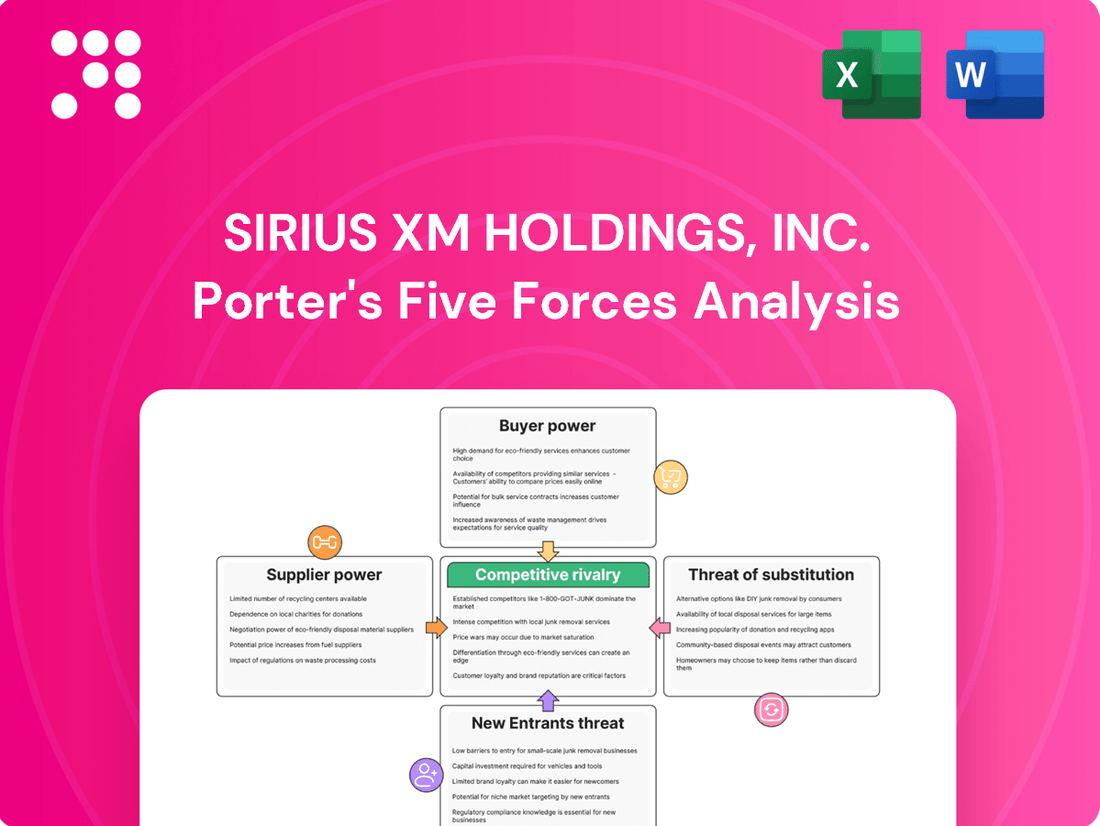

Sirius XM Holdings, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sirius XM Holdings, Inc. Bundle

Sirius XM Holdings, Inc. faces moderate threats from new entrants and substitutes, primarily due to the established brand and subscription model. However, buyer power is a significant force, as customers can choose from a vast array of entertainment options. The full Porter's Five Forces analysis reveals the strength and intensity of each market force affecting Sirius XM Holdings, Inc., complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

Content creators and talent hold significant bargaining power within Sirius XM Holdings, Inc. This is primarily due to the company's reliance on exclusive and unique programming, such as the highly popular Howard Stern show, live sports broadcasts, and a growing library of podcasts. In 2023, SiriusXM reported that its content and advertising revenue was approximately $7.7 billion, highlighting the substantial financial impact of these assets.

The ability of Sirius XM to attract and retain subscribers is directly tied to the appeal of its talent and exclusive content. When creators are highly sought after or their content is exclusive, their leverage increases, allowing them to negotiate more favorable terms. This was evident in past contract renewals for major personalities, which often involved substantial financial commitments from Sirius XM to secure continued access to their programming.

