Molinos Agro Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Molinos Agro Bundle

Molinos Agro's marketing prowess is evident in its strategic approach to the 4Ps. From their diverse product portfolio catering to various agricultural needs to their competitive pricing, they've carved a strong market presence. Their distribution network ensures accessibility, while their promotional activities resonate with their target audience.

Discover the intricate details of Molinos Agro's marketing success. This comprehensive 4Ps analysis delves into their product innovation, pricing strategies, distribution channels, and promotional campaigns, offering actionable insights for your own business planning.

Ready to elevate your marketing strategy? Gain instant access to a professionally crafted, editable 4Ps Marketing Mix Analysis for Molinos Agro, perfect for students, professionals, and consultants seeking a competitive edge.

Product

Molinos Agro's agricultural raw materials, primarily soybeans, sunflower, and corn, are the bedrock of their business. In the 2023-2024 season, Argentina was a leading global exporter of these commodities, with soybean exports alone reaching approximately 30 million tons, underscoring the significance of Molinos Agro's sourcing strategy.

The company's expertise lies in originating, processing, and selling these vital grains, leveraging Argentina's status as a major agricultural powerhouse. This focus ensures a steady stream of high-quality inputs for their diverse product lines, from oils to flours.

For the 2024-2025 period, projections indicate continued strong global demand for these agricultural staples, with Argentina expected to maintain its robust export performance, providing a favorable market environment for Molinos Agro's raw material operations.

Molinos Agro's edible oils and flours form a crucial segment of their product portfolio, transforming agricultural staples into versatile food ingredients. These products, ranging from sunflower oil to wheat flour, serve a broad customer base across both domestic Argentine markets and numerous international destinations.

The company emphasizes quality and customization, ensuring their oils and flours meet the specific needs of various food manufacturers and consumers worldwide. For instance, in 2024, Molinos Agro reported significant export volumes for its soybean oil, a key component in many processed foods, reflecting strong global demand for their value-added agricultural derivatives.

Molinos Agro's commitment extends beyond human food, with a significant focus on protein meals vital for animal feed. These meals are essential ingredients, underscoring the company's deep vertical integration in agribusiness.

The Animal Feed division provides specialized nutrition, catering to the needs of livestock and poultry farming. This segment is a key supplier to various agricultural industries, demonstrating Molinos Agro's broad impact.

In 2024, the global animal feed market was valued at approximately $470 billion and is projected to grow, with protein meals forming a substantial portion of this value. Molinos Agro's contribution supports this growing demand.

Biodiesel and Biofuels

Molinos Agro's biodiesel and biofuels segment highlights their dedication to renewable energy, positioning them as a key player in the global alternative fuels market. Their production capacity is substantial, with a significant portion often allocated to export markets, demonstrating their international reach and competitiveness.

The company's commitment to sustainability is further underscored by their adherence to international certifications such as ISCC (International Sustainability and Carbon Certification) and RTRS (Round Table on Responsible Soy). These certifications are crucial for market access and consumer trust, especially in regions with stringent environmental regulations.

In 2024, the global biodiesel market was valued at approximately USD 40 billion, with projections indicating continued growth driven by environmental policies and increasing demand for cleaner transportation fuels. Molinos Agro's involvement in this sector directly contributes to meeting these evolving market needs.

- Global Biodiesel Market Value (2024): Estimated at USD 40 billion, with strong growth anticipated.

- Key Certifications: ISCC and RTRS, demonstrating commitment to sustainable sourcing and production.

- Market Focus: Significant production is destined for international markets, indicating global competitiveness.

- Strategic Alignment: Reflects a commitment to renewable energy and sustainable practices within Molinos Agro's portfolio.

Farm Services and Financing

Molinos Agro's 'Services' component of its 4P marketing mix is crucial for supporting the agricultural supply chain. They provide essential farm inputs, including fertilizers, seeds, and agrochemicals, directly to producers. For instance, in the 2023-2024 season, Molinos Agro reported supplying a significant volume of these inputs, contributing to improved crop yields across their network.

Beyond just supplying inputs, Molinos Agro also offers agricultural financing. This financial support is vital for farmers, enabling them to acquire necessary resources and manage cash flow effectively throughout the growing season. This integrated approach demonstrates a commitment to the success of producers.

