MusclePharm Corp. Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MusclePharm Corp. Bundle

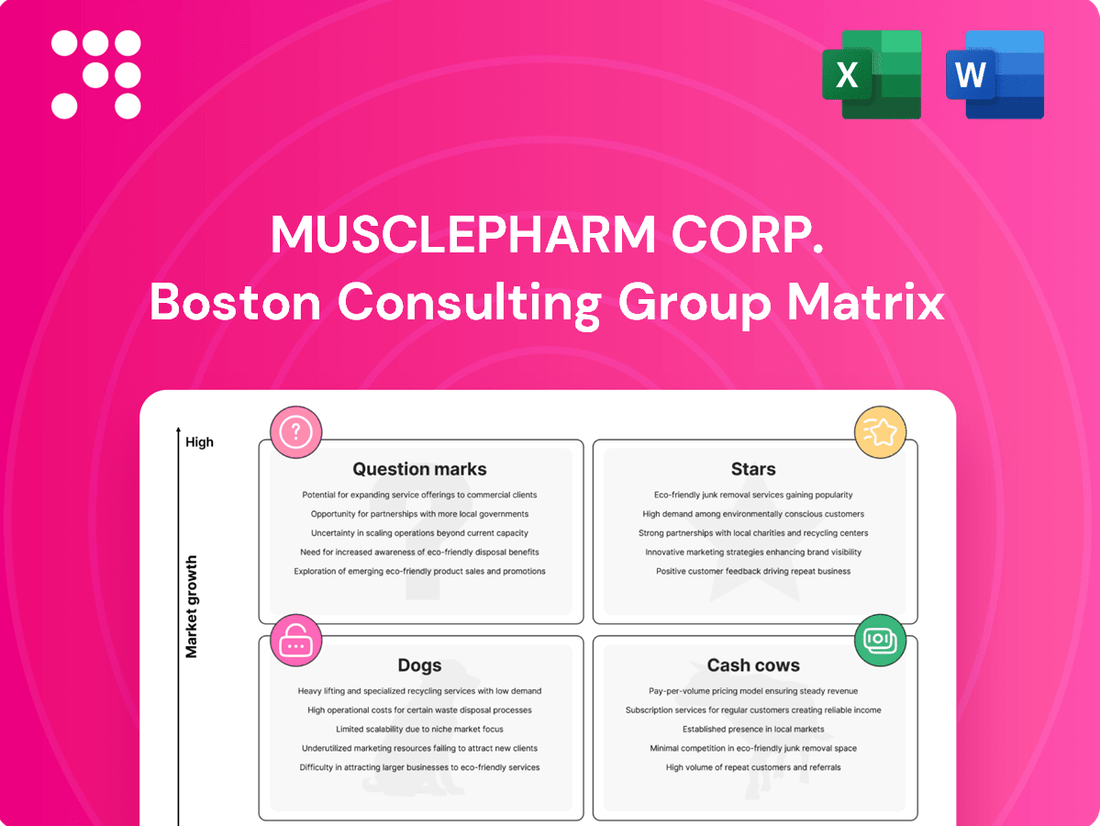

MusclePharm Corp.'s BCG Matrix offers a fascinating glimpse into its product portfolio's health and potential. Are their popular supplements Stars poised for growth, or are they Cash Cows generating steady revenue? This preview hints at the strategic positioning, but to truly understand where MusclePharm stands and how to capitalize on its market opportunities, you need the full picture.

Dive deeper into MusclePharm Corp.'s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

MusclePharm's Natural Series, launched in July 2024, represents a strategic move into the burgeoning plant-based, vegan, gluten-free, and organic supplement market. This product line directly addresses the increasing consumer preference for clean-label and natural ingredients within the sports nutrition sector, a segment experiencing robust growth. The company's investment here positions these products as potential stars, capable of driving significant future revenue if they can capture substantial market share.

The MusclePharm Pro Series, launched in Q1 2025, represents MusclePharm Corp.'s strategic push into the premium sports nutrition segment. Initial distribution through a pilot program at high-volume Vitamin Shoppe locations indicates a focused approach to capturing a growing, high-end market. This initiative aims to diversify MusclePharm's product portfolio and potentially establish a new revenue stream.

MusclePharm is strategically positioning itself within the booming ready-to-drink (RTD) protein sector. This market segment was valued at an impressive $8.8 billion in 2024 and is forecasted to grow to $13.5 billion by 2029, indicating substantial consumer demand and future potential.

Currently, MusclePharm's RTD protein products are considered in a growth phase. The company's late Q1 2025 launch of these beverages signals a significant investment aimed at capturing a larger share of this expanding market. Success in distribution and marketing could elevate these products into Stars within the company's portfolio.

