Samsung Electronics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Samsung Electronics Bundle

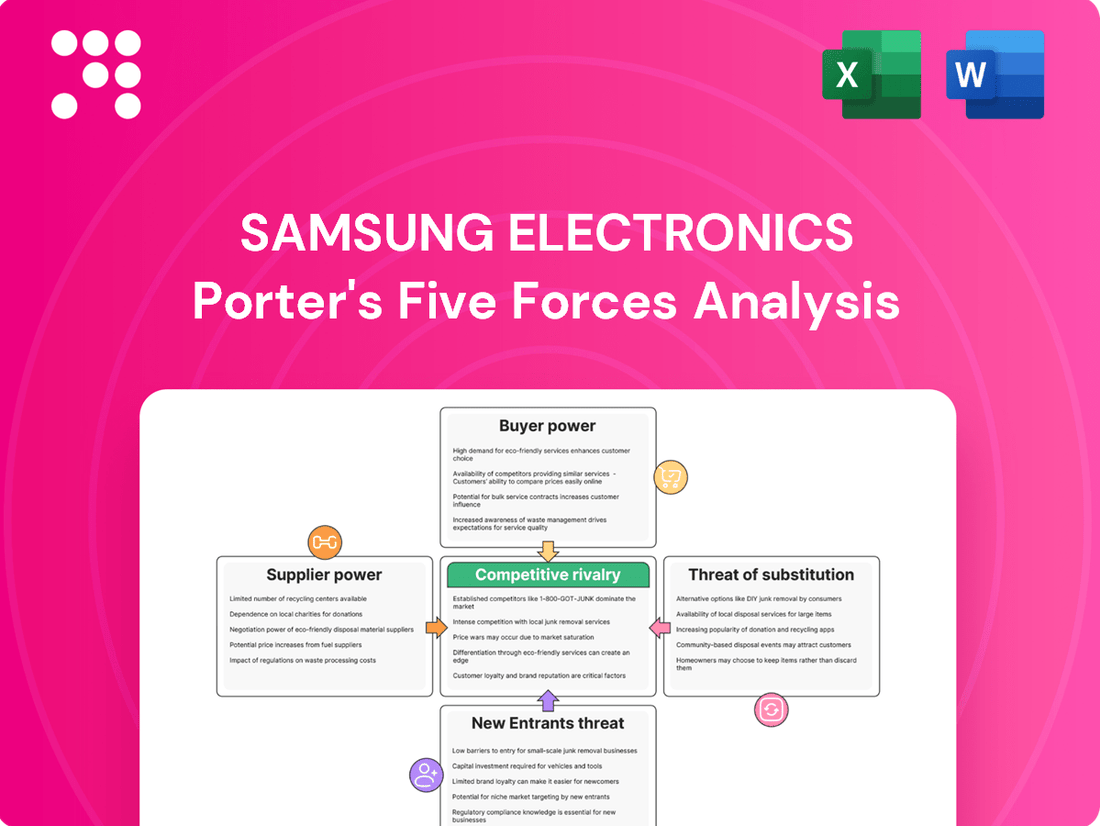

Samsung Electronics navigates a fiercely competitive landscape, where intense rivalry among established players and the looming threat of new entrants significantly shape its market. Understanding the power of buyers and suppliers, along with the constant pressure from substitute products, is crucial for Samsung's strategic planning.

The complete report reveals the real forces shaping Samsung Electronics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Samsung Electronics faces considerable bargaining power from its suppliers due to the high concentration of key component providers. For instance, the market for Dynamic Random-Access Memory (DRAM) is dominated by a few players, with Samsung, SK Hynix, and Micron Technology collectively holding approximately 94% of the global market share as of early 2024. This limited number of specialized suppliers for critical components like advanced semiconductor memory and high-end displays means Samsung has fewer alternatives, strengthening the suppliers' leverage.

