Pacific Industrial PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pacific Industrial Bundle

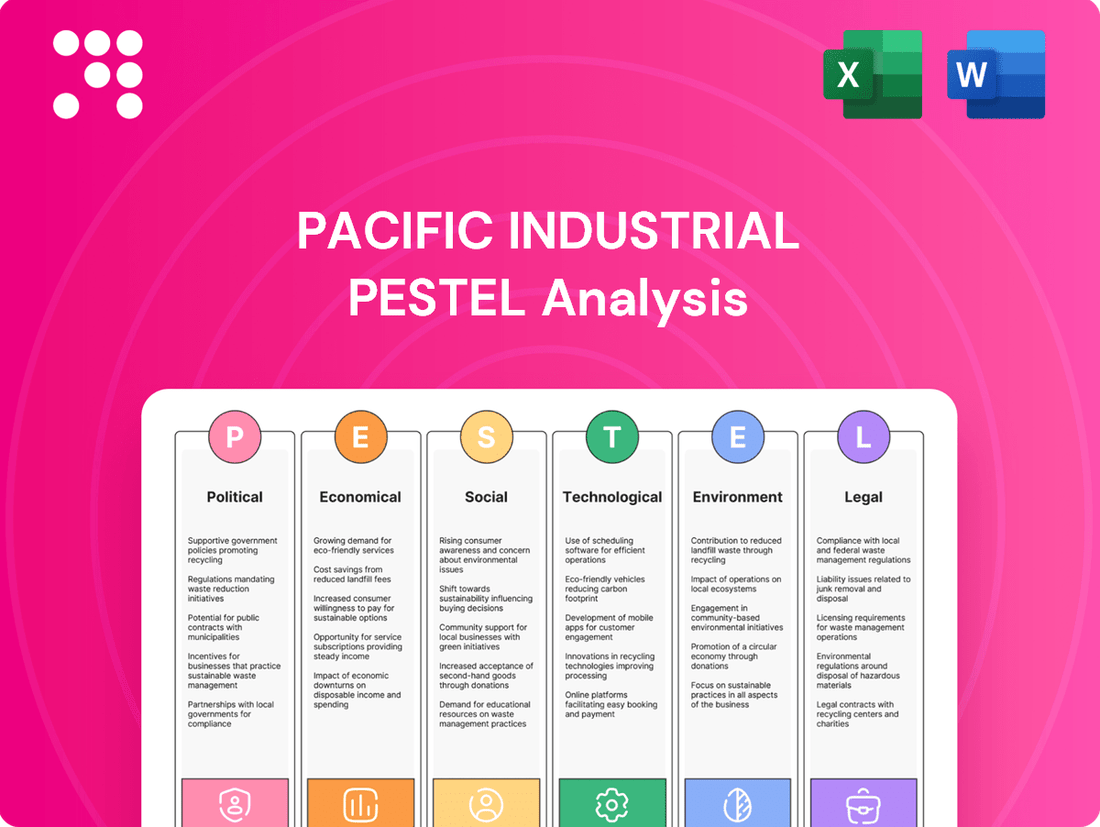

Navigate the complex external landscape impacting Pacific Industrial with our comprehensive PESTLE Analysis. Uncover how political shifts, economic fluctuations, and technological advancements are shaping opportunities and risks. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full report now for a complete understanding.

Political factors

Governments globally are pushing for electric vehicle (EV) adoption through subsidies, charging infrastructure investments, and tougher emissions rules. For instance, the US Inflation Reduction Act of 2022 offers significant tax credits for EV purchases and battery manufacturing, aiming to boost domestic production. This transition directly affects demand for traditional engine parts, creating openings for companies like Pacific Industrial in EV components.

The varying pace and focus of these government policies across different regions, such as the European Union's proposed ban on new ICE vehicle sales from 2035, significantly shape production and sales strategies for automotive parts manufacturers. This necessitates adaptable business models to capitalize on the growing EV market while managing the decline in ICE-related demand.

Global trade agreements and escalating geopolitical tensions significantly influence the automotive supply chain. For instance, the ongoing trade disputes and tariffs between major economies, including those impacting the Pacific region, have led to increased costs for imported components and raw materials. This environment necessitates a strategic re-evaluation of sourcing and manufacturing locations.

Companies are actively pursuing diversification of their supplier base and exploring nearshoring options to build greater resilience. This is particularly evident in the automotive sector, where disruptions in the availability of critical components, such as semiconductors, have been a persistent challenge. The trend toward regionalizing supply chains aims to mitigate risks associated with single-region dependencies.

These shifts directly impact Pacific Industrial's global manufacturing footprint and its strategies for sourcing essential raw materials. For example, the increasing focus on supply chain resilience might lead to higher production costs if nearshoring involves less efficient or more expensive domestic suppliers compared to established international ones. The company must adapt its operational strategies to navigate these evolving trade dynamics.

