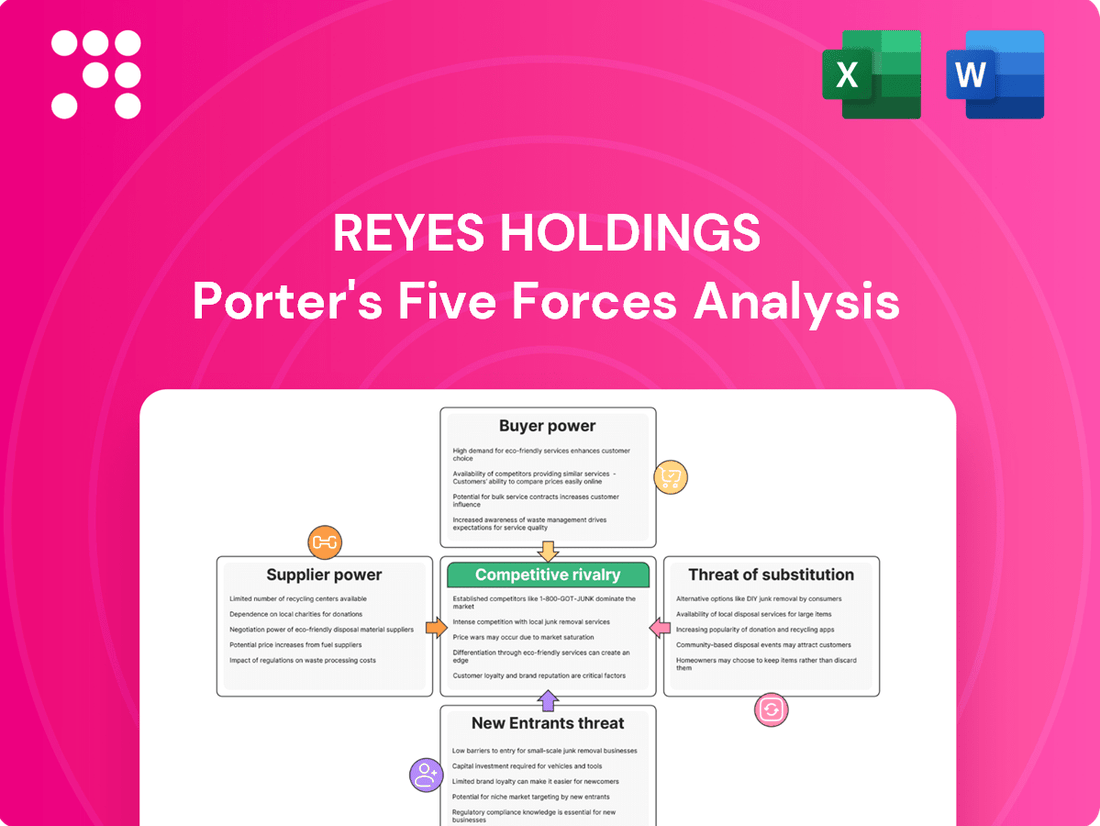

Reyes Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Reyes Holdings Bundle

Reyes Holdings operates within a dynamic distribution landscape, facing significant pressures from powerful buyers and intense rivalry among established players. Understanding the nuances of supplier bargaining power and the threat of substitutes is crucial for navigating this competitive arena.

The complete report reveals the real forces shaping Reyes Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of key brand manufacturers is a significant force for Reyes Holdings. Major beverage companies such as Coca-Cola, Molson Coors, Constellation Brands, and Diageo hold considerable sway. Their established brand recognition and widespread consumer demand grant them substantial leverage in dictating terms.

These powerful brands can influence pricing, product allocation, and the level of marketing support Reyes provides. While Reyes is essential for their distribution, the ultimate control over the products rests with the manufacturers themselves, allowing them to negotiate favorable conditions.

For divisions such as Martin Brower, a key player in global food service distribution, specialized logistics technology providers represent a significant supplier group. These technology partners offer critical solutions for inventory management and demand forecasting. For instance, Martin Brower's use of Blue Yonder's platform highlights a reliance on advanced, proprietary systems that enhance operational efficiency.