The escalating demand for components powering AI and generative AI applications significantly boosts the bargaining power of specialized semiconductor suppliers. This surge is particularly evident in the market for Graphics Processing Units (GPUs) and dedicated AI processors, essential for handling complex AI workloads.

For companies like Samsung Electronics, this translates to a stronger negotiating position for suppliers of these high-value, in-demand AI chips. For instance, the global AI chip market was projected to reach over $100 billion by 2024, with growth driven by these very trends.

New tariffs imposed by the US on countries like Vietnam and India, where Samsung Electronics has substantial manufacturing, directly impact its supply chain costs. For instance, if tariffs on key components sourced from these regions increase by 10%, it could add hundreds of millions of dollars to Samsung's production expenses. This situation can inadvertently bolster the bargaining power of suppliers who are either unaffected by these tariffs or possess the agility to absorb or pass on these increased costs, potentially forcing Samsung to accept less favorable terms.

High switching costs for specialized components

For highly specialized components, like advanced memory chips or custom processors, Samsung faces substantial supplier bargaining power. Switching suppliers for these critical parts can incur significant costs, including extensive redesign, re-tooling, and rigorous re-qualification procedures. This dependency makes it challenging for Samsung to shift away from established suppliers, thereby strengthening their negotiating position.

Samsung's reliance on specialized components means suppliers can command higher prices or dictate terms. For instance, in 2024, the semiconductor industry saw supply chain disruptions and increased demand for advanced chips, potentially giving suppliers of these specialized components leverage. This situation is further exacerbated when a supplier holds patents or unique manufacturing capabilities for essential elements in Samsung's product lines, such as the cutting-edge Exynos processors or advanced NAND flash memory.

- High Switching Costs: Redesigning products around new components can cost millions and delay market entry.

- Supplier Dependency: For niche, high-performance chips, Samsung may only have a few qualified suppliers.

- Intellectual Property: Suppliers with proprietary technology for critical components hold significant sway.

- Industry Dynamics: In 2024, tight supply for advanced semiconductors amplified supplier power.

Suppliers' ability for forward integration

Samsung Electronics faces a potential threat from key component suppliers, especially in the semiconductor sector, who have the financial muscle and technical know-how to move into finished product manufacturing. This capability, even if not actively pursued, grants them significant bargaining power during price and supply negotiations.

For instance, major memory chip manufacturers could theoretically leverage their expertise to produce their own branded smartphones or other electronic devices, directly competing with Samsung. While this is a less frequent occurrence, the mere possibility influences supplier-customer dynamics.

- Semiconductor Suppliers' Forward Integration Potential: Companies like TSMC, a leading contract chip manufacturer, possess the advanced technology to produce high-end processors, a critical component in smartphones and other electronics.

- Financial Strength of Key Suppliers: Major component suppliers often have substantial cash reserves, enabling them to invest in new manufacturing capabilities or acquire smaller firms to facilitate forward integration.

- Impact on Samsung's Margins: The threat of suppliers becoming competitors can pressure Samsung to accept less favorable terms, potentially impacting its profit margins on finished goods.

Samsung Electronics faces strong bargaining power from its suppliers, particularly for critical components like advanced semiconductors and specialized displays. The limited number of providers for these high-tech parts, such as the DRAM market where Samsung itself is a major player alongside SK Hynix and Micron holding about 94% of the market share in early 2024, means Samsung has fewer alternatives. This dependency grants suppliers significant leverage in price negotiations and terms.

| Component Type | Key Suppliers (Examples) | Market Concentration (Approx. 2024) | Impact on Samsung |

|---|---|---|---|

| DRAM Memory | Samsung, SK Hynix, Micron | ~94% combined | High supplier leverage due to limited alternatives. |

| Advanced Processors (AI Chips) | Qualcomm, NVIDIA, TSMC (foundry) | High concentration for cutting-edge nodes | Increased supplier power due to surging AI demand; potential for higher pricing. |

| High-End Displays (OLED) | Samsung Display, LG Display | Concentrated market | Samsung Display, as a sister company, mitigates some power, but external sourcing still faces concentration. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Samsung Electronics' diverse product portfolio and global operations.

