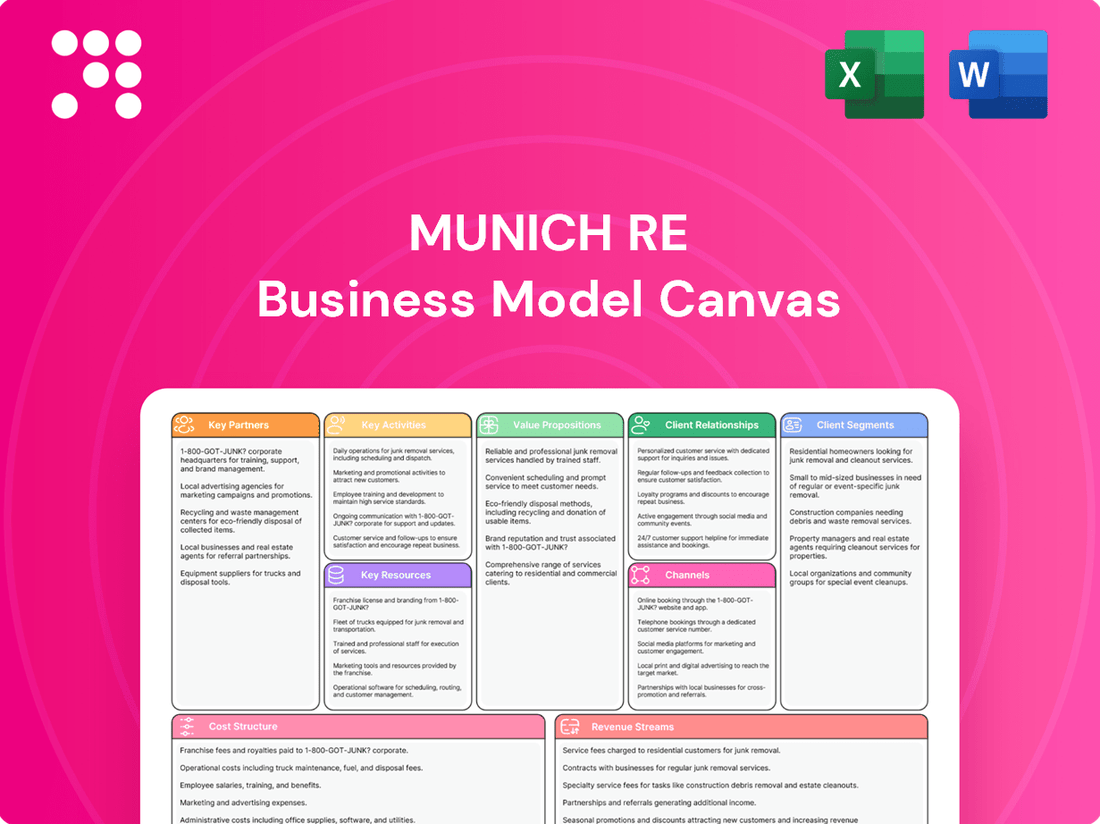

Munich Re Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Munich Re Bundle

Uncover the intricate workings of Munich Re's global reinsurance empire with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and key partnerships, offering a clear roadmap to their success.

Dive into the strategic core of Munich Re's operations and understand how they leverage their unique capabilities to manage risk and create value. This downloadable canvas is essential for anyone seeking to learn from a leader in the insurance industry.

Ready to gain a competitive edge? Access the full Munich Re Business Model Canvas, packed with actionable insights into their revenue streams, cost structure, and competitive advantages. Download it now to fuel your own strategic planning.

Partnerships

Munich Re's primary insurers are crucial partners, forming the bedrock of its reinsurance operations. These relationships allow Munich Re to accept a share of the risks that primary insurers take on, helping those insurers manage their capital and protect against significant claims. In 2024, Munich Re continued to strengthen these vital alliances, recognizing that the stability and breadth of coverage offered by primary insurers directly contribute to the diversification and profitability of its own risk portfolio.

Munich Re actively partners with major corporations and public entities, providing sophisticated risk management and bespoke insurance for intricate and novel exposures. These collaborations often involve developing innovative risk transfer methods and offering expert guidance on evolving challenges such as cyber threats and climate change impacts, going beyond standard reinsurance. For instance, in 2024, Munich Re continued its focus on climate solutions, working with a major European utility to develop a parametric insurance product for extreme weather events impacting renewable energy generation.

Munich Re actively cultivates partnerships with technology and data providers to bolster its core operations. These collaborations are vital for integrating cutting-edge analytics, artificial intelligence, and novel data streams. For instance, in 2024, Munich Re continued its focus on enhancing cyber risk modeling through strategic alliances with specialized technology firms.

These partnerships enable Munich Re to refine its underwriting accuracy and streamline claims processing. By leveraging advanced data analytics, the company gains deeper insights into complex risk profiles, leading to more innovative insurance solutions. Collaborations on AI-driven features are a key component of this strategy, aiming to improve efficiency and predictive capabilities.

Research Institutions and Academia

Munich Re actively partners with leading universities and research institutions globally. These collaborations are crucial for staying ahead in understanding and quantifying complex risks, particularly those emerging from climate change and technological advancements. For instance, their work with academic bodies on natural catastrophe modeling helps refine predictive capabilities, directly impacting underwriting accuracy and risk pricing.

These partnerships fuel innovation in risk assessment methodologies. Munich Re invests in joint research projects exploring areas like advanced climate modeling, the impact of extreme weather events, and the application of new technologies such as quantum computing for more sophisticated risk analysis. This academic engagement ensures access to cutting-edge scientific insights and talent, vital for developing next-generation risk solutions.

- Climate Change Research: Collaborations with institutions like the Potsdam Institute for Climate Impact Research (PIK) contribute to sophisticated climate models used in Munich Re's risk assessments.

- Natural Catastrophe Modeling: Partnerships with universities specializing in geophysics and atmospheric sciences enhance the accuracy of models for earthquakes, floods, and storms.