Reyes Coca-Cola Bottling relies heavily on suppliers for critical raw materials like PET resin for bottles and other packaging. The cost and consistent availability of these inputs are vital for operations. For instance, fluctuations in PET prices, driven by crude oil markets and global demand, directly impact Reyes' production costs. In 2023, global PET prices experienced volatility, with some regions seeing increases of up to 15% due to supply chain constraints and rising energy costs, giving PET resin producers significant leverage.

Transportation and Fleet Suppliers

The bargaining power of transportation and fleet suppliers for a company like Reyes Holdings is significant, given the scale of its distribution operations. Reyes' vast network necessitates a substantial fleet, making it reliant on suppliers for vehicles, maintenance, fuel, and technology. This reliance means that supplier pricing and innovation directly influence Reyes' operational expenditures and overall efficiency.

The increasing trend towards electric vehicle (EV) fleets and advanced fleet management systems further concentrates power in the hands of specialized suppliers. As of 2024, the global electric truck market is experiencing rapid growth, with projections indicating continued expansion. For instance, companies investing heavily in fleet electrification, like some major logistics players, are increasingly dependent on a smaller pool of EV manufacturers and charging infrastructure providers. This dependency can lead to less favorable terms for buyers if supply chains for critical components, such as batteries, remain constrained.

- Fleet Size Dependence: Reyes Holdings' extensive distribution network requires a large, consistent supply of vehicles and related services.

- Technological Integration: Investments in electric vehicle fleets and advanced management systems create reliance on specialized technology suppliers.

- Supplier Innovation Impact: Innovations and pricing strategies from these specialized suppliers can directly affect Reyes' operational costs and efficiency.

- Market Trends: The growing demand for sustainable transportation solutions concentrates power with suppliers offering EV technology and infrastructure.

Labor Market

The labor market significantly influences the bargaining power of suppliers for Reyes Holdings, especially concerning its distribution and logistics operations. A skilled workforce, encompassing drivers, warehouse personnel, and logistics experts, is absolutely essential for the smooth functioning of Reyes Holdings' supply chain. For instance, the American Trucking Associations reported in 2023 that the US faced a shortage of over 78,000 drivers, a figure expected to grow, directly impacting labor costs for companies like Reyes Holdings.

This scarcity, particularly acute for drivers in the food and beverage supply chain, empowers employees. When labor is in short supply, workers can demand higher wages and better benefits, thereby increasing the overall cost structure for distributors. This heightened bargaining power for labor directly translates to increased operational expenses for Reyes Holdings, potentially affecting profitability.

- Skilled Workforce Dependency: Reyes Holdings relies heavily on specialized labor such as truck drivers and warehouse staff.

- Driver Shortage Impact: The ongoing shortage of qualified truck drivers, a persistent issue in 2024, drives up wages and recruitment costs.

- Increased Labor Costs: Higher wages and improved benefits demanded by a tight labor market directly inflate Reyes Holdings' operational expenses.

- Supplier Leverage: Labor unions or collective bargaining agreements, if present, can further amplify the bargaining power of employees, acting as a supplier of labor.

The bargaining power of suppliers for Reyes Holdings is notably high across several key areas, impacting its operational costs and strategic flexibility. This leverage stems from the essential nature of their products and services, coupled with market dynamics that favor suppliers.

For instance, in the beverage sector, major brand manufacturers like Coca-Cola and Diageo wield significant power due to their strong consumer demand and established brand equity. Similarly, specialized logistics technology providers and suppliers of critical raw materials such as PET resin exert considerable influence. The ongoing driver shortage in the US, projected to exceed 78,000 in 2024, further amplifies the bargaining power of labor, a crucial supplier of services for Reyes Holdings.