Automotive manufacturers, or OEMs, hold significant bargaining power over Sirius XM Holdings. This is because OEMs are the primary channel through which Sirius XM reaches new customers, embedding satellite radio and often offering complimentary trial subscriptions with new vehicle purchases. The sheer volume of vehicles produced by major OEMs, such as General Motors and Toyota, means their decisions on whether to include Sirius XM and on what terms directly impact Sirius XM's subscriber growth and revenue.

Sirius XM Holdings, Inc. relies on a limited number of specialized suppliers for critical satellite manufacturing, launch services, and ongoing maintenance. The immense cost and technical expertise required for these services mean that these suppliers hold considerable bargaining power. For instance, the cost of launching a satellite can range from tens of millions to over $100 million, and there are only a handful of companies globally capable of providing these services reliably.

Music Licensing Organizations

Sirius XM Holdings, Inc., particularly through its Pandora segment, relies heavily on music licensing, which places significant bargaining power in the hands of music licensing organizations. These organizations, such as ASCAP, BMI, and SESAC in the U.S., represent songwriters, composers, and publishers, controlling the rights to a vast catalog of music essential for Sirius XM's operations.

The collective strength of these organizations allows them to negotiate favorable terms for royalty payments, impacting Sirius XM's cost structure. For instance, in 2023, the U.S. Copyright Royalty Board (CRB) set the mechanical royalty rate for interactive streaming services, a key component of licensing costs, at 15.1% of revenue, with annual inflation adjustments. This demonstrates the direct financial impact these organizations can have.

- Music Rights Control: Licensing organizations hold the exclusive rights to a significant portion of the music played on Sirius XM, making their cooperation indispensable.

- Collective Bargaining: Acting as a unified front, these organizations can exert considerable pressure during rate negotiations, often leading to higher licensing fees.

- Legal Framework: The U.S. Copyright Act and subsequent rulings provide a legal basis for these organizations to collect and distribute royalties, reinforcing their power.

- Industry Standards: The rates and terms set through negotiations with these bodies often become industry benchmarks, influencing the overall cost of music content for streaming services.

Technology and Chipset Providers

Sirius XM Holdings, Inc. depends on technology and chipset providers for the essential hardware that enables satellite radio reception in vehicles and other devices. Changes in the cost and availability of these critical components can directly affect Sirius XM's equipment sales and operational expenses, demonstrating a degree of supplier influence.

For instance, the semiconductor industry, which supplies these chipsets, experienced significant supply chain disruptions in 2021 and 2022, leading to increased component costs globally. While specific figures for Sirius XM's chipset procurement are not publicly detailed, broader industry trends suggest that such volatility can translate into higher costs for the company's hardware partners, potentially impacting margins.

- Reliance on Specialized Hardware: Sirius XM's service delivery is fundamentally tied to the availability and cost of specialized chipsets and receivers.

- Potential Cost Volatility: Fluctuations in the semiconductor market, as seen with global shortages in recent years, can directly impact the cost of goods for Sirius XM's hardware.

- Impact on Equipment Revenue: Higher hardware costs for manufacturers could indirectly affect Sirius XM's equipment revenue streams or necessitate price adjustments.

Sirius XM Holdings, Inc. faces significant bargaining power from its content creators and talent, as exclusive programming is crucial for subscriber acquisition and retention. The company's reliance on personalities like Howard Stern, and its investment in podcasts and live sports, means these creators can command favorable terms. In 2023, SiriusXM's content and advertising revenue reached approximately $7.7 billion, underscoring the financial weight of its talent portfolio.

What is included in the product

Tailored exclusively for Sirius XM Holdings, Inc., analyzing its position within its competitive landscape by examining the threat of new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Sirius XM Holdings, Inc.

Gain a strategic advantage by pinpointing areas of vulnerability and opportunity within Sirius XM's competitive landscape, enabling proactive decision-making.

