Pacific Industrial SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pacific Industrial Bundle

Pacific Industrial is poised for growth, but understanding its competitive landscape is key. Our comprehensive SWOT analysis reveals the core strengths and emerging opportunities that can propel its market position.

Want the full story behind Pacific Industrial's competitive advantages, potential threats, and strategic growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Pacific Industrial's position as a global automotive supplier is a significant strength, evidenced by its role in supplying components to major automakers across continents. This broad operational footprint, as of early 2024, means they are integrated into the supply chains of numerous leading car brands, reducing dependency on any single customer or region.

Their extensive global network allows for diversified revenue streams, making them less vulnerable to regional economic downturns. For instance, in fiscal year 2023, approximately 40% of their revenue was generated from outside Japan, demonstrating this geographic diversification.

The company's ability to consistently deliver essential automotive parts worldwide points to a highly efficient and resilient operational and logistical infrastructure, a critical factor in the just-in-time manufacturing environment of the automotive industry.

Pacific Industrial's strength lies in its focused product portfolio, concentrating on essential vehicle safety components like tire valves and Tire Pressure Monitoring Systems (TPMS). This specialization places them squarely within a critical, non-discretionary segment of the automotive market, ensuring consistent demand.

The company's press metal products also contribute to vehicle integrity and performance. With global trends and regulations increasingly prioritizing vehicle safety, Pacific Industrial is well-positioned to capitalize on these evolving industry standards.

Pacific Industrial's components play a vital role in enhancing vehicle performance, extending beyond just safety. Their Tire Pressure Monitoring Systems (TPMS), for instance, directly contribute to better fuel efficiency. In 2024, maintaining optimal tire pressure can improve fuel economy by up to 3%, a significant saving for consumers and a key selling point for automakers.

Furthermore, the consistent and accurate tire pressure facilitated by Pacific Industrial's technology also leads to extended tire lifespan. This reduces replacement costs for vehicle owners, adding another layer of value. This dual benefit of improved fuel economy and longer tire life makes their products highly desirable, reinforcing their necessity in modern vehicles.

Established Industry Presence and Experience

Pacific Industrial's established industry presence, dating back to its founding in 1930, signifies a deep well of experience in automotive parts manufacturing and sales. This longevity translates into refined manufacturing processes, robust quality control measures, and a keen understanding of the automotive sector's dynamic demands. Their long history builds considerable trust and reliability with customers.

Key strengths derived from this extensive history include:

- Decades of Expertise: Over 90 years in the automotive parts industry provides unparalleled technical knowledge and market insight.

- Proven Manufacturing Prowess: Established and optimized production lines ensure consistent quality and efficiency.

- Strong Customer Relationships: A long operating history fosters enduring trust and loyalty among clients.

- Adaptability Proven: The company has navigated numerous industry shifts, demonstrating resilience and a capacity for evolution.

Focus on Innovation and Technology

Pacific Industrial's dedication to innovation is evident in its focus on advanced automotive components like Tire Pressure Monitoring Systems (TPMS). This strategic direction positions the company well within a rapidly expanding market. The global TPMS market was valued at approximately USD 3.5 billion in 2023 and is projected to reach over USD 6.2 billion by 2030, growing at a CAGR of around 8.5%. This growth is fueled by increasing safety regulations and consumer demand for enhanced vehicle performance.

The company's official website further underscores this forward-looking approach, showcasing a portfolio that includes Internet of Things (IoT) products. This diversification into IoT demonstrates Pacific Industrial's commitment to integrating cutting-edge technology across its offerings, aligning with the evolving landscape of connected vehicles and smart manufacturing.

- Commitment to Advanced Automotive Tech: Pacific Industrial's development and production of TPMS and other sophisticated automotive parts highlight a strong focus on technological advancement.

- Alignment with Market Growth: The TPMS sector is experiencing robust expansion, driven by regulatory mandates and technological innovation, indicating Pacific Industrial is strategically positioned for future automotive trends.

- IoT Integration: The company's emphasis on IoT products on its official website signals a proactive strategy to embrace and leverage emerging technologies in its product development.

