Munich Re Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Munich Re Bundle

Munich Re operates in a highly competitive reinsurance market, facing significant pressure from established players and potential new entrants. Understanding the intricate interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for navigating this landscape.

The full Porter's Five Forces Analysis delves into the specific dynamics shaping Munich Re's industry—from the bargaining power of its clients to the ever-present threat of innovative solutions. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Munich Re's ability to access capital markets is crucial for its operations as a major reinsurer. In 2024 and 2025, the global reinsurance market is expected to see continued strength, with robust operating profits and strong capitalization. This positive outlook should translate into favorable conditions for Munich Re to access the necessary capital, influencing its solvency and investment income generation.

The reinsurance sector, including giants like Munich Re, heavily relies on a pool of highly specialized professionals. Think actuaries, risk modelers, and expert underwriters. Without these skilled individuals, the complex calculations and assessments crucial for the industry simply wouldn't happen.

The demand for this niche expertise often outstrips supply, especially in rapidly evolving areas such as cyber risk assessment. This scarcity naturally elevates the bargaining power of these professionals, allowing them to command higher salaries and better working conditions. For instance, the global shortage of cybersecurity professionals, a key area for reinsurance, has been a persistent challenge, with estimates suggesting millions of unfilled positions worldwide in recent years.

Munich Re, to stay ahead in this competitive landscape, must actively focus on attracting and retaining this top-tier talent. This involves not only competitive compensation but also investing in continuous training and development to keep their workforce at the forefront of industry knowledge and to effectively navigate emerging market demands and risks.

In the reinsuranc e sector, companies like Munich Re depend heavily on data and technology providers for advanced analytics, AI, and risk modeling. This reliance grants these suppliers considerable bargaining power, as they offer critical tools for assessing complex risks and boosting efficiency. For instance, the global AI market was projected to reach $181 billion in 2023 and is expected to grow substantially, highlighting the increasing value and demand for these technologies.

Munich Re's need for cutting-edge solutions in underwriting and operational improvement means technology vendors can influence pricing and contract terms. The integration of AI and machine learning is not just about improving user experiences; it's actively expanding the reinsurer's capabilities and role within the broader insurance value chain, further solidifying supplier leverage.

Retrocessionaires

Munich Re, as a leading reinsurer, also relies on retrocessionaires to manage its own risk portfolio. The bargaining power of these retrocessionaires is significant, particularly when Munich Re seeks to offload large or intricate risks. This power directly impacts Munich Re's cost of capital and the overall efficiency of its risk transfer mechanisms.

The market dynamics for retrocessionaires have been tightening. For instance, in the first half of 2024, the global reinsurance market experienced continued upward pressure on pricing for catastrophe covers. This increased demand, coupled with a more constrained supply of retrocession capacity, has effectively shifted pricing power towards retrocessionaires.

- Concentrated Market: A limited number of large retrocessionaires can exert considerable influence over pricing and terms, especially for specialized risks.

- Capacity Constraints: Reduced availability of retrocession capacity, driven by factors like increased catastrophe losses, amplifies the bargaining power of those providers who do offer capacity.

- Pricing Pressure: The current market environment, characterized by higher demand for reinsurance and retrocession, allows retrocessionaires to command higher prices, impacting Munich Re's profitability.

- Risk Specialization: For highly complex or unusual risks, Munich Re may have fewer retrocession options, further strengthening the position of available retrocessionaires.

Catastrophe Modeling Firms

Catastrophe modeling firms hold significant bargaining power over Munich Re due to the specialized and proprietary nature of their risk assessment tools. These firms provide essential data and software that Munich Re relies on to underwrite property and casualty risks, particularly in the face of increasing climate change impacts. Their ability to accurately predict and quantify natural disaster events is critical for reinsurers to manage their exposure and capital effectively.

The insights derived from these models are not easily replicated, giving these suppliers leverage in pricing and contract terms. For example, the increasing frequency and severity of weather-related events, such as the record-breaking insured losses from natural catastrophes in 2023, estimated to be around $110 billion globally by Swiss Re, underscore the indispensable value of sophisticated modeling capabilities.

- Specialized Expertise: Catastrophe modeling firms possess unique technical skills and intellectual property in assessing complex natural disaster risks.

