MusclePharm Corp. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MusclePharm Corp. Bundle

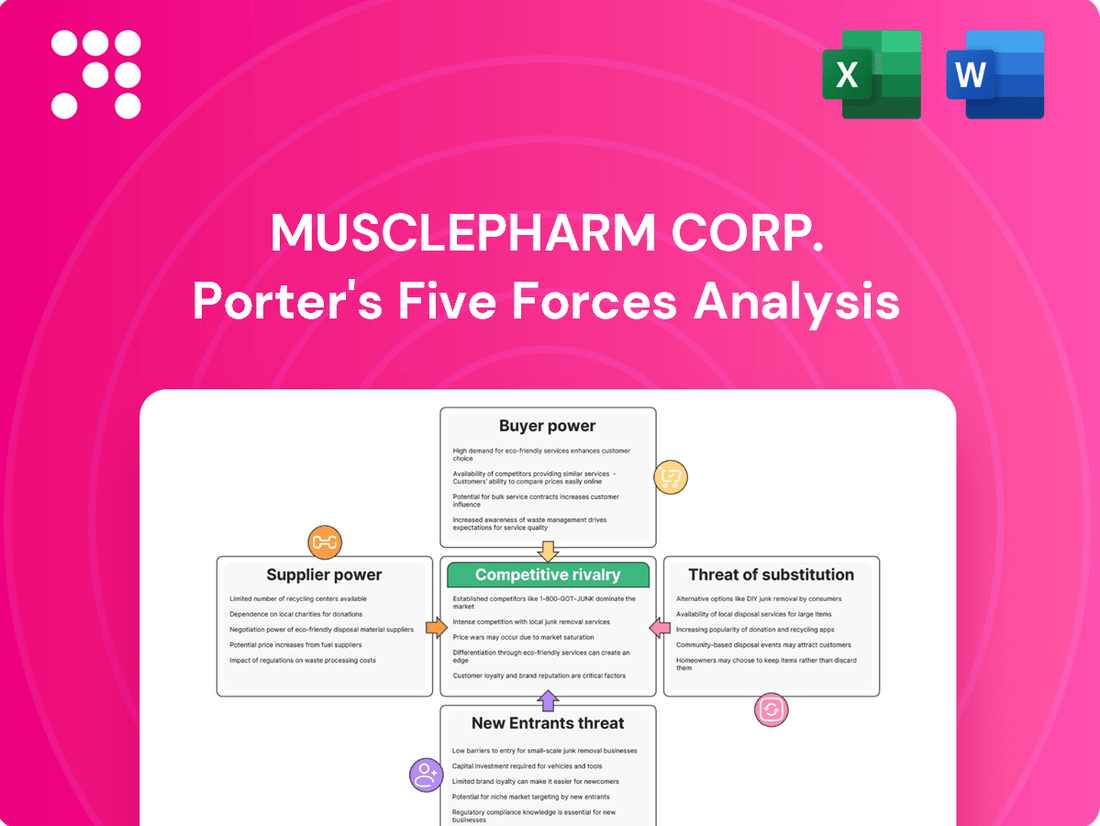

MusclePharm Corp. faces a dynamic competitive landscape, with moderate buyer power and a significant threat from new entrants due to relatively low barriers to entry in the supplement market. The intensity of rivalry is high, driven by numerous established brands and innovative product launches.

The complete report reveals the real forces shaping MusclePharm Corp.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The nutritional supplement industry, a significant market that saw global sales reach over $200 billion in 2023, heavily relies on a concentrated pool of high-quality ingredient suppliers. This dependency means these suppliers often hold considerable sway in price and contract negotiations.

MusclePharm, like its competitors, sources premium raw materials from these specialized providers. For instance, the availability of patented ingredients or unique protein isolates can be limited, increasing supplier leverage and potentially impacting MusclePharm's cost of goods sold.

