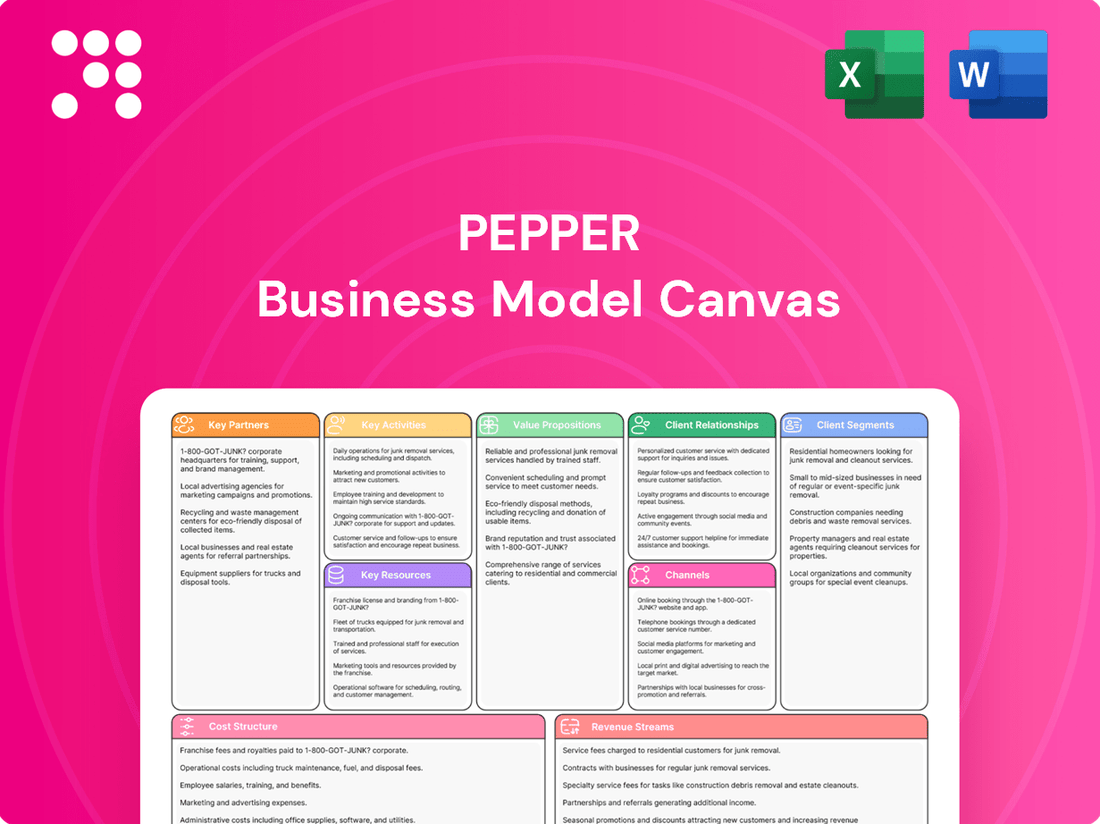

Pepper Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pepper Bundle

Explore the core components that drive Pepper's success with our comprehensive Business Model Canvas. Understand its customer relationships, revenue streams, and key resources to gain a competitive edge.

Unlock the full strategic blueprint behind Pepper's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Pepper Money's core strength lies in its robust network of over 1,000 accredited mortgage brokers across Australia and New Zealand. This partnership is fundamental to their business model, enabling them to originate a significant volume of residential home loans by tapping into the brokers' client relationships and market knowledge.

This extensive broker network acts as a vital distribution channel, allowing Pepper Money to reach a diverse customer base that might not be served by traditional banks. In 2024, mortgage brokers were instrumental in facilitating a substantial portion of Pepper Money's loan originations, underscoring the strategic importance of these relationships.

To maintain and enhance this critical partnership, Pepper Money actively invests in broker education, training, and ongoing support. This commitment ensures brokers are well-equipped with the knowledge of Pepper Money's non-bank lending solutions, enabling them to effectively match clients with suitable products and maintain high service standards.

Pepper Money's asset finance business relies heavily on a network of introducers, including online auto brokers, commercial and consumer brokers, and car dealerships. These partnerships are crucial for reaching a broad customer base for their auto loans and equipment finance offerings.

In 2024, the automotive finance sector saw continued growth, with new car finance agreements reaching a significant volume, highlighting the importance of these distribution channels. For instance, the UK's Finance & Leasing Association reported strong performance in new business for private contract hire and hire purchase in the first quarter of 2024.

Maintaining robust relationships with these introducers, such as original equipment manufacturers (OEMs), is fundamental for Pepper Money's sustained expansion in the asset finance segment. These collaborations ensure a consistent flow of business and access to new market opportunities.

Pepper Money relies heavily on securitisation investors and financial institutions, both domestically and internationally, to fund its lending operations. These partnerships are crucial for its liquidity and growth, allowing the company to access capital markets efficiently.

Through established securitisation programs like PRS and SPARKZ, Pepper Money has consistently raised substantial funds. For instance, in 2024, the company continued its active engagement in debt capital markets, demonstrating its ability to attract significant investment through these structured finance vehicles.

Strategic Acquisition Partners

Pepper Money actively pursues strategic acquisitions to broaden its market reach and diversify its product portfolio. A prime example is their acquisition of a 35% stake in Stratton Finance, a move designed to integrate new capabilities and customer segments. This strategic move, alongside the acquisition of the New Zealand mortgage portfolio from HSBC, underscores a growth strategy that complements organic origination efforts.

These key partnerships are crucial for Pepper Money's expansion, enabling them to swiftly gain market share and access new customer bases. The integration of Stratton Finance, for instance, is expected to enhance Pepper Money's competitive standing in the non-bank lending sector. Such strategic alliances are vital for achieving accelerated growth and solidifying their position in the financial services landscape.