- Data Dependency: Munich Re, like other reinsurers, depends heavily on the accuracy and comprehensiveness of these models for underwriting and pricing.

- Climate Change Impact: The growing threat of climate change amplifies the need for advanced modeling, increasing the reliance on these specialized suppliers.

Munich Re's bargaining power with its suppliers is influenced by the concentration of providers for critical services like catastrophe modeling and specialized IT solutions. The increasing demand for advanced risk assessment tools, driven by climate change and evolving cyber threats, gives these suppliers leverage. For instance, the global market for AI in insurance, a key area for Munich Re's technological needs, was projected to experience significant growth through 2024 and beyond, indicating strong demand for these specialized inputs.

The reliance on a limited number of highly specialized professionals, such as actuaries and risk modelers, also strengthens supplier power. The global shortage of cybersecurity experts, a critical talent pool for assessing new risks, further enhances the bargaining position of these individuals and the firms that employ them. This scarcity means Munich Re must compete for talent, impacting labor costs.

Retrocessionaires, who provide Munich Re with risk transfer capacity, also hold considerable bargaining power, especially in markets where capacity is constrained. The upward pressure on catastrophe reinsurance pricing observed in early 2024, due to increased insured losses from natural events, demonstrates this shift. This dynamic allows retrocessionaires to dictate terms and pricing, directly affecting Munich Re's risk management costs.

The bargaining power of Munich Re's suppliers is generally moderate to high, particularly for specialized inputs and talent. Key factors contributing to this include market concentration among providers of essential technologies like catastrophe modeling, the scarcity of specialized human capital, and the tightening capacity in the retrocession market. For example, the estimated global insured losses from natural catastrophes in 2023, around $110 billion, highlight the critical need for and value of sophisticated modeling capabilities, thereby strengthening the position of these providers.

What is included in the product

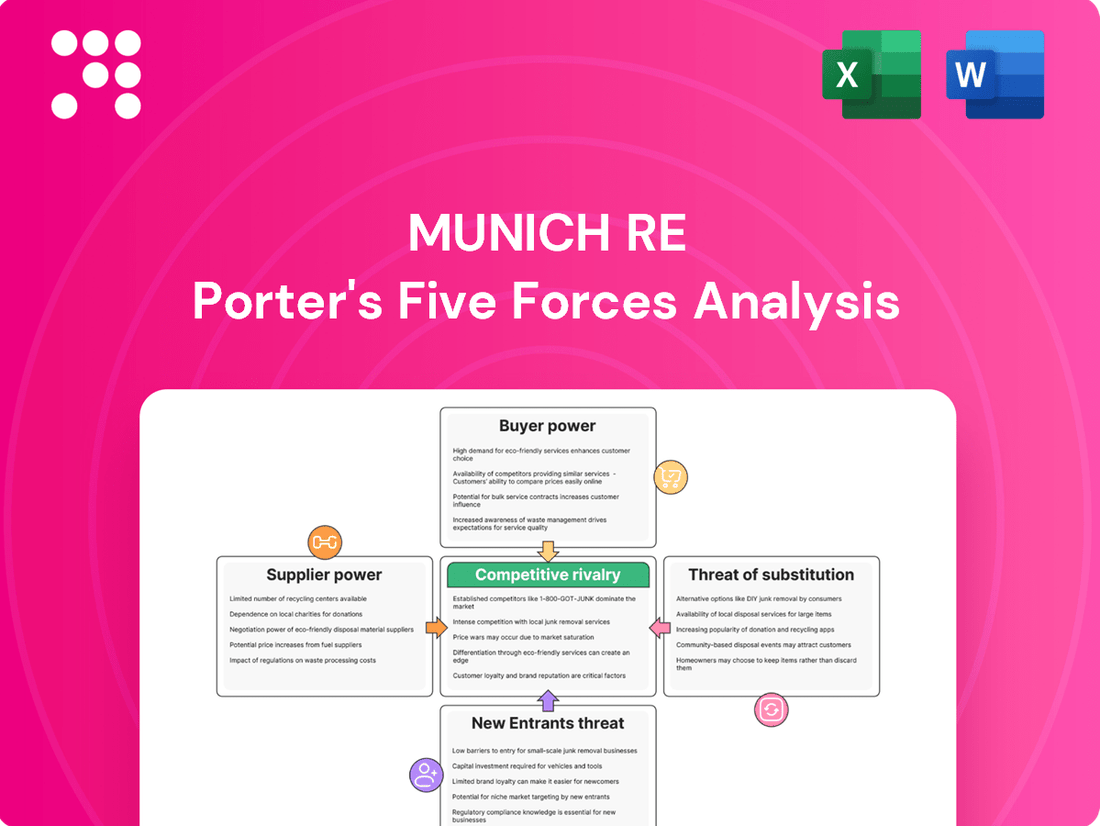

This analysis dissects the competitive forces shaping Munich Re's reinsurance market, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players.

