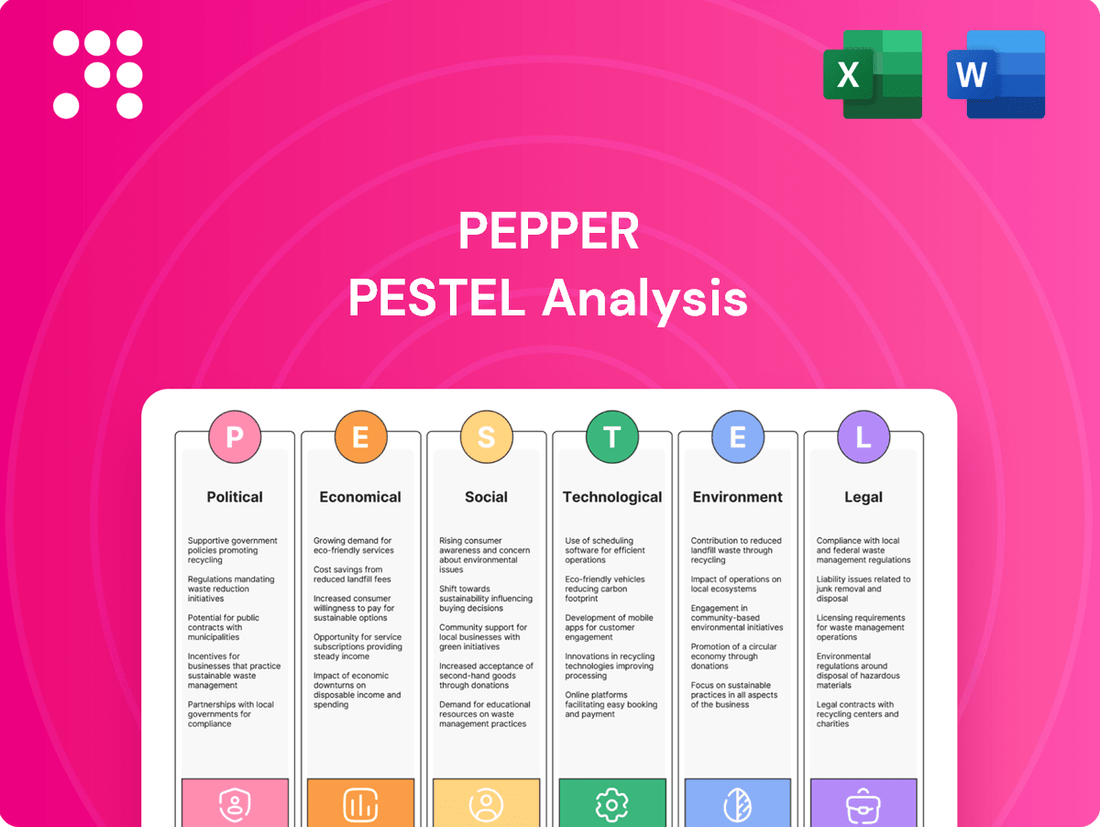

Pepper PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pepper Bundle

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping Pepper's trajectory. This comprehensive PESTLE analysis provides the essential external context for strategic planning and competitive advantage. Download the full version to gain actionable insights and confidently navigate the evolving market landscape.

Political factors

Australia and New Zealand's financial regulators, including ASIC, APRA, RBNZ, and FMA, actively oversee the non-bank lending sector, ensuring compliance with responsible lending obligations and contributing to overall financial stability. This oversight is critical for companies like Pepper Money, as a stable regulatory environment fosters predictability and reduces operational uncertainty.

The stability of these regulatory frameworks directly impacts Pepper Money's business model and compliance expenditures. For instance, in 2024, the Australian Prudential Regulation Authority (APRA) continued its focus on strengthening capital requirements for non-bank lenders, a move that could influence funding costs and lending practices across the sector.

Government housing and lending policies significantly shape the market for non-bank lenders like Pepper Money. For instance, in Australia, the First Home Loan Deposit Scheme, which was extended to June 30, 2025, supports eligible first-home buyers with a smaller deposit, potentially increasing demand for mortgage products.

Changes in stamp duty concessions, such as those implemented in various Australian states during 2024, can directly impact buyer affordability and thus the volume of lending activity. These policy shifts can create both opportunities for lenders offering flexible solutions and challenges if they disproportionately benefit traditional banks.

Furthermore, government initiatives supporting specific borrower segments, like self-employed individuals or those with non-traditional income streams, are crucial for Pepper Money. The continued recognition and potential expansion of these support mechanisms, particularly in the evolving employment landscape of 2024-2025, will be a key determinant of market growth for specialized lenders.