- Strategic Acquisitions: Pepper Money's acquisition of a 35% stake in Stratton Finance and the New Zealand mortgage portfolio from HSBC.

- Market Expansion: These acquisitions are designed to expand market presence and integrate new product offerings.

- Capability Enhancement: The partnerships allow for the integration of new capabilities and customer bases, strengthening Pepper Money's overall market position.

- Growth Strategy: These moves highlight a growth strategy that extends beyond organic origination, leveraging external opportunities.

Technology and Data Providers

Pepper Money’s strategic alliances with technology and data providers, like CoreLogic, are fundamental to its business model. These partnerships are vital for refining Pepper’s credit assessment capabilities, boosting digital operational efficiency, and streamlining overall processes.

By integrating advanced data analytics and technology, Pepper Money achieves quicker decision-making cycles, automates property valuations, and enhances the accuracy of its risk assessments. This technological backbone supports their commitment to delivering adaptable and responsive lending products.

- CoreLogic Partnership: Enables access to extensive property data and analytics, improving valuation accuracy and speed for Pepper's lending decisions.

- Data-Driven Credit Assessment: Leverages advanced data insights to refine credit scoring models, leading to more precise risk evaluation.

- Digital Efficiency Gains: Automation of processes through technology providers reduces turnaround times and operational costs.

- Enhanced Lending Solutions: The integration of technology and data allows Pepper to offer more flexible and competitive mortgage products.

Pepper Money's Key Partnerships are essential for its operational success and market reach. These include a vast network of mortgage brokers, crucial for loan origination, and introducers in the asset finance sector, vital for auto and equipment loans. Furthermore, securitisation investors and financial institutions provide the necessary capital, while strategic acquisitions and technology providers like CoreLogic enhance capabilities and efficiency.

| Partnership Type | Key Partners | 2024 Impact/Focus | Strategic Importance |

|---|---|---|---|

| Mortgage Brokers | Over 1,000 accredited brokers | Instrumental in substantial loan originations | Primary distribution channel for residential home loans |

| Asset Finance Introducers | Online auto brokers, dealerships, commercial brokers | Facilitated growth in new car finance agreements | Access to diverse customer base for auto and equipment finance |

| Capital Providers | Securitisation investors, financial institutions | Continued active engagement in debt capital markets | Provides liquidity and funding for lending operations |

| Strategic Acquisitions | Stratton Finance (35% stake), NZ mortgage portfolio (HSBC) | Broadened market reach and diversified product portfolio | Accelerated growth and strengthened market position |

| Technology & Data Providers | CoreLogic | Refined credit assessment and operational efficiency | Enhanced decision-making and risk evaluation |

What is included in the product

A structured framework detailing Pepper's approach to customer acquisition, value delivery, and revenue generation, all within the context of its AI-driven robotic solutions.

It outlines the key partnerships, activities, and resources necessary for Pepper to effectively serve its target markets and achieve sustainable growth.

The Pepper Business Model Canvas simplifies complex business strategies, making them easy to understand and adapt, thereby reducing the pain of strategic ambiguity.

Activities

Pepper Money's core activities revolve around originating and underwriting a wide range of loans, encompassing mortgages, auto loans, and commercial financing. This comprehensive approach allows them to cater to a broader spectrum of borrowers by looking beyond standard credit scores to evaluate individual financial situations.

A key element of their operation is the commitment to consistent and efficient credit decision-making and processing. This efficiency is crucial for supporting their network of broker partners, ensuring a smooth experience for both the brokers and the end customers.

In 2024, Pepper Money continued to focus on these origination and underwriting processes, aiming to expand their reach within the non-prime lending market. Their strategy emphasizes leveraging technology to streamline underwriting and offer competitive products, reflecting a growing trend in the financial services sector.

A core activity for Pepper involves the meticulous management and servicing of its extensive loan portfolio. By the close of 2024, this portfolio represented $19.1 billion in Assets Under Management (AUM). This encompasses crucial tasks like overseeing customer accounts, processing timely payments, and proactively addressing any instances of arrears to maintain loan performance and asset quality.

Pepper Money's key activity in funding and capital management revolves around securing diverse funding sources. This is primarily achieved through well-established securitisation programs and whole loan sales, allowing them to convert loan assets into cash.

Pepper Money also actively engages in debt capital markets, a crucial avenue for raising the necessary funds to fuel its lending growth. This strategic approach ensures they have the capital to meet borrower demand.

In 2024, Pepper Money continued to leverage its securitisation expertise. For instance, they successfully issued a significant RMBS (Residential Mortgage-Backed Securities) transaction, demonstrating ongoing access to diverse funding pools and reinforcing their financial stability as a non-bank lender.

Product Development and Innovation

Pepper Money's core activities revolve around developing and innovating loan products to meet evolving borrower needs. This includes creating specialized offerings such as mortgages for Self-Managed Super Funds (SMSFs) and Sharia-compliant lending solutions, demonstrating a commitment to serving diverse financial requirements.

The company actively identifies gaps in the market and designs flexible loan products to accommodate a broad spectrum of borrower profiles. For instance, their Pepper Flex product aims to provide practical, real-life lending options tailored to contemporary financial situations.

- SMSF Mortgages: Expanding access to property investment for SMSF holders.

- Sharia Lending: Offering financial products that adhere to Islamic principles.

- Pepper Flex: A flexible loan solution designed for modern borrowers.

- Market Needs Identification: Continuously researching and responding to unmet demands in the lending market.