Quickly identify and address competitive threats with a visual breakdown of Munich Re's market pressures, enabling proactive strategy adjustments.

Customers Bargaining Power

Munich Re's primary customers are insurance companies, many of which are substantial, globally recognized entities. This sophisticated client base can exert significant bargaining power, particularly as consolidation within the primary insurance market continues.

As primary insurers merge and grow, they become larger, more concentrated buyers. This scale allows them to negotiate more aggressively on pricing and terms with reinsurers like Munich Re. For instance, a report from S&P Global Market Intelligence in late 2023 indicated continued M&A activity in the insurance sector, suggesting an ongoing trend towards larger client entities.

However, this consolidation also fuels a flight to quality, benefiting well-established reinsurers. Munich Re's strong financial standing and reputation enable it to attract a greater share of business from these larger, more discerning clients who prioritize security and capacity.

The availability of reinsurance capacity significantly influences the bargaining power of customers, particularly primary insurers. In 2024, the global reinsurance market experienced a notable increase in available capital, with both traditional and alternative capital sources expanding. This surge in supply meant primary insurers had more options when seeking reinsurance coverage.

This ample capacity, especially for challenging lines like property catastrophe risks, directly translated into enhanced bargaining power for primary insurers. With a greater number of reinsurers willing to provide coverage, primary insurers could negotiate more favorable terms and pricing during renewal periods, effectively reducing their own costs and improving their profitability.

Munich Re's clientele, comprising major corporations and public sector entities, demonstrates advanced risk management capabilities. These clients often possess in-house expertise, allowing them to evaluate and pursue diverse risk transfer solutions, diminishing their dependence on any single reinsurer.

This heightened client sophistication translates into a stronger bargaining position. For instance, in 2023, the global insurance market saw a significant increase in demand for customized reinsurance solutions, with sophisticated buyers actively seeking competitive pricing and tailored coverage, directly impacting reinsurer margins.

Switching Costs and Long-Term Relationships

While switching reinsurers might involve some administrative steps, these costs aren't typically a major barrier for primary insurers, especially when there's ample capacity in the market. However, Munich Re benefits from the loyalty fostered through long-standing relationships, particularly when dealing with complex or specialized risks where established trust is paramount.

The ability of clients to switch reinsurers is somewhat limited by the administrative effort involved, though this is generally manageable. The true leverage clients have often comes from the availability of alternative reinsurers in a competitive market. For instance, in 2024, the global reinsurance market continued to see robust capacity, which generally empowers buyers.

- Switching Costs: Generally low to moderate for primary insurers, primarily involving administrative tasks.

- Long-Term Relationships: A significant factor, especially for specialty lines, fostering client loyalty and reducing the incentive to switch.

- Trust and Expertise: Crucial for complex risks, where established relationships and proven track records with Munich Re are highly valued.

- Data Alignment: Essential for bridging client needs and reinsurer capabilities, strengthening the partnership and implicitly increasing switching costs.

Information Asymmetry Reduction

The bargaining power of customers is significantly influenced by the reduction of information asymmetry. Primary insurers now possess enhanced access to data and sophisticated analytics, which helps to level the playing field that once heavily favored reinsurers. This increased transparency empowers clients, enabling them to better assess their own risk profiles and compare the reinsurance solutions available to them, thereby bolstering their negotiating leverage.

Advanced climate models and big data analytics further amplify this trend. For instance, by mid-2024, the global insurance analytics market was projected to reach over $10 billion, with significant growth driven by these technological advancements. This allows primary insurers to provide more granular risk assessments to their clients, making it easier for clients to understand the value and cost of reinsurance, and thus strengthening their position when negotiating terms.

