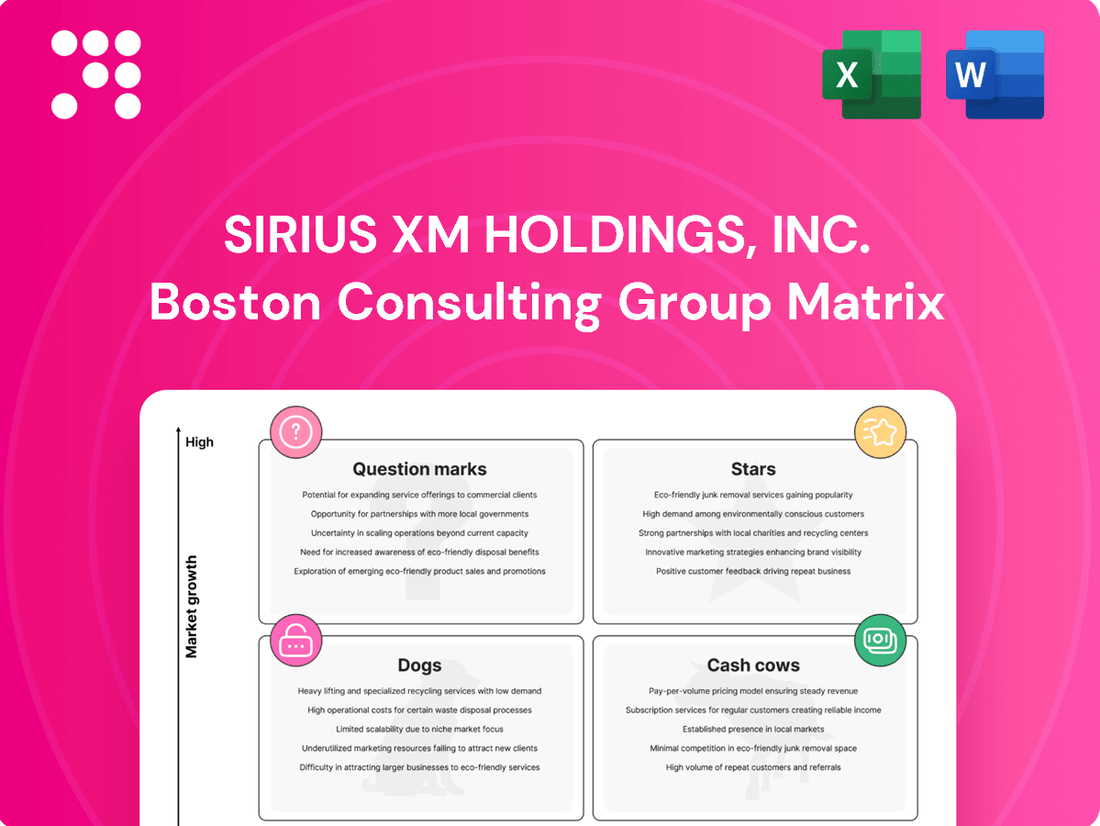

Sirius XM Holdings, Inc. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sirius XM Holdings, Inc. Bundle

Curious about Sirius XM Holdings, Inc.'s market position? Our BCG Matrix preview offers a glimpse into their product portfolio's potential, highlighting areas of growth and stability. Understand which services are driving revenue and which might need a strategic rethink.

Don't settle for a partial view. Purchase the full BCG Matrix report to gain a comprehensive understanding of Sirius XM's Stars, Cash Cows, Dogs, and Question Marks, complete with data-backed recommendations for optimizing their business strategy.

Unlock actionable insights and elevate your strategic planning. The complete BCG Matrix for Sirius XM Holdings, Inc. is your essential tool for making informed investment decisions and navigating the competitive landscape with confidence.

Stars

SiriusXM's podcast network is a prime example of a Stars in the BCG Matrix. The segment experienced a substantial 24% surge in advertising revenue throughout 2024. This growth trajectory continued into the first quarter of 2025 with a remarkable 33% year-over-year increase.

The company's strategic content acquisition, including deals with prominent talent, has fueled this expansion. By Q1 2025, SiriusXM reported reaching an impressive 70 million monthly podcast listeners, solidifying its position as a dominant force in the burgeoning audio market.

SiriusXM's 360L platform, blending satellite and streaming, is a significant growth engine. New vehicle integrations with Hyundai, Genesis, and Mitsubishi starting in 2025 are expected to bolster its reach within the automotive sector.

