Nacon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nacon Bundle

Curious about Nacon's product portfolio performance? This glimpse into their BCG Matrix reveals the strategic positioning of their offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture; purchase the complete BCG Matrix for a comprehensive analysis and actionable insights to guide your investment decisions.

Stars

Nacon's Revolution Pro controllers, particularly the new Xbox Revolution X Unlimited launched in April 2025, are performing exceptionally well. The Xbox Revolution X Unlimited has garnered an impressive average rating of 9/10 from specialist media, signaling robust market demand and a strong competitive stance in the high-end gaming accessory market.

This positive reception underscores the controllers' status as potential stars within Nacon's product portfolio. Their advanced features and consistent positive feedback suggest significant growth potential and an opportunity to capture a larger share of the premium gaming peripheral market as Nacon broadens its platform availability.

The RIG headset portfolio, including popular models like the RIG 600 PRO and the recently launched RIG 900 Max in 2024, is showing robust growth, especially in significant markets like the US and Australia. This upward trend highlights Nacon's successful strategy in the competitive gaming audio sector.

Nacon's continued commitment to developing new audio products underscores its ambition to expand its market presence in the rapidly expanding gaming audio accessories industry. The company is leveraging its well-earned reputation for delivering high-quality and innovative products to attract a larger customer base.

Ravenswatch, launched on PC in September 2024, has already garnered 800,000 players, demonstrating strong initial traction. Its upcoming console release in November 2024, supported by over 700,000 residual wishlists, points to substantial sales potential in a new market segment.

This robust performance and anticipation position Ravenswatch as a Star within the Nacon portfolio. The game's rapidly expanding player base and high demand signal a high-growth trajectory, with significant market share expansion expected in the console market, further bolstered by planned content updates.

Upcoming Nintendo Switch 2 Accessories Line-up

Nacon is strategically preparing for the Nintendo Switch 2 launch, slated for June 2025, by developing around 30 dedicated accessories. This proactive approach aims to secure immediate market presence and capitalize on the new console's ecosystem. The company's investment in this upcoming product line signifies a strong belief in the growth potential within the expanding gaming accessories market.

This extensive accessory development positions Nacon to capture significant market share from day one of the Switch 2's release. By aligning their product roadmap with the console's lifecycle, Nacon demonstrates a commitment to leveraging new hardware opportunities for substantial revenue generation. The gaming accessories market is projected to reach $12.9 billion by 2027, according to Mordor Intelligence, highlighting the lucrative nature of this segment.

Nacon's strategy for the Switch 2 accessories can be viewed through the lens of the BCG Matrix as a potential "Star" or "Question Mark" depending on initial market reception and Nacon's market share. Given the proactive development and the anticipated demand for new console accessories:

- Potential Star: Nacon's early and comprehensive accessory development for the Switch 2 positions them to capture a significant share of a high-growth market, assuming the console itself is successful.

- Market Penetration: The approximately 30 accessories developed indicate a broad strategy to cover various player needs, aiming for deep penetration into the new console’s accessory market.

- Investment Rationale: This investment is driven by the expectation of strong sales and market leadership in the accessories segment for a major new gaming platform.

- Future Growth: Success here could establish Nacon as a dominant player in Nintendo's accessory ecosystem, paving the way for sustained growth.

Test Drive Unlimited: Solar Crown (Post-Launch & Seasons)

Test Drive Unlimited: Solar Crown, despite facing technical hurdles upon its September 2024 release, has quickly attracted a substantial player base, exceeding 500,000 participants. This strong initial engagement propelled it into the top five best-selling titles within its key markets.

Nacon's strategic vision for the game includes a robust Year 2 content plan, encompassing seasons 4 through 6, which will extend development well into 2026. This sustained investment underscores a commitment to addressing launch issues and enriching the gameplay experience, with the ultimate goal of solidifying its position in the competitive racing simulation segment.

- Player Count: Over 500,000 players as of late 2024.

- Sales Performance: Ranked among the top five best-selling games in its distribution territories.

