius XM a more attractive platform.

AI and Data Analytics for Content and User Experience

Sirius XM is actively integrating artificial intelligence (AI) and advanced data analytics to refine its content delivery and user engagement. This strategic focus aims to provide highly personalized content recommendations and streamline content discovery for its subscribers.

The company's investments in AI are geared towards enhancing the scalability of its operations and continuously improving the overall user experience across its platforms. By leveraging these technologies, Sirius XM seeks to better understand listener preferences and tailor offerings accordingly.

- Personalized Recommendations: AI algorithms analyze listening habits to suggest new channels, artists, and podcasts, increasing user engagement.

- Content Discovery: Data analytics helps identify trending content and emerging artists, ensuring a fresh and relevant library for subscribers.

- Operational Efficiency: AI tools are being implemented to automate certain processes, allowing for more efficient content management and scaling of services.

- User Experience Optimization: Continuous analysis of user data informs improvements to the platform's interface and functionality, making it more intuitive and enjoyable.

Competitive Technology Landscape

Sirius XM operates in a dynamic technological arena, challenged by major streaming players. Its success hinges on technological innovation, especially in audio fidelity and cross-platform user experience, to stay competitive with giants like Spotify and Apple Music.

The competitive technology landscape is characterized by continuous advancements in audio streaming, personalized content delivery, and integrated smart device experiences. Sirius XM’s ability to adapt and leverage these technological shifts is paramount.

- Technological Competition: Sirius XM faces intense competition from digital audio platforms such as Spotify, Apple Music, and Amazon Music, which offer vast on-demand libraries and advanced personalization features.

- Innovation Imperative: Maintaining market share requires Sirius XM to continuously innovate its proprietary satellite and streaming technologies, focusing on enhanced audio quality, user interface improvements, and seamless integration across various devices and vehicles.

- Data Analytics and AI: The effective use of data analytics and artificial intelligence for content recommendation and user engagement is a key technological differentiator for competitors, a space Sirius XM must actively develop.

- Connected Car Ecosystem: As vehicles become more integrated with digital services, Sirius XM's ability to provide a superior in-car audio experience, often bundled with vehicle purchases, is a significant technological advantage, though it faces competition from native infotainment systems and smartphone mirroring technologies.

Sirius XM's technological strategy centers on its core satellite infrastructure and expanding digital platforms, requiring ongoing investment in both areas. The company is actively enhancing its streaming services, like Pandora, through AI-driven personalization and improved user interfaces to boost subscriber engagement, a critical factor given its 73.9 million total subscribers as of Q1 2024.

Furthermore, advancements in advertising technology (AdTech) are crucial for monetizing ad-supported content, with Sirius XM investing in targeted ad delivery and in-car advertising solutions to attract advertisers and improve campaign measurement.

The company's commitment to technological innovation is also evident in its focus on AI and advanced data analytics, which are being leveraged to refine content delivery, personalize recommendations, and streamline operations, ultimately aiming to enhance the overall subscriber experience.

Sirius XM faces significant competition from major streaming players, necessitating continuous innovation in audio fidelity, user experience, and cross-platform integration to maintain its market position.

| Technology Area | Key Initiatives | Impact/Goal |

|---|---|---|

| Satellite Infrastructure | Satellite launches and upgrades | Ensure uninterrupted service, broaden reach, maintain core offering |

| Digital Streaming Platforms (Pandora, SiriusXM App) | AI-driven personalization, improved UI/UX, seamless device integration | Increase user engagement, subscriber growth and retention |

| Advertising Technology (AdTech) | Targeted ad delivery, in-car advertising solutions | Grow advertising revenue, enhance advertiser value proposition |

| Data Analytics & AI | Personalized content recommendations, operational efficiency | Enhance user experience, improve scalability, better understand listener preferences |

Legal factors

Sirius XM Holdings, Inc. operates under a complex web of federal and state regulations, primarily overseen by the Federal Communications Commission (FCC). These regulations dictate everything from satellite operations and spectrum usage to content distribution and advertising standards. Failure to comply can result in significant fines and, more critically, the potential loss of essential operating licenses.

Maintaining compliance with FCC mandates, including those concerning satellite fees and broadcast content standards, is a non-negotiable aspect of Sirius XM's business model. For instance, in 2023, the company continued to navigate the ongoing regulatory landscape surrounding satellite spectrum allocation and potential future uses, which directly impacts their operational costs and strategic planning.

Sirius XM Holdings has encountered significant legal hurdles concerning consumer protection, especially regarding its subscription models and billing clarity. These challenges often stem from practices that consumers perceive as misleading or unfair.

