Nacon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nacon Bundle

Nacon operates in a dynamic gaming market, facing significant pressures from intense rivalry and the constant threat of new entrants. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this landscape effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Nacon’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Nacon's reliance on component manufacturers for electronic parts, plastics, and metals means these suppliers can wield significant influence. The availability of alternative suppliers and the uniqueness of the components themselves are key factors determining this power. For instance, if a critical chip is only produced by a few companies, Nacon's bargaining position weakens considerably.

In 2024, global supply chain disruptions continued to affect the availability and pricing of electronic components. Companies like Nacon faced increased costs for semiconductors and other essential materials, a trend driven by ongoing demand and geopolitical factors. This situation generally elevates the bargaining power of suppliers who can meet these demands, especially those offering specialized or proprietary parts.

Nacon's video game publishing arm relies on independent game development studios and intellectual property (IP) holders as its suppliers. The leverage these developers possess hinges on the distinctiveness and projected success of their games, their studio's track record, and the market's appetite for their particular genres or IPs. For example, in 2024, successful indie titles often secure higher advance payments and more favorable royalty splits, reflecting their proven ability to attract players.

Nacon likely relies on external partners for manufacturing and assembly of its gaming peripherals. The influence these partners hold is largely tied to their production capacity, operational efficiency, adherence to quality benchmarks, and the general availability of comparable manufacturing services. If Nacon faces a scarcity of manufacturers that can meet its specific quality and cost requirements, these suppliers gain greater leverage.

Technology and Software Providers

Technology and software providers, such as those offering game engines or development tools, possess a degree of bargaining power. This power stems from the critical nature of their offerings and the expense involved in switching to different solutions. For instance, reliance on proprietary game engines like Unreal Engine or Unity can create lock-in effects, making it costly for game developers to migrate their projects.

The indispensability of specific software licenses, like operating systems or middleware for audio and connectivity in gaming accessories, also grants these suppliers leverage. The cost of switching is a significant factor; if a developer has built a game around a particular engine or toolset, the effort and financial outlay to retool for a competitor's offering can be substantial. In 2024, the continued dominance of major game engines means developers often face terms dictated by these powerful software entities.

- Indispensability of Technology: Game engines like Unity and Unreal Engine are foundational for many game development studios.

- Switching Costs: Migrating a complex game project from one engine to another can incur millions in development time and resources.

- Intellectual Property Rights: Software providers protect their technology through patents and licensing agreements, limiting alternatives.

Logistics and Distribution Services

Nacon relies heavily on logistics and distribution partners to ensure its gaming products reach consumers worldwide. The efficiency, global reach, and transportation costs offered by these service providers significantly shape their bargaining power. For instance, in 2024, the ongoing volatility in global shipping rates, influenced by factors like fuel prices and container availability, directly impacts Nacon's operational costs and the leverage held by logistics firms.

A concentrated market of highly reliable and specialized logistics providers can further amplify their bargaining power. If Nacon has limited alternatives for timely and secure delivery, especially for its physical game releases and hardware, these suppliers can command higher prices or more favorable terms. This is particularly relevant given the increasing complexity of international trade regulations and the need for specialized handling of electronics.

- Increased Shipping Costs: Global freight costs saw significant fluctuations in 2024, with some routes experiencing double-digit percentage increases compared to 2023, directly impacting Nacon's distribution expenses.

- Limited Provider Options: The market for specialized gaming logistics, particularly for international distribution, can be concentrated, giving key providers more leverage.

- Dependence on Network Efficiency: The effectiveness of a logistics provider's network in reaching diverse markets is a key factor in their bargaining power.