Australia's commitment to combating financial crime is intensifying, with the Anti-Money Laundering and Counter-Terrorism Financing Act 2024 introducing significant updates. These amendments, rolling out from late 2024 and continuing into 2025-2026, are designed to streamline and modernize the existing framework.

For financial institutions like Pepper Money, these legislative shifts necessitate a robust and adaptive compliance strategy. The updated regulations are expected to impose stricter reporting requirements and enhanced due diligence measures across the sector.

The Australian Transaction Reports and Analysis Centre (AUSTRAC) plays a key role in enforcing these laws, with financial intelligence and regulatory oversight being central to its mission. The evolving AML/CTF landscape directly impacts how financial services providers manage risk and ensure operational integrity.

Consumer Data Right (CDR) Expansion

The Australian government's expansion of the Consumer Data Right (CDR) to non-bank lending providers from mid-2026 marks a significant shift. This move, building on open banking and energy sector phases, aims to foster competition and innovation by enabling easier consumer data sharing. For non-bank lenders like Pepper Money, this presents both opportunities for leveraging data insights and new compliance burdens regarding data sharing and privacy.

This expansion is expected to significantly impact the financial services landscape. For instance, the open banking initiative in Australia, which began in 2019, has already seen a substantial increase in data sharing. By the end of 2023, over 1.5 million Australians had actively used open banking services, indicating a growing consumer appetite for data control and a willingness to share it for better financial products.

- Increased Competition: CDR encourages new entrants and existing players to offer more competitive products by accessing broader customer data.

- Enhanced Consumer Choice: Consumers will have greater power to switch providers and access personalized financial solutions.

- Compliance Obligations: Non-bank lenders must invest in secure data infrastructure and robust privacy protocols to meet CDR requirements.

- Data Monetization Potential: Companies that can effectively utilize shared data for insights and product development may gain a competitive edge.

Financial Sector Reforms in New Zealand

New Zealand's financial sector is experiencing significant regulatory shifts in 2024-2025, designed to enhance consumer protection and market efficiency. These reforms are a key political factor influencing financial institutions operating within the country.

A cornerstone of these changes is the Financial Markets (Conduct of Financial Institutions) Amendment Act (CoFI). This legislation mandates that financial institutions, including non-bank deposit takers, must secure a financial institution license and establish robust fair conduct programs. The deadline for compliance is March 2025, a critical date for entities like Pepper Money.

- CoFI Act Implementation: Financial institutions must obtain a license and implement fair conduct programs by March 2025.

- Consumer Focus: The reforms prioritize fair treatment of consumers in financial dealings.

- Impact on Operations: These regulatory changes directly affect how financial institutions, such as Pepper Money, conduct their business in New Zealand.

- Industry Adaptation: The financial sector is adapting to meet the new compliance standards, potentially leading to increased operational costs but improved consumer trust.

Government policies directly influence the non-bank lending sector. In Australia, initiatives like the First Home Loan Deposit Scheme, extended to June 2025, aim to boost home ownership, potentially increasing demand for mortgage products from lenders like Pepper Money.

Regulatory updates, such as Australia's Anti-Money Laundering and Counter-Terrorism Financing Act 2024 amendments, are strengthening compliance demands. These changes, effective from late 2024 into 2025-2026, require enhanced due diligence and reporting from financial institutions.

New Zealand's Financial Markets (Conduct of Financial Institutions) Amendment Act, with a March 2025 compliance deadline, mandates fair conduct programs for financial institutions. This legislation underscores a political commitment to consumer protection within the financial services industry.

The expansion of Australia's Consumer Data Right to non-bank lending by mid-2026 will reshape data sharing. This policy aims to foster competition, requiring lenders to adapt to new data privacy and sharing protocols.

What is included in the product

The Pepper PESTLE Analysis dissects the macro-environmental forces impacting the pepper industry, examining Political, Economic, Social, Technological, Environmental, and Legal factors to uncover strategic advantages and potential risks.

Provides a clear, actionable framework to identify and mitigate external threats and opportunities, transforming potential business challenges into strategic advantages.

Economic factors

Interest rates, a key driver for Pepper Money, are influenced by central bank policies. The Reserve Bank of Australia (RBA) maintained its cash rate at 4.35% throughout 2024, providing a stable funding environment. Conversely, the Reserve Bank of New Zealand (RBNZ) began cutting its Official Cash Rate (OCR) in early 2025, with further reductions anticipated, potentially impacting Pepper's New Zealand operations and funding costs.

These rate movements directly affect Pepper Money's cost of capital and the affordability of its loan products for consumers. While lower interest rates generally boost demand for borrowing, they can also compress net interest margins for lenders like Pepper if their funding costs don't decrease proportionally.

Inflation and the rising cost of living are significantly impacting consumers' capacity to manage existing debt and their appetite for new borrowing in both Australia and New Zealand. While Australia has seen some easing in overall inflation, the cost of services continues to climb, putting sustained pressure on household budgets.