Instantly visualize the competitive landscape for Samsung Electronics, highlighting key pressures from rivals, suppliers, buyers, new entrants, and substitutes.

Gain actionable insights into Samsung's strategic positioning by clearly mapping the intensity of each of Porter's five forces.

Customers Bargaining Power

Samsung operates in a consumer electronics landscape, particularly for smartphones and televisions, characterized by intense competition. In 2024, the global smartphone market saw shipments exceed 1.2 billion units, with numerous brands vying for market share. This abundance of choice means consumers can readily switch to competitors offering similar or better value, significantly increasing Samsung's customer bargaining power.

For many of Samsung's consumer electronics, like smartphones and televisions, the cost and effort for customers to switch to a competitor are quite low. This ease of switching is a significant factor. For instance, a customer might easily move from a Samsung Galaxy phone to an iPhone or another Android device with minimal financial or technical hurdles.

This low switching cost directly amplifies customer bargaining power. With readily available market information and the prevalence of similar operating systems, such as Android used by multiple manufacturers, consumers can readily compare prices and features. This accessibility empowers them to demand better value or switch to a competitor if Samsung's offerings don't meet their expectations.

In saturated markets like smartphones and televisions, customers often become highly sensitive to price, particularly in the mid-range and budget categories. This intense price sensitivity compels companies such as Samsung to adopt aggressive pricing strategies to defend their market share. For instance, the television market has experienced significant price declines driven by fierce competition.

Diverse product portfolio offers internal substitutes

Samsung's extensive product range, from Galaxy smartphones and tablets to smart refrigerators and QLED TVs, creates a dynamic where customers can often find alternative Samsung devices that fulfill similar needs. This internal product diversity grants customers leverage, allowing them to switch between Samsung's own offerings if pricing or features on one product line become less attractive. For instance, a customer considering a new tablet might opt for a Samsung Galaxy Tab instead of a Samsung laptop if the price point and functionality align better, demonstrating their power to choose within the brand's ecosystem.

This internal substitutability significantly influences customer bargaining power by:

- Offering readily available alternatives within Samsung's portfolio, reducing reliance on external competitors for certain functionalities.

- Enabling customers to shift spending between product categories if one segment experiences price increases or feature stagnation.

- Potentially leading to lower switching costs for customers who are already invested in the Samsung ecosystem, making them more price-sensitive.

Access to comprehensive market information

Customers today possess unprecedented access to comprehensive market information, including detailed product reviews, price comparisons, and in-depth specifications readily available online. This heightened transparency significantly diminishes information asymmetry, empowering consumers to make more informed purchasing decisions and thereby amplifying their bargaining power.

For Samsung Electronics, this means customers can easily benchmark its products against competitors, scrutinizing features, performance, and pricing. For instance, in the highly competitive smartphone market, a quick online search can reveal user satisfaction ratings and comparative performance benchmarks, directly influencing a customer's willingness to pay a premium or seek alternatives.

- Informed Decision-Making: Customers can readily compare Samsung's QLED TV prices and features against those of LG or Sony, influencing their purchasing choices.

- Price Sensitivity: Online price comparison tools allow consumers to identify the lowest available prices for Samsung appliances, increasing pressure on Samsung to remain competitive.

- Brand Loyalty Impact: While brand loyalty exists, easy access to detailed product reviews and comparisons can sway even loyal customers if competitor offerings are perceived as superior in key areas.

The bargaining power of Samsung's customers is substantial, driven by the vast array of choices available in the consumer electronics market. In 2024, global smartphone shipments alone surpassed 1.2 billion units, illustrating the intense competition and the ease with which consumers can switch between brands like Samsung, Apple, and numerous Android manufacturers.

