MusclePharm Corp. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MusclePharm Corp. Bundle

MusclePharm Corp. faces a dynamic market, with its strong brand recognition and diverse product line presenting significant strengths. However, potential challenges like intense competition and evolving consumer preferences necessitate a closer look.

Want the full story behind MusclePharm's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

MusclePharm's diversified product portfolio is a significant strength, spanning sports nutrition, weight management, and general health categories. This broad offering allows the company to appeal to a wider customer base, reducing dependency on any single market segment. For instance, in 2023, MusclePharm reported net sales of $177.3 million, with their Bodybuilding.com partnership contributing to their strong performance in the sports nutrition sector, while their expansion into general health supplements like collagen and vitamins taps into growing consumer wellness trends.

MusclePharm Corp.'s multi-channel distribution strategy is a significant strength, encompassing online retailers, specialty stores, and direct-to-consumer (DTC) sales. This diversified approach broadens market reach, making their products accessible to a wider consumer base.

By leveraging e-commerce platforms and investing in DTC capabilities, MusclePharm aligns with the burgeoning online sales trend within the sports nutrition sector. This strategy proved beneficial in 2023, with online sales continuing to be a dominant channel for supplement purchases, reflecting a sustained consumer shift towards digital convenience.

MusclePharm's core strength lies in its commitment to science-backed supplements. This focus directly addresses the increasing consumer demand for products with proven efficacy and research-backed ingredients, a trend that gained significant momentum leading into 2024 and is projected to continue.

By emphasizing scientific validation, MusclePharm cultivates consumer trust and differentiates itself in a crowded market. This strategy positions the company to capture a larger share of the health-conscious consumer base actively seeking reliable and effective nutritional support.

Strong Brand Recognition (Historical)

MusclePharm's legacy brand recognition in sports nutrition, built over years, remains a significant asset. Despite recent sales shifts under new ownership, this historical strength offers a foundation for re-engaging consumers. For instance, in 2023, while FitLife Brands experienced a revenue decline, the MusclePharm brand still held considerable awareness within its target demographic, a testament to its past market penetration.

This established brand equity can be leveraged to rebuild trust and attract customers seeking familiar, trusted products. The challenge lies in revitalizing this recognition to align with current market demands and competitive offerings.

- Historical Brand Strength: MusclePharm cultivated a strong presence in the sports nutrition sector for many years.

- Consumer Awareness: Despite recent changes, the brand name still resonates with a segment of the market.

- Foundation for Rebuilding: This legacy recognition provides a starting point for re-establishing customer loyalty.

Leveraging Growth in Sports Nutrition Market

MusclePharm is well-positioned to benefit from the robust expansion of the global sports nutrition market. This sector is anticipated to surpass $53 billion by 2025 and is projected to reach around $94 billion by 2033, indicating significant upward momentum.

The company can leverage this growth by tapping into several key trends:

- Increasing Health Consciousness: Consumers are more aware of the link between nutrition and overall well-being, driving demand for sports nutrition products.

- Rise in Fitness Engagement: A growing number of individuals are participating in fitness activities, from casual gym-goers to professional athletes, all seeking to enhance their performance and recovery.

- Demand for Performance and Recovery Products: There's a consistent and growing need for products that aid in muscle repair, energy replenishment, and overall athletic performance enhancement.

- Market Expansion: The sports nutrition market's projected trajectory suggests ample opportunities for companies like MusclePharm to increase market share and revenue.

MusclePharm's diversified product portfolio is a significant strength, spanning sports nutrition, weight management, and general health categories, appealing to a wider customer base. For instance, in 2023, MusclePharm reported net sales of $177.3 million, with their Bodybuilding.com partnership contributing to their strong performance in the sports nutrition sector.

The company's multi-channel distribution strategy, including online retailers, specialty stores, and direct-to-consumer (DTC) sales, broadens market reach, making products accessible to a wider consumer base, aligning with the burgeoning online sales trend.

MusclePharm's commitment to science-backed supplements addresses the increasing consumer demand for products with proven efficacy and research-backed ingredients, a trend that gained significant momentum leading into 2024.

Legacy brand recognition in sports nutrition provides a foundation for re-engaging consumers, with the brand name still resonating with a segment of the market, offering a starting point for re-establishing customer loyalty.

MusclePharm is well-positioned to benefit from the robust expansion of the global sports nutrition market, anticipated to surpass $53 billion by 2025, driven by increasing health consciousness and a rise in fitness engagement.

