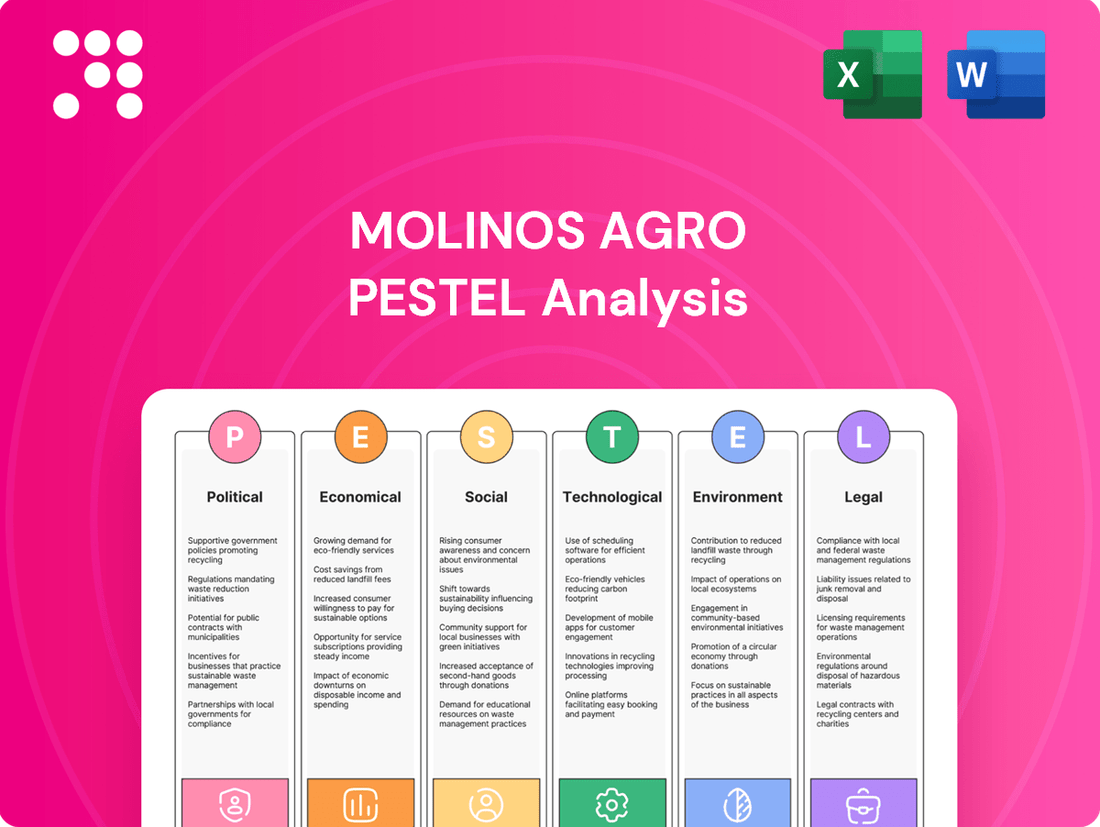

Molinos Agro PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Molinos Agro Bundle

Uncover the critical Political, Economic, Social, Technological, Environmental, and Legal factors shaping Molinos Agro's trajectory. This comprehensive PESTLE analysis provides a clear roadmap of external influences, empowering you to anticipate challenges and seize opportunities. Download the full report now to gain the strategic advantage you need.

Political factors

Government policies in Argentina, particularly export taxes on key agricultural commodities like soybeans, corn, and sunflower, directly influence Molinos Agro's profitability and its ability to compete in international markets. For instance, in early 2024, Argentina maintained export duties on soybeans at 33%, corn at 12%, and sunflower at 12%, impacting the net revenue received by agricultural producers and, by extension, companies like Molinos Agro that process and export these goods.

Fluctuations in these export duties or the introduction of new agricultural subsidies can significantly alter Molinos Agro's operating expenses and revenue generation. For example, a reduction in export taxes would improve the company's margins, while an increase would put pressure on profitability. The political landscape in Argentina, and the resultant predictability of these agricultural policies, is a critical factor for Molinos Agro's long-term investment strategies and operational planning.

International trade agreements and evolving tariff structures significantly influence Molinos Agro's global market access. For instance, the Mercosur-European Union trade deal, if fully ratified and implemented, could reduce tariffs on agricultural products, potentially boosting Molinos Agro's exports of soybean oil and meal to Europe. Conversely, the imposition of retaliatory tariffs, such as those seen in past trade disputes impacting agricultural commodities, could erect substantial barriers, impacting profitability and market share.

Argentina's political landscape significantly impacts Molinos Agro. For instance, the country experienced a notable shift in economic policy following the 2023 general election, with the new administration implementing measures aimed at fiscal consolidation and market liberalization. This transition, while potentially offering long-term stability, creates short-term uncertainty for businesses like Molinos Agro, affecting investment decisions and operational planning.

