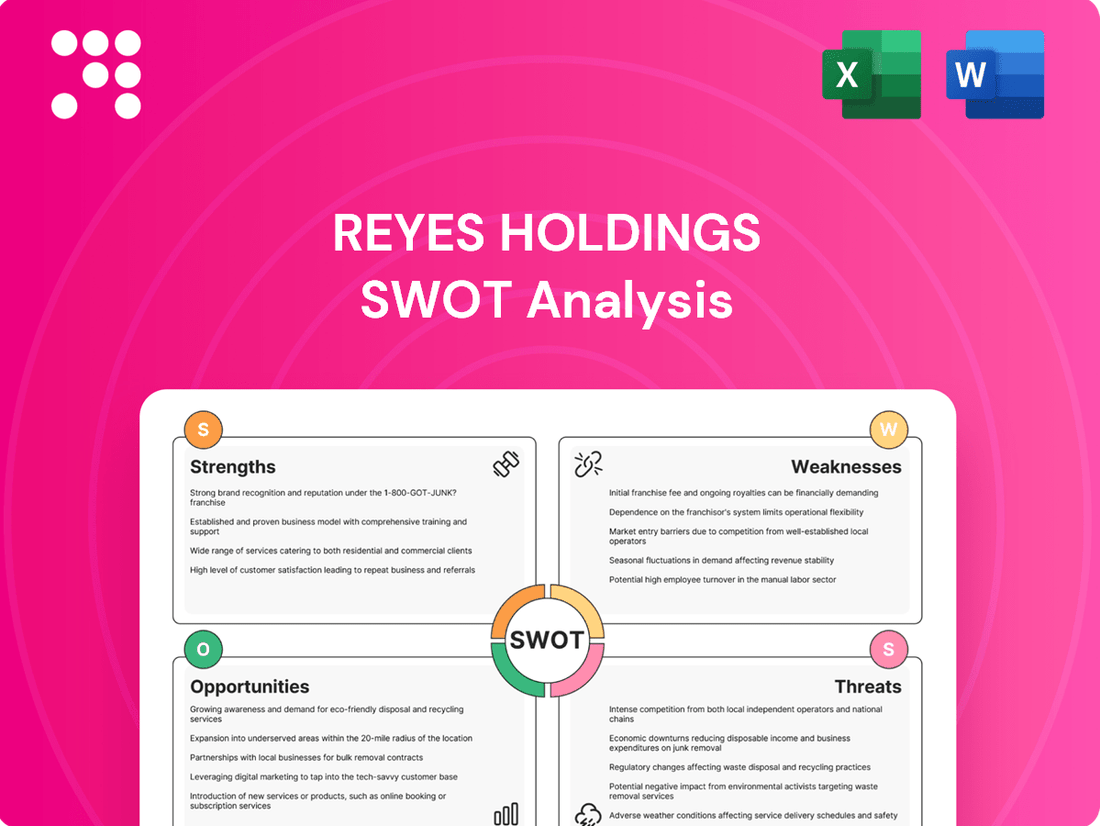

Reyes Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Reyes Holdings Bundle

Reyes Holdings boasts significant strengths in its vast distribution network and strong brand partnerships, but faces challenges from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for any stakeholder looking to navigate the food and beverage landscape.

Want the full story behind Reyes Holdings' market advantages, potential threats, and opportunities for expansion? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Reyes Holdings boasts a diversified business portfolio, encompassing the Reyes Beer Division, Martin Brower, and Reyes Coca-Cola Bottling. This strategic spread across beer, soft drinks, and global foodservice logistics creates a resilient revenue stream. Such diversification significantly reduces the company's vulnerability to downturns in any single sector, providing a more stable financial foundation.

Reyes Holdings possesses an impressive distribution network, covering 48 U.S. states and extending into 18 countries. This vast infrastructure facilitates the annual distribution of over 1.3 billion cases of beverage and food products, showcasing its significant scale and operational capacity.

This extensive reach is a major strength, enabling Reyes Holdings to efficiently serve a broad customer base, including countless retailers and restaurants. Their ability to penetrate diverse markets and ensure timely delivery of goods is a testament to their robust logistics and market presence.

Reyes Holdings boasts powerful, enduring alliances with industry titans like Coca-Cola and McDonald's. These relationships are not just historical; they translate into predictable revenue streams and preferential terms, giving Reyes a significant edge in the market.

These deep connections often involve exclusive distribution rights and highly integrated supply chain operations, which are critical for efficiency and cost management. For instance, their long-standing relationship with Coca-Cola has been a cornerstone of their beverage distribution business for decades, ensuring consistent demand and operational synergy.