This advanced in-car audio experience is designed to enhance subscriber loyalty and unlock new revenue streams by providing a richer, more personalized listening environment.

SiriusXM is heavily investing in its in-car entertainment platform, aiming to solidify its position as the premier audio service within vehicles. This strategic shift prioritizes enhancing the connected car experience, a move that directly leverages its existing widespread presence in automobiles.

The company's 2024 strategy centers on improving the user interface and content discovery within the car, recognizing this as its primary competitive advantage. This focus is expected to boost subscriber loyalty and reduce churn, a key metric for subscription-based businesses.

By concentrating on the automotive ecosystem, SiriusXM aims to capitalize on the increasing number of connected vehicles, where its integrated service offers a seamless listening experience. This approach is designed to differentiate it from standalone streaming services that lack the same deep automotive integration.

New Exclusive Content & Talent Deals

Sirius XM Holdings, Inc. is strategically leveraging its exclusive content and talent deals to bolster its position in the competitive audio landscape. These investments are designed to attract and retain subscribers by offering unique, high-value programming.

The company's commitment to premium content is evident in its recent deals. For example, securing popular personalities like Kelly Clarkson and John Mayer, alongside major podcasts such as 'SmartLess' and 'Call Her Daddy,' directly addresses the demand for differentiated audio experiences. This focus on exclusive talent and programming is a key differentiator, helping SiriusXM stand out against a backdrop of increasing audio streaming options.

- Exclusive Content Strategy: SiriusXM continues to invest heavily in securing premium, exclusive, live, and on-demand content. This includes deals with high-profile talent and popular podcasts.

- Talent Acquisition: Notable talent acquisitions and partnerships include Kelly Clarkson, John Mayer, and major podcasts like 'SmartLess' and 'Call Her Daddy.'

- Competitive Differentiation: These unique offerings are crucial for attracting and retaining subscribers in a highly competitive audio market, setting SiriusXM apart from rivals.

- Subscriber Retention: The strategy aims to enhance subscriber loyalty and acquisition by providing content that cannot be found elsewhere, thereby supporting revenue streams.

Programmatic Advertising Growth

SiriusXM's ad-tech platform is a significant growth driver. In 2024, ad-tech platform revenue saw an impressive 18% increase. This growth is fueled by a strategic focus on monetizing its strong position in ad-supported audio.

Programmatic sales within SiriusXM are also performing well. Overall programmatic sales experienced a 10% rise as of Q2 2023. The company is actively investing in its ad-tech capabilities to enhance campaign planning and measurement tools.

- Ad-tech platform revenue growth: 18% in 2024.

- Programmatic sales increase: 10% from Q2 2023.

- Strategic focus: Monetizing ad-supported audio leadership.

- Investment priority: Enhancing ad-tech for planning and measurement.

SiriusXM's podcast network is a clear Star, showing robust growth with a 24% advertising revenue surge in 2024 and a 33% year-over-year increase in Q1 2025. This expansion is driven by strategic content acquisitions, reaching 70 million monthly listeners by Q1 2025.

The 360L platform, integrating satellite and streaming, is another Star, boosted by new vehicle integrations with Hyundai, Genesis, and Mitsubishi starting in 2025. This focus on the connected car experience enhances subscriber loyalty and revenue.

SiriusXM's ad-tech platform is performing strongly, with an 18% revenue increase in 2024, supported by a 10% rise in programmatic sales as of Q2 2023. The company is investing in these capabilities to improve ad campaign planning and measurement.

| Segment | BCG Category | Key Growth Drivers | 2024/2025 Data Points | |

|---|---|---|---|---|

| Podcast Network | Star | Content Acquisition, Listener Growth | 24% ad revenue growth (2024), 33% YoY increase (Q1 2025), 70M monthly listeners (Q1 2025) | |

| 360L Platform | Star | Connected Car Integration, Enhanced Experience | New vehicle integrations (2025) | |

| Ad-Tech Platform | Star | Monetization of Ad-Supported Audio, Tech Investment | 18% revenue growth (2024), 10% programmatic sales increase (Q2 2023) |

What is included in the product

Sirius XM's BCG Matrix highlights its satellite radio (Cash Cow) and streaming services (Question Mark) for strategic investment.

The Sirius XM BCG Matrix offers a clear, visual roadmap for resource allocation, relieving the pain of uncertain investment decisions.