- Post-Launch Strategy: Nacon has committed to a Year 2 roadmap, covering seasons 4-6 through 2026.

- Genre Positioning: Aims to strengthen its market share in the racing simulation genre through ongoing development and content expansion.

Nacon's Revolution Pro controllers, like the Xbox Revolution X Unlimited, are performing exceptionally well, earning high ratings and indicating strong market demand. The RIG headset portfolio, including the RIG 600 PRO and RIG 900 Max, shows robust growth, particularly in the US and Australia, reflecting Nacon's successful strategy in gaming audio.

Ravenswatch, launched in September 2024, has already attracted 800,000 players on PC, with significant console sales anticipated due to over 700,000 wishlists. Test Drive Unlimited: Solar Crown, despite initial hurdles, has surpassed 500,000 players and is a top-five seller, with a strong Year 2 content plan extending into 2026.

Nacon's proactive development of approximately 30 accessories for the upcoming Nintendo Switch 2, slated for June 2025, positions them to capture significant market share in a high-growth segment projected to reach $12.9 billion by 2027.

| Product/Game | Launch/Status | Key Metrics | Market Position | BCG Category |

|---|---|---|---|---|

| Xbox Revolution X Unlimited | April 2025 | 9/10 average media rating | High-end gaming accessory | Star |

| RIG 600 PRO / 900 Max | 2024 (900 Max) | Robust growth in US/Australia | Gaming audio accessories | Star |

| Ravenswatch | Sept 2024 (PC) | 800,000 players; 700,000+ wishlists (console) | PC/Console gaming | Star |

| Test Drive Unlimited: Solar Crown | Sept 2024 | 500,000+ players; Top 5 sales | Racing simulation | Star |

| Switch 2 Accessories | Pre-launch (June 2025) | ~30 accessories developed | New console accessories | Potential Star / Question Mark |

