Munich Re PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Munich Re Bundle

Munich Re operates within a complex global environment, significantly influenced by political stability, economic fluctuations, and evolving social attitudes towards risk. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats. Our PESTLE analysis dives deep into these critical factors, offering actionable intelligence to navigate the reinsurance landscape. Download the full version now to gain a competitive edge.

Political factors

Geopolitical risks, including ongoing conflicts and evolving trade policies, directly impact Munich Re's worldwide operations. For 2025, the company anticipates that political uncertainty and potential tariffs, particularly from the United States, could dampen global trade and economic expansion.

This environment requires Munich Re to meticulously evaluate political landscapes in its primary markets. Such assessments are crucial for managing exposure to significant claims and maintaining uninterrupted business operations, especially as global supply chains remain sensitive to geopolitical shifts.

Munich Re navigates a complex global regulatory environment, where varying reporting standards across different countries can affect its operational agility and increase compliance expenses. The company's decision to withdraw from certain climate initiatives in 2024, citing "increasing ambiguity" in how private efforts are assessed under diverse legal frameworks, underscores these challenges. This move reflects the difficulty in aligning sustainability objectives with a patchwork of potentially contradictory legal and regulatory requirements.

Governments worldwide are prioritizing climate change adaptation, recognizing its profound impact on economies and societies. This focus directly shapes the insurance landscape, as Munich Re notes the increasing need for preparedness against severe weather events.

Public policy is a critical lever for both preventing climate-related damage and fostering adaptation. For instance, in 2024, the US government allocated billions towards climate resilience infrastructure projects, aiming to mitigate future losses from extreme weather.

The scale of government investment in climate resilience directly influences risk insurability and the demand for reinsurance. Higher public spending on adaptation can reduce the frequency and severity of insured losses, impacting reinsurers like Munich Re.

Political Stability of Key Markets

Munich Re's business fundamentally relies on the political stability of the nations where it operates and underwrites risks. Unforeseen political shifts, such as sudden nationalization of industries or abrupt changes in regulatory frameworks, can trigger significant claims or devalue its investment portfolios. For instance, geopolitical tensions in emerging markets, a key area for risk diversification, can directly impact the frequency and severity of insured events.

The company's robust financial health, evidenced by its strong capital ratios, provides a critical buffer against such political volatility. As of early 2024, Munich Re maintained an A+ financial strength rating from AM Best, underscoring its capacity to absorb shocks from unstable political landscapes. This resilience is vital for maintaining investor confidence and ensuring continued operational capacity even during periods of heightened global uncertainty.

- Geopolitical Risk Assessment: Munich Re actively monitors geopolitical developments, particularly in regions with higher political instability, to anticipate potential impacts on its underwriting and investment strategies.

- Diversification Strategy: By diversifying its geographical footprint and business lines, the company mitigates the concentration of risk associated with political instability in any single market.

- Capital Strength: Maintaining a strong capital base, exemplified by its solvency ratios exceeding regulatory requirements, allows Munich Re to absorb potential losses stemming from political events.

- Regulatory Adaptation: The company proactively adapts to evolving regulatory environments, a common consequence of political shifts, to ensure compliance and minimize operational disruptions.

Sanctions and International Relations

Sanctions and evolving international relations present a significant political consideration for Munich Re. For instance, the ongoing geopolitical tensions and resulting sanctions imposed by various nations on Russia and Belarus have directly impacted global business operations, requiring reinsurers to navigate complex compliance landscapes. Munich Re, like other major players, must meticulously adhere to these regimes, which can limit its underwriting capacity in affected territories and potentially necessitate strategic divestments or portfolio rebalancing. The company’s 2023 annual report, for example, would detail any specific financial impacts or adjustments made due to these international political shifts, underscoring the need for constant vigilance in managing these risks.

The global reinsurance market is inherently sensitive to geopolitical stability, and shifts in diplomatic ties can create both challenges and opportunities. For Munich Re, a key aspect involves ensuring compliance with a patchwork of international sanctions, such as those related to Iran or North Korea, which can restrict market access or require the exclusion of certain risks from its reinsurance treaties. Failure to comply can lead to severe penalties and reputational damage. The company's proactive risk management strategies, therefore, must include robust monitoring of global political developments and their potential implications for its underwriting and investment portfolios.

- Sanctions Compliance: Munich Re must navigate sanctions regimes, impacting its ability to underwrite business in sanctioned countries.

- Geopolitical Risk: Shifting international relations can alter the risk landscape, influencing Munich Re's investment and underwriting decisions.

