Samsung Electronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung Electronics Bundle

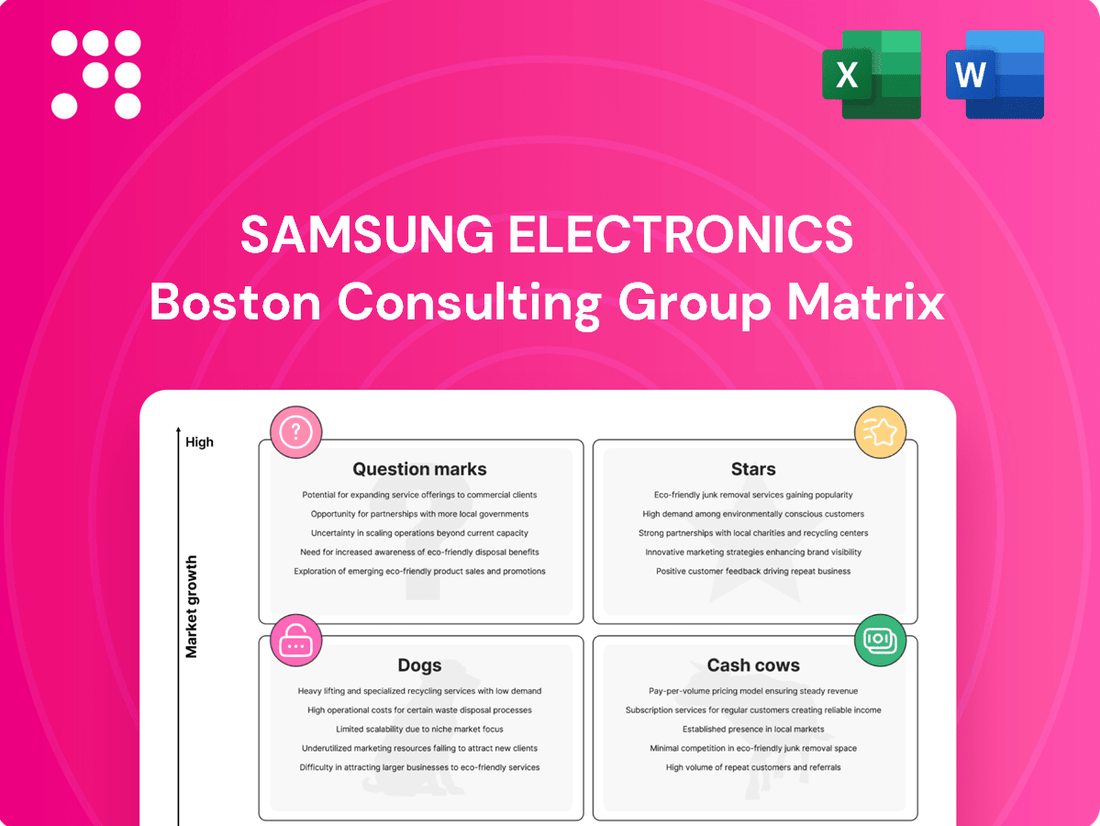

Curious about Samsung Electronics' product portfolio performance? This preview hints at their strategic positioning, but the full BCG Matrix unlocks the complete picture, revealing their Stars, Cash Cows, Dogs, and Question Marks.

Dive deeper into Samsung's market share and growth potential. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to optimize your investment and product development strategies.

Don't miss out on the critical data that drives success. Get the full BCG Matrix report to gain a clear understanding of Samsung's product lifecycle and a roadmap for future growth and resource allocation.

Stars

Samsung Electronics solidified its status as the top semiconductor supplier globally in 2024, achieving $66.5 billion in revenue and capturing a 10.5% market share. This resurgence was largely propelled by a recovery in memory chip pricing, highlighting the cyclical yet powerful nature of this segment.

The semiconductor market, particularly driven by the insatiable demand for AI processors and graphics processing units (GPUs), is experiencing a period of substantial expansion. This trend firmly places Samsung's memory and foundry operations within a high-growth trajectory.