What is included in the product

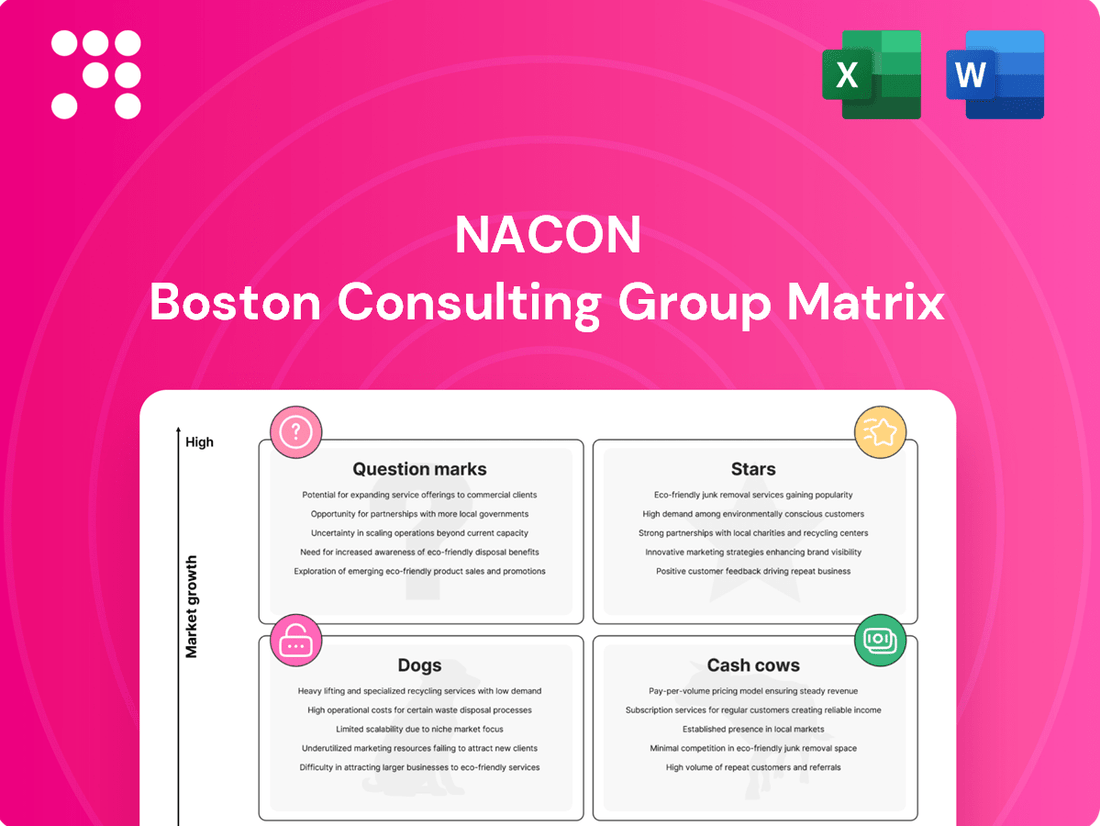

The Nacon BCG Matrix provides a strategic overview of a company's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

Nacon BCG Matrix provides a clear, one-page overview to quickly identify and address underperforming business units.

Cash Cows

RoboCop: Rogue City, released in late 2023, has proven to be a significant cash cow for Nacon. Throughout 2024, it maintained strong player engagement, exceeding one million players and continuing to be a key driver of back catalogue revenue.

This title exemplifies a mature product within Nacon's portfolio, holding a substantial market share. Its ability to generate consistent revenue with minimal incremental marketing spend solidifies its position as a reliable cash generator for the company.

Nacon's overall back catalogue gaming sales have been a standout performer, showing robust growth. In fiscal year 2024/25, these established titles generated €58.6 million in sales, marking a significant 31.2% increase. This strong showing underscores the enduring appeal and profitability of Nacon's older game library.

The momentum continued into the fourth quarter of FY 2024/25, with back catalogue sales surging by 45.6%. This consistent, high-level performance from previously released games is a hallmark of a cash cow. These titles represent a stable and reliable revenue stream that typically requires less investment in marketing and development compared to new releases, contributing significantly to Nacon's financial health.

Nacon's core gaming peripherals, including its extensive range of console controllers and headsets, represent a significant cash cow. With over two decades in the market, Nacon has solidified its position as a leading producer of these essential gaming accessories.

This established business segment generated €65.2 million in sales during FY 2024/25. It operates within a mature market, where Nacon holds a substantial market share, ensuring a steady and reliable stream of cash flow. The consistent performance of these established product lines necessitates minimal promotional expenditure to sustain their market standing.

'Life' Simulation Game Series

Nacon's 'Life' simulation game series, including titles like Taxi Life and Ambulance Life, represents a strong Cash Cow within the company's portfolio. These games consistently attract a dedicated player base, ensuring reliable sales and predictable revenue streams. Their established presence in mature, niche markets allows for steady, dependable cash flow generation.

The 'Life' series benefits from a loyal audience that appreciates the detailed simulation aspects. This consistent demand translates into steady financial performance for Nacon. For example, as of early 2024, simulation games as a genre continue to demonstrate resilience, with established franchises often seeing sustained interest year-over-year, contributing to Nacon's overall financial stability.

- Consistent Niche Performance: The 'Life' series games reliably perform well within their specific simulation sub-genres.

- Dedicated Audience: These titles cater to a focused group of players, guaranteeing steady sales.

- Predictable Cash Flow: Their established position in mature markets ensures a dependable source of revenue for Nacon.

- Brand Loyalty: The series has cultivated brand loyalty, encouraging repeat purchases and sustained engagement.

Annual Sports Simulation Titles

Nacon's annual sports simulation titles, such as Tour de France and Pro Cycling Manager, are firmly positioned as cash cows. These franchises consistently release new iterations, like the anticipated Tour de France 2025 and Pro Cycling Manager 25, tapping into a dedicated and stable player base within a mature market. This predictable demand translates into reliable, year-on-year revenue streams for the company.