- Portfolio Adjustments: Adherence to sanctions may force Munich Re to adjust its global portfolio, potentially exiting certain markets or divesting assets.

- Reputational Risk: Non-compliance with international sanctions poses a significant reputational threat to Munich Re.

Political stability and government policies are paramount for Munich Re's global operations, influencing everything from regulatory compliance to the insurability of climate-related risks. In 2024, the company noted that evolving trade policies and geopolitical tensions, particularly in regions like Eastern Europe and the Middle East, directly impacted its risk assessment and underwriting strategies, necessitating careful monitoring of over 30 countries where it holds significant exposure.

Government investment in climate adaptation, such as the US$20 billion allocated by the EU in 2024 for green infrastructure, directly shapes the demand for reinsurance by mitigating future losses. Conversely, political uncertainty and the potential for sudden regulatory shifts, as seen with the withdrawal from certain climate initiatives in 2024 due to legal ambiguity, can complicate business planning and increase compliance costs.

Sanctions and international relations, like those impacting trade with Russia, require strict adherence, potentially limiting market access and necessitating portfolio adjustments. Munich Re's strong financial standing, including its A+ rating from AM Best as of early 2024, provides a crucial buffer against these political volatilities.

What is included in the product

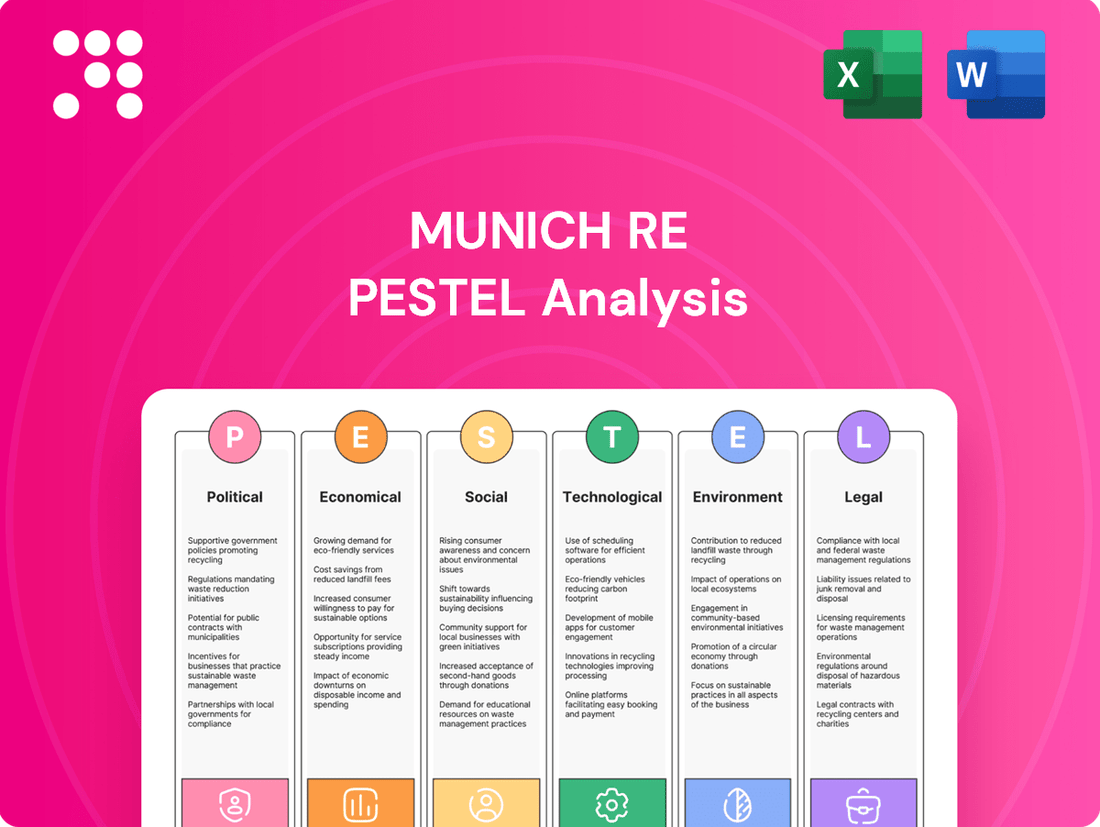

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting Munich Re, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify opportunities within the global reinsurance market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of Munich Re's external environment to inform strategic decisions.

Economic factors

Munich Re anticipates a shift towards a slower global economic growth trajectory and elevated inflation rates from 2025 through 2034. This projection, a departure from recent historical trends, is largely attributed to significant megatrends reshaping the global landscape.