Market Leadership in Key Segments

Reyes Holdings boasts significant market leadership, notably as the largest beer distributor in the United States. Its subsidiary, Martin Brower, holds the distinction of being the largest global distributor for McDonald's. This dual dominance in crucial sectors provides substantial leverage.

This commanding presence translates into significant advantages. Reyes Holdings can capitalize on economies of scale, reducing operational costs. Furthermore, its strong market position grants considerable negotiating power with both suppliers and customers, a key factor in maintaining profitability and market share.

The company's market leadership is underpinned by its vast operational network and established relationships. For instance, in 2023, Reyes Beer Division managed the distribution of over 300 million cases of beer, solidifying its top position in the U.S. market. Similarly, Martin Brower's extensive global supply chain serves tens of thousands of McDonald's locations worldwide.

Key strengths derived from this market leadership include:

- Unmatched Scale: Operating as the largest beer distributor in the US and the primary global distributor for McDonald's.

- Negotiating Power: Ability to secure favorable terms with suppliers and customers due to market dominance.

- Operational Efficiency: Leveraging economies of scale to drive down costs and improve profitability.

- Brand Strength: Association with leading brands like McDonald's enhances its reputation and reliability.

Commitment to Sustainability and Operational Innovation

Reyes Holdings is actively pursuing sustainability, evidenced by their adoption of lighter-weight packaging for Coca-Cola products, a move that reduces material usage and transportation emissions. In 2024, their fleet modernization included the deployment of electric delivery trucks, aiming to cut down on carbon footprint and operational costs.

Further demonstrating their commitment, Reyes Holdings continues to upgrade facilities with energy-efficient technologies. These investments not only improve operational efficiency, potentially lowering energy expenditures by an estimated 10-15% in upgraded locations, but also position the company favorably to meet increasing environmental regulations and consumer preferences for sustainable business practices.

- Reduced Material Usage: Lighter packaging for Coca-Cola products.

- Lower Emissions: Deployment of electric delivery trucks in 2024.

- Operational Efficiency: Facility upgrades with energy-efficient technologies.

- Market Alignment: Meeting growing environmental consumer and regulatory demands.

Reyes Holdings' diversification across beer, soft drinks, and foodservice logistics provides a robust and stable financial foundation. This broad operational scope, covering 48 U.S. states and 18 countries, ensures resilience against sector-specific downturns. Their distribution network handles over 1.3 billion cases annually, highlighting significant operational capacity and market penetration.

The company benefits from deeply entrenched partnerships with industry leaders like Coca-Cola and McDonald's. These alliances translate into consistent revenue streams and preferential terms, such as exclusive distribution rights, which are crucial for cost management and market advantage. For example, their long-standing relationship with Coca-Cola has been a pillar of their beverage distribution for decades.

Reyes Holdings commands significant market leadership, notably as the largest beer distributor in the United States and the primary global distributor for McDonald's through its subsidiary, Martin Brower. This dual dominance offers substantial economies of scale and powerful negotiating leverage with both suppliers and customers. In 2023, Reyes Beer Division distributed over 300 million cases of beer, underscoring its top-tier market position.

Their commitment to sustainability is evident in initiatives like lighter-weight packaging for Coca-Cola products and the deployment of electric delivery trucks in 2024. These efforts not only reduce environmental impact and operational costs but also align the company with growing consumer and regulatory demands for sustainable practices.

| Business Segment | Market Position | Key Metric/Fact |

|---|---|---|

| Reyes Beer Division | Largest Beer Distributor in the U.S. | Distributed over 300 million cases in 2023. |

| Martin Brower | Largest Global Distributor for McDonald's | Serves tens of thousands of McDonald's locations globally. |

| Reyes Coca-Cola Bottling | Major Coca-Cola Bottler | Distributes over 1.3 billion cases annually across its network. |

| Sustainability Initiatives | Environmental Focus | Deployed electric delivery trucks in 2024; lighter packaging for Coca-Cola products. |

What is included in the product

This SWOT analysis provides a comprehensive review of Reyes Holdings's internal strengths and weaknesses, alongside external opportunities and threats within its operating landscape.

Offers a clear, actionable SWOT breakdown of Reyes Holdings to pinpoint and address strategic vulnerabilities.

Weaknesses

Reyes Holdings' significant reliance on a few major clients presents a notable weakness. For instance, Martin Brower, a key subsidiary, generates a substantial portion of its revenue from McDonald's. Similarly, Reyes Coca-Cola Bottling's business is heavily tied to its distribution agreement with Coca-Cola.