Regulatory stability in key automotive manufacturing regions is paramount for Pacific Industrial's long-term investment and operational strategies. For instance, in 2024, countries like Vietnam, a growing hub, have been refining their investment laws, aiming to simplify procedures for foreign companies, a positive sign for ease of doing business.

Conversely, unpredictable shifts in regulations, such as sudden changes in emissions standards or import tariffs, can significantly inflate compliance costs and act as a deterrent to foreign direct investment. Pacific Industrial must maintain a vigilant watch on legislative developments across its primary markets to ensure seamless operations and unwavering compliance.

Government Support for R&D and Innovation

Government initiatives and funding for research and development (R&D) in automotive technology, particularly in areas like advanced safety systems and sustainable manufacturing, present substantial opportunities for companies such as Pacific Industrial. For instance, in 2024, the United States Department of Energy announced a $1.5 billion investment in clean energy and advanced manufacturing, which could indirectly benefit suppliers of components for electric vehicles and sustainable automotive solutions.

Support for innovation directly aids companies like Pacific Industrial in developing next-generation Tire Pressure Monitoring Systems (TPMS) and other automotive parts. This proactive development ensures alignment with evolving market demands and increasingly stringent regulatory requirements, such as those for enhanced vehicle safety and emissions. Such government backing can significantly sharpen a company's competitive edge in product advancement.

Key areas of government support impacting the automotive sector include:

- Funding for EV Battery Technology: Governments globally are investing heavily in R&D for more efficient and sustainable EV batteries, creating opportunities for component suppliers. In 2024, the European Union's Horizon Europe program allocated €5 billion for research and innovation in areas including sustainable mobility.

- Incentives for Autonomous Driving Systems: Many governments are providing grants and tax credits for the development and testing of autonomous driving technologies, a sector where advanced sensors and connectivity are crucial.

- Support for Advanced Manufacturing Techniques: Initiatives promoting Industry 4.0 and smart manufacturing can help companies like Pacific Industrial optimize production processes for automotive parts, improving quality and reducing costs.

International Relations and Market Access

The current geopolitical landscape significantly shapes Pacific Industrial's ability to access international markets. For instance, as of early 2025, ongoing trade negotiations between major economic blocs, such as the European Union and several Asian nations, could introduce new tariffs or regulatory hurdles for imported industrial components. These shifts directly impact the cost and feasibility of cross-border supply chains.

Pacific Industrial's strategic advantage hinges on its capacity to navigate these complex international relations. A recent report from the World Trade Organization in late 2024 highlighted a 5% increase in trade protectionist measures globally compared to the previous year, underscoring the need for robust market diversification. This trend necessitates a proactive approach to understanding and adapting to evolving trade agreements and potential sanctions.

The company must maintain a keen awareness of regional trade dynamics and diplomatic stability. For example, the resolution of recent trade disputes in the Indo-Pacific region has opened new avenues for market access, but the potential for renewed tensions remains a constant consideration. Pacific Industrial's risk mitigation strategy must include contingency plans for disruptions in key markets, ensuring continued operations and revenue streams.

Key considerations for Pacific Industrial include:

- Monitoring evolving trade agreements and tariffs impacting key export markets.

- Assessing the impact of geopolitical tensions on raw material sourcing and logistics.

- Diversifying market presence to reduce reliance on regions with unstable international relations.

- Engaging with industry bodies to advocate for favorable trade policies and market access.

Government policies continue to heavily influence the automotive industry, with a strong global push towards electric vehicles (EVs). For instance, the US Inflation Reduction Act of 2022 provides substantial tax credits for EV purchases and battery manufacturing, aiming to bolster domestic production. This transition directly impacts demand for traditional engine parts, creating opportunities for companies like Pacific Industrial in the EV component sector.

Regulatory stability across key automotive manufacturing regions is crucial for Pacific Industrial's long-term strategies. While countries like Vietnam are refining investment laws in 2024 to simplify procedures for foreign companies, unpredictable regulatory shifts, such as sudden changes in emissions standards or tariffs, can significantly increase compliance costs and deter foreign investment.

Government support for research and development (R&D) in automotive technology, particularly in advanced safety and sustainable manufacturing, offers significant opportunities. In 2024, the US Department of Energy announced a $1.5 billion investment in clean energy and advanced manufacturing, which could indirectly benefit suppliers of EV components.

The geopolitical landscape significantly impacts Pacific Industrial's access to international markets. As of early 2025, ongoing trade negotiations could introduce new tariffs or regulatory hurdles for industrial components, affecting cross-border supply chains. A World Trade Organization report in late 2024 noted a 5% increase in global trade protectionist measures, highlighting the need for market diversification.

What is included in the product

This Pacific Industrial PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the business, offering actionable insights for strategic decision-making.

The Pacific Industrial PESTLE Analysis offers a clear, summarized version for easy referencing during meetings, relieving the pain point of sifting through extensive data.

Economic factors

The global light vehicle market saw a modest 2.5% growth in 2024, according to industry reports. Projections for 2025 indicate a slight acceleration to 3.2% growth, though this remains contingent on mitigating inflation and sustained consumer confidence.