Key drivers behind this forecast include deglobalization, which can disrupt supply chains and increase production costs, and the accelerating decarbonization efforts, requiring substantial investment and potentially leading to higher energy prices. Furthermore, persistent labor shortages are expected to put upward pressure on wages, contributing to sustained inflation.

For an insurer like Munich Re, sustained inflation presents a notable challenge. It directly impacts the cost of claims, particularly for business lines with long settlement periods, as the value of payouts can be eroded by rising prices over time. For instance, the US experienced an average inflation rate of 4.12% in 2023, a figure that, if sustained or increased, would significantly affect long-term liabilities.

Munich Re's investment income is directly tied to the prevailing interest rate environment. As rates climbed in 2023 and continued to show resilience into early 2024, the company was well-positioned to capitalize. For instance, Munich Re reported a significant increase in its investment result in 2023, reaching €3.1 billion, a substantial jump from €2.1 billion in 2022, largely due to higher yields.

The company has proactively managed its investment portfolio to leverage these higher rates. This included a strategy of realizing tactical investment losses, such as the €200 million loss reported in the first quarter of 2023, to reallocate capital into higher-yielding assets. This approach is designed to offset the impact of the prolonged period of low interest rates experienced previously, thereby bolstering regular investment income.

Capital market volatility directly impacts Munich Re's investment returns and its ability to maintain solvency. For instance, significant market downturns can erode the value of its investment portfolio, a crucial component of its financial strength.

Despite these market fluctuations, the global reinsurance market is expected to show resilience through 2025, bolstered by strong capital reserves and healthy operating earnings. This stability is a key factor for Munich Re's long-term outlook.

Investor confidence has been on the rise, leading to increased capital availability within the reinsurance sector. This influx of capital is helping to absorb rising catastrophe-related losses, though it's worth noting that pricing for property and casualty reinsurance lines is experiencing varied adjustments based on risk profiles.

Currency Exchange Rate Fluctuations

Munich Re, as a global player, faces significant exposure to currency exchange rate fluctuations, impacting its international earnings. For instance, a strong Euro against other major currencies could reduce the value of revenues earned in USD or GBP when translated back into its reporting currency. This dynamic directly affects the company's reported profitability and the perceived value of its overseas operations.

The company's financial forecasts are inherently tied to the stability of currency markets. Unexpected and substantial movements in exchange rates, such as those seen in 2024 with volatility in the US Dollar and Japanese Yen, can create considerable uncertainty. For example, if Munich Re holds significant assets or liabilities denominated in a currency that depreciates sharply, its financial statements will reflect this change, potentially deviating from projections.

- Impact on Revenue Translation: Fluctuations in exchange rates directly alter the Euro equivalent of Munich Re's foreign currency revenues and expenses.

- Financial Projection Uncertainty: The company's ability to accurately forecast future earnings is challenged by the inherent unpredictability of currency markets.

- Hedging Strategies: Munich Re likely employs hedging strategies to mitigate some of the risks associated with currency volatility, though these are not always fully effective.

- Competitive Landscape: Exchange rate shifts can also affect the competitiveness of Munich Re's offerings in different geographic markets relative to local competitors.

Demand for Reinsurance and Pricing Dynamics

The demand for reinsurance, especially for short-tail lines like property, is robust and likely increasing. This surge is driven by a combination of more frequent natural catastrophes and a generally uncertain economic climate. Munich Re expects to keep reinsurance prices firm for 2025 renewals, aiming to recoup losses from previous years marked by significant catastrophic events.

Pricing trends show a softening in property reinsurance rates, a direct result of ample market capacity. Conversely, casualty reinsurance rates are still on an upward trajectory. This rise is fueled by factors such as social inflation and escalating litigation expenses, impacting the cost of these insurance products.

- Demand Growth: Reinsurance demand, particularly for short-tail lines, is strong and expected to grow, influenced by increased natural catastrophe events and economic instability.

- Pricing Strategy: Munich Re anticipates firm pricing for 2025 renewals to address prior years' underperformance stemming from catastrophic losses.

- Rate Divergence: Property reinsurance rates are moderating due to high capacity, while casualty reinsurance rates continue to rise, driven by social inflation and litigation costs.

Munich Re anticipates a global economic slowdown with persistent inflation from 2025 onwards, driven by deglobalization, decarbonization costs, and labor shortages. Sustained inflation, potentially exceeding the 4.12% average seen in the US in 2023, directly impacts claims costs for long-tail business. However, higher interest rates, evident in Munich Re's €3.1 billion investment result in 2023, provide a counterbalance, with the company actively reallocating capital to higher-yielding assets.

