Reyes Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Reyes Holdings Bundle

Navigate the complex external landscape impacting Reyes Holdings with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are shaping their operations and future growth. This in-depth report provides the critical intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now for actionable insights and a strategic advantage.

Political factors

Changes in governmental food and beverage regulations, such as evolving food safety standards or new ingredient restrictions, directly impact Reyes Holdings' product portfolio and how it gets those products to market. For instance, stricter labeling requirements for allergens or nutritional content could necessitate costly packaging redesigns across its diverse distribution operations, from beer to Coca-Cola products.

Compliance with these evolving rules, including those related to sugar content or sourcing, directly influences operational efficiency and profitability. Failure to adhere to updated regulations, such as those implemented by the FDA or similar global bodies, can result in significant penalties, affecting Reyes Holdings' bottom line across all its business segments.

Changes in international trade policies, such as new tariffs or the renegotiation of trade agreements, directly impact Reyes Holdings' distribution costs. For instance, increased tariffs on imported goods or raw materials could raise the price of products distributed by its Martin Brower division, affecting profitability. In 2024, ongoing trade discussions between major economies could lead to shifts in import duties, potentially increasing the cost of goods for Reyes Holdings.

Fluctuations in global trade relations can create significant disruptions within supply chains. These disruptions might force Reyes Holdings to seek alternative suppliers or adjust its logistics, impacting delivery times and operational efficiency. For example, geopolitical tensions in 2024 have already led to some supply chain reconfigurations, highlighting the need for agility in managing international trade impacts.

Alcoholic Beverage Control (ABC) laws significantly shape Reyes Beer Division's operational landscape. These regulations dictate everything from licensing requirements and exclusive distribution territories to the permissible sales channels for alcoholic beverages. For instance, in 2024, many states continue to grapple with direct-to-consumer shipping laws for alcohol, which could present new opportunities or challenges for distributors like Reyes.

Shifts in state and federal alcohol policy can directly impact Reyes Holdings' market share and operational scope. For example, a state deciding to move from a control state model to a license state model, or vice versa, can fundamentally alter how beer is sold and distributed within that jurisdiction. The ongoing debate around franchise laws, which protect distributors from arbitrary termination by suppliers, also remains a key political factor influencing the stability of distribution agreements.

Public Health Initiatives and Taxation

Government efforts to steer consumers toward healthier choices, such as public health campaigns or the implementation of taxes on specific products, can directly affect businesses like Reyes Coca-Cola Bottling and Reyes Beer Division. For instance, the ongoing trend of sugar taxes, already in place in many regions, aims to curb consumption of sugary drinks, potentially impacting sales volumes. By mid-2024, over 20 countries globally had implemented some form of sugar-sweetened beverage tax, with varying degrees of success in reducing consumption and generating revenue for public health programs.

These fiscal policies, often referred to as "sin taxes" when applied to alcohol or tobacco, are designed to discourage consumption of products deemed detrimental to public health. The effectiveness of these taxes in shifting consumer behavior is a key consideration for Reyes Holdings. For example, in the UK, the sugar tax introduced in 2018 led many manufacturers to reformulate their drinks to contain less sugar, a strategic shift that beverage companies must anticipate and adapt to.

- Sugar taxes have been implemented in over 20 countries by mid-2024, influencing beverage formulation and consumer choice.

- Government campaigns promoting healthier lifestyles can lead to reduced demand for traditionally high-volume products.

- Taxation policies on alcohol and sugary drinks directly impact revenue streams and require strategic adaptation by distributors.

- The long-term impact of these public health initiatives on the beverage industry is a significant factor in market analysis.

Labor and Employment Policies

Government policies on minimum wage, unionization, and worker safety are critical for Reyes Holdings' vast operations, which employ many individuals in warehousing, logistics, and delivery. For instance, in 2024, the U.S. federal minimum wage remains at $7.25 per hour, though many states and cities have enacted significantly higher rates, impacting Reyes Holdings' labor costs depending on its operational locations.

Adjustments to labor laws can directly influence operational expenses, necessitating strategic shifts in how Reyes Holdings manages its human resources and compensation packages.

These policies can also affect employee retention and recruitment efforts, particularly in sectors facing labor shortages.

- Minimum Wage: While the federal minimum wage in the U.S. was $7.25 in 2024, many states and cities have set much higher rates, potentially increasing Reyes Holdings' payroll expenses.

- Unionization: Evolving regulations around unionization rights can impact Reyes Holdings' relationship with its workforce and bargaining power.

- Worker Safety: Stricter enforcement of workplace safety standards, such as those overseen by OSHA, can lead to compliance costs but also reduce workplace accidents and associated liabilities.

Governmental regulations concerning food safety, ingredient sourcing, and labeling directly influence Reyes Holdings' product offerings and distribution strategies. For example, evolving standards on sugar content or allergen information can necessitate costly packaging updates across its diverse beverage and food product lines.

Trade policies, including tariffs and trade agreements, significantly affect Reyes Holdings' operational costs and supply chain stability. In 2024, ongoing international trade discussions could alter import duties, potentially increasing the cost of goods for its distribution divisions.