The increasing consumer preference for natural, organic, and specialized ingredients in the health and wellness sector significantly bolsters supplier bargaining power. As companies like MusclePharm strive to meet these evolving demands, securing access to premium, niche ingredients becomes a competitive advantage, giving suppliers more leverage in pricing and terms.

When suppliers offer proprietary or unique ingredients, their bargaining power significantly increases. For instance, if a key ingredient in MusclePharm's science-backed supplements is only available from a single, patented source, that supplier can dictate higher prices. This exclusivity means MusclePharm has limited options for sourcing, directly impacting its cost of goods sold and potentially squeezing profit margins.

Regulatory and Quality Compliance Costs

Suppliers in the nutritional supplement industry face significant costs related to quality control and regulatory adherence. These expenses, often substantial, can be directly influenced by evolving standards from bodies like the FDA or international equivalents.

For manufacturers such as MusclePharm Corp., these compliance costs for suppliers translate into higher input prices. This is particularly true for specialized ingredients requiring rigorous testing and certifications, thereby strengthening the suppliers' leverage in negotiations.

- Increased Supplier Leverage: Suppliers who invest heavily in meeting stringent quality and regulatory demands gain a stronger negotiating position with buyers like MusclePharm.

- Pass-Through Costs: The financial burden of compliance, including advanced testing and certifications for ingredients, is often passed on to manufacturers, impacting product cost structures.

- Ingredient Specificity: Ingredients demanding extensive regulatory approval or unique quality certifications command higher prices, further empowering their suppliers.

Supply Chain Stability and Geopolitical Factors

Global supply chain stability and ongoing geopolitical events significantly influence the availability and cost of raw materials crucial for MusclePharm. While improvements were noted in supply chain operations throughout 2024, persistent challenges with freight costs continue to exert pressure. This situation can amplify the bargaining power of suppliers capable of ensuring consistent ingredient delivery, thereby impacting MusclePharm's production schedules and pricing strategies.

These factors can lead to:

- Increased input costs: Higher freight expenses and potential material shortages directly translate to higher costs for MusclePharm's raw materials.

- Supplier leverage: Suppliers who can navigate these disruptions effectively gain leverage, potentially dictating terms and pricing.

- Production delays: Inconsistent supply can lead to manufacturing slowdowns or halts, affecting MusclePharm's ability to meet market demand.

- Impact on profit margins: Unforeseen cost increases or production issues can squeeze MusclePharm's profit margins.

Suppliers in the nutritional supplement sector, especially those providing specialized or patented ingredients, wield significant bargaining power. This is amplified by the increasing consumer demand for premium, natural, and organic components, which limits the pool of viable suppliers for companies like MusclePharm. The global supply chain, while showing signs of improvement in 2024, still faces challenges like elevated freight costs, further empowering suppliers who can guarantee consistent delivery.

| Factor | Impact on MusclePharm | Supplier Leverage | 2024 Data Point/Trend |

| Ingredient Specialization | Higher cost of goods sold for unique/patented items | High for proprietary ingredients | Continued growth in demand for specialized protein isolates |

| Quality & Regulatory Compliance | Increased input costs due to supplier compliance expenses | Moderate to High for compliant suppliers | Ongoing stringent FDA regulations for supplement ingredients |

| Supply Chain Stability | Potential production delays and increased freight costs | Moderate for reliable suppliers | Freight costs remained elevated in early 2024, impacting raw material pricing |

What is included in the product

This analysis of MusclePharm Corp. reveals intense rivalry from established brands and emerging players, moderate buyer power due to brand loyalty, and significant threats from substitutes like whole foods.

MusclePharm Corp.'s Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making regarding competitive pressures.

Customers Bargaining Power

The sports nutrition market is incredibly crowded, with countless brands vying for consumer attention. In 2024, this intense competition means customers have a vast array of options, making it easy for them to shift their loyalty if they find a better deal or product elsewhere.

