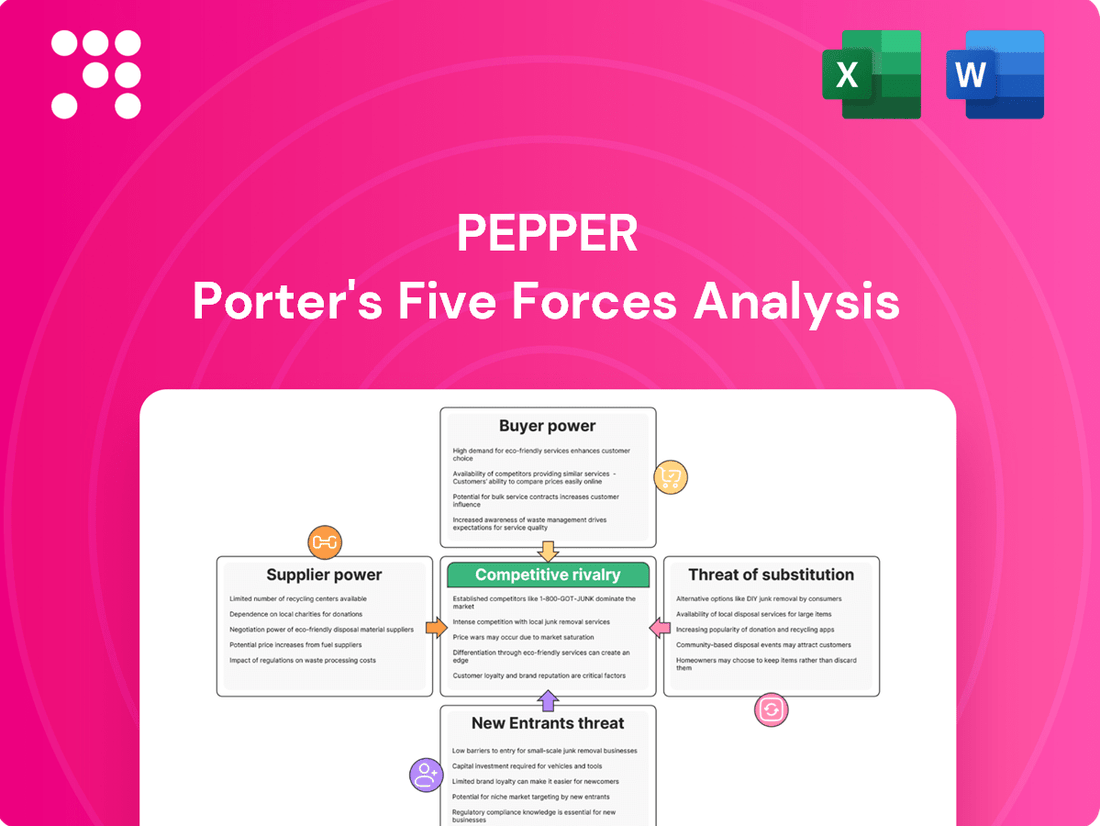

Pepper Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pepper Bundle

Understanding the competitive landscape for Pepper is crucial for strategic success. Our analysis delves into the five key forces that shape its market, from the bargaining power of buyers to the intensity of rivalry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Pepper’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Pepper Money, a non-bank lender, sources its capital predominantly from wholesale funding markets, securitisation, and institutional investors. The cost and availability of these funding sources are critical to its operations, as they represent the essential raw material for its lending business.

In 2024, the cost of wholesale funding, particularly for non-bank lenders, remained a key consideration. For instance, the AustralianSecuritisation Forum reported that while securitisation markets remained active, pricing for RMBS (Residential Mortgage-Backed Securities) was influenced by broader economic conditions and investor risk appetite. This means that shifts in market sentiment or liquidity directly empower these funding providers, potentially increasing the cost of capital for Pepper Money.

Specialized technology and data analytics providers are vital for Pepper Money's alternative lending operations, powering everything from loan origination and servicing to sophisticated risk assessment. Their ability to offer unique, proprietary solutions means they can wield significant influence. This leverage stems from high switching costs and the specialized nature of their services, making it difficult for Pepper Money to find comparable alternatives.