- Enhanced Data Access: Primary insurers leverage big data and advanced analytics to gain deeper insights into risk, reducing the knowledge gap with reinsurers.

- Client Empowerment: Improved transparency allows clients to better understand their own risks and compare reinsurance options, strengthening their negotiating power.

- Technological Advancements: Sophisticated tools like advanced climate models provide clients with more precise risk information, further tipping the scales in their favor.

The bargaining power of Munich Re's customers, primarily primary insurers, is substantial due to market consolidation and increased client sophistication. In 2024, a robust reinsurance market with abundant capital meant primary insurers had more options, enabling them to negotiate better pricing and terms. This increased capacity, particularly for catastrophe risks, directly enhanced their leverage, as evidenced by competitive renewal cycles reported throughout the year.

| Factor | Impact on Customer Bargaining Power | 2024 Market Context |

|---|---|---|

| Market Consolidation | Increases buyer concentration, leading to stronger negotiation positions. | Continued M&A activity in primary insurance sector. |

| Availability of Reinsurance Capacity | More options empower clients to seek favorable terms and pricing. | Significant influx of traditional and alternative capital. |

| Client Sophistication & Data Access | Clients leverage advanced analytics to understand risks and compare solutions. | Growth in insurance analytics market, exceeding $10 billion projected by mid-2024. |

What You See Is What You Get

Munich Re Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Munich Re's competitive landscape through Porter's Five Forces, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the reinsurance industry. This comprehensive assessment is crucial for understanding Munich Re's strategic positioning and future challenges.

Rivalry Among Competitors

The global reinsurance market is highly concentrated, with a few major players like Munich Re, Swiss Re, and Hannover Re holding significant market share, creating an oligopolistic environment. This concentration means that while direct competition is limited, the rivalry among these dominant firms is fierce, fueled by their ambition for market dominance and financial success.

Munich Re has demonstrated a strong competitive edge, notably outperforming its peers in profit growth. For instance, in 2023, Munich Re reported a profit of €4.2 billion, a substantial increase that highlights its ability to navigate the competitive landscape effectively and generate superior returns.

The reinsurance market has seen a significant shift towards hardening, marked by rising prices and more stringent contract terms, especially in property catastrophe coverage. This trend, which began in recent years, has continued into 2024, with reinsurers prioritizing risk selection and profitability over aggressive market share grabs.

While some rate moderation is occurring in specific segments, reinsurers are largely maintaining their underwriting discipline. This means competition is now more focused on the nuances of contract terms and conditions rather than solely on price, pushing cedents to accept more restrictive clauses to secure capacity.

Industry-wide, reinsurers are anticipated to earn their cost of capital for the 2024 and 2025 periods. For instance, S&P Global Ratings projected that the global reinsurance sector's combined ratio would improve to 93.7% in 2024, a significant enhancement from 97.2% in 2023, indicating a return to profitability and a strong pricing environment.

The global reinsurance market is experiencing robust growth, projected to expand due to escalating natural catastrophe losses and a growing demand for protection against emerging risks such as cyber threats. This expansion, however, doesn't diminish the fierce competition among reinsurers.

In 2024, the reinsurance industry saw its capital reach unprecedented heights, providing ample capacity. Despite this, companies are intensely competing to secure profitable business lines, leading to sustained rivalry.

Product Differentiation and Specialization

Reinsurers, including Munich Re, actively differentiate themselves by offering specialized solutions for increasingly complex risks. This includes areas like cyber threats and climate change impacts, where tailored expertise is crucial. Munich Re's extensive service portfolio and deep risk management knowledge are significant competitive advantages, allowing them to provide more than just coverage.

Value-added services, such as risk consulting and data analytics, further set reinsurers apart. For instance, Munich Re's focus on emerging risks like cyber liability is supported by their ability to analyze and model these evolving threats. The integration of technologies like AI and machine learning is enhancing user experience and broadening the scope of services reinsurers can offer, moving beyond traditional risk transfer.

- Specialized Risk Solutions: Munich Re offers tailored reinsurance for cyber, climate, and other complex risks.

- Value-Added Services: Risk consulting and data analytics are key differentiators.

- Technological Integration: AI and ML are improving user experience and service offerings.