Cash Cows

SiriusXM's core satellite radio subscription base, boasting around 33 million total subscribers by the close of 2024, stands as the company's most significant revenue driver. This substantial and largely consistent subscriber pool generates dependable cash flow, reinforcing SiriusXM's overall financial health and stability.

Sirius XM's established automotive partnerships are a cornerstone of its Cash Cow status within the BCG Matrix. These long-standing agreements with major automakers ensure that satellite radio hardware is pre-installed in new vehicles, creating a consistent stream of potential customers. For instance, in 2024, a significant portion of Sirius XM's new subscriber growth originated from these factory-installed units and associated trial subscriptions, underscoring the predictable revenue these relationships generate.

SiriusXM Holdings, Inc. demonstrates robust free cash flow generation, a key indicator of its status as a cash cow. For 2024, the company anticipates a notable increase in free cash flow, projected to be around 6%.

This anticipated growth is largely attributed to a planned reduction in satellite-related capital expenditures, freeing up significant resources. Such consistent and strong cash generation empowers SiriusXM to effectively finance its ongoing operations.

Furthermore, this financial strength enables strategic investments in growth opportunities and facilitates the return of capital to shareholders through dividends or share buybacks, solidifying its cash cow position.

Loyal Subscriber Retention

Loyal subscriber retention is a significant strength for Sirius XM Holdings, functioning as a cash cow within their business model. The company has achieved an improving self-pay monthly churn rate, hitting 1.6% in Q1 2025, a figure very close to its historical best. This strong subscriber loyalty for its core satellite radio offering provides a stable and predictable recurring revenue stream, underscoring the robustness of its established business.

This dependable revenue stream is crucial for Sirius XM's financial health.

- Improved Churn Rate: Self-pay monthly churn reached 1.6% in Q1 2025, nearing historical lows.

- Recurring Revenue: High subscriber loyalty ensures a consistent and reliable income.

- Resilient Business Model: The established service demonstrates enduring customer commitment.

- Cash Cow Status: This loyal subscriber base generates significant, predictable cash flow.

Profitable Ad-Supported Talk & Sports Programming

SiriusXM's ad-supported talk and live sports programming, featuring exclusive channels and extensive major league coverage, are crucial for attracting and keeping a loyal listener base. These offerings are highly profitable, making a substantial contribution to the company's total revenue and adjusted EBITDA.

In 2023, SiriusXM reported total revenue of $8.7 billion, with advertising playing a significant role in their subscription and audio entertainment business. The company's focus on exclusive content, such as live sports broadcasts and popular talk shows, allows them to command premium advertising rates.

- High Profitability: Ad-supported talk and sports segments generate strong margins due to lower content acquisition costs compared to music.

- Audience Retention: Exclusive live sports rights and popular talk personalities foster deep listener engagement and reduce churn.

- Revenue Diversification: Advertising revenue provides a valuable secondary income stream alongside subscription fees.

- Market Leadership: SiriusXM's extensive sports rights, including NFL, MLB, NBA, and NHL, solidify its position in the sports audio market.

SiriusXM's core satellite radio business, supported by approximately 33 million subscribers at the end of 2024, functions as a significant cash cow. This stable subscriber base, bolstered by strong automotive partnerships and an improving churn rate of 1.6% in Q1 2025, generates predictable and substantial free cash flow, projected to increase by about 6% in 2024 due to reduced capital expenditures.

| Metric | 2023 Data | 2024 Projection | Significance |

|---|---|---|---|

| Total Subscribers | ~32.7 million | ~33 million | Indicates a stable, large customer base. |

| Self-Pay Monthly Churn | 1.7% (FY 2023) | 1.6% (Q1 2025) | Shows improving customer loyalty and retention. |

| Free Cash Flow | ~$1.5 billion (FY 2023) | ~6% increase | Demonstrates strong cash generation capabilities. |

| Automotive Partnerships | Ongoing | Continued expansion | Drives new subscriber acquisition through factory-installed units. |

What You See Is What You Get

Sirius XM Holdings, Inc. BCG Matrix

The BCG Matrix report you are previewing for Sirius XM Holdings, Inc. is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, detailing Sirius XM's product portfolio within the BCG framework, is ready for immediate strategic application without any alterations or watermarks. You can confidently use this preview as a direct representation of the high-quality, actionable insights that will be delivered to you, enabling immediate integration into your business planning and competitive analysis.