| Supplier Category | Key Dependencies for Reyes Holdings | Supplier Bargaining Power Factors | Impact on Reyes Holdings |

|---|---|---|---|

| Brand Manufacturers (e.g., Coca-Cola, Diageo) | Product allocation, pricing, marketing support | Brand recognition, consumer demand, product control | Influenced terms, potential margin pressure |

| Logistics Technology Providers (e.g., Blue Yonder) | Inventory management, demand forecasting systems | Proprietary systems, operational efficiency enhancement | Reliance on specialized solutions, integration costs |

| Raw Material Suppliers (e.g., PET resin) | Packaging materials for bottling | Crude oil prices, supply chain constraints, global demand | Volatile input costs, potential production disruptions |

| Fleet & EV Suppliers | Vehicles, maintenance, fuel, fleet management tech | Growth in EV market, limited specialized suppliers | Increased operational expenditures, dependence on innovation |

| Labor (Drivers, Warehouse Staff) | Essential workforce for distribution and logistics | Skilled labor shortage, wage demands, collective bargaining | Higher labor costs, recruitment challenges |

What is included in the product

This analysis unpacks the competitive forces impacting Reyes Holdings, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes within the beverage and food distribution industry.

Instantly identify and mitigate competitive threats with a comprehensive, visual breakdown of Reyes Holdings' market landscape.

Customers Bargaining Power

Large retail chains and restaurant groups, like McDonald's, represent a significant portion of Reyes Holdings' customer base. These powerful buyers, such as Martin Brower serving McDonald's, often procure vast quantities of goods. Their substantial purchasing volume grants them considerable leverage to negotiate favorable pricing and service conditions, as they can easily explore alternative distribution partners or demand specific concessions.

Customers in the food and beverage sector place a high premium on receiving goods punctually, ensuring product freshness, and benefiting from streamlined supply chains. This strong preference for superior service levels directly translates into significant bargaining power for these buyers.

Distributors must consistently invest in advanced technology and operational improvements to satisfy these demanding expectations. For instance, the global cold chain logistics market, crucial for maintaining product freshness, was valued at approximately $250 billion in 2023 and is projected to grow significantly, reflecting the ongoing investment required to meet customer service standards.

Failure to meet these service benchmarks can lead to swift customer attrition, compelling distributors to offer competitive pricing or enhanced services to retain business, thereby amplifying customer leverage.

Consumer preferences are a significant force, especially in the beverage sector. For instance, in 2024, there was a notable surge in demand for plant-based and low-sugar drinks, with sales in these categories growing by an estimated 15% year-over-year. This shift directly impacts retailers, who then must adjust their orders to Reyes Holdings, effectively dictating the product mix they need.

This customer-driven demand means Reyes Holdings has to be highly responsive. If consumers are increasingly asking for beverages with specific functional benefits, like added vitamins or probiotics, retailers will place orders reflecting that. Reyes Holdings, in turn, must ensure its supply chain can meet these evolving product requirements, giving customers substantial leverage over the distributor's inventory decisions and purchasing strategies.

Potential for Direct-to-Consumer (DTC) Models

The increasing viability of direct-to-consumer (DTC) models in the beverage industry presents a subtle but significant shift that could influence customer bargaining power for Reyes Holdings. As more beverage manufacturers explore or expand their DTC capabilities, they gain the potential to bypass traditional distribution channels.

This disintermediation trend might lead retailers, who are essentially Reyes's customers in many segments, to anticipate more favorable terms. If manufacturers can reach end consumers directly, distributors like Reyes might face pressure to offer more competitive pricing or enhanced value-added services to retain their retail partners.

For instance, in 2024, the global DTC e-commerce market continued its robust growth, with beverage sales playing an increasingly prominent role. This expansion suggests that the threat of manufacturers circumventing distributors is not merely theoretical but a developing reality.

- DTC Growth: The global DTC e-commerce market is projected to see continued expansion in 2024, impacting traditional distribution models.

- Manufacturer Bypass: Beverage manufacturers exploring DTC can reduce reliance on intermediaries, potentially altering distributor relationships.

- Retailer Expectations: Retailers may leverage the DTC trend to negotiate better pricing or demand more services from distributors like Reyes.