- Emerging Technologies: Engagements with academic centers focused on AI, quantum computing, and spatial intelligence explore their potential application in risk management and data analysis.

- Knowledge Transfer: These relationships facilitate the exchange of knowledge and expertise, ensuring Munich Re's understanding of risks remains current and scientifically grounded.

Financial Institutions and Investors

Munich Re's financial strength and operational reach are significantly bolstered by its key partnerships with a diverse array of financial institutions and investors. These relationships are fundamental to its investment activities and sophisticated capital management strategies.

Collaborations with banks and investment funds provide Munich Re with essential access to capital markets and diverse investment opportunities, enabling efficient deployment of its substantial assets. This network is crucial for optimizing returns and maintaining financial stability.

Furthermore, Munich Re actively engages with investors in insurance-linked securities (ILS) and other alternative risk transfer mechanisms. These partnerships are vital for broadening the distribution of risk and tapping into a wider pool of capital, thereby enhancing its capacity to underwrite complex risks.

- Strategic Alliances: Partnerships with major banks and investment funds facilitate access to global capital markets and sophisticated financial instruments, crucial for Munich Re's asset management.

- Risk Diversification: Collaborations with investors in insurance-linked securities (ILS) allow Munich Re to transfer significant portions of its underwriting risk, accessing alternative capital sources and diversifying its risk exposure.

- Capital Generation: These financial partnerships are instrumental in generating the capital necessary for underwriting large-scale risks and pursuing new growth opportunities, reinforcing Munich Re's market position.

Munich Re's network of primary insurers is foundational, enabling risk sharing and capital management for these partners. In 2024, these alliances continued to be strengthened, ensuring a diversified and profitable risk portfolio for Munich Re.

What is included in the product

Munich Re's Business Model Canvas outlines its core strategy of providing risk management and insurance solutions, detailing its customer segments (insurers, corporations), value propositions (risk transfer, expertise), and channels (brokers, direct sales).

It further elaborates on key activities (underwriting, claims management), resources (actuarial expertise, capital), and partnerships, while defining cost structures and revenue streams from premiums and investment income.

Munich Re's Business Model Canvas offers a structured approach to dissecting complex reinsurance strategies, alleviating the pain of information overload by providing a clear, visual representation of their operations.

It simplifies the understanding of Munich Re's multifaceted business by condensing intricate relationships into an easily digestible, one-page framework, thereby reducing the cognitive burden on stakeholders.

Activities

Munich Re's core activity revolves around rigorously evaluating and accepting risks from insurance companies and large corporations. This involves leveraging extensive actuarial expertise and advanced modeling techniques to accurately price and manage potential losses across diverse insurance portfolios.

The company's success hinges on its disciplined underwriting approach, ensuring that the risks assumed are priced appropriately to generate profitable and sustainable returns. This meticulous assessment, crucial for managing exposure, directly impacts Munich Re's overall financial performance and stability.

In 2024, Munich Re continued to emphasize its commitment to disciplined underwriting, a strategy that has historically supported its robust financial results. For instance, the company's gross premiums written in the first half of 2024 reached €30.3 billion, demonstrating the significant volume of risk it underwrites.

Munich Re actively manages its vast investment portfolio, a cornerstone for financial resilience and profit generation. This involves strategic asset allocation and tactical shifts across diverse financial instruments to seize market opportunities and mitigate risks.

The company's investment strategy is crucial for balancing stability with growth. In 2024, Munich Re reported a significant increase in its investment result, demonstrating effective capital management in a dynamic market environment.

Further strengthening this trend, Munich Re's investment performance continued its upward trajectory into 2025, underscoring the success of its capital management and investment activities in generating substantial returns.

Munich Re's claims management and settlement process is a cornerstone of its business, focusing on efficient and fair handling to build and maintain client trust. This involves swift assessment of damages, precise calculation of payments, and seamless collaboration with primary insurers, especially following significant events such as natural disasters.

The company's capacity to effectively manage substantial losses underscores its robust financial stability. For instance, in 2023, Munich Re reported a profit of €4.3 billion, demonstrating its financial resilience and ability to absorb and manage large claims, which is critical in the reinsurance sector.

Product Development and Innovation

Munich Re's product development and innovation are central to its strategy, focusing on creating new and improved insurance and risk management solutions. This involves anticipating and responding to changing client demands and emerging threats, such as cyber risks and the impacts of climate change.

The company actively develops specialized coverage for complex and novel risks. This includes expanding offerings in areas like renewable energy projects, pandemic preparedness, and the growing field of cyber security insurance. For instance, Munich Re has been a significant player in providing coverage for large-scale renewable energy installations, reflecting the global shift towards sustainable energy sources.

Leveraging technological advancements is also a core component of their innovation. Munich Re utilizes new technologies to refine existing products and create more efficient, data-driven solutions. Their Tech Trend Radar 2025 report underscores a forward-looking approach, identifying key technological shifts that will shape future insurance needs and product development.

- Developing specialized insurance for emerging risks like cyber threats and the energy transition.

- Enhancing existing products through the integration of advanced technologies and data analytics.

- Anticipating future market needs as highlighted in their Tech Trend Radar 2025, ensuring product relevance.

Risk Consulting and Advisory Services

Munich Re's risk consulting and advisory services are a cornerstone of its business model, extending far beyond conventional insurance. These services focus on providing expert guidance and tailored solutions for risk management, mitigation, and transfer. This proactive approach helps clients, ranging from large corporations to public sector organizations, to better understand and navigate the intricate web of modern risks, fostering greater resilience.

Leveraging Munich Re's deep pool of knowledge and sophisticated analytical tools, these advisory services empower clients to anticipate and address potential threats. This includes offering insights into areas like climate change adaptation, cyber security, and supply chain vulnerabilities. For instance, in 2024, Munich Re continued to expand its offerings in emerging risk areas, with a notable focus on the financial implications of climate-related events for businesses.