What is included in the product

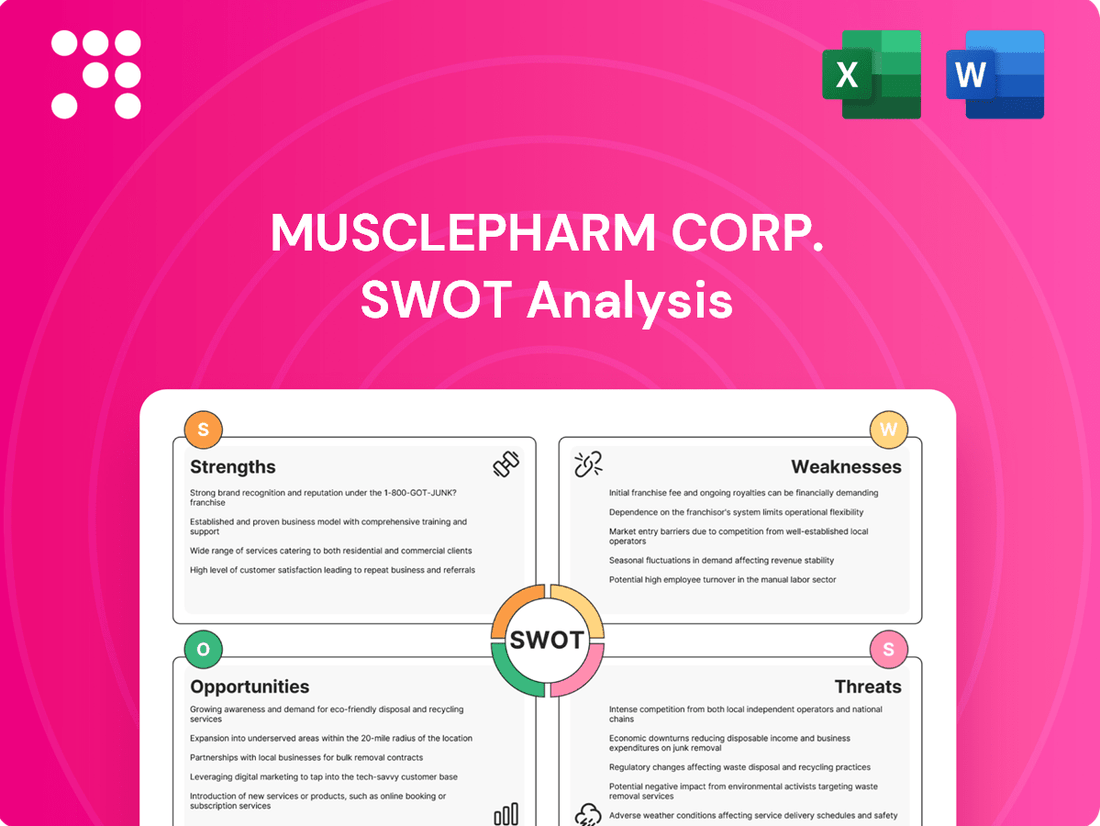

Offers a full breakdown of MusclePharm Corp.’s strategic business environment, examining its internal strengths and weaknesses alongside external market opportunities and threats.

MusclePharm Corp.'s SWOT analysis offers a clear roadmap to navigate competitive pressures and capitalize on emerging market opportunities.

Weaknesses

MusclePharm's FitLife Brands segment has experienced a notable revenue decline. In the first quarter of 2025, this segment brought in just under $2.0 million, marking a 6% decrease compared to the same period in the prior year.

Furthermore, the segment saw a substantial 30% sequential drop in revenue from the fourth quarter of 2024 to the first quarter of 2025. This trend highlights persistent challenges in boosting sales and achieving a positive recovery following the acquisition.

MusclePharm has historically faced challenges with product line extension creep, a strategy that saw the brand venturing into numerous off-brand trends. This approach risked diluting its core identity and weakening its emotional connection with consumers, a critical factor in the highly competitive sports nutrition market.

This broad expansion can lead to a lack of clear brand positioning. For instance, in the first quarter of 2024, MusclePharm reported net sales of $42.1 million, a slight decrease from $42.6 million in the prior year's quarter, suggesting that the market may not fully embrace every new product introduction.

MusclePharm is encountering hurdles in rebuilding its wholesale connections. Despite FitLife Brands' efforts to reconnect with past and present wholesale clients, this endeavor demands time and a careful selection of products that resonate with these retail partners.