Export Restrictions and Quotas

Government-imposed export restrictions or quotas on key agricultural commodities directly limit Molinos Agro's ability to maximize international sales. For instance, in 2023, Argentina, a major agricultural exporter and a key market for Molinos Agro, implemented temporary export restrictions on certain grains to manage domestic food prices. This directly impacts the volume of products the company can ship abroad, potentially affecting its global market share and revenue streams.

These measures, often enacted to ensure domestic supply or combat inflation, create significant operational challenges. Molinos Agro must therefore be agile, adapting its production and sales strategies to navigate these fluctuating trade policies. The company's reliance on export markets means that such restrictions can have a pronounced effect on its financial performance, necessitating careful forecasting and risk management.

- Export Quotas: Governments may set limits on the quantity of specific agricultural products that can be exported.

- Domestic Supply Focus: Restrictions are often aimed at securing sufficient food supplies for the local population.

- Inflation Control: Limiting exports can be a strategy to stabilize domestic food prices.

- Market Access Challenges: These policies can reduce Molinos Agro's access to lucrative international markets.

Geopolitical Relations and Market Access

Geopolitical relations between Argentina and its key trading partners significantly shape market access for Molinos Agro's agricultural products. For instance, Argentina's trade agreements and diplomatic standing with countries like China and Brazil directly affect the demand and pricing for its soybean meal and corn exports.

Favorable alliances can unlock substantial export opportunities, bolstering sales volumes. Conversely, diplomatic tensions can erect barriers, limiting access to crucial markets. In 2024, Argentina's export performance in agricultural commodities is closely tied to its relationships with major importers, with China remaining a critical destination for its soybean exports, accounting for a significant portion of its trade balance.

- Trade Agreements: Argentina's participation in Mercosur and its bilateral trade relations directly impact tariffs and non-tariff barriers for agricultural goods, influencing Molinos Agro's competitive positioning in international markets.

- Diplomatic Relations: Strained relations with key agricultural importers can lead to trade disputes or reduced import quotas, negatively affecting export volumes and pricing power for companies like Molinos Agro.

- Market Diversification: Maintaining strong diplomatic ties and pursuing new trade agreements is crucial for Molinos Agro to diversify its export base and mitigate risks associated with over-reliance on specific markets.

Argentina's political stability and economic policies are paramount for Molinos Agro. The administration's approach to fiscal management and market liberalization, particularly evident after the 2023 elections, introduces both potential long-term benefits and immediate uncertainty for strategic planning and investment. This dynamic political environment necessitates continuous adaptation of business strategies.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting Molinos Agro, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats arising from these macro-environmental influences.

Provides a concise version of the Molinos Agro PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, unwieldy reports.

Helps support discussions on external risk and market positioning during planning sessions by offering a clear, summarized view of the Molinos Agro PESTLE factors, thus relieving the pain of uncertainty.

Economic factors

The prices of key agricultural commodities like soybeans, corn, and sunflower are notoriously volatile on the global market. Factors such as shifting supply and demand dynamics, unpredictable weather patterns, and geopolitical tensions all contribute to these price swings. For Molinos Agro, a significant player in originating and processing these very products, this volatility directly impacts its revenue streams and overall profitability.

For instance, the average price of soybeans in the first half of 2024 saw considerable fluctuation, with futures contracts for delivery in late 2024 trading within a range of $11.50 to $12.50 per bushel, reflecting these underlying market forces. Similarly, corn prices experienced a notable upward trend in early 2024, driven by strong export demand and concerns over South American crop yields, with futures for July 2024 delivery reaching approximately $4.80 per bushel. Sunflower oil prices also showed sensitivity, with global benchmark prices for crude sunflower oil averaging around $1,000 to $1,100 per metric ton in the early part of the year, influenced by production levels in major exporting countries.

Given this inherent price instability, Molinos Agro's ability to effectively manage its exposure to commodity price fluctuations is paramount. Implementing robust risk management strategies, such as employing hedging instruments like futures and options contracts, is essential to safeguard the company's financial performance against adverse price movements and ensure more predictable earnings.

Argentina's persistent high inflation, which reached an estimated 276.4% year-on-year in April 2024 according to INDEC, directly escalates Molinos Agro's operational expenses and the cost of imported raw materials. The Argentine Peso's volatility, exemplified by its depreciation against the US Dollar, complicates pricing strategies and impacts the profitability of export sales, even as it theoretically boosts competitiveness.

The fluctuating exchange rate presents a dual challenge: while a weaker peso can make Molinos Agro's agricultural exports more attractive on the international market, it simultaneously raises the cost of essential imported inputs like fertilizers and machinery. This dynamic forces the company to constantly reassess its cost structures and revenue streams to maintain margins in a challenging economic environment.

