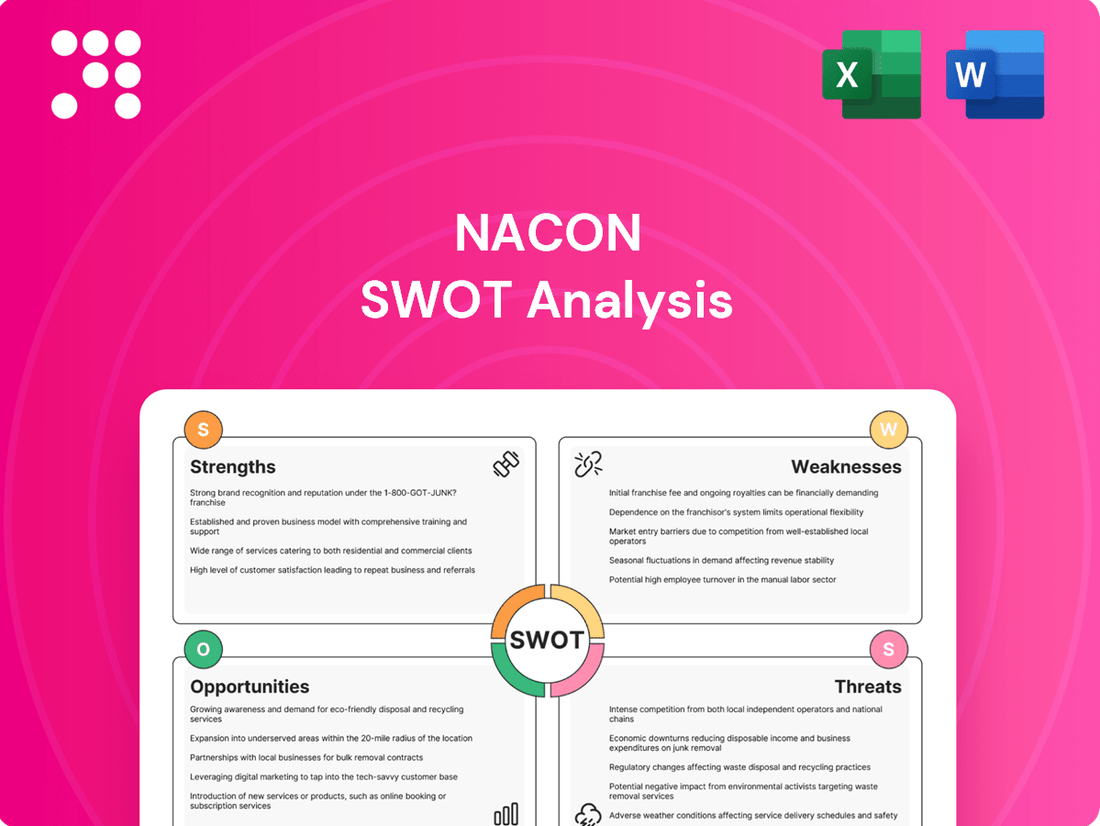

Nacon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nacon Bundle

Nacon's market position is defined by its innovative gaming accessories and strong brand recognition, but it also faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Nacon's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Nacon's strength lies in its dual business model, effectively operating in both gaming accessories and video game publishing. This diversification creates a robust revenue stream, reducing the company's vulnerability to fluctuations in any single market segment. For example, in the first half of fiscal year 2024 (ending September 30, 2023), Nacon reported revenue of €130.7 million, with a significant portion coming from its diverse activities.

Nacon boasts a strong portfolio of gaming accessories, built over two decades of experience. Their Nacon brand offers a diverse range of peripherals, from controllers to headsets, catering to a broad gaming audience. This established market presence is a significant advantage.

Innovation is a key strength, evident in recent product releases. The Revolution 5 Pro controller, for instance, features advanced Hall Effect technology, promising improved durability and precision for gamers. Nacon's continued investment in new technologies signals a commitment to staying competitive.

Nacon's strength lies in its expansive and varied video game library, cultivated by its 16 dedicated development studios. This diverse catalog spans multiple genres, ensuring broad appeal to a wide range of gamers.

The company demonstrates a consistent ability to launch successful new titles. For instance, RoboCop: Rogue City has attracted over one million players, while Session: Skate Sim has reached more than 2.5 million players as of 2024, highlighting Nacon's capability in creating engaging gaming experiences.