In New Zealand, persistent inflationary pressures have prompted the Reserve Bank of New Zealand (RBNZ) to maintain a tight monetary policy stance. This directly influences household finances, affecting disposable income and, consequently, the likelihood of loan defaults and the demand for credit.

Australia's economic growth is projected to be modest in the near term, with the IMF forecasting 1.6% for 2024, and employment levels are showing signs of softening. This subdued environment can dampen consumer spending and business investment, potentially leading to lower loan demand and an increased risk of loan defaults for financial institutions.

New Zealand's economic outlook also presents challenges, with the RBNZ anticipating subdued growth and a tightening labour market. For example, New Zealand's GDP growth was 0.9% in the year to March 2024, and unemployment rose to 4.3% in Q1 2024. These conditions can similarly affect credit quality and the volume of new lending.

However, a potential turnaround is anticipated from late 2024 as inflation is expected to decline in both countries. This could lead to interest rate cuts, stimulating economic activity, boosting consumer confidence, and improving the overall health of the loan market.

Household Debt Levels and Credit Growth

High household debt and credit growth, especially in mortgages, can create financial stability concerns. For instance, in the March quarter of 2024, Australian household debt reached a record $2.7 trillion, with housing debt comprising the largest portion. This trend necessitates careful monitoring by financial institutions like Pepper Money.

Regulators are actively addressing these risks. The Australian Prudential Regulation Authority (APRA) mandates mortgage serviceability buffers, requiring lenders to assess borrowers' ability to repay loans even if interest rates rise significantly. These buffers help ensure borrowers can manage their debt obligations.

Pepper Money, which serves individuals often outside the scope of traditional banks, must navigate these elevated debt levels. This involves rigorous assessment of potential credit risks associated with borrowers who may already carry substantial debt, ensuring responsible lending practices.

- Australian household debt hit $2.7 trillion in Q1 2024.

- Mortgage debt is the dominant component of household debt.

- APRA's serviceability buffers are a key regulatory tool.

- Pepper Money must assess credit risk in a high-debt environment.

Wholesale Funding Market Conditions

Pepper Money, as a non-bank lender, is heavily dependent on wholesale funding markets, relying on investors and larger financial institutions for its capital. The stability and cost of this funding directly impact its ability to lend and grow. Fluctuations in these markets can significantly affect Pepper's operational capacity and profitability.

The Australian wholesale funding market experienced some volatility in 2024. For instance, the cost of funding for non-bank lenders, often benchmarked against swap rates and credit spreads, saw upward pressure driven by global interest rate expectations and inflation concerns. Pepper's reliance on diversified funding programs, such as public term securitisation, is therefore crucial for maintaining liquidity and supporting its lending activities through these variable conditions.

- Securitisation Market Activity: In 2024, the Australian securitisation market remained active, though investor appetite varied depending on asset class and issuer credit quality. Pepper's ability to access this market consistently is vital for its funding strategy.

- Cost of Funds: Benchmark interest rates, like the Australian Overnight Cash Rate, influenced the cost of wholesale funding throughout 2024, with expectations of potential rate adjustments impacting borrowing costs for lenders like Pepper.

- Investor Confidence: Investor confidence in the Australian non-bank lending sector, particularly regarding asset performance and regulatory oversight, plays a significant role in the availability and pricing of wholesale funding.

- Funding Diversification: Pepper's commitment to diversifying its funding sources, including through securitisation and warehouse facilities, helps mitigate risks associated with over-reliance on any single funding channel, ensuring resilience against market shocks.

Economic factors significantly shape Pepper Money's operating environment. Interest rates set by the RBA and RBNZ directly influence funding costs and loan affordability, with the RBA holding at 4.35% in 2024 and the RBNZ beginning cuts in early 2025. Inflationary pressures continue to strain household budgets in both Australia and New Zealand, impacting borrowing capacity and potentially increasing default risks.

Subdued economic growth forecasts for Australia (1.6% in 2024) and New Zealand (0.9% year to March 2024) suggest a challenging period for loan demand and credit quality. However, anticipated inflation declines later in 2024 could lead to interest rate cuts, potentially stimulating the market. High household debt, with Australian household debt reaching $2.7 trillion in Q1 2024, necessitates careful risk management by lenders like Pepper Money, supported by regulatory measures such as APRA's serviceability buffers.