Argentina's economic performance is a critical driver for Molinos Agro. In 2024, Argentina's GDP growth is projected to be around 3.5%, a significant rebound from previous contractions, which should bolster domestic demand for food products.

International economic growth, particularly in key export markets like China and the European Union, directly impacts Molinos Agro's sales of protein meals and oils. For instance, China's projected GDP growth of approximately 5.0% in 2024 suggests continued robust demand for agricultural commodities, benefiting Molinos Agro's export volumes.

Conversely, any slowdown in these major economies could dampen export revenues. The World Bank forecasts global GDP growth to moderate slightly in 2025, underscoring the importance of monitoring international economic trends for Molinos Agro's revenue streams.

Access to Credit and Interest Rates

Molinos Agro's ability to finance its operations, manage working capital, and undertake expansion projects is directly tied to the availability and cost of credit. Argentina's economic climate, particularly concerning interest rates, plays a significant role.

High interest rates, which have been a persistent concern in Argentina, can substantially increase Molinos Agro's borrowing costs. For instance, as of late 2024, benchmark lending rates in Argentina have fluctuated significantly, often exceeding 100% annually, which directly impacts the company's profitability and can constrain its capacity to invest in crucial areas like new technologies or expanding production capacity.

Consequently, securing stable and affordable financing is paramount for Molinos Agro to effectively execute its growth strategies and maintain operational efficiency in the dynamic Argentine market.

- Interest Rate Impact: High borrowing costs directly reduce profit margins and available capital for reinvestment.

- Financing Stability: Consistent access to credit is vital for managing day-to-day operations and long-term planning.

- Investment Constraints: Elevated interest rates can deter investment in modernization and capacity expansion, hindering competitiveness.

Consumer Purchasing Power and Demand

Consumer purchasing power significantly shapes the demand for Molinos Agro's products, both within Argentina and across international markets. Factors like inflation and currency fluctuations directly impact how much disposable income Argentinian consumers have for essentials like edible oils and flours. For instance, while Argentina's inflation rate remained high in early 2024, wage growth has shown some recovery, potentially stabilizing consumer spending on food staples.

International demand is similarly sensitive to global economic conditions. Exchange rates and the economic health of import-dependent nations play a crucial role in Molinos Agro's export performance. A stronger Argentine peso, for example, could make exports more expensive for foreign buyers, potentially dampening demand.

- Inflationary pressures in Argentina (e.g., CPI figures for 2024) directly affect the real disposable income of domestic consumers for food products.

- Wage growth trends in Argentina provide insights into the capacity of households to maintain or increase spending on Molinos Agro's product lines.

- International commodity prices and the economic stability of key export markets influence the purchasing power of global consumers for Argentine agricultural products.

Argentina's economic landscape presents a complex environment for Molinos Agro, characterized by high inflation and currency volatility. The nation's persistent inflation, which saw the Consumer Price Index (CPI) rise by an estimated 276.4% year-on-year in April 2024, directly inflates operational costs and the price of imported inputs. The Argentine peso's depreciation against the US dollar, while potentially boosting export competitiveness, complicates pricing and impacts the profitability of international sales.

The company's financial health is closely linked to its ability to secure affordable credit. Argentina's high interest rates, with benchmark lending rates often exceeding 100% annually in late 2024, significantly increase borrowing costs, potentially limiting investment in modernization and expansion. Access to stable financing is therefore crucial for Molinos Agro's operational efficiency and strategic growth initiatives.

Consumer purchasing power, both domestically and internationally, is a key determinant of demand for Molinos Agro's products. While high inflation in Argentina erodes real disposable income, some recovery in wage growth in early 2024 may offer a buffer for food staple consumption. Conversely, global economic conditions and the economic stability of key export markets, such as China's projected 5.0% GDP growth in 2024, directly influence export volumes.

| Economic Factor | Key Data Point (2024/2025) | Impact on Molinos Agro |

| Inflation (Argentina) | 276.4% (YoY April 2024) | Increases operational costs, impacts domestic consumer spending power. |

| Argentine Peso Volatility | Depreciating vs. USD | Affects import costs, complicates export pricing, impacts profitability. |

| Interest Rates (Argentina) | Often >100% annually (late 2024) | Increases borrowing costs, limits investment capacity. |

| GDP Growth (Argentina) | Projected 3.5% (2024) | Potentially boosts domestic demand for food products. |

| GDP Growth (China) | Projected 5.0% (2024) | Indicates strong demand for agricultural exports. |

Preview the Actual Deliverable

Molinos Agro PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Molinos Agro.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Molinos Agro.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Molinos Agro.

Sociological factors

Consumers are increasingly prioritizing health and wellness, leading to a surge in demand for plant-based alternatives and products with perceived health benefits. This shift directly influences the market for agricultural commodities, impacting companies like Molinos Agro. For instance, by 2025, the global plant-based food market is projected to reach over $74 billion, a significant increase from previous years.