- Competitive Pressure: Increased DTC options for manufacturers could indirectly heighten competitive pressure on Reyes's B2B distribution services.

Importance of Local Sourcing and Supply Chain Resilience

The growing consumer interest in local food systems and resilient supply chains significantly impacts the bargaining power of customers. As consumers increasingly seek regional products and distributors with stable supply chains, they gain leverage. This trend empowers customers looking to diversify their sourcing and lessen dependence on distant, potentially fragile networks.

For a company like Reyes Holdings, this translates into a need to demonstrate strong local sourcing capabilities and a robust, adaptable supply chain. Customers, especially those in the food service and retail sectors, are more likely to favor suppliers who can guarantee consistent availability of diverse products, including those sourced regionally. This can lead to increased price sensitivity and demands for customized solutions.

- Increased Demand for Local Products: In 2024, the market for locally sourced food continued its upward trajectory, with consumer surveys indicating a strong preference for regional options, often driven by perceived freshness and support for local economies.

- Supply Chain Transparency as a Differentiator: Customers are increasingly scrutinizing supply chains. Distributors that can provide clear visibility into their sourcing and logistics, particularly highlighting resilience against disruptions, gain a competitive edge.

- Customer Leverage in Sourcing Diversification: As customers actively seek to reduce reliance on single or distant supply sources, they are better positioned to negotiate terms with multiple distributors, including Reyes Holdings, thereby increasing their bargaining power.

- Impact on Pricing and Service Demands: The ability of customers to source locally or find alternative resilient supply chains can translate into greater pressure on pricing and service level agreements from existing suppliers.

The bargaining power of customers for Reyes Holdings is substantial, driven by the concentration of its buyer base and the critical nature of its services. Large retail chains and restaurant groups, representing a significant portion of Reyes's clientele, wield considerable leverage due to their massive purchasing volumes. This allows them to negotiate favorable pricing and service terms, as they can readily switch to alternative distributors or demand specific concessions.

Customers prioritize punctuality, product freshness, and efficient supply chains, making superior service levels a key factor that amplifies their bargaining power. Distributors must continuously invest in technology and operations to meet these high expectations. For instance, the global cold chain logistics market, vital for freshness, was valued at approximately $250 billion in 2023.

Consumer-driven demand also plays a crucial role. In 2024, the surge in demand for plant-based and low-sugar drinks, estimated at a 15% year-over-year growth, forces retailers to adjust orders, thereby influencing Reyes Holdings' product mix and inventory decisions. This responsiveness to evolving consumer preferences directly translates into customer leverage.

The rise of direct-to-consumer (DTC) models in the beverage industry further empowers customers. As manufacturers increasingly adopt DTC strategies, they can bypass traditional distributors, potentially leading retailers to anticipate better terms from intermediaries like Reyes. The global DTC e-commerce market's continued robust growth in 2024, with beverages gaining prominence, underscores this evolving landscape.

Furthermore, the growing consumer interest in local food systems and resilient supply chains grants customers more leverage. They can diversify sourcing and reduce reliance on distant networks, making them more inclined to negotiate with distributors that can guarantee consistent availability and regional product options, increasing price sensitivity and demands for customized solutions.

| Factor | Impact on Reyes Holdings | Supporting Data (2023-2024) |

|---|---|---|

| Customer Concentration | High leverage for large buyers | Major retail chains and restaurant groups form a significant portion of the customer base. |

| Service Expectations | Need for continuous investment in logistics and technology | Global cold chain logistics market valued at ~$250 billion (2023). |

| Consumer Preferences | Influence on product mix and inventory | 15% YoY growth in plant-based/low-sugar drinks (2024 estimate). |

| DTC Trend | Potential pressure on distributor terms | Continued robust growth of global DTC e-commerce market (2024). |

| Local Sourcing Demand | Need to demonstrate supply chain resilience and regional capabilities | Increased consumer preference for regional food options (2024). |

Full Version Awaits

Reyes Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Reyes Holdings, offering a detailed examination of industry competition, buyer and supplier power, threat of new entrants, and substitute products. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises and full value. You are looking at the actual document, which will be yours to download and utilize the moment your transaction is complete.