Low switching costs are a key enabler of this customer power. For instance, migrating data and settings between different Android smartphones or even from Android to iOS involves minimal financial or technical barriers, allowing customers to readily shift their allegiance based on price, features, or brand perception.

This ease of switching, coupled with widespread access to price comparison tools and detailed product reviews, empowers consumers to demand better value. For example, a customer can easily compare Samsung's latest QLED TV models against offerings from LG or Sony, influencing their purchasing decisions and putting pressure on Samsung to maintain competitive pricing.

Samsung's broad product portfolio also contributes to customer leverage. A consumer looking for a new mobile device might choose between a Samsung Galaxy smartphone or a Samsung tablet, depending on which offers a better price-to-performance ratio for their specific needs, demonstrating their ability to influence sales within the brand itself.

| Factor | Impact on Samsung | Example |

|---|---|---|

| Market Saturation & Competition | High | Over 1.2 billion smartphones shipped globally in 2024, offering abundant alternatives. |

| Switching Costs | Low | Easy data transfer between Android devices or to iOS. |

| Information Availability | High | Online reviews and price comparison sites empower informed decisions. |

| Price Sensitivity | High | Customers readily seek deals, especially in mid-range and budget segments. |

Full Version Awaits

Samsung Electronics Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces analysis of Samsung Electronics you'll receive immediately after purchase, detailing the competitive landscape and strategic implications. You're looking at the actual document, which thoroughly examines the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry within the electronics industry. Once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning.

Rivalry Among Competitors

Samsung Electronics navigates a landscape of intense competition across its vast product portfolio, from cutting-edge smartphones and high-definition televisions to essential home appliances and critical semiconductor components. This broad market presence means Samsung is constantly vying for market share against formidable global players like Apple in mobile devices, LG and Sony in consumer electronics, and Intel and NVIDIA in the semiconductor arena. The sheer diversity of its offerings amplifies the competitive pressure, demanding continuous innovation and strategic pricing to maintain its standing.

Samsung Electronics faces fierce rivalry in crucial market segments, most notably in the global smartphone arena. Here, Samsung and Apple are locked in a perennial battle for the leading market share. This intense competition is further amplified by the aggressive expansion of Chinese manufacturers such as Xiaomi, Oppo, and Vivo, which are not only capturing significant market share but also driving substantial volume growth worldwide.

Samsung operates in fiercely competitive markets, particularly consumer electronics and semiconductors, where technological innovation is relentless. This necessitates substantial Research and Development (R&D) spending to stay ahead. For instance, in 2023, Samsung Electronics allocated approximately 21.4 trillion Korean Won (around $16 billion USD) to R&D, a significant portion of its revenue.

This constant drive for advancement means companies like Samsung must continuously invest in areas such as artificial intelligence, next-generation display technologies, and improved semiconductor performance. Failing to do so quickly leads to obsolescence and loss of market share to rivals who are quicker to adopt or develop new technologies.

Aggressive pricing strategies and margin pressures

Samsung Electronics faces intense competitive rivalry, especially from brands aggressively competing on price, particularly in the mid-range and budget smartphone markets. This dynamic often forces companies to adopt similar pricing strategies to remain competitive, leading to considerable pressure on profit margins. Samsung's significant market share in 2024, particularly in the global smartphone sector, highlights its ability to navigate these pressures, though it does mean a constant balancing act between volume and profitability.

This aggressive pricing environment directly impacts profitability. Companies may sacrifice immediate profit margins to gain or maintain market share, a strategy that can be particularly challenging in a sector with high research and development costs. For instance, while Samsung reported impressive revenue figures, the intense competition means that maintaining robust net profit margins requires constant innovation and operational efficiency to offset price reductions.

- High Competition: Brands like Xiaomi, Oppo, and Vivo frequently offer comparable features at lower price points, intensifying rivalry.

- Margin Pressure: Aggressive pricing by competitors directly squeezes Samsung's potential profit margins on individual devices.

