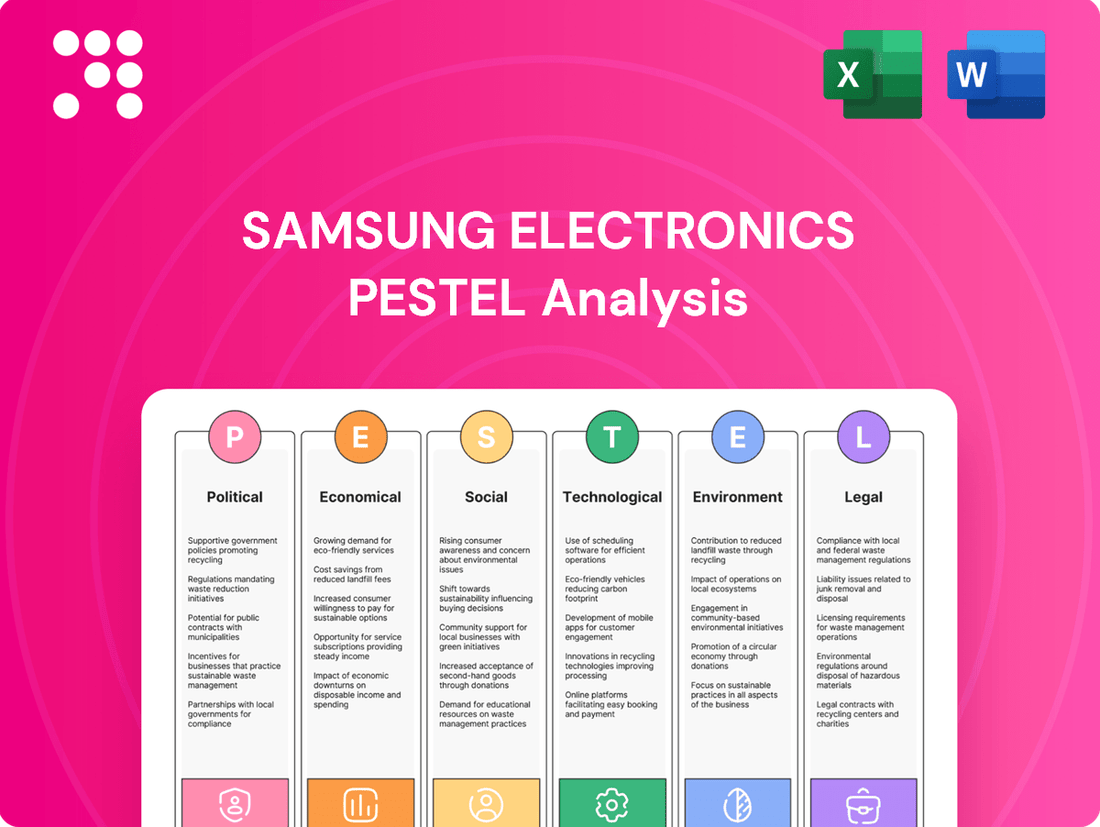

Samsung Electronics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung Electronics Bundle

Navigate the complex global landscape impacting Samsung Electronics with our detailed PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping their operations and future growth. Gain a competitive edge by leveraging these critical insights to refine your own market strategies. Download the full PESTLE analysis now for actionable intelligence that drives informed decisions.

Political factors

Samsung's global operations make it particularly vulnerable to geopolitical friction, especially between economic giants like the United States and China. These ongoing disputes can manifest as escalating tariffs or stricter export controls, directly disrupting Samsung's intricate supply chains and ultimately affecting its bottom line.

The intensifying tech rivalry between the US and China, for example, has a significant ripple effect on the semiconductor sector, a cornerstone of Samsung's business. In 2023, global semiconductor sales saw a notable downturn, with industry-wide revenues estimated to be around $520 billion, a decrease from the previous year, highlighting the sensitivity of this market to geopolitical pressures.

Samsung Electronics operates across the globe, necessitating compliance with diverse government regulations covering everything from labor practices to stringent data privacy mandates like GDPR. These varying legal frameworks significantly impact operational costs and market access.

South Korea's government actively supports its vital semiconductor sector through initiatives such as the K-CHIPS Act. This legislation offers substantial tax credits and aims to simplify regulatory processes, fostering a more competitive environment for domestic players like Samsung. The government is channeling significant investment into developing large-scale semiconductor clusters, further enhancing the industry's infrastructure.

South Korea's domestic political stability is a crucial element for Samsung Electronics, directly impacting its operational efficiency and the confidence of its investors. Any significant shifts or instability can create uncertainty, affecting market sentiment and investment flows.