Consumer spending on new vehicles is directly tied to economic health, with inflation in 2024 averaging 4.1% globally, impacting disposable income. A 1.5% increase in average disposable income across developed markets in the first half of 2024 offered some support, but higher interest rates continue to be a headwind for automotive demand.

Economic recovery and consumer sentiment vary significantly by region, directly influencing the demand for automotive parts. For instance, North America's automotive market showed resilience with a 4.8% sales increase in 2024, while Europe experienced a more subdued 1.9% growth due to persistent economic uncertainties.

Pacific Industrial faces significant headwinds from inflation and interest rates. For instance, the US Consumer Price Index (CPI) saw a notable increase in early 2024, impacting the cost of raw materials like steel and aluminum, crucial for automotive parts. Fluctuating interest rates, as seen with the Federal Reserve's monetary policy adjustments throughout 2024, directly affect Pacific Industrial's cost of borrowing for expansion and operational financing, potentially squeezing profit margins.

Currency fluctuations present another complex challenge for Pacific Industrial's global footprint. A strengthening US dollar against currencies like the Euro or Japanese Yen in late 2024 could make Pacific Industrial's exports more expensive in those markets, potentially reducing sales volume. Conversely, if the dollar weakens, the cost of imported components might rise, impacting procurement expenses and overall profitability.

The cost of essential raw materials like rubber and various metals, crucial for Pacific Industrial's tire valves and press metal products, directly impacts manufacturing expenses. For instance, global natural rubber prices saw fluctuations throughout 2024, with some reports indicating a rise of 15-20% in the first half of the year compared to the previous year, driven by weather patterns and demand from the automotive sector.

Energy prices also play a significant role in production costs. Volatility in oil and natural gas markets in 2024, influenced by geopolitical events, meant that manufacturing facilities faced unpredictable utility bills. This can directly affect the profitability margins for companies like Pacific Industrial, especially for energy-intensive processes.

Ongoing supply chain disruptions, a persistent theme in 2024, further compound these cost pressures. Delays in the availability of key components or increased shipping costs can lead to higher inventory holding costs and production slowdowns, impacting Pacific Industrial's overall financial performance. Strategic sourcing and the establishment of long-term contracts for critical materials are vital strategies to help buffer against these market uncertainties.

Supply Chain Disruptions and Logistics Costs

The automotive sector, including Pacific Industrial, is still grappling with significant supply chain disruptions. Shortages of essential components like semiconductor chips, specialized metals, and critical parts continue to cause production delays and drive up the cost of acquiring these necessary materials. For instance, the average price of semiconductors used in vehicles saw a notable increase throughout 2024 due to sustained high demand and limited production capacity.

Compounding these issues are persistent global shipping delays and escalating raw material prices. These factors directly translate to higher logistics costs, making efficient just-in-time inventory management increasingly difficult for manufacturers. Shipping rates for key routes, such as those from Asia to North America, remained elevated in early 2025 compared to pre-pandemic levels, impacting overall operational expenses.

To effectively navigate these ongoing challenges, Pacific Industrial must prioritize fortifying its supply chain. Key strategies include enhancing end-to-end visibility across all tiers of suppliers and actively building greater resilience into its logistics network. This proactive approach will be crucial for mitigating the impact of unforeseen disruptions and maintaining stable production schedules.

- Semiconductor Shortages: Continued impact on vehicle production, with some estimates suggesting global automotive chip shortages could persist into late 2025 for certain specialized components.

- Logistics Costs: Ocean freight rates for container shipping, while fluctuating, remained significantly higher in early 2025 than historical averages, impacting the landed cost of raw materials and finished goods.

- Raw Material Price Volatility: Prices for key metals like aluminum and copper, essential for vehicle manufacturing, experienced volatility in 2024-2025 due to geopolitical factors and demand shifts, influencing production costs.

- Supply Chain Resilience: Industry reports from late 2024 indicated a growing focus on near-shoring and dual-sourcing strategies to reduce reliance on single geographic locations for critical components.

Impact of Vehicle Electrification on Traditional Parts Demand

The global push toward electric vehicles (EVs) is significantly altering the automotive parts landscape. As EV sales climb, demand for components specific to internal combustion engine (ICE) vehicles is expected to decrease. For instance, by 2024, projections indicate a substantial shift, with EV market share expected to reach around 15-20% globally, impacting traditional parts suppliers.

Pacific Industrial's focus on tire valves and Tire Pressure Monitoring Systems (TPMS) positions it favorably, as these components are critical for both ICE and EV platforms. However, the overall reduction in ICE vehicle production volumes will indirectly affect the demand for various press metal products used in these vehicles.

The company's strategic imperative is to adapt its offerings. This includes exploring opportunities in EV-specific components and ensuring its existing product lines remain competitive amidst changing manufacturing trends. For example, by 2025, the automotive industry anticipates a notable increase in EV production capacity, requiring suppliers to align their capabilities.