This indicates a potential delay in fully capitalizing on established retail distribution networks, impacting MusclePharm's reach in traditional brick-and-mortar sales channels.

High Product Costs and Premium Pricing Perception

MusclePharm's premium pricing strategy, while aiming for higher margins, can be a significant hurdle, especially for the middle-income consumer segment. This higher cost can limit widespread adoption of their sports nutrition products.

Furthermore, a lingering perception within the market that sports nutrition is solely for elite athletes or professional bodybuilders may inadvertently shrink the potential customer base for MusclePharm. This perception needs to be actively addressed to broaden appeal.

For instance, in the first quarter of 2024, MusclePharm reported a gross profit margin of 31.2%, indicating the cost of goods sold remains a substantial factor in their pricing structure. This aligns with the challenge of maintaining competitive pricing in a crowded market.

- High Product Costs: Premium pricing can deter price-sensitive consumers.

- Perception Barrier: Sports nutrition often seen as niche, limiting broader market reach.

- Competitive Landscape: Competitors may offer more accessible price points.

Intense Competition in the Supplement Market

MusclePharm operates within a fiercely competitive landscape, facing established players and a constant influx of new brands in the dietary supplement and sports nutrition sectors. This crowded market, characterized by increasing product variety, presents a significant hurdle for the company in carving out and retaining its market share. For instance, the global sports nutrition market was valued at approximately $57.7 billion in 2023 and is projected to grow, highlighting the intense battle for consumer attention and dollars.

The sheer volume of competitors means MusclePharm must continually innovate and differentiate its offerings to stand out. This intense rivalry can also put pressure on pricing strategies, potentially impacting profit margins. Given MusclePharm's recent financial performance, this competitive pressure becomes an even more critical weakness to address.

- High Market Saturation: The supplement industry is crowded with many brands, making it difficult to capture consumer attention.

- Price Sensitivity: Intense competition often leads to price wars, potentially eroding profitability for companies like MusclePharm.

- Innovation Demands: Competitors are constantly launching new products, requiring significant R&D investment to keep pace.

- Brand Loyalty Challenges: Consumers may switch brands easily in a market with abundant choices and aggressive marketing.

MusclePharm's FitLife Brands segment continues to struggle, reporting a 6% revenue decrease in Q1 2025 compared to the previous year, bringing in just under $2.0 million. This follows a significant 30% sequential drop from Q4 2024, indicating ongoing challenges in sales recovery post-acquisition.

The company's past strategy of extensive product line extensions, venturing into numerous off-brand trends, may have diluted its core identity and weakened consumer connection. This broad expansion risks a lack of clear brand positioning, as evidenced by a slight overall net sales decrease from $42.6 million to $42.1 million in Q1 2024 year-over-year.

Rebuilding wholesale relationships is proving difficult, requiring time and careful product selection to regain traction with retail partners. This slow progress impacts MusclePharm's ability to leverage established distribution networks and reach consumers through traditional brick-and-mortar channels.

MusclePharm's premium pricing strategy, while aiming for higher margins, can limit its appeal to middle-income consumers. Additionally, the perception that sports nutrition is only for elite athletes restricts the potential customer base, a challenge exacerbated by a Q1 2024 gross profit margin of 31.2% which suggests significant cost of goods sold.

| Segment | Q1 2025 Revenue | YoY Change | QoQ Change |

|---|---|---|---|

| FitLife Brands | ~$2.0 million | -6% | -30% |

| Overall Net Sales (Q1 2024) | $42.1 million | -1.2% (vs. Q1 2023) | N/A |

| Gross Profit Margin (Q1 2024) | 31.2% | N/A | N/A |

Full Version Awaits

MusclePharm Corp. SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive look at MusclePharm Corp.'s Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The demand for personalized nutrition is surging, with the global personalized nutrition market projected to reach $19.1 billion by 2027, growing at a CAGR of 13.5%. MusclePharm can capitalize on this by developing supplements tailored to specific dietary needs, fitness goals, and even genetic predispositions, offering a competitive edge.

Simultaneously, the plant-based food and beverage sector is experiencing robust expansion, with the global vegan food market expected to hit $31.4 billion by 2026. MusclePharm has a significant opportunity to innovate and broaden its product portfolio with high-quality, plant-based protein powders and other supplements to capture this expanding consumer base.

MusclePharm can tap into the growing consumer demand for convenient and easy-to-consume products by expanding its offerings into new delivery formats. The market for gummies, melts, effervescent tablets, powders, and ready-to-drink (RTD) beverages is experiencing significant growth, with consumers actively seeking alternatives to traditional pills and capsules.