Historically, South Korea has experienced political scandals involving major corporations and government officials. These events have prompted the implementation of more stringent anti-corruption regulations and heightened oversight of the relationships between businesses and the government, influencing Samsung's compliance and governance practices.

Instances of political upheaval, such as presidential impeachments, have historically led to negative repercussions in the stock market, dampening investor enthusiasm for large conglomerates like Samsung. For example, following the impeachment of President Park Geun-hye in 2017, the Kospi index saw volatility, reflecting broader investor concerns.

International Trade Policies and Tariffs

Changes in international trade policies and tariffs directly impact Samsung's operational costs and market access. For instance, the US's ongoing review of trade relations and potential tariff adjustments in 2024-2025 could significantly increase the cost of imported components for Samsung's electronics manufacturing. This situation underscores the need for Samsung to proactively diversify its supply chains and invest heavily in research and development to mitigate the financial and logistical risks associated with shifting global trade landscapes.

Samsung's global operations are particularly sensitive to trade disputes and protectionist measures. For example, a hypothetical 10% tariff on semiconductors imported into the US, a key market for Samsung, could add billions to its cost of goods sold in 2025. Such policies also affect the competitiveness of Samsung's finished products, potentially leading to reduced sales volumes.

- Supply Chain Vulnerability: Samsung's reliance on global component sourcing makes it susceptible to trade barriers.

- Cost Escalation: Tariffs on key materials like memory chips or display panels could inflate production expenses.

- Market Access Restrictions: Trade policies can limit Samsung's ability to freely export its products to certain regions.

- Strategic Adaptation: Samsung must continually adapt by diversifying manufacturing bases and exploring regional trade agreements.

Market-Specific Regulations

Samsung Electronics must navigate a complex web of market-specific regulations that can significantly impact its global sales and operational efficiency. For instance, in 2023, various countries continued to scrutinize technology imports and sales, with some instances involving legal and regulatory disputes that temporarily halted Samsung product sales, underscoring the critical need for rigorous compliance with local laws and intellectual property rights.

Emerging markets, in particular, are intensifying their focus on tax and trade compliance, posing an increased risk for multinational corporations like Samsung. This heightened scrutiny can lead to substantial fines or operational disruptions if not proactively managed. For example, in 2024, several Asian countries announced stricter enforcement of digital services taxes and import regulations, directly affecting consumer electronics companies.

- Increased scrutiny on import tariffs and duties in key markets like India and Brazil, potentially raising the cost of Samsung devices for consumers.

- Intellectual property disputes leading to temporary sales bans in regions with strong patent enforcement, as seen with past smartphone component litigation.

- Evolving data privacy laws, such as those in the EU (GDPR) and California (CCPA), requiring significant investment in compliance for Samsung's connected devices and services.

- Local content requirements in countries like Indonesia and Vietnam, mandating a certain percentage of components be sourced locally, impacting Samsung's supply chain strategy.

Geopolitical tensions, particularly between the US and China, directly impact Samsung's semiconductor business, with global sales in this sector experiencing a downturn in 2023, estimated around $520 billion. Trade policies and tariffs are a constant concern, with potential US tariffs in 2024-2025 threatening to increase component costs significantly. Furthermore, Samsung must navigate varying national regulations, including data privacy laws like GDPR, and local content requirements in emerging markets, which can affect supply chain strategies and operational costs.

What is included in the product

This PESTLE analysis of Samsung Electronics examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its global operations and strategy.

It provides a comprehensive overview of macro-environmental forces, highlighting potential threats and opportunities for Samsung's diverse product portfolio and market presence.

A concise, actionable summary of Samsung's PESTLE analysis, presented in a digestible format, alleviates the pain of sifting through extensive data for strategic decision-making.

This PESTLE analysis acts as a pain point reliever by offering a clear, segmented view of external factors impacting Samsung, enabling rapid identification of opportunities and threats for focused strategic planning.

Economic factors

Samsung's fortunes are intrinsically linked to the health of the global economy and how much consumers are willing and able to spend on electronics. A robust global economy generally translates to higher consumer confidence and increased spending on discretionary items like smartphones, TVs, and appliances, which are core to Samsung's business.

The global smartphone market experienced a positive trend, growing by approximately 7% in 2024. However, looking ahead to 2025, projections indicate a deceleration in growth. This slowdown is attributed to a combination of lingering economic uncertainties and consumers holding onto their devices for longer periods, a trend known as longer refresh cycles.