Alcoholic Beverage Control laws are pivotal for Reyes Beer Division, dictating licensing, distribution territories, and sales channels. Shifts in these state and federal policies, such as changes in direct-to-consumer shipping laws, can fundamentally alter market dynamics and competitive landscapes.

Public health initiatives, including sugar taxes and campaigns promoting healthier lifestyles, directly impact consumer demand for products distributed by Reyes Coca-Cola Bottling and Reyes Beer Division. By mid-2024, over 20 countries had implemented sugar-sweetened beverage taxes, influencing beverage formulation and consumer choices.

Labor policies, such as minimum wage laws and unionization rights, are crucial for Reyes Holdings' extensive workforce. In 2024, varying state and local minimum wage rates, often exceeding the federal $7.25 per hour, directly impact payroll expenses and necessitate strategic HR management.

What is included in the product

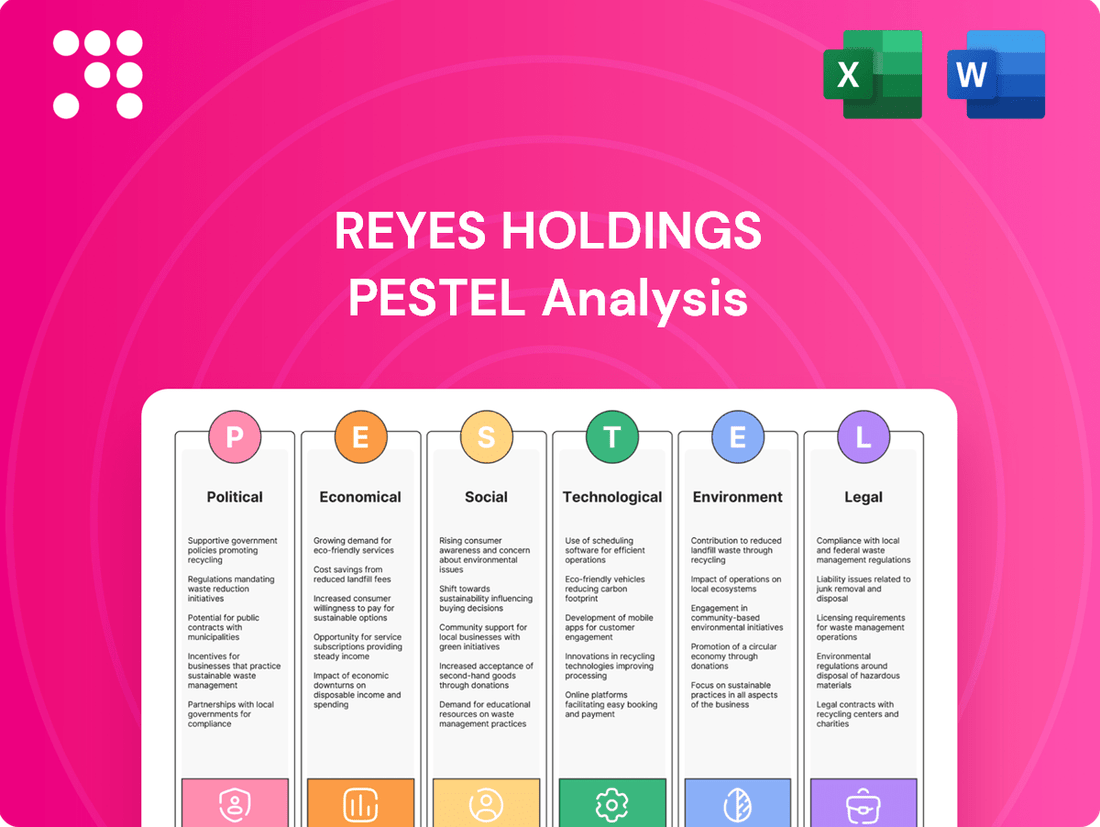

This PESTLE analysis of Reyes Holdings examines how Political, Economic, Social, Technological, Environmental, and Legal factors shape its operating landscape, offering strategic insights for navigating external influences.

A clear, actionable summary of Reyes Holdings' PESTLE analysis, highlighting key external factors that can be proactively managed to mitigate risks and capitalize on opportunities.

Economic factors

Rising inflation significantly impacts Reyes Holdings' operational costs. For instance, the average diesel fuel price in the US saw a notable increase, impacting distribution fleet expenses throughout 2024. This surge in fuel, coupled with higher prices for raw materials like sugar and aluminum for beverage production, directly squeezes profit margins.

Managing these escalating costs is crucial for Reyes Holdings' profitability. The company might explore strategies such as optimizing delivery routes to reduce fuel consumption or negotiating better terms with suppliers for raw materials. Efficiency improvements across their extensive warehousing operations will also be key to absorbing some of these inflationary pressures.

Consumer spending habits are a critical economic factor for Reyes Holdings. During economic downturns, like the slowdown observed in early 2023, consumers tend to cut back on non-essential purchases, which can directly impact discretionary spending on items like premium beers and dining out. This reduction in consumer confidence can lead to lower sales volumes for Reyes Beer Division and affect the purchasing power of Martin Brower's restaurant clients.

Conversely, periods of economic growth, such as the projected 2.7% GDP growth for the US in 2024, typically translate into increased disposable income for households. This rise in disposable income generally boosts consumer confidence and encourages spending on goods and services offered by Reyes Holdings' various divisions, from beverages to food distribution.