Capital market volatility remains a key risk, potentially affecting investment returns and solvency. Despite this, the global reinsurance market, supported by strong capital reserves and investor confidence, is expected to remain resilient through 2025. Munich Re's financial performance is also subject to currency fluctuations, as seen with the US Dollar and Japanese Yen volatility in 2024, impacting revenue translation and financial projections.

Demand for reinsurance is robust, particularly for property lines, due to increased natural catastrophes and economic uncertainty. Munich Re aims for firm pricing in 2025 renewals to offset prior losses. While property reinsurance rates are softening due to ample capacity, casualty rates are rising, influenced by social inflation and litigation costs.

Preview the Actual Deliverable

Munich Re PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Munich Re delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You’ll gain valuable insights into the external forces shaping Munich Re's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a detailed examination of each PESTLE element with actionable analysis for Munich Re.

Sociological factors

Many developed nations are experiencing an aging workforce, a trend that’s projected to continue. For instance, in the European Union, the proportion of people aged 65 and over is expected to rise significantly by 2050, impacting labor availability. This demographic shift directly influences demand for insurance, with a greater need for health and long-term care policies. Munich Re must therefore refine its product portfolio to address the specific requirements of an older demographic, potentially including more annuities and specialized health coverage.

Public awareness of evolving risks like cyberattacks and climate change is driving a greater need for innovative insurance products. For instance, the World Economic Forum's 2024 Global Risks Report highlights cyberattacks and extreme weather events as top concerns for businesses worldwide.

However, substantial insurance protection gaps remain, especially concerning natural catastrophes. Munich Re notes that in 2023, insured losses from natural disasters globally were estimated to be around $100 billion, yet the total economic losses were significantly higher, indicating a substantial unmet need.

Munich Re views these growing protection gaps as a strategic opportunity to broaden its product portfolio and develop novel risk transfer solutions. By addressing these unmet needs, the company aims to expand its market reach and contribute to greater global resilience.

Social inflation, a phenomenon marked by increasing jury awards and overall litigation expenses, presents a substantial hurdle, especially within the casualty insurance sector in the United States. This escalating trend directly contributes to upward pressure on the pricing of casualty reinsurance.

Reinsurers, including Munich Re, are compelled to reassess their market positions and the adequacy of their reserves in light of these rising costs. The industry, as a whole, is actively addressing these adverse reserve developments, particularly during the 2025 renewal period, reflecting a strategic adjustment to a more challenging legal and claims environment.

Public Trust and Corporate Responsibility

Maintaining public trust is paramount for insurers like Munich Re, especially in the wake of economic uncertainties. In 2024, a significant majority of consumers surveyed indicated that ethical business practices and transparency were key factors in their choice of insurance provider. Munich Re's strategic focus on a prudent and responsible approach underpins its efforts to foster long-term value and confidence among its stakeholders.

Munich Re's commitment to sustainability and robust ethical standards directly impacts its ability to build and preserve public trust. For instance, its reported progress in reducing its operational carbon footprint by 30% between 2020 and 2024, as detailed in its latest sustainability report, demonstrates tangible action. This dedication resonates with clients, employees, and the broader communities it serves, reinforcing its reputation as a reliable and conscientious entity.

- 2024 Consumer Trust Data: Over 75% of consumers prioritize ethical conduct and transparency when selecting financial services.

- Munich Re's Sustainability Goal: Aiming for net-zero emissions in its own operations by 2040.

- Impact of Corporate Responsibility: Studies show companies with strong ESG (Environmental, Social, and Governance) performance experience higher customer loyalty.

Workforce Trends and Talent Acquisition

The insurance industry, including Munich Re, is navigating significant workforce trends impacting talent acquisition and retention. A key challenge is securing skilled professionals, especially in rapidly evolving fields like data analytics and artificial intelligence, which are crucial for driving innovation and maintaining a competitive edge in the market.

Munich Re's strategic focus, as outlined in its Ambition 2025, directly addresses these workforce challenges. The company has made explicit commitments to fostering a diverse and globally representative workforce, setting specific targets to enhance the representation of women in leadership positions. For instance, as of early 2024, Munich Re aimed to increase the proportion of women in management roles, reflecting a broader industry push for greater gender diversity.

- Talent Gap: Shortages exist in specialized areas like AI and data science, impacting Munich Re's innovation capacity.