Pacific Industrial's extensive global reach is a core strength, with operations and sales spanning multiple continents. This geographic diversification, which saw over 40% of its fiscal year 2023 revenue generated outside Japan, insulates the company from localized economic shocks and provides access to a wider customer base.

Their specialization in critical safety components like tire valves and Tire Pressure Monitoring Systems (TPMS) ensures consistent demand, as these are essential, non-discretionary items in modern vehicles. This focus aligns perfectly with global trends and regulations prioritizing automotive safety and efficiency.

With a history dating back to 1930, Pacific Industrial possesses over nine decades of accumulated expertise in automotive manufacturing. This long-standing presence translates into refined production processes, proven quality control, and deep-seated trust with its clientele, a significant competitive advantage.

The company's commitment to innovation is demonstrated by its strategic investment in advanced technologies such as TPMS, a market projected to grow significantly. Furthermore, their exploration of IoT products signals an adaptability to emerging trends in connected vehicles and smart manufacturing.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Global Presence | Diversified Revenue Streams | Over 40% of FY2023 revenue from outside Japan. |

| Product Specialization | Essential Safety Components | Focus on tire valves and TPMS, critical for vehicle safety and performance. |

| Industry Experience | Long-Standing Expertise | Founded in 1930, over 90 years of automotive manufacturing experience. |

| Innovation Focus | Advanced Automotive Technology | Active development in TPMS (market projected to exceed USD 6.2 billion by 2030) and IoT products. |

What is included in the product

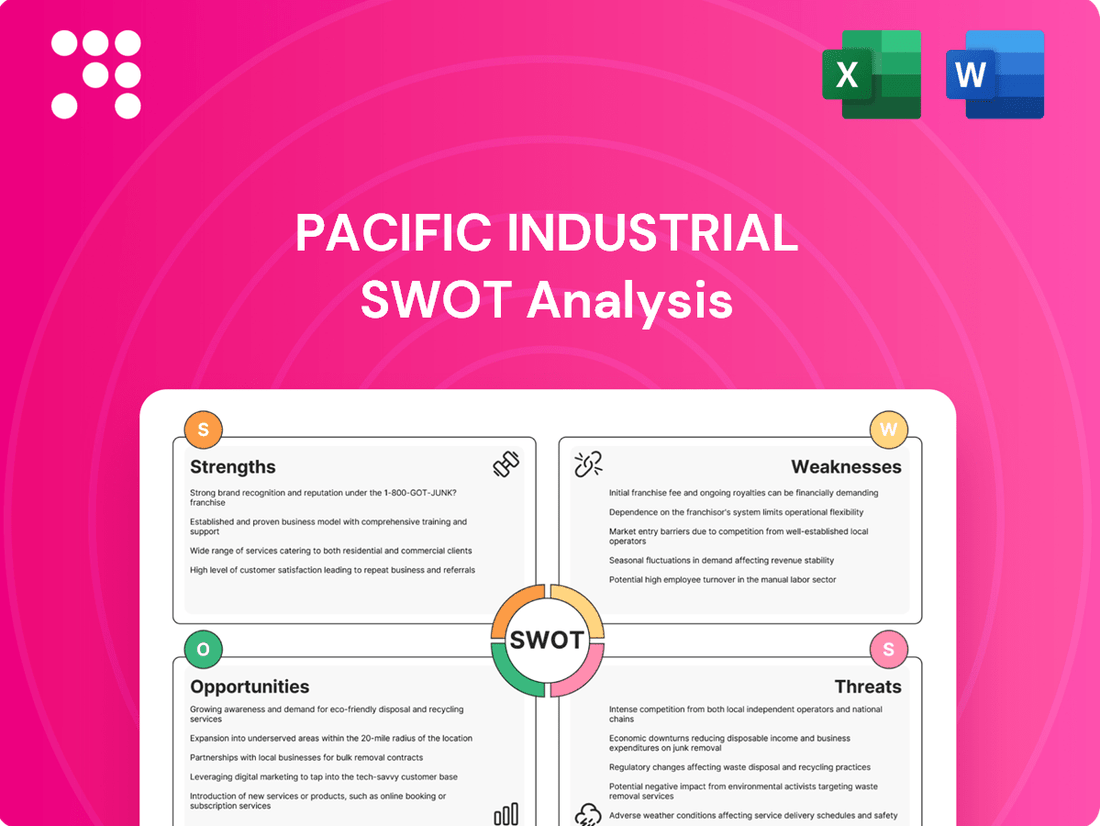

Analyzes Pacific Industrial’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical market vulnerabilities, thereby relieving strategic uncertainty.