Switching between dietary supplement brands typically involves minimal effort and cost for consumers. This low barrier to entry for customers directly translates into increased bargaining power, as they can readily explore and adopt alternatives without significant financial or logistical hurdles.

MusclePharm faces growing customer power due to increasing health consciousness. Consumers now demand detailed information about ingredients, their origins, and scientific backing for product claims. This trend means customers expect higher quality, proven effectiveness, and ethical sourcing from supplement providers.

While consumers are increasingly prioritizing health and wellness, economic headwinds and the sheer volume of available products mean they remain quite price-sensitive. This means customers will closely compare MusclePharm's offerings against those of its competitors, weighing the perceived value. For instance, a survey in early 2024 indicated that over 60% of supplement buyers consider price a primary factor in their purchase decisions, directly impacting MusclePharm's ability to maintain premium pricing.

Multi-channel Distribution and Online Retailer Influence

MusclePharm's multi-channel distribution strategy, encompassing online retailers, specialty stores, and direct-to-consumer sales, significantly impacts customer bargaining power. The extensive reach of online marketplaces, especially Amazon, which was a major channel for MusclePharm's sales in 2024, grants these platforms considerable leverage. This influence translates to pressure on pricing and promotional activities, ultimately benefiting the end consumer.

- Online Retailer Dominance: Platforms like Amazon, a key sales driver for MusclePharm in 2024, dictate terms and often compete on price, empowering customers with more choices and better deals.

- Price Transparency: Online channels facilitate easy price comparison, forcing MusclePharm to remain competitive and potentially limiting its pricing flexibility.

- Promotional Leverage: Retailers can demand promotional support or co-op advertising, which, while a cost for MusclePharm, offers customers access to discounts and bundled offers.

- Customer Aggregation: Online retailers aggregate large customer bases, giving them a stronger negotiating position with suppliers like MusclePharm.

Growing Demand for Personalized and Targeted Solutions

Consumers are increasingly seeking out personalized nutrition and supplements. This means products tailored to individual health goals, genetic makeup, and daily routines are becoming more important. For instance, the global personalized nutrition market was valued at approximately $11.4 billion in 2023 and is projected to grow significantly, indicating a strong customer preference for customized offerings.

This growing demand for specificity places greater bargaining power in the hands of customers. They can more easily find and switch to brands that offer the precise solutions they need, forcing companies like MusclePharm to be highly responsive and innovative. Failure to adapt to these evolving consumer preferences can lead to a loss of market share.

- Rising Demand: Consumers want supplements designed for their unique needs.

- Market Growth: The personalized nutrition sector shows strong expansion.

- Customer Power: Specificity empowers buyers to choose niche providers.

- Innovation Imperative: Companies must continuously innovate to meet these demands.

Customers hold significant bargaining power in the sports nutrition market due to the abundance of choices and low switching costs. In 2024, consumers are well-informed, price-sensitive, and increasingly demand personalized products. This empowers them to easily compare offerings and shift allegiances, putting pressure on companies like MusclePharm to deliver value and innovation.

What You See Is What You Get

MusclePharm Corp. Porter's Five Forces Analysis

This preview provides a comprehensive Porter's Five Forces Analysis of MusclePharm Corp., detailing the competitive landscape and strategic positioning within the sports nutrition industry. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, offering actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The sports nutrition landscape is crowded, featuring a multitude of established giants and a constant influx of new brands. MusclePharm operates within this intensely competitive environment, facing rivals of all sizes, from global conglomerates to specialized startups, all vying for consumer attention and market share.

In 2024, the global sports nutrition market was valued at an estimated $62.5 billion, with projections indicating continued growth. This robust market size attracts a diverse range of competitors, including major players like Optimum Nutrition, Bodybuilding.com, and GNC, alongside innovative emerging brands that often focus on specific niches or ingredient trends.