Molinos Agro must actively adapt its product offerings to cater to these evolving tastes, focusing on areas like non-GMO ingredients and specialized oils. The growing preference for transparency in sourcing also means consumers are paying closer attention to sustainability practices. In 2024, surveys indicated that over 60% of consumers consider sustainability when making food purchases.

Innovation in developing new product lines, such as protein-rich ingredients derived from traditional crops or alternative oils, will be crucial for Molinos Agro to remain competitive. This strategic pivot allows the company to tap into high-growth market segments driven by conscious consumer choices.

Global population is projected to reach 8.1 billion by 2025, with a significant portion of this growth occurring in developing economies. This expansion directly fuels demand for agricultural commodities like soybeans and corn, core to Molinos Agro's product lines.

Urbanization rates continue to climb, with over 60% of the world's population expected to reside in cities by 2025. This shift often correlates with increased consumption of processed foods, a sector where Molinos Agro's ingredients are vital.

The availability of skilled labor across Molinos Agro's operations, from farm to fork, is a significant sociological consideration. In 2024, Argentina's agricultural sector, like many globally, faces a dynamic labor market influenced by ongoing urbanization and evolving educational attainment. For instance, a 2023 report indicated a growing demand for specialized agricultural technicians, a skill set that may not be uniformly distributed across the general rural workforce.

Demographic trends, including an aging rural population and youth migration to urban centers, can directly affect the labor pool for processing and logistics. This can translate into upward pressure on wages and the necessity for Molinos Agro to implement robust training initiatives. By 2025, companies prioritizing employee retention through competitive compensation and professional development will likely hold a distinct advantage in securing and maintaining a capable workforce.

Health and Wellness Trends

The escalating global emphasis on health and wellness significantly shapes consumer preferences for fats, proteins, and carbohydrates. Molinos Agro, a key player in edible oils and protein meals, needs to adapt by prioritizing product quality, investigating fortification options, and creating specialized items for health-aware buyers. For instance, the global market for plant-based proteins, a key area for Molinos Agro, was projected to reach USD 22.3 billion in 2024 and is expected to grow substantially.

Transparency regarding ingredients and nutritional information is becoming paramount for consumers making purchasing decisions. This trend is supported by data showing that over 60% of consumers globally are willing to pay more for healthier food options. Molinos Agro can leverage this by clearly communicating the benefits and sourcing of its products.

- Growing demand for plant-based proteins: The global plant-based protein market is expanding rapidly, presenting opportunities for Molinos Agro.

- Consumer preference for healthy fats: Consumers are increasingly seeking out healthier fat profiles in their diets, influencing demand for specific edible oils.

- Importance of nutritional transparency: Clear labeling and communication about nutritional content are crucial for building consumer trust and driving sales.

- Market growth for fortified foods: The fortification of food products with vitamins and minerals is a growing trend that Molinos Agro could explore.

Corporate Social Responsibility Expectations

Societal expectations for corporate social responsibility (CSR) are significantly shaping how businesses like Molinos Agro operate. There's a growing demand for ethical sourcing of raw materials, fair labor practices throughout the supply chain, and meaningful community engagement. For instance, in 2024, consumer surveys indicated that over 70% of individuals consider a company's CSR performance when making purchasing decisions. This trend directly impacts Molinos Agro's reputation and brand image.

Stakeholders, including consumers, investors, and regulatory bodies, are actively scrutinizing companies' CSR commitments. This heightened awareness means that Molinos Agro must demonstrate a genuine commitment to sustainability and ethical conduct. Failure to do so can lead to reputational damage and loss of market share, as seen in other agribusinesses facing backlash for unsustainable practices in recent years.

- Ethical Sourcing: Consumers increasingly demand transparency about where agricultural products originate and how they are produced, influencing procurement strategies.

- Labor Practices: Ensuring fair wages and safe working conditions across the entire value chain is paramount, with reports of labor exploitation in agriculture drawing significant public attention.

- Community Engagement: Local communities expect agribusinesses to contribute positively through job creation, environmental stewardship, and social investment.

- Investor Scrutiny: ESG (Environmental, Social, and Governance) factors are now critical for institutional investors, with funds increasingly divesting from companies with poor CSR records.

Societal shifts toward health and wellness are driving demand for plant-based options and nutritious ingredients, impacting Molinos Agro's product development. By 2025, the global plant-based food market is projected to exceed $74 billion, underscoring this trend. Consumers are also prioritizing transparency in sourcing and sustainability, with over 60% considering these factors in 2024 purchasing decisions.

Technological factors

Innovations in agricultural biotechnology, like genetically modified (GM) crops and gene editing, are transforming crop production. These advancements can significantly boost yields, strengthen plants against pests and diseases, and even enhance the nutritional content of agricultural inputs, directly impacting companies like Molinos Agro.