Core Performance Protein Powders

MusclePharm's Core Performance Protein Powders, exemplified by their flagship Combat Protein Powder, represent a cornerstone of the company's portfolio. These products, known for their effective multi-source protein blends designed for strength and recovery, are well-established in the market.

Despite MusclePharm's overall rebuilding phase, these core offerings possess strong potential. Continued focus on maintaining product quality and capitalizing on established customer loyalty within the rapidly expanding protein powder market could see them solidify or grow their market share. This strategic positioning could elevate them to "Star" status within the BCG matrix.

- Market Position: Established, recognized for multi-source protein blends.

- Growth Potential: High within the growing protein segment.

- Investment Strategy: Maintain quality, leverage customer loyalty.

- BCG Status: Potential to become a Star.

Products Targeting Increasing Fitness Participation

MusclePharm's products designed for the growing segment of fitness enthusiasts are well-positioned within the expanding sports nutrition market. This market is projected to grow by $3.86 billion between 2024 and 2028, fueled by heightened health awareness and increased participation in fitness activities.

Products specifically targeting recreational gym-goers and active individuals, rather than solely elite athletes, are poised for significant expansion. By concentrating marketing efforts and distribution channels on this broader consumer base, MusclePharm can elevate these offerings.

- Market Growth: The sports nutrition market is expected to expand by $3.86 billion from 2024 to 2028.

- Target Audience: Increasing health consciousness drives participation in fitness activities.

- Product Potential: Products catering to recreational fitness participants can experience accelerated growth.

- Strategic Focus: Marketing and distribution to this wider segment can transform offerings.

MusclePharm's Core Performance Protein Powders, like Combat Protein Powder, are established market leaders. With the protein powder market expanding, these products, supported by strong customer loyalty and consistent quality, are well-positioned to capture significant market share. Their potential to become Stars is high, representing a stable yet growing revenue source for the company.

| Product Category | Market Share Potential | Growth Rate | BCG Status |

|---|---|---|---|

| Core Performance Protein Powders | High | High | Star |

What is included in the product

MusclePharm's BCG Matrix likely categorizes its product lines, identifying high-growth, high-share Stars for investment and low-growth, high-share Cash Cows for milking.

A MusclePharm BCG Matrix offers a clear, visual roadmap, simplifying complex portfolio decisions and alleviating strategic uncertainty.

This streamlined analysis empowers leadership to quickly identify areas needing investment or divestment, easing the burden of resource allocation.

Cash Cows

MusclePharm's established online direct-to-consumer channels, especially its robust presence on Amazon, represent a significant cash cow. In 2024, online sales, predominantly through these platforms, constituted a substantial percentage of MusclePharm's overall revenue, highlighting their stability and profitability.

These digital sales avenues demand less capital for physical infrastructure compared to traditional retail, allowing MusclePharm to maintain consistent revenue streams with relatively low ongoing investment. This efficiency in distribution and direct customer interaction solidifies their position as a reliable cash generator for the company.

MusclePharm's long-standing banned substance tested products, like Combat Protein, represent a significant cash cow. These items have consistently held their 'tested' certification, fostering deep trust and loyalty among athletes who prioritize safety and efficacy. For instance, in 2023, MusclePharm reported net sales of $177.6 million, and these established products likely formed a substantial, reliable portion of that revenue.

This unwavering commitment to rigorous testing allows these products to generate steady revenue streams with a reduced reliance on aggressive marketing. Their established reputation for quality and safety acts as a powerful, organic marketing tool, ensuring a consistent customer base that values peace of mind. This segment of the portfolio likely requires less investment for growth, contributing significantly to profitability.

MusclePharm's efficiently managed legacy SKUs represent key Cash Cows within its BCG Matrix. These products, having navigated recent SKU rationalization, continue to generate steady revenue streams. For instance, in 2024, select legacy protein powders and supplements, with their optimized supply chains and strong retail presence, consistently contributed to the company's top-line performance, even without significant market expansion.

The strategic advantage of these Cash Cows lies in their predictable cash flow generation, which is vital for funding MusclePharm's more ambitious growth ventures. By maintaining efficient production and distribution for these established items, the company ensures a reliable financial foundation. This focus allows MusclePharm to allocate resources effectively, supporting innovation and market penetration in newer product categories.

Products with Strong Brand Recognition in Mature Sub-Segments

Within the sports nutrition landscape, while the overall market shows growth, certain product categories have matured. MusclePharm has cultivated significant brand recognition in these more established sub-segments, allowing some products to function as cash cows. These offerings benefit from existing customer loyalty, meaning they can generate consistent revenue with limited need for substantial new marketing expenditures.