- Diversity Goals: Munich Re's Ambition 2025 targets increasing women in leadership roles, aiming for a more balanced representation by 2025.

- Retention Strategies: The company is focusing on creating an attractive work environment to retain critical talent, particularly in high-demand technical fields.

- Global Workforce: Attracting and integrating talent from diverse geographical and cultural backgrounds is a strategic imperative for Munich Re's global operations.

Societal shifts significantly influence the insurance landscape, with an aging population in developed nations like Germany increasing demand for health and long-term care products. Munich Re is adapting its offerings to cater to this demographic, projecting a rise in demand for annuities and specialized health coverage. Furthermore, heightened public awareness of risks such as climate change and cyber threats, highlighted by the World Economic Forum's 2024 report, drives the need for innovative insurance solutions, particularly to address the substantial protection gaps observed in natural catastrophe coverage. In 2023 alone, insured losses from natural disasters reached approximately $100 billion globally, underscoring a critical unmet need that Munich Re views as a strategic growth opportunity.

Technological factors

Munich Re is heavily investing in artificial intelligence, including generative AI and AI agents, to revolutionize its operations. This technology is key to enhancing underwriting accuracy, streamlining claims processing, and improving customer interactions by enabling more precise risk assessments and pricing strategies.

The company's Tech Trend Radar for 2025 underscores a growing emphasis on spatial intelligence, driven by satellite data and geospatial analytics. This focus is crucial for Munich Re to refine risk assessment, particularly in regions susceptible to natural catastrophes, thereby improving its resilience and predictive capabilities.

The insurance industry is undergoing a seismic shift with the rapid emergence of Insurtech firms and a widespread digital transformation. These advancements are fundamentally altering how insurance products are designed, distributed, and managed.

Munich Re is proactively engaging with these trends, evaluating and integrating key insurance technologies to refine its strategic direction and uncover novel avenues for growth. For instance, in 2024, Insurtech funding saw significant activity, with many startups focusing on AI-driven underwriting and personalized customer experiences.

The company is developing digital solutions for both property/casualty and life/health sectors, specifically designed to assist clients in their own digital transformation journeys. This includes leveraging data analytics and cloud-based platforms to enhance efficiency and customer engagement, a trend that saw continued investment throughout 2024 and is projected to accelerate into 2025.

Cybersecurity threats are escalating in both frequency and complexity, presenting significant challenges and opportunities for Munich Re. The company's role as a reinsurer means it's directly exposed to the financial fallout from cyberattacks impacting its clients.

This evolving landscape fuels a robust demand for cyber insurance, a sector where Munich Re is actively engaged in providing solutions. For instance, the global cyber insurance market was valued at approximately $11.5 billion in 2023 and is projected to reach $35.2 billion by 2028, demonstrating substantial growth potential.

Munich Re's commitment to understanding and mitigating cyber risks is evident in its continuous tracking of cyber trends and threats. This proactive approach ensures they can better serve clients by offering tailored insurance products and managing their own operational resilience against these pervasive digital dangers.

Use of IoT and Telematics for Risk Monitoring

The insurance industry, including major reinsurers like Munich Re, is increasingly exploring the use of Internet of Things (IoT) devices and telematics for real-time risk monitoring and proactive loss prevention. This technology allows for the collection of granular data on user behavior and asset condition, enabling more accurate risk assessment and the development of tailored insurance products. For instance, in the automotive sector, telematics data from connected vehicles can help insurers understand driving habits, leading to usage-based insurance (UBI) policies that reward safer drivers.

While specific Munich Re initiatives in this exact area aren't extensively detailed in the latest public disclosures, the company's broader investment in data analytics and artificial intelligence (AI) strongly indicates a strategic focus on leveraging such advanced technologies. The global market for IoT in insurance is projected for significant growth, with estimates suggesting it could reach tens of billions of dollars in the coming years. This trend underscores the potential for Munich Re to harness IoT and telematics to refine underwriting, improve claims management, and offer innovative risk mitigation services to its clients.

The application of IoT and telematics presents several key opportunities for reinsurers:

- Enhanced Risk Assessment: Real-time data from IoT devices provides a more dynamic and precise understanding of risks compared to traditional actuarial models.

- Loss Prevention and Mitigation: Proactive alerts and insights from telematics can help policyholders prevent incidents, thereby reducing claims frequency and severity.

- Personalized Insurance Products: Data-driven insights allow for the creation of highly customized insurance offerings that better align with individual risk profiles and behaviors.

- New Revenue Streams: Beyond traditional insurance, reinsurers can offer data analytics and risk management consulting services powered by IoT insights.