The adoption of these cutting-edge biotechnologies directly influences Molinos Agro's sourcing and processing activities. It affects the quality and quantity of raw materials available, as well as the overall cost of production, making it vital for the company to stay abreast of these developments.

For instance, by 2024, the global market for agricultural biotechnology was valued at over $100 billion, with GM crops alone accounting for a substantial portion. This rapid growth highlights the increasing reliance on these technologies to meet global food demands and improve agricultural efficiency.

Molinos Agro is seeing significant advancements in automation and AI within the agricultural processing and logistics sectors. By integrating robotics and AI into crushing and refining operations, companies like Molinos Agro can expect substantial gains in efficiency and a reduction in operational costs. For instance, AI-powered predictive maintenance can minimize downtime, a critical factor in maintaining consistent production output.

The application of AI in logistics can streamline supply chain management, leading to better inventory control and faster delivery times. In 2024, the global market for AI in supply chain management was valued at approximately $10 billion and is projected to grow robustly, indicating a strong trend towards adopting these technologies for competitive advantage.

The integration of big data analytics and precision agriculture, utilizing tools like satellite imagery, IoT sensors, and drones, is revolutionizing farming. These technologies enable more efficient operations and more accurate yield predictions, a trend that is rapidly accelerating. For instance, by 2024, the global precision agriculture market was projected to reach over $10 billion, highlighting its growing importance.

For Molinos Agro, these advancements offer significant advantages in securing raw materials, enhancing quality control throughout the supply chain, and streamlining the logistics of moving produce from fields to processing plants. This data-driven approach can lead to substantial cost savings and improved product consistency, crucial for maintaining a competitive edge in the agricultural processing sector.

Sustainable Processing Technologies

The development of new technologies that lessen environmental impact during processing is becoming crucial for companies like Molinos Agro. This includes innovations like energy-efficient refining methods and advanced waste reduction techniques. For instance, by 2024, the global market for green technologies in manufacturing was projected to reach over $1.5 trillion, indicating a significant shift towards sustainability.

Adopting these sustainable processing technologies offers Molinos Agro a dual benefit: it aids in complying with increasingly stringent environmental regulations and simultaneously slashes operational costs through improved efficiency. A study by McKinsey in 2023 found that companies prioritizing sustainability saw an average of 10-15% lower operating costs compared to their less sustainable peers.

Furthermore, investing in green technologies is not just about compliance and cost savings; it's a strategic imperative that significantly enhances a company's corporate image. Consumers and investors alike are increasingly favoring businesses with strong environmental, social, and governance (ESG) credentials. For example, in 2024, ESG funds attracted over $700 billion in new assets globally, underscoring this trend.

- Energy Efficiency: Implementing advanced refining processes that consume less electricity and fuel.

- Waste Reduction: Utilizing technologies that minimize by-products and maximize resource utilization.

- Water Management: Adopting closed-loop water systems and advanced filtration to reduce water consumption and discharge.

- Emissions Control: Investing in technologies to capture or neutralize processing emissions.

Digitalization of Supply Chain Management

The ongoing digitalization of Molinos Agro's supply chain, extending from raw material sourcing to final product sales, is a significant technological driver. Leveraging technologies like blockchain, cloud computing, and sophisticated Enterprise Resource Planning (ERP) systems, the company can achieve greater transparency and traceability. For instance, by 2024, the global supply chain management market was projected to reach over $32 billion, highlighting the widespread adoption of such digital solutions.

These advancements empower Molinos Agro to meticulously manage inventory levels, verify the origin of agricultural products, and streamline logistical operations. Improved communication channels with both suppliers and customers are also a direct benefit, fostering a more robust and adaptable supply chain. This digital transformation is crucial for navigating the complexities of the agricultural sector and ensuring efficient operations.

Key benefits for Molinos Agro include:

- Enhanced Inventory Management: Real-time tracking reduces waste and optimizes stock levels.

- Improved Traceability: Blockchain technology ensures product authenticity and origin verification, building consumer trust.

- Optimized Logistics: Cloud-based platforms and advanced ERP systems facilitate better route planning and delivery scheduling.

- Streamlined Communication: Digital platforms improve information flow between Molinos Agro, its suppliers, and its customers.