Despite facing initial hurdles with yield rates, Samsung is making substantial investments in cutting-edge foundry technologies, including the development of 2nm and 3nm processes. This strategic commitment underscores the company's long-term vision for its foundry business in a market with significant future potential.

Samsung is aggressively integrating AI across its vast product range, aiming to bring its Galaxy AI features to over 400 million devices worldwide by the close of 2025. This significant push underscores Samsung's ambition to be the undisputed leader in AI for 2025, identifying it as a crucial catalyst for future growth.

The company's strategy involves embedding AI deeply within its SmartThings ecosystem and pioneering new AI-driven home appliances. This move directly addresses the robust consumer appetite for smarter, more efficient living solutions, positioning AI-powered devices as a key growth area.

Samsung's dominance in premium and ultra-large TVs, including QLED and OLED technologies, is a significant strength. For 19 years straight, they've led the global TV market, holding a substantial 28.3% share in 2024. This leadership is especially pronounced in high-value segments, where they've captured nearly half of the premium TV market.

The company's performance in the ultra-large TV category is equally impressive, with a 28.7% market share. Furthermore, Samsung saw a remarkable 42% year-over-year increase in OLED TV sales in 2024, pushing their market share in this advanced technology to 27.3%. This growth highlights strong consumer demand for their high-end offerings.

High-Bandwidth Memory (HBM)

Samsung's High-Bandwidth Memory (HBM) is positioned as a star in its BCG matrix. Despite fierce competition in the general DRAM sector, Samsung is significantly expanding its HBM production, planning to double its bit supply in 2025 to meet the surging demand from AI applications. This segment represents a high-growth, high-value area within semiconductors.

The explosive growth in HBM is directly fueled by the increasing needs of AI hardware. Samsung's strategic focus includes securing crucial certifications from leading GPU manufacturers, such as Nvidia, which is vital for capturing a larger share of this rapidly expanding market. This proactive approach solidifies HBM's status as a key growth driver for Samsung.

- HBM Market Growth: Driven by AI, the HBM market is experiencing exponential growth.

- Samsung's Supply Expansion: Samsung aims to double its total HBM bit supply in 2025.

- Key Partnerships: Securing certifications from major GPU manufacturers like Nvidia is a critical objective.

- Strategic Importance: HBM is a high-value, high-growth segment critical for Samsung's future in AI hardware.

Galaxy S Series Smartphones

Samsung's Galaxy S series, particularly the latest S25 lineup, firmly anchors its position as a Star in the BCG Matrix. This segment consistently drives significant revenue, evidenced by a 10.44% year-over-year increase in mobile revenue for Q1 2025, reaching a substantial 60.5 million units shipped globally.

The premium Galaxy S25 Ultra model is a standout performer within the series, capturing 56% of all S series shipments. This dominance highlights its strength in the high-end smartphone market, a segment experiencing robust growth.

- Galaxy S Series Revenue Growth: Q1 2025 saw a 10.44% year-over-year increase in mobile revenue.

- Total Shipments: 60.5 million units shipped globally in Q1 2025.

- S25 Ultra Market Share: Accounted for 56% of S series shipments.

- Market Position: Represents a high-market-share segment in the growing high-end smartphone market.

Samsung's High-Bandwidth Memory (HBM) is a prime example of a Star in its BCG Matrix. The company aims to double its HBM bit supply in 2025 to meet surging AI demand. Securing certifications from major GPU manufacturers like Nvidia is a crucial objective for this high-growth, high-value segment.

The Galaxy S series, particularly the S25 lineup, also shines as a Star. Q1 2025 saw a 10.44% year-over-year increase in mobile revenue, with 60.5 million units shipped globally. The S25 Ultra model alone captured 56% of S series shipments, demonstrating strong performance in the high-end smartphone market.

| Product Category | BCG Classification | Key Performance Indicators (2024-2025) | Growth/Market Share |

|---|---|---|---|

| High-Bandwidth Memory (HBM) | Star | Doubling bit supply in 2025; Nvidia certification crucial | High Growth, High Market Share Potential |

| Galaxy S Series (Smartphones) | Star | 10.44% YoY mobile revenue growth (Q1 2025); 60.5M units shipped (Q1 2025) | High Market Share in Growing Segment |

What is included in the product

This analysis categorizes Samsung's diverse product lines into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The Samsung Electronics BCG Matrix provides a clear, one-page overview of each business unit's market position, relieving the pain of strategic uncertainty.