The sports nutrition industry is a hotbed of innovation, with companies like MusclePharm needing to constantly adapt. In 2024, we're seeing a surge in new product formulations, incorporating ingredients like plant-based proteins, adaptogens, and functional mushrooms. Delivery formats are also diversifying, with ready-to-drink options and gummies gaining significant traction, forcing all players to keep pace with consumer demand.

MusclePharm faces fierce competition in the sports nutrition market, with rivals frequently launching aggressive marketing and promotional campaigns. These efforts often include extensive social media engagement, partnerships with prominent fitness influencers, and substantial advertising spend to capture consumer mindshare and boost sales. For instance, in 2024, major competitors were observed to allocate upwards of 15-20% of their revenue towards marketing initiatives.

To effectively counter this, MusclePharm must maintain a robust investment in advertising and promotion across both its wholesale distribution networks and direct-to-consumer online platforms. This sustained visibility is crucial for retaining brand relevance and competing head-to-head in a crowded marketplace. Failure to do so could result in a significant loss of market share to more heavily promoted brands.

Shift Towards Holistic Health and Lifestyle Integration

The competitive landscape for MusclePharm is intensifying as the market embraces a holistic view of health. Consumers are increasingly moving beyond simply treating ailments to proactively managing their well-being through integrated lifestyle choices. This means supplements are no longer standalone purchases but are woven into routines that prioritize exercise, nutrition, and mental wellness.

This shift demands that MusclePharm differentiate itself by championing a comprehensive wellness philosophy, not just product sales. Companies that successfully align with and promote this integrated approach will likely capture greater market share. For instance, a 2024 survey indicated that 65% of consumers consider the brand's commitment to overall healthy living when purchasing supplements, a notable increase from previous years.

- Market Trend: Growing consumer focus on proactive self-care and integrated healthy lifestyles, encompassing exercise, diet, and supplements.

- Competitive Imperative: MusclePharm must align with and actively promote a holistic wellness approach to stand out.

- Consumer Behavior: In 2024, a significant majority of consumers factored a brand's dedication to overall healthy living into their supplement purchasing decisions.

Regional and Global Market Dominance

While North America remains a core market, the sports nutrition landscape is undeniably global, with regions like Asia-Pacific experiencing particularly robust expansion. For MusclePharm, this presents a significant competitive hurdle.

Large, established multinational corporations already command a substantial share of the worldwide sports nutrition market. These giants, with their extensive distribution networks and brand recognition, pose a direct challenge to MusclePharm's aspirations for broader international reach and effective global competition.

- Global Market Share: In 2024, the global sports nutrition market was valued at approximately $62.5 billion, with projections indicating continued growth.

- Key Competitors: Major players like Nestlé (through its acquisition of The Bountiful Company), Glanbia, and PepsiCo (with its Quaker Oats and Gatorade brands) hold significant global market positions.

- Asia-Pacific Growth: The Asia-Pacific sports nutrition market is anticipated to grow at a CAGR exceeding 8% from 2024 to 2030, driven by increasing health consciousness and disposable incomes.

- MusclePharm's International Footprint: MusclePharm's international sales represented approximately 25% of its total revenue in 2023, highlighting the room for expansion against larger, more globally entrenched competitors.

The competitive rivalry within the sports nutrition sector is intense, characterized by a high number of players and aggressive strategies. MusclePharm faces direct competition from both global giants and nimble niche brands, all vying for consumer loyalty and market share.

In 2024, companies like Optimum Nutrition, Bodybuilding.com, and GNC continue to be significant forces, alongside emerging brands focusing on specialized ingredients or direct-to-consumer models. This crowded field necessitates continuous innovation and strong marketing to maintain relevance.

The market is further heated by frequent product launches and promotional activities. Competitors often allocate substantial portions of their revenue, sometimes 15-20% in 2024, to marketing and influencer partnerships to capture consumer attention.