Blockchain and Quantum Computing

Munich Re is actively monitoring quantum computing, recognizing its future potential to revolutionize risk modeling and complex financial simulations. While commercial applications are still some years off, their Tech Trend Radar 2025 highlights this as a significant long-term development to watch.

The company also sees value in blockchain technology, particularly for standardizing insurance APIs. This could significantly improve data sharing and efficiency, especially in areas like claims processing, by offering enhanced transparency and security.

- Blockchain's Role: Enhancing transparency and efficiency in insurance claims processing through standardized APIs.

- Quantum Computing's Potential: Long-term impact on risk modeling and financial simulations, as identified in Munich Re's 2025 Tech Trend Radar.

- Data Sharing Advancement: API standardization, potentially powered by distributed ledger technology, to streamline data exchange within the industry.

Munich Re is heavily investing in AI, including generative AI and AI agents, to enhance underwriting accuracy and streamline operations, a trend that saw significant Insurtech funding in 2024 focused on AI-driven underwriting.

The company's 2025 Tech Trend Radar highlights spatial intelligence from satellite data for improved catastrophe risk assessment, while blockchain is being explored for API standardization to boost data sharing and efficiency in claims processing.

The escalating frequency and complexity of cybersecurity threats drive demand for cyber insurance, a sector where Munich Re is active, with the global cyber insurance market projected to grow substantially from an estimated $11.5 billion in 2023.

Munich Re is also leveraging IoT and telematics for real-time risk monitoring, aiming to refine underwriting and offer personalized insurance products, a sector poised for significant growth in the coming years.

| Technology Area | Munich Re Focus/Investment | Industry Trend/Data (2024/2025 Projections) |

|---|---|---|

| Artificial Intelligence (AI) | Generative AI, AI agents for underwriting and claims | Significant Insurtech funding in AI for underwriting (2024); AI adoption accelerating |

| Spatial Intelligence | Satellite data, geospatial analytics for catastrophe risk | Growing emphasis in 2025 Tech Trend Radar |

| Blockchain | API standardization for data sharing and claims processing | Potential to improve transparency and efficiency |

| Cybersecurity | Developing cyber insurance solutions, managing own resilience | Global cyber insurance market ~$11.5B (2023), projected growth |

| IoT & Telematics | Data analytics for risk monitoring and personalized products | Sector poised for tens of billions in market value |

Legal factors

Data privacy regulations, like the General Data Protection Regulation (GDPR), profoundly affect how Munich Re manages sensitive client information across its global operations. Compliance is paramount, shaping practices for data collection, storage, and utilization in underwriting and claims processing.

As of early 2024, the global regulatory landscape for data privacy continues to evolve, with many nations updating or introducing new legislation. Munich Re must remain agile, adapting its data handling protocols to meet these varying and often stringent requirements, ensuring lawful and ethical data stewardship.

The challenge lies in balancing robust data protection with the need to leverage data for innovation in areas like risk assessment and product development. Munich Re's ability to navigate these complex legal frameworks will be critical for maintaining trust and operational efficiency in the coming years.

Changes in insurance contract law and liability frameworks globally directly influence Munich Re's policy structures and the risks it underwrites. For example, evolving legal interpretations in the United States, particularly concerning casualty lines, have led to concerns about adverse reserve development, impacting how long-tail liabilities are managed and provisioned for.

Munich Re, operating globally, faces stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These rules mandate rigorous customer due diligence and continuous transaction monitoring to thwart illicit financial flows, a critical aspect for any major financial player.

Failure to comply can result in severe legal penalties, including substantial fines and operational restrictions. For instance, in 2023, financial institutions worldwide faced billions in AML-related fines, underscoring the high stakes involved. Munich Re's commitment to robust compliance frameworks is therefore essential to safeguard its reputation and financial stability.

Competition Law and Antitrust Regulations

Competition law and antitrust regulations are crucial for the global insurance and reinsurance sectors, shaping how companies like Munich Re operate, particularly concerning market consolidation and pricing strategies. These frameworks ensure fair play and prevent monopolistic practices, which is vital for a healthy market. Munich Re's adherence to these laws is paramount for its continued success and reputation.

The reinsurance market, while experiencing some competitive shifts, is generally anticipated to maintain a degree of discipline in its pricing and practices. For instance, regulatory scrutiny on mergers and acquisitions within the insurance industry, which can impact reinsurance capacity, remains a constant factor. The European Union's Directorate-General for Competition actively monitors market concentration, and recent enforcement actions in related financial services sectors underscore the importance of compliance.