Suppliers to Nacon, particularly those providing critical electronic components and specialized manufacturing services, hold significant bargaining power. This is amplified when these suppliers have few direct competitors or when their products are highly differentiated, making it difficult for Nacon to find viable alternatives. In 2024, the continued strain on global supply chains for semiconductors meant that manufacturers of these essential parts could dictate terms more readily.

| Supplier Type | Factors Influencing Bargaining Power | Impact on Nacon |

|---|---|---|

| Component Manufacturers (Electronics) | Concentration of producers, uniqueness of parts, supply chain disruptions | Increased costs, potential production delays if critical components are scarce. In 2024, semiconductor shortages contributed to an average 15% increase in component costs for some electronics firms. |

| Game Development Studios/IP Holders | Success of titles, studio reputation, exclusivity of content | Higher royalty rates or advance payments for popular games, potentially limiting Nacon's profit margins. Successful indie games in 2024 often commanded upfront payments exceeding $1 million. |

| Manufacturing & Assembly Partners | Production capacity, quality control, specialized capabilities | Higher manufacturing fees if Nacon has limited options for high-quality production. Specialized assembly can cost 10-20% more than standard processes. |

| Logistics & Distribution Providers | Global reach, efficiency, shipping costs, specialized handling | Increased distribution expenses due to volatile shipping rates. Global freight costs saw a 25% year-over-year increase on average in early 2024 for certain routes. |

What is included in the product

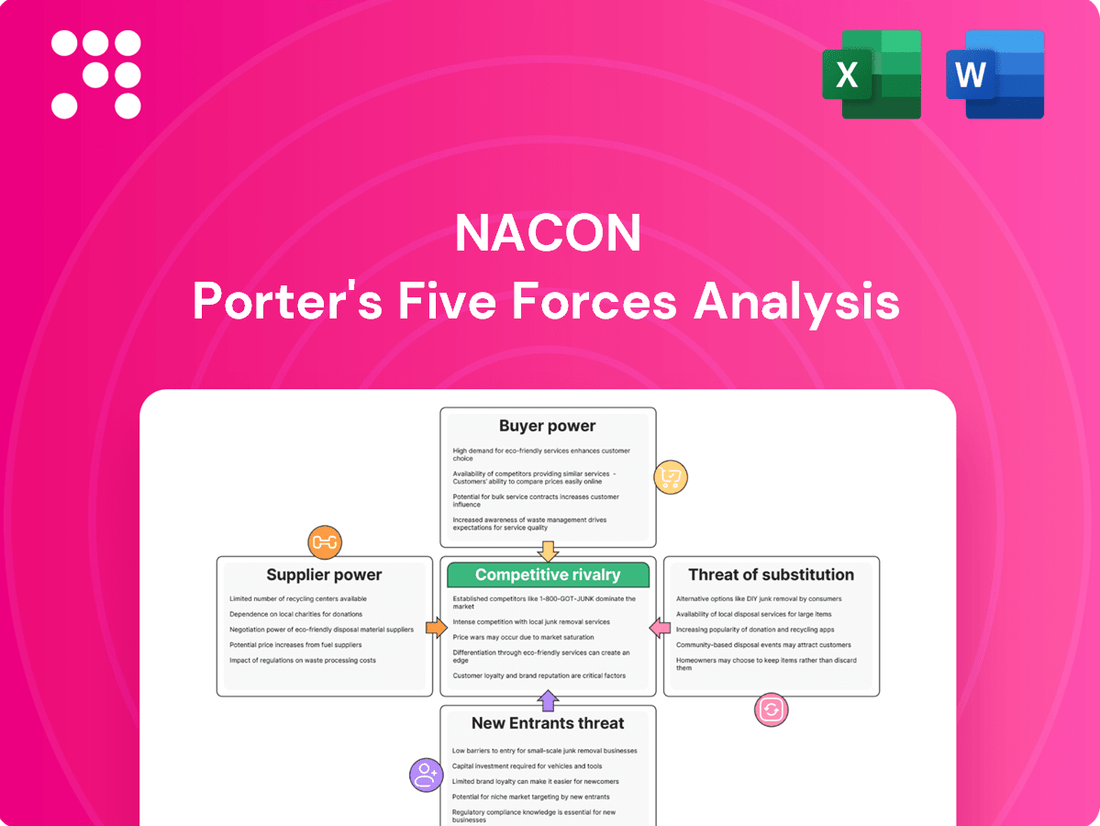

Nacon's Porter's Five Forces analysis dissects the competitive intensity within the gaming accessories and publishing market, examining supplier and buyer power, the threat of new entrants and substitutes, and the overall rivalry.

Effortlessly visualize competitive intensity and identify strategic vulnerabilities with intuitive, pre-built charts.