- Farm Inputs: Molinos Agro supplies fertilizers, seeds, and agrochemicals, vital for crop production.

- Agricultural Financing: The company provides financial solutions to support farmers' operations and resource acquisition.

- Value Proposition: This integrated service offering enhances Molinos Agro's value to farmers and strengthens its ecosystem position.

Molinos Agro's product strategy centers on transforming core agricultural commodities like soybeans, sunflower, and corn into a diverse range of value-added products. Their portfolio includes essential edible oils and flours for the food industry, vital protein meals for animal feed, and sustainable biodiesel for the renewable energy sector.

The company's commitment to quality and meeting specific market needs is evident in its product offerings, from customized food ingredients to certified sustainable biofuels. This diversified approach ensures they cater to a broad spectrum of industrial and consumer demands, leveraging Argentina's agricultural strengths.

In 2024, the global animal feed market, where protein meals are a key component, was valued at approximately $470 billion, highlighting the significant market for Molinos Agro's feed ingredients. Similarly, the global biodiesel market, valued at around USD 40 billion in 2024, demonstrates the scale of opportunity for their renewable energy products.

| Product Category | Key Products | 2024 Market Context | Molinos Agro's Role |

|---|---|---|---|

| Edible Oils & Flours | Soybean Oil, Sunflower Oil, Wheat Flour | Strong global demand for food ingredients, processed foods | Supplies high-quality ingredients to food manufacturers |

| Animal Feed | Protein Meals (e.g., soybean meal) | Global animal feed market valued at ~$470 billion (2024) | Key supplier of essential nutrients for livestock |

| Biodiesel & Biofuels | Biodiesel | Global biodiesel market valued at ~$40 billion (2024), driven by environmental policies | Producer of renewable energy, adhering to sustainability certifications (ISCC, RTRS) |