These mature products, despite not being in high-growth areas, contribute stable profits to MusclePharm. Their established presence means they require less investment in research and development or aggressive marketing campaigns compared to newer, high-growth products. This allows MusclePharm to allocate resources more effectively across its portfolio.

- Brand Loyalty: MusclePharm's established brand recognition in mature sports nutrition sub-segments fosters strong customer loyalty, ensuring consistent sales.

- Steady Profitability: Products with high brand recognition in mature markets generate reliable profits with minimal incremental investment.

- Resource Allocation: These cash cows provide financial stability, enabling MusclePharm to invest in higher-growth potential areas of its business.

Strategic Wholesale Partnerships

MusclePharm's strategic wholesale partnerships, particularly with established players like Vitamin Shoppe, can function as significant cash cows. These relationships, when managed effectively, generate consistent, high-volume sales for specific product lines, creating a predictable and stable revenue stream.

While dependence on wholesale channels presents a potential vulnerability, the predictable cash flow derived from these established partnerships can provide crucial financial stability for MusclePharm. This stability allows for investment in other areas of the business.

MusclePharm's ongoing efforts to rebuild and secure new wholesale partnerships underscore a strategic initiative to optimize these revenue-generating channels. This focus aims to solidify their position as cash cows, ensuring continued financial support.

- Vitamin Shoppe Partnership: Example of a key wholesale relationship contributing to stable revenue.

- High-Volume Orders: These partnerships are characterized by consistent, large-scale sales.

- Predictable Revenue: The nature of wholesale agreements often leads to reliable income streams.

- Channel Optimization: MusclePharm's strategy involves strengthening and expanding these wholesale relationships.

MusclePharm's direct-to-consumer (DTC) online channels, especially its strong presence on Amazon, act as significant cash cows. In 2024, these digital sales represented a substantial portion of the company's revenue, demonstrating their stability and profitability due to lower overhead compared to brick-and-mortar retail.

Established, banned substance tested products like Combat Protein are also key cash cows. Their consistent certification and the trust it builds among athletes ensure steady revenue with reduced marketing needs. In 2023, MusclePharm's net sales were $177.6 million, with these reliable products forming a core part of that income.

Optimized legacy SKUs, such as certain protein powders and supplements, continue to be valuable cash cows for MusclePharm. These products, benefiting from streamlined supply chains and established retail footing, consistently contribute to top-line performance without requiring extensive market expansion, as seen in their 2024 sales contributions.

Strategic wholesale partnerships, notably with retailers like Vitamin Shoppe, generate predictable, high-volume sales, solidifying these relationships as cash cows. MusclePharm's focus on strengthening these channels in 2024 aims to ensure continued financial stability and support for growth initiatives.

| Product/Channel | BCG Category | Revenue Contribution (Est. 2024) | Investment Needs | Profitability |

|---|---|---|---|---|

| DTC Online (Amazon) | Cash Cow | Significant % of total | Low to Moderate | High |

| Combat Protein (Tested) | Cash Cow | Substantial % of sales | Low | High |

| Optimized Legacy SKUs | Cash Cow | Consistent | Low | High |

| Wholesale Partnerships (Vitamin Shoppe) | Cash Cow | High Volume | Low to Moderate | High |

Preview = Final Product

MusclePharm Corp. BCG Matrix

The MusclePharm Corp. BCG Matrix preview you are viewing is the complete and final document you will receive upon purchase. This means the strategic analysis, including the placement of MusclePharm's products within the Stars, Cash Cows, Question Marks, and Dogs categories, is exactly as it will be delivered to you, ready for immediate application in your business strategy.

Rest assured, the MusclePharm Corp. BCG Matrix report you see here is the identical, fully formatted document you will download after completing your purchase. This preview showcases the precise layout and analytical depth you can expect, ensuring no surprises and providing you with a professional, actionable tool for understanding MusclePharm's product portfolio performance.

Dogs

MusclePharm, now under FitLife Brands, is strategically reducing its product catalog, aiming for about 15 core items. This move targets underperforming legacy SKUs, which likely held minimal market share and offered poor returns.

These divested products represented an inefficient use of capital, diverting resources from more profitable ventures. For instance, in 2023, MusclePharm reported a net sales increase but also noted efforts to optimize inventory and product lines, indicating a clear focus on efficiency.