This export-ready design allows for quick drag-and-drop into PowerPoint, eliminating the hassle of manual chart creation.

Cash Cows

Samsung's dominance in the global TV market, marked by 19 consecutive years at the top and a 28.3% market share in 2024, firmly places its TV division as a Cash Cow. This sustained leadership in a mature, low-growth market, which saw only 3% expansion in 2024, highlights the division's ability to generate substantial and consistent cash flow due to its strong brand and extensive distribution network.

Samsung continues to dominate the global smartphone arena, holding a significant 19.7% market share in Q2 2025 with 58 million units shipped. This leadership position in a mature market translates into reliable revenue streams and consistent profitability for the company.

The company's extensive product lineup, particularly the well-received Galaxy A series, plays a crucial role. By integrating advanced AI capabilities into its mid-range offerings, Samsung has effectively driven growth and maintained its strong market standing.

Samsung Electronics holds a dominant position in the traditional DRAM and NAND flash memory markets, which are considered mature industries. These segments are crucial cash cows for the company, consistently generating revenue despite their cyclical nature.

The broader memory chip market experienced a substantial revenue rebound of 71.8% in 2024, largely attributed to recovering prices. This rebound significantly benefits Samsung's established DRAM and NAND flash businesses, reinforcing their role as reliable cash generators for the company.

US Home Appliances Market

Samsung Electronics' presence in the US home appliances market is a prime example of a cash cow. In 2023, the company secured the top spot, commanding a significant 21% of the market by sales and 19% by unit volume.

This leadership in a mature market, where demand is generally stable, translates into a reliable and substantial source of cash flow for Samsung. The company's ongoing investment in AI integration for its appliance lines is a strategic move to preserve this dominance and boost operational efficiency, reinforcing its cash cow status.

- Market Share: Samsung held 21% of the US home appliance market by sales in 2023.

- Unit Volume: The company's share in terms of quantity sold was 19% in the same year.

- Market Maturity: The US home appliance sector is characterized by stable demand, supporting consistent cash generation.

- Strategic Focus: AI integration in new products is key to maintaining Samsung's strong position and improving efficiency.

QLED TVs (Non-OLED Premium)

Samsung's QLED TVs, a significant player in the premium non-OLED segment, demonstrated robust performance in 2024. These televisions, built on advanced LCD technology, achieved sales of 8.34 million units, securing an impressive 46.8% market share within their specific category. This strong market presence highlights their established position in a mature, yet profitable, market segment.

While the sales volume for QLED TVs remained stable, showing no growth from 2023, this stability, coupled with their substantial market share, firmly places them in the cash cow quadrant of the BCG matrix. This segment consistently generates strong revenue streams, contributing significantly to Samsung's overall financial health, even as other, faster-growing technologies emerge.

- 2024 QLED TV Unit Sales: 8.34 million units

- 2024 QLED TV Market Share (Non-OLED Premium): 46.8%

- Sales Trend: Flat compared to 2023

- BCG Matrix Classification: Cash Cow

Samsung's memory chip division, particularly DRAM and NAND flash, continues to be a bedrock of its financial strength. Despite the mature nature of these markets, they consistently generate substantial cash flow. The significant 71.8% revenue rebound in the broader memory chip market in 2024, driven by price recovery, directly bolsters these established segments, underscoring their cash cow status.

| Business Segment | Market Maturity | Cash Flow Generation | Key Data Point |

|---|---|---|---|

| DRAM & NAND Flash Memory | Mature | High & Consistent | 71.8% revenue rebound in memory market (2024) |

| Smartphones | Mature | Reliable Revenue Streams | 19.7% market share (Q2 2025) |

| Televisions | Mature | Substantial & Consistent | 19 consecutive years as market leader |

Delivered as Shown

Samsung Electronics BCG Matrix

The Samsung Electronics BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This ensures complete transparency, as you can assess the quality and depth of the analysis before committing, knowing no watermarks or demo content will be present in your final download.