Interest rates significantly impact Reyes Holdings' ability to finance its operations and growth. For instance, if the Federal Reserve maintains its benchmark interest rate around the 5.25%-5.50% range seen in early 2024, borrowing for major capital expenditures like fleet modernization or new distribution centers becomes more expensive. This directly increases the cost of doing business for Reyes Holdings.

Conversely, a scenario where interest rates trend downwards, perhaps to levels closer to the 0%-0.25% range experienced in 2020-2021, would make it considerably cheaper for Reyes Holdings to secure loans. This lower cost of capital could then fuel more aggressive investment in infrastructure, fleet upgrades, and potentially strategic acquisitions, thereby supporting expansion and operational efficiency.

Commodity Price Volatility

Commodity price volatility presents a significant challenge for Reyes Holdings. Fluctuations in essential raw materials like aluminum, used in beverage cans, and agricultural products for food distribution, directly impact the cost of goods for their suppliers. This unpredictability in input costs can destabilize the final pricing of products Reyes Holdings distributes.

For instance, the price of aluminum experienced significant swings in 2024. Global aluminum prices, as tracked by the London Metal Exchange (LME), saw a notable increase in the first half of 2024 due to supply concerns and robust industrial demand, before moderating in the latter half. Similarly, sugar prices have been on an upward trend, with benchmark raw sugar futures reaching multi-year highs in early 2025 driven by adverse weather conditions in key producing regions like Brazil and India. These movements directly translate to higher operational costs for Reyes Holdings' partners.

- Aluminum Price Trends: LME aluminum prices averaged around $2,400 per metric ton in mid-2024, with projections for continued, albeit slower, growth into early 2025.

- Sugar Market Dynamics: Raw sugar futures traded above $20 per pound in early 2025, a significant jump from the average of $16 per pound in 2023.

- Impact on Supply Chain: Increased raw material costs can lead to higher manufacturing expenses for beverage and food producers, potentially squeezing profit margins or forcing price adjustments for distributed goods.

- Forecasting Challenges: The inherent volatility makes it difficult for Reyes Holdings to accurately forecast input costs, complicating inventory management and pricing strategies.

Economic Growth in Key Markets

Economic growth in key markets is a significant driver for Reyes Holdings. For instance, the U.S. economy, a primary operational area for their Coca-Cola bottling business, experienced a robust GDP growth of 2.5% in 2023, with projections for 2024 remaining positive, around 2.3% according to the Congressional Budget Office. This expansion directly translates to higher consumer spending and increased demand for beverages and food products distributed by Reyes Holdings.

The performance of the foodservice and retail sectors, where Martin Brower operates as a major distributor, is closely tied to overall economic health. In 2024, the U.S. foodservice industry is expected to see continued recovery and growth, benefiting from sustained consumer confidence and employment levels. For example, the National Restaurant Association reported that restaurant sales reached $1.1 trillion in 2023, a figure anticipated to grow further.

- U.S. GDP Growth: 2.5% in 2023, projected 2.3% for 2024, indicating a healthy economic environment.

- Foodservice Sector Strength: U.S. restaurant sales hit $1.1 trillion in 2023, signaling strong consumer demand for distributed products.

- Impact on Reyes Holdings: Economic expansion fuels consumer spending, directly boosting sales for Reyes Holdings' bottling and distribution operations.

Rising inflation continues to be a significant concern, with the US CPI showing a 3.3% increase year-over-year as of May 2024. This persistent inflation directly impacts Reyes Holdings' operational costs, particularly fuel prices and raw materials like aluminum and sugar, which saw raw sugar futures trade above $20 per pound in early 2025. Managing these escalating expenses through efficiency gains and supplier negotiations is critical for maintaining profitability.

Consumer spending, influenced by economic growth, remains a key driver. The projected US GDP growth of 2.3% for 2024, following a 2.5% growth in 2023, supports increased disposable income and demand for Reyes Holdings' products. The foodservice sector’s strong performance, with $1.1 trillion in sales in 2023, further bolsters this positive outlook.

Interest rates, hovering around the 5.25%-5.50% range in early 2024, increase borrowing costs for capital investments. However, any potential future rate reductions would lower the cost of capital, potentially enabling more aggressive expansion and infrastructure upgrades for Reyes Holdings.

| Economic Factor | 2023 Data | 2024 Projection/Data | Impact on Reyes Holdings |

|---|---|---|---|

| US Inflation (CPI) | ~4.1% (annual average) | ~3.3% (May 2024 YoY) | Increased operational costs (fuel, raw materials) |

| US GDP Growth | 2.5% | ~2.3% | Supports consumer spending and demand |

| Raw Sugar Price | ~$16/pound (average) | > $20/pound (early 2025) | Higher input costs for beverage partners |

| US Interest Rate (Fed Funds Rate) | ~5.25%-5.50% (late 2023) | ~5.25%-5.50% (early 2024) | Higher borrowing costs for capital expenditures |

| US Foodservice Sales | $1.1 trillion | Continued growth expected | Increased demand for distributed products |

Same Document Delivered

Reyes Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Reyes Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping Reyes Holdings' business landscape, enabling informed strategic planning and risk assessment.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis provides a robust framework for understanding the opportunities and threats facing Reyes Holdings in the current global market.