- Market Share Focus: Companies often prioritize capturing market share, sometimes at the expense of short-term profitability, to build long-term customer bases.

- 2024 Market Dynamics: The smartphone market in 2024 continued to see intense price competition, with Samsung actively participating in promotional activities to defend its market position.

High exit barriers for established players

Samsung Electronics faces exceptionally high exit barriers due to its massive investments. Consider the billions poured into state-of-the-art semiconductor fabrication plants and extensive global supply chains. These sunk costs, coupled with significant R&D expenditures and established brand loyalty, make it incredibly difficult and costly for Samsung to simply walk away from the competitive landscape. This financial commitment inherently forces continued participation and intense rivalry, even when market conditions are challenging.

The sheer scale of Samsung's operational infrastructure creates formidable obstacles to exiting. For instance, the capital required to build and maintain advanced semiconductor foundries, which can easily run into tens of billions of dollars, represents a significant sunk cost. This financial reality means that even during periods of reduced demand or profitability, these assets cannot be easily repurposed or sold without substantial losses, compelling Samsung to persevere and compete vigorously.

- High Capital Investment: Samsung's semiconductor operations alone require tens of billions of dollars in capital expenditure for advanced fabrication facilities.

- Integrated Supply Chains: The company's extensive and complex global supply chain, built over decades, is difficult and expensive to dismantle.

- R&D Commitments: Continuous, substantial investment in research and development for next-generation technologies locks in resources and expertise.

- Brand Equity: The significant value and recognition of the Samsung brand represent a major asset that would be lost upon exiting key markets.

Samsung Electronics operates within an intensely competitive environment, particularly in the smartphone and consumer electronics sectors. Rivalry is fierce, driven by global giants like Apple and numerous aggressive Chinese manufacturers such as Xiaomi and Oppo, who often compete aggressively on price. This dynamic forces Samsung into a constant cycle of innovation and strategic pricing to maintain its market position and profitability.

The semiconductor industry also presents significant competitive pressures, with players like Intel and TSMC demanding continuous technological advancement. Samsung's substantial R&D investment, approximately 21.4 trillion Korean Won in 2023, underscores the need to stay ahead in this fast-paced market. Despite these challenges, Samsung's market share in 2024, especially in smartphones, demonstrates its resilience in navigating these demanding conditions.

| Competitor | Primary Market | Competitive Strategy |

|---|---|---|

| Apple | Smartphones, Consumer Electronics | Premium Branding, Ecosystem Integration |

| Xiaomi | Smartphones, Consumer Electronics | Aggressive Pricing, Value Proposition |

| Intel | Semiconductors (CPUs) | Technological Leadership, Performance |

| LG | Consumer Electronics | Product Innovation, Design |

SSubstitutes Threaten

The rise of alternative computing devices like tablets and wearables presents a significant threat of substitutes for Samsung's traditional smartphone and laptop offerings. These devices increasingly offer integrated functionalities, blurring the lines between product categories and expanding the competitive landscape beyond direct rivals. For instance, in 2024, the global tablet market was projected to reach over $70 billion, with shipments expected to grow, indicating a strong consumer preference for these versatile alternatives.

For Samsung's premium OLED and QLED televisions, the threat of substitutes is significant, primarily from alternative display technologies like advanced IPS LCD smart TVs. These alternatives often provide compelling performance at more accessible price points, directly impacting Samsung's high-end market share.

For instance, while Samsung continues to push the boundaries with its QLED technology, which saw significant sales growth in 2023, the availability of high-quality LCD televisions with improved local dimming and wider color gamuts presents a strong alternative for budget-conscious consumers. This broadens consumer choice and can divert demand away from Samsung's more expensive offerings.

The increasing prevalence of multi-functional smart devices and the expansion of the Internet of Things (IoT) present a significant threat of substitutes for Samsung. As more devices integrate capabilities, consumers can consolidate tasks, reducing the need for specialized Samsung products. For instance, a single smart display might handle functions previously requiring separate smart speakers or even basic entertainment devices.