Capitalization and Financial Strength

Competitive rivalry in the reinsurance sector, including for a major player like Munich Re, is significantly influenced by capitalization and financial strength. Reinsurers with strong capital adequacy, such as Munich Re, are inherently more competitive. This robust financial backing allows them to absorb substantial losses more effectively, offer higher coverage limits to clients, and crucially, maintain and build client trust in their ability to meet obligations.

The reinsurance industry, as a whole, has demonstrated a consistent trend of being well-capitalized. This general strength in the sector acts as a crucial buffer against potential financial stresses and market volatility. For instance, as of early 2024, the global reinsurance market's capital base remained solid, with major reinsurers reporting strong solvency ratios, underscoring the importance of financial resilience in this competitive landscape.

- Capital Adequacy: Reinsurers with strong capital positions can absorb larger losses and offer higher limits.

- Client Confidence: Robust financial strength directly translates to greater client trust and loyalty.

- Market Resilience: The sector generally remains well-capitalized, providing a buffer against economic shocks.

- Competitive Advantage: Financial strength is a key differentiator, allowing well-capitalized firms to attract and retain business.

Competitive rivalry among reinsurers, including Munich Re, is intense, driven by the need to secure profitable business in a well-capitalized market. This rivalry is less about price wars and more about offering specialized risk solutions and value-added services like risk consulting and data analytics. Companies leveraging technologies such as AI and machine learning are gaining an edge, enhancing client experience and expanding service capabilities beyond traditional risk transfer.

The reinsurance market's strong capitalization, with global reinsurers reporting solid solvency ratios in early 2024, means that financial strength is a key differentiator. Reinsurers with robust capital adequacy, like Munich Re, can absorb greater losses, offer higher coverage limits, and build client confidence, which is crucial for retaining and attracting business in this competitive environment.

| Metric | 2023 | 2024 Projection |

|---|---|---|

| Munich Re Profit | €4.2 billion | N/A |

| Global Reinsurance Combined Ratio | 97.2% | 93.7% |

| Market Capitalization Trend | Strong | Robust Growth |

SSubstitutes Threaten

Large corporations and sophisticated primary insurers are increasingly opting to self-insure a significant portion of their risks or establish captive insurance companies. This strategic move directly diminishes their dependence on traditional reinsurance markets, particularly for risks that are more predictable or less prone to frequent occurrence. For instance, in 2024, the global captive insurance market continued its robust growth, with estimates suggesting it handles hundreds of billions of dollars in premiums annually, reflecting a growing trend towards in-house risk management.

While self-insurance and captives offer advantages for managing certain types of losses, the fundamental need for traditional reinsurance persists, especially when dealing with catastrophic events or highly complex and unpredictable risks. The sheer scale and potential financial impact of such events often exceed the capacity of even well-funded self-insurance programs or individual captive insurers, underscoring the vital role of reinsurers in providing essential risk transfer and capacity.

The burgeoning insurance-linked securities (ILS) market, encompassing instruments like catastrophe bonds and collateralized reinsurance, presents a significant alternative to traditional reinsurance. These capital market solutions offer direct access to investor capital, effectively bypassing traditional reinsurers for specific risk exposures.

This trend allows cedents to diversify their risk transfer options and potentially secure capacity at competitive prices. The ILS market has seen consistent, albeit modest, capacity growth, demonstrating its increasing relevance as a substitute risk transfer mechanism.

Government-backed insurance or reinsurance schemes, particularly for perils like terrorism or floods, present a significant threat of substitution in certain regions. When private market capacity tightens or becomes prohibitively expensive, these public sector initiatives can step in, offering an alternative for risk coverage. For instance, in the United States, the National Flood Insurance Program (NFIP) provides flood insurance in communities that adopt flood management regulations, acting as a direct substitute for private flood insurance, especially in high-risk areas.

Risk Retention and Higher Deductibles

Primary insurers and corporations are increasingly choosing to retain more risk by raising their deductibles or attachment points on reinsurance contracts. This strategy is a direct response to the rising cost of reinsurance, especially evident in the current hard market conditions. By self-insuring more, these entities signal a decreased dependence on extensive reinsurance protection.

This shift towards higher attachment points has demonstrably improved the financial results for reinsurers. For instance, in 2023, the property catastrophe reinsurance market saw significant price increases, leading many cedents to explore higher retentions to manage their treaty costs. This trend is expected to continue as insurers seek to optimize their risk transfer strategies in a challenging economic environment.