- Expert Risk Assessment: Providing in-depth analysis of potential risks across various sectors.

- Mitigation Strategies: Developing practical plans to reduce the likelihood and impact of identified risks.

- Risk Transfer Solutions: Designing innovative insurance and reinsurance products to transfer residual risks.

- Resilience Building: Assisting clients in creating robust frameworks to withstand and recover from disruptions.

Munich Re's key activities center on underwriting risks, managing a substantial investment portfolio, and providing expert risk consulting. They also focus on claims management and developing innovative insurance products. These activities are crucial for their role as a leading reinsurer.

| Key Activity | Description | 2024/2025 Relevance |

| Risk Underwriting | Evaluating and accepting risks from insurers and corporations. | Gross premiums written reached €30.3 billion in H1 2024. |

| Investment Management | Strategic asset allocation and management of financial instruments. | Reported a significant increase in investment result in 2024; continued upward trajectory into 2025. |

| Risk Consulting | Providing expert guidance on risk management and mitigation. | Expanded offerings in emerging risk areas, focusing on climate-related financial impacts in 2024. |

| Product Development | Creating new and improved insurance solutions for emerging threats. | Tech Trend Radar 2025 identifies key technological shifts for future product needs. |

Preview Before You Purchase

Business Model Canvas

The Munich Re Business Model Canvas preview you are viewing is an authentic representation of the final deliverable. Upon purchase, you will receive the identical document, complete with all sections and data, ready for immediate use. This ensures absolute transparency and guarantees that what you see is precisely what you will get, allowing you to confidently integrate Munich Re's strategic framework into your own business planning.

Resources

Munich Re's financial capital and reserves are a cornerstone of its business model, representing its substantial financial strength. This robust capital base, coupled with prudently managed reserves, enables the company to absorb significant losses and reliably meet its client obligations.

This financial fortitude is critical for underwriting large and complex risks, underpinning Munich Re's credibility in the global insurance market. For instance, the company reported a strong solvency ratio of 287% at the close of 2024, demonstrating its capacity to handle unforeseen events and maintain operational stability.

Munich Re's approximately 44,000 employees worldwide represent a critical asset, embodying the collective knowledge, experience, and skills essential for its operations. This human capital is particularly concentrated in specialized fields like underwriting, risk modeling, actuarial science, and claims management.

The depth of expertise within its workforce directly fuels Munich Re's capacity to accurately understand, assess, and price intricate risks. This proficiency is paramount in navigating the complexities of the global insurance and reinsurance markets, allowing for informed decision-making and robust risk mitigation strategies.

Furthermore, this highly skilled human capital is the engine behind Munich Re's innovation. It enables the company to adapt and develop new solutions in response to evolving market dynamics and emerging risks, ensuring its continued relevance and competitive edge.

Munich Re leverages its access to vast datasets, enhanced by sophisticated analytical tools and artificial intelligence, as a cornerstone of its business model. This capability allows for deep dives into risk patterns, enabling predictive modeling for future trends and highly optimized pricing strategies. For instance, in 2024, the company continued its significant investment in AI, aiming to process and analyze an ever-increasing volume of data to refine its underwriting and risk assessment processes.

The strategic application of AI and spatial intelligence empowers Munich Re to develop innovative risk management solutions tailored to client needs. This data-driven approach is crucial for identifying emerging risks and creating bespoke insurance products. By integrating AI into its operations, Munich Re aims to achieve greater efficiency and accuracy in its risk evaluations, a trend that has been a key focus throughout 2024.

Global Network and Brand Reputation

Munich Re’s extensive global network, established over its long history, is a cornerstone of its business model. This allows the company to underwrite risks and offer reinsurance solutions across numerous international markets, leveraging diverse economic and regulatory landscapes. By 2024, Munich Re's operations spanned over 150 countries, demonstrating its significant reach.

The company's brand reputation, built on a foundation of financial strength, reliability, and deep expertise in risk management since its founding in 1880, is a critical intangible asset. This strong reputation fosters trust with clients, partners, and stakeholders, enabling Munich Re to attract and retain business, as well as secure top talent in the competitive insurance and reinsurance sector.

- Global Reach: Operations in over 150 countries by 2024.

- Brand Equity: Long-standing reputation for financial stability and risk expertise since 1880.

- Talent Acquisition: Attracts skilled professionals due to its esteemed reputation.

- Client Trust: Fosters strong, enduring relationships with a global client base.

Proprietary Risk Models and Technology Platforms

Munich Re leverages its proprietary risk models and advanced technology platforms as core resources. These internally developed systems are crucial for their competitive edge, allowing for precise risk assessment and streamlined operations. For instance, their sophisticated underwriting platforms enable the creation of tailored insurance products for emerging threats.

These technological assets are vital for Munich Re's ability to innovate and address evolving risk landscapes. The company actively develops coverage for new and complex risks, such as cyber threats and artificial intelligence, demonstrating the adaptability of their proprietary technology. This focus on cutting-edge solutions positions them as a leader in the insurance sector.

- Proprietary Risk Models: Enable sophisticated analysis and pricing of complex risks, including emerging areas like cyber and AI.

- Underwriting Platforms: Streamline the process of assessing and accepting risks, allowing for customization and efficiency.

- Technological Infrastructure: Supports data analytics, operational efficiency, and the development of innovative insurance solutions.

- Competitive Advantage: These proprietary tools provide a distinct edge in risk assessment accuracy and operational effectiveness.