Cloud-based services and software solutions

The increasing adoption of cloud-based services and Software-as-a-Service (SaaS) presents a significant threat of substitution for Samsung Electronics. As more computing power and applications move to the cloud, the demand for high-performance, locally installed hardware diminishes. This trend effectively substitutes for some of Samsung's traditional consumer electronics, like powerful PCs or dedicated gaming consoles, by offering similar functionality through web browsers or less powerful devices connected to the internet.

This shift fundamentally alters value creation, moving it from the sale of hardware to the ongoing provision of services. For instance, companies like Microsoft with its Azure cloud platform and Microsoft 365 suite, or Google with Google Cloud and Workspace, are capturing value that might have previously been tied to hardware purchases. Samsung's challenge lies in adapting its business model to capitalize on this service-oriented economy, rather than solely relying on hardware unit sales.

The impact is evident in the growing market for cloud gaming and streaming services, which reduce the need for dedicated gaming hardware. In 2024, the global cloud gaming market was projected to reach over $10 billion, demonstrating a clear consumer preference for accessing content and experiences without significant upfront hardware investment. This directly competes with Samsung's premium smartphone and tablet offerings, which are often used for mobile gaming.

- Reduced Hardware Dependency: Cloud computing and SaaS models allow users to access sophisticated software and processing power without requiring top-tier local hardware, thereby substituting for the need to purchase high-end devices.

- Shift in Value Proposition: Value is increasingly captured by service providers offering ongoing access to applications and data, rather than by manufacturers selling discrete hardware units.

- Market Growth in Cloud Services: The global cloud computing market, including SaaS, continues to expand rapidly, with projected revenues in the hundreds of billions of dollars for 2024, indicating a strong consumer and business migration towards these solutions.

- Competition from Service Giants: Major tech players focusing heavily on cloud infrastructure and subscription-based software pose a direct competitive threat by offering integrated ecosystems that can reduce the perceived need for Samsung's hardware.

Emerging technologies like AR/VR/XR and personal robots

Emerging technologies such as augmented reality (AR), virtual reality (VR), and extended reality (XR) glasses, alongside personal robots, present a significant threat of substitution for Samsung Electronics. These advancements offer novel ways for consumers to engage with digital content and receive assistance, potentially displacing traditional devices.

For instance, AR/VR/XR could substitute for smartphones and tablets in entertainment, gaming, and even communication, offering more immersive experiences. Personal robots, in turn, might fulfill roles currently occupied by smart home devices or personal assistants, providing physical interaction and task completion.

- Immersive Entertainment: AR/VR/XR could replace consoles and streaming devices by offering interactive, virtual environments for gaming and media consumption.

- Enhanced Communication: XR technologies might offer more engaging alternatives to video calls, simulating in-person interactions.

- Personalized Assistance: Personal robots could substitute for smart speakers and other home automation devices by performing physical tasks and offering companionship.

- Market Penetration: While still nascent, the global AR/VR market was projected to reach over $100 billion by 2025, indicating substantial future growth and potential for substitution.

The threat of substitutes for Samsung's diverse product portfolio is substantial, driven by evolving consumer preferences and technological advancements. Alternative computing devices, like tablets and wearables, increasingly offer integrated functionalities that blur product lines and compete with traditional smartphones and laptops. For example, the global tablet market was projected to exceed $70 billion in 2024, highlighting a strong consumer appetite for these versatile devices.