What you see here is the definitive Samsung Electronics BCG Matrix report, identical to the one you will acquire after completing your purchase. This preview showcases the professional design and comprehensive market analysis that will be delivered directly to you, ready for immediate strategic application.

This preview accurately represents the Samsung Electronics BCG Matrix file you will download post-purchase, offering a direct look at the final product. Once purchased, this analysis-ready document will be instantly available for your team's strategic planning and decision-making processes.

Dogs

Samsung's dominance in smartphone display panels saw a notable dip, with its market share falling from 50.1% to 41.3% in 2024. This contraction, even amidst robust AMOLED demand, points to Samsung ceding ground in specific market niches, possibly those relying on older or less lucrative display technologies.

The increasing market penetration of Chinese manufacturers in both premium AMOLED and budget LCD segments suggests these areas, where Samsung might be losing share, could represent potential cash traps. This trend highlights the competitive pressures Samsung faces as rivals expand their reach across various price points and technology types.

Harman's Digital Cockpit, a Samsung subsidiary, is currently positioned as a 'Dog' in the BCG Matrix. Its market share has notably decreased, falling to 12.5% in 2024 from 16.5% in 2023.

This downward trend suggests a challenging market environment for digital cockpits, with Samsung's segment likely facing low growth prospects. The diminishing market share indicates that this business unit may be consuming resources without generating substantial returns or demonstrating a clear trajectory towards market dominance.

Samsung's legacy, undifferentiated low-end smartphone models are a concern. While Samsung held a stable 23% US smartphone market share in Q3 2024, competitors like Motorola are making inroads in the budget segment. This suggests that Samsung's entry-level phones, if not innovating or capturing significant market share, could be underperforming.

Older Generation, Non-AI Integrated Home Appliances

Older generation, non-AI integrated home appliances represent Samsung's potential 'Dogs' in the BCG Matrix. As Samsung aggressively pivots towards AI-powered smart home solutions, targeting 70% of its India sales from these products by 2025, investment and focus on legacy appliances are naturally declining. This segment operates in a saturated market characterized by intense competition and thinner profit margins, making it less attractive for continued strategic development.

Samsung's strategic reallocation of resources away from these older models is a clear indicator of their declining importance within the company's portfolio. The emphasis on AI integration signifies a move towards higher-value, differentiated products, leaving the non-AI segment to manage its own decline with minimal new investment. This is a common strategy for companies seeking to optimize their product mix and focus on future growth drivers.

- Mature Market: The market for traditional, non-smart appliances is largely saturated with established players.

- Lower Margins: Price competition in this segment typically leads to reduced profitability compared to innovative, AI-driven products.

- Declining Investment: Samsung's strategic shift means reduced R&D and marketing spend on these older product lines.

- Focus on AI: The company's commitment to AI integration in 70% of India sales by 2025 highlights the prioritization of future-oriented technologies.

Older Generation TV Models (Non-Premium LCD)

Older generation TV models, specifically non-premium LCDs, are a segment where Samsung Electronics faces increasing competition. While Samsung maintained a strong overall TV market share of 28.3% in 2024, this was a slight decrease from 30.1% in 2023. This indicates that in the lower-tier LCD market, particularly in larger screen sizes, Chinese brands are making significant inroads and in some cases, overtaking Samsung.

This situation positions these older, non-premium LCD TV models as a potential cash cow for Samsung. The market for these units, while experiencing growth challenges, still generates revenue. Samsung can leverage its existing manufacturing capabilities and brand recognition to continue selling these products, extracting value without significant new investment.