Pepper Money's reliance on specific credit bureaus for non-traditional data further amplifies the bargaining power of these data suppliers. For instance, as of early 2024, the demand for alternative credit data, often sourced from utility payments or rental history, has surged, giving providers of such datasets more pricing power. The integration of these data streams is not merely supplementary; it's fundamental to Pepper Money's underwriting process.

Broker networks are a significant channel for Pepper Money, with a substantial portion of their mortgage and asset finance deals originating from accredited brokers and introducers. This reliance places considerable bargaining power in the hands of these intermediaries.

The power of these broker networks is amplified when they can direct significant customer flow and maintain relationships with multiple lenders, giving them leverage to choose partners based on competitive offerings and ease of integration. For instance, in 2024, mortgage broker activity remained a dominant force in the Australian housing market, with brokers facilitating over 60% of new home loans.

Human Capital

The bargaining power of suppliers, particularly in the context of human capital for non-bank lenders, is significantly influenced by specialized talent. Expertise in areas like credit assessment for non-conforming loans or in financial technology (FinTech) is a scarce and valuable resource. This scarcity translates directly into leverage for these skilled individuals.

Key employees and management possessing specific knowledge of alternative lending models can command higher compensation. In a competitive labor market, their ability to negotiate better terms or even move to competing firms gives them considerable influence. For instance, in 2024, the demand for experienced FinTech professionals in the lending sector saw salary increases of up to 15% for specialized roles, reflecting this strong bargaining position.

- Scarcity of specialized skills: Talent in non-conforming loan assessment and FinTech is limited.

- Employee leverage: Expertise in alternative lending models allows key personnel to negotiate higher pay.

- Competitive labor market: Increased demand for FinTech talent drove up salaries by as much as 15% in 2024 for specific roles in lending.

- Supplier influence: Skilled human capital can dictate terms, impacting the cost of operations for non-bank lenders.

Regulatory Compliance Services

The increasing regulatory landscape for non-bank lenders, such as Pepper Money, significantly bolsters the bargaining power of specialized regulatory compliance service providers. As new mandates emerge, like those related to the Consumer Data Right and climate-related financial disclosures, the need for expert legal and compliance guidance becomes critical.

These service providers are essential for Pepper Money to navigate the complexities of evolving regulations, ensuring adherence and avoiding penalties. The cost associated with obtaining and implementing this expert advice and necessary compliance systems can be substantial, further amplifying the suppliers' leverage.

- Increased Regulatory Scrutiny: Non-bank lenders are facing heightened oversight, demanding specialized knowledge.

- New Compliance Requirements: Initiatives like the Consumer Data Right and climate reporting necessitate expert support.

- Essential for Adherence: Pepper Money relies on these services to meet evolving legal and ethical standards.

- Costly Implementation: The investment in expert advice and compliance systems grants suppliers greater influence.

The bargaining power of suppliers for Pepper Money is most pronounced with its wholesale funding providers and specialized technology partners. These entities control essential inputs, and their pricing power can directly impact Pepper Money's cost of capital and operational efficiency. For instance, in 2024, the cost of securitisation funding remained sensitive to market liquidity, with pricing fluctuations directly reflecting investor sentiment.

The reliance on specialized FinTech providers and credit data services also grants these suppliers significant leverage. Their unique offerings, coupled with high integration costs, make switching difficult for Pepper Money. This is particularly true for alternative credit data providers, whose insights are crucial for underwriting non-traditional loans, a segment experiencing growing demand.

| Supplier Type | Key Input | 2024 Market Trend Impacting Bargaining Power | Example of Influence |

|---|---|---|---|

| Wholesale Funding Markets | Capital for lending | Sensitivity to liquidity and investor risk appetite | Increased securitisation pricing due to broader economic uncertainty |

| FinTech Providers | Loan origination & servicing technology | Demand for proprietary solutions and high switching costs | Ability to dictate terms for specialized risk assessment platforms |

| Credit Data Providers | Alternative credit data | Surging demand for non-traditional data sources | Increased pricing power for utility and rental payment data |

What is included in the product

Pepper's Five Forces Analysis provides a comprehensive framework for understanding the competitive intensity and attractiveness of its market, examining threats from new entrants, the power of buyers and suppliers, the risk of substitutes, and the rivalry among existing competitors.

Quickly identify and neutralize competitive threats with pre-built templates for each Porter's Five Forces element.