Customers Bargaining Power

Individual gamers, Nacon's end-consumers, form a highly fragmented market. This fragmentation inherently grants them significant bargaining power. With a vast array of gaming accessories and titles available from numerous competitors, gamers can easily switch brands if Nacon's pricing or product offerings are not to their liking.

The bargaining power of these gamers is amplified by several factors. They are often price-sensitive, constantly seeking the best value for their money. Furthermore, switching costs are minimal; a gamer can readily purchase a controller or game from a different manufacturer without incurring substantial expense or effort. The widespread availability of online reviews and detailed product comparisons also empowers consumers, allowing them to make informed decisions and exert pressure on manufacturers like Nacon.

Large retail chains and online marketplaces wield considerable influence over Nacon. For instance, in 2024, major retailers like GameStop and Amazon continue to dominate physical and digital sales channels, respectively, allowing them to negotiate aggressively on pricing and promotional terms. Their ability to move substantial volumes of Nacon's products makes them essential partners, and they leverage this to secure advantageous deals.

These powerful intermediaries act as gatekeepers, directly connecting Nacon to the end-consumer. Their extensive customer bases mean that securing shelf space or prominent placement on online platforms is critical for Nacon's sales success. Consequently, these customers can demand concessions such as marketing support and favorable payment schedules, impacting Nacon's profitability and cash flow.

Platform holders like Sony, Microsoft, and Nintendo, along with PC storefronts such as Steam, wield considerable influence over game developers like Nacon. These entities act as gatekeepers to the player base, dictating terms for distribution and revenue sharing. For instance, console platform holders typically take a cut of around 30% from game sales, a standard that significantly impacts developer profitability.

Wholesalers and Resellers

Wholesalers and smaller resellers, while having less clout than major retailers, still possess bargaining power. Their ability to consolidate demand and extend Nacon's reach to numerous smaller shops allows them to negotiate for better pricing and terms. This is crucial for them to protect their own profit margins in a competitive distribution landscape.

These intermediaries often leverage their distribution networks to influence Nacon. For instance, if a wholesaler handles a significant portion of Nacon's sales in a particular region, they can demand more favorable payment terms or marketing support. In 2024, the ongoing consolidation in some wholesale sectors could further amplify this power for larger players.

- Demand Aggregation: Wholesalers and resellers act as aggregators, channeling demand from many small retailers to Nacon, which gives them leverage.

- Distribution Reach: Their networks are essential for Nacon to access a broader market, especially in regions with fragmented retail landscapes.

- Margin Sensitivity: Like larger retailers, these intermediaries are highly sensitive to their profit margins and will push for pricing concessions.

- Competitive Landscape: The presence of alternative suppliers for similar gaming accessories can empower wholesalers and resellers to seek better deals from Nacon.

Subscription Service Providers

The increasing prevalence of gaming subscription services like Xbox Game Pass and PlayStation Plus significantly impacts Nacon's bargaining power with these platforms. These services act as substantial customers, negotiating licensing terms for Nacon's published titles to be featured in their extensive game libraries.

The sheer volume of subscribers these services command, often in the tens of millions, grants them considerable leverage. For instance, as of early 2024, Xbox Game Pass reportedly boasts over 34 million subscribers, while PlayStation Plus has a substantial user base as well, though specific consolidated figures are less frequently updated. This massive reach allows these platforms to influence pricing and content inclusion terms, potentially reducing Nacon's direct revenue per game compared to traditional sales models.

- Massive Subscriber Bases: Services like Xbox Game Pass (over 34 million subscribers as of early 2024) and PlayStation Plus represent a concentrated customer base with significant demand for diverse game content.

- Content Discovery Engine: These platforms act as powerful discovery tools for games, driving player engagement and potentially increasing a game's overall visibility and player base, which can be leveraged in negotiations.

- Licensing Fee Negotiation: The ability of these subscription services to negotiate licensing fees for game inclusion directly impacts Nacon's revenue streams and profit margins on games offered through these channels.

Nacon faces considerable bargaining power from its end-consumers, individual gamers, due to market fragmentation and low switching costs. This allows gamers to easily shift to competitors if pricing or offerings are unfavorable. Furthermore, gamers are often price-sensitive, actively seeking the best value, which intensifies this pressure.