- Increased Deductibles: Insurers and corporations are opting to absorb smaller losses themselves.

- Cost Reduction Driver: This move is primarily motivated by the desire to lower reinsurance premiums.

- Hard Market Impact: The current reinsurance market conditions exacerbate this trend.

- Reinsurer Benefit: Higher attachment points have positively impacted reinsurers' profitability.

Technological Solutions for Risk Management

The rise of advanced technological solutions presents a significant threat of substitutes for traditional reinsurance. Innovations in predictive analytics, the Internet of Things (IoT), and artificial intelligence (AI) are empowering companies to manage risks more effectively in-house.

These internal capabilities can reduce reliance on external risk transfer mechanisms like reinsurance. For instance, AI and machine learning are not only enhancing user experiences but also expanding the reinsurer's potential role within the broader value chain, potentially disintermediating traditional functions.

By 2024, the global InsurTech market was valued at over $10 billion, with a significant portion dedicated to risk management and analytics solutions. This growth indicates a clear trend towards companies investing in technologies that can mitigate risks internally, thereby diminishing the perceived need for traditional reinsurance coverage.

- Predictive Analytics: Enables proactive risk identification and mitigation, reducing the need for post-event coverage.

- IoT Integration: Provides real-time data for continuous risk monitoring and assessment, fostering internal control.

- AI/ML Advancements: Improves underwriting accuracy and claims processing, potentially lowering the cost of internal risk management versus external transfer.

- InsurTech Growth: The expanding InsurTech sector offers alternative risk management tools and platforms, directly competing with reinsurer services.

The threat of substitutes for Munich Re's reinsurance services is multifaceted, encompassing self-insurance, captive insurers, insurance-linked securities (ILS), and government-backed schemes. These alternatives allow businesses to manage risks internally or access capital markets directly, bypassing traditional reinsurers. For example, the global captive insurance market handles hundreds of billions in premiums annually, showcasing a significant shift towards in-house risk management.

The expanding InsurTech market, valued at over $10 billion in 2024, offers advanced analytics and AI solutions that empower companies to mitigate risks internally, reducing their reliance on external reinsurance. Furthermore, government programs for specific perils, like the US National Flood Insurance Program, provide direct substitutes for private reinsurance in certain high-risk areas.

The increasing tendency for primary insurers and corporations to raise deductibles or attachment points on reinsurance contracts, driven by hard market conditions, also represents a form of substitution. This strategy allows them to retain more risk, thereby decreasing their dependence on comprehensive reinsurance coverage.

Entrants Threaten

Entering the reinsurance market, the arena where Munich Re operates, demands immense financial resources. Companies need significant capital not only to absorb potentially massive losses but also to comply with strict regulatory solvency mandates designed to protect policyholders. This necessity creates a formidable barrier, effectively deterring many aspiring new entrants from seriously challenging established players like Munich Re.

The sheer scale of capital required is a major deterrent. For instance, global reinsurance capital reached an all-time high in 2023, demonstrating the substantial financial muscle needed to compete effectively. This escalating capital requirement means that only well-funded entities can realistically consider entering this space, thus limiting the threat of new competition.

The reinsurance sector presents substantial barriers to entry due to stringent regulatory frameworks and intricate licensing requirements that vary significantly across different countries. Potential new players must invest heavily in understanding and complying with these diverse rules, a process that can be both time-consuming and costly. For instance, as of early 2024, obtaining the necessary approvals to operate in key markets like the EU or the US involves extensive documentation and capital adequacy assessments, deterring many aspiring entrants.

Furthermore, the recent adoption of IFRS 17, a new accounting standard for insurance contracts, has added another layer of complexity for reinsurers. This standard, fully implemented by many companies in 2023 and 2024, requires significant changes to financial reporting and data systems. New entrants face the challenge of building or adapting their infrastructure to meet these demanding reporting standards, which can be a substantial initial investment and operational hurdle.

Established reinsurers like Munich Re leverage substantial economies of scale, making it challenging for newcomers to match their efficiency in underwriting, claims management, and risk pooling. Their extensive historical data and decades of accumulated expertise represent a formidable barrier, as this knowledge base is crucial for accurate pricing and risk assessment.

