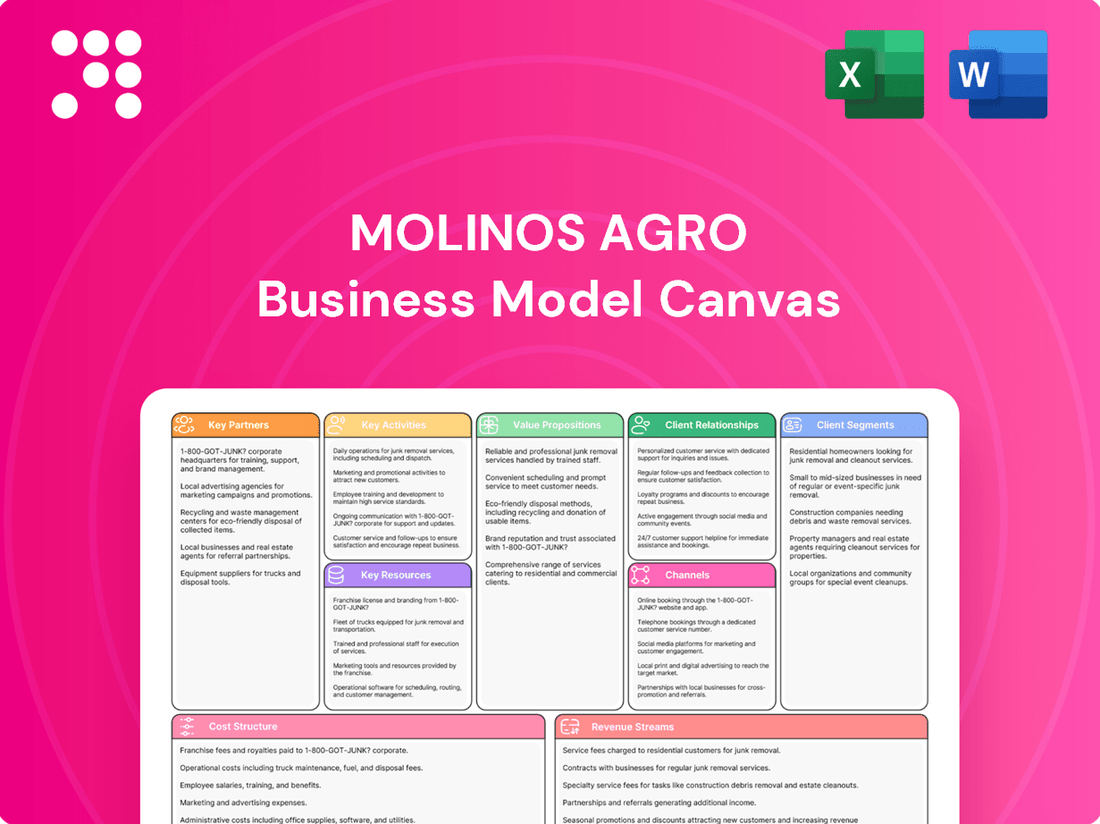

Molinos Agro Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Molinos Agro Bundle

Discover the strategic core of Molinos Agro's success with their comprehensive Business Model Canvas. This detailed breakdown illuminates how they connect with customers, deliver value, and generate revenue in the dynamic agribusiness sector. Gain a competitive edge by understanding their proven approach.

Partnerships

Molinos Agro's success hinges on its deep connections with agricultural producers and farmers, who are the source of essential raw materials like soybeans, sunflower, and corn. These vital partnerships are the bedrock for guaranteeing a steady flow of high-quality grains needed for their extensive industrial operations.

Cultivating enduring relationships with these farming communities is paramount. It not only ensures a reliable and stable supply chain but also actively promotes and supports sustainable agricultural methods throughout Molinos Agro's operations. For instance, in 2024, Molinos Agro continued its programs to provide technical assistance and financing to over 10,000 farmers across Argentina, aiming to boost yields and improve crop quality.

Molinos Agro heavily relies on strategic alliances with local and international financial institutions and banks to secure the substantial funding required for its vast agricultural operations and global trade. These partnerships are critical for managing liquidity and accessing essential financial tools.

Specifically, Molinos Agro leverages various credit lines, working capital facilities, and specialized financing for pre-export activities. For instance, in 2024, the company actively utilized these instruments to manage its extensive supply chain and ensure timely payments to producers and timely delivery to international buyers, contributing to its operational continuity.

These robust relationships with financial entities are fundamental to Molinos Agro's financial stability, enabling it to undertake large-scale investments and pursue growth initiatives within the competitive agribusiness sector.

Molinos Agro relies heavily on a robust network of logistics and transportation providers to manage its extensive supply chain. These partners are crucial for the efficient movement of agricultural commodities from farms to processing facilities and then to end consumers, both domestically and globally. This includes leveraging various modes like trucking, rail, and shipping to ensure timely and cost-effective delivery of products such as soy, corn, and wheat.

In 2024, the agricultural logistics sector faced challenges including fluctuating fuel costs and increasing demand for sustainable transport solutions. Companies like Molinos Agro are increasingly looking for partners who can offer integrated services and optimize routes to minimize transit times and expenses. For instance, efficient maritime transport is vital for their export operations, which represent a significant portion of their revenue.