Large retail chains and digital storefronts, such as Amazon and Steam, exert significant influence. In 2024, their substantial sales volumes enable them to negotiate aggressively on pricing and promotional terms, making them critical partners for Nacon's market access and sales success.

What You See Is What You Get

Nacon Porter's Five Forces Analysis

This preview displays the complete Nacon Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is precisely the same professionally formatted report you will receive immediately after completing your purchase. You can be confident that what you preview is your final deliverable, ready for immediate use without any alterations or placeholders.

Rivalry Among Competitors

The gaming accessories market is a crowded arena, with giants like Logitech, Razer, and SteelSeries consistently pushing the boundaries of innovation. Console makers themselves, such as Sony with its DualSense controllers and Microsoft with its Xbox Wireless Controllers, also present formidable competition, often setting the benchmark for quality and integration within their respective ecosystems. This intense rivalry means Nacon must not only match but exceed expectations in areas like product performance, aesthetics, and user experience to capture market share.

The video game publishing landscape is highly competitive, featuring giants like Electronic Arts and Activision Blizzard alongside a multitude of mid-tier companies and a burgeoning independent sector. This fragmentation means publishers constantly vie for crucial intellectual property, top development talent, and significant marketing reach to stand out. The market's reliance on blockbuster releases and rapid adaptation to player preferences intensifies this rivalry.

The gaming accessory and video game sectors are characterized by swift technological evolution and compressed product lifecycles. Competitors frequently launch updated models, enhanced features, and novel game content, compelling Nacon to allocate substantial resources to research and development alongside marketing efforts to maintain its market standing. This intense pressure to innovate rapidly and successfully is a primary catalyst for competitive rivalry within the industry.

Brand Loyalty and Ecosystems

While some gamers show loyalty to console makers or specific accessory brands, Nacon faces a landscape where it's generally easy for customers to switch. Competitors often use their established brand names, broad product ranges, and advertising to attract and keep players, which heats up the competition for market share.

The gaming accessory market, including brands like Nacon, sees intense competition from established players such as:

- Logitech G: Known for its wide range of gaming peripherals, Logitech G consistently invests in R&D and marketing, holding a significant market share.

- Razer: This brand is synonymous with high-performance gaming gear and boasts a strong community following, often leading in product innovation.

- Turtle Beach: A major player in gaming headsets, Turtle Beach benefits from strong brand recognition in its niche, often securing partnerships with game developers.

- SteelSeries: SteelSeries is recognized for its quality and performance, particularly among esports professionals, fostering a loyal customer base.

Pricing Pressure and Promotional Activities

The gaming accessories market, where Nacon operates, is characterized by intense competition, often leading to significant pricing pressure. With numerous brands offering similar functionalities, particularly for accessories, Nacon must constantly strive to maintain competitive pricing. This dynamic necessitates ongoing engagement in promotional activities, discounts, and bundled offers to capture customer attention and market share, directly impacting profit margins across both its hardware and software offerings.

In 2024, the gaming hardware market saw continued price sensitivity. For instance, while specific Nacon product margins aren't publicly detailed, industry trends indicate that aggressive pricing strategies are common. Competitors frequently employ sales events, such as Black Friday or seasonal promotions, to move inventory and attract new users. Nacon's need to participate in these activities, offering discounts that could range from 10% to 30% on popular items, directly squeezes potential profitability.

- Intense Competition: The gaming accessories sector features a high number of players, intensifying rivalry.

- Pricing Pressure: Similar product functionalities across brands force Nacon to offer competitive pricing.

- Promotional Necessity: Discounts, bundles, and sales events are crucial for customer acquisition and retention.

- Margin Impact: These activities can significantly affect Nacon's profit margins on both hardware and software.

The competitive rivalry within the gaming accessories market is fierce, with Nacon facing established giants like Logitech G, Razer, and SteelSeries. These competitors consistently invest in innovation and marketing, often holding substantial market share and strong brand loyalty. Nacon must therefore not only match but exceed industry standards in performance, design, and user experience to effectively compete for consumer attention and sales.