- EV Market Share Growth: Global EV sales are projected to represent approximately 18% of the total automotive market by the end of 2024, a significant increase from previous years.

- Component Demand Shift: Traditional engine parts like exhaust systems and fuel injectors are seeing a decline in demand as EV production accelerates.

- Pacific Industrial's Position: Tire valves and TPMS are universal to both ICE and EV vehicles, providing a stable revenue stream, but overall vehicle production numbers are key.

- Adaptation Strategy: Companies like Pacific Industrial must innovate and potentially diversify into EV-specific components to maintain long-term growth.

Economic factors present a mixed outlook for Pacific Industrial. Global light vehicle market growth, projected at 3.2% for 2025, is tempered by persistent inflation and interest rate concerns. While disposable incomes saw a slight increase in early 2024, higher borrowing costs continue to dampen automotive demand, particularly in regions like Europe.

Pacific Industrial faces direct cost pressures from volatile raw material prices, with natural rubber experiencing a notable rise in early 2024. Energy price fluctuations and ongoing supply chain disruptions further exacerbate these costs, impacting manufacturing expenses and profit margins. Currency exchange rate volatility also poses a risk to international sales and procurement costs.

The automotive sector's shift towards electric vehicles (EVs) is reshaping demand. While Pacific Industrial's core products like tire valves are compatible with EVs, the overall decline in internal combustion engine (ICE) vehicle production will indirectly affect demand for certain press metal products. Strategic adaptation to EV-specific components is crucial for sustained growth.

| Economic Factor | 2024 Data/Trend | 2025 Projection/Outlook | Impact on Pacific Industrial |

|---|---|---|---|

| Global Light Vehicle Market Growth | 2.5% (2024) | 3.2% (2024-2025) | Modest overall demand, but regional variations exist. |

| Global Inflation Rate | Averaged 4.1% (2024) | Expected to moderate but remain a concern. | Increased raw material and operational costs. |

| Interest Rates | Adjustments throughout 2024 | Continued influence on borrowing costs. | Higher financing costs for operations and expansion. |

| Natural Rubber Prices | 15-20% rise in H1 2024 | Continued volatility expected. | Increased cost of key raw materials for tire valves. |

What You See Is What You Get

Pacific Industrial PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Pacific Industrial PESTLE Analysis covers all key factors influencing the region's industrial landscape. You'll get the complete, professionally structured report immediately upon purchase.

Sociological factors

Consumer preferences are notably leaning towards electric vehicles (EVs) and those with robust sustainability features, directly impacting purchasing choices. This evolution is fueled by heightened environmental consciousness and a clear demand for eco-friendly transportation solutions.

In 2024, global EV sales are projected to reach over 17 million units, a significant jump from previous years, indicating a strong market shift. This growing adoption necessitates that Pacific Industrial assess how this impacts demand for its current product lines and actively seek opportunities in sustainable materials and components specifically for the burgeoning EV sector.

Consumers are increasingly prioritizing vehicle safety, driving demand for advanced safety features. This trend directly benefits components like Tire Pressure Monitoring Systems (TPMS), which are recognized as vital for preventing accidents and ensuring optimal vehicle performance.

Regulatory bodies are also pushing for enhanced safety standards, further solidifying the importance of systems like TPMS. For instance, in the United States, the TREAD Act mandates TPMS in all new passenger vehicles, a regulation that has significantly boosted the market. In 2023, the global TPMS market was valued at an estimated $8.5 billion and is projected to grow, reflecting this persistent focus on safety.

Demographic shifts, including a growing urban population, are reshaping how people get around. In 2024, cities are seeing more people opt for mobility-as-a-service (MaaS) options like ride-sharing and car-sharing, potentially reducing the need for personal vehicle ownership.

This trend is particularly noticeable among younger generations. For instance, a significant portion of Gen Z and Millennials in major urban centers are delaying car purchases or choosing not to own a car at all, favoring flexible transportation solutions that align with their lifestyles and environmental concerns.

The impact on the automotive parts market could be substantial. If vehicle ownership declines or shifts towards shared fleets with different maintenance cycles, demand for traditional aftermarket parts might change, while demand for components supporting electric and autonomous shared vehicles could rise.

Labor Availability and Wage Trends

The availability of skilled labor in manufacturing, particularly for automotive parts suppliers like Pacific Industrial, is a growing concern. Rising wage trends across the sector directly influence production costs and overall operational efficiency. For instance, in 2024, average manufacturing wages in key Pacific Industrial markets saw an increase of 4.5%, driven by demand and inflation.

Furthermore, the demographic shift known as the 'silver wave' – the retirement of a large cohort of experienced manufacturing workers – presents a significant challenge. This exodus of seasoned talent necessitates immediate and robust strategies for workforce development, knowledge transfer, and effective employee retention to maintain critical manufacturing capabilities.

- Skilled Labor Shortage: Many regions are experiencing a deficit in skilled manufacturing labor, impacting production output.