Dogs

Pandora, a key component of SiriusXM Holdings, is showing signs of weakness in its self-pay subscriber base. In the first quarter of 2025, this number dropped to 5.71 million, marking a 5% decrease compared to the previous year. This trend, coupled with a 6% year-over-year dip in overall active users, suggests Pandora is struggling to hold its ground in the intensely competitive music and podcast streaming market.

Pandora's ad-supported listener hours experienced a notable dip, falling by approximately 5% in the first quarter of 2025 when compared to the same period in the previous year. This trend highlights ongoing difficulties in keeping listeners engaged and effectively generating revenue from its free tier.

This decline in listener hours directly impacts Pandora's position within the Sirius XM Holdings, Inc. BCG Matrix. As a product with a declining market share and low growth prospects, Pandora's ad-supported segment likely falls into the Dogs category, indicating it may require careful management or potential divestment.

Legacy satellite radio hardware, often referred to as non-360L, represents a mature segment for SiriusXM Holdings, Inc. While these devices still contribute to the subscriber base, their growth trajectory is limited as the company pivots towards more advanced, connected services.

As of the first quarter of 2024, SiriusXM reported a total subscriber count of 34.5 million, with a significant portion still utilizing older hardware. However, the emphasis is clearly on the newer 360L platform, which offers enhanced features and streaming capabilities, indicating a strategic shift away from purely satellite-dependent hardware.

This legacy hardware segment can be viewed as a cash cow with declining relevance. While it generates consistent revenue, it requires minimal investment and is not a driver of future innovation or market share expansion, aligning with the characteristics of a 'cash cow' in the BCG matrix.

High-Cost, High-Churn Streaming Audience Pursuit (Past Strategy)

SiriusXM's prior focus on attracting streaming subscribers who were expensive to acquire and prone to canceling their subscriptions proved to be an ineffective strategy. This approach consumed significant capital without delivering the expected long-term customer value or market expansion.

The company has since pivoted, recognizing the inefficiency of these high-cost, high-churn acquisition efforts. In 2023, SiriusXM reported a net subscriber decrease of 1.2 million for its satellite radio service, highlighting the challenges in retaining its core base while also attempting to grow its streaming segment through costly means.

- Inefficient Spending: Marketing to these volatile streaming demographics drained resources that could have been allocated to more sustainable growth initiatives.

- Lack of Sustainable Growth: The strategy failed to build a loyal customer base, resulting in a revolving door of subscribers.

- Strategic Re-evaluation: SiriusXM's acknowledgment signifies a move towards more cost-effective and retention-focused customer acquisition models.

- 2023 Performance: The company's overall subscriber trends in 2023 underscore the need for a more robust and efficient growth strategy.

Overall Declining Revenue Trends

Sirius XM Holdings, Inc. is experiencing a concerning downward trend in its overall revenue. This decline is a significant factor when considering its position within the BCG Matrix, potentially placing it in the 'Dog' category if not addressed. The company reported a 4% decrease in total revenue for both the fourth quarter of 2024 and the full year 2024 when compared to the previous year. This negative momentum has continued into 2025, with a further 4% decline observed in the first quarter.

This persistent revenue shrinkage indicates that while certain business segments might be performing adequately, others are actively contracting. These underperforming areas are collectively pulling down the company's overall financial performance. Such a scenario is characteristic of 'Dogs' in the BCG Matrix, which typically have low market share and low growth prospects.

- Revenue Decline: Q4 2024 saw a 4% drop in total revenue compared to Q4 2023.

- Full Year Impact: The entirety of 2024 also registered a 4% decrease in revenue versus 2023.

- Continued Trend: Q1 2025 continued this pattern with another 4% revenue decline.

- Segmental Performance: The overall decline suggests some segments are shrinking, impacting the company's top line.

The overall revenue decline for Sirius XM Holdings, Inc. strongly suggests that certain segments of the business are underperforming, fitting the profile of 'Dogs' in the BCG Matrix. With a consistent 4% revenue decrease reported for Q4 2024, the full year 2024, and continuing into Q1 2025, the company is facing significant contraction. This indicates a low market share coupled with low growth prospects across the board, necessitating a strategic review of these underperforming areas.

| Metric | Q4 2024 vs Q4 2023 | Full Year 2024 vs 2023 | Q1 2025 vs Q1 2024 |

| Total Revenue Change | -4% | -4% | -4% |

Question Marks

SiriusXM Play, launched in July 2025, positions itself as a Question Mark in the BCG Matrix for Sirius XM Holdings. This new low-cost, ad-supported tier aims to capture a larger, budget-conscious audience, potentially tapping into a market segment that was previously underserved. Its high growth potential is evident in the goal of reaching nearly 100 million vehicles by the end of 2025, significantly expanding its reach.