The difficulty for new entrants to quickly build comparable data sets and operational efficiencies significantly deters their entry. This advantage is underscored by Munich Re's performance; its share price has nearly doubled since the unveiling of its Ambition 2025 strategy, reflecting investor confidence in its established strengths.

Brand Reputation and Client Relationships

New entrants face a significant hurdle in building the trust and long-standing relationships essential in the reinsurance market. Munich Re, for instance, has spent decades cultivating deep connections with its clients, who entrust the company with substantial risk portfolios. This established credibility is a formidable barrier.

The lack of an established brand reputation and proven track record makes it difficult for newcomers to compete directly with established players like Munich Re. Clients often prioritize reliability and a history of performance, a phenomenon known as the 'flight to quality,' which favors incumbents.

In 2024, the reinsurance industry continued to emphasize stability and proven expertise. For example, rating agencies like AM Best maintained a strong focus on financial strength and operational track records when assessing reinsurers, further highlighting the importance of established reputations for new market entrants.

- Brand Reputation: New entrants struggle to match the decades-long brand building and trust established by firms like Munich Re.

- Client Relationships: The deep, long-standing ties insurers have with reinsurers are hard for new players to replicate, impacting market entry.

- Flight to Quality: In uncertain economic times, clients gravitate towards reinsurers with proven stability and a history of reliable performance, which new entrants typically lack.

- Market Entry Barrier: The significant investment in time and resources required to build comparable brand equity and client loyalty presents a substantial threat to new entrants.

Access to Specialized Expertise and Distribution Channels

New entrants into the reinsurance market grapple with securing essential specialized expertise. The demand for actuaries, underwriters, and risk modelers, particularly in emerging fields like cyber risk, often outstrips available talent. For instance, in 2024, the global shortage of cybersecurity professionals was estimated to be around 3.4 million, impacting reinsurers' ability to underwrite complex cyber risks effectively.

Accessing established distribution channels and broker networks presents another significant hurdle. These channels are frequently dominated by incumbent reinsurers with long-standing relationships, making it difficult for newcomers to gain traction. Building these crucial partnerships requires time, trust, and a proven track record, which new entrants inherently lack.

- Talent Acquisition Challenges: Reinsurers require highly specialized skills in actuarial science, underwriting, and sophisticated risk modeling.

- Distribution Channel Barriers: Established broker networks and client relationships are difficult for new entrants to penetrate.

- Cyber Risk Expertise Gap: The growing demand for cyber reinsurance expertise exacerbates the talent shortage for new market participants.

The threat of new entrants in the reinsurance market is generally low due to substantial barriers. These include the immense capital required, stringent regulatory compliance, and the need for specialized expertise, all of which favor established players like Munich Re.

Newcomers struggle to replicate the deep client relationships and brand reputation that incumbents have cultivated over decades. This "flight to quality" means clients often stick with proven reinsurers, especially during uncertain economic periods, further solidifying the position of established firms.

The complexity of underwriting new risks, such as cyber threats, exacerbates the talent shortage for new entrants. Furthermore, gaining access to established distribution channels and broker networks is a significant hurdle, as these are often controlled by existing, trusted reinsurers.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Extremely high initial and ongoing capital needed for solvency and to absorb potential losses. | Significant deterrent; only well-funded entities can compete. |

| Regulatory Hurdles | Complex, varying licensing and compliance requirements across jurisdictions. | Time-consuming and costly to navigate, demanding extensive resources. |

| Economies of Scale & Expertise | Established players benefit from lower costs and superior risk assessment due to scale and historical data. | New entrants find it difficult to match pricing and underwriting efficiency. |

| Brand Reputation & Trust | Long-standing relationships and proven track records are crucial for client loyalty. | New entrants lack the credibility to attract clients, especially for large risks. |

| Talent & Distribution Access | Shortage of specialized skills (e.g., cyber) and difficulty accessing established broker networks. | Limits operational capacity and market reach for new players. |

Porter's Five Forces Analysis Data Sources

Our Munich Re Porter's Five Forces analysis is built upon a foundation of industry-leading data, including Munich Re's annual reports, financial statements, and investor presentations. We also incorporate insights from reputable market research firms, insurance industry publications, and regulatory filings to ensure a comprehensive and accurate assessment of the competitive landscape.