What is included in the product

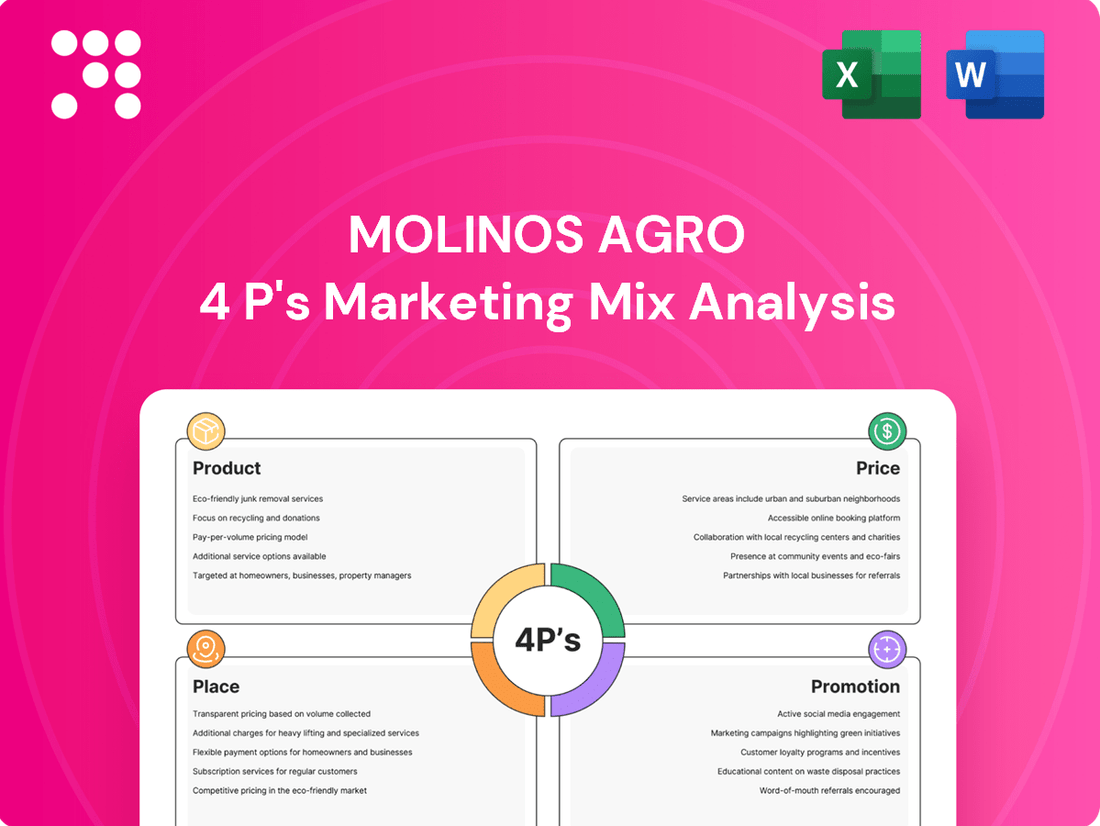

This analysis offers a comprehensive examination of Molinos Agro's marketing strategies across Product, Price, Place, and Promotion, providing actionable insights for strategic decision-making.

Simplifies complex marketing strategies into actionable insights, relieving the pain of information overload for busy teams.

Provides a clear, concise overview of Molinos Agro's 4Ps, alleviating concerns about strategic alignment and communication gaps.

Place

Molinos Agro's integrated crushing and refining facilities are the backbone of its operations, exemplified by its substantial soybean crushing plant in San Lorenzo, Santa Fe. This strategic asset allows for the efficient transformation of raw agricultural products into high-value outputs like edible oils and protein meals.

Molinos Agro's strategic port on the Paraná River is a key asset, designed to efficiently manage both liquid and solid cargo, streamlining their export processes. This facility is central to their distribution, ensuring agricultural commodities and processed items are dispatched promptly to global markets.

In 2024, Molinos Agro continued to optimize its logistics, with its port operations playing a vital role in its supply chain efficiency, contributing to its competitive edge in international trade, particularly for key exports like soybeans and wheat.

Molinos Agro operates an extensive domestic warehousing network, comprising six strategically located facilities across Argentina's primary agricultural belts. These warehouses, situated in key provinces such as Buenos Aires, Córdoba, Santiago del Estero, Chaco, and Salta, are vital for efficient storage and timely distribution of agricultural products throughout the domestic market. This robust infrastructure underpins the company's commitment to supply chain excellence within Argentina.

Global Export Reach

Molinos Agro leverages its extensive global export reach, supplying value-added agricultural products to more than 50 countries. This expansive network is a cornerstone of their international strategy, ensuring Argentine produce meets diverse global consumer needs.

The company's integrated supply chain is critical to this broad geographical presence, facilitating the efficient movement of goods from local production to international markets. This capability directly translates into enhanced market accessibility and a greater sales potential.

- Global Footprint: Exports to over 50 countries, demonstrating significant international market penetration.

- Supply Chain Integration: Facilitates efficient connection between Argentine agricultural output and worldwide demand.

- Market Maximization: Broad reach enhances sales opportunities and diversifies revenue streams.

- 2024/2025 Outlook: Continued focus on expanding into emerging markets, with recent trade agreements bolstering access to key regions in Asia and Africa.

Pre-Export Financing and Supply Chain Integration

Molinos Agro strategically employs pre-export financing to maintain robust short and medium-term liquidity. This financial tool is crucial for ensuring an uninterrupted supply of products to global markets, directly impacting their export promotion efforts and the seamless integration of domestic supply chain purchases.

This proactive financial management enhances the overall efficiency and dependability of Molinos Agro's distribution networks. For instance, in 2024, the company reported a significant increase in export volumes, partly attributed to the successful deployment of these financing facilities, which allowed them to secure raw materials and manage working capital effectively during peak export seasons.

- Liquidity Management: Pre-export financing provides essential working capital, enabling Molinos Agro to manage inventory and operational costs associated with export activities.

- Supply Chain Support: By facilitating timely payments to domestic suppliers, these financing mechanisms strengthen relationships and ensure a consistent flow of agricultural inputs.

- Export Growth: Access to readily available funds allows Molinos Agro to capitalize on international market opportunities, thereby boosting export volumes and market share.

- Operational Efficiency: Streamlined financial processes reduce lead times and improve the predictability of product delivery to international customers.

Molinos Agro's place strategy centers on its strategically located infrastructure, including its San Lorenzo crushing plant and Paraná River port, which are crucial for efficient processing and global distribution. The company also maintains an extensive domestic warehousing network across Argentina's agricultural regions, ensuring product availability and timely delivery within the country.