Extensive International Presence and Distribution

Nacon's extensive international presence is a significant strength, with operations touching 100 countries through its 25 subsidiaries. This broad global footprint is key to successfully distributing its diverse portfolio of gaming accessories and video game titles to a worldwide customer base.

The company's robust distribution network, reaching 100 countries, ensures its products are accessible to a vast international market. This wide reach is instrumental in Nacon's strategy to capitalize on global gaming trends and consumer demand.

- Global Reach: Operates in 100 countries.

- Subsidiary Network: Leverages 25 subsidiaries for international operations.

- Distribution Power: Extensive network facilitates worldwide product availability.

Strategic Investments in Future Growth Areas

Nacon is strategically investing in high-growth areas, notably its expansion into simracing with the launch of the REVOSIM brand and a dedicated Racing department. This focus is evident in their development of new racing wheels and accessories, aiming to capture a significant share of this expanding market.

These strategic moves are designed to capitalize on emerging trends and unlock new revenue streams. For instance, the simracing market, a key focus for Nacon, is projected to see continued growth, with industry reports indicating a compound annual growth rate (CAGR) of approximately 7-9% through 2027, driven by increased interest in esports and realistic simulation experiences.

- Expansion into Simracing: Launch of REVOSIM brand and dedicated Racing department.

- Product Development: Focus on new racing wheels and accessories to meet market demand.

- Market Opportunity: Capitalizing on the projected 7-9% CAGR of the simracing market through 2027.

Nacon's dual business model, encompassing both gaming accessories and video game publishing, provides significant revenue diversification. This strategy shields the company from over-reliance on a single market segment, as demonstrated by its €130.7 million revenue in the first half of FY2024 (ending September 30, 2023).

The company leverages a strong, two-decade-old foundation in gaming accessories with its Nacon brand, offering a wide array of peripherals like controllers and headsets that appeal to a broad gaming demographic.

Nacon consistently demonstrates innovation, exemplified by the Revolution 5 Pro controller's advanced Hall Effect technology, enhancing durability and precision for gamers.

The company's extensive video game portfolio, developed by 16 studios, covers diverse genres, ensuring broad appeal to a wide gamer base.

Nacon has a proven track record of successful game launches; RoboCop: Rogue City has surpassed one million players, and Session: Skate Sim has reached over 2.5 million players as of 2024, underscoring their ability to create engaging titles.

A key strength is Nacon's expansive international presence, operating in 100 countries through 25 subsidiaries, which facilitates the global distribution of its products.

The company's robust distribution network across 100 countries ensures widespread product availability, crucial for capitalizing on global gaming trends.

Nacon's strategic expansion into simracing with the REVOSIM brand and a dedicated Racing department positions it to capture growth in this expanding market, which is projected to grow at a CAGR of 7-9% through 2027.

| Strength Area | Key Feature | Impact | Supporting Data (FY2024 H1) |

|---|---|---|---|

| Business Model | Dual focus: Accessories & Publishing | Revenue diversification, reduced market risk | Revenue: €130.7 million |

| Gaming Accessories | Established Nacon brand, broad product range | Strong market presence, wide customer appeal | N/A (Long-standing strength) |

| Innovation | Advanced technology in new products (e.g., Hall Effect) | Enhanced product performance, competitive edge | Revolution 5 Pro controller |

| Video Game Portfolio | Diverse genres, 16 development studios | Broad gamer appeal, varied content offering | RoboCop: Rogue City (>1M players), Session: Skate Sim (>2.5M players) |

| Global Operations | Presence in 100 countries, 25 subsidiaries | Extensive market reach, efficient distribution | N/A (Operational scope) |

| Strategic Growth | Simracing expansion (REVOSIM) | Capitalizing on high-growth market (7-9% CAGR projected to 2027) | N/A (Strategic initiative) |

What is included in the product

Analyzes Nacon’s competitive position through key internal and external factors, detailing its strengths in gaming peripherals and its weaknesses in brand recognition, while exploring opportunities in emerging markets and threats from intense competition.

Nacon's SWOT analysis offers a clear framework to identify and address internal weaknesses and external threats, thereby alleviating the pain points associated with strategic uncertainty and competitive pressures.