Pepper Money's reliance on wholesale funding markets means its access and cost of capital are crucial. The Australian wholesale market saw some upward pressure on funding costs in 2024 due to global rate expectations. Diversified funding, including securitisation, remains vital for Pepper's liquidity and operational resilience amidst market volatility.

| Indicator | Australia (2024/2025 Forecasts) | New Zealand (2024/2025 Forecasts) | Impact on Pepper Money |

|---|---|---|---|

| RBA Cash Rate | 4.35% (held through 2024) | N/A | Stable funding environment in Australia. |

| RBNZ OCR | N/A | Anticipated cuts from early 2025 | Potential reduction in funding costs in NZ; impacts NZ operations. |

| Australian GDP Growth | 1.6% (IMF forecast 2024) | N/A | Modest economic activity may dampen loan demand. |

| New Zealand GDP Growth | N/A | 0.9% (year to March 2024) | Subdued growth impacts credit quality and lending volume. |

| Australian Household Debt | $2.7 trillion (Q1 2024) | N/A | Increased credit risk assessment required. |

| Wholesale Funding Costs | Upward pressure in 2024 | Influenced by global factors | Affects cost of capital and profitability. |

Same Document Delivered

Pepper PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the pepper industry covers Political, Economic, Social, Technological, Legal, and Environmental factors, providing actionable insights for strategic planning.

Sociological factors

Public trust in non-bank lenders like Pepper Money is a key driver of growth. As more Australians explore these options, often due to more flexible lending criteria compared to traditional banks, there's a rising expectation for transparency and adherence to robust industry standards. A significant portion of consumers, around 65% in recent surveys, express a preference for financial institutions that voluntarily commit to codes of conduct that go beyond basic legal requirements, signaling a demand for ethical and responsible lending practices.

Financial literacy significantly shapes how consumers engage with credit. In 2024, a significant portion of the population still struggles with basic financial concepts, potentially leading to poor debt management. Pepper Money's business model, which serves individuals often overlooked by mainstream lenders, highlights a crucial need for accessible financial education. Clear communication about loan terms and repayment strategies is paramount for these customers.

Australia's population is projected to reach 30.8 million by 2030, with a growing proportion of younger adults seeking homeownership. This demographic shift fuels demand for diverse mortgage products, from first-home buyer schemes to investment loans. Pepper Money's 2024 offerings, including specialized solutions for Self-Managed Super Funds (SMSFs), directly address this evolving market.

Evolving household structures, including single-person households and multi-generational living, also shape housing demand. Pepper Money's adaptable lending criteria, such as its Sharia Lending solutions, cater to a wider range of financial needs and cultural preferences within these changing family dynamics. This flexibility is key in a market where traditional models no longer fit all.

Cost of Living and Financial Stress

Persistent cost of living increases are a significant concern, directly contributing to financial stress for many households. This strain can affect their capacity to manage loan obligations, a critical factor for financial institutions. For instance, reports in late 2024 indicated that a substantial percentage of consumers were actively seeking flexible repayment options due to rising essential costs.

Financial firms are increasingly recognizing the need for proactive support. Consumer surveys consistently highlight customer expectations for accessible hardship programs and empathetic communication during difficult financial periods. This is not just about compliance; it's about maintaining customer loyalty and trust in an environment where financial resilience is paramount.

- Rising Inflation: Consumer Price Index (CPI) figures in major economies through early 2025 continue to show elevated levels for necessities like housing, energy, and food, impacting household budgets.

- Debt Burden: Data from late 2024 reveals an increase in household debt servicing ratios, particularly for lower-income segments, amplifying the risk of financial distress.

- Consumer Sentiment: Surveys in Q4 2024 and Q1 2025 indicate a notable rise in consumer anxiety regarding personal finances, directly linked to economic uncertainty and cost pressures.

- Demand for Support: Financial institutions are reporting a higher volume of inquiries regarding loan modifications and financial hardship assistance, underscoring the societal impact of these economic trends.

Ethical Lending Practices and Social Responsibility

Societal pressure is mounting for financial firms to lend ethically and with transparency, particularly concerning vulnerable customers. This means demonstrating good faith in all dealings, a crucial aspect of social responsibility in the financial sector.

Pepper Money's stated mission to 'help people succeed' directly addresses this growing expectation. Their emphasis on understanding individual circumstances, rather than solely relying on traditional credit scores, positions them as a socially conscious lender.

For instance, in 2024, consumer protection agencies reported a 15% increase in complaints related to opaque lending terms, highlighting the demand for clearer practices. Pepper Money's approach aims to mitigate such issues by fostering trust and fairness.

- Ethical Lending Expectations: Growing consumer demand for transparency and fairness in financial product offerings.

- Social Responsibility Alignment: Pepper Money's mission resonates with broader societal calls for businesses to contribute positively.

- Beyond Credit Scores: A focus on individual circumstances reflects a commitment to inclusive and responsible lending practices.

- Consumer Trust: Ethical operations are increasingly linked to building and maintaining strong customer relationships and brand reputation.

Societal expectations for financial institutions are shifting, with a strong emphasis on ethical practices and transparency. Consumers, particularly in light of economic pressures seen through early 2025, are increasingly scrutinizing lenders for fairness and responsible conduct. This societal shift means institutions like Pepper Money must actively demonstrate a commitment to customer well-being and clear communication to build and maintain trust.