- Regulatory Oversight: Antitrust authorities globally, including the European Commission and the U.S. Department of Justice, scrutinize mergers and acquisitions in the insurance and reinsurance industries to prevent undue market power.

- Pricing Practices: Competition laws govern how insurers and reinsurers set prices, prohibiting collusion and anti-competitive behavior that could harm consumers or other market participants.

- Market Discipline: Despite potential competitive pressures, the reinsurance industry generally exhibits pricing discipline, influenced by capital availability and risk appetite, a dynamic that must align with regulatory expectations.

- Compliance Burden: Munich Re, as a global entity, faces a complex web of national and international competition laws, requiring robust internal compliance programs to navigate varying legal interpretations and enforcement priorities.

Climate Change Litigation and Environmental Liabilities

The landscape of climate change litigation is rapidly evolving, posing significant new environmental liabilities for insurers and reinsurers. As of early 2025, there's a notable uptick in lawsuits targeting corporations and governments for their alleged contributions to climate change or for failing to adequately mitigate its impacts. This trend necessitates a rigorous assessment of legal risks, including potential claims stemming from climate-induced damages like extreme weather events or inadequate climate adaptation strategies.

Munich Re is proactively adapting its risk assessment frameworks to navigate these emerging legal challenges. The company is enhancing its risk models to better incorporate the complexities of climate change litigation and its potential financial repercussions. This includes analyzing case law developments and evolving regulatory frameworks globally to ensure comprehensive coverage and risk management strategies. For instance, by mid-2024, several high-profile climate lawsuits were proceeding in major jurisdictions, highlighting the growing legal exposure.

- Growing Litigation: Lawsuits related to climate change impacts and corporate responsibility are on the rise globally, creating new legal precedents.

- Environmental Liabilities: Insurers and reinsurers face increased exposure to claims for climate-induced damages and failures in climate action.

- Risk Model Adaptation: Munich Re is enhancing its risk models to account for the evolving legal and financial implications of climate change litigation.

- Regulatory Scrutiny: Increased regulatory focus on climate-related disclosures and corporate accountability is also shaping the legal environment.

Munich Re's operations are significantly shaped by evolving insurance and reinsurance regulations worldwide, impacting everything from solvency requirements to product design and market conduct. For instance, the Solvency II directive in Europe, and similar frameworks in other regions, dictate capital adequacy and risk management practices, influencing Munich Re's strategic planning and investment decisions.

The company must also navigate complex legal frameworks related to consumer protection and fair practices, ensuring transparency and ethical conduct in its dealings with clients and business partners. Compliance with these varied legal requirements across different jurisdictions is a continuous operational challenge and a significant cost factor.

Furthermore, the increasing focus on environmental, social, and governance (ESG) factors by regulators means Munich Re must demonstrate robust governance and sustainability practices, which can influence its license to operate and its attractiveness to investors. For example, by 2024, many jurisdictions were implementing stricter ESG disclosure mandates for financial institutions.

Environmental factors

Climate change is undeniably fueling a rise in natural disasters, making 2024 a particularly tough year. Munich Re's data highlights this, showing global losses hit $320 billion, with weather events causing a staggering 93% of that damage.

This escalating frequency and intensity of events directly impacts Munich Re by increasing its claims payouts. Consequently, the company must continuously refine its risk assessment models and adjust its pricing strategies to account for these heightened perils.

The global push towards a net-zero emissions future creates significant transition risks for Munich Re. These risks are particularly pronounced in its investment portfolio and underwriting activities, especially those tied to fossil fuels. For instance, as of early 2024, the increasing regulatory pressure and market sentiment against carbon-intensive industries could devalue assets heavily reliant on fossil fuel extraction and consumption.

Munich Re is actively addressing these risks by setting ambitious decarbonization targets. By 2025, the company aims to substantially reduce its exposure to coal and lower emissions from oil and gas production within its insurance business. This strategy involves strategic divestments from high-carbon assets and a careful adaptation of its underwriting guidelines to align with a lower-carbon economy.

Physical risks, driven by climate change, are increasingly impacting insured assets worldwide. Munich Re highlights that events like rising sea levels, more intense hurricanes and floods, and prolonged heatwaves are escalating claims. For instance, in 2023, insured losses from natural catastrophes were estimated to be around $110 billion, a notable figure underscoring the growing threat.

Munich Re is actively addressing these escalating physical risks by developing innovative solutions. The company recognizes that without targeted mitigation strategies, the frequency and severity of these events will continue to drive higher insured losses. This proactive approach is crucial for maintaining insurability and financial stability in the face of a changing climate.