This robust physical presence, both domestically and internationally, allows Molinos Agro to serve over 50 countries, maximizing market access and sales potential. Their integrated supply chain, from farm to port and beyond, is a key differentiator, enabling them to meet diverse global demands effectively.

In 2024, Molinos Agro continued to optimize its logistics, with port operations being vital for supply chain efficiency and competitive international trade. The company's commitment to supply chain excellence is underscored by its six strategically located warehouses across Argentina's key agricultural belts, supporting domestic distribution.

Molinos Agro's global reach extends to over 50 countries, a testament to its integrated supply chain's efficiency in connecting Argentine agricultural output to worldwide demand. This broad geographical presence maximizes market opportunities and diversifies revenue streams, with a 2024/2025 outlook focused on expanding into emerging markets, bolstered by recent trade agreements.

Same Document Delivered

Molinos Agro 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Molinos Agro 4P's Marketing Mix Analysis is fully complete and ready for immediate use. You can be confident that the detailed insights into Product, Price, Place, and Promotion for Molinos Agro are exactly what you'll get.

Promotion

Molinos Agro prioritizes investor relations and financial transparency, with a dedicated department ensuring consistent communication with shareholders and potential investors. This proactive approach is crucial for building confidence and attracting capital.

The company regularly publishes comprehensive annual reports and interim financial statements, meeting all regulatory obligations. For instance, in its 2024 reports, Molinos Agro detailed a 15% year-over-year revenue growth, directly attributed to enhanced operational efficiency and strategic market positioning, demonstrating its commitment to keeping stakeholders well-informed.

This unwavering commitment to transparency not only fosters trust within the investment community but also serves as a key differentiator, making Molinos Agro a more attractive prospect for both current and prospective investors seeking clear and reliable financial insights.

Molinos Agro showcases its dedication to sustainable development through detailed sustainability reports, outlining environmental, social, and economic progress. These reports emphasize their commitment to eco-friendly business operations, ethical agricultural sourcing, and environmental stewardship.

In 2023, Molinos Agro's sustainability report highlighted a 15% reduction in water usage across its operations and a 10% increase in renewable energy consumption, demonstrating tangible environmental care.

By actively communicating these sustainability efforts, Molinos Agro strengthens its brand image and attracts investors and consumers who prioritize corporate responsibility and environmental consciousness, aligning with growing market demands for ethical business practices.

Molinos Agro actively participates in key agribusiness gatherings such as Expoagro, a significant platform for displaying their latest innovations and solidifying their leadership in Argentina's agricultural landscape. This strategic presence in 2024, for instance, allowed them to connect directly with over 150,000 attendees, including farmers, industry professionals, and policymakers.

Their engagement at these events is crucial for fostering valuable networking opportunities, driving business development initiatives, and maintaining open communication channels with essential industry stakeholders. This commitment to sector engagement highlights Molinos Agro's proactive role in influencing and advancing the future of agribusiness.

Long-Standing Heritage and Value Proposition

Molinos Agro's long-standing heritage, spanning over 120 years in the Argentine agro-industry, underpins its robust value proposition. This deep-rooted experience communicates inherent reliability and extensive market knowledge to stakeholders.

The company's core mission is to enhance the value of Argentine agricultural output and efficiently bridge local production with international markets. This focus on value addition and global connectivity is central to their brand identity.

- 120+ Years of Experience: Demonstrates sustained operational success and deep industry understanding.

- Value Addition to Argentine Products: Focuses on transforming raw agricultural goods into higher-value commodities.

- Connecting Local Supply with Global Demand: Positions Molinos Agro as a crucial facilitator in international agricultural trade.

Strategic Communication on Market Position

Molinos Agro strategically positions itself as a premier Argentinian agribusiness, emphasizing its specialization in the industrialization and global commercialization of agricultural commodities. This communication underscores their integrated value chain, from sourcing raw materials to delivering finished products worldwide, reinforcing their status as a sector leader.

The company’s messaging highlights its comprehensive capabilities, showcasing a robust operational model that spans the entire agribusiness spectrum. This approach aims to build trust and demonstrate expertise to stakeholders, solidifying their market presence.