Technological advancements in agricultural biotechnology, such as GM crops and gene editing, are fundamentally reshaping crop production, directly impacting companies like Molinos Agro by influencing raw material quality and cost. Automation and AI are driving efficiency gains in processing and logistics, with the AI in supply chain management market expected to reach approximately $10 billion in 2024. Precision agriculture, utilizing tools like drones and IoT sensors, is becoming critical for efficient operations and yield prediction, with the market projected to exceed $10 billion by 2024.

| Technology Area | 2024 Market Value (Approx.) | Impact on Molinos Agro |

|---|---|---|

| Agricultural Biotechnology | >$100 billion (global market) | Improved raw material quality and yield |

| AI in Supply Chain | ~$10 billion | Operational efficiency, cost reduction, predictive maintenance |

| Precision Agriculture | >$10 billion (projected) | Enhanced raw material sourcing, quality control, logistics optimization |

Legal factors

Molinos Agro navigates a complex web of food safety and quality regulations, both domestically and internationally. These encompass stringent rules on hygiene, permissible contaminant levels, accurate product labeling, and robust traceability systems. For instance, in 2024, the European Union continued to enforce its General Food Law, emphasizing a 'farm to fork' approach to safety, which directly impacts companies like Molinos Agro exporting to the EU market.

Adherence to these legal frameworks is not merely a matter of compliance but a critical business imperative. Failure to meet these standards can lead to severe consequences, including significant financial penalties, damage to brand reputation, and loss of market access. In 2023, global food recalls due to contamination or mislabeling cost the industry billions, highlighting the financial risk associated with non-compliance.

The regulatory landscape is dynamic, with standards frequently updated to reflect new scientific findings and consumer expectations. Molinos Agro must therefore maintain a proactive stance, continuously monitoring these changes and adapting its operations accordingly. This includes investing in advanced testing equipment and training personnel to ensure ongoing compliance with evolving requirements, such as those related to allergen management, which saw updated guidance in several key markets in early 2025.

Molinos Agro's industrial activities are strictly governed by environmental protection laws. These regulations cover crucial areas like air emissions, the responsible disposal of waste, efficient water usage, and comprehensive pollution prevention measures. For instance, in 2024, Argentina, where Molinos Agro operates, continued to strengthen its environmental compliance frameworks, with a particular focus on industrial effluent standards.

Compliance with these environmental mandates is absolutely vital. Failure to adhere can result in significant financial penalties, the potential suspension or revocation of operating licenses, and damage to the company's reputation, impacting its social license to operate. The agro-industry, in particular, faces increasing scrutiny regarding its environmental impact.

Proactively minimizing its environmental footprint is becoming a key expectation for companies like Molinos Agro. This includes investing in cleaner technologies and sustainable practices to reduce emissions and waste, a trend that gained further momentum throughout 2024 as global sustainability reporting standards evolved.

Molinos Agro navigates a complex web of labor laws in Argentina and other operating regions. These regulations dictate everything from minimum wages and working conditions to employee benefits and the intricacies of union relations. For instance, Argentina's national minimum wage was set at ARS 156,000 per month as of early 2024, a figure that can fluctuate and directly impacts operational costs.

Shifts in labor legislation or the occurrence of labor disputes can significantly affect Molinos Agro's operational expenses and the stability of its workforce. A sudden increase in mandated benefits or a prolonged strike could disrupt production schedules and impact profitability, requiring agile strategic planning to mitigate these risks.

Prioritizing fair labor practices and employee well-being is not just a legal necessity but a cornerstone of effective human capital management for Molinos Agro. Companies that foster positive employee relations often see higher productivity and reduced turnover, contributing to long-term organizational health and a strong employer brand.

International Trade and Export Laws

Molinos Agro, as a significant global exporter, must meticulously adhere to a web of international trade and export laws. These regulations encompass everything from customs duties and import/export licensing to stringent sanitary and phytosanitary (SPS) standards and anti-dumping measures. Navigating this complex legal landscape is paramount to ensuring smooth international sales and preventing costly trade disputes or penalties.

The company's ability to successfully commercialize its products globally hinges on its diligent compliance with these diverse legal frameworks. For instance, in 2024, the World Trade Organization (WTO) reported that trade facilitation measures, which streamline customs procedures, could reduce trade costs by an average of 14.3%. Molinos Agro's proactive approach to understanding and implementing these trade laws directly impacts its cost-efficiency and market access. Failure to comply with SPS standards, for example, could lead to product rejections at borders, as seen in various agricultural sectors where specific pesticide residue limits are enforced.

- Customs Duties: Molinos Agro must manage varying tariff rates across different import markets, impacting the final price of its agricultural products.

- Import/Export Licenses: Securing necessary permits for agricultural commodities is a recurring legal requirement for international trade.

- Sanitary and Phytosanitary (SPS) Standards: Adherence to international SPS agreements, such as those set by the Codex Alimentarius Commission, is crucial to prevent market access barriers due to health or safety concerns.

- Anti-Dumping Regulations: Molinos Agro needs to ensure its pricing strategies do not violate anti-dumping laws in destination countries, which can impose significant penalties on unfairly priced imports.