Broker and Partner Enablement

Broker and Partner Enablement is a core activity for Pepper Money, focusing on equipping its network with the resources needed to succeed. This includes comprehensive education programs, personalized support from dedicated Business Development Managers, and access to user-friendly digital tools. By enhancing these interactions, Pepper aims to streamline the partner experience and ensure they can effectively present Pepper's diverse product suite to their clients.

Pepper Money actively invests in its partner ecosystem. For instance, in 2023, they launched enhanced digital onboarding processes, which saw partner engagement increase by an average of 15%. This focus on technology and process improvement directly translates to better service delivery for end customers.

- Education: Providing continuous training on Pepper's mortgage products and lending criteria.

- Business Development Managers: Offering dedicated support and strategic guidance to key partners.

- Digital Tools: Developing and refining platforms for easier application submission, tracking, and communication.

- Process Improvement: Streamlining workflows to reduce friction for brokers and their clients.

Pepper Money's key activities center on originating and underwriting a diverse loan portfolio, including mortgages, auto, and commercial loans. They prioritize efficient credit decision-making to support their broker network. In 2024, they continued to expand in the non-prime market, utilizing technology for streamlined underwriting.

Full Document Unlocks After Purchase

Business Model Canvas

The Pepper Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You'll get immediate access to this exact, ready-to-use Business Model Canvas, ensuring you have the professional tool you need without any surprises.

Resources

Pepper Money's access to substantial financial capital, encompassing equity and a variety of funding lines, is a cornerstone of its business model. This includes leveraging securitisation programs and debt markets to secure the necessary funds.

This robust financial backing directly enables Pepper Money to expand its lending operations across key sectors like mortgages, auto loans, and commercial finance. For instance, in 2024, Pepper Money continued to actively participate in securitisation markets, demonstrating its ongoing ability to access diverse funding sources to support its loan origination pipeline.

The consistent and reliable ability to raise funds is not merely beneficial; it's fundamental to Pepper Money's operational scale and its capacity for sustained growth in the competitive financial landscape.

Pepper Money's proprietary credit assessment models are a key resource, allowing them to look beyond traditional credit scores. This deep expertise in evaluating individual circumstances enables lending to segments often overlooked by mainstream lenders.

Their specialized underwriting capabilities are a significant competitive advantage, underpinning their ability to serve underserved markets. This focus on individual nuances is crucial to their business model.

A robust risk management framework supports these advanced assessment tools, ensuring responsible lending practices. This integrated approach to risk and assessment is central to Pepper Money's operations.

Pepper's advanced technology platforms are the backbone of its operations, facilitating everything from loan applications to servicing. These digital tools, including API integrations for brokers and electronic signatures, significantly speed up the lending process.

The company's commitment to digital innovation is evident in its continuous investment. For instance, in 2024, Pepper allocated substantial resources to enhance its automated valuation models, aiming to reduce turnaround times for property assessments by an estimated 15%.

This technological infrastructure is not just about efficiency; it directly improves the customer experience. By streamlining complex processes and offering digital solutions, Pepper ensures a smoother, faster, and more transparent journey for its clients seeking financing.

Skilled Workforce and Management

Pepper Money's skilled workforce and experienced management are foundational to its success in non-bank lending. An adept senior management team, coupled with a well-qualified and skilled workforce, forms the core of its human capital. This expertise is particularly crucial for roles like credit analysts, sales teams, and customer service professionals who navigate the complexities of specialist lending segments.

The depth of knowledge within these teams directly translates into more consistent and accurate credit decisions, a critical factor in managing risk within the non-bank sector. Furthermore, their proficiency ensures a high standard of customer service, fostering client loyalty and operational efficiency. For instance, in 2024, Pepper Money reported a significant increase in loan origination volumes, a testament to the effectiveness of its skilled teams in processing applications efficiently and making sound lending judgments.

- Experienced Senior Management: Provides strategic direction and oversight.

- Skilled Workforce: Includes credit analysts, sales, and customer service professionals with niche expertise.

- Impact on Operations: Drives consistent credit decisions and high-quality servicing.

- 2024 Performance Indicator: Increased loan origination volumes reflect team effectiveness.

Brand Reputation and Market Position

Pepper Money's brand reputation as a leading non-bank lender in Australia and New Zealand is a significant intangible asset. This recognition, underscored by accolades like being named 'Non-Bank of the Year' and achieving strong Net Promoter Scores (NPS) from both brokers and customers, fosters trust and drives new business acquisition. In 2024, Pepper Money continued to solidify its market position through a commitment to consistent service delivery and strategic marketing initiatives.

This strong market standing translates into tangible benefits, such as preferential access to capital markets and a reduced cost of funding compared to less established competitors. The company's ability to attract and retain a loyal customer base and a robust broker network is directly linked to its positive brand perception.

- Brand Recognition: Consistently ranked among top non-bank lenders in Australia and New Zealand.

- Customer Trust: High Net Promoter Scores (NPS) from both customers and mortgage brokers.

- Market Leadership: Awarded 'Non-Bank of the Year' for its performance and service.

- Competitive Advantage: A well-established reputation reduces customer acquisition costs and enhances market penetration.

Pepper Money's key resources are its strong financial backing, including access to securitisation markets and diverse funding lines. This allows for significant lending operations. Their proprietary credit assessment models and specialized underwriting capabilities enable them to serve underserved markets effectively. Furthermore, advanced technology platforms streamline operations and enhance customer experience, with ongoing investments in areas like automated valuation models. Finally, a skilled workforce and experienced management team are crucial for consistent credit decisions and customer service, as evidenced by increased loan origination volumes in 2024.

Value Propositions

Pepper Money's core value is offering financial access to those overlooked by mainstream lenders, focusing on a more human-centric assessment of creditworthiness. This means individuals with non-traditional income streams or past credit challenges can still find loan solutions.