- Market Share Shift: Samsung's overall TV market share dipped to 28.3% in 2024, down from 30.1% in 2023, signaling pressure in certain segments.

- Competitive Landscape: Chinese brands are aggressively capturing market share in older, non-premium LCD TV segments, especially in larger screen sizes.

- Strategic Positioning: These models represent a low-growth, low-market-share category, fitting the profile of a cash cow within the BCG matrix.

- Revenue Generation: Despite competitive pressures, these older models continue to contribute to Samsung's revenue stream, providing a stable, albeit potentially declining, source of cash.

Samsung's legacy, undifferentiated low-end smartphone models are a concern. While Samsung held a stable 23% US smartphone market share in Q3 2024, competitors like Motorola are making inroads in the budget segment. This suggests that Samsung's entry-level phones, if not innovating or capturing significant market share, could be underperforming and are considered Dogs.

Harman's Digital Cockpit, a Samsung subsidiary, is currently positioned as a 'Dog' in the BCG Matrix. Its market share has notably decreased, falling to 12.5% in 2024 from 16.5% in 2023, indicating low growth prospects and diminishing returns.

Older generation, non-AI integrated home appliances represent Samsung's potential 'Dogs.' As Samsung pivots towards AI-powered solutions, these legacy products operate in a saturated market with thinner profit margins, making them less attractive for continued strategic development.

Older generation TV models, specifically non-premium LCDs, are also considered Dogs. While Samsung maintained a strong overall TV market share of 28.3% in 2024, this was a slight decrease from 30.1% in 2023, signaling pressure in segments where Chinese brands are gaining ground.

| Business Unit | BCG Category | Market Share (2024) | Trend | Notes |

|---|---|---|---|---|

| Low-end Smartphones | Dog | 23% (US Market) | Stable overall, but competitive pressure in budget segment | Competitors like Motorola gaining share |

| Harman Digital Cockpit | Dog | 12.5% | Decreasing (from 16.5% in 2023) | Low growth prospects, consuming resources |

| Non-AI Home Appliances | Dog | N/A (Segment Specific) | Declining focus and investment | Saturated market, lower margins |

| Non-Premium LCD TVs | Dog | N/A (Segment Specific) | Decreasing overall share (28.3% in 2024 vs 30.1% in 2023) | Chinese brands gaining share in this segment |

Question Marks

Samsung's advanced foundry business, targeting 2nm and 3nm processes, is positioned in a high-growth segment of the semiconductor market. The company is making significant strides in developing these cutting-edge technologies, aiming to capture a larger share of this expanding industry.

Despite aggressive development, Samsung faces a considerable challenge in its 2nm chip yield rate, reported between 20-30%. This contrasts sharply with TSMC's reported 60% yield for comparable processes, highlighting a significant gap in manufacturing efficiency and maturity. TSMC also maintains a dominant market share in the foundry sector.

This scenario places Samsung's advanced foundry operations in a classic "question mark" category within the BCG matrix. The market is attractive due to its high growth potential, but Samsung's current market share is low and its competitive position is hampered by lower yields, necessitating substantial ongoing investment to improve production and close the gap with industry leaders.

Samsung's advanced semiconductor solutions for the automotive sector, particularly for electric vehicles (EVs) and autonomous driving, represent a significant growth opportunity. The global automotive semiconductor market is projected to reach $114.9 billion by 2027, with EVs and advanced driver-assistance systems (ADAS) being key drivers.

While Samsung is investing heavily in this high-potential area, its current market share in these specialized automotive semiconductor niches is likely still developing. This positions it as a 'Question Mark' in the BCG matrix, demanding considerable investment to build brand recognition and capture substantial market share against established players.

Samsung Electronics is significantly increasing its investments in quantum computing, a nascent technology with the potential to revolutionize various industries. This strategic move reflects the company's commitment to future growth, even though the market is still in its infancy. For instance, global spending on quantum computing is projected to reach $1.5 billion in 2024, a substantial increase from previous years, highlighting the burgeoning interest and investment in this area.