Customers Bargaining Power

Individual subscribers to Sirius XM Holdings, Inc. possess moderate bargaining power. The sheer volume of alternative audio entertainment, including Spotify, Apple Music, and a vast podcast landscape, provides consumers with readily available substitutes, limiting Sirius XM's pricing leverage. In 2023, the global music streaming market alone was valued at over $30 billion, highlighting the competitive intensity.

Customers often receive trial subscriptions to SiriusXM with new vehicle purchases, giving them significant leverage. Their choice to convert to a paid subscription hinges on their perceived value, directly impacting SiriusXM's revenue. In 2023, SiriusXM reported a subscriber base of approximately 33.6 million, highlighting the importance of this conversion process.

Advertisers on Pandora and Sirius XM's ad-supported channels hold moderate bargaining power. This power is shaped by the broader digital advertising landscape and Sirius XM's ability to deliver engaged audiences. In 2024, the digital advertising market continued its robust growth, with total U.S. ad spending projected to reach over $350 billion, creating a competitive environment where advertisers have choices.

The effectiveness of Sirius XM's audience reach and its sophisticated targeting capabilities directly influence how much leverage advertisers have. If Sirius XM can demonstrate superior reach within specific demographics or more precise targeting than competitors, its bargaining power increases, thus reducing the advertisers' leverage. Conversely, a highly fragmented ad market or less differentiated audience offerings would empower advertisers.

Businesses (Sirius XM Music for Business)

Businesses that subscribe to Sirius XM's commercial music services, like Sirius XM Music for Business, do possess a degree of bargaining power. This power stems from their potential purchase volume and the existence of alternative background music solutions available in the market. Sirius XM acknowledges this and strives to meet the diverse requirements of its business clientele through customized packages and service tiers.

The bargaining power of these business customers is influenced by several factors:

- Volume of Subscription: Larger businesses with multiple locations or higher anticipated usage can negotiate better rates due to their significant contribution to Sirius XM's revenue.

- Availability of Alternatives: The market offers various competitors providing background music, including streaming services, curated playlists, and even in-house music systems, giving businesses options to switch if pricing or service is unsatisfactory.

- Contractual Terms: The length and flexibility of contracts play a role; longer commitments might secure lower prices, but shorter terms offer more agility for businesses to re-evaluate their needs.

- Customization Needs: Businesses requiring specific genre mixes, ad-free experiences, or integration with their own branding can exert influence by demanding tailored solutions that competitors might offer more readily.

Price Sensitivity and Churn Rate

The price sensitivity of Sirius XM's customer base is a significant indicator of their bargaining power. When customers feel prices are too high or the value proposition isn't strong enough, they are more likely to seek alternatives or cancel their subscriptions, known as churn. This directly impacts Sirius XM's revenue and growth.

Sirius XM actively works to mitigate this customer power by offering a range of subscription tiers and content packages. These efforts are designed to cater to different customer needs and price points, aiming to reduce churn and maintain subscriber loyalty. For instance, in the first quarter of 2024, Sirius XM reported a subscriber base of 33.5 million, highlighting the scale of their customer relationships.

- Customer Price Sensitivity: High, as evidenced by the need for varied pricing plans.

- Churn Rate Impact: Directly affects revenue and requires retention strategies.

- Retention Efforts: Sirius XM utilizes diverse content bundles and pricing tiers to keep subscribers.

- 2024 Data: As of Q1 2024, Sirius XM maintained approximately 33.5 million total subscribers.