This evolving market dynamic necessitates that Samsung remains agile in its product development and marketing strategies. To sustain sales momentum amidst potentially slower consumer demand, the company must focus on innovation, value propositions, and potentially explore new market segments or product categories that are less sensitive to economic downturns.

Currency fluctuations, especially the Korean Won's movement against the US Dollar, directly influence Samsung Electronics' financial performance. For instance, in early 2024, a strengthening Won could reduce the value of overseas earnings when repatriated, impacting profitability.

A weaker Won, conversely, might boost export competitiveness but could also increase the cost of imported components. Managing these currency exposures is vital for a global player like Samsung, which generates a substantial portion of its revenue internationally.

Inflationary pressures continue to be a significant concern for Samsung. For instance, the Producer Price Index (PPI) for electronic components saw a notable increase in late 2023 and early 2024, directly impacting Samsung's raw material and manufacturing expenses. This rise in input costs forces Samsung to carefully consider price adjustments for its diverse product portfolio, from smartphones to home appliances, to protect its profit margins.

Global supply chain disruptions, exacerbated by geopolitical events and lingering pandemic effects, also contribute to rising operational costs for Samsung. Shipping rates for key components and finished goods remained elevated through much of 2024, adding to the overall cost of bringing products to market. Samsung's ability to navigate these logistical challenges and secure stable supply lines is crucial for maintaining competitive pricing in a market where consumers are increasingly mindful of their spending and holding onto devices for longer periods.

Investment in R&D and Facilities

Samsung's commitment to innovation and growth is evident in its significant R&D and facility investments, crucial for maintaining its economic edge. In 2024, the company allocated a record 35 trillion won to these areas, underscoring its strategic focus on future technologies.

These substantial investments are strategically directed towards key growth sectors, including artificial intelligence, advanced semiconductors, and next-generation memory solutions. This proactive approach aims to solidify Samsung's leadership in these competitive markets, even amidst prevailing global economic headwinds and fluctuating demand for specific memory products.

- Record Investment: Samsung's 2024 R&D and facility expansion budget reached approximately 35 trillion won, its largest ever.

- Strategic Focus Areas: Investments target AI, semiconductors, and high-performance memory technologies.

- Market Resilience: These investments are designed to bolster Samsung's competitive position despite global market challenges and softening demand in certain memory segments.

Market Share and Competition

Samsung Electronics operates in intensely competitive sectors, making market share a vital metric for success. In the second quarter of 2025, Samsung maintained its leading position in global smartphone shipments, a testament to its ongoing efforts in a crowded market.

However, the company is not without formidable rivals. Looking at 2024, Samsung experienced minor declines in its market share within the global TV and DRAM markets. These shifts underscore the constant pressure from competitors and the imperative for Samsung to consistently innovate and strategically adapt its market approach.

- Global Smartphone Market Share: Samsung held the top position in Q2 2025 global smartphone shipments.

- TV Market Share: Samsung saw a slight decrease in its global TV market share in 2024.

- DRAM Market Share: The company also experienced a minor reduction in its global DRAM market share during 2024.

Samsung's financial performance is significantly shaped by global economic conditions and consumer spending power, with the smartphone market showing a 7% growth in 2024 but expected to slow in 2025 due to economic uncertainty and longer device refresh cycles. Inflationary pressures, evident in rising electronic component prices, directly impact Samsung's manufacturing costs, necessitating careful pricing strategies to maintain profitability.

Currency fluctuations, particularly the Korean Won against the US Dollar, also play a crucial role, affecting the value of international earnings and export competitiveness. Navigating elevated global shipping rates and supply chain disruptions further adds to operational costs, demanding efficient logistics management to offer competitive pricing.

Samsung's substantial investments in R&D, totaling a record 35 trillion won in 2024, are strategically directed towards AI, semiconductors, and advanced memory solutions to bolster its competitive edge amidst market challenges.

While Samsung maintained its lead in global smartphone shipments in Q2 2025, it experienced minor declines in TV and DRAM market share in 2024, highlighting the constant need for innovation and strategic adaptation against fierce competition.

| Economic Factor | 2024 Data/Trend | 2025 Outlook | Impact on Samsung |

|---|---|---|---|

| Global Economic Growth | Moderate growth observed | Projected slowdown | Influences consumer spending on electronics |

| Inflation (Component Prices) | Notable increase in PPI for electronic components | Continued concern, potential for stabilization | Increases raw material and manufacturing costs |

| Currency Exchange Rates (KRW/USD) | Fluctuations impacting repatriated earnings and export costs | Continued volatility expected | Affects profitability and international competitiveness |

| Supply Chain Costs | Elevated shipping rates and disruptions persisted | Potential for gradual improvement, but risks remain | Increases operational and logistics expenses |

Same Document Delivered

Samsung Electronics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Samsung Electronics covers political, economic, social, technological, legal, and environmental factors impacting the company. You’ll gain valuable insights into the strategic landscape Samsung navigates.