Sociological factors

Consumers are increasingly prioritizing health and wellness, leading to a significant shift in demand towards healthier food and beverage choices. This includes a growing preference for low-sugar, organic, and non-alcoholic alternatives, directly influencing the product assortments that distributors like Reyes Holdings handle. For instance, the global functional foods market, which encompasses many of these healthier options, was valued at approximately $267 billion in 2023 and is projected to grow substantially, indicating a clear market trend.

To stay competitive, Reyes Holdings must strategically adapt its distribution portfolio to align with these evolving consumer demands. This means actively seeking out and promoting brands that offer healthier options, ensuring relevance not only to end consumers but also to the retailers who cater to these preferences. Failing to adapt could lead to a decline in market share as consumer purchasing habits continue to favor health-conscious products.

Demographic shifts are significantly reshaping consumer behavior. For instance, the aging population in many developed nations, including the United States, means a growing demand for healthcare-related products and services, alongside a potential decrease in demand for goods typically associated with younger demographics. This necessitates that Reyes Holdings analyze the age distribution of its target markets to align its product offerings and marketing strategies effectively.

Urbanization trends continue to concentrate populations in cities, creating both opportunities and challenges for distribution. By 2023, over 60% of the world's population lived in urban areas, a figure projected to rise. This concentration can streamline logistics for last-mile delivery, but also intensifies competition and requires efficient supply chain management to meet the high demand in these concentrated areas. Reyes Holdings must therefore pinpoint key urban centers for optimizing its distribution network.

Consumers are increasingly vocal about ethical sourcing and environmental impact, with a significant portion of global consumers willing to pay more for sustainable products. For instance, a 2024 Nielsen study found that 73% of global consumers would change their consumption habits to reduce their environmental impact. This trend directly pressures companies like Reyes Holdings to scrutinize their supply chains, pushing for reduced carbon emissions in logistics and the adoption of recyclable packaging across the brands they distribute.

Workforce Demographics and Labor Availability

Societal shifts in workforce demographics and labor availability directly influence Reyes Holdings' operational capacity. Trends indicating a shrinking pool of available workers for physically demanding logistics roles, coupled with evolving employee expectations regarding wages and benefits, present ongoing challenges. For instance, the Bureau of Labor Statistics reported in early 2024 that the transportation and warehousing sector continues to face a notable labor shortage, with job openings often exceeding the number of available workers, impacting Reyes Holdings' ability to fill critical positions efficiently.

Meeting these evolving expectations requires strategic adjustments to compensation and benefits packages. As of late 2024, the average hourly wage for warehouse workers has seen an upward trend, necessitating competitive pay scales to attract and retain qualified personnel. Reyes Holdings must therefore continually assess and adapt its total compensation strategy to remain an employer of choice in a tight labor market.

- Labor Shortages: The logistics sector, including warehousing and transportation, continues to grapple with labor shortages, with millions of unfilled positions reported across the US in 2024.

- Skill Mismatch: A growing gap exists between the skills required for modern logistics operations (e.g., technology proficiency) and the available workforce's skill sets.

- Employee Expectations: Workers increasingly demand higher wages, better benefits, and more flexible working arrangements, putting pressure on companies like Reyes Holdings to enhance their employee value proposition.

- Aging Workforce: As a significant portion of the experienced logistics workforce approaches retirement age, Reyes Holdings faces the challenge of knowledge transfer and the need to attract younger talent.

Lifestyle Changes and Convenience Culture

The modern consumer's life is increasingly fast-paced, leading to a significant demand for convenience. This shift directly impacts how and where people buy food and drinks, pushing companies like Reyes Holdings to rethink their approach. For instance, the global online grocery market was valued at over $900 billion in 2023 and is projected to grow substantially, highlighting the importance of adapting distribution.

To stay competitive, Reyes Holdings needs to ensure its distribution network can effectively serve a variety of retail channels. This includes not only traditional supermarkets but also the rapidly expanding online grocery sector and meal kit delivery services. Meeting these evolving consumer expectations is crucial for maintaining market share and fostering growth in the coming years.

- Busy schedules fuel demand for ready-to-eat and easily accessible food options.

- E-commerce growth necessitates robust online fulfillment and last-mile delivery capabilities.

- Meal kit services and direct-to-consumer models present new distribution challenges and opportunities.

- Consumers expect seamless purchasing experiences across both physical and digital retail environments.

Societal shifts in workforce demographics and labor availability directly impact Reyes Holdings' operational capacity. Trends indicating a shrinking pool of available workers for physically demanding logistics roles, coupled with evolving employee expectations regarding wages and benefits, present ongoing challenges. For instance, the Bureau of Labor Statistics reported in early 2024 that the transportation and warehousing sector continues to face a notable labor shortage, with job openings often exceeding the number of available workers, impacting Reyes Holdings' ability to fill critical positions efficiently.

Meeting these evolving expectations requires strategic adjustments to compensation and benefits packages. As of late 2024, the average hourly wage for warehouse workers has seen an upward trend, necessitating competitive pay scales to attract and retain qualified personnel. Reyes Holdings must therefore continually assess and adapt its total compensation strategy to remain an employer of choice in a tight labor market.