Regulatory Pressure and ESG Performance

Munich Re is navigating increasing regulatory pressure and evolving stakeholder expectations around Environmental, Social, and Governance (ESG) performance, which directly impacts its strategic direction. The company has embedded sustainability into its core operations and business model, as detailed in its Group Ambition 2025, demonstrating a commitment to responsible business practices.

While Munich Re has strategically withdrawn from certain climate initiatives, citing legal ambiguities, it maintains a strong dedication to climate protection through its self-defined targets and strategic initiatives. This approach allows the company to adapt to the dynamic regulatory landscape while pursuing its sustainability goals.

- Regulatory Scrutiny: Growing governmental regulations globally are mandating greater transparency and action on climate-related risks and opportunities for insurers.

- ESG Integration: Munich Re's Group Ambition 2025 includes specific targets for reducing its operational carbon footprint and increasing investments in sustainable solutions.

- Strategic Adaptability: The company's withdrawal from specific climate alliances, while maintaining internal commitments, highlights its careful navigation of legal and reputational risks associated with climate action.

- Stakeholder Demands: Investors, clients, and employees increasingly expect strong ESG performance, pushing Munich Re to continuously improve its sustainability reporting and impact.

Opportunities in Green Insurance Products

The increasing global focus on sustainability and climate action is opening doors for Munich Re in the realm of green insurance. As businesses and governments commit to net-zero targets, there's a rising demand for insurance solutions that support these environmentally conscious endeavors. This trend presents a significant growth avenue for the company.

Munich Re is actively capitalizing on this opportunity through its 'Green Solutions' initiative. This program is designed to assist clients in achieving their net-zero goals by offering specialized insurance products. The company's ambition is to become a market leader in commercial specialty and primary green insurance risks by the year 2030, reflecting a strategic commitment to this evolving sector.

- Growing Demand: The global market for green insurance products is expanding rapidly, driven by corporate sustainability commitments.

- Munich Re's Strategy: The 'Green Solutions' initiative directly addresses this demand, aiming to support net-zero ambitions.

- Market Ambition: Munich Re targets a leading market share in green insurance risks by 2030.

- Investment Focus: This strategy includes a notable increase in investments directed towards renewable energy projects.

The increasing frequency and severity of climate-related events are a major concern, with global losses from natural catastrophes in 2024 reaching $320 billion, 93% of which stemmed from weather events. This trend directly impacts Munich Re through higher claims payouts, necessitating continuous refinement of risk models and pricing strategies to account for these escalating perils.

Munich Re is actively responding to these environmental shifts by setting ambitious decarbonization targets, aiming to significantly reduce its exposure to coal and lower emissions from oil and gas production within its insurance business by 2025. This proactive strategy involves divesting from high-carbon assets and adapting underwriting guidelines to align with a lower-carbon economy, demonstrating a commitment to navigating transition risks.

The company is also developing innovative solutions to address the growing physical risks posed by climate change, such as rising sea levels and more intense storms, which drove insured losses to approximately $110 billion in 2023. Munich Re's focus on targeted mitigation strategies is crucial for maintaining insurability and financial stability in the face of a changing climate.

Furthermore, Munich Re is capitalizing on the growing demand for green insurance, driven by net-zero commitments, through its 'Green Solutions' initiative. The company aims to become a market leader in this sector by 2030, which includes a notable increase in investments directed towards renewable energy projects.

| Environmental Factor | Impact on Munich Re | Munich Re's Response/Strategy |

|---|---|---|

| Climate Change & Natural Disasters | Increased claims payouts, need for refined risk models and pricing. | Continuous adaptation of risk assessment and pricing strategies. |

| Transition to Net-Zero | Devaluation of fossil fuel-reliant assets, investment portfolio risks. | Decarbonization targets, divestment from high-carbon assets, adaptation of underwriting. |

| Physical Risks (Sea Level Rise, Extreme Weather) | Escalating insured losses, impacting financial stability. | Development of innovative solutions, targeted mitigation strategies. |

| Growing Demand for Green Insurance | Opportunity for new market segments and growth. | 'Green Solutions' initiative, targeting market leadership by 2030, increased investment in renewables. |

PESTLE Analysis Data Sources

Our Munich Re PESTLE Analysis is built on a comprehensive foundation of data, drawing from official reports from international organizations like the IMF and World Bank, as well as reputable market research firms and government publications. This ensures that each factor, from political stability to technological advancements, is grounded in current, fact-based insights.