Rivalry Among Competitors

While Reyes Holdings holds dominant positions, such as being the largest beer distributor in the U.S. and the top global McDonald's distributor, the broader food and beverage distribution landscape remains notably fragmented. This fragmentation means numerous smaller players operate, creating a complex competitive environment.

However, a significant trend of consolidation is reshaping the industry. Larger entities, including Reyes Holdings, are actively acquiring smaller competitors. For instance, in 2023, Reyes Holdings itself continued its strategic growth through acquisitions, further consolidating its market share and intensifying rivalry among the remaining major distributors who are also pursuing similar expansion strategies.

The distribution sector, particularly for staple goods, is characterized by intense price competition, often squeezing profit margins. This environment necessitates a relentless pursuit of operational efficiencies and scale, a challenge Reyes Holdings addresses through strategic investments in its infrastructure and technology.

Competitive rivalry in the beverage distribution sector, particularly for companies like Reyes Holdings, is intensified by service differentiation beyond basic delivery. Competitors are increasingly vying to offer value-added services such as sophisticated inventory management, in-depth data analytics, and targeted marketing support to their clients.

Reyes Holdings actively addresses this through tools like SipMarket, which provides customers with valuable data and actionable insights. This strategic offering helps differentiate Reyes from rivals who may only focus on the transactional aspect of distribution, thereby enhancing customer loyalty and market position.

Geographic Expansion and Strategic Partnerships

Rivalry among competitors is intense, with companies actively pursuing geographic expansion and forging strategic alliances with suppliers to gain market share. Reyes Holdings has demonstrated this trend through its own acquisitions and new distribution agreements, highlighting a competitive environment where growth and portfolio diversification are key strategies.

This drive for expansion means that companies are constantly evaluating new markets and seeking partnerships that can enhance their product offerings and distribution networks. For instance, in 2024, the beverage distribution sector saw several key players announce new territories or acquire smaller regional distributors to bolster their presence.

- Geographic Expansion: Competitors are actively entering new regions to capture untapped markets and increase their overall reach.

- Strategic Partnerships: Alliances with suppliers are crucial for securing favorable terms, ensuring product availability, and introducing new products.

- Acquisition Activity: Companies like Reyes Holdings are engaging in mergers and acquisitions to consolidate market share and expand their operational footprint.

- Distribution Deals: Securing new distribution rights for brands is a common tactic to broaden product portfolios and revenue streams.

Technological Adoption and Innovation

The competitive rivalry within the distribution and logistics sector, particularly concerning technological adoption, is intensifying. Companies are increasingly leveraging Artificial Intelligence (AI), machine learning, and sophisticated logistics solutions as critical differentiators. Those that excel in using these technologies for improved demand forecasting, optimized routing, and enhanced supply chain visibility are gaining a significant competitive advantage, compelling rivals to make substantial investments in comparable technologies.

This technological arms race means that staying ahead requires continuous innovation and significant capital expenditure. For instance, in 2024, major logistics players are reporting substantial increases in their IT budgets, with some allocating over 15% of their operational expenditure to technology upgrades and AI integration. This focus on digital transformation is not just about efficiency; it's about fundamentally reshaping service offerings and customer expectations.

Key areas of technological focus include:

- AI-powered demand forecasting: Reducing inventory holding costs and stockouts.

- Machine learning for route optimization: Minimizing fuel consumption and delivery times.

- Blockchain for supply chain visibility: Enhancing transparency and trust among partners.

- Robotics and automation in warehouses: Increasing throughput and reducing labor dependency.

Competitive rivalry for Reyes Holdings is fierce, driven by industry fragmentation and a strong consolidation trend. Companies are actively pursuing geographic expansion and strategic alliances, as seen in 2024 with several beverage distributors announcing new territories or acquiring smaller regional players to bolster their market presence.

Beyond basic delivery, competitors differentiate through value-added services like advanced inventory management and data analytics, compelling players like Reyes to invest in tools such as SipMarket to enhance customer loyalty. The sector also faces intense price competition, pushing firms to optimize operations and scale through acquisitions, a strategy Reyes Holdings has consistently employed.