Munich Re's key resources are its substantial financial capital and reserves, its highly skilled global workforce of approximately 44,000 employees, its extensive global network spanning over 150 countries by 2024, and its strong brand reputation built since 1880. Additionally, the company relies on its proprietary risk models and advanced technology platforms for a competitive edge.

| Resource Category | Specific Resource | Significance | Supporting Data (2024) |

| Financial Capital & Reserves | Financial Strength | Enables underwriting large risks and meeting obligations. | Solvency Ratio: 287% |

| Human Capital | Skilled Workforce | Expertise in underwriting, risk modeling, and claims management. | Approx. 44,000 employees worldwide |

| Network & Brand | Global Reach & Reputation | Access to diverse markets and fosters client trust. | Operations in >150 countries; Established 1880 |

| Intellectual Property | Proprietary Risk Models & Tech | Drives innovation and accurate risk assessment. | Enables coverage for cyber and AI risks. |

Value Propositions

Munich Re offers primary insurers crucial capital relief by reinsuring a portion of their liabilities. This strategic move allows these insurers to strengthen their balance sheets and enhance their financial resilience, enabling them to take on more underwriting opportunities.

By transferring risk, primary insurers can operate with greater solvency, better equipped to absorb significant, unexpected claims. For instance, in 2024, the global insurance industry continued to navigate complex risk landscapes, making capital efficiency paramount for sustained growth and stability.

Munich Re's expertise in complex and emerging risks is a cornerstone of its value proposition. They provide primary insurers with unparalleled capabilities in assessing, pricing, and managing risks that are often beyond the scope of individual companies, such as sophisticated cyber threats and the fallout from novel technologies.

This specialized knowledge translates into advanced coverage solutions for natural catastrophes and other intricate perils. For instance, in 2024, Munich Re continued to be a leading reinsurer for global property catastrophe risks, a sector characterized by increasing volatility and the need for deep actuarial insight.

Munich Re offers customized risk solutions and strategic advisory, moving beyond traditional reinsurance to provide bespoke strategies for corporations and public entities. This tailored approach empowers clients to identify, assess, and mitigate specific threats, thereby strengthening their overall resilience and operational continuity.

In 2024, Munich Re continued its focus on developing innovative risk management frameworks. For instance, their expertise in cyber risk advisory helps businesses navigate an increasingly complex digital landscape, with the global cyber insurance market projected to reach over $20 billion in premiums by 2025, highlighting the demand for such specialized services.

Global Reach and Diversification

Munich Re's global reach is a cornerstone of its value proposition, enabling clients to diversify risk across numerous countries and sectors. This expansive network ensures clients have a reliable partner capable of underwriting their international ventures, offering substantial capacity and stability.

This diversification is crucial in today's interconnected world. For instance, in 2024, Munich Re continued to leverage its presence in key markets, providing reinsurance solutions that helped clients manage exposure to a wide array of perils, from natural catastrophes in Asia to cyber risks in Europe.

- Global Network: Facilitates risk diversification across geographies and industries.

- Broad Capacity: Offers clients access to significant underwriting capabilities for international operations.

- Stable Partner: Provides a reliable and experienced partner for global businesses.

- Risk Mitigation: Enables clients to manage diverse and complex risks effectively.

Innovation and Future-Proofing

Munich Re’s commitment to innovation is central to its value proposition, ensuring clients are equipped for tomorrow’s risks. By investing heavily in research and development, the company actively creates novel insurance solutions and risk management strategies. For instance, in 2024, Munich Re announced significant advancements in its AI-driven underwriting platforms, aiming to process complex data sets more efficiently and identify emerging risk patterns faster than ever before.

This forward-thinking approach allows Munich Re’s clients to proactively adapt to a rapidly changing world. The company’s focus on future-proofing means clients gain access to cutting-edge tools and expertise, enabling them to navigate uncertainties with greater confidence. Munich Re’s 2024 sustainability report highlighted a 15% increase in investments dedicated to climate risk modeling, demonstrating a tangible commitment to addressing long-term environmental challenges through innovative financial products.

- AI-Powered Risk Assessment: Munich Re leverages artificial intelligence to analyze vast datasets, predicting and mitigating future risks.

- Product Development: Continuous innovation leads to new insurance products designed for emerging threats, such as cyber risks and climate change impacts.

- Client Adaptation: The company empowers clients to stay ahead of evolving threats by providing advanced risk transfer and management solutions.

- Technological Integration: Munich Re actively integrates advanced technologies, including machine learning and big data analytics, to enhance its service offerings.

Munich Re provides primary insurers with essential capital relief by reinsuring a portion of their liabilities. This strengthens their financial resilience, allowing them to underwrite more business, especially in 2024's challenging risk environment where solvency is key.

The company’s deep expertise in complex and emerging risks, like advanced cyber threats and new technologies, is a core value. This specialized knowledge allows them to offer sophisticated coverage for perils that individual insurers may struggle to manage independently, a critical need in 2024's volatile market.

Munich Re delivers customized risk solutions and strategic advice, moving beyond standard reinsurance. This tailored approach helps clients, including corporations and public entities, identify and mitigate specific threats, enhancing their operational continuity and resilience, a trend amplified in 2024 by increasing global uncertainties.

Their global network facilitates vital risk diversification across numerous countries and industries, offering substantial capacity and stability for international ventures. This broad reach is crucial for clients navigating diverse global risks, as demonstrated by Munich Re’s continued support for property catastrophe risks in 2024.

| Value Proposition | Description | 2024 Relevance |

|---|---|---|

| Capital Relief | Reinsuring liabilities to strengthen balance sheets. | Enhances solvency for taking on more underwriting in a complex risk landscape. |

| Expertise in Emerging Risks | Assessing, pricing, and managing complex and novel risks. | Provides advanced coverage for cyber threats and new technologies, critical in 2024. |

| Customized Solutions | Bespoke strategies for risk mitigation and operational continuity. | Empowers clients to address specific threats, improving resilience in uncertain times. |

| Global Reach & Diversification | Underwriting international ventures and diversifying risk across sectors. | Offers capacity and stability for global businesses managing diverse perils. |

Customer Relationships

Munich Re cultivates long-term strategic partnerships with its primary insurer clients, moving beyond a transactional risk carrier role to become a trusted advisor. This deep engagement involves consistent communication and collaborative efforts in assessing and managing risks.