Individual subscribers hold moderate bargaining power due to numerous audio entertainment alternatives, a factor underscored by the global music streaming market's valuation exceeding $30 billion in 2023. This power is further influenced by trial subscriptions often bundled with new vehicle purchases, making conversion to paid services a critical decision point for the approximately 33.6 million subscribers in 2023.

| Factor | Impact on Bargaining Power | Sirius XM's Position |

| Availability of Substitutes | Moderate to High | Numerous streaming services and podcasts offer alternatives. |

| Switching Costs | Low | Easy to cancel or switch to a competitor. |

| Price Sensitivity | Moderate to High | Customers may churn if prices are perceived as too high. |

| Volume of Purchase (Business) | Moderate | Larger businesses can negotiate better rates. |

Preview the Actual Deliverable

Sirius XM Holdings, Inc. Porter's Five Forces Analysis

This preview showcases the complete Sirius XM Holdings, Inc. Porter's Five Forces analysis, offering a detailed examination of industry rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely what you will receive immediately after purchase, providing you with actionable insights into Sirius XM's competitive landscape without any surprises or placeholders.

Rivalry Among Competitors

The audio entertainment landscape is intensely competitive, with music streaming services like Spotify, Apple Music, and Amazon Music presenting a formidable rivalry to SiriusXM. These platforms boast extensive music catalogs, sophisticated recommendation engines, and a growing presence in podcasts and audiobooks, often available through freemium models or attractively priced subscriptions.

In 2024, Spotify continued its dominance, reporting over 615 million monthly active users by the first quarter, showcasing the sheer scale of its reach. Apple Music, while not releasing granular user numbers as frequently, is estimated to have over 100 million subscribers. Amazon Music also commands a significant user base, integrated within the broader Amazon ecosystem, further intensifying the competition for listener attention and subscription revenue.

The podcasting landscape is fiercely competitive, fueled by rapid industry growth and a constant influx of new platforms and exclusive content. Sirius XM, through its ownership of Pandora and its own podcast network, is directly in the thick of this rivalry.

Major players like Spotify, Apple Podcasts, and Amazon Music are aggressively acquiring talent and striking exclusive deals, creating significant competition for listener attention and advertising dollars. For instance, Spotify alone has invested heavily in podcasting, acquiring companies like Gimlet Media and Anchor, and signing high-profile personalities, aiming to capture a larger share of the estimated $2 billion podcast advertising market projected for 2024.

Traditional AM/FM radio continues to be a competitor, especially for local information like news and traffic, and for free music, particularly within vehicles. In 2024, a significant portion of in-car listening still favors AM/FM, with studies indicating it accounts for over 70% of audio consumed by drivers.

However, AM/FM radio's competitive edge is blunted by its limited national reach and inability to offer the diverse, ad-free programming found on satellite radio services. While it provides a free, accessible option, it cannot match the curated content and broader appeal of platforms like SiriusXM.

In-Vehicle Infotainment Systems and Connectivity

Automakers are increasingly embedding sophisticated infotainment systems and robust internet connectivity directly into vehicles. This trend allows consumers to access a wide array of streaming services and applications, effectively bypassing traditional satellite radio. For Sirius XM, this means a heightened competitive landscape as these integrated systems offer alternatives that reduce reliance on their core offering.

The shift towards in-car digital ecosystems directly challenges Sirius XM's market position. For instance, by 2024, a significant percentage of new vehicles are expected to feature advanced connectivity, providing seamless integration with popular music and podcast platforms. This growing capability within the vehicle itself presents a direct substitute for satellite radio content, intensifying rivalry.

- Increased Vehicle Connectivity: By 2024, over 90% of new vehicles sold in major markets are projected to feature some form of advanced connectivity, enabling direct app access.

- Growth of In-Car Streaming: The market for in-car audio streaming services is expanding rapidly, with projections indicating double-digit annual growth through 2025.

- Automaker Partnerships: Major automakers are forging direct partnerships with tech companies and streaming providers, further integrating these alternatives into the vehicle's native experience.

- Consumer Preference Shift: Consumer surveys indicate a growing preference for integrated, app-based entertainment solutions over subscription-based satellite services.

Emerging Audio Technologies (e.g., AI-generated audio, Spatial Audio)

Emerging audio technologies like AI-generated audio and spatial audio represent a nascent but potentially disruptive force for Sirius XM Holdings. While these technologies are still in their early stages, they could fundamentally alter content creation and how audiences experience audio, potentially introducing new competitive avenues.