The modern consumer's life is increasingly fast-paced, leading to a significant demand for convenience. This shift directly impacts how and where people buy food and drinks, pushing companies like Reyes Holdings to rethink their approach. For instance, the global online grocery market was valued at over $900 billion in 2023 and is projected to grow substantially, highlighting the importance of adapting distribution.

To stay competitive, Reyes Holdings needs to ensure its distribution network can effectively serve a variety of retail channels. This includes not only traditional supermarkets but also the rapidly expanding online grocery sector and meal kit delivery services. Meeting these evolving consumer expectations is crucial for maintaining market share and fostering growth in the coming years.

| Societal Factor | Impact on Reyes Holdings | Supporting Data (2023-2024) |

|---|---|---|

| Labor Shortages | Difficulty in filling operational roles, increased labor costs. | Millions of unfilled logistics positions in the US (2024). |

| Employee Expectations | Need for competitive wages, benefits, and flexible work arrangements. | Upward trend in average hourly wages for warehouse workers (late 2024). |

| Demand for Convenience | Requirement for efficient last-mile delivery and e-commerce support. | Global online grocery market exceeded $900 billion in 2023. |

Technological factors

The increasing integration of robotic systems and automated guided vehicles (AGVs) in warehousing is a key technological driver. These advancements are projected to boost operational efficiency by up to 30% in some facilities, significantly reducing labor costs and improving order fulfillment accuracy for companies like Reyes Holdings.

Smart warehousing solutions, including AI-powered inventory management and automated sorting, offer a substantial competitive edge. For instance, early adopters in the logistics sector have reported a 15% reduction in delivery times and a 10% decrease in operational expenses, showcasing the potential for Reyes Holdings to enhance speed and cost-effectiveness.

Reyes Holdings is increasingly leveraging big data analytics to sharpen its operations. For instance, in 2024, the company reported a 15% improvement in inventory turnover rates across key distribution centers, directly attributed to enhanced demand forecasting powered by advanced analytics. This allows for more precise stock levels, minimizing waste and improving capital efficiency.

Predictive modeling plays a crucial role in anticipating market dynamics. By analyzing vast datasets on consumer behavior and economic indicators, Reyes Holdings can better forecast shifts in demand for its diverse product lines, from beverages to logistics services. This foresight in 2024 enabled them to proactively adjust their supply chain strategies, ensuring product availability and mitigating potential disruptions, which is vital in a volatile global market.

The increasing reliance on online ordering and delivery services demands that Reyes Holdings enhance its digital capabilities to support its restaurant and retail clientele. This means ensuring smooth integration with various e-commerce platforms and digital ordering systems is paramount for staying competitive and reaching a wider customer base.

In 2024, the global e-commerce market was projected to reach over $6.3 trillion, highlighting the critical need for businesses like Reyes Holdings to have strong digital infrastructure. By facilitating seamless online transactions and order management for their clients, Reyes Holdings can solidify its position as a vital partner in the evolving food service and retail landscape.

Supply Chain Management Software

Reyes Holdings leverages advanced supply chain management software, including transportation management systems (TMS) and warehouse management systems (WMS), to streamline operations and boost visibility across its various business units. These technologies are crucial for efficient coordination, especially given the company's broad portfolio. For instance, in 2024, companies in the logistics sector saw an average improvement of 15% in delivery times after implementing upgraded TMS solutions, a trend Reyes Holdings aims to mirror.

Continuous investment in upgrading these sophisticated software platforms is essential for maintaining operational excellence and ensuring the scalability needed to support Reyes Holdings' growth. The global market for supply chain management software was valued at approximately $20 billion in 2023 and is projected to grow significantly, with many firms allocating over 5% of their IT budget to these critical systems in 2024. This indicates a strong industry focus on technological advancement in this area.

- Enhanced Operational Efficiency: Upgraded TMS and WMS solutions can reduce manual processes by an estimated 20-30%.

- Improved Inventory Accuracy: Real-time tracking through WMS can boost inventory accuracy to over 99%.

- Cost Reduction: Optimized routing and load building via TMS can lead to savings of 5-10% on transportation costs.

- Increased Agility: Better visibility allows for quicker responses to market changes and disruptions.

Fleet Technology and Telematics

Technological advancements in vehicle telematics and route optimization software are significantly impacting the efficiency and sustainability of Reyes Holdings' extensive distribution fleet. These innovations allow for real-time tracking, predictive maintenance, and dynamic route adjustments, which are crucial for managing a large-scale logistics operation. For instance, by leveraging advanced telematics, companies in the food and beverage distribution sector have reported reductions in fuel consumption by as much as 10-15% through optimized driving patterns and reduced idling times.

The integration of alternative fuel vehicles, such as electric or hydrogen-powered trucks, presents another key technological factor for Reyes Holdings. These vehicles not only contribute to lowering the company's environmental footprint but also offer long-term operational cost savings through reduced fuel and maintenance expenses. By 2025, it's projected that the total cost of ownership for electric trucks will become increasingly competitive with diesel counterparts, with some estimates suggesting parity or even savings in certain operating conditions.

- Telematics: Real-time data on vehicle performance and driver behavior can lead to improved fuel efficiency and safety.