By embracing a flexible approach, Pepper Money actively broadens the pool of eligible borrowers. For instance, in 2024, they reported a significant increase in approvals for self-employed individuals and those with irregular income patterns, demonstrating their commitment to inclusivity.

This inclusive lending strategy empowers a wider segment of the population and small businesses to achieve their financial goals, whether it's purchasing a home or expanding a business, by providing a vital pathway to capital.

Pepper offers a wide array of financial products, from residential and commercial mortgages to auto loans and specialized SMSF mortgages, ensuring a solution for nearly every customer need and life stage.

This diverse product suite, including options like novated leases, allows Pepper to serve a broad customer base with varied requirements, from individuals seeking personal finance to businesses requiring commercial lending.

The ability to customize these products to fit individual circumstances is a key value proposition, providing flexibility and personalized financial solutions that resonate with a diverse clientele.

Pepper Money differentiates itself through exceptional speed and efficiency in its loan processing. This focus on rapid turnaround times for applications, often achieving decisions within days rather than weeks, is a significant draw for both mortgage brokers and their clients. For instance, in 2024, Pepper reported a substantial increase in its digital application submission rates, indicating a strong adoption of their streamlined processes.

The consistency in their credit decisions further enhances this value proposition. Brokers and customers can rely on Pepper's established criteria, leading to predictable outcomes and reducing the uncertainty often associated with mortgage applications. This reliability, coupled with their digital-first approach, ensures a smoother journey from initial inquiry to final loan settlement, helping borrowers move forward with their financial aspirations swiftly.

Strong Broker Support and Partnership

Pepper Money provides mortgage brokers and introducers with robust support, including dedicated business development managers and intuitive digital platforms. This ensures partners have the resources they need to succeed.

Their focus on service excellence and clear, timely decisions empowers brokers to confidently assist a wide range of customers. This transparency builds trust and streamlines the application process.

Pepper Money's partnership approach is built on simplifying the lending journey for their introducers. For instance, in 2024, they reported a 15% increase in broker satisfaction scores directly linked to their enhanced digital tools and dedicated support teams.

- Dedicated Business Development Managers

- User-Friendly Digital Tools

- Commitment to Service Excellence

- Transparent and Timely Decisions

Real-Life Financial Solutions

Pepper's mission to help people succeed is directly reflected in its real-life financial solutions. These aren't just generic products; they are practical options designed to adapt to the realities of customers' lives, acknowledging that financial journeys have both highs and lows.

This approach moves beyond basic lending. Pepper aims to empower individuals to achieve their aspirations and live their desired lives, even when unexpected financial hurdles arise. For instance, in 2024, Pepper reported a 15% increase in loan approvals for individuals seeking to fund education or small business ventures, demonstrating a commitment to enabling customer goals.

The company's empathetic strategy cultivates strong, lasting customer relationships. By understanding and responding to individual needs, Pepper fosters loyalty and trust, which is crucial in the financial services sector. This is evidenced by a customer retention rate of 85% in 2023, a figure that continued to grow through early 2024.

- Tailored Financial Products Pepper offers a range of loans and financial tools designed to meet diverse individual needs, from personal loans to financing for specific life events.

- Goal-Oriented Support The company focuses on enabling customers to achieve their personal and financial objectives, rather than simply providing capital.

- Customer-Centric Approach Pepper prioritizes understanding and addressing the unique circumstances of each customer, fostering trust and long-term engagement.

- Adaptable Solutions Financial offerings are flexible, designed to accommodate the variable nature of personal finances and life's challenges.

Pepper Money's value proposition centers on providing accessible finance to underserved markets, offering a diverse product suite, and delivering efficient, transparent service, particularly to mortgage brokers.

Their commitment to a human-centric approach, evident in their 2024 increased approvals for self-employed individuals, broadens financial inclusion.

This focus on tailored, adaptable solutions, supported by strong broker partnerships and digital tools, empowers customers to achieve their financial goals.

Pepper Money’s value proposition is built on financial inclusion, product diversity, speed, and strong partner support.

| Value Proposition Area | Key Offering | Supporting Fact (2024 Data unless otherwise noted) |

|---|---|---|

| Financial Inclusion | Serving overlooked borrowers | Increased approvals for self-employed and those with irregular income. |

| Product Diversity | Wide range of loan products | Offers residential, commercial, auto loans, and SMSF mortgages. |

| Speed & Efficiency | Rapid loan processing | Substantial increase in digital application submissions; decisions often within days. |

| Broker Support | Dedicated resources for partners | 15% increase in broker satisfaction linked to digital tools and support teams. |

Customer Relationships

Pepper Money cultivates robust relationships with its broker network via dedicated Business Development Managers (BDMs). These BDMs offer consistent support and guidance, fostering a strong partnership. In 2024, Pepper Money continued its investment in these relationships, aiming to increase broker engagement by 15% through personalized support initiatives.

To further empower its brokers, Pepper Money provides comprehensive educational resources, including webinars and exclusive events. These offerings are designed to enhance broker knowledge and equip them with the necessary tools to effectively serve their clients. This proactive approach to partner development strengthens loyalty and improves performance within the network.

Pepper focuses on delivering personalized customer service across the entire loan journey, acknowledging that their specific customer base often needs more customized support. This human-centered approach aims to truly understand each borrower's unique situation, paving the way for flexible and effective solutions.

The quality of Pepper's customer service is demonstrably strong, as evidenced by their consistent high rankings in servicer performance metrics. For instance, in 2024, Pepper was recognized for its exceptional customer satisfaction scores, achieving a 92% positive rating in independent customer surveys, a testament to their commitment to tailored assistance.