Samsung's premium televisions face competition from advanced IPS LCD smart TVs, which provide comparable performance at lower price points, impacting high-end market share. Similarly, the growth of cloud-based services and Software-as-a-Service (SaaS) diminishes the need for high-performance local hardware, substituting for PCs and gaming consoles. The cloud gaming market alone was expected to surpass $10 billion in 2024, illustrating a shift towards service-based entertainment.

| Substitute Area | Key Substitutes | Impact on Samsung | 2024 Market Data/Projections |

|---|---|---|---|

| Computing Devices | Tablets, Wearables | Cannibalizes smartphone/laptop sales | Tablet market > $70 billion |

| Televisions | Advanced IPS LCD TVs | Threatens premium segment share | N/A (general trend) |

| Hardware-centric Services | Cloud Computing, SaaS, Cloud Gaming | Reduces demand for high-end devices | Cloud Gaming market > $10 billion |

| Immersive Technologies | AR/VR/XR Glasses, Personal Robots | Potential displacement of current devices | AR/VR market projected > $100 billion by 2025 |

Entrants Threaten

The sheer scale of investment needed to compete in Samsung Electronics' core markets, like semiconductors and advanced displays, presents a formidable barrier. Building state-of-the-art fabrication plants, known as fabs, can easily cost billions of dollars, with leading-edge facilities often exceeding $20 billion. For instance, Intel's investment in new fabs in Arizona, announced in 2021, was initially pegged at $20 billion, highlighting the immense capital required.

Beyond the initial construction, ongoing investment in research and development is critical to stay competitive. Samsung consistently spends billions annually on R&D to innovate in areas like AI, 5G, and next-generation memory chips. In 2023, Samsung's R&D expenditure was approximately 20.1 trillion Korean Won (around $15 billion USD), a figure that new entrants would need to match to even approach parity.

This necessity for massive upfront capital and continuous R&D spending significantly deters potential new players. Without access to substantial funding and a proven track record, it is incredibly difficult for newcomers to establish a foothold and challenge established giants like Samsung, creating a high barrier to entry.

The sheer scale of ongoing research and development (R&D) required for market leadership presents a significant barrier for new entrants. Samsung's commitment to innovation, particularly in fast-evolving sectors like semiconductors, advanced displays, and artificial intelligence (AI), necessitates massive, sustained financial outlays. For instance, in 2023, Samsung Electronics allocated approximately 22.7 trillion Korean won (around $17.3 billion USD) to R&D, a testament to the continuous investment needed to stay competitive.

New players would find it incredibly challenging to replicate the established technological expertise and extensive patent portfolios held by industry leaders like Samsung. These intellectual property assets, built over years of dedicated innovation, create a formidable moat, making it difficult for newcomers to offer comparable products or to do so without infringing on existing patents.

Samsung benefits from decades of brand building, fostering strong customer loyalty that makes it difficult for newcomers to gain traction. This loyalty is a significant barrier, as consumers often prefer the familiarity and perceived reliability of established brands.

Established distribution networks are another formidable hurdle. Samsung boasts extensive global channels, encompassing everything from major retail partnerships to a robust online presence, ensuring its products are readily available. New entrants struggle to replicate this reach, facing immense challenges in securing effective market access and competing for shelf space or online visibility.

Economies of scale and cost advantages

Samsung Electronics benefits from substantial economies of scale, a significant barrier to entry for potential new competitors. Its vast production capacity, particularly in memory chips and smartphones, allows it to spread fixed costs over a much larger output, driving down per-unit manufacturing expenses. For example, in 2023, Samsung's semiconductor division alone generated approximately 83.5 trillion Korean Won (around $63 billion USD), showcasing the sheer volume of its operations.

New entrants would struggle to match these cost advantages. Without the established infrastructure and massive production volumes that Samsung commands, newcomers would face considerably higher per-unit costs. This would make it incredibly challenging to compete on price with Samsung's offerings, potentially leading to significant initial losses for any new player attempting to gain market share.

- Economies of Scale: Samsung's immense production volumes in semiconductors and consumer electronics enable lower per-unit costs, a key advantage.

- Cost Advantages: Established players like Samsung have optimized supply chains and manufacturing processes that are difficult and expensive for new entrants to replicate.

- Price Competition: New entrants would find it hard to match Samsung's pricing without incurring substantial initial losses due to their smaller scale.