This concentration means that any adverse shifts in these cornerstone clients' operations, such as changes in their purchasing volumes or supply chain strategies, could have a disproportionately large negative effect on Reyes Holdings' overall financial health and stability.

Reyes Holdings' extensive global distribution network, spanning numerous countries and product lines like food and beverage, creates significant operational hurdles. Coordinating logistics and managing inventory across such a vast and varied landscape is inherently complex. For instance, the sheer volume of SKUs and geographic points necessitates sophisticated systems to maintain efficiency and avoid disruptions, a challenge amplified by differing local regulations and infrastructure quality.

Reyes Holdings, despite its strong operational foundation, faces inherent vulnerabilities within its vast global supply chain. Events like the ongoing geopolitical tensions impacting shipping routes or the lingering effects of pandemic-related disruptions can significantly affect its ability to source and distribute products efficiently. For instance, the Suez Canal blockage in 2021, which rerouted millions of tons of goods, highlights the systemic risks that can cascade through extensive international networks, potentially leading to increased operational costs and product availability issues for companies like Reyes.

Industry-Wide Labor Shortages

Reyes Holdings, like many in the broader logistics and food and beverage distribution sectors, is grappling with significant industry-wide labor shortages. This persistent challenge directly affects operational efficiency, as a lack of available workers can lead to slower delivery times and reduced throughput.

The scarcity of qualified personnel also drives up labor costs through increased wages and benefits, impacting the company's bottom line. Furthermore, these shortages pose a risk to Reyes Holdings' capacity to meet escalating customer demand and pursue strategic expansion initiatives. For instance, the American Trucking Associations reported a shortage of over 80,000 drivers in late 2023, a critical role within the logistics chain.

- Persistent Labor Shortages: The logistics and food/beverage distribution industries continue to experience a deficit in available workforce.

- Impact on Operations: Shortages can reduce efficiency, increase delivery times, and strain existing resources.

- Rising Labor Costs: Increased competition for talent is driving up wages and benefit expenses.

- Hindered Growth: Inability to secure sufficient staff can limit expansion plans and the ability to service growing demand.

Capital-Intensive Business Model

Reyes Holdings operates a capital-intensive business model. Maintaining and expanding its extensive food and beverage distribution and bottling infrastructure, including warehouses, transportation fleets, and technology, demands significant and continuous capital outlay. For instance, in 2023, capital expenditures were reported to be substantial, reflecting ongoing investments in fleet modernization and facility upgrades to meet growing demand and operational efficiency targets.

This high level of capital expenditure can put pressure on profitability and cash flow, particularly during economic downturns when revenues might be less predictable. The need for constant reinvestment in physical assets means that a larger portion of earnings is often tied up in maintaining the business's operational capacity rather than being available for other strategic initiatives or shareholder returns.

- High Capital Requirements: Significant ongoing investment is needed for warehouses, transportation, and technology.

- Impact on Cash Flow: Substantial capital expenditures can strain cash flow and profitability.

- Economic Sensitivity: Periods of economic uncertainty exacerbate the challenges of a capital-intensive model.

Reyes Holdings' significant reliance on a few major clients presents a notable weakness, as adverse shifts in their operations could disproportionately affect the company's financial health.

The company's extensive global distribution network, spanning numerous countries and product lines, creates inherent complexity in logistics and inventory management, amplified by differing local regulations.

Vulnerabilities within its vast global supply chain, such as geopolitical tensions impacting shipping or pandemic-related disruptions, can significantly affect efficient sourcing and distribution, leading to increased costs.

Persistent labor shortages in the logistics and food/beverage distribution sectors directly impact operational efficiency and drive up labor costs, potentially hindering growth initiatives.

What You See Is What You Get

Reyes Holdings SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The global non-alcoholic beverage market is booming, projected to reach $1.7 trillion by 2027, with functional beverages and low/no-alcohol options seeing particular acceleration. Consumers are increasingly prioritizing health and wellness, creating a substantial opportunity for Reyes Holdings to expand its distribution into these rapidly growing segments.

The beverage and food distribution sectors remain quite fragmented, offering Reyes Holdings significant opportunities to grow through strategic acquisitions. This fragmentation allows for consolidation, enhancing efficiency and market penetration.

Reyes Holdings has actively engaged in acquiring businesses to expand its geographic footprint and solidify its market share. For instance, in 2024, the company continued its acquisition strategy, building on its established network and reinforcing its leadership in key markets.