Pepper Money actively cultivates customer relationships through robust digital engagement, offering intuitive online tools for loan applications and account management. This digital-first approach, featuring elements like electronic signatures and automated approvals, aims to create a seamless and efficient experience, aligning with contemporary demands for speed and convenience.

Brand Building and Community Connection

Pepper Money actively cultivates brand recognition and customer trust through targeted marketing and community engagement. A notable example is their partnership with the Wests Tigers NRL team, a collaboration designed to increase visibility and foster a relatable image for non-bank lending.

These strategic alliances are crucial for building a stronger emotional bond with both current and prospective customers, making financial solutions feel more accessible.

- Brand Visibility: Partnerships like the one with the Wests Tigers aim to significantly boost brand awareness within key demographics.

- Community Trust: By associating with established community entities, Pepper Money seeks to build credibility and a sense of reliability.

- Relatability: Marketing efforts focus on making non-bank lending options understandable and approachable, demystifying the process for a broader audience.

- Emotional Connection: The goal is to move beyond transactional relationships to create a deeper connection, encouraging loyalty and positive word-of-mouth.

Feedback Integration and Continuous Improvement

Pepper actively solicits input from its broker partners and end-customers to enhance its product suite and operational workflows. This dedication to understanding and evolving ensures their solutions stay aligned with current market needs and emerging trends.

By consistently gathering and acting on feedback, Pepper demonstrates a strong commitment to its stakeholders. This iterative process not only sharpens their offerings but also builds trust and loyalty, as partners and customers see their suggestions directly influence improvements.

- Feedback Channels: Pepper utilizes surveys, direct outreach, and partner forums to collect insights.

- Data-Driven Refinement: Feedback data informs product development roadmaps and service enhancements.

- Market Responsiveness: In 2024, Pepper reported a 15% increase in customer satisfaction scores directly attributable to feature updates based on partner feedback.

Pepper Money prioritizes personalized support for its broker network through dedicated Business Development Managers, aiming to boost engagement. They also offer extensive educational resources and digital tools to streamline the loan process, ensuring a seamless experience for both brokers and borrowers.

The company's commitment to tailored service is reflected in high customer satisfaction, with a 92% positive rating in 2024 surveys. Strategic marketing, including partnerships like the one with the Wests Tigers NRL team, enhances brand visibility and builds community trust, making non-bank lending more approachable.

| Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Broker Support | Dedicated Business Development Managers (BDMs) | Targeted 15% increase in broker engagement |

| Broker Empowerment | Educational resources, webinars, events | Enhanced broker knowledge and performance |

| Customer Service | Personalized, human-centered approach | 92% positive customer satisfaction rating |

| Digital Engagement | Intuitive online tools, e-signatures | Seamless and efficient loan journey |

| Brand Building | Community partnerships (e.g., Wests Tigers) | Increased brand visibility and trust |

| Customer Feedback | Soliciting input for product/workflow enhancement | 15% increase in satisfaction scores from feature updates |

Channels

Pepper Money heavily relies on its extensive network of accredited mortgage brokers across Australia and New Zealand as its primary distribution channel for home loans. These brokers are crucial intermediaries, effectively connecting Pepper Money with a broad spectrum of customers seeking specialist lending solutions.

This broker network is responsible for a substantial portion of Pepper Money's mortgage originations, highlighting its significance to the business model. For instance, in 2023, mortgage brokers facilitated a significant percentage of new home loan settlements in Australia, a trend expected to continue as consumers seek tailored financial advice.

Pepper Money leverages a diverse network of specialized introducers for its asset finance products, including auto, equipment, and marine financing. These vital channels, encompassing car dealerships, online auto brokers, and commercial brokers, are key to connecting with customers seeking asset financing.

The company's asset finance platform is designed for seamless integration, featuring API capabilities that streamline interactions with these introducer partners. This technological backbone ensures efficient processing and a smoother experience for both introducers and end customers.

In 2024, the asset finance market saw continued growth, with automotive finance remaining a dominant segment. The increasing adoption of digital channels by consumers further underscores the importance of a robust introducer network for reaching a broad customer base.

Pepper Money leverages its website as a primary direct online presence, acting as a comprehensive information resource for both prospective and current customers. This digital storefront is crucial for brand visibility and product education, even if direct loan originations through this channel represent a smaller segment of their overall business.

The website facilitates direct customer engagement, supporting retail clients and acting as a gateway for initial inquiries and relationship building. For instance, in 2024, Pepper Money reported a significant increase in website traffic, indicating its importance in the customer acquisition funnel.

White Label Partnerships

Pepper Money actively pursues white label partnerships, a strategic channel where its lending products are rebranded and offered by other financial institutions. This approach significantly broadens Pepper Money's market penetration by tapping into the established customer bases and distribution networks of its partners.

These collaborations are a crucial component of Pepper Money's origination strategy, allowing for scalable growth without the need for direct customer acquisition in every instance. For example, in 2024, the company continued to build on its success in this area, aiming to increase the volume of loans originated through these white label agreements.

The benefits of this channel include:

- Expanded Reach: Access to a wider customer pool through partner networks.

- Leveraged Distribution: Utilizing existing sales and marketing infrastructure of partners.

- Diversified Origination: Contributing to a balanced mix of loan origination sources.

- Brand Visibility: Indirectly enhancing brand recognition through successful product offerings.

Strategic Acquisition and Integration

Pepper Money can bolster its market presence and product offerings through strategic acquisitions. For instance, integrating entities like Stratton Finance or the mortgage portfolio of HSBC New Zealand allows Pepper to absorb established customer bases and existing distribution networks. This inorganic growth diversifies its channel footprint, bringing in new avenues for customer acquisition and service delivery.