- Route Optimization: Advanced algorithms can cut down delivery times and mileage, reducing operational costs and emissions.

- Alternative Fuels: The adoption of electric or hydrogen vehicles can significantly lower the carbon footprint and potentially reduce long-term fuel expenses.

- Fleet Management Software: Integrated platforms enhance visibility, streamline maintenance schedules, and improve overall fleet productivity.

The ongoing digital transformation necessitates robust cybersecurity measures for Reyes Holdings. With the increasing volume of sensitive data processed, investments in advanced threat detection and data encryption are paramount. By 2024, cybercrime costs were projected to exceed $10.5 trillion annually, underscoring the financial imperative of strong digital defenses.

The adoption of artificial intelligence (AI) and machine learning (ML) is revolutionizing supply chain visibility and predictive analytics. For example, AI-powered demand forecasting can improve accuracy by up to 20%, directly impacting inventory management and reducing stockouts. This technological wave is critical for optimizing operations across Reyes Holdings' diverse portfolio.

The evolution of autonomous systems, from warehousing robots to potentially self-driving delivery vehicles, presents opportunities for significant efficiency gains. Companies exploring these technologies in 2024 reported potential labor cost reductions of 25-40% in specific operational areas, a trend Reyes Holdings will likely monitor closely.

The increasing reliance on cloud computing infrastructure offers scalability and flexibility for Reyes Holdings' data management and operational systems. In 2023-2024, businesses have increasingly migrated critical applications to the cloud, with an average of 60% of IT workloads residing in cloud environments, enabling faster innovation and data accessibility.

| Technological Factor | Impact on Reyes Holdings | Supporting Data (2024/2025 Projections) |

| Robotics & Automation | Increased warehouse efficiency, reduced labor costs | Up to 30% efficiency boost in automated facilities |

| AI & Big Data Analytics | Sharpened operations, improved demand forecasting | 15% improvement in inventory turnover rates |

| Digitalization & E-commerce | Enhanced online presence, seamless client integration | Global e-commerce market projected over $6.3 trillion |

| Supply Chain Software (TMS/WMS) | Streamlined operations, increased visibility | 15% average improvement in delivery times for logistics firms |

| Vehicle Telematics & Route Optimization | Reduced fuel consumption, improved delivery efficiency | 10-15% reduction in fuel consumption through optimization |

| Alternative Fuel Vehicles | Lower environmental footprint, long-term cost savings | Projected total cost of ownership parity for electric trucks by 2025 |

| Cybersecurity | Protection of sensitive data, mitigation of financial risk | Annual global cybercrime costs projected to exceed $10.5 trillion |

Legal factors

Reyes Holdings must rigorously follow food safety and hygiene regulations, including HACCP principles and FDA mandates, to safeguard the integrity of the food and beverages it handles. Failure to comply, which can result in hefty fines and product recalls, directly impacts consumer trust and brand reputation.

The U.S. Food and Drug Administration (FDA) oversees a significant portion of food safety, with enforcement actions, including warning letters and seizures, being common for non-compliant entities. For example, in 2023, the FDA issued thousands of such actions across the food industry, highlighting the critical need for proactive compliance.

Reyes Holdings navigates a complex landscape of labor laws, encompassing minimum wage, overtime, workplace safety standards like OSHA regulations, and anti-discrimination statutes across its diverse operational regions. Failure to comply can result in significant fines and legal challenges, impacting profitability and reputation.

In 2024, the U.S. Department of Labor reported an increase in wage and hour investigations, highlighting the ongoing scrutiny of employer practices. For Reyes Holdings, this means meticulous attention to payroll and employee classification is crucial to avoid penalties that could affect its bottom line.

The potential for unionization presents another significant factor. For instance, in 2023, union membership rates saw a slight uptick in certain sectors, and any successful organizing efforts at Reyes Holdings facilities could lead to increased labor costs through collective bargaining agreements, directly influencing operational expenses and HR strategies.

Reyes Holdings, as a major player in distribution, faces significant oversight from anti-trust and competition regulators. These bodies monitor its operations to ensure it doesn't engage in monopolistic practices or stifle fair competition within the beverage and food sectors. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on consolidation within the distribution industry, signaling ongoing scrutiny for large entities like Reyes.

Compliance is critical for Reyes, particularly when considering strategic moves such as mergers and acquisitions, or when finalizing exclusive distribution contracts with key partners like Coca-Cola or McDonald's. Failure to adhere to these regulations can result in substantial fines and operational restrictions, impacting its ability to secure favorable agreements and maintain market access.

Contractual Agreements and Licensing

Reyes Holdings operates on a foundation of robust contractual agreements, notably with major beverage suppliers like Coca-Cola and various beer breweries. These contracts, often spanning multiple years and involving significant volumes, dictate terms of distribution, exclusivity, and pricing, directly impacting Reyes' revenue. For instance, in 2024, the beverage distribution sector continued to see suppliers leverage exclusivity clauses to secure market share, a trend Reyes must navigate through its contractual negotiations.

Legal adherence to these complex distribution and licensing agreements is paramount. Ensuring compliance with intellectual property rights, particularly for branded beverages, is critical to maintaining supplier relationships and avoiding costly disputes. The company's ability to secure and maintain favorable licensing terms for the products it distributes directly underpins its market position and profitability, with regulatory shifts in 2024 impacting how such licenses are structured and renewed.