The intense competition leads to significant pricing pressure, as many brands offer accessories with similar functionalities. This necessitates Nacon's participation in frequent promotional activities, discounts, and bundled offers to attract and retain customers. Such strategies, while vital for market share, can directly impact profit margins across both hardware and software segments.

In 2024, the gaming hardware market continued to exhibit price sensitivity, with competitors frequently employing sales events. For example, discounts of 10% to 30% on popular items are common during major sale periods, directly affecting profitability for companies like Nacon.

| Competitor | Key Strengths | 2024 Market Focus |

|---|---|---|

| Logitech G | Broad product range, R&D investment | Performance-driven peripherals, esports integration |

| Razer | High-performance gear, strong community | Premium accessories, lifestyle branding |

| Turtle Beach | Gaming headsets, brand recognition | Audio solutions, developer partnerships |

| SteelSeries | Quality, performance, esports focus | Professional-grade equipment, loyal user base |

SSubstitutes Threaten

The primary threat to Nacon's video game business comes from a wide array of alternative entertainment forms. Consumers today have numerous choices for their leisure time and spending, ranging from streaming services like Netflix and Disney+ to social media platforms, traditional media such as movies and books, live sports, and even outdoor activities.

This broad competitive landscape means Nacon's games are not just competing with other video games but with any activity that captures a consumer's attention and disposable income. For instance, the global video game market, while robust, is just one slice of the larger entertainment pie, which also includes the booming streaming industry and the ever-present pull of social media engagement.

In 2024, the digital entertainment market continues its expansion, with consumers allocating significant portions of their budgets to various forms of media consumption. This intense competition for consumer attention and wallet share underscores the critical importance for Nacon to differentiate its offerings and deliver compelling value propositions to stand out against these numerous substitutes.

Generic or multi-purpose electronics like standard headphones or office keyboards can act as substitutes for Nacon's specialized gaming peripherals. These alternatives, while lacking gaming-specific features, appeal to casual gamers or budget-conscious consumers due to their lower price point and wider usability. For instance, the global market for standard computer peripherals, including keyboards and mice, is substantial, with many consumers opting for these versatile devices rather than dedicated gaming gear.

The burgeoning mobile gaming sector presents a considerable threat of substitutes, especially for casual players who are increasingly opting for touch-screen controls or basic accessories over specialized gaming gear. By late 2023, the global mobile gaming market was valued at over $100 billion, underscoring its massive appeal and reach.

Furthermore, the advancement of cloud gaming services is another potent substitute, potentially diminishing the demand for Nacon's high-end hardware and peripherals. These services allow users to stream games across various devices, bypassing the need for expensive local hardware and, by extension, the specialized accessories Nacon offers.

Free-to-Play Games and Subscription Models

The rise of free-to-play (F2P) games and subscription services presents a significant threat of substitutes for Nacon's premium-priced titles. These alternative models offer access to extensive game libraries with minimal or no upfront cost, directly competing for consumer entertainment budgets. For instance, services like Xbox Game Pass and PlayStation Plus provide hundreds of games for a monthly fee, making individual game purchases seem less appealing to budget-conscious players.

This trend is particularly impactful as the gaming industry saw continued growth in subscription revenue. In 2023, the global games subscription revenue was estimated to be around $10.9 billion, a figure projected to reach $13.1 billion by 2027. This highlights a clear shift in consumer preference towards access-based models over ownership of individual titles.

- Free-to-Play Dominance: F2P titles, often monetized through in-game purchases, attract a massive player base, potentially drawing attention and spending away from Nacon's full-price releases.

- Subscription Service Appeal: Services like Xbox Game Pass and PlayStation Plus offer a vast catalog of games for a recurring fee, diminishing the perceived value of buying individual premium games.

- Changing Consumer Habits: The increasing accessibility and affordability of subscription services are reshaping how consumers engage with gaming content, favoring broad access over single-title purchases.

- Impact on Premium Sales: As subscription services grow and F2P markets expand, Nacon faces pressure to justify the higher price point of its premium games, as consumers may opt for cheaper, more comprehensive alternatives.