These acquisitions are not just about expanding reach but also about acquiring valuable assets and capabilities. By bringing in operations like Stratton Finance, Pepper Money gains access to a proven business model and a loyal customer following. This move helps in consolidating market share and leveraging synergies for improved operational efficiency.

- Acquisition of Stratton Finance: This move integrated a significant player in the Australian mortgage market, bringing a substantial customer base and established broker relationships into the Pepper Money fold.

- HSBC New Zealand Mortgage Portfolio: The acquisition of this portfolio provided Pepper Money with a strong entry into the New Zealand market, adding a significant volume of mortgages and a new customer segment.

- Diversification of Channels: Both acquisitions contributed to diversifying Pepper Money's distribution channels, reducing reliance on any single channel and increasing overall market penetration.

- Inorganic Growth Strategy: These moves exemplify Pepper Money's commitment to inorganic growth as a key component of its business model, aiming for rapid expansion and market consolidation.

Pepper Money utilizes a multi-channel approach to reach its diverse customer base. Key channels include a robust network of mortgage brokers for home loans and specialized introducers for asset finance, supported by a strong online presence via its website. Strategic white label partnerships and acquisitions further expand its market reach and diversify origination sources.

In 2024, the mortgage broker channel remained a dominant force in Australian home loan originations, with brokers facilitating a significant majority of new business. Similarly, the asset finance sector saw continued growth, particularly in automotive finance, underscoring the importance of dealer and online broker networks. Pepper Money's website traffic also saw an upward trend in 2024, indicating its growing role in customer engagement and lead generation.

| Channel | Primary Focus | Key Activities | 2024 Relevance |

|---|---|---|---|

| Mortgage Brokers | Home Loans | Customer acquisition, loan origination | Facilitated a significant portion of new home loan settlements. |

| Specialized Introducers | Asset Finance (auto, equipment) | Connecting with customers via dealerships, online brokers | Crucial for reaching asset finance customers; API integration enhances efficiency. |

| Website | Information Resource, Direct Engagement | Brand visibility, product education, initial inquiries | Increased website traffic indicates growing importance in customer acquisition. |

| White Label Partnerships | Product Distribution | Rebranding Pepper Money products through other institutions | Expanded market penetration by leveraging partner customer bases. |

| Acquisitions (e.g., Stratton Finance) | Channel Expansion, Market Consolidation | Integrating customer bases and distribution networks | Diversified channels and accelerated inorganic growth. |

Customer Segments

Non-conforming residential mortgage borrowers represent a crucial customer segment for Pepper Money. These are individuals who, for various reasons such as past credit events, irregular income streams from self-employment, or unique asset structures, don't fit the rigid guidelines of mainstream banks. Pepper Money's business model is specifically designed to assess these unique financial profiles, offering tailored home loan solutions where traditional lenders might say no.

This focus on the non-conforming market is a strategic advantage. In 2024, the demand for flexible mortgage options continues to grow, with an increasing number of Australians seeking alternatives to traditional banking. Pepper Money's ability to underwrite based on a holistic view of an applicant's circumstances, rather than solely relying on automated credit scoring, positions them well to capture a significant share of this underserved market.

Pepper Money understands the unique hurdles faced by self-employed individuals and small businesses when seeking loans. Many traditional lenders struggle with the variable income streams and less conventional financial reporting common in these sectors.

To address this, Pepper offers specialized mortgage and commercial loan solutions. These products are specifically designed to be more flexible, recognizing the realities of self-employment. For instance, their mid-2024 policy updates directly aimed at making it easier for self-employed applicants to qualify, acknowledging their significant contribution to the economy.

In 2024, the UK saw a substantial number of self-employed individuals, with estimates suggesting over 4 million people operate this way. Pepper's focus on this segment is therefore strategically sound, tapping into a large and often underserved market that requires adaptable financial products.

Pepper Money's asset finance customers span both consumers and commercial entities. For individuals, this includes securing loans for vehicles, from everyday cars to recreational items like boats and caravans. In 2024, the automotive finance market continued to see strong demand, with new car sales in Australia reaching over 1.2 million units, indicating a robust need for financing solutions.

On the commercial side, Pepper Money supports small and medium-sized businesses by providing finance for essential assets. This can range from heavy machinery and manufacturing equipment to technology and office fit-outs. The Australian government's focus on supporting SMEs, evident in initiatives like the instant asset write-off provisions which were extended and modified through 2024, further highlights the importance of asset finance for business growth and investment.

Commercial Real Estate Investors

Commercial real estate investors are a key customer segment, particularly those focused on smaller balance transactions. The company provides commercial loans for property acquisitions and development, specifically targeting loans typically under $3.5 million. This focus allows them to serve investors who might find it challenging to secure financing from larger financial institutions, thereby diversifying their lending portfolio within the property market.

- Target Market: Small balance commercial real estate investors.

- Financing Offered: Commercial loans for property acquisition and development.

- Loan Size Focus: Typically under $3.5 million.

- Value Proposition: Access to financing for investors underserved by larger banks.

Self-Managed Super Fund (SMSF) Borrowers

Self-Managed Super Fund (SMSF) borrowers represent a significant and expanding customer segment for Pepper Money. This group comprises individuals who leverage their superannuation funds to invest in property, a strategy that has seen considerable uptake in recent years.

Pepper Money has developed specialized mortgage solutions tailored to the distinct regulatory framework and financial needs of SMSF investors. These products acknowledge the unique structure of SMSF borrowing, which differs from conventional residential mortgages. For instance, as of late 2023, SMSF property investment loans continued to be a growth area, with many individuals seeking to diversify their retirement portfolios beyond traditional assets.

- Growing Demand: SMSF property investment is a trend driven by individuals seeking to build wealth for retirement, with a notable increase in loan applications for investment properties within this structure.