Technological adoption, particularly AI and machine learning for forecasting and route optimization, is a critical battleground, with significant IT budget increases reported by major logistics players in 2024. This technological race necessitates continuous innovation and substantial capital investment to maintain a competitive edge.

| Competitive Tactic | Examples | Impact on Reyes Holdings |

|---|---|---|

| Geographic Expansion | Acquiring regional distributors, entering new markets | Increases market share, potential for economies of scale |

| Strategic Partnerships | Alliances with suppliers, securing new distribution rights | Ensures product availability, broadens product portfolio |

| Value-Added Services | Data analytics, enhanced inventory management | Differentiates from competitors, builds customer loyalty |

| Technological Adoption | AI for forecasting, route optimization | Improves efficiency, reduces costs, enhances service offerings |

SSubstitutes Threaten

Major beverage and food manufacturers, particularly those with significant market share, possess the capital and operational capacity to develop their own distribution channels. This vertical integration strategy allows them to bypass intermediaries like Reyes Holdings, potentially reducing costs and gaining greater control over their supply chain. For instance, a large brewery might invest in its own fleet of trucks and warehousing facilities to directly service retail outlets.

While establishing an in-house distribution network is a substantial undertaking, it represents a viable substitute for third-party distributors, especially for manufacturers dealing with high volumes of consistent demand. The cost savings and enhanced control can outweigh the initial investment over time. This threat is amplified as manufacturers increasingly seek to optimize their end-to-end operations to improve efficiency and customer service.

The rise of direct-to-consumer (DTC) sales channels, especially for niche beverage brands, poses a significant threat of substitution for Reyes Holdings. These brands can bypass traditional distribution networks, directly reaching end consumers and diminishing the need for intermediaries like Reyes.

For instance, in 2024, the global DTC e-commerce market continued its robust growth, with beverage sales playing a notable part. This trend empowers manufacturers to control their brand narrative and customer relationships, offering a compelling alternative to the services provided by established distributors.

The threat of substitutes for Reyes Holdings' distribution services is significant, as businesses can bypass comprehensive distributors by utilizing alternative logistics providers or developing in-house capabilities. The market for third-party logistics (3PLs) is robust, with many specialized firms offering tailored solutions for transportation, warehousing, and supply chain management. For instance, the global 3PL market was valued at approximately $1.15 trillion in 2023 and is projected to reach $1.76 trillion by 2028, indicating a highly competitive landscape where Reyes must continually demonstrate its value proposition against a multitude of alternatives.

Furthermore, the increasing availability of freight brokers and digital freight platforms provides businesses with flexible and often cost-effective options for moving goods, directly substituting the need for a full-service distributor. These platforms connect shippers with carriers, streamlining the process and reducing reliance on traditional distribution models. The agility and cost-efficiency offered by these substitutes can be particularly attractive to smaller or rapidly growing companies, posing a direct challenge to Reyes Holdings' market share.

Shift to Digital and Virtual Consumption

The increasing prevalence of digital and virtual consumption presents a subtle yet impactful threat of substitutes for businesses like Reyes Holdings, which primarily deal in physical food and beverage distribution. As consumers increasingly opt for online entertainment, streaming services, and digital experiences over traditional out-of-home dining or physical product purchases, there's a potential diversion of disposable income. This shift can indirectly reduce the overall demand for the physical goods Reyes facilitates. For instance, a growing preference for home-based entertainment, fueled by subscription services, might mean less spending on restaurant meals or convenience foods that Reyes distributes.

This trend is reflected in the continued growth of the digital entertainment sector. In 2024, global spending on digital media, including streaming, gaming, and online content, is projected to reach substantial figures, indicating a significant portion of consumer budgets being allocated to these non-physical alternatives. This diversion of consumer spending away from physical goods, even if indirect, can impact the volume and revenue generated by distributors like Reyes.