Weaknesses

Pacific Industrial's significant reliance on the automotive industry presents a major weakness. In 2024, the global automotive market experienced a projected 3% contraction in production compared to 2023 figures, according to industry analysts, directly impacting demand for Pacific Industrial's components.

This concentrated focus leaves the company vulnerable to the cyclical nature of vehicle sales and production. Any slowdown in new car purchases, driven by economic uncertainty or changing consumer preferences, can disproportionately affect Pacific Industrial's financial performance.

Pacific Industrial's reliance on metals like steel and aluminum, alongside electronic components, makes it susceptible to price swings. For instance, the average price of steel coil experienced significant volatility in late 2023 and early 2024, impacting manufacturers. If Pacific Industrial cannot effectively pass these rising input costs onto its automotive clients, its profit margins could shrink considerably.

The automotive parts manufacturing sector is incredibly crowded, with many companies vying for business both globally and locally. This fierce competition often forces companies like Pacific Industrial to keep prices down, invest heavily in new technologies, and constantly work to hold onto their customer base. In 2024, the global automotive aftermarket, a key segment for parts suppliers, was valued at over $400 billion, highlighting the sheer scale of competition.

Potential for High R&D Costs in Evolving Technologies

While Pacific Industrial's innovation is a strength, keeping pace with rapid technological advancements, such as in electric vehicles (EVs) and autonomous driving, demands substantial investment in research and development. This can put a strain on financial resources, particularly if new product lines struggle to gain immediate market acceptance or if development timelines extend significantly.

For instance, the automotive sector's shift towards electrification and advanced driver-assistance systems (ADAS) necessitates continuous R&D spending. Companies in this space might see R&D expenses as a percentage of revenue increase. In 2024, many automotive suppliers are reporting higher R&D allocations to secure future market share in these evolving segments, with some dedicating upwards of 10-15% of their revenue to R&D to stay competitive.

- High R&D Investment: Adapting to new technologies like EVs and autonomous driving requires significant capital outlay for research and development.

- Market Traction Risk: There's a risk that new product lines may not achieve market traction quickly, impacting the return on R&D investments.

- Extended Development Cycles: Prolonged development periods can further strain financial resources and delay product launches.

- Competitive Pressure: Competitors investing heavily in these areas can create pressure to match R&D spending, even if it impacts short-term profitability.

Exposure to Global Supply Chain Disruptions

Pacific Industrial's global operations expose it to significant vulnerabilities within international supply chains. Disruptions stemming from geopolitical instability, like the ongoing trade tensions between major economies, or unforeseen events such as the lingering effects of the COVID-19 pandemic on shipping, can severely impede the timely delivery of essential components. For instance, in late 2023, many industrial manufacturers reported lead times for critical electronic components extending by as much as 50% compared to pre-pandemic levels, directly impacting production schedules and increasing operational costs.

This reliance on a complex web of international suppliers means that events far beyond Pacific Industrial's direct control can lead to production stoppages. Such disruptions not only cause delays in fulfilling customer orders, potentially damaging client relationships and market share, but also drive up logistics expenses due to expedited shipping or the need to source alternative, often more expensive, materials. In 2024, the Suez Canal blockage incident highlighted the fragility of key maritime routes, with shipping costs for certain industrial goods reportedly surging by over 200% in the immediate aftermath.

- Geopolitical Risks: Trade wars and regional conflicts can disrupt the flow of raw materials and finished goods.

- Logistical Bottlenecks: Port congestion and shipping container shortages, as seen throughout 2023 and early 2024, increase transit times and costs.

- Natural Disasters: Extreme weather events can damage manufacturing facilities or transportation infrastructure in key sourcing regions.

- Pandemic Recurrence: Future health crises could again lead to factory shutdowns and labor shortages globally.