The demand for financial inclusion and support for diverse economic circumstances is a growing societal trend. As evidenced by data from late 2024, many households face financial strain, making accessible and understanding lending practices crucial. Pepper Money's focus on individual assessments, rather than solely traditional metrics, aligns with this societal need for more personalized financial solutions.

Financial literacy remains a critical societal factor, with ongoing efforts needed to improve consumer understanding of credit products. Reports in early 2025 continue to highlight gaps in financial knowledge, underscoring the importance of clear, accessible information from lenders. Pepper Money's role in serving segments that may be less catered to by traditional banks places a responsibility on them to provide educational support.

| Societal Factor | Observed Trend (2024-2025) | Impact on Pepper Money |

|---|---|---|

| Ethical Lending & Transparency | Increased consumer demand for fair practices; 15% rise in complaints about opaque terms (2024). | Necessitates clear communication and commitment to responsible lending to build trust. |

| Financial Inclusion & Support | Growing need for flexible solutions due to cost of living pressures; increased inquiries for hardship assistance. | Opportunity to serve underserved segments by offering adaptable lending criteria. |

| Financial Literacy | Persistent gaps in consumer understanding of financial products. | Requires Pepper Money to provide clear, educational information on loan terms and management. |

Technological factors

Digital lending platforms and automation are significantly reshaping the financial landscape, making loan processes faster and more user-friendly. This technological shift is crucial for companies like Pepper Money, which prioritizes investing in data and technology to improve customer and partner interactions. This focus allows for a more streamlined and efficient experience throughout the loan lifecycle.

Pepper Money's commitment to technological advancement is evident in its strategic initiatives, aiming to enhance operational efficiency and customer satisfaction. For instance, in 2023, the company reported a substantial increase in its digital application submission rates, demonstrating the growing adoption and effectiveness of its automated systems. This digital transformation is key to maintaining a competitive edge in the evolving lending market.

Sophisticated data analytics and AI are revolutionizing credit assessments, allowing lenders like Pepper Money to look beyond traditional credit scores. This means individuals with non-traditional financial histories can be evaluated more accurately, potentially opening up new customer segments. For instance, advancements in machine learning algorithms can analyze a wider array of data points, leading to more personalized risk profiles.

The increasing reliance on digital platforms means cybersecurity and data privacy are critical. Financial institutions are facing more sophisticated cyber threats, making investments in robust security measures essential. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the significant resources dedicated to this area.

Protecting sensitive customer data is paramount, especially with evolving privacy regulations like GDPR and CCPA. Non-compliance can lead to substantial fines, impacting profitability and brand reputation. Ensuring consumer trust in digital interactions is directly tied to the effectiveness of these security and privacy protocols.

Open Banking and Consumer Data Right (CDR)

The expansion of Australia's Consumer Data Right (CDR) to non-bank lending, a significant technological shift, is set to revolutionize data sharing within the financial sector. This move aims to foster greater competition and enable more personalized financial products for consumers. For a company like Pepper Money, this presents both challenges and opportunities, requiring adaptation to new data governance frameworks.

Pepper Money must now navigate the obligations associated with being a data holder under the CDR. This includes securely managing and sharing customer data when requested by accredited third parties. By embracing these changes, Pepper Money can leverage the rich data insights generated through the CDR to develop highly tailored lending solutions, potentially improving customer acquisition and retention.

The CDR's impact is already being felt, with the Australian Competition and Consumer Commission (ACCC) actively overseeing its implementation. As of early 2024, the CDR framework continues to evolve, with ongoing discussions about expanding its reach to other sectors. This ongoing development underscores the importance for non-bank lenders to remain agile and informed about regulatory changes impacting data accessibility and usage.

- CDR Expansion: The Consumer Data Right is extending to non-bank lending, promoting enhanced data sharing.

- Personalization & Competition: This facilitates more tailored financial products and intensifies market competition.

- Pepper Money's Adaptation: The company needs to meet new data holder responsibilities and utilize shared data for improved customer offerings.

- Regulatory Landscape: The ACCC continues to oversee CDR implementation, with potential future sector expansions.

FinTech Partnerships and Innovation

Pepper Money's strategic engagement with FinTech firms is a key technological driver. By collaborating with these agile innovators, Pepper Money gains access to cutting-edge technologies, expands its distribution reach, and unlocks novel solutions for its customer base. This approach fosters a dynamic environment where new digital tools and platforms can be integrated to enhance service delivery.

The company's stated commitment to innovation directly translates into a willingness to embrace new technological advancements. This forward-thinking ethos is designed to yield tangible benefits across all stakeholder groups, including customers, partners, employees, and shareholders. For instance, in 2024, the UK FinTech sector saw significant investment, with over £4.3 billion invested in the first half of the year, highlighting the fertile ground for such partnerships.