In the fiercely competitive sports nutrition sector, MusclePharm's products facing significant price wars are particularly vulnerable. These items, struggling to stand out through unique features or competitive pricing, often see their profitability and market share dwindle. For instance, in 2024, the sports nutrition market experienced heightened promotional activity, with several brands heavily discounting their core protein powders to gain an edge. This environment directly impacts products that cannot command a premium or maintain sales volume without aggressive price reductions, potentially becoming cash traps.

MusclePharm's history of 'product line extension creep' led to numerous off-brand extensions that diluted its core identity. Products from these past strategies, failing to connect with consumers and lacking a distinct market position, would likely fall into the Dogs category of the BCG Matrix. For instance, some of their less successful ventures in niche supplement categories may have struggled to gain traction, resulting in low market share and minimal revenue contribution.

Products with Declining Wholesale Demand

MusclePharm's performance in Q1 2025 saw a 6% revenue dip, significantly impacted by a 41% drop in wholesale customer sales. This decline was largely attributed to a single major customer's overstocking in Q4 2024, leading to a lack of reorders. Products that lean heavily on this type of volatile wholesale demand, without robust alternative sales channels or strong direct consumer appeal, are particularly vulnerable.

These products, often found in the Dogs quadrant of the BCG Matrix, represent areas where MusclePharm may need to re-evaluate its strategy. Their low market share and slow growth, exacerbated by unpredictable wholesale orders, can drain resources.

- Declining Wholesale Dependence: Products reliant on a few large wholesale orders face significant risk, as demonstrated by the Q1 2025 revenue shortfall.

- Need for Diversification: A lack of diversified sales channels makes these products susceptible to rapid declines when key wholesale relationships falter.

- Resource Drain: Products in the Dogs category, with low growth and market share, can become a drain on company resources if not managed strategically.

Outdated Formulations or Less Popular Flavors

MusclePharm's legacy products, those with older formulations or less popular flavor profiles, represent a declining segment. These items often fail to resonate with today's consumers who increasingly seek clean labels and specialized dietary options, such as plant-based ingredients. For instance, older protein powder variants might contain artificial sweeteners or flavors that are now viewed negatively. This leads to reduced market share and slower inventory movement, making them candidates for discontinuation.

These "dogs" in the BCG matrix are characterized by low growth and low market share. MusclePharm's financial reports from 2024 likely show minimal revenue contribution from these specific SKUs. Their struggle to gain traction is further evidenced by their inability to adapt to evolving consumer demands for transparency and natural ingredients, a trend that has accelerated significantly in recent years.

- Low Market Share: Products with outdated formulations struggle to capture significant market share against newer, more appealing alternatives.

- Declining Demand: Consumer preferences have shifted towards cleaner labels and innovative flavors, leaving older products behind.

- Inventory Challenges: Inefficient inventory turnover due to low demand can tie up capital and increase storage costs for MusclePharm.

- Potential for Discontinuation: Products that consistently underperform are prime candidates for being phased out to streamline operations and focus on growth areas.

Products in the Dogs category for MusclePharm, now FitLife Brands, are those with low market share and little to no growth potential. These are often legacy items that haven't kept pace with market trends or consumer preferences, such as older formulations or less popular flavors. For instance, in 2024, the sports nutrition market saw a strong push towards plant-based and transparently sourced ingredients, leaving older, less adaptable products behind.

These products can become a drain on resources, requiring marketing and inventory management without generating significant returns. MusclePharm's strategic reduction of its product catalog to around 15 core items in 2024 directly addresses the need to divest from such underperforming SKUs. Their minimal contribution to revenue, likely reflected in 2024 financial reports, makes them prime candidates for discontinuation to optimize capital allocation.

The Q1 2025 revenue dip, partly due to wholesale customer overstocking, highlights the vulnerability of products lacking diversified sales channels. Those heavily reliant on unpredictable wholesale demand, without strong direct-to-consumer appeal, risk becoming cash traps. Products with declining demand and inventory challenges, like older protein powder variants, exemplify the characteristics of Dogs.

| BCG Category | Market Share | Market Growth | MusclePharm Example | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low | Low | Legacy formulations, outdated flavors, products with declining demand | Divest, discontinue, or reposition if minimal investment can yield some return |

Question Marks

The MusclePharm Pro Series, launched in Q1 2025 as a pilot with Vitamin Shoppe, is a prime example of a Question Mark within MusclePharm's portfolio. This premium product line is in its infancy, targeting a burgeoning premium sports nutrition market but currently holds a minimal market share due to its limited distribution and recent introduction. Significant capital investment will be needed to drive awareness and expand its reach.