Furthermore, the trend towards holistic wellness means brands must now integrate their offerings into broader lifestyle narratives, a shift that requires strategic positioning beyond just supplement sales. In 2024, 65% of consumers considered a brand's commitment to overall healthy living when making supplement purchases.

| Competitor | 2023 Revenue (Approx.) | Key Market Focus | 2024 Marketing Spend (Est.) |

| Optimum Nutrition | $1.5 Billion+ | Broad range of supplements, global | 15-20% of Revenue |

| Glanbia (Owner of Optimum Nutrition) | $4.5 Billion+ (Performance Nutrition Segment) | Diversified sports nutrition, global | Significant investment |

| Nestlé (The Bountiful Company) | $1 Billion+ (Sports Nutrition Segment) | Acquired brands, broad consumer health | Strategic marketing |

SSubstitutes Threaten

Consumers increasingly favor whole foods and balanced diets, viewing them as direct substitutes for nutritional supplements. This trend is particularly strong among health-conscious individuals who prioritize lifestyle changes, such as increased physical activity, over purchasing supplements. For instance, a 2024 survey indicated that over 60% of adults reported making significant dietary changes in the past year to improve their health, potentially reducing their reliance on products like those offered by MusclePharm.

The threat of substitutes for MusclePharm Corp. is significant, as the broader health and wellness market offers a wide array of alternative solutions. Consumers can opt for traditional gyms, specialized fitness classes like yoga or CrossFit, or even explore holistic remedies and personalized nutrition plans as substitutes for MusclePharm's protein powders and supplements.

For instance, the global digital fitness market alone was valued at approximately USD 15.2 billion in 2023 and is projected to grow substantially, indicating a strong consumer shift towards accessible and varied fitness solutions that bypass traditional supplement channels. This presents a clear competitive threat, as these alternatives cater to personalized health journeys and can be perceived as more holistic or effective by some consumers.

The increasing consumer preference for herbal and natural remedies poses a significant threat of substitution for MusclePharm's products. Many individuals are actively seeking holistic health solutions, driving growth in the natural products sector. For instance, the global herbal supplements market was valued at approximately $59.1 billion in 2023 and is anticipated to expand significantly in the coming years.

Functional Foods and Beverages

The expanding market for functional foods and beverages presents a significant threat of substitutes for traditional sports nutrition products. Consumers are increasingly seeking convenient ways to boost their nutrient intake, turning to items like protein bars, fortified smoothies, and specialty drinks. For instance, the global functional food market was valued at approximately $268 billion in 2023 and is projected to grow substantially, offering consumers alternatives to MusclePharm's core offerings.

These readily available food items can directly compete with ready-to-drink protein shakes and other supplement formats. As consumers prioritize convenience and holistic wellness, these functional food products offer a perceived simpler path to achieving nutritional goals. This trend is particularly noticeable in the snacking category, where protein-enriched snacks are gaining popularity as meal replacements or post-workout recovery options.

- Growth in Functional Foods: The global functional food market is a rapidly expanding sector, offering consumers diverse nutritional options beyond traditional supplements.

- Convenience as a Driver: Functional foods and beverages provide a convenient alternative for consumers looking to meet their protein and nutrient needs, directly impacting the demand for ready-to-drink supplements.

- Market Value: In 2023, the global functional food market was valued at around $268 billion, highlighting the significant scale of these substitute products.

- Consumer Preference Shift: A growing consumer preference for convenient, integrated nutritional solutions in everyday food items poses a threat to specialized sports nutrition brands.

Pharmaceuticals and Medical Interventions

For certain health concerns, pharmaceuticals or medical interventions can serve as direct substitutes for nutritional supplements. Consumers might opt for prescribed medications if they perceive them as more effective or essential for managing specific conditions, bypassing supplements altogether. This is particularly relevant for issues like severe nutrient deficiencies or chronic illnesses where medical treatments are the standard of care.

The perceived efficacy and regulatory backing of pharmaceuticals can make them a more attractive option for some consumers, especially when dealing with serious health issues. For instance, while MusclePharm offers products for muscle growth and recovery, individuals experiencing significant joint pain might turn to prescription anti-inflammatories or physical therapy rather than relying solely on supplements. This substitution dynamic is influenced by medical advice and the availability of proven treatment pathways.