Customers Bargaining Power

Pepper Money's customers, often those who don't fit traditional lending criteria, still have choices. The alternative lending market is expanding, offering non-bank lenders and fintech solutions as viable alternatives. This growing competition means customers can shop around for the best deals.

For instance, by mid-2024, the UK's alternative finance market facilitated over £2.3 billion in new lending, demonstrating a robust and growing ecosystem of non-traditional providers. This availability of options, even if specialized, gives customers leverage to negotiate for more favorable terms or tailored financial products, impacting Pepper Money's pricing and service offerings.

The rise of online comparison platforms has dramatically increased information transparency for loan products. In 2024, a significant portion of consumers actively use these tools to compare rates and fees, finding it easier than ever to switch providers. This accessibility directly shifts bargaining power towards the customer.

For instance, by mid-2024, over 60% of individuals seeking personal loans reported using comparison websites to find the best terms. This widespread adoption means lenders must offer competitive rates and clear, understandable terms to attract and retain borrowers, as switching costs are virtually eliminated.

The ease with which customers can switch lenders, particularly for mortgages, significantly amplifies their bargaining power. This is especially true when refinancing opportunities arise, allowing borrowers to capitalize on changing market conditions. For instance, in 2023, Australian mortgage refinancing activity reached record highs, demonstrating a clear customer preference for seeking better deals.

Product Commoditization

The inherent commoditization of core lending products, like mortgages and auto loans, significantly bolsters customer bargaining power. Even within Pepper Money's niche of alternative lending, the fundamental nature of these financial products means they are often perceived as interchangeable by consumers.

This similarity drives customers to focus on price, making them highly sensitive to interest rates and associated fees. For instance, a 0.25% difference in an annual percentage rate (APR) on a mortgage can translate into thousands of dollars over the loan's life, pushing customers to shop around for the best deal rather than sticking with a particular lender based on brand alone.

- Commoditized Products: Mortgages and auto loans are largely undifferentiated financial instruments.

- Price Sensitivity: Customers prioritize lower interest rates and fees due to product similarity.

- Increased Switching: Customers are more likely to switch lenders for better pricing, amplifying their power.

- Impact on Lenders: Lenders face pressure to compete on price, potentially squeezing profit margins.

Economic Conditions Impacting Borrower Demand

In periods of high interest rates or economic uncertainty, borrower demand can soften. For example, in early 2024, many potential homebuyers hesitated due to elevated mortgage rates, impacting origination volumes for lenders.

This softening demand shifts bargaining power towards borrowers. Lenders become more eager to attract and retain customers, often leading to more competitive loan terms and lower fees to maintain business.

- Increased Lender Competition: As borrower demand cools, lenders must actively compete for a smaller pool of applicants.

- Favorable Borrower Terms: Borrowers gain leverage, potentially securing lower interest rates or more flexible repayment options.

- Impact on Origination Volumes: Lenders focus on maintaining origination volumes, making them more amenable to borrower demands.

The bargaining power of Pepper Money's customers is significant, driven by the availability of alternatives and increased market transparency. In 2024, over 60% of personal loan seekers used comparison sites, highlighting a strong tendency to switch for better terms. This ease of switching, amplified by record refinancing activity in Australia during 2023, forces lenders to compete on price.

| Factor | Description | Impact on Pepper Money | 2024 Data/Trend |

|---|---|---|---|

| Availability of Alternatives | Growing non-bank and fintech lenders offer choices. | Pressure on pricing and product differentiation. | UK alternative finance market exceeded £2.3 billion in new lending by mid-2024. |

| Information Transparency | Online comparison platforms make rates easily accessible. | Customers can readily identify and switch to cheaper options. | Over 60% of personal loan seekers used comparison websites in 2024. |

| Product Commoditization | Core lending products are perceived as similar. | Customers prioritize price over lender brand. | A 0.25% APR difference on a mortgage can save thousands, driving shopping. |

Full Version Awaits

Pepper Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual, professionally written Five Forces analysis for Pepper, detailing its competitive landscape and strategic positioning. Once you complete your purchase, you’ll get instant access to this exact file, ready for your immediate use.

Rivalry Among Competitors

Pepper Money operates in a crowded Australian and New Zealand non-bank lending market, facing intense competition from numerous specialist lenders, agile challenger banks, and an ever-increasing wave of fintech innovators. This diverse competitive landscape means Pepper Money must constantly adapt to offerings from entities that may focus on specific niches or provide alternative financial products.