Do-It-Yourself (DIY) or Open-Source Solutions

In specific niches, tech-savvy gamers might bypass traditional accessory purchases by opting for do-it-yourself (DIY) solutions or open-source software and hardware. This can range from custom-built PC components to self-programmed game modifications. While not a widespread threat, it does siphon off a segment of potential customers who prefer personalized, often lower-cost, alternatives to commercially produced gaming peripherals.

The impact of DIY and open-source substitutes, though currently limited, warrants attention. For instance, the open-source gaming community has seen growth, with projects like RetroArch offering emulation solutions that can reduce the need for specialized retro gaming hardware. In 2024, the global market for PC gaming hardware, a segment where DIY is more prevalent, was valued at approximately $60 billion, indicating a substantial market where such alternatives could gain traction.

- DIY and open-source solutions offer customizable and often cost-effective alternatives to commercial gaming accessories.

- While a smaller threat, these alternatives appeal to tech-savvy consumers seeking personalized gaming experiences.

- The growth of open-source projects and the DIY PC market highlights the potential for these substitutes to capture niche segments.

The threat of substitutes for Nacon is significant due to the vast array of entertainment options available. Beyond competing with other video games, Nacon's products face competition from streaming services, social media, traditional media, and even outdoor activities, all vying for consumer attention and disposable income. The global entertainment market is diverse, with consumers readily allocating budgets across these varied forms of leisure.

In 2024, the digital entertainment sector continues its robust expansion. Consumers are increasingly choosing subscription models and free-to-play games, which offer broad access to content at a lower upfront cost compared to Nacon's premium titles and hardware. This shift in consumer habits means Nacon must continually demonstrate superior value to retain its customer base against these more accessible alternatives.

Furthermore, generic electronics and cloud gaming services pose additional substitute threats. Standard peripherals lack gaming-specific features but appeal to budget-conscious users, while cloud gaming bypasses the need for dedicated hardware, potentially reducing demand for Nacon's specialized gaming accessories. The global market for standard computer peripherals alone is substantial, highlighting the broad appeal of multi-purpose devices.

| Substitute Category | Examples | Impact on Nacon | Market Context (2023-2024 Data) |

|---|---|---|---|

| Alternative Entertainment | Netflix, Disney+, Social Media, Live Sports | Diverts consumer attention and spending from gaming. | Global entertainment market valued in trillions; streaming services alone saw significant growth. |

| Gaming Business Models | Free-to-Play (F2P) Games, Subscription Services (e.g., Game Pass) | Reduces demand for premium-priced games and hardware by offering lower-cost access. | Global games subscription revenue reached ~$10.9 billion in 2023. F2P market continues to dominate player acquisition. |

| Generic Electronics | Standard Keyboards, Mice, Headphones | Appeals to casual or budget gamers, offering lower-cost alternatives to specialized gaming gear. | The global market for computer peripherals is extensive, with many consumers opting for versatile, less expensive options. |

| Cloud Gaming Services | GeForce Now, Xbox Cloud Gaming | Diminishes the need for high-end gaming hardware and accessories by enabling game streaming. | The cloud gaming market is projected to grow significantly, offering a compelling alternative for hardware-agnostic gamers. |

Entrants Threaten

Entering the video game publishing arena demands substantial financial investment. This includes funding the creation of games, executing robust marketing strategies, and negotiating distribution agreements. For instance, major AAA game development and marketing campaigns can easily exceed $100 million, a significant hurdle for newcomers.

Newcomers must contend with the inherent risk of funding projects with unpredictable revenue streams. Established publishers, boasting extensive financial resources and a catalog of proven intellectual properties (IPs), possess a distinct advantage. This financial muscle and brand recognition create a formidable barrier, making it challenging for new entities to gain traction and compete effectively.

The gaming accessories market is characterized by powerful, established brands that have cultivated significant customer loyalty and built extensive distribution channels. These incumbents, including Nacon, benefit from deep-rooted relationships with retailers, both physical and online, making it challenging for newcomers to gain traction.

For any new entrant aiming to compete, the barrier to entry is substantial. Significant capital investment is required not only for product development and manufacturing at scale but also for building brand awareness and securing prime placement in a crowded marketplace. For instance, in 2024, the global gaming accessories market was valued at approximately $15 billion, with major players like Sony and Microsoft holding considerable market share, underscoring the dominance of established entities.