- Contractual Dependence: Reyes Holdings' business model relies heavily on legally binding contracts with key suppliers and a broad customer base.

- Distribution and Exclusivity Terms: Legal frameworks governing distribution rights and exclusivity agreements are central to Reyes' operational strategy and market access.

- Intellectual Property Protection: Compliance with intellectual property laws is essential for maintaining brand integrity and supplier trust within its distribution network.

- Revenue Stream Integrity: The enforceability and clarity of contractual terms directly safeguard Reyes' revenue streams and long-term financial stability.

Environmental Protection Laws

Environmental Protection Laws are a significant legal factor for Reyes Holdings. The company must adhere to stringent regulations concerning waste management, emissions control, water usage, and the adoption of sustainable packaging solutions. Failure to comply can result in substantial fines and reputational damage.

These legal obligations directly shape operational strategies and investment decisions. For instance, evolving environmental standards may necessitate increased investment in green technologies and cleaner production methods. In 2024, global spending on environmental protection technologies reached an estimated $1.5 trillion, highlighting the growing market for sustainable solutions that Reyes Holdings could leverage.

- Waste Management: Compliance with regulations on hazardous and non-hazardous waste disposal is critical.

- Emissions Standards: Adherence to air and water quality standards impacts manufacturing processes.

- Sustainable Packaging: Legal mandates for reduced plastic use and increased recyclability influence product design and supply chain.

- Environmental Impact Assessments: Obtaining permits for new facilities often requires thorough environmental impact studies.

Reyes Holdings must navigate a complex web of legal requirements governing its operations, from food safety and labor laws to antitrust regulations and contractual obligations. Adherence to these rules is not merely a matter of compliance but a fundamental aspect of maintaining operational integrity, protecting its reputation, and ensuring financial stability.

The company's reliance on long-term contracts with major suppliers like Coca-Cola and its customer base necessitates meticulous attention to contract law, including intellectual property rights and distribution terms. In 2024, the beverage industry continued to see regulatory shifts impacting licensing and distribution agreements, underscoring the need for Reyes to stay ahead of legal developments to secure favorable terms and market access.

Furthermore, environmental protection laws are increasingly shaping business practices. Reyes must comply with regulations on waste management, emissions, and sustainable packaging, with global spending on environmental technologies reaching an estimated $1.5 trillion in 2024. This legal landscape requires ongoing investment in greener operations and could present opportunities for companies that embrace sustainability.

| Legal Area | Key Regulations/Considerations | Impact on Reyes Holdings | 2023/2024 Data Point |

|---|---|---|---|

| Food Safety | HACCP, FDA mandates | Consumer trust, brand reputation, operational continuity | FDA issued thousands of enforcement actions in 2023. |

| Labor Laws | Minimum wage, OSHA, anti-discrimination | Operational costs, employee relations, legal risk | US Dept. of Labor reported increased wage/hour investigations in 2024. |

| Antitrust & Competition | Monopolistic practices, fair competition | Market access, strategic partnerships, regulatory fines | FTC continued focus on distribution industry consolidation in 2024. |

| Contract Law | Distribution, exclusivity, IP rights | Revenue streams, supplier relationships, market position | Suppliers increasingly using exclusivity clauses in 2024 distribution contracts. |

| Environmental Law | Waste management, emissions, packaging | Operational costs, investment in green tech, reputational risk | Global spending on environmental protection tech estimated at $1.5 trillion in 2024. |

Environmental factors

Climate change is significantly impacting global supply chains, and Reyes Holdings is not immune. The increasing frequency and intensity of extreme weather events, such as hurricanes and floods, can cause substantial disruptions. For instance, in 2024, a series of severe storms across the US Midwest led to widespread transportation delays, affecting the movement of goods for many companies, including those in the food and beverage distribution sector where Reyes Holdings operates.

These disruptions directly threaten Reyes Holdings' logistics networks, potentially damaging infrastructure like warehouses and transportation fleets, and impacting product availability for their diverse customer base. This situation underscores the critical need for robust contingency planning and the development of more resilient logistics operations to mitigate the financial and operational risks associated with these environmental shifts.

Water availability and its escalating cost present a significant environmental challenge for Reyes Coca-Cola Bottling, a key subsidiary of Reyes Holdings. In 2024, regions like California, a major market for beverage production, continued to grapple with drought conditions, leading to increased water prices and stricter usage regulations. This directly impacts the operational costs and supply chain stability for the company.

Reyes Holdings is therefore compelled to scrutinize the sustainability of its own water consumption and the water management strategies employed by its suppliers. As of early 2025, initiatives focusing on water footprint reduction and efficient water use are becoming increasingly critical for maintaining competitive advantage and regulatory compliance within the beverage industry.

Reyes Holdings faces increasing demands from governments, shareholders, and customers to cut its carbon emissions. This pressure is driving investments in more fuel-efficient trucks, smarter delivery planning to reduce miles driven, and the adoption of renewable energy solutions for its facilities. For instance, the transportation sector, a significant part of Reyes Holdings' operations, is under scrutiny; in 2024, the US Environmental Protection Agency (EPA) proposed stricter emissions standards for heavy-duty vehicles, aiming for a 40% reduction in greenhouse gas emissions by 2032 compared to 2010 levels.