Pacific Industrial's heavy dependence on the automotive sector makes it susceptible to market downturns. The global automotive production forecast for 2024 indicated a slight decline, impacting demand for its parts. This concentration exposes the company to the volatile nature of car sales and manufacturing output.

Fluctuations in the prices of key raw materials like steel and aluminum, along with electronic components, pose a significant threat to profit margins. For instance, steel prices saw considerable volatility in late 2023 and early 2024, directly affecting input costs for manufacturers like Pacific Industrial.

The company faces intense competition within the automotive parts manufacturing industry, a market valued at over $400 billion globally in 2024. This competitive landscape pressures pricing and necessitates continuous investment in technology to retain customers.

Navigating the complexities of global supply chains presents a notable weakness. Geopolitical tensions and logistical challenges, such as extended shipping lead times for electronic components which increased by up to 50% in late 2023, can disrupt operations and increase costs.

Same Document Delivered

Pacific Industrial SWOT Analysis

The file shown below is not a sample—it’s the real Pacific Industrial SWOT analysis you'll download post-purchase, in full detail.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

The global automotive industry's pivot towards electric vehicles (EVs) and hybrids is a substantial growth avenue. By 2024, EV sales are projected to exceed 15 million units worldwide, a figure expected to climb further in 2025, creating a robust demand for specialized components.

Pacific Industrial's established proficiency in tire valves and Tire Pressure Monitoring Systems (TPMS) positions it well to capitalize on this trend. Developing advanced, lightweight, and potentially smart tire valve solutions tailored for EV and hybrid applications, including those supporting connected vehicle ecosystems, offers a clear path to market expansion.

The global TPMS market is set to expand significantly, with projections indicating a compound annual growth rate (CAGR) of around 8-10% through 2027, reaching an estimated value exceeding $6 billion. This growth is largely fueled by mandatory TPMS installations in new vehicles across major markets like the US and Europe, alongside increasing consumer demand for enhanced vehicle safety features.

This regulatory push and heightened safety consciousness present a clear opportunity for Pacific Industrial to capitalize on. By potentially increasing production capacity and further developing its TPMS offerings, the company can capture a larger share of this expanding market.

The automotive aftermarket, a sector focused on parts and services for vehicles no longer under original manufacturer warranty, is experiencing robust growth. In 2024, the global automotive aftermarket was projected to reach over $500 billion, with continued expansion expected through 2025. This presents a significant opportunity for Pacific Industrial to bolster sales of its replacement parts as demand for vehicle maintenance and repair rises.

Digitalization and the rise of e-commerce are reshaping the aftermarket landscape. By leveraging online platforms and digital tools, Pacific Industrial can establish new sales channels, reaching a wider customer base and fostering more direct engagement. This digital shift allows for streamlined order processing and enhanced customer service, crucial for capturing market share in this evolving sector.

Development of Advanced Tire and Valve Technologies

Innovations in tire technology, particularly smart tires equipped with sensors for real-time data, and sophisticated valve designs present significant opportunities for Pacific Industrial. These advancements open doors for developing entirely new product lines and enhancing existing offerings. For instance, the global tire pressure monitoring systems (TPMS) market was valued at approximately $3.5 billion in 2023 and is projected to reach over $6 billion by 2030, indicating substantial growth potential.

Pacific Industrial could strategically invest in research and development (R&D) to pioneer next-generation tire valves and TPMS solutions. These new products could be designed to seamlessly integrate with the rapidly evolving landscape of connected and autonomous vehicle technologies, offering enhanced safety and performance features. The company's focus could be on developing smart valves that not only monitor pressure but also temperature and wear, transmitting this data wirelessly to vehicle systems.

- Smart Tire Integration: Developing tire valves compatible with advanced smart tire systems that provide real-time data on tire health, pressure, and temperature.

- TPMS Advancement: Creating next-generation TPMS solutions that offer more precise diagnostics and predictive maintenance capabilities, potentially reducing downtime for commercial fleets.

- Connectivity Solutions: Designing valve technology that supports wireless communication protocols essential for future vehicle connectivity and data exchange.

- Material Innovation: Exploring new materials for valves that offer improved durability, lighter weight, and enhanced resistance to extreme conditions, aligning with automotive lightweighting trends.