The enduring appeal of these simulation games ensures they act as dependable generators of cash. While the market for annual sports titles is established, Nacon's commitment to these franchises guarantees continued sales. For instance, the Tour de France franchise has demonstrated consistent performance, with sales figures often exceeding expectations for its genre.

- Consistent Revenue: Annual releases like Tour de France 2025 and Pro Cycling Manager 25 provide a predictable revenue stream.

- Loyal Fanbase: These franchises cultivate a dedicated community, ensuring sustained sales.

- Mature Market Stability: Operating in a well-established market reduces risk and enhances predictability.

- Cash Generation: The steady demand allows these titles to function as significant cash cows for Nacon.

Cash cows in Nacon's portfolio are products with high market share in mature markets, generating consistent revenue with minimal investment. These include established gaming titles like RoboCop: Rogue City and the 'Life' simulation series, as well as Nacon's core gaming peripherals. The company's back catalogue sales and annual sports simulations also fit this category, demonstrating sustained player engagement and predictable cash flow.

| Product Category | FY 2024/25 Sales | Key Characteristic |

|---|---|---|

| Back Catalogue Games | €58.6 million (+31.2% YoY) | High market share, low incremental marketing |

| Gaming Peripherals | €65.2 million | Established brand, mature market, consistent demand |

| 'Life' Simulation Series | Consistent sales | Dedicated audience, predictable revenue |

| Annual Sports Simulations | Steady year-on-year sales | Loyal fanbase, mature market stability |

What You’re Viewing Is Included

Nacon BCG Matrix

The BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This ensures there are no surprises, as you'll gain access to the complete, analysis-ready report without any watermarks or demo content. It's designed for immediate application in your strategic planning and decision-making processes.

Dogs

Nacon's fourth quarter of the 2024/25 financial year experienced a subdued launch slate, featuring only Rugby25 and Ambulance Life. This limited release strategy contributed to a significant 35.8% drop in catalogue sales.

The underperformance of these new titles suggests they failed to capture substantial market interest, indicating a low initial market share. Consequently, their long-term growth potential appears limited without significant strategic adjustments or marketing boosts.

Within Nacon's vast library, older game titles that haven't seen recent updates or major marketing pushes naturally fall into a category with low market share and declining sales. These games, while perhaps holding nostalgic value, often represent a drain on resources without substantial revenue generation. For instance, titles released before 2020 that haven't received significant post-launch support might be candidates for this segment, contributing minimally to Nacon's overall financial performance.

Obsolete or less popular gaming accessory models within Nacon's portfolio, such as older controller designs or less adopted headset lines, would likely fall into the Dogs quadrant of the BCG Matrix. These products typically exhibit very low market share and minimal growth potential, often due to being superseded by newer technologies or declining consumer interest. For instance, if Nacon's 2024 sales data shows a particular accessory model generating less than 1% of total revenue and experiencing a year-over-year decline of over 5%, it would strongly indicate its position as a Dog.

Games Struggling in an 'Overcrowded' Market

Nacon's head of publishing, Alain Falek, openly stated in early 2024 that the video game market is simply too crowded. This means that many new games, especially those without a clear identity or significant marketing push, find it incredibly difficult to get noticed. For Nacon, this translates to some of their less prominent or smaller-budget titles likely becoming 'Dogs' in the BCG matrix. These are games that struggle to capture significant market share and may even see declining revenue over time.

The consequence of this crowded market is that Nacon's 'Dogs' are those titles that fail to differentiate themselves and gain traction. Without strong brand recognition or unique gameplay mechanics, these games are easily overshadowed by bigger releases. This situation necessitates careful portfolio management, as resources might be better allocated to stronger performing categories.

- Market Saturation: Over 12,000 new games were released on Steam in 2023, highlighting the intense competition Nacon faces.

- Low Visibility: Titles lacking significant marketing spend or unique selling propositions are likely to be lost in the noise.

- Resource Allocation: Continued investment in underperforming 'Dog' titles can drain resources that could be used to nurture 'Stars' or 'Question Marks'.

- Strategic Review: Nacon needs to continually assess its game portfolio to identify which 'Dogs' can be revitalized or should be phased out.