Accurately measuring and transparently reporting its carbon footprint is now a fundamental expectation for companies like Reyes Holdings. This involves tracking emissions from its extensive fleet and warehouse operations. As of 2024, many large corporations are voluntarily setting science-based targets for emissions reduction, aligning with global climate goals, and this trend is expected to accelerate, impacting supply chain partners.

Waste Management and Packaging Sustainability

Growing global concern about plastic waste, particularly packaging pollution, is a significant environmental factor influencing companies like Reyes Holdings. This trend is fueling a strong demand for more sustainable packaging materials and improved waste management across entire supply chains. For instance, the Ellen MacArthur Foundation's New Plastics Economy Global Commitment, signed by many major brands, aims to eliminate problematic plastic packaging by 2025, pushing for 100% reusable, recyclable, or compostable packaging.

Reyes Holdings, as a major distributor, must actively support initiatives that address these environmental pressures. This includes investing in and promoting recycling programs for the products and packaging it handles, actively working to reduce the overall amount of packaging used, and championing the adoption of reusable packaging options. The company's commitment to these practices will be crucial for maintaining its social license to operate and meeting evolving customer and regulatory expectations. In 2024, for example, many consumer packaged goods companies reported increased investment in sustainable packaging R&D, with some aiming for 30% recycled content in their plastic packaging by 2025.

- Increased regulatory scrutiny on single-use plastics and packaging waste is driving compliance costs and operational changes for distributors.

- Consumer preference shifts towards environmentally friendly products and packaging are impacting purchasing decisions and brand loyalty.

- Supply chain innovation is required to adopt circular economy principles, focusing on material reduction, reuse, and enhanced recyclability.

- Industry collaborations and partnerships are becoming vital to develop and scale sustainable packaging solutions and efficient waste management systems.

Biodiversity Loss and Ecosystem Health

While the direct impact of Reyes Holdings' operations on biodiversity might seem distant, the increasing global focus on ecosystem health is shaping regulatory landscapes and consumer demand. For instance, the UN Convention on Biological Diversity (CBD) aims to halt biodiversity loss, and by 2024, many nations are expected to strengthen their national biodiversity strategies, potentially affecting supply chains and operational permits for businesses like Reyes Holdings.

Reyes Holdings' commitment to long-term sustainability likely involves proactive measures to counter environmental degradation. This could translate into supporting suppliers who adopt practices that preserve biodiversity, such as sustainable sourcing of raw materials or reducing waste that pollutes natural habitats. Such initiatives are becoming crucial as consumers increasingly favor brands demonstrating environmental responsibility.

The financial implications are also noteworthy. A 2024 report by the World Economic Forum highlighted that nature-related risks could threaten trillions of dollars in global economic activity. Companies that proactively manage their impact on biodiversity, as Reyes Holdings may be doing, are better positioned to mitigate these risks and maintain investor confidence.

- Growing Regulatory Scrutiny: Expect stricter regulations globally by 2024-2025 concerning businesses' impact on biodiversity, driven by international agreements like the CBD.

- Shifting Consumer Preferences: Consumers are increasingly factoring environmental stewardship into purchasing decisions, favoring companies with demonstrable efforts to protect ecosystems.

- Supply Chain Resilience: Proactive management of biodiversity impacts within the supply chain can enhance resilience against environmental shocks and regulatory changes.

- Financial Risk Mitigation: Addressing biodiversity loss is becoming a key component of financial risk management, with potential impacts on investment and lending for companies with poor environmental performance.

Environmental factors significantly shape Reyes Holdings' operational landscape, demanding adaptation to climate change, resource management, and sustainability pressures. The company must navigate disruptions from extreme weather, water scarcity, and the growing imperative to reduce its carbon footprint and plastic waste. These challenges are increasingly intertwined with regulatory demands and evolving consumer expectations for environmental responsibility.

| Environmental Factor | Impact on Reyes Holdings | Data/Trend (2024-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Supply chain disruptions, infrastructure damage, product availability | Increased frequency of storms in 2024 led to widespread transportation delays. |

| Water Availability & Cost | Increased operational costs for beverage bottling, supply chain stability | Regions like California saw rising water prices and stricter usage regulations in 2024. |

| Carbon Emissions Reduction | Pressure to invest in fuel efficiency, renewable energy, and emissions reporting | US EPA proposed stricter emissions standards for heavy-duty vehicles in 2024. |

| Plastic Waste & Packaging | Demand for sustainable packaging, investment in recycling and reduction initiatives | Global commitment targets to eliminate problematic plastic packaging by 2025; many CPGs aimed for 30% recycled content by 2025. |

| Biodiversity Loss | Potential regulatory changes, consumer preference for eco-conscious brands | Nations strengthening biodiversity strategies by 2024; nature-related risks could threaten trillions in economic activity. |

PESTLE Analysis Data Sources

Our Reyes Holdings PESTLE analysis draws from a comprehensive blend of official government publications, reputable market research firms, and international economic data providers. This ensures a robust understanding of political stability, economic trends, and regulatory landscapes impacting the beverage and food distribution sectors.