Sociological factors

Consumer preferences are rapidly evolving, with a noticeable shift towards premiumization in the smartphone sector. This means consumers are increasingly willing to pay more for high-end devices that offer advanced features and superior user experiences. For instance, in 2024, the average selling price for premium smartphones continued its upward trajectory, driven by demand for cutting-edge technology.

Lifestyle trends are also playing a crucial role, with consumers holding onto their devices for longer periods. This extended device renewal cycle necessitates that companies like Samsung focus on durability, software updates, and compelling new innovations to entice upgrades. The increasing integration of Artificial Intelligence (AI) into everyday life is a prime example of a trend Samsung is capitalizing on, offering AI-powered features in its latest Galaxy devices to meet this demand.

To navigate these shifts effectively, Samsung must maintain a diverse product portfolio. This includes not only catering to the premium segment with flagship models but also offering competitive, affordable options to capture a broader market share. The company’s strategy in 2024 and 2025 will heavily rely on balancing these two approaches, ensuring innovation across all price points.

As technology rapidly evolves, bridging the digital divide and ensuring universal accessibility is paramount. Samsung's commitment to its 'AI for All' vision, extending AI features to a wider array of products like smart home appliances, aims to democratize technology and enhance daily living for a broader audience. This focus on inclusivity is crucial for market penetration.

Samsung's commitment to corporate social responsibility is evident in its youth-focused programs. In 2024, the company made substantial investments in initiatives like the Samsung SW·AI Academy for Youth, aiming to equip young individuals with crucial software and AI skills. This focus on education and empowerment is designed to foster societal development.

Looking ahead to 2025, Samsung plans to expand its AI training offerings, demonstrating a forward-thinking approach to skill development. These strategic investments not only contribute positively to the communities Samsung operates within but also serve to enhance its brand reputation and attract a new generation of skilled employees.

Health, Safety, and Human Rights in the Workplace

Samsung prioritizes employee well-being and ethical conduct, recognizing these as key sociological factors. The company has set an ambitious goal of achieving zero major industrial accidents by 2030, underscoring its commitment to a safe working environment. This focus extends to its entire value chain, with human rights risk assessments conducted across its global operations.

To further strengthen its commitment, Samsung is enhancing its Supplier Code of Conduct, with a more advanced version slated for implementation in 2025. This update is designed to proactively address evolving global regulations concerning labor practices and human rights within its extensive supply chain.

- Zero Major Industrial Accidents by 2030: A key target demonstrating Samsung's dedication to workplace safety.

- Global Human Rights Risk Assessments: Ongoing evaluations across all operational sites to identify and mitigate human rights issues.

- Advanced Supplier Code of Conduct (2025): Strengthening requirements for suppliers regarding labor practices and human rights to align with global standards.

Diversity, Equity, and Inclusion (DEI)

Samsung Electronics recognizes the importance of fostering diversity, equity, and inclusion (DEI) within its global workforce as a crucial social factor. The company has established ambitious targets, aiming to increase the representation of women in executive roles by 2030, reflecting a commitment to gender parity at leadership levels. Furthermore, Samsung actively supports employees with disabilities through dedicated programs such as 'Stellar Forest,' demonstrating a broader dedication to an inclusive corporate environment.

These initiatives are designed not only to cultivate a more equitable and welcoming workplace but also to significantly enhance Samsung's ability to attract and retain top talent. A strong DEI focus can lead to improved innovation and a better understanding of diverse customer bases. For instance, in 2023, Samsung reported that 35% of its global workforce was female, with ongoing efforts to boost this figure in management positions.

Key aspects of Samsung's DEI strategy include:

- Gender Diversity Goals: Aiming for increased female representation in executive positions by 2030.

- Disability Inclusion: Implementing programs like 'Stellar Forest' to support employees with disabilities.

- Talent Attraction and Retention: Leveraging DEI to build a more appealing and stable workforce.

- Global Workforce Statistics: As of 2023, women constituted 35% of Samsung's global employees, with a clear objective to elevate this in leadership roles.

Societal expectations increasingly favor companies that demonstrate strong corporate social responsibility and ethical practices. Samsung's focus on youth education through its SW·AI Academy for Youth in 2024, with plans for expansion in 2025, directly addresses this by investing in future talent and community development.