Strategic Partnerships and Market Diversification

Pacific Industrial can unlock significant growth by forging strategic partnerships. Collaborating with emerging electric vehicle (EV) manufacturers, for instance, could tap into a rapidly expanding segment of the automotive market. In 2023, global EV sales exceeded 13 million units, a figure projected to climb further in 2024 and 2025, presenting a substantial opportunity for suppliers like Pacific Industrial.

Diversifying into non-automotive sectors offers another avenue. If Pacific Industrial's expertise in press metal or valve technology has applications in industries like renewable energy (e.g., solar panel mounting systems, wind turbine components) or advanced manufacturing, this could open entirely new revenue streams. This diversification strategy is crucial for mitigating risks associated with over-reliance on any single market.

- Automotive Partnerships: Explore collaborations with new EV startups and established automakers seeking advanced component solutions.

- Technology Alliances: Partner with technology firms to integrate smart features or advanced materials into their existing product lines.

- Sector Diversification: Investigate opportunities in renewable energy, aerospace, or industrial machinery where their core competencies can be leveraged.

- Market Expansion: Target new geographic markets or customer segments beyond traditional automotive OEMs to broaden their reach.

Pacific Industrial is well-positioned to benefit from the automotive industry's shift towards electric vehicles (EVs) and hybrids, with global EV sales projected to surpass 15 million units in 2024 and continue growing into 2025. The company's expertise in tire valves and Tire Pressure Monitoring Systems (TPMS) aligns perfectly with the demand for specialized components in this expanding sector. Furthermore, the global automotive aftermarket, valued at over $500 billion in 2024, presents a significant opportunity for Pacific Industrial to increase sales of replacement parts as vehicle maintenance needs rise.

By focusing on smart tire integration and TPMS advancements, Pacific Industrial can develop innovative solutions for the evolving automotive landscape. The company can also explore strategic partnerships with emerging EV manufacturers and consider diversifying into sectors like renewable energy, leveraging its core competencies to open new revenue streams and mitigate market risks.

| Opportunity Area | 2024/2025 Data/Projection | Pacific Industrial Relevance |

|---|---|---|

| EV & Hybrid Market Growth | EV sales > 15 million units (2024), projected growth | Demand for specialized tire components and TPMS |

| TPMS Market Expansion | Global TPMS market CAGR ~8-10% (through 2027), projected value > $6 billion | Regulatory mandates and safety demand drive growth |

| Automotive Aftermarket | Global aftermarket > $500 billion (2024), continued expansion | Increased demand for replacement parts |

| Smart Tire Technology | Growing integration of sensors in tires | Opportunity for advanced valve and TPMS development |

Threats

Economic downturns pose a significant threat to Pacific Industrial by directly impacting automotive sales. A global or regional economic slowdown can curb consumer spending, leading to reduced demand for new vehicles and, consequently, automotive parts. For instance, as of Q1 2024, many major economies experienced slower growth, with some analysts predicting a mild recession in certain regions by late 2024 or early 2025. This economic climate, coupled with rising interest rates and vehicle prices, has already begun to dampen consumer enthusiasm for major purchases like new cars, directly affecting Pacific Industrial's core market.

The automotive parts sector is notoriously competitive, forcing companies like Pacific Industrial to constantly battle for market share and keep prices in check. This intense rivalry directly squeezes profit margins, making it harder to invest in innovation or absorb unexpected costs.

New players entering the market, particularly those with lower production expenses, pose a significant threat. For instance, in 2024, the global automotive aftermarket was valued at over $400 billion, with a substantial portion of growth attributed to emerging markets. These new competitors can undercut existing players on price, potentially stealing customers and reducing Pacific Industrial's revenue streams.

Furthermore, established rivals employing aggressive market strategies, such as aggressive discounting or rapid product development, can further intensify pricing pressures. This can lead to a price war, diminishing profitability for all involved and making it challenging for Pacific Industrial to maintain its financial health and competitive edge.

The automotive sector is experiencing incredibly fast technological shifts, especially with the move towards electric vehicles (EVs). This rapid change means some of Pacific Industrial's current components could quickly become outdated. For instance, the demand for internal combustion engine parts is projected to decline significantly, with some analysts predicting a drop of over 30% in demand for certain traditional engine components by 2030, forcing a swift pivot.