The sheer number of players means that market share can be fragmented, with no single competitor dominating across all segments. For instance, in 2024, the Australian non-bank mortgage sector saw continued growth, with new entrants and existing players actively seeking market share, particularly in segments like prime and near-prime mortgages, where Pepper Money is active.

While the alternative lending sector shows robust growth, the broader lending market can face periods of stagnation or decline. This slowdown intensifies competition as financial institutions vie for a shrinking pool of borrowers, driving up acquisition costs and pressuring margins.

Non-bank lenders have significantly increased their market share, especially in serving investors and small to medium-sized enterprises (SMEs). This trend highlights a dynamic and increasingly competitive landscape where traditional banks are challenged by more agile, specialized lenders.

Pepper Money carves out its space by focusing on borrowers often overlooked by traditional banks, such as those with non-standard income or credit histories. However, this strategic focus isn't unique; many other non-bank lenders actively pursue these same underserved markets. This intensifies competition, with lenders vying for business by emphasizing their agility, rapid decision-making processes, and ability to craft bespoke loan products.

In 2024, the non-bank lending sector saw continued growth, with many players actively seeking to differentiate themselves. For instance, some lenders have focused on specific property types or borrower professions to build expertise and offer more attractive terms. The key for Pepper Money, and its competitors, lies in continuous innovation to present a truly distinct value proposition that resonates with these specialized customer segments.

Exit Barriers and Market Stickiness

High capital requirements, particularly in the lending sector, act as significant exit barriers for non-bank lenders. For instance, establishing a robust lending operation often necessitates substantial investment in technology, compliance, and personnel, making it difficult to recoup these costs if a firm decides to leave the market. This can trap companies within the industry, even when profitability is low.

Regulatory complexities further cement these exit barriers. Navigating licensing, reporting, and consumer protection laws requires ongoing investment and specialized expertise. The sheer effort and cost involved in complying with these regulations can deter new entrants and make it economically unfeasible for existing firms to divest easily. As of early 2024, the regulatory landscape for non-bank financial institutions continues to evolve, demanding constant adaptation and investment.

The presence of established infrastructure, such as proprietary loan origination systems, servicing platforms, and existing customer relationships, also contributes to market stickiness. These assets are often difficult to transfer or sell, increasing the cost and complexity of exiting. Consequently, firms may remain operational in a competitive environment, even if they are not performing optimally, thereby sustaining competitive intensity and potentially leading to price-based competition as they seek to maintain market share.

- High Capital Investment: Non-bank lenders often require millions of dollars to establish operations, covering technology, compliance, and staffing.

- Regulatory Hurdles: Compliance with financial regulations, such as those from the CFPB in the US, adds ongoing costs and complexity, making exit challenging.

- Infrastructure Lock-in: Significant investments in proprietary IT systems and loan servicing platforms create sunk costs that are hard to recover upon exit.

- Sustained Competition: These barriers can keep less profitable firms in the market, intensifying competition and potentially driving down margins for all players.

Regulatory Environment and Bank Constraints

Regulatory buffers on traditional banks, such as Australian Deposit-taking Institutions (ADIs), can inadvertently fuel competition in the non-bank lending sector. These capital requirements and compliance costs can make it more attractive for some borrowers to seek funding from less regulated entities.

This shift in borrower preference presents both opportunities and heightened rivalry for non-bank lenders. As more capital flows towards alternative finance providers, the competition to secure these borrowers intensifies.

- Increased Borrower Migration: For instance, in 2024, reports indicated a notable uptick in demand for alternative lending solutions as traditional banks tightened their lending criteria in response to evolving prudential standards.

- Intensified Non-Bank Competition: This growing demand segment means non-bank lenders are not only competing with each other for market share but also facing indirect pressure from the regulatory landscape shaping traditional banking.

- Focus on Niche Markets: Consequently, non-banks are increasingly focusing on specialized lending niches where they can offer more tailored solutions, further fragmenting the competitive landscape.

The competitive rivalry within the non-bank lending sector is fierce, characterized by a multitude of specialist lenders, agile challenger banks, and innovative fintech firms vying for market share in Australia and New Zealand. This crowded field means Pepper Money faces constant pressure from entities offering niche products or alternative financial solutions, with market fragmentation being a common theme as no single player dominates across all segments.