Recent legal actions, including class action lawsuits and specific court decisions, have put pressure on Sirius XM. For instance, disputes over cancellation policies and the disclosure of fees, such as the 'US Music Royalty Fees,' have led to settlements and required modifications to customer contracts and marketing materials. In 2023, the company reached a significant settlement in a class-action lawsuit concerning its cancellation practices, reportedly costing tens of millions of dollars, underscoring the financial implications of these consumer protection issues.

Sirius XM Holdings, Inc. faces significant legal challenges stemming from its extensive use of copyrighted music and other content. These intellectual property rights and royalty disputes are a constant concern, impacting its operational costs and financial stability.

The company's reliance on licensed music means it's perpetually engaged in complex royalty payment negotiations. For instance, ongoing legal battles and previously failed settlement talks with entities like SoundExchange, a digital music performance rights organization, underscore the intricate and costly nature of these licensing obligations.

In 2023, SoundExchange reported collecting over $1.1 billion in royalties, a figure that illustrates the scale of payments involved in music licensing. Sirius XM's ability to manage these royalty costs and resolve disputes efficiently is crucial for its profitability.

Data Privacy and Security Regulations

Sirius XM Holdings, Inc. operates under a complex web of data privacy and security regulations, particularly given its handling of substantial user data from its streaming services. Compliance with laws like the California Consumer Privacy Act (CCPA) and GDPR is paramount. Failure to protect this sensitive information can result in substantial penalties; for instance, under GDPR, fines can reach up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates robust data protection measures and ongoing vigilance.

The company's commitment to data security directly impacts its legal standing and financial health. In 2023, data breaches continued to be a significant concern across industries, with the average cost of a data breach reaching $4.45 million according to IBM's 2023 Cost of a Data Breach Report. For Sirius XM, a breach could trigger not only regulatory fines but also costly lawsuits from affected users and severe reputational damage, impacting subscriber trust and future revenue streams.

- Data Privacy Compliance: Sirius XM must adhere to evolving global data privacy laws, such as the CCPA and GDPR, to protect user information.

- Security Breach Costs: The average cost of a data breach in 2023 was $4.45 million, highlighting the financial risks associated with inadequate security.

- Legal Liabilities: Non-compliance can lead to significant fines, regulatory sanctions, and private litigation, impacting the company's bottom line.

- Reputational Risk: Data security failures can erode customer trust, potentially leading to subscriber churn and long-term brand damage.

Antitrust Litigation and Market Dominance

Sirius XM Holdings, Inc.'s substantial market share in satellite radio, estimated to be over 80% of the U.S. satellite radio market as of early 2024, positions it as a potential target for antitrust scrutiny. Regulatory bodies and competitors may examine its business practices to ensure they do not unfairly stifle competition in the evolving audio entertainment landscape. While no major antitrust litigation is currently ongoing, the dynamic nature of streaming services and podcasts means this remains a persistent legal risk.

The company's dominant position could lead to challenges if its pricing strategies, content exclusivity deals, or platform access are deemed anti-competitive. For instance, if Sirius XM were to leverage its subscriber base to disadvantage emerging audio platforms, it could trigger investigations. The Federal Trade Commission (FTC) and the Department of Justice (DOJ) actively monitor market concentration and competitive practices across industries.

- Market Share Dominance: Sirius XM holds a commanding position in the U.S. satellite radio sector, exceeding 80% market share.

- Potential for Scrutiny: This dominance raises the possibility of antitrust investigations if business practices are perceived as anti-competitive.

- Evolving Audio Market: Increased competition from streaming services and podcasts intensifies the need for fair market practices.

- Regulatory Oversight: Agencies like the FTC and DOJ are tasked with preventing monopolistic behavior and ensuring fair competition.

Sirius XM's operations are heavily regulated by the FCC, impacting spectrum use and content standards, with non-compliance risking fines and license loss. Consumer protection laws also pose challenges, as seen in 2023 settlements over cancellation policies, costing tens of millions. Furthermore, intellectual property rights and royalty negotiations, such as those with SoundExchange, which collected over $1.1 billion in royalties in 2023, significantly influence operational costs.

The company's substantial market share, over 80% in U.S. satellite radio by early 2024, invites potential antitrust scrutiny from bodies like the FTC and DOJ, especially as the audio market evolves with streaming and podcasts.

| Legal Factor | Description | 2023/2024 Data Point | Impact |

|---|---|---|---|

| Regulatory Compliance (FCC) | Adherence to FCC rules on spectrum, content, and operations. | Ongoing navigation of satellite spectrum allocation. | Operational costs, strategic planning. |

| Consumer Protection | Addressing issues in subscription models, billing, and cancellation policies. | 2023 class-action settlement over cancellation practices (tens of millions). | Financial costs, contract modifications. |

| Intellectual Property & Royalties | Managing music licensing and royalty payments. | SoundExchange collected over $1.1 billion in royalties in 2023. | Significant operational costs, dispute resolution. |

| Antitrust Concerns | Potential scrutiny due to dominant market share. | Over 80% U.S. satellite radio market share (early 2024). | Risk of investigations, need for fair market practices. |

Environmental factors

Sirius XM Holdings, Inc. recognizes the significance of managing its carbon footprint and actively explores avenues to enhance operational energy efficiency. This focus aligns with a broader corporate commitment to environmental stewardship and minimizing ecological impact.