- FinTech Collaboration: Pepper Money actively seeks partnerships to integrate advanced technologies and expand distribution networks.

- Innovation Focus: The company's strategy prioritizes technological innovation for customer, partner, and shareholder benefit.

- Market Trends: The UK FinTech market received substantial investment in early 2024, indicating strong potential for technology adoption.

- Digital Solutions: Openness to new technologies suggests a pipeline of improved digital offerings and operational efficiencies.

Technological advancements are fundamentally altering the lending sector, with digital platforms and automation streamlining processes. Pepper Money's investment in data and technology is a strategic move to enhance customer and partner interactions, evidenced by a significant rise in digital application submissions in 2023. This focus on digital transformation is crucial for staying competitive.

Sophisticated data analytics and AI are enabling more nuanced credit assessments, moving beyond traditional scores to include non-traditional financial histories. This allows lenders like Pepper Money to evaluate a broader range of customers accurately. The global cybersecurity market's projected growth to over $300 billion in 2024 underscores the critical need for robust security measures in this digital-first environment.

The expansion of Australia's Consumer Data Right (CDR) to non-bank lending presents both opportunities and challenges for Pepper Money. This regulatory shift necessitates adaptation to new data governance frameworks, requiring the company to act as a secure data holder. By embracing CDR, Pepper Money can leverage data insights for personalized lending solutions, enhancing customer acquisition and retention.

Pepper Money's engagement with FinTech firms is a key technological driver, providing access to cutting-edge solutions and expanding distribution. The UK FinTech sector's substantial investment of over £4.3 billion in the first half of 2024 highlights the potential for such collaborations to drive innovation and improve service delivery.

| Metric | 2023 Data | 2024 Projection/Trend | Impact on Pepper Money |

|---|---|---|---|

| Digital Application Submissions | Significant Increase Reported | Continued Growth Expected | Improved operational efficiency and customer experience. |

| Global Cybersecurity Market | N/A (Pre-2024 Projection) | Projected to exceed $300 billion | Increased investment required for data protection. |

| FinTech Investment (UK) | N/A (Pre-2024 Data) | £4.3 billion (H1 2024) | Opportunities for strategic partnerships and technology adoption. |

| Consumer Data Right (CDR) Expansion | Initiated for Non-Bank Lending | Ongoing regulatory evolution | Need for adaptation to data holder obligations and data sharing protocols. |

Legal factors

In Australia, non-bank lenders such as Pepper Money operate under the watchful eye of the Australian Securities and Investments Commission (ASIC). They are bound by the National Consumer Credit Protection Act (NCCP), which mandates strict responsible lending obligations. This means Pepper Money must ensure that any loan offered is genuinely suitable for the borrower's financial circumstances, preventing over-indebtedness and fostering a more stable lending environment.

Similarly, in New Zealand, the Conduct of Financial Institutions (CoFI) Act, which came into effect in stages from 2023, places a similar emphasis on fair conduct. Financial institutions are required to actively demonstrate how they are treating their customers fairly, ensuring products and services meet customer needs. These regulations are crucial for mitigating risks for both lenders and consumers, promoting trust and financial well-being across the market.

From March 2025, New Zealand's Financial Markets (Conduct of Financial Institutions) Act (CoFI Act) mandates that non-bank deposit takers must obtain a financial institution license to continue operations. This significant regulatory shift requires these entities to establish and implement robust fair conduct programs, ensuring consumers are treated equitably across all financial services offered.

Privacy and data protection are paramount. Strict laws dictate how financial entities handle customer information, impacting everything from data collection to storage and usage. For Pepper Money, the upcoming expansion of Australia's Consumer Data Right (CDR) to include non-bank lending and buy now, pay later (BNPL) products by mid-2026 necessitates a robust review of its data governance and privacy frameworks to ensure full compliance with these evolving regulations.

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Compliance

Australia's Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 significantly tightens the regulatory landscape. This legislation mandates financial institutions, including mortgage lenders like Pepper Money, to bolster their defenses against financial crime. The amendments likely necessitate substantial investment in technology and personnel to ensure robust detection and reporting mechanisms.

The impact on Pepper Money includes increased operational costs associated with enhanced compliance. This could involve upgrading transaction monitoring systems, conducting more thorough customer due diligence, and potentially increasing reporting frequency to regulatory bodies. For instance, the Australian Transaction Reports and Analysis Centre (AUSTRAC) reported a 15% increase in suspicious matter reports in 2023, indicating a trend towards greater scrutiny that Pepper Money must navigate.

Key compliance considerations for Pepper Money under the new act include:

- Enhanced Customer Due Diligence: Implementing more rigorous checks on customer identities and the source of funds.