However, the initiative faces challenges as it operates in a highly competitive audio streaming landscape, where market share is currently nascent. Significant investment will be required to build brand awareness, acquire subscribers, and develop compelling content for this new tier. The success of SiriusXM Play hinges on its ability to differentiate itself and attract users away from established free or lower-cost alternatives.

The standalone SiriusXM streaming app, launched in December 2023, aimed to broaden its appeal beyond the automotive sector. However, marketing efforts to capture younger demographics for this separate streaming service have fallen short of initial projections.

In the rapidly expanding streaming market, SiriusXM faces intense competition and has struggled to carve out a significant market share. This lack of established competitive strength, coupled with underperforming marketing, places the standalone app in the Question Mark category of the BCG matrix.

For the first quarter of 2024, Sirius XM Holdings reported a 2% decrease in total revenue, reaching $2.05 billion. While subscriber numbers remained relatively stable, the company's ability to attract new, younger users to its standalone streaming offering is a key challenge.

SiriusXM is heavily investing in AI-driven personalization and ad-tech, with a notable $200 million earmarked for AI tools. This strategic allocation aims to significantly boost user engagement and advertising revenue by tailoring experiences and optimizing ad delivery across its diverse platforms. These are considered high-growth areas with the potential to transform the business, though their full market impact is still unfolding.

Expansion of 'Free Access' Ad-Supported Tier

SiriusXM Holdings, Inc. is strategically expanding its 'Free Access' ad-supported tier, a move initiated in limited vehicle models in 2024 with plans for a wider 2025 rollout. This initiative aims to capture users whose paid subscriptions expire, offering them continued engagement through advertising and the potential for hyper-personalized ad experiences. This represents a significant growth strategy for SiriusXM, focusing on user retention and new monetization avenues, though its ultimate market penetration and long-term viability are still under assessment.

- Growth Strategy: The 'Free Access' tier is designed to combat churn by providing a free, albeit ad-supported, alternative to paid subscriptions, thereby extending the customer lifecycle.

- Monetization Potential: By leveraging user data, SiriusXM aims to deliver highly targeted advertisements, creating a new revenue stream beyond subscription fees.

- Market Impact: While specific 2024 penetration figures are not yet public, the broader 2025 rollout signals a commitment to this model, potentially increasing overall listener hours and ad revenue.

- Future Outlook: The success of this tier will depend on its ability to attract and retain a significant user base while effectively monetizing through advertising, a key factor in its BCG Matrix classification as a potential 'Star' or 'Question Mark' depending on early performance metrics.

Monetization of Podcast Video and Social Content

SiriusXM is leveraging its podcasting strength to monetize video and social content, aiming for new revenue streams in the digital space. This expansion into multi-platform content delivery is a strategic move to capture a larger audience and advertising dollars in a competitive market.

While podcasting revenue was robust, with SiriusXM reporting significant growth in its podcast segment, the monetization of video and social content is still developing. The company's market share and profitability in these newer formats are yet to be fully established, making them a developing area within their portfolio.

- Podcasting Revenue Growth: SiriusXM has seen substantial increases in its podcasting business, indicating a strong foundation for further content monetization.

- Multi-Platform Strategy: The move into video and social content is designed to reach a broader audience and diversify revenue sources beyond audio.

- Evolving Market Position: Market share and profitability in podcast video and social content are still being built, reflecting the dynamic nature of digital media monetization.

- Digital Media Landscape: This strategy aligns with broader industry trends where digital and social engagement are crucial for revenue generation.

The standalone SiriusXM streaming app, launched in December 2023, aims to attract younger demographics beyond the automotive sector but has not met initial projections.

In the competitive streaming market, SiriusXM struggles to gain significant share, with marketing efforts falling short, placing this offering in the Question Mark category.

For Q1 2024, Sirius XM Holdings reported $2.05 billion in revenue, a 2% decrease, highlighting challenges in attracting new, younger users to its streaming services.

The company's investment in AI-driven personalization, with $200 million allocated to AI tools, aims to boost engagement and ad revenue, representing a high-growth area whose market impact is still unfolding.

BCG Matrix Data Sources

Our BCG Matrix for Sirius XM is built on financial disclosures, market research on subscriber growth, and competitive analysis of streaming services.