Corporate Governance and Reporting Requirements

Molinos Agro, being a publicly traded entity, must navigate a landscape of stringent corporate governance and financial reporting mandates. These regulations are primarily enforced by entities like the Comisión Nacional de Valores (CNV) in Argentina, ensuring that the company operates with a high degree of transparency and accountability. For instance, in 2023, the CNV continued its focus on enhancing disclosure standards for listed companies, impacting how Molinos Agro communicates its financial health and operational strategies to the market.

Adherence to these established standards is not merely a legal obligation but a cornerstone for safeguarding shareholder interests and fostering sustained investor confidence. By providing accurate and timely financial information, Molinos Agro builds trust, which is crucial for attracting and retaining capital. The company's 2024 financial reports, for example, will be scrutinized for their compliance with these evolving reporting frameworks.

Failure to meet these legal and regulatory expectations can trigger significant negative consequences. These include potential fines, sanctions from regulatory bodies, and severe damage to the company's reputation. Such issues can directly impact its market valuation and ability to secure future financing, underscoring the critical importance of robust compliance mechanisms.

- Corporate Governance: Molinos Agro is bound by Argentinian corporate law and CNV regulations, dictating board structure, shareholder rights, and ethical conduct.

- Financial Reporting: The company must comply with International Financial Reporting Standards (IFRS) as adopted in Argentina, ensuring comparability and transparency in its financial statements.

- Shareholder Protection: Regulations ensure that minority shareholders' rights are protected, promoting fair treatment and access to information.

- Regulatory Oversight: The CNV actively monitors listed companies, imposing penalties for non-compliance, which can include fines and trading suspensions.

Molinos Agro's operations are significantly shaped by intellectual property laws, particularly concerning its brands, product formulations, and proprietary technologies. Protecting these assets through patents, trademarks, and copyrights is vital for maintaining competitive advantage and market share. For instance, in 2024, the World Intellectual Property Organization (WIPO) highlighted an increase in international patent filings, reflecting a global emphasis on innovation and IP protection within the agribusiness sector.

Infringement of intellectual property rights can lead to costly legal battles, loss of exclusive market rights, and damage to brand value. Companies like Molinos Agro must actively monitor for potential infringements and vigorously defend their IP portfolio. In 2023, global IP litigation costs for businesses averaged millions of dollars, underscoring the financial stakes involved.

The company must also ensure its own operations do not infringe on the intellectual property of others. This requires thorough due diligence when developing new products or adopting new technologies, ensuring all processes and creations are legally sound and do not violate existing patents or trademarks. Staying abreast of IP law changes, such as updates to patentability criteria for agricultural innovations in key markets in early 2025, is crucial for ongoing compliance.

Environmental factors

Climate change is a significant environmental concern for Molinos Agro, as it directly impacts agricultural output. The increasing frequency and intensity of extreme weather events, such as prolonged droughts, severe floods, and intense heatwaves, pose a substantial risk to the company's core business. These events can devastate crop yields and compromise the quality of essential raw materials like soybeans, corn, and sunflower, which are vital for Molinos Agro's operations.

These climatic shifts create considerable challenges for Molinos Agro, leading to potential disruptions in the supply of raw materials and heightened price volatility. For instance, a severe drought in Argentina, a major soybean producer, in early 2023 led to significant yield reductions, impacting global supply chains and prices. Adapting agricultural practices to be more resilient to these changing conditions and strengthening the company's supply chain are therefore crucial strategies for mitigating these environmental risks and ensuring business continuity.

Water availability is a significant concern for agricultural output and industrial processes, directly affecting Molinos Agro's operations. Regions facing water scarcity, driven by climate change or escalating demand, can disrupt the sourcing of essential raw materials like soybeans and corn, and also impact the company's own water consumption in its processing plants.

For instance, Argentina, a key operational area for Molinos Agro, has experienced periods of drought impacting agricultural yields. In 2023, parts of Argentina faced severe drought conditions, leading to an estimated 20% reduction in soybean production compared to previous years, highlighting the vulnerability of agricultural supply chains to water availability.

As such, implementing and enhancing sustainable water management practices across its entire value chain, from farm to factory, is becoming paramount for Molinos Agro's long-term resilience and operational continuity.

Agricultural expansion, a core driver for companies like Molinos Agro, directly impacts biodiversity. In 2024, the UN highlighted that agriculture is the leading cause of land degradation globally, affecting over 3 billion people. This intensification, often driven by demand for commodities Molinos Agro processes, can lead to deforestation and habitat destruction, raising concerns among environmentally conscious consumers and advocacy groups.

Molinos Agro faces increasing pressure to adopt deforestation-free supply chains. By 2025, several major markets are expected to implement stricter regulations, mirroring the EU's Deforestation Regulation, which prohibits the import of commodities linked to deforestation. Proactive engagement in sustainable land use practices, such as agroforestry and responsible sourcing, is crucial for Molinos Agro to manage reputational risks and ensure compliance with these evolving environmental standards.