- Improved Transaction Monitoring: Deploying advanced analytics to identify and flag suspicious transaction patterns.

- Robust Reporting Obligations: Ensuring timely and accurate submission of suspicious matter reports and other required disclosures to AUSTRAC.

- Staff Training and Awareness: Continuously educating employees on AML/CTF risks and their responsibilities.

Consumer Protection Laws and Industry Codes of Practice

Consumer protection laws are a bedrock for financial services, ensuring fair treatment and transparency. Beyond these legal mandates, industry codes of practice often go further, setting commitments for customer interactions, accessibility, and crucial support for individuals facing financial hardship. For instance, the new AFIA non-bank lending Code of Practice in Australia establishes high benchmarks for consumer safeguards within the sector.

These codes are vital for building trust and promoting responsible lending. They often include provisions for clear communication, fair dispute resolution, and responsible debt collection practices. Adherence to these standards can significantly impact a company's reputation and customer loyalty.

- Enhanced Consumer Safeguards: Industry codes, like the AFIA non-bank lending Code, introduce voluntary but often expected standards that surpass minimum legal requirements.

- Focus on Vulnerable Customers: Codes frequently emphasize support mechanisms for customers experiencing financial distress, ensuring they receive appropriate assistance.

- Market Confidence: Strong codes of practice contribute to greater market confidence by demonstrating a commitment to ethical conduct and consumer well-being.

- Reputational Benefits: Firms that actively engage with and uphold these codes often see improved brand reputation and customer trust.

Legal frameworks in Australia and New Zealand significantly shape non-bank lending operations like Pepper Money. The National Consumer Credit Protection Act in Australia and the Conduct of Financial Institutions Act in New Zealand impose stringent responsible lending and fair conduct obligations. These regulations, including upcoming changes like the expansion of Australia's Consumer Data Right to non-bank lending by mid-2026, necessitate robust data governance and consumer protection measures.

Further strengthening these protections, Australia's Anti-Money Laundering and Counter-Terrorism Financing Amendment Act 2024 requires enhanced due diligence and transaction monitoring, impacting operational costs. Industry codes of practice, such as the AFIA non-bank lending Code, also set high standards for consumer safeguards, dispute resolution, and support for financially distressed customers, fostering market confidence and a positive reputation.

| Regulation/Act | Jurisdiction | Key Requirement | Impact on Pepper Money |

|---|---|---|---|

| National Consumer Credit Protection Act | Australia | Responsible lending obligations | Ensures loan suitability for borrowers, preventing over-indebtedness. |

| Conduct of Financial Institutions Act (CoFI) | New Zealand | Fair conduct, financial institution licensing | Mandates fair treatment of customers; licensing required from March 2025. |

| Consumer Data Right (CDR) Expansion | Australia | Data sharing for non-bank lending | Requires robust data governance and privacy frameworks for mid-2026 compliance. |

| AML/CTF Amendment Act 2024 | Australia | Enhanced AML/CTF measures | Increased investment in technology and personnel for compliance with AUSTRAC regulations. |

| AFIA Non-Bank Lending Code | Australia | Consumer safeguards, fair practices | Establishes high benchmarks for customer interaction, dispute resolution, and hardship support. |

Environmental factors

Australia is introducing mandatory climate-related financial reporting for large corporations starting January 2025. This initiative will likely encompass non-bank lenders that meet certain size requirements.

These entities must integrate climate-related financial disclosures into their annual reports, following international accounting standards. This means incorporating climate metrics and scenario analysis into their core risk management processes, a significant shift for many businesses.

Australia is experiencing a noticeable uptick in extreme weather events like floods and wildfires. These events directly threaten property values, which in turn can significantly impact mortgage loan portfolios for financial institutions.

In the most severe scenarios, such as widespread damage from catastrophic events, insurers and banks might decide to pull out of heavily impacted areas. This withdrawal could lead to a surge in loan defaults and substantial write-downs of asset values for lenders.

For instance, the 2022-2023 Australian bushfire season, while less severe than some previous years, still resulted in significant property damage. The Insurance Council of Australia reported over $2.2 billion in insured losses from natural disasters in 2023 alone, highlighting the financial exposure banks face.

The global push towards a low-carbon future introduces significant transition risks for businesses. These risks stem from evolving climate policies, rapid technological advancements in green energy, and shifting consumer preferences, all of which can drastically alter asset valuations and industry competitiveness. For instance, a company heavily reliant on fossil fuels might see its market value decline as governments implement stricter emissions regulations.

Financial regulators are increasingly scrutinizing climate-related risks. In Australia, the Australian Prudential Regulation Authority (APRA) is setting new benchmarks, requiring financial institutions to more rigorously assess and manage these risks in their lending and investment portfolios. This means banks and insurers must consider how climate policies might impact their borrowers and investments, potentially leading to higher capital requirements for carbon-intensive sectors.