Weaknesses

Nacon's financial performance for the 2024/25 fiscal year, which saw stable sales of €167.9 million year-on-year, was notably affected by the postponement of several significant game and accessory releases. These delays directly impacted the company's ability to meet revenue targets for the period.

The shift of these crucial product launches into the 2025/26 fiscal year creates uncertainty in financial forecasting and can negatively influence investor sentiment due to the disruption of anticipated sales streams.

Nacon's operating income saw a dramatic fall to €1.1 million for the 2024/25 fiscal year, a stark contrast to the €20.9 million reported in the prior year. This sharp decline, despite relatively stable sales, indicates potential issues with managing operational costs or a squeeze on profit margins for their product portfolio.

Nacon operates in a gaming accessories market characterized by intense competition. Major players like Logitech G, Razer Inc., and Corsair command significant market share, creating a challenging environment for Nacon to carve out and maintain its position. For instance, in 2023, Logitech G reported net sales of $2.27 billion, highlighting the scale of its operations.

This intense rivalry necessitates constant product innovation and differentiation. Nacon must continuously invest in research and development to offer unique features and superior performance to stand out against established brands that have strong brand loyalty and extensive distribution networks.

Challenges in Video Game Market Saturation

Nacon faces significant headwinds due to an oversaturated video game market, as acknowledged by its publishing head. This means there are simply too many games vying for player attention, making it a real struggle for new releases to stand out and gain momentum.

This intense competition directly translates into higher marketing expenses as Nacon must invest more to cut through the noise. Consequently, individual game sales can fall short of expectations, impacting overall profitability and growth potential.

- Market Saturation: The video game industry is flooded with releases, making discoverability a major hurdle.

- Increased Marketing Costs: To gain visibility, Nacon likely faces escalating advertising and promotional expenditures.

- Reduced Sales Potential: Oversaturation can dilute player spending and attention, leading to lower-than-anticipated revenue per title.

Inconsistent Critical Reception for Published Games

Nacon's published games faced a challenging year in 2024, with Metacritic rankings highlighting inconsistent critical reception. This variability in quality and market appeal across their diverse game portfolio can indeed impact brand perception and, consequently, future sales performance.

The mixed reviews suggest that while some titles resonate strongly with critics, others may fall short, creating a perception of unreliability among players. For instance, while Nacon had some well-received titles, others garnered scores that placed them in the lower half of publisher performance metrics for the year.

- Inconsistent Metacritic Scores: Nacon's 2024 publisher rankings on Metacritic revealed a significant spread in review scores for their released games.

- Impact on Brand Reputation: This uneven critical reception can dilute brand strength and make it harder to build player loyalty.

- Future Sales Uncertainty: A history of inconsistent quality can lead potential customers to hesitate before purchasing new Nacon titles.

Nacon's significant drop in operating income to €1.1 million in 2024/25, down from €20.9 million in the prior year, points to potential issues with cost management or margin pressures despite stable sales. This sharp decline, coupled with the postponement of key releases, creates financial uncertainty and could negatively impact investor confidence.

The company also faces intense competition in the gaming accessories market from giants like Logitech G, which reported $2.27 billion in net sales in 2023. This necessitates continuous innovation and investment in R&D to differentiate from established brands with strong loyalty and distribution.

Furthermore, the oversaturated video game market presents a significant challenge, requiring higher marketing spend to achieve visibility for Nacon's titles. This can lead to lower-than-expected sales per game, impacting overall profitability.

Nacon's game portfolio exhibited inconsistent critical reception in 2024, with varying Metacritic scores. This uneven quality can harm brand perception and future sales, as players may become hesitant to purchase new titles.

| Weakness | Description | Impact | Example/Data |

| Financial Performance Decline | Sharp fall in operating income despite stable sales. | Reduced profitability, potential investor concern. | Operating income fell to €1.1 million (2024/25) from €20.9 million (2023/24). |

| Market Competition | Intense rivalry in gaming accessories. | Requires significant investment in R&D and marketing. | Logitech G's 2023 net sales of $2.27 billion. |

| Market Saturation (Publishing) | Oversaturated video game market. | Increased marketing costs, lower sales potential per title. | Acknowledged by Nacon's publishing head. |

| Inconsistent Game Quality | Variability in critical reception of published games. | Damages brand reputation, impacts future sales. | Inconsistent Metacritic scores for 2024 releases. |

What You See Is What You Get

Nacon SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. The Nacon SWOT analysis you see here is the exact same file you'll download after purchase, offering a clear and actionable overview of their strategic position.