For instance, the global sports nutrition market, which includes these formats, was valued at approximately $57.9 billion in 2023 and is projected to reach $83.3 billion by 2030, growing at a compound annual growth rate (CAGR) of 5.4% according to some market analyses. This presents a substantial opportunity for MusclePharm to innovate and capture market share by introducing products in these popular and accessible forms.

MusclePharm can capitalize on the booming e-commerce and direct-to-consumer (DTC) landscape to connect directly with its customer base. This strategic shift allows for greater control over brand messaging and customer experience, potentially leading to increased loyalty and higher profit margins by cutting out intermediaries. For instance, the global e-commerce market was projected to reach $6.3 trillion in 2024, a significant arena for MusclePharm to expand its digital footprint.

By investing in search engine optimization (SEO) specifically tailored for health supplements, MusclePharm can ensure its products are discoverable by consumers actively seeking them online. Furthermore, aligning marketing campaigns with peak consumer interest periods, such as New Year's resolutions or pre-summer fitness drives, can significantly amplify online sales performance and market penetration.

Focus on Mental Wellness and Condition-Specific Solutions

The market is seeing a significant uptick in demand for supplements that boost mental clarity, build resilience, improve mood, and help manage stress. This trend is coupled with a growing interest in condition-specific innovations targeting immunity, brain health, heart health, and gut health. MusclePharm can capitalize on these trends by developing specialized product lines.

For instance, the global mental wellness market was valued at approximately $130 billion in 2023 and is projected to reach over $200 billion by 2028, showcasing substantial growth potential. MusclePharm could introduce nootropics for cognitive enhancement or adaptogen blends for stress relief.

- Mental Wellness Market Growth: Anticipated to exceed $200 billion by 2028, up from $130 billion in 2023.

- Condition-Specific Demand: Increasing consumer focus on immunity, brain, heart, and gut health supplements.

- Product Development Opportunity: MusclePharm can create targeted solutions for stress management, cognitive function, and overall well-being.

- Market Differentiation: Offering specialized products can help MusclePharm stand out in a crowded supplement industry.

Strategic Acquisitions and Partnerships

FitLife Brands, MusclePharm's parent company, is actively exploring mergers and acquisitions, with a focus on acquiring niche brands. This creates a significant opportunity for MusclePharm to strategically integrate smaller, innovative companies into its portfolio. Such acquisitions could bolster market share and introduce valuable new technologies or specialized ingredient knowledge.

For example, in 2024, the sports nutrition market saw continued consolidation, with companies like GNC reporting strategic partnerships aimed at expanding their product offerings. MusclePharm could leverage this trend by targeting brands with unique formulations or strong followings in emerging health categories, potentially boosting its revenue streams beyond current projections.

- Acquire niche brands to expand product lines.

- Integrate new technologies and ingredient expertise.

- Increase overall market share through strategic M&A.

MusclePharm can leverage the growing demand for personalized nutrition, with the market projected to reach $19.1 billion by 2027. Expanding into plant-based options, tapping into the $31.4 billion vegan food market by 2026, and developing convenient product formats like gummies and RTDs, which are part of the $57.9 billion global sports nutrition market in 2023, are key opportunities. Furthermore, capitalizing on the booming e-commerce landscape, with the global market projected for $6.3 trillion in 2024, and addressing the rising interest in mental wellness supplements, a market valued at $130 billion in 2023, present significant growth avenues.

| Opportunity Area | Market Size/Projection | Growth Driver | MusclePharm Action |

|---|---|---|---|

| Personalized Nutrition | $19.1 billion by 2027 | Demand for tailored health solutions | Develop customized supplement plans |

| Plant-Based Products | $31.4 billion (vegan food) by 2026 | Increasing consumer preference for veganism | Expand plant-based protein offerings |

| Convenient Formats (Gummies, RTDs) | Part of $57.9 billion sports nutrition market (2023) | Consumer preference for ease of use | Innovate in delivery systems beyond pills |

| E-commerce & DTC | $6.3 trillion global e-commerce market (2024 projection) | Shift to online purchasing | Strengthen direct-to-consumer channels |

| Mental Wellness Supplements | $130 billion market (2023) | Growing focus on cognitive and mood health | Introduce nootropics and stress-relief blends |

Threats

MusclePharm operates within the sports nutrition and dietary supplement sectors, which are subject to a complex web of global regulations. These rules cover everything from the safety of ingredients to how products are labeled and the health claims that can be made. For instance, the U.S. Food and Drug Administration (FDA) oversees dietary supplements, and changes in their enforcement or new guidelines can directly impact product development and marketing.