Reyes Holdings can significantly boost its operational performance by investing in advanced supply chain technologies. Embracing AI for demand forecasting, for instance, could refine inventory management, potentially reducing carrying costs by an estimated 10-15% based on industry averages from 2024.

Automation in warehousing and transportation, a trend accelerating in 2025, promises to streamline processes, leading to faster order fulfillment and reduced labor expenses. Companies adopting these technologies have reported efficiency gains of up to 20%.

Enhanced data analytics offers critical insights into logistics networks, enabling route optimization and identifying cost-saving opportunities. This data-driven approach can improve on-time delivery rates, a key metric for customer satisfaction, with many leading logistics firms targeting 98%+ reliability by late 2025.

Expansion into New Product Categories (e.g., Wine and Spirits)

Reyes Beer Division is strategically broadening its reach by venturing into wine and spirits, a move supported by recent distribution agreements and emerging partnerships. This diversification is designed to access new, expanding markets and serve a more diverse consumer base.

The global wine and spirits market is substantial and continues to grow. For instance, the global spirits market was valued at approximately $1.3 trillion in 2023 and is projected to reach over $1.8 trillion by 2030, demonstrating significant upside potential for Reyes Holdings.

- Market Diversification: Entering wine and spirits allows Reyes to reduce reliance on the beer segment and capture a larger share of the beverage alcohol market.

- Revenue Growth: The premiumization trend in wine and spirits, coupled with increasing consumer demand for variety, presents a strong opportunity for revenue expansion.

- Synergies: Leveraging existing distribution networks and operational expertise can create cost efficiencies and accelerate market penetration in these new categories.

Meeting Evolving Sustainability and ESG Demands

Reyes Holdings can capitalize on the growing demand for sustainability by integrating robust ESG practices across its operations. This includes optimizing logistics for reduced emissions and ensuring ethical sourcing throughout its supply chains, aligning with increasing consumer and regulatory pressures. For instance, in 2024, the global ESG investing market was projected to reach over $33 trillion, highlighting a significant financial incentive for companies to demonstrate strong ESG performance.

By proactively enhancing its sustainability initiatives, Reyes Holdings has a clear opportunity to build a stronger brand image and attract environmentally conscious partners and investors. This focus can translate into tangible business benefits, such as improved operational efficiency and access to capital from funds prioritizing ESG criteria.

- Enhanced Brand Reputation: Demonstrating commitment to ESG can elevate Reyes Holdings' public image.

- Attracting ESG-Focused Investors: The growing ESG investment market offers a significant opportunity for capital.

- Strengthening Partnerships: Collaborating with businesses that prioritize sustainability can lead to new ventures.

- Operational Efficiencies: Implementing green logistics can reduce costs and environmental impact.

Reyes Holdings is well-positioned to expand its distribution into the rapidly growing non-alcoholic beverage market, which is expected to reach $1.7 trillion by 2027, particularly with functional and low/no-alcohol options. The company can also leverage the fragmented nature of the beverage and food distribution sectors for growth through strategic acquisitions, continuing its pattern of expansion seen in 2024.

Diversifying into wine and spirits offers significant revenue growth potential, tapping into a market valued at approximately $1.3 trillion in 2023, with projections to exceed $1.8 trillion by 2030. This move allows Reyes to reduce its reliance on beer and capitalize on premiumization trends and consumer demand for variety.

Investing in advanced supply chain technologies, such as AI for demand forecasting and automation in warehousing, presents an opportunity to boost operational performance. These investments can lead to efficiency gains of up to 20% and improved on-time delivery rates, targeting over 98% reliability by late 2025.

Furthermore, integrating robust ESG practices can enhance Reyes Holdings' brand reputation and attract capital from the growing ESG investing market, projected to exceed $33 trillion in 2024. This focus on sustainability can also drive operational efficiencies and strengthen partnerships.

| Opportunity Area | Market Size/Growth (2024/2025 Data) | Key Benefit for Reyes | Example Action |

|---|---|---|---|

| Non-Alcoholic Beverages | Global market projected to reach $1.7T by 2027 | Capture growth in health-conscious segments | Expand distribution of functional beverages |

| Market Consolidation | Fragmented distribution sectors | Increase market share and efficiency | Strategic acquisitions in beverage/food distribution |

| Wine & Spirits Expansion | Global spirits market ~$1.3T (2023), growing | Diversify revenue, tap premium markets | Leverage existing networks for new product lines |

| Supply Chain Technology | Efficiency gains up to 20% with automation | Improve operational performance, reduce costs | Implement AI for demand forecasting, automate warehousing |

| ESG Integration | ESG market >$33T (2024 projection) | Enhance brand, attract ESG investors | Optimize logistics for reduced emissions |

Threats

Global geopolitical conflicts and escalating trade tensions present a significant threat to Reyes Holdings. For instance, ongoing conflicts in Eastern Europe and the Middle East have already disrupted global supply chains, leading to increased shipping costs and delivery delays throughout 2024.