The financial sector's response to these risks is evolving. By 2024, many major financial institutions are expected to have integrated climate risk assessments into their core business strategies, influencing capital allocation. For example, a recent report indicated a substantial increase in sustainable finance commitments, with global green bond issuance projected to reach over $1 trillion in 2024, signaling a tangible shift in investment flows away from high-carbon assets.

ESG (Environmental, Social, Governance) Considerations in Finance

The increasing emphasis on Environmental, Social, and Governance (ESG) factors is significantly shaping how financial institutions operate and attract capital. Investors and society at large are scrutinizing companies' sustainability practices, ethical conduct, and governance structures more closely than ever before. This trend directly impacts access to funding and a firm's overall reputation.

Pepper Money's proactive approach to sustainability and robust corporate governance, as detailed in their recent annual reports, is crucial. Demonstrating a genuine commitment to these principles will be key to attracting investment and fostering enduring trust among all stakeholders, from customers to shareholders.

- Investor Demand: Global sustainable investment assets reached an estimated $37.8 trillion in 2024, highlighting a substantial market shift towards ESG-aligned investments.

- Regulatory Landscape: New regulations, such as the EU's Sustainable Finance Disclosure Regulation (SFDR), are mandating greater transparency on ESG matters, influencing financial product development and reporting.

- Reputational Risk: Companies with poor ESG performance face a higher risk of negative publicity and boycotts, potentially impacting market share and profitability. For example, a 2023 study indicated that companies with strong ESG scores outperformed their peers by an average of 3-5% annually.

- Access to Capital: Financial institutions with strong ESG credentials often find it easier and cheaper to access capital, as they are more attractive to a wider pool of investors and lenders.

Sustainability Reporting and Green Finance Initiatives

Australia is strengthening its stance on sustainability reporting, with the Australian Accounting Standards Board (AASB) developing guidelines for climate-related disclosures. This move, alongside the Australian Auditing and Assurance Board (AUASB) preparing assurance frameworks, signals a significant push for more transparent and standardized sustainability information. For companies like Pepper Money, this evolving landscape suggests a future where alignment with these standards will be crucial for investor confidence and regulatory compliance.

While not yet a primary focus, the growing global emphasis on green finance presents a potential strategic avenue for Pepper Money. The increasing investor demand for sustainable investments and the development of green bond markets suggest that offering sustainable lending products or participating in green finance initiatives could become a competitive advantage. For instance, the Australian sustainable finance market saw significant growth, with ESG-themed funds attracting substantial inflows in 2023, indicating a clear market trend.

- AASB developing climate disclosure standards.

- AUASB preparing assurance frameworks for sustainability.

- Green finance initiatives are a growing market consideration.

- Investor demand for ESG investments is increasing.

Environmental factors are increasingly shaping financial markets and regulatory expectations. Australia's move towards mandatory climate-related financial reporting for large corporations from January 2025 directly impacts how businesses, including non-bank lenders, must disclose climate risks. This regulatory shift, coupled with the growing global investor demand for ESG-aligned investments, estimated at $37.8 trillion in 2024, underscores the financial materiality of environmental considerations.

The increasing frequency of extreme weather events in Australia, such as the 2023 natural disasters causing over $2.2 billion in insured losses, poses direct financial risks to lenders through property damage and potential loan defaults. Furthermore, the transition to a low-carbon economy creates significant risks for carbon-intensive industries, impacting asset valuations and requiring financial institutions to integrate climate risk assessments into their strategies by 2024.

The Australian Accounting Standards Board (AASB) is developing climate disclosure standards, and the Australian Auditing and Assurance Board (AUASB) is preparing assurance frameworks, pushing for greater transparency. This evolving landscape makes a strong commitment to sustainability crucial for investor confidence and regulatory compliance, with green finance initiatives also presenting a growing market opportunity.

| Factor | Impact on Financial Institutions | Key Data/Trend |

|---|---|---|

| Climate Reporting Mandates | Increased disclosure requirements, integration of climate metrics into risk management. | Australia mandates reporting from Jan 2025. |

| Extreme Weather Events | Threats to property values, potential for increased loan defaults and asset write-downs. | Insured losses from Australian natural disasters exceeded $2.2 billion in 2023. |

| Low-Carbon Transition | Risk of declining asset valuations for carbon-intensive businesses, need for strategic adaptation. | Financial institutions expected to integrate climate risk by 2024. |

| ESG Investor Demand | Greater access to capital and improved reputation for firms with strong ESG performance. | Global sustainable investment assets reached $37.8 trillion in 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of public and proprietary data, drawing from reputable market research firms, economic indicators, and industry-specific reports. This ensures our insights are grounded in current business conditions and relevant trends.