A key aspect of these partnerships is the co-development of innovative solutions tailored to specific client needs and the dynamic insurance landscape. This collaborative approach ensures that Munich Re and its clients are jointly equipped to navigate emerging market challenges and opportunities.

For instance, in 2024, Munich Re reported that over 80% of its major clients engage in co-creation initiatives, highlighting the success of this strategic relationship model. These partnerships are crucial for mutual growth and resilience in the global insurance sector.

Munich Re's commitment to dedicated account management ensures clients receive personalized attention and a deep understanding of their unique risk profiles. This approach fosters strong relationships built on trust and tailored solutions.

Clients gain access to Munich Re's extensive network of specialists across diverse risk disciplines. This expertise is crucial for navigating complex underwriting challenges and claims, offering invaluable support and specialized knowledge.

For instance, in 2023, Munich Re reported a net result of €4.3 billion, underscoring its financial strength and ability to invest in high-caliber client service and expert resources. This robust performance allows for the continued development of specialized teams dedicated to client success.

Munich Re goes beyond simple insurance transactions, acting as a strategic partner. They provide expert advice on managing risks, optimizing capital, and navigating new market developments. This advisory role solidifies their position as a go-to source for insights, helping clients build stronger risk management frameworks.

Tailored Solutions and Flexible Structures

Munich Re excels by crafting highly customized reinsurance treaties and solutions, precisely aligning with each client's distinct risk profile and strategic goals. This bespoke approach ensures clients receive coverage meticulously tailored to their specific needs.

- Customization: Reinsurance programs are designed on a case-by-case basis, reflecting unique client exposures.

- Flexibility: Treaty structures can be adapted to accommodate evolving client strategies and market dynamics.

- Partnership: Munich Re fosters long-term relationships built on understanding and responsiveness to client requirements.

- Expertise: Clients benefit from Munich Re's deep actuarial and underwriting knowledge to develop optimal risk transfer solutions.

Innovation Collaboration and Knowledge Sharing

Munich Re actively engages clients in co-creating innovative solutions, particularly in areas like parametric insurance and digital risk management. This collaborative approach ensures products meet evolving client needs.

By sharing their deep expertise on emerging risks, such as climate change impacts and cyber threats, Munich Re empowers clients to build resilience. For instance, their 2024 NatCatSERVICE report provided detailed analysis of 2023’s record-breaking weather events, offering actionable insights for risk mitigation strategies.

- Client Co-Development: Munich Re involves clients in pilot programs for new digital platforms and risk assessment tools, gathering direct feedback to refine offerings.

- Knowledge Dissemination: Through webinars, white papers, and direct consultations, Munich Re shares its proprietary research on topics like the economic impact of AI adoption in the insurance sector.

- Partnership for Innovation: In 2024, Munich Re partnered with several InsurTech startups to accelerate the development and deployment of cutting-edge insurance products, sharing both capital and intellectual property.

Munich Re builds enduring relationships by acting as a strategic partner, offering expert advice beyond traditional reinsurance. They focus on co-creating tailored solutions and sharing deep knowledge on emerging risks, fostering client resilience and innovation.

This collaborative approach is evident in their client engagement. For example, in 2024, Munich Re reported that over 80% of its major clients actively participate in co-creation initiatives, demonstrating a strong commitment to mutual development.

Their dedication to personalized service is supported by robust financial performance; in 2023, Munich Re achieved a net result of €4.3 billion, enabling continued investment in specialized client support teams and resources.

Munich Re's expertise is a key differentiator, with clients gaining access to a vast network of specialists for complex underwriting and claims management, ensuring optimal risk transfer solutions.

| Relationship Type | Key Activities | Client Benefit | 2024 Data Point |

| Strategic Partnership | Risk assessment, co-development of solutions | Enhanced risk management, tailored products | 80%+ major clients in co-creation |

| Advisory Role | Expert advice on capital, market trends | Improved strategic decision-making | N/A |

| Knowledge Sharing | Insights on emerging risks (climate, cyber) | Increased client resilience | NatCatSERVICE report on 2023 events |

Channels

Munich Re's direct sales and underwriting teams are the backbone of its client relationships, directly engaging with primary insurers and major corporations. These specialized teams, organized by geographic region and insurance sector, possess deep market knowledge. This allows them to craft bespoke reinsurance solutions, fostering strong, long-term partnerships. For instance, their expertise in property-casualty reinsurance is crucial for managing complex risks for global insurers.

Munich Re's extensive global branch network and representative offices are crucial for its business model, enabling direct client engagement and market penetration. As of the end of 2023, the company operated a significant number of these outposts worldwide, facilitating a deep understanding of diverse local market needs and regulatory landscapes.

This widespread presence allows Munich Re to offer tailored solutions and responsive service, fostering strong client relationships. For instance, its operations in emerging markets are supported by local teams who navigate unique risk environments, contributing to the company's ability to underwrite complex risks effectively.

Munich Re leverages a robust network of brokerage and intermediary channels to connect with a diverse array of primary insurers and specialized clientele. This strategic approach significantly broadens their market penetration and allows for the efficient placement of intricate and unique risk portfolios.

These partnerships are crucial for Munich Re, enabling them to tap into markets and client segments they might otherwise find challenging to reach directly. For instance, in 2024, the global insurance brokerage market was estimated to be worth over $150 billion, highlighting the significant role these intermediaries play in the industry's distribution landscape.

Digital Platforms and Online Portals

Munich Re is increasingly leveraging digital platforms and online portals to enhance client engagement and operational efficiency. These platforms serve as crucial channels for communication, data sharing, and service delivery, making it easier for clients to access information and utilize Munich Re's offerings. This digital push is a key component of their strategy to remain competitive and responsive in the evolving insurance and reinsurance landscape.

These digital tools are designed to streamline processes and provide clients with convenient, self-service options. For instance, clients can access policy information, manage claims, and utilize risk management tools through dedicated online portals. This not only improves the client experience but also frees up internal resources for more complex tasks.