Games with Persistent Underperformance Post-Launch

Games in the 'Dog' quadrant of Nacon's BCG matrix represent titles that, despite initial investment, exhibit persistent underperformance and low market share. These games often struggle to gain or retain a significant player base, consuming resources without generating substantial returns.

A prime example that could be considered within this category is Test Drive Unlimited: Solar Crown. While it launched with a player base, its initial reception was hampered by significant server instability and optimization problems, resulting in mixed critical and player reviews. If such technical hurdles are not adequately addressed or if player retention remains low, it would solidify its position as a 'Dog'.

For instance, if a Nacon title experiences continued player churn, failing to build a sustainable community post-launch, it would be categorized as a 'Dog'. This scenario implies that the game is not generating sufficient revenue or engagement to justify ongoing development and marketing expenditure, especially when compared to Nacon's more successful 'Stars' or 'Cash Cows'.

- Low Player Retention: Games that fail to maintain an active player base after the initial launch period.

- Server and Optimization Issues: Persistent technical problems that detract from the player experience.

- Mixed or Negative Reviews: Critical and user feedback that indicates a failure to meet player expectations.

- Resource Drain: Titles that require ongoing investment in support and updates without yielding commensurate financial returns.

Nacon's 'Dogs' represent products with low market share and minimal growth potential, often requiring careful management to avoid becoming a drain on resources. These are typically older titles or accessories that have been surpassed by newer offerings or simply failed to gain significant traction in a competitive market.

For example, if Nacon's 2024 financial reports indicate that a particular game title, released in 2022, is generating less than 0.5% of the company's total gaming revenue and has seen a year-on-year decline in active players exceeding 15%, it would be a strong candidate for the 'Dog' category. Similarly, accessory lines that haven't been updated in several years and show declining sales figures would also fit this classification.

The challenge with these 'Dogs' lies in their inability to generate substantial returns while still potentially consuming marketing and support resources. Nacon must strategically decide whether to divest from these products, invest in a revitalization effort, or simply let them fade out to reallocate capital to more promising segments of their portfolio.

The crowded nature of the gaming market, with over 12,000 new titles released on platforms like Steam in 2023 alone, exacerbates the 'Dog' problem. Titles that don't stand out due to unique gameplay, strong IP, or effective marketing are highly susceptible to becoming 'Dogs' quickly, struggling to capture even a small slice of market share.

| Product Category | Market Share (Estimated) | Growth Potential | Nacon Example (Hypothetical) |

|---|---|---|---|

| Older Game Titles | < 2% | Low / Declining | A racing game released in 2019 with no significant post-launch updates. |

| Legacy Accessories | < 1% | Very Low | A gaming headset model from 2020 that has been discontinued by competitors. |

| Underperforming New Releases | < 5% (post-launch) | Limited | A title launched in late 2024 that received mixed reviews and failed to build a strong player base. |

Question Marks

New intellectual property (IP) games like Hell is Us and Dragonkin: The Banished are poised to enter the adventure and fantasy genres, which are seeing considerable growth. Hell is Us is slated for a September 2025 release, and Dragonkin: The Banished is expected in the second half of fiscal year 2025/26. These titles, representing significant development investments, currently hold no market share, placing them in the Question Mark category of the BCG Matrix.

Their future trajectory depends heavily on market reception and adoption. To move towards becoming Stars, these games will need robust marketing campaigns and positive critical reviews. For instance, the global video game market was valued at approximately $225 billion in 2023 and is projected to reach $379 billion by 2030, highlighting the potential, but also the competition, within these genres.

Nacon's upcoming Cthulhu Mythos titles, The Mound: Omen of Cthulhu (2025) and The Cosmic Abyss (2026), are positioned as Question Marks in the BCG Matrix. These games target a specific horror and adventure niche, a segment that has seen steady growth in recent years, with the global video game market projected to reach $229 billion by 2024.