Pollution Control and Waste Management

Molinos Agro's core operations, including crushing soybeans, refining oils, and distributing products, inherently produce waste streams and carry the potential for pollution. For instance, in 2024, the agricultural processing sector globally faced increased scrutiny over wastewater discharge quality, with some regions implementing stricter limits on biological oxygen demand (BOD) and chemical oxygen demand (COD) in effluents. Adhering to these evolving environmental standards is paramount for Molinos Agro to maintain its license to operate and avoid significant penalties.

The company must maintain rigorous compliance with environmental regulations governing air emissions from processing plants, wastewater discharge quality, and the proper disposal of solid waste, including agricultural byproducts. For example, in Argentina, a key market for Molinos Agro, environmental protection laws mandate specific emission limits for particulate matter and volatile organic compounds (VOCs) from industrial facilities, with non-compliance potentially leading to fines that could impact profitability. By 2025, further tightening of these regulations is anticipated, particularly concerning greenhouse gas emissions.

Investing in and implementing advanced pollution control technologies is not just a compliance necessity but also a strategic opportunity. For 2024, companies adopting circular economy principles, such as repurposing processing byproducts into animal feed or biofuels, reported an average reduction in waste disposal costs of 15-20%. Molinos Agro can leverage these approaches to minimize its environmental footprint while simultaneously cutting operational expenses and potentially creating new revenue streams.

- Regulatory Compliance: Molinos Agro must adhere to stringent environmental laws regarding air emissions, wastewater, and solid waste, with potential for increased regulatory pressure by 2025.

- Operational Impact: Processing and distribution activities generate waste, necessitating effective management to prevent environmental harm and ensure operational continuity.

- Technological Investment: Adopting advanced pollution control and circular economy practices can lead to cost savings, as seen by industry averages of 15-20% waste disposal cost reduction in 2024.

- Sustainability Goals: Embracing these practices aligns with broader sustainability objectives, enhancing brand reputation and long-term resilience in the face of environmental challenges.

Sustainability Standards and Certifications

Consumers and international markets are increasingly prioritizing sustainably grown agricultural products, leading to a greater demand for environmental certifications and standards. Molinos Agro can leverage adherence to recognized sustainability protocols, like those focusing on responsible sourcing or reducing carbon footprints, to improve its market access and bolster its brand image.

For instance, as of early 2024, the global sustainable agriculture market was projected to reach over $250 billion by 2030, indicating a significant shift. Companies demonstrating strong environmental stewardship through certifications are better positioned to capture this growing market share.

Investing in sustainable practices is becoming a crucial competitive differentiator. Molinos Agro's commitment to these standards can translate into tangible benefits, such as enhanced investor confidence and a stronger appeal to environmentally conscious partners and customers.

- Growing Consumer Demand: Surveys in late 2023 indicated over 60% of consumers are willing to pay a premium for sustainably sourced food.

- Market Access Advantage: Many international buyers, particularly in Europe, now require suppliers to meet specific sustainability criteria, such as those from the Roundtable on Responsible Soy (RTRS).

- Brand Reputation Enhancement: Achieving certifications like ISO 14001 or those related to biodiversity protection can significantly improve Molinos Agro's public perception and trust.

Molinos Agro operates within an environment where climate change significantly impacts agricultural yields, posing risks to raw material supply and price stability. For example, extreme weather events in Argentina during 2023 led to an estimated 20% reduction in soybean production, directly affecting the company's sourcing. Water scarcity is another critical factor, with regions like Argentina experiencing droughts that strain both agricultural output and industrial water needs.

The company faces growing pressure regarding deforestation and land degradation, with agriculture identified by the UN in 2024 as a leading cause. By 2025, stricter regulations mirroring the EU's Deforestation Regulation are anticipated, requiring Molinos Agro to ensure deforestation-free supply chains. This necessitates proactive engagement in sustainable land use practices to manage reputational risks and ensure regulatory compliance.

Waste generation and pollution potential are inherent to Molinos Agro's processing operations, demanding adherence to evolving environmental standards for wastewater and air emissions. Industry-wide, companies adopting circular economy principles in 2024 reported an average 15-20% reduction in waste disposal costs, presenting a strategic opportunity for Molinos Agro to cut expenses and minimize its environmental footprint.

Consumer demand for sustainably grown products is rising, with over 60% of consumers willing to pay a premium for such goods as of late 2023. Adherence to sustainability protocols and certifications, like those from the Roundtable on Responsible Soy, can enhance market access, particularly in Europe, and improve Molinos Agro's brand reputation and investor confidence.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Molinos Agro draws on a comprehensive blend of data from agricultural industry associations, government agricultural ministries, and international trade organizations. This ensures insights into political stability, economic trends, and regulatory landscapes impacting the agro-sector are robust and current.