In 2024, the Australian non-bank mortgage market continued its robust growth, with both new entrants and established players actively pursuing market share, particularly in prime and near-prime segments where Pepper Money is active. This dynamic environment necessitates continuous innovation from lenders to differentiate their offerings and attract borrowers often overlooked by traditional banks.

The intense competition drives lenders to emphasize agility, rapid decision-making, and the creation of bespoke loan products to capture borrowers with non-standard income or credit histories. This strategic focus on underserved markets, while a strength for Pepper Money, is also a common battleground for many other non-bank lenders.

Exit barriers, such as high capital investment, regulatory complexity, and entrenched infrastructure, contribute to sustained competition by keeping less profitable firms in the market. This can lead to price-based competition as lenders strive to maintain their position, further intensifying the rivalry for all participants.

SSubstitutes Threaten

For many businesses and individuals, traditional bank loans are a readily available substitute. Banks frequently offer more competitive interest rates compared to alternative lenders, especially for borrowers with strong credit profiles. In 2024, the average interest rate for a small business loan from a bank hovered around 8-12%, making it an attractive option for those who qualify.

Emerging peer-to-peer (P2P) lending platforms and other fintech innovations present a significant threat of substitution for traditional non-bank financial products. These platforms offer direct alternatives for borrowers seeking personal loans, small business finance, and even real estate funding, often with more agile approval processes and unique risk evaluation models.

For instance, the global P2P lending market was valued at approximately $100 billion in 2023 and is projected to grow substantially. In 2024, platforms like LendingClub and Prosper continue to facilitate billions in loans, directly competing with traditional installment loans and credit lines by offering potentially lower interest rates and faster access to capital for a diverse borrower base.

Individuals and businesses often turn to personal savings or equity in existing assets, such as home equity lines of credit, as alternatives to new financing. This directly impacts the demand for lenders like Pepper Money, as self-funding reduces the need for external capital. For instance, in 2024, household savings rates saw fluctuations, with some periods indicating a willingness to deploy accumulated funds rather than borrowing.

Delayed Consumption or Investment

When economic conditions sour or borrowing costs climb, consumers and businesses may simply put off significant purchases or investments. This postponement acts as a substitute for taking out loans, directly affecting the volume of new loans lenders can originate.

For instance, in the first quarter of 2024, U.S. consumer credit card debt reached an all-time high of over $1.1 trillion, indicating that while some are borrowing, others might be delaying larger, potentially loan-financed purchases due to economic uncertainty or high interest rates.

This threat of delayed consumption or investment can be seen in several key areas:

- Housing Market: Rising mortgage rates can deter potential homebuyers, leading them to delay purchasing a new home, thus reducing demand for mortgage loans.

- Automotive Sales: Similar to housing, higher auto loan rates or economic fears can cause consumers to postpone buying new vehicles.

- Business Investment: Companies facing an uncertain economic outlook or expensive financing might defer capital expenditures, impacting commercial lending.

Government Programs and Grants

Government programs and grants can act as powerful substitutes for private financial products, particularly in areas like housing and small business. For instance, first-home buyer grants directly reduce the capital needed, lessening reliance on mortgages. In 2024, many countries continued to offer such incentives to stimulate specific sectors.

These initiatives can significantly alter the competitive landscape by lowering the barrier to entry or consumption, thereby diminishing the demand for traditional financing. For example, a substantial government grant for renewable energy adoption might substitute for a business loan that a company would otherwise seek to fund such a project.

- Government Initiatives: Programs like first-home buyer grants or small business support schemes offer direct financial aid.

- Substitution Effect: These grants can reduce or eliminate the need for private lending products.

- Targeted Impact: While often specific, these programs can substitute for particular loan types.

- 2024 Data: Many governments in 2024 maintained or expanded programs aimed at supporting housing affordability and small business growth, directly impacting the demand for related financial services.

The threat of substitutes for lenders like Pepper Money comes from various sources that fulfill similar financial needs. Traditional bank loans remain a significant substitute, especially for borrowers with good credit, as seen in 2024 when average small business loan rates from banks were around 8-12%. Fintech platforms, such as P2P lenders, offer faster, alternative financing, with the global P2P market valued at around $100 billion in 2023.

Individuals and businesses also utilize personal savings or existing assets, like home equity, as substitutes for new loans, a trend observed in 2024 with fluctuating household savings rates. Furthermore, delaying purchases due to economic uncertainty or high interest rates acts as an indirect substitute, as evidenced by U.S. consumer credit card debt exceeding $1.1 trillion in early 2024, suggesting some consumers might be postponing larger expenditures.