Currently, these titles hold zero market share, reflecting their nascent stage and speculative nature. Their success hinges on strong player reception and effective marketing campaigns by Nacon, which will determine if they can transition from Question Marks to Stars in the future.

The REVOSIM range of premium racing accessories, launched in June 2025, is positioned as a Star within Nacon's BCG Matrix. This new product line targets the rapidly expanding sim-racing market, a segment experiencing significant growth and innovation. While its current market share is understandably low due to its recent introduction, the substantial investment in marketing, distribution, and brand building aims to solidify its position and capture a greater portion of this lucrative market.

Future WRC License Games (2027-2032)

Nacon's acquisition of exclusive World Rally Championship (WRC) game rights from 2027 to 2032 positions these future titles as potential stars in the BCG matrix. While these games are not yet released and thus have no current market share, their exclusive nature in a popular genre signifies substantial future growth potential.

The investment required for development and marketing of these new WRC titles will be significant, reflecting their status as high-potential, yet unproven, ventures. By 2024, the global esports market was valued at over $1.5 billion, highlighting the lucrative nature of competitive gaming.

- Future WRC Games (2027-2032): Designated as Stars due to exclusive rights and high growth potential in the racing/esports genre.

- Current Market Share: Zero, as development and release are pending.

- Investment Requirement: High, necessary for development and market penetration.

- Strategic Importance: Secures a long-term asset in a popular and growing entertainment sector.

Diversified New Releases in 2025/26 Lineup

Nacon's 2025/26 lineup features over 10 diverse new game releases, aiming to capture market share in high-growth genres. Titles like Edge of Memories, Styx: Blades of Greed, Rennsport, and Endurance Motorsport Series are positioned as new entrants with currently low market share.

These new releases are considered Question Marks in the BCG matrix. Their future success hinges on gaining traction with players. For instance, the racing genre, where Rennsport and Endurance Motorsport Series operate, saw significant growth in 2023, with the global market valued at approximately $10 billion and projected to expand further.

- New Market Entrants: Over 10 new titles launched in 2025/26.

- Low Initial Market Share: These games are starting from a low base.

- Genre Focus: Success depends on resonating within genres like action, RPG, and racing.

- Investment Needs: Significant marketing and development investment is crucial to elevate their market position.

Question Marks represent Nacon's new ventures with low market share but high growth potential. These are speculative investments requiring substantial funding for development and marketing. Their success depends on market acceptance and strategic positioning to potentially become Stars.

Nacon's upcoming titles like Hell is Us and Dragonkin: The Banished, along with Cthulhu Mythos games, are prime examples of Question Marks. These games are new entrants in growing genres, currently holding no market share. The global video game market was valued at approximately $225 billion in 2023, indicating significant opportunity but also fierce competition for these unproven titles.

The REVOSIM racing accessories, despite being a new launch in June 2025, are positioned as Stars due to their targeting of the rapidly expanding sim-racing market. While their current market share is minimal, substantial investment aims to capture a larger segment of this lucrative industry. Similarly, future World Rally Championship (WRC) games, secured through exclusive rights from 2027-2032, are projected Stars, leveraging the popularity of esports, which was valued at over $1.5 billion in 2024.

| Nacon Product/Venture | BCG Category | Market Potential | Current Market Share | Investment Need |

|---|---|---|---|---|

| Hell is Us | Question Mark | High (Adventure/Fantasy) | Zero | High |

| Dragonkin: The Banished | Question Mark | High (Adventure/Fantasy) | Zero | High |

| The Mound: Omen of Cthulhu | Question Mark | Moderate (Horror/Adventure) | Zero | High |

| The Cosmic Abyss | Question Mark | Moderate (Horror/Adventure) | Zero | High |

| REVOSIM Accessories | Star | High (Sim-Racing) | Low (New Launch) | High |

| Future WRC Games (2027-2032) | Star (Projected) | Very High (Esports/Racing) | Zero (Future Release) | Very High |

| Edge of Memories, Styx: Blades of Greed, Rennsport, Endurance Motorsport Series | Question Mark | High (Various Genres) | Low (New Entrants) | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.