The impact on competitive rivalry is currently low but expected to grow. For instance, AI-generated audio could lower the barrier to entry for content creation, enabling smaller players to produce professional-sounding audio without traditional studio costs. Spatial audio, on the other hand, could shift listener expectations towards more immersive experiences, potentially favoring platforms that can deliver this enhanced quality.

- AI-Generated Audio: This technology can create realistic voiceovers, music, and even entire podcasts, potentially reducing reliance on human talent and opening doors for new, automated content providers.

- Spatial Audio: Offering a more immersive, 3D sound experience, spatial audio could become a key differentiator, requiring significant investment in content production and playback technology.

- Potential Impact: While Sirius XM is investing in advanced audio experiences, the long-term competitive landscape could see new entrants leveraging these technologies to offer niche or broadly appealing audio content in novel ways.

SiriusXM faces intense rivalry from streaming giants like Spotify, Apple Music, and Amazon Music, which offer vast catalogs and integrated podcasting. In 2024, Spotify's over 615 million monthly active users and Apple Music's estimated 100 million subscribers highlight the scale of this competition for listener attention and subscription revenue.

Traditional AM/FM radio remains a competitor, particularly for local content and free in-car listening, still accounting for over 70% of driver audio consumption in 2024. However, its limited reach and inability to offer curated, ad-free content make it less of a threat compared to digital platforms.

The increasing integration of advanced infotainment systems and connectivity in new vehicles by 2024, with over 90% of new vehicles in major markets featuring such technology, directly challenges SiriusXM. These systems enable seamless access to streaming services, reducing reliance on satellite radio.

Emerging technologies like AI-generated audio and spatial audio present a nascent but growing competitive threat, potentially lowering entry barriers for new content creators and shifting listener expectations for immersive experiences.

SSubstitutes Threaten

Free online radio and music applications, such as Spotify Free, Pandora Free, and YouTube Music, present a potent threat of substitutes for Sirius XM. These platforms offer vast music libraries and live radio-like stations, often supported by advertising, providing a zero-cost alternative for consumers. For instance, Spotify reported over 600 million monthly active users globally as of Q1 2024, with a significant portion utilizing their free tier, highlighting the broad reach of these substitutes.

Consumers increasingly rely on personal music libraries, encompassing downloaded tracks and streaming service offline caches, which directly compete with Sirius XM's curated audio content. This trend is fueled by the accessibility of vast digital music collections, often acquired through various platforms, offering a cost-effective alternative to recurring subscription fees.

The rising appeal of audiobooks and platforms like Audible, owned by Amazon, offers a significant alternative to Sirius XM's spoken-word content. In 2023, the audiobook market was valued at over $1.7 billion, demonstrating substantial consumer adoption.

Similarly, specialized educational content platforms, such as MasterClass or Coursera, provide engaging audio and video learning experiences that can substitute for Sirius XM's talk radio and educational programming. These platforms cater to a desire for knowledge and self-improvement, directly competing for listener attention and time.

In-Car Connectivity and Smartphone Integration (Apple CarPlay, Android Auto)

The increasing prevalence of in-car connectivity, particularly Apple CarPlay and Android Auto, presents a significant threat of substitution for satellite radio services like Sirius XM. These platforms enable drivers to access a vast array of audio content, including music streaming, podcasts, and audiobooks, directly through their vehicle's existing infotainment systems. This integration diminishes the unique value proposition of satellite radio by offering a readily available and often more personalized alternative.

The adoption rate of these technologies is substantial. For instance, by the end of 2023, a significant percentage of new vehicles sold globally were equipped with either Apple CarPlay or Android Auto, making it a standard feature for many consumers. This widespread availability means that a large and growing segment of the driving population has direct access to competitive audio entertainment options.

Consider these points regarding the threat of substitutes:

- Seamless Integration: Apple CarPlay and Android Auto offer a familiar and intuitive interface, allowing users to control their smartphone's audio apps using voice commands or the car's touchscreen.