The implications for Reyes Holdings include a potential need to adapt distribution strategies to cater to evolving consumer preferences. This might involve exploring partnerships with digital platforms or focusing on products that complement the digital lifestyle. The threat is not about replacing food and beverages entirely, but rather about capturing a smaller share of the consumer's wallet as digital alternatives become more attractive and accessible.

- Digital Entertainment Growth: Global spending on digital media is a significant and growing market, diverting consumer budgets.

- Shift in Consumer Habits: Increased preference for home-based, digital entertainment can reduce demand for out-of-home dining and related physical products.

- Indirect Impact on Distribution: While not a direct substitute for food, the shift impacts overall consumer spending patterns that Reyes Holdings relies on.

- Adaptation Needs: Distributors may need to adjust strategies to align with evolving consumer preferences towards digital and virtual experiences.

Changes in Food Service Models

The rise of ghost kitchens and the increasing dominance of food delivery platforms are fundamentally reshaping how restaurants operate. These models bypass traditional distribution, creating a direct substitute for the delivery services Reyes Holdings traditionally provides.

For instance, in 2024, the global ghost kitchen market was valued at approximately $50 billion, with projections indicating significant growth. This shift means restaurants might opt for platforms that manage their own logistics, reducing their reliance on external distributors like Reyes.

This evolution presents a tangible threat as it offers alternative supply chain solutions. Restaurants can leverage these new models to reach consumers directly, diminishing the necessity of traditional, Reyes-managed delivery networks.

- Ghost Kitchens: Operating without a physical storefront, these kitchens focus solely on delivery, creating a direct alternative to traditional restaurant models that require distribution.

- Delivery Platform Logistics: Platforms like DoorDash and Uber Eats are increasingly managing their own delivery fleets, offering restaurants a self-contained solution that substitutes for third-party distributors.

- Changing Consumer Habits: A growing preference for convenience and at-home dining fuels the adoption of these delivery-centric models, further pressuring traditional distribution channels.

- Reduced Reliance on Reyes: As restaurants integrate these alternative models, their dependence on Reyes Holdings for efficient and cost-effective delivery could significantly decrease.

The threat of substitutes for Reyes Holdings' distribution services is substantial, as manufacturers and businesses can opt for vertical integration or leverage specialized third-party logistics (3PL) providers. The global 3PL market, valued at approximately $1.15 trillion in 2023 and projected to reach $1.76 trillion by 2028, highlights the competitive landscape where Reyes must prove its value against numerous alternatives.

Furthermore, the rise of direct-to-consumer (DTC) models and digital freight platforms offers agile and often more cost-effective ways to move goods, directly substituting the need for comprehensive distribution networks. The increasing preference for digital entertainment also indirectly impacts Reyes by diverting consumer spending away from physical goods.

Ghost kitchens and the logistics managed by food delivery platforms represent another significant substitute, allowing restaurants to bypass traditional distribution channels entirely. The global ghost kitchen market, estimated at $50 billion in 2024, underscores this shift towards delivery-centric operations.

| Substitute Type | Description | Market Data/Examples |

| Vertical Integration | Manufacturers developing own distribution | Large breweries investing in own fleets |

| Third-Party Logistics (3PL) | Specialized logistics providers | Global 3PL market: $1.15T (2023) to $1.76T (2028) |

| Direct-to-Consumer (DTC) | Brands selling directly to consumers | Niche beverage brands bypassing intermediaries |

| Digital Freight Platforms | Connecting shippers with carriers | Streamlined, cost-effective shipping solutions |

| Ghost Kitchens/Delivery Platforms | Delivery-focused operations | Global ghost kitchen market: ~$50B (2024) |

| Digital Entertainment | Consumer spending shift | Diverts disposable income from physical goods |

Entrants Threaten

Entering the food and beverage distribution sector, particularly at the scale Reyes Holdings operates, necessitates significant upfront capital. This includes substantial investments in extensive warehouse networks, specialized cold storage facilities, a robust fleet of delivery vehicles, and sophisticated logistics management technology. For instance, building a single, modern distribution center can easily cost tens of millions of dollars.