Suppliers like Pacific Industrial must adapt to new vehicle designs and powertrain technologies, such as advanced battery systems and electric motors. Those that don't keep pace risk falling behind and losing their place in the market. Companies that invested heavily in EV component production in 2024, for example, saw their market share in that segment grow by an average of 15% compared to those still focused on legacy parts.

Geopolitical Tensions and Trade Barriers

Geopolitical tensions pose a significant threat to Pacific Industrial. Trade wars and escalating tariffs, such as those seen between the US and China impacting billions in trade in 2023, directly increase import and export costs, potentially squeezing profit margins and limiting access to key markets. Furthermore, geopolitical instability can lead to volatile raw material prices and supply chain disruptions, as witnessed with energy market fluctuations following regional conflicts.

These trade barriers and geopolitical uncertainties create a challenging operating environment:

- Disrupted Supply Chains: Tariffs and trade disputes can force costly rerouting or sourcing of materials, impacting production timelines and costs.

- Increased Operational Costs: Higher import duties and potential retaliatory tariffs directly inflate the cost of goods sold and reduce competitiveness.

- Limited Market Access: Protectionist policies can erect barriers to entry in crucial international markets, hindering sales growth.

- Volatile Input Prices: Geopolitical instability often translates to unpredictable fluctuations in the cost of essential raw materials, impacting financial planning.

Supply Chain Vulnerabilities and Raw Material Shortages

Pacific Industrial faces ongoing threats from supply chain vulnerabilities and raw material shortages. The automotive sector, a key market for many industrial suppliers, continues to grapple with persistent semiconductor shortages, impacting vehicle production and, by extension, demand for industrial components. For instance, in late 2024, reports indicated that some automakers were still facing production cuts due to a lack of critical chips, a situation that directly affects parts manufacturers like those within Pacific Industrial's sphere of influence.

Labor shortages also remain a significant concern, exacerbating production challenges. This scarcity of skilled workers can lead to increased labor costs and hinder the ability to ramp up production to meet demand, further contributing to potential delays and cost overruns for companies reliant on a stable manufacturing environment. The general volatility in the availability and pricing of essential raw materials, from steel to specialized alloys, adds another layer of risk, potentially squeezing profit margins and impacting competitive pricing strategies.

- Semiconductor Shortages: Continued disruptions in chip supply directly impact automotive production volumes, a major end-market for industrial components.

- Labor Scarcity: A lack of skilled labor can slow production, increase operational expenses, and limit output capacity for parts manufacturers.

- Raw Material Volatility: Fluctuations in the availability and cost of key materials like steel and aluminum create uncertainty and can compress profit margins.

- Production Delays: These combined factors can lead to significant production delays, affecting delivery schedules and customer satisfaction.

The automotive industry's rapid shift toward electric vehicles (EVs) presents a significant threat, as traditional internal combustion engine (ICE) components may become obsolete. Many analysts predict a substantial decline in demand for ICE parts, potentially impacting companies heavily invested in legacy technologies. For example, by 2030, demand for certain traditional engine components could drop by over 30%, necessitating swift adaptation.

Intensifying competition, both from new market entrants and aggressive established rivals, squeezes profit margins and necessitates constant innovation. Emerging market players, often with lower production costs, can undercut prices, while rivals employing aggressive discounting strategies can trigger price wars. This competitive pressure makes maintaining profitability and investing in future technologies a challenge.

Geopolitical instability and trade tensions pose risks through disrupted supply chains, increased operational costs due to tariffs, and limited market access. Fluctuations in raw material prices, such as steel and semiconductors, further exacerbate these challenges, impacting production schedules and overall financial health.

Supply chain vulnerabilities, particularly ongoing semiconductor shortages, continue to affect automotive production volumes, directly impacting demand for industrial components. Labor shortages also contribute to production challenges, increasing labor costs and limiting output capacity.

SWOT Analysis Data Sources

This analysis draws on a robust combination of publicly available financial reports, comprehensive market research data, and expert industry commentary to provide a well-rounded view of the Pacific industrial landscape.