Opportunities

The global gaming accessories market is booming, with projections suggesting it will reach approximately $14.7 billion by 2026, up from $9.1 billion in 2021, according to industry reports. This surge is driven by the escalating popularity of esports, which saw a viewership of over 474 million in 2023, and the increasing integration of virtual and augmented reality technologies into gaming experiences. Furthermore, gamers are consistently seeking higher-performance peripherals to enhance their gameplay, creating a strong demand for Nacon's product offerings.

The gaming industry's rapid evolution, particularly with the rise of VR/AR and cloud gaming, offers significant avenues for Nacon. As of early 2025, the global VR gaming market is projected to reach over $30 billion, demonstrating a strong appetite for immersive experiences.

Nacon can capitalize on this by developing innovative peripherals like VR headsets, haptic feedback controllers, and AR-enhanced accessories. Furthermore, creating exclusive or optimized game titles for these platforms will attract a new wave of gamers and expand Nacon's market reach, potentially boosting sales by an estimated 15-20% in these emerging segments by 2026.

The global esports market is experiencing rapid growth, projected to reach $2.7 billion by 2025, up from $1.1 billion in 2023. This surge directly fuels demand for high-performance gaming accessories, a segment where Nacon excels.

Nacon's strategic investment in professional-grade peripherals, like their recently launched Revolution 5 Pro controller, aligns perfectly with the needs of competitive gamers. These players prioritize precision, customization, and reliability, areas where Nacon's offerings are designed to shine.

Strategic Licensing and Content Acquisition

Nacon's strategic licensing, particularly its exclusive World Rally Championship (WRC) agreement from 2027 to 2032, presents a significant opportunity. This long-term deal ensures a consistent flow of highly anticipated content, bolstering Nacon's standing in the racing simulation genre.

These exclusive agreements are crucial for building a strong brand identity and attracting a dedicated player base. By securing rights to popular franchises, Nacon can differentiate itself in a competitive market and drive consistent revenue streams through game sales and related merchandise.

- Exclusive WRC License: Secures content rights from 2027 to 2032, guaranteeing a pipeline of popular racing titles.

- Genre Dominance: Strengthens Nacon's position in the lucrative racing game market.

- Brand Loyalty: Exclusive content fosters deeper player engagement and brand affinity.

- Revenue Stability: Predictable revenue through guaranteed access to high-demand intellectual property.

Stronger Game Release Pipeline in Upcoming Years

Nacon is poised for substantial growth, projecting a busy release schedule for the 2025/26 financial year. The company anticipates launching over 10 major titles, strategically focusing on its established specialist genres. This robust pipeline is a direct response to a period of development adjustments and is expected to significantly boost Nacon's business performance and operating income.

The upcoming slate of releases is designed to capitalize on market demand and strengthen Nacon's position in key gaming segments. This strategic focus on a strong release pipeline is a key driver for anticipated financial improvements.

- Projected 2025/26 Releases: Over 10 major titles planned.

- Genre Focus: Emphasis on Nacon's specialist gaming genres.

- Financial Impact: Expected to drive significant business growth and improved operating income.

Nacon can leverage the expanding esports market, projected to reach $2.7 billion by 2025, by supplying high-performance accessories. The company's exclusive World Rally Championship (WRC) license, running from 2027 to 2032, offers a stable revenue stream and strengthens its position in the racing simulation genre. Furthermore, a robust release schedule of over 10 major titles in the 2025/26 financial year, focusing on specialist genres, is expected to significantly boost Nacon's business performance and operating income.

| Opportunity | Market Projection | Nacon's Strategic Alignment |

|---|---|---|

| Esports Growth | $2.7 billion by 2025 | Supplying high-performance accessories |

| WRC License | 2027-2032 | Dominance in racing simulation, stable revenue |

| New Game Releases | 10+ major titles (2025/26) | Capitalizing on demand, boosting operating income |

Threats

Nacon navigates fiercely competitive arenas in both gaming accessories and video game publishing. Established players and nimble newcomers alike create a challenging environment, often triggering price wars and escalating marketing costs, which can strain market share and profit margins.