The constant evolution of these regulations presents a significant challenge. Amendments, such as potentially tighter restrictions on certain active ingredients or shifts in how 'healthy' claims are defined, could necessitate costly product reformulations or marketing adjustments for MusclePharm. Such changes can also introduce logistical hurdles in ensuring compliance across different international markets, potentially impacting sales and operational efficiency.

Geopolitical tensions and trade restrictions, such as those impacting global shipping and raw material sourcing, can significantly disrupt MusclePharm's supply chain. For instance, in early 2024, ongoing conflicts in Eastern Europe continued to affect energy prices and transportation costs, indirectly impacting the cost of many chemical and agricultural inputs used in sports nutrition products. This volatility in ingredient availability and pricing directly pressures profit margins and the affordability of MusclePharm's product lines, underscoring the need for robust cost management strategies.

The proliferation of counterfeit MusclePharm products poses a significant threat, undermining consumer confidence and damaging the brand's hard-earned reputation. This issue is particularly concerning in the sports nutrition industry, where ingredient efficacy and safety are paramount. For instance, a 2024 report by the International Chamber of Commerce estimated that the global trade in fake goods could reach $4.2 trillion by 2022, highlighting the widespread nature of this problem.

MusclePharm must actively combat this by implementing robust quality assurance protocols and investing in technologies that verify product authenticity, such as secure packaging or blockchain-based tracking systems. Failure to address counterfeiting can lead to decreased sales and a loss of market share to illegitimate competitors, impacting revenue streams and overall profitability.

Intense Competition and Market Saturation

The sports nutrition sector is incredibly crowded, with many well-known brands and a constant stream of new companies entering the fray. This dynamic leads to a wide variety of products and intense promotional efforts from all sides. For MusclePharm, this means a constant challenge to stand out and keep its profit margins healthy.

Market saturation in specific product categories further complicates matters. For instance, the protein powder segment, a core area for many sports nutrition companies, saw a growth rate of approximately 8-10% in 2023, but with a very high number of competing brands offering similar formulations. This makes it harder for MusclePharm to capture significant market share and maintain premium pricing without substantial innovation or marketing investment.

- High number of established brands like Optimum Nutrition, Bodybuilding.com, and GNC.

- Emergence of direct-to-consumer (DTC) brands that bypass traditional retail channels.

- Price wars and promotional activities impacting overall industry profitability.

- Difficulty in product differentiation due to similar ingredient profiles and marketing messages.

Shifting Consumer Preferences and Brand Loyalty

MusclePharm faces a significant threat from shifting consumer preferences. The market is seeing a strong move towards personalized nutrition, clean-label ingredients, and ethically sourced products. For instance, a 2024 report indicated that 65% of consumers are actively seeking products with transparent ingredient lists, and 50% are willing to pay a premium for sustainable options. Failure to quickly align with these evolving demands could see MusclePharm lose ground to competitors who are more responsive to consumer values.

Brand loyalty is also becoming more fluid. As consumers prioritize these new values, their allegiance can shift rapidly if a brand doesn't demonstrably meet their expectations. MusclePharm needs to actively rebuild emotional connections by showcasing its commitment to these emerging trends. Without this adaptation, the company risks ceding market share to more agile competitors who are already capturing consumer interest through authentic engagement with health-conscious and sustainability-minded buyers.

The challenge is amplified by the speed at which consumer tastes can change. What is popular today might be overlooked tomorrow. MusclePharm's ability to innovate and communicate its adaptation to these preferences will be critical. For example, in early 2025, several emerging brands saw significant growth by launching product lines specifically highlighting plant-based ingredients and reduced sugar content, directly addressing consumer demand for healthier alternatives.

MusclePharm operates in a highly competitive and regulated industry, facing threats from evolving government policies, geopolitical instability impacting supply chains, and the pervasive issue of product counterfeiting. The company must navigate stringent regulations, potential ingredient restrictions, and the rising costs associated with global trade disruptions. Furthermore, the proliferation of fake products erodes consumer trust and brand reputation, necessitating robust anti-counterfeiting measures.

SWOT Analysis Data Sources

This MusclePharm Corp. SWOT analysis is built upon a foundation of credible data, including their official financial filings, comprehensive market research reports, and expert industry commentary to provide an accurate and insightful assessment.