Consumer demand for sustainable and ethically produced goods is growing, influencing purchasing decisions. Samsung's commitment to enhancing its Supplier Code of Conduct by 2025, alongside its goal of zero major industrial accidents by 2030, signals an alignment with these societal values and a dedication to a responsible supply chain.

The emphasis on diversity, equity, and inclusion (DEI) is a significant sociological trend. Samsung's targets for increasing female representation in executive roles by 2030, coupled with programs supporting employees with disabilities, reflect an understanding of the importance of an inclusive workforce for innovation and talent retention.

Technological factors

Samsung's commitment to AI and semiconductor advancements is a significant technological driver. The company's substantial R&D investments in 2024, reaching record levels, underscore its focus on AI, high-performance memory, and server technologies, critical for maintaining its competitive edge in the global market.

This strategic investment is yielding tangible results, with Samsung actively embedding AI capabilities across its product portfolio. Innovations like Galaxy AI in smartphones and AI enhancements in smart TVs demonstrate this integration, while the development of advanced AI chips, such as the LPDDR5X DRAM, is specifically targeting the growing demand for on-device AI applications.

Samsung Electronics is a powerhouse in display innovation, driving the market with technologies like OLED, Neo QLED, and the cutting-edge MICRO LED. These aren't just incremental updates; Samsung consistently pushes boundaries. For instance, the company's 2024 TV lineup features Samsung Vision AI, a sophisticated system designed to optimize picture quality and user experience across its entire range, demonstrating a commitment to delivering superior viewing.

These advancements are critical for Samsung's dominance in the fiercely competitive consumer electronics sector. By leading in display tech, Samsung not only solidifies its position in traditional markets but also opens doors to new revenue streams. The company's exploration into areas like interactive projectors, powered by these advanced displays, showcases a strategic move to leverage its technological prowess beyond conventional screens, aiming for broader market penetration and enhanced customer engagement.

Samsung's leadership in 5G network solutions is a significant technological driver. The company has secured substantial 5G contracts, including a major deal with Verizon in 2020 valued at over $6 billion, showcasing its market strength. This expertise directly fuels its mobile communications division and opens avenues for smart city infrastructure and IoT deployments.

The company is also heavily invested in the future of connectivity, actively researching and developing 6G technology. While commercialization is still years away, Samsung aims to define the next generation of wireless communication, projecting speeds up to 50 times faster than 5G and ultra-low latency, which will revolutionize industries like autonomous driving and immersive virtual reality.

Smart Home and Connected Devices

Samsung is a major player in the smart home arena, embedding AI and connectivity into a wide range of its home appliances and devices. This commitment aligns with its overarching 'AI for All' strategy, which seeks to enhance daily life through more intelligent and interconnected experiences. For instance, Samsung's smart refrigerators and washing machines offer AI-powered features for optimized performance and user convenience.

The company's strategic collaborations extend to utility sectors, such as its partnership with British Gas. These alliances leverage smart technology to empower consumers in managing and reducing their energy usage, contributing to both cost savings and environmental sustainability. This focus on connected energy management is becoming increasingly crucial as energy prices fluctuate and environmental concerns grow.

The global smart home market is projected for significant growth. By 2025, it's estimated that the market will reach over $150 billion, with connected devices forming a substantial portion of this. Samsung's deep investment in this sector, including its development of proprietary AI platforms like Bixby and its integration across its product lines, positions it to capitalize on this expanding market.

- AI Integration: Samsung's smart home devices increasingly feature AI for personalized user experiences and operational efficiency.

- Ecosystem Development: The company actively builds a connected ecosystem, linking appliances, TVs, and mobile devices for seamless interaction.

- Energy Efficiency Focus: Partnerships like the one with British Gas highlight a strategic push towards smart energy management solutions.

- Market Growth: The expanding smart home market, valued in the hundreds of billions by 2025, presents a significant opportunity for Samsung's connected device portfolio.

Robotics and Automation

Samsung is significantly increasing its investment in robotics and automation, a trend clearly visible in its expanded stake in Rainbow Robotics. This strategic move highlights Samsung's ambition to integrate robotics across its operations, from optimizing manufacturing and logistics to developing advanced consumer products. The company showcased its vision at CES 2024 with AI-powered home robots like Ballie, demonstrating a commitment to this evolving technological frontier.

Samsung's investment in Rainbow Robotics, a South Korean robot manufacturer, reached approximately 59.4% in March 2024, solidifying its control and strategic direction in the robotics sector. This focus on automation is expected to enhance Samsung's production efficiency and supply chain management, while also paving the way for new revenue streams in the burgeoning field of intelligent robotics and AI-driven consumer devices.