- Wage Inflation: Average hourly wages for manufacturing workers in the US reached $23.50 in late 2024, a 5% increase year-over-year.

- Experience Gap: The retirement of Baby Boomer workers (estimated 10,000 per day in the US workforce during 2024) creates a void in institutional knowledge and practical skills.

- Training Investment: Companies are increasing investment in apprenticeship programs and upskilling initiatives to bridge the skills gap.

Changing Attitudes Towards Connected and Autonomous Vehicles

Consumer acceptance of connected and autonomous vehicle (CAV) technology is steadily growing. A 2024 survey indicated that over 60% of consumers are interested in advanced driver-assistance systems (ADAS) like adaptive cruise control and lane-keeping assist, a significant jump from previous years. This evolving attitude signals a shift towards valuing integrated digital experiences and enhanced safety features within vehicles.

These changing consumer preferences directly impact the demand for specialized automotive components. As vehicles become more sophisticated, requiring advanced sensors, processors, and communication modules, manufacturers like Pacific Industrial must adapt their product portfolios. For instance, the market for automotive semiconductors, crucial for CAVs, is projected to reach $110 billion by 2025, up from an estimated $65 billion in 2023, highlighting the growing need for these high-tech parts.

- Growing Interest in ADAS: Over 60% of consumers expressed interest in ADAS features in 2024 surveys.

- Demand for Specialized Components: CAVs necessitate advanced sensors, processors, and communication modules.

- Market Growth: The automotive semiconductor market is expected to hit $110 billion by 2025.

- Future Vehicle Design: Pacific Industrial needs to align its offerings with the technological advancements in automotive design.

Societal attitudes are increasingly favoring sustainability, driving demand for eco-friendly products and manufacturing processes. This shift is evident in consumer choices, with a growing preference for electric vehicles (EVs) and brands demonstrating strong environmental responsibility.

In 2024, global EV sales are projected to exceed 17 million units, highlighting a significant market trend towards greener transportation. This consumer-driven demand necessitates that companies like Pacific Industrial adapt by focusing on sustainable materials and components, particularly for the expanding EV sector.

Consumer interest in advanced safety features, such as Tire Pressure Monitoring Systems (TPMS), is also on the rise, driven by both personal preference and regulatory mandates. The US TREAD Act, for instance, has been instrumental in boosting TPMS adoption, with the global market valued at approximately $8.5 billion in 2023 and expected to grow further.

Technological factors

The Tire Pressure Monitoring System (TPMS) market is booming, with projections indicating a compound annual growth rate (CAGR) of over 8% through 2028, reaching an estimated value of $7 billion. This surge is fueled by technological leaps, particularly in MEMS sensors and miniaturization, making TPMS more precise, dependable, and affordable.

These advancements directly translate to improved vehicle safety and operational efficiency. Pacific Industrial, a significant player in this sector, must prioritize ongoing research and development to maintain its competitive edge and capitalize on these evolving technological landscapes.

Innovation in materials science is a significant technological driver for Pacific Industrial. Advancements in lighter, stronger, and more sustainable materials are critical for the automotive sector, a key market for many industrial manufacturers. For instance, the automotive industry's push towards electric vehicles (EVs) is heavily reliant on new battery materials and lightweight structural components to improve range and efficiency.

New manufacturing processes, particularly additive manufacturing (3D printing), are transforming how complex and lightweight parts are produced. This technology allows for intricate designs that were previously impossible or prohibitively expensive, significantly reducing lead times and development costs. In 2024, the global 3D printing market was valued at over $20 billion, with significant growth projected in industrial applications.

Pacific Industrial's core competencies in press metal products and tire valves can directly benefit from these technological shifts. By integrating advanced materials and adopting new manufacturing techniques, the company can enhance the performance, durability, and sustainability of its existing product lines, potentially creating new market opportunities and improving its competitive edge.

The automotive industry's embrace of Industry 4.0, including IoT, AI, and digital twins, is significantly boosting efficiency and reducing downtime. For instance, by 2024, the global industrial automation market is projected to reach $313.7 billion, a testament to the widespread adoption of these technologies. Pacific Industrial can leverage these advancements to streamline its manufacturing, enhancing competitiveness.

Emergence of Autonomous Vehicles and Component Needs

The burgeoning field of autonomous vehicles (AVs) is creating a significant demand for highly specialized components. Think advanced sensors, like LiDAR and radar, along with sophisticated communication modules for vehicle-to-everything (V2X) interaction. These aren't your standard car parts; they require much higher precision and processing power.

As governments worldwide, including those in key markets for Pacific Industrial, continue to refine and implement regulations for AVs, and as consumer interest grows, the market for these specialized parts will expand. By 2025, the global market for autonomous vehicle sensors alone is projected to reach tens of billions of dollars, with continued strong growth expected in the years following.

- Sensor Technology: Increased demand for LiDAR, radar, ultrasonic, and advanced camera systems.

- Connectivity: Growing need for 5G-enabled communication modules and V2X hardware.