- Cost-Effectiveness: For many consumers, using their existing smartphone data plans to stream audio through these systems is perceived as more cost-effective than a separate satellite radio subscription.

- Content Variety: The sheer volume and diversity of content available through streaming services and apps far exceed the curated channels offered by satellite radio, catering to a wider range of tastes and preferences.

- Technological Advancement: As smartphone capabilities and app ecosystems continue to evolve, the functionality and appeal of in-car smartphone integration are likely to grow, further intensifying the competitive pressure on satellite radio.

Other Forms of In-Vehicle Entertainment

Other forms of in-vehicle entertainment can act as substitutes for Sirius XM's audio offerings. These include integrated navigation systems that provide auditory cues, built-in infotainment systems capable of video streaming in some newer models, and even the simple act of enjoying silence or engaging in conversation with passengers.

These alternatives compete for the driver's and passengers' attention and time within the vehicle. For instance, while Sirius XM provides curated audio content, a driver might opt for a podcast downloaded to their phone or a playlist streamed via Bluetooth, directly bypassing the need for a satellite radio subscription.

- Built-in Navigation Systems: Offer auditory directions and traffic updates, reducing reliance on separate audio entertainment.

- Video Streaming Capabilities: Newer vehicles increasingly feature screens that can display video content, diverting attention from audio.

- Personalized Audio Options: Streaming services and downloaded media offer tailored listening experiences that may be preferred over satellite radio channels.

The threat of substitutes for Sirius XM is significant, primarily driven by the widespread availability and low cost of digital audio alternatives. Free streaming services like Spotify and Pandora, along with personal music libraries, offer vast content choices that directly compete with Sirius XM's curated programming. These digital platforms are increasingly accessible through in-car systems like Apple CarPlay and Android Auto, which are now standard in a majority of new vehicles sold, further eroding Sirius XM's market position.

The growing popularity of audiobooks, exemplified by Audible's substantial market presence, and educational platforms like MasterClass, also divert listener attention from Sirius XM's spoken-word content. Consumers are seeking diverse audio experiences, and these substitutes provide compelling alternatives, often at a lower or no direct cost compared to a satellite radio subscription.

The ability to access personalized playlists, podcasts, and even video content through integrated vehicle systems means consumers have more control and variety than ever before. This shift in consumer behavior, coupled with the technological advancements in infotainment, creates a challenging landscape for traditional satellite radio providers.

| Substitute Category | Key Players/Examples | Consumer Benefit | Impact on Sirius XM |

|---|---|---|---|

| Free Music Streaming | Spotify Free, Pandora Free, YouTube Music | Vast libraries, zero cost (ad-supported) | Directly competes for music listening time |

| Personal Music Libraries | Downloaded tracks, offline streaming caches | Cost-effective, personalized control | Reduces reliance on curated channels |

| Audiobooks | Audible, Libro.fm | Engaging spoken word, educational | Substitutes for talk radio and podcasts |

| In-Car Connectivity | Apple CarPlay, Android Auto | Seamless integration, access to all apps | Enables easy switching to competing services |

Entrants Threaten

Launching a new satellite radio service demands a colossal upfront investment, encompassing satellite manufacturing, launch services, and ground infrastructure. For instance, the initial capital outlay for a single geostationary satellite can easily run into hundreds of millions of dollars, with multiple satellites needed for comprehensive coverage.

Beyond the financial strain, new entrants face significant regulatory obstacles. Obtaining licenses from bodies like the Federal Communications Commission (FCC) is a complex and lengthy process, often involving extensive spectrum auctions and compliance with stringent operational standards. These barriers effectively deter smaller players from entering the market, reinforcing the dominance of established companies like Sirius XM.

New entrants face a significant hurdle in content acquisition and licensing. Building a library comparable to Sirius XM's, which includes exclusive deals with artists and sports leagues, would require immense upfront investment and time. For instance, securing rights for popular music genres and exclusive podcasts can cost millions, a barrier that deters many potential competitors.