Government programs, such as first-home buyer grants or small business support schemes, also serve as direct substitutes by providing capital that would otherwise be sought through private lending. Many nations continued these initiatives in 2024 to stimulate specific economic sectors.

Entrants Threaten

The financial services sector in Australia and New Zealand faces substantial regulatory and licensing demands. New companies must secure specific authorizations, adhere to strict responsible lending practices, and navigate complex frameworks such as the Consumer Data Right. These rigorous compliance obligations significantly deter potential new entrants, creating a high barrier to entry.

Establishing a non-bank lending operation demands significant capital, often in the hundreds of millions of dollars, for loan origination, robust operational infrastructure, and stringent regulatory compliance. For instance, a new fintech lender might need to secure substantial seed funding and ongoing credit lines to compete effectively.

Accessing reliable and cost-effective wholesale funding markets presents a considerable hurdle for newcomers. In 2024, the cost of capital for non-bank lenders can fluctuate significantly based on market sentiment and investor confidence, making it challenging to secure the necessary liquidity at competitive rates.

Building a strong brand reputation and customer trust in the financial services industry is a significant hurdle for newcomers. It requires substantial investment in marketing and consistent delivery of reliable services over many years. For instance, established entities like Pepper Money have cultivated decades of trust, making it difficult for new entrants to attract customers without a proven track record.

Distribution Channels and Broker Relationships

Establishing robust distribution channels, especially strong ties with mortgage and asset finance brokers, is paramount for market entry. Newcomers face a significant hurdle, needing substantial investment to cultivate these vital networks, a process that typically proves both time-consuming and expensive. This investment barrier provides existing players with a distinct competitive edge.

In 2024, the reliance on broker networks remains a cornerstone of financial services distribution. For instance, in the UK mortgage market, broker-originated lending consistently accounts for a substantial share, often exceeding 70% of new business. Building comparable relationships from scratch requires considerable time and resources, making it a formidable challenge for any new entrant aiming to replicate the reach of established firms.

- Broker Dependency: The UK mortgage market saw approximately 75% of lending originated through brokers in early 2024, highlighting the critical need for new entrants to establish these relationships.

- Investment Costs: Developing a comprehensive broker network can cost new entrants millions in upfront fees, training, and ongoing relationship management.

- Incumbent Advantage: Established firms benefit from years of accrued trust and preferential terms with brokers, creating a significant barrier to entry.

Technological Sophistication and Data Access

The threat of new entrants in non-bank lending, particularly for specialized markets, is significantly influenced by technological sophistication and data access. New players need to develop or acquire advanced data analytics for precise credit scoring and build resilient technology infrastructure. For instance, in 2024, fintech lenders continued to leverage AI and machine learning, with some reporting a reduction in default rates by up to 15% through enhanced risk assessment models.

Gaining access to comprehensive and reliable data is a critical hurdle. New entrants must establish partnerships or invest heavily in data aggregation to compete with established players who already possess rich historical data. This data advantage allows incumbents to refine their algorithms and offer more competitive terms, thereby raising the barrier to entry.

- Technological Investment: New entrants require substantial upfront investment in data analytics platforms and AI capabilities, often running into millions of dollars for robust systems.

- Data Acquisition Costs: Securing access to diverse data sources, such as credit bureaus, transaction histories, and alternative data, can be costly and complex.

- Regulatory Compliance: Navigating data privacy regulations like GDPR and CCPA adds another layer of complexity and cost for new entrants.

- Talent Acquisition: The need for skilled data scientists and engineers to build and maintain these sophisticated systems presents a significant human capital challenge.

The threat of new entrants in the non-bank lending sector is significantly mitigated by high capital requirements and the need for substantial technological investment. For instance, establishing a competitive fintech lending platform in 2024 often necessitates millions in upfront capital for licensing, technology development, and initial marketing efforts. Furthermore, acquiring the necessary data and developing sophisticated risk assessment models, potentially leveraging AI and machine learning, adds considerable cost and complexity, creating a formidable barrier for aspiring competitors.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of publicly available data, including company annual reports, industry-specific market research, and government economic indicators. This ensures a comprehensive understanding of competitive intensity and strategic positioning.