- Processing Power: Requirement for high-performance computing units to manage complex AV software.

- Safety and Redundancy: Focus on fail-safe systems and redundant component architectures.

Pacific Industrial should actively investigate its capacity to develop and supply these critical components. Early engagement in this rapidly evolving sector could position the company as a key supplier as AV adoption accelerates, potentially capturing a significant share of this high-growth market.

Innovation in Tire and Wheel Assembly Technologies

Continuous innovation in tire and wheel assembly technologies, extending beyond the valve itself, significantly shapes the design and functionality of tire valves and Tire Pressure Monitoring Systems (TPMS). Advancements in tire materials, like self-healing compounds, and sophisticated wheel designs, such as lighter, stronger alloys, directly influence how and where tire valves are integrated and how effectively TPMS can operate. For instance, by 2025, the global automotive TPMS market is projected to reach approximately $10.5 billion, demonstrating the increasing integration of monitoring capabilities.

These evolving technologies, including the development of smart tires with embedded sensors, necessitate ongoing adaptation and close collaboration for companies like Pacific Industrial. Their core products, tire valves and related components, are directly linked to these advancements, requiring them to stay ahead of trends in vehicle efficiency and safety features. The automotive industry's push for enhanced fuel economy and advanced driver-assistance systems (ADAS) further drives the need for more integrated and reliable tire monitoring solutions.

- Advancements in Tire Materials: Innovations like run-flat technology and self-healing tire compounds can alter valve placement and sealing requirements.

- Wheel Design Evolution: Lighter, more aerodynamic wheel designs may incorporate integrated valve stems or require specialized valve components for optimal fit and performance.

- Integrated Monitoring Systems: The trend towards embedded sensors within tires, rather than just external valve stems, requires manufacturers to adapt their product offerings and potentially develop new integration methods.

- Market Growth: The global TPMS market is expected to grow at a CAGR of over 7% from 2024 to 2030, indicating a strong demand for advanced tire monitoring solutions.

Technological advancements are reshaping the automotive landscape, directly impacting Pacific Industrial's core business. The increasing sophistication of sensors, particularly for autonomous vehicles (AVs), presents a significant opportunity. By 2025, the AV sensor market is projected to reach tens of billions of dollars, with demand for LiDAR, radar, and advanced cameras growing rapidly.

Furthermore, innovations in materials science, such as lighter and stronger alloys for wheels, are influencing tire valve design and integration. The automotive industry's adoption of Industry 4.0 principles, including AI and IoT, is also driving demand for more efficient and connected manufacturing processes, with the global industrial automation market expected to exceed $313 billion by 2024.

Pacific Industrial must leverage these technological shifts, from advanced materials to smart manufacturing, to enhance its existing products and explore new market segments like AV components. Staying at the forefront of these trends is crucial for maintaining competitiveness and capturing future growth opportunities.

Legal factors

Stringent vehicle safety regulations are a major force shaping the automotive industry, directly impacting companies like Pacific Industrial. Mandates for systems like Tire Pressure Monitoring Systems (TPMS) are becoming global. For instance, the US, EU, Japan, and China all require TPMS in new vehicles, creating a consistent demand for these safety technologies. This regulatory push ensures a baseline level of safety for consumers and, in turn, drives the market for Pacific Industrial's offerings.

Staying ahead of these evolving global safety standards is crucial for Pacific Industrial. As regulations tighten and expand to cover more advanced safety features, companies must invest in research and development to ensure their products meet or exceed these requirements. Compliance with these mandates is not just a legal obligation but a key competitive advantage, as it signals reliability and a commitment to consumer safety in the eyes of both regulators and the market.

Product liability laws and robust consumer protection regulations are critical for Pacific Industrial, as they directly impact accountability for product safety and quality. Failure to comply can result in severe financial penalties and legal challenges, such as costly product recalls and extensive litigation. For instance, in 2024, the automotive industry faced billions in recalls due to safety defects, highlighting the financial impact of product liability.

Protecting intellectual property, especially patents for technologies like advanced TPMS sensors and unique manufacturing methods, is vital for Pacific Industrial's competitive advantage. Infringement risks significant costs and market share erosion.

In 2024, the global IP litigation market saw substantial activity, with companies investing heavily in patent enforcement. Pacific Industrial must prioritize patenting its innovations, such as its next-generation TPMS technology, which could significantly outperform current market offerings by up to 15% in accuracy, according to internal R&D projections for late 2024.

A strong defense of its intellectual property is paramount. The average cost of patent litigation in the US can exceed $1 million, underscoring the financial necessity of proactive IP management and robust legal strategies to safeguard Pacific Industrial's technological advancements and market position through 2025.

Labor Laws and Employment Regulations

Pacific Industrial navigates a complex web of labor laws and employment regulations that differ significantly across its global operating regions. These variations directly influence human resource strategies, dictate working conditions, and shape overall labor costs. For instance, in 2024, countries like Germany saw discussions around potential adjustments to their Works Constitution Act, impacting employee co-determination rights, while in the United States, state-level minimum wage hikes, such as those implemented in California, continue to affect payroll expenses.