In 2023, Sirius XM reported that its Scope 1 and Scope 2 greenhouse gas emissions were approximately 19,000 metric tons of CO2 equivalent, a slight decrease from 2022. The company is investing in upgrading its data center cooling systems and transitioning to more energy-efficient lighting across its facilities to achieve further reductions.

Sirius XM's reliance on satellites means environmental concerns extend beyond Earth's atmosphere. The launch of new satellites and the ongoing management of existing ones are subject to regulations aimed at minimizing the creation of space debris. While Sirius XM hasn't publicly highlighted space debris as a primary risk, the increasing global focus on sustainable space operations, with entities like the European Space Agency actively tracking and mitigating debris, presents an indirect environmental factor for satellite operators.

Sirius XM, as a provider of satellite radio receivers, must consider the environmental impact of electronic waste. The disposal and recycling of these devices are growing concerns globally. For instance, the United Nations reported in 2022 that global e-waste generation reached 53.6 million metric tons, highlighting the scale of the issue.

While Sirius XM's direct manufacturing is limited, the lifecycle of its hardware necessitates responsible end-of-life management. Companies in the electronics sector are increasingly scrutinized for their e-waste policies, with regulatory bodies worldwide implementing stricter guidelines for disposal and recycling programs. This trend is likely to continue, influencing operational considerations for all electronics-dependent businesses.

Regulatory Compliance with Environmental Laws

Sirius XM Holdings, Inc. actively monitors and adapts its operations to comply with a growing landscape of environmental regulations. This includes adhering to standards related to emissions, waste management, and energy consumption, crucial for a company with a significant physical infrastructure and broadcast operations.

The company's commitment to environmental compliance is a strategic imperative, aiming to avoid penalties and safeguard its brand image. For instance, in 2023, the US Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act, impacting broadcast tower operations and vehicle manufacturing standards that indirectly affect satellite radio adoption.

- Regulatory Scrutiny: Increased focus on carbon emissions and electronic waste management presents ongoing compliance challenges.

- Compliance Costs: Investments in cleaner technologies and waste reduction programs are factored into operational budgets.

- Reputational Risk: Non-compliance can lead to significant fines and damage public perception, impacting subscriber trust.

- Future Legislation: Anticipating evolving environmental policies, such as those concerning data center energy efficiency, is key to long-term operational planning.

Corporate Environmental Responsibility Initiatives

Sirius XM Holdings, Inc. integrates environmental responsibility into its core strategy, featuring a dedicated pillar for 'Efficiency & Environmental Responsibility' within its corporate framework. This approach highlights a commitment to enhancing its offerings while actively considering environmental impacts.

This strategic focus demonstrates an intent to harmonize business operations with overarching environmental sustainability objectives, reflecting a growing trend among media and entertainment companies to address their ecological footprint.

- Operational Efficiency: Sirius XM's commitment to efficiency likely translates to efforts in reducing energy consumption across its broadcast infrastructure and office spaces.

- Sustainable Content Delivery: The company may explore more energy-efficient methods for content streaming and distribution to minimize its carbon emissions.

- Waste Reduction: Initiatives could include programs for reducing waste in office environments and potentially exploring recycling and sustainable sourcing for hardware and materials.

Sirius XM's environmental strategy focuses on reducing its carbon footprint, with a reported 19,000 metric tons of CO2 equivalent in Scope 1 and 2 emissions in 2023. The company is investing in energy-efficient upgrades for its data centers and facilities. Beyond terrestrial operations, the company must also consider the environmental implications of space debris for its satellite infrastructure, a growing global concern.

| Environmental Focus Area | 2023 Data/Initiatives | Impact/Consideration |

|---|---|---|

| Greenhouse Gas Emissions | 19,000 metric tons CO2e (Scope 1 & 2) | Slight decrease from 2022; ongoing efficiency upgrades |

| Energy Efficiency | Data center cooling upgrades, energy-efficient lighting | Reducing operational energy consumption |

| Space Debris | N/A (Indirect factor) | Increasing global focus on sustainable space operations |

| Electronic Waste (E-waste) | N/A (Hardware lifecycle) | Global e-waste reached 53.6 million metric tons in 2022; increasing regulatory scrutiny |

PESTLE Analysis Data Sources

Our Sirius XM PESTLE Analysis is built on a robust foundation of data from official government filings, reputable financial news outlets, and leading industry research firms. We incorporate regulatory updates, economic indicators, and technological advancements to provide a comprehensive view.