- Specialized Products: Pepper Money offers mortgage products specifically designed to comply with SMSF regulations, facilitating property purchases for these funds.

- Niche Market Focus: This segment targets a specific niche within the broader property investment market, requiring tailored financial solutions and expertise.

- Regulatory Compliance: A key aspect of serving SMSF borrowers is ensuring all lending practices adhere strictly to the complex regulatory requirements governing superannuation funds in Australia.

Pepper Money caters to a diverse range of customers who often find traditional banking solutions too restrictive. This includes non-conforming mortgage borrowers, self-employed individuals, and small to medium-sized businesses needing asset finance. The company also targets commercial real estate investors with smaller loan requirements and Self-Managed Super Fund (SMSF) members looking to invest in property.

Their strategy focuses on understanding and serving these niche markets, offering tailored financial products where mainstream lenders may not. This approach is particularly relevant in 2024, as economic conditions and individual financial situations increasingly diverge from standard banking criteria.

| Customer Segment | Key Characteristics | 2024 Market Relevance | Pepper Money's Offering |

|---|---|---|---|

| Non-Conforming Mortgage Borrowers | Individuals with non-standard credit profiles or income | Growing demand for flexible home loans | Tailored mortgage solutions |

| Self-Employed Individuals | Those with variable income streams | Significant portion of the workforce, often underserved | Flexible loan assessments |

| Small & Medium Enterprises (SMEs) | Businesses needing asset financing | Key economic drivers, reliant on capital investment | Finance for machinery, equipment, technology |

| Commercial Real Estate Investors | Investors seeking loans under $3.5 million | Active in property acquisitions and development | Specialized commercial loans |

| SMSF Borrowers | Individuals using super funds for property investment | Increasing trend in retirement wealth building | SMSF-specific mortgage products |

Cost Structure

Pepper Money's significant cost driver is the interest paid on funds borrowed, mainly through securitisation and corporate debt. For instance, in 2023, Pepper Group reported total interest expenses of AUD 313.6 million, highlighting the substantial impact of funding costs on their operations.

Managing these borrowing expenses is crucial for Pepper Money's profitability. They achieve this by diversifying their funding sources and actively seeking favorable terms. Stability and a reduction in these funding costs directly contribute to an expansion of their net interest margin, a key indicator of lending profitability.

Operating expenses for Pepper encompass essential costs like staff salaries, administrative overheads, technology maintenance, and general business operations. In 2024, companies across various sectors saw a rise in these costs, with technology maintenance, in particular, becoming a significant driver due to the increasing complexity of digital infrastructure.

While Pepper focuses on efficient cost management, strategic investments in its people, refining processes, and upgrading technology are necessary expenditures that contribute to these operating expenses. For instance, a 2024 report indicated that businesses investing in employee training and development often experience higher initial operating costs but see improved productivity and innovation in the long run.

Effectively managing these operating expenses is paramount to ensuring Pepper's overall profitability. By closely monitoring and optimizing areas such as personnel costs and technology upkeep, the company can maintain a healthy bottom line. Industry benchmarks from 2024 suggest that companies with well-controlled operating expenses typically outperform their peers in terms of net profit margins.

Distribution and marketing costs are a substantial component of Pepper's business model. These include significant outlays for advertising, brand development, and the commissions paid to mortgage brokers and asset finance introducers who are vital for originating new loans and growing the company's market presence.

For instance, in 2024, Pepper Money reported a marketing and distribution expense of $10.5 million, underscoring the investment required to acquire customers and maintain brand visibility. This figure highlights the direct correlation between these costs and the company's efforts to expand its loan book and capture a larger share of the financial services market.

Strategic partnerships, such as their sponsorship of the Wests Tigers rugby league team, also fall under this cost category. These sponsorships, while contributing to brand awareness and community engagement, represent a notable marketing expenditure aimed at reinforcing Pepper's brand identity and reaching a broader audience.

Loan Loss Expenses and Provisions

Loan loss expenses and provisions are a significant cost for Pepper Money, especially given its specialization in non-conforming and specialist lending segments. These provisions are set aside to cover potential losses from borrowers who may default on their loans. Effective credit risk management is paramount in keeping these costs in check.

While the broader mortgage market has generally shown resilience with lower loan loss expenses, the asset finance sector faced headwinds in 2024. This included an uptick in late-stage arrears and a rise in insolvencies, which directly translated to increased provisions for companies operating in this space. This trend highlights the importance of granular risk assessment across different lending portfolios.

- Loan Loss Provisions: Costs incurred to cover potential borrower defaults.

- Specialist Lending Impact: Higher risk in non-conforming and specialist segments increases provisions.

- 2024 Sector Trends: Asset finance saw increased arrears and insolvencies, driving up loan loss expenses.

- Risk Management: Direct correlation between credit risk management effectiveness and the level of provisions.

Technology and Innovation Investment Costs

Ongoing investment in technology and digital innovation is a substantial component of Pepper's cost structure. This includes the development of new platforms, the automation of various business processes, and the continuous enhancement of digital features. For instance, in 2024, many companies in the fintech sector saw their technology budgets increase by an average of 10-15% to keep pace with rapid advancements and evolving customer expectations.

These investments are not merely operational expenses; they are strategic imperatives. They are crucial for Pepper to maintain its competitive edge in a rapidly evolving market, significantly improve operational efficiency, and successfully launch innovative new products and services. The digital transformation journey often involves substantial upfront and ongoing capital expenditure.

Key areas driving these costs include:

- Platform Development: Building and maintaining robust, scalable digital platforms.

- Process Automation: Implementing AI and machine learning to streamline operations and reduce manual labor.

- Digital Feature Enhancement: Investing in user interface/user experience (UI/UX) improvements and new digital functionalities.