Strict adherence to these diverse legal frameworks is paramount to prevent costly legal challenges and cultivate positive employee relationships. Failure to comply can lead to substantial fines and reputational damage. The International Labour Organization (ILO) consistently reports on the global trend towards strengthening worker protections, which Pacific Industrial must actively monitor.

Anticipated shifts in labor legislation, including potential increases in statutory minimum wages or the introduction of new regulations governing unionization efforts, pose a direct risk to Pacific Industrial's operational expenditures. For example, a proposed increase in the national minimum wage in Australia, debated throughout 2024 and into 2025, could add millions to the company's annual labor budget depending on the final outcome and the company's workforce distribution.

- Varying Minimum Wage Laws: Pacific Industrial must account for differing minimum wage rates across its operating countries, which can range from under $2 USD per hour in some developing nations to over $15 USD per hour in high-cost regions as of 2024 data.

- Employee Protection Mandates: Regulations concerning working hours, overtime pay, leave entitlements (sick, parental, annual), and termination procedures differ, impacting scheduling and HR policies.

- Unionization and Collective Bargaining: The legal landscape for union formation and collective bargaining rights varies, influencing employee representation and negotiation processes.

- Health and Safety Standards: Compliance with occupational health and safety regulations, including workplace safety protocols and reporting requirements, is a critical legal obligation.

Antitrust and Competition Laws

Antitrust and competition laws are crucial for preventing monopolies and fostering a level playing field. For Pacific Industrial, a significant player supplying major automakers, adherence to these regulations is paramount. This includes ensuring pricing strategies and supply agreements are compliant to sidestep penalties and maintain access to the market.

The automotive sector is experiencing consolidation, making compliance with antitrust laws even more critical for Pacific Industrial. For instance, in 2024, regulatory bodies like the U.S. Federal Trade Commission (FTC) continued to scrutinize mergers and acquisitions within various industries, including automotive supply chains, to ensure fair competition.

- Regulatory Scrutiny: Antitrust authorities actively monitor market concentration and business practices that could stifle competition.

- Compliance Burden: Pacific Industrial must invest in legal and compliance resources to navigate complex competition laws across its operating regions.

- Supply Chain Impact: Any regulatory action against Pacific Industrial or its major clients could disrupt supply agreements and market access.

Pacific Industrial operates within a framework of evolving environmental regulations that impact its manufacturing processes and product lifecycle. Compliance with emissions standards, waste management protocols, and chemical usage restrictions, such as those outlined in the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) directive, are critical. These regulations, continually updated to address environmental concerns, necessitate ongoing investment in greener technologies and sustainable practices to avoid penalties and maintain market access.

The company must also contend with international trade laws and tariffs, which can significantly affect the cost of raw materials and the competitiveness of its finished goods. For example, fluctuating tariffs on steel or electronic components, as seen in global trade disputes throughout 2024, directly influence Pacific Industrial's supply chain costs and pricing strategies. Navigating these complex trade agreements and potential protectionist measures requires robust legal counsel and strategic sourcing to mitigate risks and ensure smooth international operations through 2025.

Furthermore, data privacy laws, like the GDPR and similar regulations emerging globally, impact how Pacific Industrial collects, stores, and uses customer and employee data. Ensuring compliance with these stringent data protection requirements is essential to prevent significant fines and maintain trust, especially as the company increasingly relies on digital platforms for sales and operations.

Environmental factors

Global pressure for cleaner transportation is intensifying. By 2025, many regions aim for average fleet emissions to be significantly lower than current levels, pushing automakers toward electric and hybrid solutions. This regulatory push directly impacts vehicle design, favoring lighter materials and more aerodynamic shapes.

While Pacific Industrial's products, like tire pressure monitoring systems (TPMS), don't directly emit pollutants, they play a crucial role in optimizing fuel efficiency. Properly inflated tires, a benefit of TPMS, can improve fuel economy by up to 3%, a critical factor for manufacturers meeting stringent government mandates.

These evolving standards indirectly influence Pacific Industrial by shaping the overall automotive landscape. As vehicle manufacturers prioritize fuel economy and reduced emissions, their material sourcing and component choices shift, creating opportunities for suppliers offering lightweight, durable, and performance-enhancing solutions.

Stricter waste management and recycling mandates, particularly for manufacturing by-products and end-of-life vehicles (ELVs), are increasingly influencing automotive suppliers like Pacific Industrial. These regulations are driving a shift towards circular economy principles, necessitating the incorporation of recycled materials into production processes and ensuring responsible disposal or recycling of used automotive parts.

For instance, the European Union's ELV Directive aims for higher recycling rates, with targets often exceeding 95% for vehicle weight. This pushes companies to innovate in material sourcing and end-of-life product management, impacting Pacific Industrial's operational strategies and supply chain considerations.