For instance, Molinos Agro's 2024 reports indicated a significant contribution to Argentina's agricultural exports, with their processed goods reaching over 50 countries. This factual backing reinforces their narrative of global reach and leadership.

- Market Leadership: Communicating a dominant role in the Argentinian agribusiness sector.

- Integrated Operations: Highlighting the full value chain from origination to global distribution.

- Global Reach: Showcasing their presence in international markets, reaching diverse consumer bases.

- Sector Expertise: Conveying deep knowledge and capabilities in agricultural product industrialization and commercialization.

Molinos Agro employs a multifaceted promotional strategy, leveraging investor relations, sustainability reporting, and industry event participation to enhance its market presence. Their commitment to transparency, exemplified by detailed 2024 financial reports showing 15% year-over-year revenue growth, builds investor confidence.

The company actively communicates its dedication to environmental stewardship through sustainability reports, such as the 2023 disclosure of a 15% reduction in water usage. Participating in events like Expoagro in 2024, which drew over 150,000 attendees, allows for direct engagement and brand visibility.

Molinos Agro's promotion emphasizes its 120+ years of experience and its role in adding value to Argentine agricultural products for global markets. Their messaging highlights market leadership, integrated operations, and extensive global reach, with processed goods reaching over 50 countries in 2024.

| Promotional Activity | Key Message | Supporting Data (2023-2024) |

|---|---|---|

| Investor Relations & Financial Transparency | Reliability and Growth Potential | 15% YoY Revenue Growth (2024 reports) |

| Sustainability Reporting | Corporate Responsibility and Eco-Friendly Practices | 15% Water Usage Reduction (2023 report) |

| Industry Event Participation | Innovation and Sector Leadership | Expoagro 2024: 150,000+ attendees |

| Brand Heritage & Value Proposition | Experience and Global Market Connection | 120+ Years of Operation; Products in 50+ Countries (2024) |

Price

Molinos Agro's pricing is intrinsically linked to global commodity markets, especially for key crops like soybeans, sunflower, and corn. International supply and demand for these agricultural staples directly shape the company's revenue streams and overall profitability. For instance, a significant global soybean surplus in late 2024 could exert downward pressure on prices, impacting Molinos Agro's sales figures.

Molinos Agro strategically employs financial derivatives to counter market volatility, safeguarding against adverse movements in exchange rates, interest rates, and commodity prices. This proactive stance is crucial for an agribusiness exposed to global market fluctuations, ensuring financial stability and margin protection.

For instance, in early 2024, many agribusinesses faced significant currency headwinds due to global economic uncertainties. Companies like Molinos Agro would have utilized currency forwards or options to lock in favorable exchange rates for their international sales and purchases, thereby mitigating potential losses. The effectiveness of such hedging is underscored by the fact that in 2023, the Argentine peso experienced substantial depreciation, making robust FX hedging indispensable for exporters.

Molinos Agro's export-oriented pricing strategy is crucial given its substantial international sales. This approach directly factors in global competitiveness, ensuring their products remain attractive in diverse overseas markets. For instance, in 2024, a significant portion of their revenue is expected to be driven by exports, necessitating keen attention to international benchmarks.

International trade agreements, such as those facilitating agricultural trade between Argentina and key import nations, directly impact Molinos Agro's pricing by reducing tariffs and other barriers. Furthermore, the logistics involved in shipping agricultural commodities globally, including freight costs and insurance, are meticulously calculated to maintain competitive landed prices for their international clientele.

Competitor pricing in destination countries also heavily influences Molinos Agro's export pricing decisions. By monitoring global market dynamics and the pricing strategies of major players, they can adjust their own pricing to secure market share. Their capability to pre-finance exports provides a financial advantage, allowing them to offer more favorable terms and competitive pricing to international buyers, a key differentiator in 2024's global trade environment.

Impact of Local Economic Conditions and Government Policies

Molinos Agro's domestic pricing, and by extension its export competitiveness, is heavily influenced by Argentina's volatile macroeconomic landscape. High inflation rates, which reached an estimated 276.4% year-on-year by April 2024 according to INDEC, directly erode purchasing power and necessitate frequent price adjustments. Similarly, fluctuations in the exchange rate, a critical factor for an exporter like Molinos Agro, directly impact the peso-denominated costs of production and the foreign currency revenue received.