Complex regulatory landscape and geopolitical risks

The global electronics industry is heavily influenced by a complex web of regulations, trade policies, and geopolitical risks. For instance, in 2024, ongoing trade disputes and the implementation of tariffs, particularly between major economic blocs, can significantly increase the cost of components and finished goods for new entrants. Navigating these shifting international trade dynamics and potential export restrictions presents a substantial barrier, making it difficult for newcomers to establish a stable and cost-effective global supply chain and market presence.

New companies face considerable challenges in understanding and complying with diverse national and international regulations governing product safety, environmental standards, and data privacy. The escalating geopolitical tensions witnessed throughout 2024, including regional conflicts and the rise of protectionist policies, further complicate market entry. These factors can lead to unpredictable market access, supply chain disruptions, and increased operational costs, deterring potential new competitors from entering the market.

- Regulatory Hurdles: New entrants must contend with varying product certification requirements and environmental compliance mandates across different regions, adding significant upfront costs and time delays.

- Geopolitical Instability: Trade wars, sanctions, and national security concerns can abruptly alter market access and sourcing strategies, creating an unpredictable operating environment.

- Tariff Impact: In 2024, tariffs on key electronic components and finished products, such as those seen in US-China trade relations, can inflate production costs by as much as 10-25% for new companies.

- Supply Chain Vulnerability: Geopolitical events can disrupt global supply chains, making it difficult for new players to secure reliable and affordable access to essential materials and manufacturing capabilities.

The threat of new entrants for Samsung Electronics is significantly mitigated by the immense capital requirements and technological expertise needed to compete. Building and maintaining cutting-edge manufacturing facilities, like semiconductor fabrication plants, demands billions of dollars, a sum few new companies can readily access. Furthermore, Samsung's substantial and continuous investment in research and development, totaling approximately $17.3 billion USD in 2023, creates a high bar for any newcomer aiming to match its innovation pace.

Established brand loyalty and extensive global distribution networks also pose considerable challenges for new entrants. Samsung has cultivated decades of consumer trust, making it difficult for unproven brands to gain market share. Replicating Samsung's reach, which spans major retail partnerships and a robust online presence, requires significant investment and time, further deterring potential competitors.

Economies of scale provide Samsung with a crucial cost advantage. Its massive production volumes allow for lower per-unit manufacturing costs, especially in areas like semiconductors where its 2023 revenue was around $63 billion USD. New entrants, operating at a much smaller scale, would face higher per-unit costs, making price competition against Samsung extremely difficult and potentially unsustainable.

Navigating complex global regulations and geopolitical risks presents another significant barrier. In 2024, trade disputes and varying international compliance standards can inflate costs and disrupt supply chains for new companies. For instance, tariffs on electronic components can increase production costs by 10-25%, a burden that established players like Samsung are better equipped to absorb.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

| Capital Requirements | High cost of building advanced manufacturing facilities. | Deters entry due to prohibitive upfront investment. | Semiconductor fabs can cost over $20 billion. |

| R&D Investment | Continuous spending needed for technological advancement. | Requires matching significant annual R&D budgets. | Samsung's 2023 R&D: ~$17.3 billion USD. |

| Brand Loyalty & Distribution | Established customer trust and extensive sales channels. | Difficult for new brands to gain traction and market access. | Samsung's global reach includes major retailers and online platforms. |

| Economies of Scale | Lower per-unit costs due to high production volumes. | Makes price competition challenging for smaller players. | Samsung's 2023 semiconductor revenue: ~$63 billion USD. |

| Regulatory & Geopolitical Factors | Complex compliance rules and trade policy uncertainties. | Increases operational costs and market access risks. | Tariffs in 2024 can raise component costs by 10-25%. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Samsung Electronics is built upon a foundation of credible data, including Samsung's official annual reports, investor relations disclosures, and filings with regulatory bodies like the SEC. We also incorporate insights from reputable market research firms and industry-specific publications to capture a comprehensive view of the competitive landscape.