Broader economic uncertainties, including persistent inflation and the looming possibility of recessions in key markets, further exacerbate these risks. Inflationary pressures, which averaged around 4.5% globally in early 2025, directly increase operational costs for Reyes Holdings, while a potential economic downturn could significantly reduce consumer purchasing power and dampen demand for their distributed products.

Consumer tastes are evolving quickly, and Reyes Holdings must stay ahead of these changes. For instance, a reported 15% year-over-year increase in online grocery sales in early 2024 highlights a growing preference for digital channels, potentially impacting traditional distribution models. This shift demands constant adaptation and a willingness to innovate.

The food and beverage distribution landscape is intensely competitive, with Reyes Holdings facing pressure from both long-standing companies and emerging players. This heightened rivalry, especially with aggressive pricing tactics and market consolidation trends observed in 2024, directly challenges Reyes Holdings' profitability and standing in the market.

Increased Regulatory Scrutiny and Anti-Trust Concerns

Reyes Holdings' significant presence in the beer distribution market, fueled by consistent acquisitions, raises the likelihood of increased regulatory attention and potential anti-trust investigations. This heightened scrutiny could impact its ability to pursue further consolidation or impose operational constraints.

For instance, in 2024, the beer distribution industry continued to see consolidation, with Reyes Holdings being a key player. Regulatory bodies are increasingly monitoring market concentration to prevent monopolistic practices, meaning Reyes Holdings may face stricter oversight on future deals.

- Market Dominance: Reyes Holdings' substantial market share in key regions could trigger anti-trust reviews.

- Acquisition Pace: The company's aggressive acquisition strategy may attract regulatory scrutiny regarding market consolidation.

- Operational Restrictions: Potential investigations could lead to limitations on business practices or future expansion.

Cybersecurity Risks and Data Integrity Issues

Reyes Holdings' growing dependence on technology for its vast supply chain, logistics, and data analysis makes it vulnerable to cybersecurity threats. A significant breach could halt operations, compromise sensitive data, and result in substantial financial losses, impacting its market standing.

The potential for data integrity issues also poses a threat, as inaccuracies or corruption within its systems could lead to flawed decision-making. For instance, in 2023, the global average cost of a data breach reached $4.45 million, according to IBM's Cost of a Data Breach Report. This highlights the financial exposure Reyes Holdings faces.

- Cybersecurity Breaches: Increased reliance on digital platforms amplifies the risk of ransomware, phishing, and other cyber-attacks.

- Data Integrity: Errors or manipulation of data within logistics and analytics systems can lead to incorrect business strategies.

- Operational Disruption: A successful attack could paralyze supply chain operations, affecting delivery schedules and customer service.

- Reputational Damage: Data breaches and operational failures can severely erode customer trust and brand reputation.

The intense competition within the food and beverage distribution sector, marked by aggressive pricing and consolidation trends observed in 2024, directly challenges Reyes Holdings' market position and profitability. Simultaneously, evolving consumer preferences, such as the 15% year-over-year growth in online grocery sales seen in early 2024, necessitate continuous adaptation and innovation in distribution strategies.

Escalating global geopolitical conflicts and trade tensions pose a significant threat, disrupting supply chains and increasing operational costs, as evidenced by rising shipping expenses throughout 2024. Broader economic uncertainties, including persistent inflation averaging around 4.5% globally in early 2025, further compound these risks by increasing operational expenses and potentially reducing consumer demand.

| Threat Category | Specific Risk | Impact on Reyes Holdings | 2024/2025 Data Point |

|---|---|---|---|

| Competitive Landscape | Intensified rivalry and aggressive pricing | Erosion of profit margins, market share loss | Industry consolidation trends prominent in 2024 |

| Changing Consumer Behavior | Shift towards digital channels | Reduced reliance on traditional distribution models | 15% YoY growth in online grocery sales (early 2024) |

| Geopolitical & Economic Instability | Supply chain disruptions and inflation | Increased operational costs, reduced consumer spending | Global inflation averaged ~4.5% (early 2025) |

SWOT Analysis Data Sources

This SWOT analysis for Reyes Holdings is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic overview.