- Pharmaceuticals offer targeted solutions for specific medical conditions, often with stronger clinical evidence than supplements.

- Consumers may choose prescription drugs over supplements for perceived greater efficacy or necessity in managing health issues.

- The medical community's recommendation plays a significant role in driving consumers toward pharmaceutical interventions.

- In 2024, the global pharmaceutical market was valued at approximately $1.6 trillion, indicating a substantial consumer preference for regulated medical treatments.

The threat of substitutes for MusclePharm is considerable due to the growing popularity of whole foods and balanced diets as primary sources of nutrition. Many consumers now view lifestyle changes like increased physical activity as sufficient, reducing their need for supplements. A 2024 survey found over 60% of adults modified their diet for health, potentially decreasing supplement reliance.

Beyond dietary shifts, the broader health and wellness sector offers diverse alternatives. Consumers are increasingly engaging with digital fitness platforms and specialized classes such as yoga or CrossFit, which can be seen as substitutes for traditional supplement-based fitness routines. The global digital fitness market, valued at approximately USD 15.2 billion in 2023, underscores this trend towards varied and accessible fitness solutions.

Furthermore, the rising interest in herbal remedies and natural products presents another significant substitution threat. The global herbal supplements market, valued at around $59.1 billion in 2023, indicates a strong consumer movement towards holistic health solutions that bypass conventional supplement brands.

The expanding functional food and beverage market directly competes with MusclePharm's offerings, particularly ready-to-drink protein shakes. With the global functional food market valued at approximately $268 billion in 2023, consumers are opting for convenient items like protein bars and fortified drinks to meet their nutritional goals, viewing them as simpler alternatives.

Pharmaceuticals also act as substitutes, especially for consumers addressing specific health concerns. For conditions requiring targeted treatment, prescription medications or medical interventions may be preferred over supplements due to perceived efficacy and regulatory assurance. The global pharmaceutical market, valued at roughly $1.6 trillion in 2024, highlights a significant consumer preference for medically-backed solutions.

| Substitute Category | Example | 2023 Market Value (Approx.) | Key Driver |

|---|---|---|---|

| Whole Foods & Balanced Diets | Nutrient-rich foods, lifestyle changes | N/A (Dietary Trend) | Holistic health, preventative care |

| Digital Fitness & Classes | Online workout programs, yoga, CrossFit | USD 15.2 billion (Digital Fitness) | Convenience, variety, community |

| Herbal & Natural Remedies | Herbal supplements, traditional medicine | USD 59.1 billion (Herbal Supplements) | Natural ingredients, holistic approach |

| Functional Foods & Beverages | Protein bars, fortified drinks, smoothies | USD 268 billion (Functional Foods) | Convenience, integrated nutrition |

| Pharmaceuticals | Prescription medications, medical treatments | USD 1.6 trillion (Pharmaceuticals) | Efficacy, medical endorsement, specific conditions |

Entrants Threaten

The supplement industry has historically been characterized by low barriers to entry, contributing to a crowded market. This ease of access means new brands can emerge relatively quickly, posing a persistent threat to established players like MusclePharm. For instance, in 2024, the direct-to-consumer model continues to lower the initial capital required to launch a supplement brand, bypassing traditional retail gatekeepers.

The nutritional supplement and sports nutrition sectors are booming, fueled by a growing emphasis on health and fitness. This expansion is a magnet for new businesses eager to tap into rising consumer interest, thereby increasing the threat of new entrants.

The rise of e-commerce platforms, with giants like Amazon and direct-to-consumer (DTC) websites, significantly lowers the barrier to entry for new sports nutrition brands. These digital channels allow emerging companies to bypass the substantial costs and complexities associated with building traditional brick-and-mortar retail networks, a key advantage when competing with established players like MusclePharm. In 2024, the global e-commerce market is projected to exceed $7 trillion, highlighting the vast reach and accessibility these platforms offer to newcomers.