- Client Portals: Munich Re offers secure online portals for clients to access policy details, claims status, and financial statements, providing 24/7 convenience.

- Data Exchange Platforms: Specialized digital platforms facilitate the secure and efficient exchange of complex data between Munich Re and its partners, crucial for underwriting and risk assessment.

- Digital Service Offerings: Certain services, such as risk engineering insights and tailored analytics, are increasingly delivered through these online channels, expanding reach and accessibility.

- Innovation Focus: By mid-2024, Munich Re continued to invest in enhancing its digital infrastructure, aiming to integrate AI and advanced analytics into these platforms for predictive capabilities.

Industry Events and Thought Leadership

Munich Re actively participates in key industry events, such as the International Insurance Society (IIS) Global Forum and the Pan-Asian Reinsurance Forum, to connect with clients and shape industry dialogue. In 2024, the company continued to leverage these platforms to share its insights on emerging risks and market trends, reinforcing its position as a thought leader.

Through the publication of its renowned "Topics" report and various white papers, Munich Re disseminates valuable research and analysis. These materials, often cited by industry professionals and academics, demonstrate the company's deep understanding of complex risk landscapes and its commitment to advancing knowledge in the insurance sector.

- Industry Conferences: Participation in events like the Monte Carlo Reinsurance Rendez-vous provides direct client engagement and market intelligence.

- Thought Leadership Publications: Munich Re's "Topics" annual report is a cornerstone for sharing expertise on global risk trends, with the 2024 edition focusing on climate change impacts.

- Digital Engagement: Webinars and online seminars extend reach, allowing Munich Re to share its expertise with a broader audience beyond physical events.

Munich Re utilizes a multi-channel approach to reach its diverse clientele. Direct sales teams, a global branch network, and strategic partnerships with brokers are key to engaging primary insurers and corporations. Digital platforms are increasingly important for client interaction and service delivery, streamlining processes and offering convenient access to information.

These channels are vital for understanding local market needs and delivering tailored reinsurance solutions. For instance, in 2024, Munich Re continued to invest in digital infrastructure to enhance client engagement and operational efficiency. The company's participation in industry conferences and publication of thought leadership reports further solidify its market presence and expertise.

| Channel Type | Key Activities | Clientele Served | 2024 Focus/Data Point |

|---|---|---|---|

| Direct Sales & Underwriting | Bespoke solution crafting, risk assessment | Primary insurers, large corporations | Deep market knowledge by sector and region |

| Global Branch Network | Local market understanding, relationship building | Diverse insurers, businesses in various regions | Significant global presence for tailored service |

| Brokerage & Intermediaries | Market penetration, risk portfolio placement | Wide range of insurers, specialized clients | Leveraging a $150+ billion global brokerage market |

| Digital Platforms & Portals | Data exchange, service delivery, client communication | All client segments | Enhancing AI integration for predictive capabilities |

| Industry Events & Publications | Thought leadership, networking, market dialogue | Industry professionals, academics | Focus on emerging risks like climate change impacts |

Customer Segments

Primary insurance companies, spanning property-casualty, life, and health sectors, represent Munich Re's most significant customer base. These insurers, from global giants to local players, rely on Munich Re to offload parts of their risk portfolios, seeking vital capital relief and enhanced risk diversification.

These clients leverage Munich Re's expertise for specialized underwriting capacity, a crucial element in managing complex or volatile risks. For instance, in 2024, the global insurance market continued to grapple with increasing catastrophe losses, making reinsurance solutions from partners like Munich Re more critical than ever for primary insurers to maintain solvency and profitability.

Munich Re directly engages with large corporations and industrial clients, offering tailored risk management and insurance for complex exposures. These clients, spanning sectors like automotive, energy, and technology, often have intricate risk portfolios encompassing property damage, business interruption, and significant liability exposures.

In 2024, Munich Re continued to be a leading reinsurer for global industrial giants, providing coverage for risks that are often too large or specialized for primary insurers alone. For example, their property and casualty reinsurance segment saw robust demand from these sectors, reflecting the ongoing need for protection against catastrophic events and complex operational hazards.

Munich Re serves public sector entities and governments by offering risk transfer solutions crucial for major public infrastructure projects and natural catastrophe protection. For instance, in 2024, global insured losses from natural catastrophes were projected to exceed $100 billion, highlighting the significant need for sovereign risk management.

These governmental bodies and international organizations rely on Munich Re's specialized expertise in managing complex systemic risks. The company develops tailored solutions to address sovereign risks, ensuring stability and resilience in public finances.

Specialty and Niche Insurance Providers

Munich Re collaborates with specialty and niche insurance providers, often acting as a reinsurer for Managing General Underwriters (MGUs). These partnerships are crucial for accessing and serving specialized market segments where deep underwriting expertise is paramount. For instance, in 2024, the MGU market continued its robust growth, with many MGUs focusing on areas like cyber insurance, professional liability, and parametric solutions, all of which require tailored reinsurance support.

These collaborations allow Munich Re to tap into specific, often underserved, markets by leveraging the MGU's established distribution channels and specialized underwriting capabilities. This strategic approach enables Munich Re to diversify its portfolio and gain exposure to high-growth, specialized areas without the need for direct market entry and the associated overhead. The global specialty insurance market, valued at hundreds of billions of dollars, presents significant opportunities for such partnerships.

- Niche Market Access: MGUs provide Munich Re with direct access to specialized customer bases in areas like construction defect, environmental liability, or unique commercial risks.

- Expertise Leverage: Partnering with MGUs allows Munich Re to benefit from their deep technical knowledge and underwriting acumen in complex or emerging risk areas.

- Distribution Synergies: MGUs often have established broker relationships and distribution networks that Munich Re can utilize to expand its reach.

- Portfolio Diversification: These partnerships help Munich Re to broaden its exposure beyond traditional lines of insurance, mitigating concentration risk.