Positioned as a 'Question Mark' within the BCG matrix, quantum computing represents a high-risk, high-reward opportunity for Samsung. While the long-term growth prospects are exceptionally high, Samsung's current market share and commercialized products in this domain are likely negligible. This necessitates substantial research and development (R&D) expenditure, with uncertain immediate returns, as the company navigates this highly speculative technological frontier.

Foldable Smartphones

Foldable smartphones represent a 'Question Mark' for Samsung Electronics within the BCG Matrix. While Samsung was an early leader, its projected global market share in this expanding sector is expected to decline from 45.2% in 2024 to 35.4% in 2025. This shift is driven by intensified competition from rivals entering the foldable space.

- Market Growth: The foldable smartphone market is experiencing rapid expansion.

- Samsung's Market Share: Projected to decrease from 45.2% in 2024 to 35.4% in 2025.

- Competitive Landscape: Increasing competition is impacting Samsung's dominance.

- Strategic Implications: Samsung's reduced foldable production targets for 2025 signal a need for strategic investment and innovation to maintain its position.

Diversified AI Partnerships (beyond Google Gemini)

Samsung is actively exploring partnerships with AI leaders beyond Google, including discussions with OpenAI and Perplexity AI. This move is designed to broaden the AI functionalities available on future Galaxy devices, catering to the dynamic and rapidly expanding AI sector. These emerging collaborations represent potential stars in Samsung's portfolio, though their market share and impact are still developing, necessitating strategic nurturing.

- Diversifying AI Providers: Samsung is in talks with OpenAI and Perplexity AI to integrate a broader spectrum of AI services into its upcoming Galaxy devices, aiming to reduce reliance on Google's Gemini.

- Market Expansion Strategy: This diversification strategy is intended to enhance Samsung's AI capabilities and product offerings within the fast-paced and high-growth artificial intelligence market.

- Emerging Partnerships: The market share and ultimate success of these new AI partnerships are still in the process of being defined, positioning them as question marks that require careful development and investment.

Samsung's advanced foundry business, particularly its efforts in 2nm and 3nm chip manufacturing, represents a significant investment in a high-growth market. However, current yield rates of 20-30% lag behind competitors like TSMC, placing it firmly in the question mark category. This requires substantial capital to improve efficiency and gain market share.

The company's push into automotive semiconductors for EVs and autonomous driving also fits the question mark profile. While the market is expanding rapidly, Samsung's current share in these specialized niches is still developing, necessitating ongoing investment to build its presence and compete effectively.

Quantum computing is another area where Samsung is investing heavily, reflecting its potential for future disruption. With global spending projected to reach $1.5 billion in 2024, this nascent field offers high rewards but also carries significant risk due to its early stage and uncertain commercialization path.

Samsung's foldable smartphone market share is projected to decrease from 45.2% in 2024 to 35.4% in 2025 due to increased competition. This trend, coupled with reduced production targets for 2025, indicates a need for strategic adjustments and innovation to maintain its leadership in this segment.

Emerging AI partnerships with companies like OpenAI and Perplexity AI position Samsung's future Galaxy devices as potential question marks. While diversifying AI providers aims to enhance product offerings in a high-growth market, the ultimate market share and success of these new collaborations remain to be seen, requiring careful nurturing and investment.

| Business Area | Market Growth | Samsung's Market Share | Investment Needs | BCG Category |

|---|---|---|---|---|

| Advanced Foundry (2nm/3nm) | High | Low (Yield challenges) | High | Question Mark |

| Automotive Semiconductors (EV/ADAS) | High | Developing | High | Question Mark |

| Quantum Computing | Very High (Nascent) | Negligible | Very High | Question Mark |

| Foldable Smartphones | High | Decreasing (45.2% in 2024 to 35.4% in 2025) | Moderate to High | Question Mark |

| New AI Partnerships | Very High | Undeveloped | High | Question Mark |

BCG Matrix Data Sources

Our Samsung Electronics BCG Matrix is built using comprehensive data from financial reports, market research, and internal sales figures to accurately assess product performance and market share.