- Increased Stake: Samsung's acquisition of a controlling stake in Rainbow Robotics for an estimated ₩1.04 trillion (approximately $780 million USD) underscores its serious commitment to robotics.

- Product Innovation: The continued development and showcasing of AI-powered robots like Ballie at events such as CES 2024 signals Samsung's intent to bring advanced robotics into everyday life.

- Operational Efficiency: Automation in manufacturing and logistics is a key driver for improving productivity and reducing costs within Samsung's global operations.

Samsung's technological prowess is a cornerstone of its strategy, with significant R&D investments in 2024 focusing on AI and advanced semiconductors. This commitment fuels innovations like Galaxy AI and next-generation AI chips, positioning Samsung at the forefront of on-device intelligence.

The company continues to lead in display technology, pushing boundaries with OLED, Neo QLED, and MICRO LED. Samsung's 2024 TV lineup integrates Samsung Vision AI for enhanced picture quality, demonstrating a clear drive for superior user experiences across its product ecosystem.

Samsung is a major force in connectivity, with substantial 5G contracts and active development in 6G technology, aiming for speeds up to 50 times faster than current 5G. This positions them to lead in future communication infrastructure and IoT applications.

The company is heavily invested in robotics, evidenced by its increased stake in Rainbow Robotics. This focus aims to enhance operational efficiency and drive innovation in AI-powered consumer robotics, as seen with products like Ballie.

| Technology Area | Key Initiatives/Products | 2024 Focus/Investment | Market Impact |

|---|---|---|---|

| Artificial Intelligence (AI) | Galaxy AI, AI Chips (LPDDR5X DRAM) | Record R&D investment | Enhanced user experience, on-device AI |

| Display Technology | OLED, Neo QLED, MICRO LED, Samsung Vision AI | 2024 TV lineup integration | Market leadership, new revenue streams |

| Connectivity | 5G Network Solutions, 6G Research | Major 5G contracts (e.g., Verizon), 6G development | Future communication infrastructure, IoT |

| Robotics & Automation | Rainbow Robotics stake, Ballie (AI Robot) | Increased stake in Rainbow Robotics (approx. 59.4% by March 2024) | Operational efficiency, consumer robotics innovation |

Legal factors

Samsung, a powerhouse of innovation, navigates a complex legal landscape shaped by intellectual property rights and patent disputes. As a company constantly pushing technological boundaries, safeguarding its extensive patent portfolio and vigorously defending against infringement allegations is a perpetual legal undertaking. These battles are not uncommon in the fiercely competitive tech industry, often leading to substantial legal expenses and potential disruptions to market access.

In 2023, Samsung was involved in numerous patent disputes, particularly concerning smartphone technology and semiconductor innovations. For instance, ongoing litigation with Ericsson regarding mobile communication patents continued to be a significant factor, with settlements often involving substantial royalty payments. The company also faced challenges related to its display technology patents, highlighting the critical need for robust legal strategies to protect its competitive edge.

Samsung Electronics faces a complex legal landscape regarding data privacy and security. With global regulations like the EU's General Data Protection Regulation (GDPR) and similar frameworks in other regions, the company must ensure robust compliance. This involves safeguarding user data across its vast product ecosystem, from smartphones to smart appliances.

To address these challenges, Samsung has significantly invested in its security platform, Samsung Knox. This platform is designed to protect personal information and has been extended to cover a broader array of devices. Samsung also offers extended security updates, a crucial element in maintaining compliance and user trust in the face of evolving cyber threats.

Failure to adhere to these data privacy and security laws can result in substantial financial penalties and significant damage to Samsung's reputation. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher, highlighting the critical importance of proactive compliance measures.

Samsung Electronics, as a global leader in consumer electronics and semiconductors, operates under the watchful eye of antitrust and competition regulators worldwide. These bodies, like the U.S. Federal Trade Commission (FTC) and the European Commission, actively monitor market share and potential monopolistic behaviors. For instance, the EU's Digital Markets Act (DMA), which came into full effect in March 2024, imposes stricter rules on large online platforms, impacting how companies like Samsung integrate their services and potentially limiting exclusive arrangements.

Violations of these laws can result in significant penalties, including substantial fines and operational restrictions. In 2023, for example, South Korea's Fair Trade Commission (KFTC) fined Samsung Electronics approximately $13 million for unfair trade practices related to its affiliate transactions. Such regulatory actions underscore the importance of Samsung's commitment to fair competition to ensure continued market access and foster sustainable growth across its diverse product portfolios.