Sirius XM's deeply entrenched relationships with major automakers, like Ford and General Motors, represent a formidable barrier to new entrants. These partnerships ensure their satellite radio service is pre-installed and offered with trial subscriptions in millions of new vehicles annually. For instance, in 2023, Sirius XM reported that approximately 70% of new vehicles sold in the U.S. came equipped with their satellite radio, a testament to these established ties.

The sheer scale and longevity of these collaborations make it incredibly difficult for any newcomer to replicate the same level of market penetration. Building similar trust and integration with automotive manufacturers requires substantial time, investment, and a proven track record, which new entrants simply lack.

Brand Recognition and Subscriber Base

Sirius XM benefits from a deeply ingrained brand recognition and a substantial, loyal subscriber base. This established presence acts as a significant barrier to entry, as new competitors would need to invest heavily in marketing and customer acquisition to even begin to challenge Sirius XM's entrenched position. The network effect, where more subscribers make the service more valuable, further solidifies this advantage.

Consider the sheer scale: as of the first quarter of 2024, Sirius XM reported approximately 33.5 million total subscribers. This vast customer pool is difficult and costly for new entrants to replicate.

- Brand Loyalty: Sirius XM's brand is synonymous with satellite radio for many consumers, fostering a strong sense of loyalty.

- Subscriber Lock-in: Once a customer is subscribed, the cost and effort to switch to a new service can be a deterrent.

- Economies of Scale: Sirius XM's large subscriber base allows for greater economies of scale in content acquisition and technology development, making it harder for smaller, new entrants to compete on price or offering.

- Customer Acquisition Costs: New entrants would face immense customer acquisition costs, needing to offer significant discounts or unique value propositions to lure subscribers away from the established player.

Technological Advancements and Infrastructure

While streaming platforms have lowered the barrier to entry for audio content, a new competitor aiming to replicate Sirius XM's integrated satellite and streaming model faces substantial hurdles. The sheer capital required for establishing and maintaining a robust satellite network, coupled with the development of a comparable digital streaming infrastructure, presents a significant deterrent.

- Satellite Infrastructure Investment: Building and launching a proprietary satellite constellation demands billions of dollars in upfront capital and ongoing operational expenses, a cost prohibitive for most new entrants.

- Hybrid Model Complexity: Integrating satellite delivery with a seamless digital streaming experience requires sophisticated technology and extensive network management, a complex undertaking to replicate.

- Spectrum Licensing: Securing the necessary radio spectrum licenses for satellite broadcasting is a lengthy and costly process, often involving government auctions and regulatory approvals.

The threat of new entrants for Sirius XM Holdings is generally low due to substantial capital requirements for satellite infrastructure and content licensing, alongside significant regulatory hurdles. For instance, as of Q1 2024, Sirius XM maintained approximately 33.5 million subscribers, a scale difficult for newcomers to match, and its established relationships with automakers, with around 70% of new U.S. vehicles featuring their service in 2023, further solidify its market position.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High cost of satellite manufacturing, launch, and ground infrastructure. | Prohibitive for most potential competitors. | Single geostationary satellite launch can cost hundreds of millions. |

| Regulatory Hurdles | Complex and lengthy licensing processes from bodies like the FCC. | Deters smaller players and requires significant compliance effort. | Spectrum auctions and stringent operational standards. |

| Content Acquisition | Immense investment needed for exclusive deals with artists and leagues. | Difficult to replicate Sirius XM's content library. | Securing rights for popular music and podcasts costs millions. |

| Distribution Channels | Entrenched relationships with automakers for pre-installation. | Limits market access for new entrants. | ~70% of new U.S. vehicles had Sirius XM in 2023. |

| Brand Loyalty & Scale | Established brand recognition and a large subscriber base. | High customer acquisition costs for newcomers. | ~33.5 million total subscribers as of Q1 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Sirius XM Holdings, Inc. is built upon a foundation of publicly available information, including their annual reports (10-K filings), investor presentations, and SEC filings. We also incorporate insights from reputable industry research reports and financial news outlets to capture current market dynamics and competitive pressures.