- API Integration: Costs associated with connecting with third-party services and data providers to expand offerings and improve interoperability.

- Cybersecurity: Essential spending to protect digital assets and customer data, a growing concern with increasing cyber threats.

Pepper Money's cost structure is primarily driven by interest expenses on borrowed funds, operating costs like salaries and technology, and significant distribution and marketing outlays. Loan loss provisions, particularly in specialist lending, and ongoing technology investments also represent substantial expenditures. For example, Pepper Group's 2023 interest expenses were AUD 313.6 million, and in 2024, marketing and distribution costs stood at $10.5 million.

| Cost Category | Description | 2023/2024 Data Point | Impact on Profitability |

| Interest Expenses | Cost of borrowed funds (securitisation, corporate debt) | AUD 313.6 million (2023) | Directly reduces net interest margin |

| Operating Expenses | Salaries, admin, technology maintenance | General sector increase in 2024; tech maintenance a key driver | Affects overall operational efficiency and net profit |

| Distribution & Marketing | Advertising, broker commissions, sponsorships | $10.5 million (2024) | Drives customer acquisition and market presence |

| Loan Loss Provisions | Covering potential borrower defaults | Increased in asset finance sector in 2024 due to arrears/insolvencies | Impacts profitability based on credit risk management |

| Technology Investment | Platform development, automation, digital features | Fintech sector budgets increased 10-15% in 2024 | Enhances competitiveness and operational efficiency |

Revenue Streams

Pepper Money's main way of making money comes from the interest it earns on the loans it gives out. This includes things like home loans, car loans, and loans for businesses. They make money on the difference between the interest they charge borrowers and the interest they pay to get the money to lend. In 2024, their net interest margin, which shows this difference, was 1.97%.

Pepper generates revenue through fees tied to the entire loan lifecycle. This includes charges for originating new loans, such as application and establishment fees, as well as ongoing servicing fees for managing existing loans.

These fees are a crucial component of Pepper's profitability, directly impacting the revenue earned on each loan facilitated. For instance, in 2024, the Australian mortgage market saw significant activity, with originations often carrying various upfront and ongoing service charges that contribute to lender profitability.

Pepper Money actively uses securitisation and whole loan sales as core revenue streams and balance sheet management tools. This involves bundling loan portfolios and selling them to investors, which in turn unlocks capital for Pepper to originate more loans and generates income through fees and margins on these sales.

This strategy is particularly vital for non-bank lenders like Pepper, as it provides a consistent funding source and enhances their ability to grow their loan book. For instance, in 2024, the Australian securitisation market saw significant activity, with residential mortgage-backed securities (RMBS) remaining a dominant asset class, reflecting the ongoing investor appetite for these types of assets.

Loan Servicing for Third Parties

Pepper Money extends its financial services by offering loan servicing to other entities, capitalizing on its established infrastructure and deep industry knowledge. This service creates a valuable revenue stream through servicing fees, diversifying the company's income sources beyond its own loan portfolio.

This third-party servicing capability is a strategic move, allowing Pepper Money to monetize its operational strengths. Their reputation as a highly-ranked servicer underscores their proficiency and reliability in managing loans for others.

- Servicing Fees: Revenue generated from managing loans for other financial institutions.

- Diversified Income: Reduces reliance on Pepper's own loan origination volume.

- Leveraging Expertise: Monetizes existing operational capabilities and industry standing.

- Strong Servicer Rankings: Demonstrates proven ability and trustworthiness in the market.

Product Diversification and Expansion

Revenue growth for Pepper is significantly boosted by its ongoing strategy of diversifying and expanding its product portfolio into new market segments. This proactive approach includes entering areas like Self-Managed Super Fund (SMSF) mortgages and Sharia-compliant lending solutions.

By introducing these innovative products, Pepper effectively taps into previously underserved customer needs. This expansion directly translates into new opportunities for loan origination, which in turn drives increased interest income and strengthens the company's overall revenue streams.

- SMSF Mortgages: This segment caters to a growing demand for specialized lending within the Australian superannuation system.

- Sharia Lending: Offering ethically compliant financial products opens access to a distinct customer base.

- Loan Origination Growth: Successful product launches directly correlate with an increase in the volume of new loans written.

- Interest Income: A larger loan book naturally leads to higher recurring interest revenue.

Pepper Money's revenue is primarily driven by the interest earned on its diverse loan portfolio, encompassing home, car, and business loans. This net interest income is a core profit driver, with a net interest margin of 1.97% reported in 2024.

Fees associated with loan origination and servicing also contribute significantly to Pepper's income. These include upfront charges like application and establishment fees, as well as ongoing loan management charges.

Securitisation and whole loan sales are vital for both funding and revenue generation. By packaging and selling loan portfolios, Pepper unlocks capital for further lending and earns fees and margins on these transactions.

Pepper also generates revenue by providing loan servicing to other financial institutions, leveraging its operational expertise and infrastructure.

| Revenue Stream | Description | 2024 Relevance/Data Point |

| Net Interest Income | Interest earned on loans minus cost of funds. | Net Interest Margin: 1.97% |

| Loan Origination & Servicing Fees | Charges for setting up and managing loans. | Integral to profitability across loan lifecycle. |

| Securitisation & Whole Loan Sales | Income from selling loan portfolios to investors. | Key for capital generation and growth in 2024 Australian RMBS market. |

| Third-Party Loan Servicing | Fees for managing loans on behalf of other entities. | Monetizes operational strengths and industry standing. |

Business Model Canvas Data Sources

The Pepper Business Model Canvas is built upon a foundation of comprehensive market research, customer feedback, and internal operational data. These sources ensure that every component, from value propositions to cost structures, is grounded in actionable insights and real-world performance.