Reyes Holdings boasts an extensive network and infrastructure, a significant barrier for potential new entrants. Building a comprehensive distribution network across multiple states or globally, as Reyes Holdings has, requires substantial time, considerable investment, and meticulous strategic planning. For instance, in 2024, the logistics and warehousing industry saw continued investment, with companies needing to deploy millions to establish comparable reach.

Reyes Holdings benefits from deeply entrenched relationships with iconic brands such as Coca-Cola and McDonald's, alongside a vast network of retail and restaurant customers. These long-standing partnerships, often exclusive, create significant barriers for any new competitor seeking to replicate Reyes's product portfolio or customer access.

Regulatory Complexity and Compliance

The food and beverage sector, including distribution like Reyes Holdings operates in, is a minefield of regulations. Think stringent rules on food safety, quality standards, and even the nitty-gritty of temperature-controlled transportation. For any newcomer, deciphering and adhering to these complex requirements is a major barrier to entry.

Ensuring compliance isn't just about understanding the rules; it's about investing in the infrastructure and processes to meet them. This can involve significant upfront capital for specialized equipment and ongoing costs for audits and certifications. For instance, the Food Safety Modernization Act (FSMA) in the United States places substantial responsibilities on food facilities, requiring robust preventive controls.

- Regulatory Hurdles: New entrants face significant challenges in navigating complex food safety, quality, and transportation regulations.

- Compliance Costs: Adhering to these regulations requires substantial investment in infrastructure, technology, and ongoing compliance measures.

- Industry Standards: Meeting established industry standards for product integrity and supply chain management is critical and costly for new players.

Economies of Scale and Operational Efficiency

New entrants face a significant hurdle due to the substantial economies of scale enjoyed by established players like Reyes Holdings. These scale advantages translate into lower per-unit costs across purchasing, logistics, and overall operations. For instance, in the food and beverage distribution sector where Reyes Holdings is a major player, bulk purchasing can lead to considerable discounts from suppliers, a benefit not readily available to smaller, newer companies.

This operational efficiency allows incumbents to maintain competitive pricing, a critical factor in attracting and retaining customers. A new entrant would likely incur higher initial costs for everything from warehousing to transportation, making it difficult to match the price points offered by a company that has optimized its supply chain over years of operation. In 2023, for example, major logistics providers reported significant cost savings through optimized route planning and fleet management, savings that are harder for newcomers to replicate immediately.

- Economies of Scale: Incumbents benefit from lower per-unit costs due to high-volume operations.

- Operational Efficiency: Established companies have streamlined logistics and supply chains, reducing overhead.

- Pricing Power: Scale allows incumbents to offer more competitive pricing, a barrier for new entrants.

- Capital Investment: Achieving comparable efficiency requires substantial upfront capital investment, which new entrants may lack.

The threat of new entrants for Reyes Holdings is generally low due to several formidable barriers. The immense capital required for infrastructure, like warehouses and fleets, coupled with established relationships and regulatory complexities, makes entry exceedingly difficult. Furthermore, the significant economies of scale enjoyed by Reyes Holdings create a cost disadvantage for any new competitor, solidifying the low threat level.

| Barrier Category | Specific Barrier | Impact on New Entrants | Example/Data Point (2024) |

| Capital Requirements | Infrastructure Investment | High | Building a modern distribution center can cost tens of millions of dollars. |

| Brand & Customer Loyalty | Entrenched Relationships | High | Exclusive partnerships with major brands like Coca-Cola and McDonald's. |

| Regulation & Compliance | Food Safety & Transport Rules | High | FSMA compliance necessitates significant investment in preventive controls and infrastructure. |

| Economies of Scale | Operational Efficiency & Cost Savings | High | Bulk purchasing discounts and optimized logistics in 2023 led to significant cost savings for major players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Reyes Holdings is built upon a foundation of comprehensive data, including annual reports, investor presentations, and industry-specific market research from firms like IBISWorld. We also leverage publicly available financial data and news releases from Reyes Holdings and its key competitors to assess competitive dynamics.