Product Safety and Consumer Protection Laws

Samsung Electronics operates under a complex web of product safety and consumer protection laws globally. These regulations mandate rigorous quality control and safety standards for all its electronic devices, from smartphones to home appliances. For instance, in the European Union, the General Product Safety Regulation (2001/95/EC) requires that products placed on the market do not endanger the safety or health of consumers. Failure to comply can lead to significant penalties, including fines and market withdrawal. In 2023, Samsung faced scrutiny in several markets regarding data privacy and security features, highlighting the ongoing need for robust compliance.

Ensuring product quality and providing timely security updates are paramount. This is particularly critical for connected devices and mobile phones, where vulnerabilities can lead to data breaches. For example, the US Consumer Product Safety Commission (CPSC) has the authority to recall unsafe products. Samsung's commitment to regular software updates for its Galaxy devices, often pushing out monthly security patches, directly addresses these legal and consumer expectations. In 2024, the company continued to invest heavily in cybersecurity research and development to meet evolving threats and regulatory demands.

Adherence to these laws is not just about avoiding penalties; it's crucial for maintaining consumer trust and brand reputation. Product recalls or major security incidents can severely damage a company's image and lead to substantial financial losses. Samsung's proactive approach to addressing potential safety concerns, such as the battery issues with earlier foldable phones, demonstrates an understanding of the importance of consumer protection. The company's 2024 sustainability reports often detail their efforts in product lifecycle management and responsible manufacturing, directly linking to consumer safety and regulatory compliance.

Key legal factors impacting Samsung include:

- Compliance with global safety standards such as ISO 9001 for quality management and specific regional certifications for electronics.

- Data protection regulations like the EU's GDPR and similar laws in other jurisdictions, governing the collection and use of consumer data.

- Mandatory security update provisions for connected devices to protect against cyber threats and ensure consumer privacy.

- Consumer rights legislation that dictates warranty terms, repair obligations, and product return policies across different markets.

Supply Chain Due Diligence and Labor Laws

Global regulations are increasingly focusing on supply chain ethics and labor practices. For instance, the upcoming Corporate Sustainability Due Diligence Directive (CSDDD) in the EU will mandate rigorous due diligence for companies like Samsung. This means Samsung must proactively identify and address human rights and environmental risks throughout its operations and value chains.

Samsung is responding to these evolving legal landscapes by strengthening its due diligence processes. The company announced plans in 2024 for an enhanced integrated due diligence policy to be implemented in 2025. This policy aims to proactively manage risks associated with its vast global supply network.

To further mitigate risks, Samsung is expanding its third-party audits. This expansion will now include second-tier suppliers, a crucial step in uncovering potential issues like forced labor and child labor. This proactive approach is vital for maintaining compliance and ethical standards in a complex global manufacturing environment.

- CSDDD Compliance: Samsung must align its operations with the EU's Corporate Sustainability Due Diligence Directive to avoid penalties and maintain market access.

- Enhanced Due Diligence: The 2025 policy update signifies a commitment to deeper scrutiny of its supply chain's ethical and labor standards.

- Second-Tier Audits: Expanding audits to suppliers beyond immediate partners is critical for identifying and rectifying hidden labor abuses, such as forced or child labor.

- Reputational Risk: Non-compliance with labor laws and ethical sourcing can lead to significant reputational damage and loss of consumer trust.

Samsung's legal obligations span intellectual property, data privacy, antitrust, and product safety. The company must navigate a global landscape of evolving regulations, such as the EU's Digital Markets Act, which impacts its digital service integration. In 2023, Samsung faced significant patent disputes, including ongoing litigation with Ericsson, and was fined approximately $13 million in South Korea for unfair trade practices.

Compliance with data privacy laws like GDPR is critical, with potential fines up to 4% of global annual revenue. Samsung's investment in its Knox security platform and extended security updates aims to meet these demands. Furthermore, the company is preparing for the EU's Corporate Sustainability Due Diligence Directive, requiring enhanced supply chain scrutiny to prevent human rights abuses.

Environmental factors

Samsung is actively tackling climate change, setting aggressive targets for cutting emissions. Their commitment includes achieving net zero for Scope 1 and 2 emissions by 2050, with a more immediate goal for their Device eXperience (DX) Division to reach net zero by 2030.

To meet these objectives, Samsung is prioritizing a transition to renewable energy sources across its operations. Furthermore, the company is investing in innovative technologies, such as regenerative catalytic systems, designed to significantly reduce greenhouse gas emissions.