For game publishing, securing compelling intellectual property and attracting experienced game development talent are critical barriers to entry. Established publishers like Nacon, which operates under the umbrella of Bigben Interactive, benefit from existing relationships and a proven track record. This makes it significantly harder for new entrants to acquire top-tier game projects and secure the creative teams needed to develop them.

Regulatory Hurdles and Platform Access

New entrants face significant regulatory challenges. For instance, hardware accessories must comply with safety standards, while game publishers must adhere to content rating systems like ESRB or PEGI. These requirements add complexity and cost, acting as a barrier to entry.

Access to key distribution channels is another major hurdle. Companies aiming to publish games must gain approval from console manufacturers like Sony (PlayStation), Microsoft (Xbox), and Nintendo, as well as PC storefronts such as Steam. These platforms have stringent technical and business requirements, often favoring established players.

In 2024, the cost of obtaining necessary certifications for hardware can range from thousands to tens of thousands of dollars, depending on the product's complexity and target markets. Similarly, securing placement on major digital storefronts often involves revenue-sharing agreements and adherence to platform-specific guidelines, which can be difficult for smaller, new companies to meet.

- Regulatory Compliance Costs: Hardware certification can cost $5,000-$50,000+ in 2024.

- Platform Gatekeeping: Console and PC storefronts require technical and business vetting, limiting new publisher access.

- Content Rating Fees: Game rating submissions incur fees, adding to initial operational expenses for new entrants.

Economies of Scale and Experience Curve

Incumbent companies like Nacon leverage significant economies of scale in areas such as manufacturing and procurement, which directly impacts their cost structure. For instance, their larger production volumes allow for lower per-unit costs for components and finished goods. This cost advantage makes it challenging for new entrants to match pricing without sacrificing profitability.

Nacon also benefits from an established experience curve, accumulating knowledge in efficient supply chain management and effective marketing strategies over time. This accumulated expertise translates into smoother operations and better-targeted campaigns, which are difficult for newcomers to replicate quickly. By 2024, Nacon's established market presence and operational efficiencies, honed over years, present a formidable barrier.

- Economies of Scale: Nacon's large-scale production in gaming accessories can reduce per-unit manufacturing costs significantly compared to smaller, new operations.

- Experience Curve: Years of experience in the gaming market allow Nacon to optimize supply chains and marketing, leading to greater efficiency and lower operational costs.

- Cost Disadvantage for Entrants: New competitors face higher initial costs for establishing manufacturing, securing suppliers, and building brand recognition, making it harder to compete on price.

- Market Knowledge: Nacon's deep understanding of consumer preferences and market trends, gained through experience, provides a competitive edge that new entrants must invest heavily to acquire.

The threat of new entrants in the video game sector is significantly mitigated by substantial capital requirements for game development, marketing, and distribution, with AAA titles often costing over $100 million. Established players like Nacon benefit from strong brand recognition, existing intellectual property, and deep financial reserves, creating a formidable barrier for newcomers. Furthermore, gaining access to crucial distribution channels, such as console manufacturers and major PC storefronts, involves stringent vetting processes and revenue-sharing agreements, favoring incumbents.

New entrants face considerable hurdles in securing intellectual property and attracting skilled development talent, areas where established publishers possess an advantage through existing relationships. Regulatory compliance, including hardware safety standards and game content ratings, adds complexity and cost. In 2024, hardware certification alone could cost tens of thousands of dollars, while platform gatekeeping by storefronts further limits access for smaller companies.

| Barrier Type | Description | 2024 Impact/Example |

|---|---|---|

| Capital Requirements | High costs for game development, marketing, and distribution. | AAA game budgets exceeding $100 million. |

| Brand Loyalty & IP | Established brands and proven intellectual property create customer preference. | Nacon's existing catalog and brand recognition. |

| Distribution Access | Need for approval from console manufacturers and digital storefronts. | Stringent requirements from Sony, Microsoft, Nintendo, and Steam. |

| Regulatory Compliance | Adherence to safety standards and content rating systems. | Hardware certification costs $5,000-$50,000+; content rating fees. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research from firms like Gartner and IDC, and publicly available financial filings from regulatory bodies such as the SEC.