The gaming accessory market faces a significant challenge from counterfeit products, which directly threaten established brands like Nacon. These fakes can damage Nacon's carefully built reputation and erode the trust consumers place in their products.

The proliferation of these illicit goods directly impacts sales, as consumers may unknowingly purchase lower-quality counterfeits instead of genuine Nacon items. This issue is particularly concerning as the global gaming market continues its rapid expansion, projected to reach over $200 billion by 2025, creating a larger playground for counterfeiters.

The video game market is incredibly crowded, with thousands of new titles launching each year. For Nacon, this means it's a constant battle to get their games noticed, especially for titles that aren't from the biggest studios. This saturation makes it harder and more expensive to ensure a game actually reaches players and makes an impact, potentially leading to sales that don't meet expectations.

Revenue Volatility Tied to Game Release Success

Nacon's revenue is closely tied to the success of its game and accessory releases. For instance, the company experienced a negative impact on its 2024/25 financial results due to game postponements, highlighting this vulnerability.

This reliance on major launches means that if key titles underperform or face further delays, it could significantly dent Nacon's revenue and overall profitability.

- Revenue Sensitivity: Nacon's financial results are heavily influenced by the timing and reception of new game and accessory launches.

- Impact of Delays: Postponements, as seen impacting the 2024/25 period, directly affect revenue streams and profitability projections.

- Risk of Underperformance: A failure of major titles to meet sales expectations poses a substantial threat to the company's financial health.

Rapid Technological Change and Evolving Consumer Demands

The gaming sector is a whirlwind of technological progress and changing player tastes, meaning Nacon needs to constantly innovate its hardware and game offerings. Failure to do so risks making products obsolete quickly. For instance, the shift towards cloud gaming and subscription services, which gained significant traction in 2024, requires Nacon to adapt its business model and content delivery strategies to remain competitive.

Nacon faces the threat of rapid technological change and evolving consumer demands. The gaming industry is characterized by swift advancements in hardware, such as the increasing power and adoption of next-generation consoles and PC components, alongside evolving software trends like the rise of live-service games and augmented reality experiences. For Nacon, this necessitates substantial and ongoing investment in research and development to ensure its products, including gaming accessories and its own game titles, remain technologically relevant and appealing to a dynamic gamer base. For example, a significant portion of the gaming market in 2024 and early 2025 has been driven by the demand for high-fidelity graphics and immersive gameplay, requiring continuous updates to development tools and engine capabilities.

- Technological Obsolescence: The fast pace of hardware upgrades can quickly render existing Nacon products less desirable.

- Shifting Consumer Preferences: A failure to anticipate and adapt to new gaming genres or player engagement models could lead to declining market share.

- R&D Investment Strain: Continuous innovation requires significant capital outlay, potentially impacting profitability if not managed effectively.

- Competitive Landscape: Competitors who adapt more quickly to technological shifts or consumer trends can capture market advantage.

Nacon's financial performance is highly sensitive to the success and timing of its game and accessory launches. Delays in key titles, such as those impacting the 2024/25 period, directly reduce revenue and profitability. Furthermore, the intense competition and the constant need for innovation in a rapidly evolving technological landscape, including the rise of cloud gaming, demand significant R&D investment, posing a continuous threat to market share and margins if not managed effectively.

| Threat Category | Specific Threat | Impact on Nacon | Industry Trend/Data Point |

|---|---|---|---|

| Market Competition | Intense competition from established and new players | Price wars, increased marketing costs, strained market share | Global gaming market projected to exceed $200 billion by 2025 |

| Product Vulnerability | Counterfeit gaming accessories | Reputational damage, lost sales | Significant portion of consumer spending on accessories can be diverted to fakes |

| Revenue Dependency | Reliance on major game and accessory launches | Negative impact on financial results from postponements or underperformance | Nacon's 2024/25 financial results were negatively affected by game postponements |

| Technological Change | Rapid technological advancements and shifting consumer preferences | Risk of product obsolescence, need for continuous R&D investment | Growth in cloud gaming and subscription services requires business model adaptation |

SWOT Analysis Data Sources

This Nacon SWOT analysis is built upon a robust foundation of data, incorporating official financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded and accurate strategic overview.