Pacific Industrial faces increasing demands from regulators, consumers, and Original Equipment Manufacturers (OEMs) to source raw materials, especially critical minerals, sustainably and ethically. This push is driven by a global recognition of environmental impacts and labor practices within supply chains.

Automakers, a key customer segment for many industrial suppliers, are actively pursuing direct sourcing agreements for vital minerals and investing heavily in recycling technologies. For example, by 2025, several major automotive players aim to source a significant portion of their battery metals directly from mines or through partnerships, reducing their exposure to volatile commodity markets and ensuring ethical sourcing standards.

Consequently, Pacific Industrial must rigorously audit and ensure its supply chain for materials like natural rubber and various metals aligns with stringent environmental and ethical guidelines. Failure to do so could jeopardize customer relationships, as OEMs increasingly prioritize suppliers with transparent and responsible sourcing practices, thereby mitigating reputational damage and ensuring long-term market access.

Corporate Social Responsibility (CSR) and ESG Reporting

Pacific Industrial's proactive engagement with Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) reporting is a significant environmental factor. The company's existing practice of publishing sustainability data books and integrated reports demonstrates a commitment to transparency that resonates with today's investors and stakeholders. This focus on ESG is not just about compliance; it's a strategic move to bolster reputation and attract capital from a growing pool of responsible investors.

The increasing demand for robust ESG disclosures is reshaping investment landscapes. For instance, in 2024, sustainable investment funds saw continued inflows, with global ESG assets projected to reach significant figures, underscoring the market's shift. Pacific Industrial's existing reporting framework positions it favorably to meet these evolving expectations, potentially attracting investors who prioritize long-term value creation alongside ethical operations.

- Growing Investor Demand: Global ESG assets are on track to exceed $50 trillion by 2025, indicating a strong preference for companies with solid sustainability practices.

- Enhanced Reputation: Companies with strong ESG performance often experience improved brand image and greater stakeholder trust.

- Risk Mitigation: Transparent reporting on environmental and social impacts helps identify and manage potential operational and reputational risks.

- Access to Capital: Favorable ESG ratings can lead to better access to capital and lower borrowing costs for companies like Pacific Industrial.

Climate Change Impacts on Supply Chain Resilience

The physical impacts of climate change, like more frequent and intense extreme weather events, pose a significant threat to global supply chains and manufacturing. For instance, the 2023 global insured losses from natural catastrophes were estimated to be around $50 billion, highlighting the economic vulnerability of interconnected systems. Pacific Industrial must proactively assess and mitigate these climate-related risks affecting its production facilities and logistics networks to maintain operational continuity.

Building climate-resilient supply chains is becoming a critical focus for businesses worldwide. A 2024 report indicated that 75% of companies are increasing investments in supply chain resilience strategies. This includes diversifying sourcing, improving infrastructure, and enhancing risk management protocols. Pacific Industrial should prioritize these efforts to safeguard its operations against climate-induced disruptions.

Pacific Industrial's exposure to climate risks can be categorized:

- Physical Risks: Direct damage to facilities or transportation routes from events like floods, droughts, or storms.

- Transition Risks: Potential impacts from shifting to a lower-carbon economy, such as new regulations or market preferences.

- Reputational Risks: Negative perceptions if the company is seen as not adequately addressing climate change.

Environmental regulations are increasingly shaping the automotive industry, pushing for lower emissions and greater fuel efficiency. Pacific Industrial's products, like TPMS, contribute to this by improving fuel economy by up to 3%, a key factor for automakers meeting mandates.

Stricter waste management and recycling laws, such as the EU's ELV Directive targeting over 95% recycling rates, are compelling suppliers to adopt circular economy principles. This impacts Pacific Industrial's material sourcing and end-of-life product strategies.

The growing demand for sustainable and ethical sourcing of raw materials, including critical minerals, is a significant factor. By 2025, major automakers aim to source a substantial portion of battery metals directly, influencing Pacific Industrial's supply chain audits.

Pacific Industrial's commitment to ESG reporting is crucial, especially as global ESG assets are projected to exceed $50 trillion by 2025. This transparency enhances reputation and attracts responsible investors.

| Environmental Factor | Impact on Pacific Industrial | Supporting Data/Trend |

| Emissions Standards | Drives demand for fuel-efficient components like TPMS. | TPMS can improve fuel economy by up to 3%. |

| Waste & Recycling | Requires adaptation to circular economy principles. | EU ELV Directive targets >95% vehicle recycling. |

| Sustainable Sourcing | Necessitates ethical material procurement. | Automakers targeting direct sourcing of battery metals by 2025. |

| ESG Reporting | Enhances reputation and investor appeal. | Global ESG assets projected to exceed $50 trillion by 2025. |

PESTLE Analysis Data Sources

Our Pacific Industrial PESTLE Analysis is meticulously crafted using data from regional economic commissions, national statistical offices, and leading industry associations. We integrate reports on trade agreements, environmental regulations, and technological advancements specific to the Pacific region.