Financial Institutions and Pension Funds

Financial institutions, including major banks and investment firms, represent a crucial customer segment for Munich Re. These entities often seek sophisticated financial market reinsurance solutions to mitigate their exposure to market volatility and credit risk. For instance, in 2024, the global reinsurance market continued to see strong demand for risk transfer solutions aimed at managing large-scale financial exposures.

Pension funds are another key group within this segment. They are increasingly looking to transfer longevity risk, a significant long-term liability. Munich Re provides specialized products designed to help pension funds manage these complex risks, thereby improving their financial stability and capital efficiency. The trend of pension schemes seeking de-risking solutions intensified through 2024, driven by low interest rate environments and increasing life expectancies.

Munich Re's offerings to this segment are highly tailored, focusing on optimizing capital structures and managing financial risks effectively. This includes developing innovative products that address specific needs, such as the transfer of credit default risk or the hedging of interest rate sensitivities. By partnering with Munich Re, these financial players can bolster their balance sheets and enhance their capacity to take on new business.

- Financial Institutions: Banks and investment firms utilize Munich Re for market risk and credit risk transfer solutions.

- Pension Funds: These entities seek longevity risk transfer to manage long-term liabilities.

- Tailored Products: Munich Re offers customized solutions to optimize capital structures and manage financial exposures.

- Market Demand: Strong demand for financial reinsurance and risk transfer solutions persisted through 2024.

Munich Re's customer base extends to various specialized entities, including managing general agents (MGAs) and brokers who act as intermediaries. These partners are crucial for accessing niche markets and distributing specialized insurance products. In 2024, the MGA sector continued its expansion, particularly in areas like cyber and parametric insurance, demonstrating a consistent need for reinsurance support.

These partnerships allow Munich Re to leverage the underwriting expertise and distribution networks of its partners, reaching segments that might otherwise be difficult to access directly. The global specialty insurance market, a key area for MGAs, remained robust, with Munich Re actively participating through these collaborations.

Munich Re also serves large corporations and industrial clients directly, offering tailored risk management for complex exposures. Sectors like energy and technology frequently require specialized coverage for operational hazards and significant liability risks. In 2024, demand for property and casualty reinsurance from these large clients remained strong, reflecting ongoing concerns about catastrophic events and complex operational risks.

| Customer Segment | Key Needs | 2024 Relevance |

|---|---|---|

| Primary Insurers | Capital relief, risk diversification, underwriting capacity | Critical due to rising catastrophe losses |

| Large Corporations/Industrial Clients | Complex risk management, specialized coverage for property, liability | Robust demand for P&C reinsurance |

| Public Sector/Governments | Risk transfer for infrastructure, natural catastrophe protection | Essential given projected $100B+ insured losses from natural catastrophes |

| Financial Institutions/Pension Funds | Market risk, credit risk transfer, longevity risk management | High demand for de-risking solutions |

| MGAs/Brokers | Reinsurance for niche markets, distribution support | Continued growth in specialty lines like cyber |

Cost Structure

The most substantial cost for Munich Re revolves around the payout of claims and losses stemming from the diverse risks it underwrites. This category encompasses significant financial outlays for events like natural catastrophes, large-scale liability incidents, and various other insured perils, with these figures naturally exhibiting considerable year-on-year volatility.

In 2024, Munich Re reported claims expenses totaling €43.036 billion. This figure underscores the direct impact of underwriting success and the management of risk exposure on the company's financial performance.

Underwriting and acquisition costs are fundamental to Munich Re's business, representing the expenses incurred to secure new insurance policies. These include commissions paid to intermediaries like brokers and primary insurers, alongside the internal operational costs of assessing risk, evaluating applications, and issuing new policies. Munich Re reported administration and acquisition costs of €8.968 billion in 2024, highlighting the significant investment in growing its business.

Munich Re's operating and administrative expenses encompass the essential overheads that keep its global reinsurance operations running smoothly. This includes costs like salaries for support staff, the vast IT infrastructure required for data management and analytics, office leases in key international locations, and all other administrative functions. For instance, in 2024, the company continued its focus on optimizing these costs through digitalization and process improvements, a strategy that has historically contributed to its competitive advantage.

Investment Management Costs

Munich Re incurs significant costs in managing its substantial investment portfolio. These include fees paid to external asset managers who handle portions of the company's assets, as well as the operational expenses of trading securities. Costs for investment research and analysis, crucial for informed decision-making, also contribute to this category. For instance, in 2023, Munich Re reported investment management expenses that were a key component of its overall cost structure, though these are strategically balanced against the substantial investment income generated.

These investment management costs are a vital part of Munich Re's business model, directly impacting profitability. The efficiency and effectiveness of managing these expenses are closely monitored. While specific figures fluctuate, the scale of Munich Re's investments means these costs are inherently material.

- External Asset Manager Fees: Payments to third-party firms for managing specific investment mandates.

- Trading Costs: Expenses incurred from buying and selling securities, including brokerage commissions and bid-ask spreads.

- Research and Analysis Expenses: Costs associated with market data subscriptions, analytical tools, and expert consultations.

Research, Development, and Innovation Costs

Munich Re dedicates substantial resources to research, development, and innovation, aiming to refine its risk assessment models and pioneer new insurance solutions. A significant portion of its budget is allocated to exploring cutting-edge technologies such as artificial intelligence and quantum computing, which are seen as vital for future growth.

These R&D efforts are directly linked to maintaining Munich Re's leading position in the global reinsurance market and ensuring sustained profitability. For instance, in 2023, the company’s investment in innovation was a key driver behind its ability to adapt to evolving climate risks and cyber threats.

- Enhanced Risk Modeling: Investments in data analytics and AI improve the accuracy of predicting and pricing complex risks.

- New Product Development: R&D fuels the creation of innovative insurance products to meet emerging market needs.

- Technological Advancement: Exploration of AI and quantum computing aims to revolutionize underwriting and claims processing.