Rise of Personalized Nutrition and Niche Markets

The burgeoning personalized nutrition sector, fueled by technological advancements and a growing consumer desire for tailored health solutions, presents a significant threat of new entrants for established players like MusclePharm. These new entrants can leverage data analytics and direct-to-consumer models to target specific niche markets with highly specialized products, bypassing traditional distribution channels.

For instance, the global personalized nutrition market was valued at approximately USD 11.6 billion in 2022 and is projected to grow substantially, with some estimates suggesting a CAGR of over 10% through 2030. This rapid expansion indicates fertile ground for agile startups to carve out market share by addressing unmet needs in areas like sports-specific diets, allergen-free formulations, or age-related nutritional support.

- Niche Market Focus: New entrants can concentrate on highly specific consumer segments, offering tailored solutions that larger companies might overlook.

- Technological Advantage: Innovations in genetic testing, AI-driven dietary recommendations, and advanced supplement formulations allow new players to offer unique value propositions.

- Direct-to-Consumer (DTC) Models: Many new entrants bypass traditional retail, building direct relationships with consumers and gathering valuable data for further personalization, reducing reliance on established distribution networks.

- Agility and Innovation: Smaller, specialized companies can adapt more quickly to evolving consumer preferences and scientific research, bringing innovative products to market faster than larger, more bureaucratic organizations.

Availability of Contract Manufacturing and White Labeling

The availability of contract manufacturing and white-labeling services significantly lowers the barrier to entry in the sports nutrition market. Companies can outsource production, avoiding the substantial capital expenditure typically associated with building and maintaining manufacturing facilities. This makes it easier and cheaper for new brands to launch, increasing competitive pressure.

For instance, many emerging supplement brands leverage contract manufacturers to produce their products, allowing them to focus on marketing and distribution rather than the complexities of production. This model democratizes the industry, enabling smaller players to compete with established companies. In 2024, the global contract manufacturing market for dietary supplements continued to grow, reflecting this trend.

- Reduced Capital Requirements: New entrants can bypass the need for expensive manufacturing plants.

- Faster Market Entry: Outsourcing production accelerates the launch timeline for new brands.

- Increased Competition: Lower entry costs lead to a more crowded and competitive marketplace.

- Focus on Branding and Marketing: Entrepreneurs can concentrate resources on product differentiation and customer acquisition.

The threat of new entrants remains a significant factor for MusclePharm. The nutritional supplement market, particularly the sports nutrition segment, continues to attract new players due to its growth and evolving consumer demands. New companies can leverage digital channels and contract manufacturing to enter the market with lower initial investment, increasing competitive pressure.

In 2024, the ease of access through e-commerce and direct-to-consumer models allows nimble startups to quickly establish a presence. This trend is further amplified by the rise of personalized nutrition, where niche players can cater to specific consumer needs more effectively than larger, established brands. The availability of contract manufacturing services also democratizes production, lowering capital barriers substantially.

| Factor | Impact on New Entrants | Example/Data (2024) |

|---|---|---|

| E-commerce & DTC | Lowers distribution costs and customer acquisition barriers | Global e-commerce market projected to exceed $7 trillion in 2024 |

| Contract Manufacturing | Reduces capital expenditure on production facilities | Growing market for supplement contract manufacturing |

| Personalized Nutrition | Enables niche market penetration and differentiation | Personalized nutrition market valued at USD 11.6 billion in 2022, with strong projected growth |

| Innovation Potential | Allows new entrants to offer unique value propositions | Advancements in AI for dietary recommendations and advanced formulations |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for MusclePharm Corp. is built upon a foundation of publicly available financial data from SEC filings, industry-specific market research reports from firms like IBISWorld, and insights from reputable financial news outlets and analyst reports.