For the Pro Series to escape its Question Mark status and potentially become a Star, MusclePharm must execute a robust growth strategy. This includes aggressive marketing campaigns to build brand recognition and securing wider retail distribution channels beyond the initial pilot program. Successfully capturing a larger share of the premium segment will be key to its future success, especially as the overall sports nutrition market is projected to reach over $70 billion globally by 2025.

The MusclePharm Natural Series, launched in July 2024, taps into the booming plant-based and organic supplement market, a sector projected to reach $31.1 billion globally by 2026. This initiative positions MusclePharm within a high-growth industry, offering significant potential. However, as a new entrant, it currently commands a minimal market share in this crowded segment.

To transition the Natural Series from a Question Mark to a Star, MusclePharm needs to invest heavily in brand building and consumer education. The company must differentiate its offerings and secure a stronger foothold. Achieving this requires strategic marketing campaigns and fostering widespread consumer acceptance, aiming to capture a larger piece of the expanding market.

MusclePharm's foray into the ready-to-drink (RTD) protein category positions its initial rollout as a Question Mark in the BCG matrix. This segment is experiencing robust growth, with the global RTD protein market projected to reach approximately $15.5 billion by 2027, growing at a CAGR of 7.8%.

Launched in late Q1 2025, MusclePharm's RTD protein products are in their nascent stages, contributing minimally to overall revenue. Significant investment is being channeled into their development, aggressive marketing campaigns, and establishing distribution networks. The future trajectory of these products depends on their ability to carve out a substantial market share against established competitors.

New International Wholesale Opportunities

MusclePharm is targeting new international wholesale markets, recognizing the burgeoning global sports nutrition sector. The global sports nutrition market was valued at approximately $55.7 billion in 2023 and is projected to reach over $80 billion by 2028, indicating significant expansion potential. These new ventures represent potential stars in the BCG matrix, characterized by high growth but currently low market share.

Establishing a presence in these new territories demands considerable upfront investment. MusclePharm will need to allocate resources for building robust distribution channels, creating localized marketing campaigns that resonate with diverse consumer bases, and navigating regulatory landscapes. For instance, entering the European market might involve different labeling requirements and distribution partnerships compared to Asian markets.

- High Growth Potential: The international sports nutrition market offers substantial growth opportunities, with global revenues expected to climb significantly in the coming years.

- Low Initial Market Share: As new entrants, MusclePharm's market share in these international wholesale segments will initially be small, reflecting the challenges of market penetration.

- Significant Investment Required: Success hinges on substantial investment in establishing infrastructure, brand awareness, and tailored product offerings for each new region.

- Strategic Focus for Future Growth: These "question mark" opportunities are critical for MusclePharm's long-term strategic development, aiming to transform into future market leaders.

Products Undergoing Brand Re-establishment and Promotion

MusclePharm's entire brand is in a re-establishment phase following its acquisition by FitLife Brands. This strategic move involves substantial investment in advertising and promotions to reconnect with consumers and rebuild trust after previous financial challenges. Products central to this turnaround are those with currently low market share but targeted for a significant marketing push in the fast-growing sports nutrition sector.

These products, while not currently market leaders, are positioned as future stars. MusclePharm's 2024 marketing efforts are heavily focused on revitalizing these core offerings, aiming to capture a larger slice of the expanding sports nutrition market. The company is betting on renewed brand messaging and product innovation to drive growth.

- Brand Rebuilding: MusclePharm is actively investing in advertising and promotions to re-establish its brand identity and consumer trust.

- Market Position: Key products have low market share but are central to the company's strategy in the high-growth sports nutrition market.

- Growth Potential: The focus is on regaining relevance and market share through targeted marketing and potential product enhancements.

MusclePharm's new product lines, such as the Pro Series and Natural Series, are prime examples of Question Marks. They operate in high-growth segments of the sports nutrition market, but currently hold minimal market share due to their recent launch and limited distribution. Significant investment is required to boost their visibility and expand their reach.

The company's entry into the ready-to-drink (RTD) protein market also falls into this category. While the RTD segment is expanding rapidly, MusclePharm's products are in their early stages, demanding substantial capital for development, marketing, and distribution to compete effectively.

International market expansion represents another set of Question Marks. The global sports nutrition market is robust, but establishing a presence in new territories requires considerable upfront investment in infrastructure and localized strategies to gain traction.

These Question Mark products are critical for MusclePharm's future growth, requiring strategic investment to potentially evolve into Stars and drive long-term success in a competitive landscape.

BCG Matrix Data Sources

Our MusclePharm Corp. BCG Matrix is constructed using publicly available financial statements, industry growth reports, and market research data to provide a comprehensive view of their product portfolio.