- Competitive Advantage: Continuous innovation is essential for staying ahead in the dynamic reinsurance landscape.

Munich Re's cost structure is dominated by claims payouts, which reached €43.036 billion in 2024, reflecting the core business of risk transfer. Underwriting and acquisition expenses, covering commissions and policy issuance, amounted to €8.968 billion in the same year, highlighting the investment in business growth.

Operating and administrative costs support the global infrastructure, while investment management expenses, though not explicitly detailed for 2024 in this context, are a material component due to the company's large asset base. The company also invests in research and development to maintain its competitive edge.

| Cost Category | 2024 Figures (€ billion) | Key Components |

| Claims and Losses | 43.036 | Payouts for insured events, natural catastrophes, liability. |

| Underwriting and Acquisition | 8.968 | Commissions, risk assessment, policy issuance. |

| Operating and Administrative | Not specified | Salaries, IT, office leases, general overheads. |

| Investment Management | Not specified | Asset manager fees, trading costs, research. |

| Research & Development | Not specified | AI, quantum computing, new product development. |

Revenue Streams

Munich Re's core business generates revenue through reinsurance premiums. These are payments received from primary insurers who transfer a portion of their risk to Munich Re. This covers a broad spectrum of insurance types, including property and casualty, life, and health.

The company engages in various reinsurance structures, such as proportional treaties where premiums and losses are shared, and non-proportional treaties where coverage kicks in above a certain loss threshold. In 2024, Munich Re reported substantial insurance revenue from these contracts, amounting to €60.830 billion.

Munich Re generates significant revenue through its primary insurance subsidiary, ERGO. ERGO offers a broad spectrum of insurance products tailored for both individuals and businesses, contributing substantially to the Group's overall financial performance.

For 2025, ERGO is projected to achieve €22 billion in insurance revenue, underscoring its importance as a core revenue driver for Munich Re.

Munich Re's investment income is a cornerstone of its profitability, generated from a vast portfolio of financial assets. These returns, encompassing interest, dividends, and capital gains, significantly enhance the company's overall financial strength.

In 2024, Munich Re demonstrated the power of its investment strategy, reporting an impressive investment result of €7.191 billion. This substantial figure underscores the critical role of investment performance in bolstering the company's financial results and resilience.

Risk Consulting and Advisory Fees

Munich Re earns significant revenue through its specialized risk consulting and advisory services. These fees are generated by offering expert analysis and strategic guidance to a diverse clientele, including corporations and public entities, on navigating complex risk landscapes.

The advisory arm of Munich Re provides deep dives into areas such as climate risk, cyber security, and emerging liabilities. For instance, in 2023, the company continued to expand its capabilities in providing tailored solutions for clients facing unprecedented environmental and digital threats, contributing to its overall fee income.

- Expertise in Risk Assessment: Fees are charged for Munich Re's specialized knowledge in identifying, quantifying, and managing a wide array of risks.

- Strategic Guidance: Revenue is generated by providing clients with actionable strategies to mitigate potential losses and enhance resilience.

- Complex Risk Solutions: Munich Re charges for developing and implementing bespoke solutions for intricate and evolving risk challenges faced by businesses and governments.

Fees from Insurance-Linked Securities (ILS) and Capital Markets Activities

Munich Re generates revenue by facilitating and participating in insurance-linked securities (ILS) and other capital markets activities focused on risk transfer. This includes structuring and managing innovative alternative risk transfer solutions for a diverse client base and investors.

These activities allow Munich Re to tap into capital markets for risk financing, offering clients access to a broader risk appetite and potentially more efficient capital. For example, in 2024, the ILS market continued to show resilience, with issuance of catastrophe bonds and other ILS instruments remaining robust as cedents sought to diversify their risk transfer options.

- Fee Income: Munich Re earns fees for structuring, underwriting, and managing ILS transactions, such as catastrophe bonds, industry loss warranties, and collateralized reinsurance.

- Investment Income: The company earns investment income on the collateral posted to support ILS transactions, which is typically invested in conservative, high-quality assets.

- Commissions and Servicing Fees: Revenue is also derived from commissions and servicing fees associated with placing risks in the capital markets and managing ongoing ILS programs for clients.

- Basis Risk and Parametric Triggers: Fees can also be structured around basis risk or parametric triggers, providing clients with payouts based on predefined, objective events rather than actual losses.

Beyond its core reinsurance and primary insurance operations, Munich Re also generates revenue from its investment management activities. The company actively manages a substantial investment portfolio, generating income from interest, dividends, and capital gains.

In 2024, Munich Re reported a significant investment result of €7.191 billion, highlighting the crucial role of its investment strategy in overall profitability and financial stability.

Furthermore, Munich Re earns fees for its specialized risk consulting and advisory services, offering expert guidance on complex risk management challenges to clients. This includes income from structuring and managing insurance-linked securities (ILS) and other capital markets transactions, providing alternative risk transfer solutions.

| Revenue Stream | Description | 2024 Data/Projection |

|---|---|---|

| Reinsurance Premiums | Payments from primary insurers transferring risk. | €60.830 billion (Insurance Revenue) |

| Primary Insurance (ERGO) | Revenue from ERGO's diverse insurance products. | €22 billion (ERGO Insurance Revenue Projection for 2025) |

| Investment Income | Returns from managing a large financial asset portfolio. | €7.191 billion (Investment Result) |

| Consulting & Advisory Fees | Fees for specialized risk analysis and strategic guidance. | Continued expansion in 2023 for complex risk solutions. |

| Insurance-Linked Securities (ILS) | Fees from structuring and managing capital markets risk transfer. | Robust ILS market issuance in 2024. |

Business Model Canvas Data Sources

Munich Re's Business Model Canvas is informed by a blend of internal financial data, extensive market research on insurance trends, and strategic assessments of global risks. These diverse sources ensure a comprehensive and accurate representation of our operations and market positioning.