Samsung is deeply focused on resource circularity and waste management as core environmental goals. A significant target is integrating recycled materials into every new mobile product launched by 2025, demonstrating a commitment to reducing reliance on virgin resources.

Furthermore, the company has ambitious plans to utilize recycled materials across all plastic components by the year 2050. This long-term vision underscores a comprehensive approach to material sustainability throughout its product lifecycle.

To support these objectives, Samsung actively manages e-waste collection programs. These initiatives are operational in roughly 80 countries, actively working to bolster worldwide recycling and material recovery systems, thereby closing the loop on electronic waste.

Samsung is significantly increasing its reliance on renewable energy sources to power its worldwide operations. This strategic move is driven by the need to manage growing energy requirements and lower its carbon footprint.

By the close of 2024, Samsung's DX Division reported an impressive 93.4% renewable energy adoption rate. Furthermore, key manufacturing sites in several important areas are now fully powered by renewable energy.

The company continues to strengthen its commitment by entering into new agreements for solar power procurement, ensuring a sustainable energy future for its expanding infrastructure.

Sustainable Product Design and Packaging

Samsung Electronics is actively prioritizing sustainable product design and packaging to minimize its environmental impact. A key initiative is the complete elimination of single-use plastics from its mobile device packaging by 2025. This commitment extends to integrating recycled materials, such as recycled cobalt, rare earth elements, and steel, into the manufacturing of its core device components.

The company's efforts are already visible in its product lines. For instance, the Galaxy S24 series showcases this focus by exclusively using 100% recycled paper for all its packaging. This strategic shift reflects a broader industry trend towards circular economy principles and responsible resource management.

- Target: Eliminate single-use plastics from mobile packaging by 2025.

- Material Integration: Incorporating recycled cobalt, rare earth elements, and steel into key device components.

- Packaging Example: Galaxy S24 series utilizes 100% recycled paper for its packaging.

Water Management and Pollution Control

Samsung Electronics is deeply invested in responsible water management and pollution control, recognizing these as critical environmental factors. Beyond managing emissions and waste, the company actively works to minimize its footprint by carefully managing on-site waste, reducing overall water consumption, and implementing stringent controls on air pollution across its facilities.

These initiatives are integral to Samsung's broader sustainability strategy, aiming to address environmental challenges through innovative technological solutions. For instance, in 2023, Samsung reported a 10% reduction in water usage intensity compared to its 2020 baseline across its major semiconductor manufacturing sites. The company also invested over $50 million in advanced wastewater treatment technologies that year, significantly improving the quality of discharged water.

- Water Usage Reduction: Samsung targets a 20% reduction in water usage intensity by 2025 compared to 2020 levels, with significant progress already made.

- Wastewater Treatment: The company employs advanced treatment processes to ensure discharged water meets or exceeds local environmental regulations, often achieving over 95% pollutant removal rates.

- Air Quality Management: Investments in air pollution control equipment, such as regenerative thermal oxidizers, help Samsung minimize volatile organic compound (VOC) emissions, achieving a 15% reduction in VOC intensity in 2023.

- Circular Economy Integration: Efforts are underway to integrate circular economy principles into water management, exploring water recycling and reuse opportunities within its manufacturing processes.

Samsung is aggressively pursuing net-zero emissions, targeting 2050 for overall operations and 2030 for its DX Division, with a significant 93.4% renewable energy adoption rate reported by the DX Division by the end of 2024.

The company is committed to resource circularity, aiming to use recycled materials in all new mobile products by 2025 and all plastic components by 2050, evidenced by the Galaxy S24 series' 100% recycled paper packaging.

Samsung is prioritizing responsible water management, achieving a 10% reduction in water usage intensity in 2023 compared to 2020, and investing in advanced wastewater treatment to ensure high pollutant removal rates.

| Environmental Factor | Target/Initiative | Progress/Data (as of latest available) |

|---|---|---|

| Emissions | Net Zero Scope 1 & 2 by 2050; DX Division Net Zero by 2030 | |

| Renewable Energy | Increase adoption across global operations | DX Division 93.4% adoption by end of 2024 |

| Recycled Materials | Recycled materials in all new mobile products by 2025; recycled plastic in all components by 2050 | Galaxy S24 series uses 100% recycled paper packaging |

| Water Management | Reduce water usage intensity | 10% reduction in 2023 vs. 2020 baseline; invested over $50 million in wastewater treatment in 2023 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Samsung Electronics is built on a robust foundation of data from reputable sources, including official government reports, leading economic indicators, and up-to-date market research from firms like Statista and Gartner. This ensures comprehensive coverage of political, economic, social, technological, environmental, and legal factors impacting Samsung.