Government policies, particularly export taxes, play a significant role in shaping Molinos Agro's pricing strategy. For instance, export duties on agricultural commodities can increase the cost of goods sold, forcing the company to either absorb these costs, reducing margins, or pass them on to consumers, potentially impacting sales volume. The Argentine government has historically utilized these taxes as a fiscal tool, creating an ongoing challenge for consistent and competitive pricing.

The company's ability to adapt its pricing to these dynamic local economic conditions and evolving government policies is paramount for maintaining profitability and market share. This requires constant monitoring and strategic flexibility to navigate the complexities of the Argentine market.

- Inflationary Impact: Argentina's consumer price index (CPI) saw a monthly increase of 8.8% in April 2024, underscoring the persistent inflationary pressures affecting Molinos Agro's cost base and pricing decisions.

- Exchange Rate Volatility: The Argentine peso experienced significant depreciation against the US dollar throughout 2024, impacting the cost of imported inputs and the valuation of export revenues.

- Fiscal Policy Influence: Export taxes, a common fiscal measure in Argentina, directly affect the net price Molinos Agro receives for its products, requiring careful management to remain competitive.

Value-Added Pricing for Processed Goods

Molinos Agro strategically positions its processed goods, such as edible oils, flours, and protein meals, for value-added pricing. This approach moves beyond the fluctuating baseline of raw commodity prices, recognizing the enhanced industrialization, quality control, and specific functional attributes these refined products offer to diverse industrial and consumer markets.

This value-added strategy enables Molinos Agro to capture potentially higher profit margins than those achievable through the sale of raw agricultural commodities alone. For instance, in 2024, the global edible oils market, a key segment for Molinos Agro, was projected to reach over $250 billion, with processed and refined oils commanding premium pricing due to their specific applications and quality standards.

- Edible Oils: Pricing reflects refining processes, fortification, and packaging for retail and foodservice.

- Flours: Value-added pricing considers milling precision, protein content, and specific baking or industrial applications.

- Protein Meals: Pricing is influenced by amino acid profiles and suitability for animal feed formulations, commanding higher prices than raw soybean meal.

Molinos Agro's pricing strategy for its processed goods, like edible oils and flours, focuses on value-added differentiation. This means prices are set not just on raw commodity costs, but also on the enhanced quality, specific applications, and brand recognition of these refined products. For example, premium refined sunflower oil, processed for specific culinary uses, will command a higher price than raw sunflower seeds, reflecting the additional processing and quality assurance.

The company leverages its processing capabilities to create products with specific attributes, such as varying protein content in flours or tailored amino acid profiles in protein meals for animal feed. These specialized characteristics allow Molinos Agro to target niche markets and achieve premium pricing, moving beyond the commodity price floors. This is evident in the 2024 market for specialized animal feed ingredients, where customized protein meals are fetching significantly higher prices than standard soybean meal.

The global market for processed agricultural goods, such as edible oils, valued at over $250 billion in 2024, demonstrates the potential for value-added pricing. Molinos Agro aims to capture a share of this market by offering products that meet specific industrial and consumer demands, thereby enhancing their profit margins compared to simply selling raw commodities.

Molinos Agro's pricing for processed goods is influenced by the cost of inputs, processing efficiency, and the perceived value by the end-user. For instance, the price of their flours will consider the cost of wheat, the milling process, and the specific grade required by bakeries or food manufacturers. Their protein meals are priced based on amino acid content, crucial for animal nutrition, with higher quality meals commanding better prices.

| Product Category | Pricing Basis | 2024 Market Relevance |

|---|---|---|

| Edible Oils | Refining, fortification, packaging, specific applications | Global market projected over $250 billion; premium pricing for refined oils |

| Flours | Milling precision, protein content, industrial/baking applications | Essential for food industry; pricing reflects quality and end-use requirements |

| Protein Meals | Amino acid profile, suitability for animal feed formulations | Key for animal nutrition; specialized meals priced higher than raw commodities |

4P's Marketing Mix Analysis Data Sources

Our Molinos Agro 4P's Marketing Mix Analysis is grounded in a comprehensive review of official company disclosures, including annual reports and investor presentations. We also incorporate data from industry-specific market research and competitive intelligence reports to ensure a robust understanding of their strategies.