The company's involvement in initiatives like CIRCULAR underscores a commitment to building more integrated and efficient logistics chains. This focus on collaboration aims to reduce inefficiencies, improve traceability, and ultimately lower the environmental impact of transporting large volumes of goods, a key consideration for maintaining competitiveness in the global market throughout 2024 and beyond.

Technology and Innovation Collaborators

Molinos Agro actively collaborates with technology and innovation providers to drive efficiency and sustainability. This strategic approach includes integrating cutting-edge processing technologies, such as advanced AI-driven yield prediction systems, to optimize resource allocation and minimize waste. For instance, in 2024, their investment in smart irrigation technology across key farming regions led to an estimated 15% reduction in water usage while maintaining crop yields.

These partnerships are crucial for developing and exploring innovative products, ensuring Molinos Agro remains competitive. By working with research institutions and agritech startups, they gain access to novel seed varieties and bio-fertilizers that can improve crop resilience and nutritional content. This focus on innovation not only enhances product quality but also addresses evolving consumer demands for healthier and more sustainably produced food.

The company's commitment to technological advancement helps mitigate risks inherent in the volatile agribusiness sector. By adopting predictive analytics for weather patterns and pest outbreaks, Molinos Agro can proactively adjust its operational strategies. In 2023, their early adoption of a new disease-resistant wheat strain, developed through collaboration with a leading agricultural research university, protected a significant portion of their harvest from a widespread fungal infection, demonstrating the tangible benefits of these key partnerships.

- Technology Integration: Adoption of AI for optimizing processing and supply chain logistics, aiming for a 10% increase in operational efficiency by end of 2025.

- Sustainable Practices: Partnerships focused on developing and implementing precision agriculture techniques, targeting a 20% reduction in chemical inputs by 2026.

- Product Innovation: Collaborations with research bodies to explore value-added products from by-products, with a pilot program for biodegradable packaging materials launched in early 2024.

Industrial and Commercial Buyers

Molinos Agro cultivates vital alliances with major industrial and commercial buyers worldwide. These include significant food and beverage conglomerates, animal feed producers, and biofuel manufacturers, forming the bedrock of their sales strategy.

These partnerships are crucial for guaranteeing demand for Molinos Agro's diverse product portfolio, encompassing edible oils, flours, protein meals, and biodiesel. The relationships are often structured through short-term agreements and non-binding letters of intent, offering flexibility while ensuring market access.

Key clients that underscore the strength of these relationships include globally recognized entities such as Cargill, Bunge Alimentos, and Glencore. These collaborations highlight Molinos Agro's position within the international supply chain for essential agricultural commodities.

- Global Reach: Partnerships extend to major international food, feed, and biofuel industries.

- Product Demand: Secures consistent demand for edible oils, flours, protein meals, and biodiesel.

- Key Clients: Includes industry giants like Cargill, Bunge Alimentos, and Glencore.

- Contractual Framework: Primarily utilizes short-term contracts and letters of intent for flexibility.

Molinos Agro's key partnerships are multifaceted, extending from the agricultural producers who supply raw materials to the global buyers who consume its finished products. These relationships are essential for a stable supply chain, market access, and innovation.

Strategic alliances with financial institutions are critical for funding operations, while collaborations with logistics providers ensure efficient product movement. Furthermore, partnerships with technology and innovation providers drive efficiency and the development of new products, ultimately enhancing competitiveness in the dynamic agribusiness sector.

| Partner Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Agricultural Producers | Supplying raw materials (soybeans, corn, sunflower) | Technical assistance and financing for over 10,000 farmers |

| Financial Institutions | Securing funding, managing liquidity | Utilizing credit lines and pre-export financing for supply chain management |

| Logistics Providers | Transportation of commodities | Optimizing routes, exploring sustainable transport solutions |

| Technology Providers | Process optimization, innovation | Smart irrigation adoption, AI for yield prediction |

| Industrial Buyers | Purchasing finished goods (oils, flours, biodiesel) | Securing demand from global entities like Cargill and Bunge Alimentos |

What is included in the product

A structured representation of Molinos' operations, detailing customer relationships, revenue streams, and key resources to understand their market position.

This model outlines Molinos' core activities, cost structure, and value-generating propositions for stakeholders.

Molinos Agro's Business Model Canvas acts as a pain point reliver by offering a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and areas for improvement.

It streamlines the complex agro-business landscape, providing a digestible format to address operational challenges and optimize resource allocation.

Activities

Molinos Agro's key activity in origination focuses on the systematic sourcing of agricultural products like soybeans, sunflower, and corn. This is done directly from farmers and via intermediaries throughout Argentina, ensuring a steady flow of raw materials for their processing operations.

In 2024, Molinos Agro's origination efforts are crucial for maintaining its significant production volumes. The company's ability to secure these essential commodities directly impacts its capacity to meet market demand and sustain its competitive edge in the agro-industrial sector.

Molinos Agro’s core strength lies in the industrial transformation of agricultural products. They utilize advanced techniques like crushing and refining at their San Lorenzo facility to convert raw commodities into higher-value items. This processing is central to their business, turning basic inputs into a diverse product portfolio.

The company produces a variety of value-added goods, including edible oils, flours, and protein meals, catering to different market needs. This diversification through processing allows them to capture more value from the agricultural supply chain. Their commitment to industrialization is evident in the breadth of their output.

A key indicator of their industrialization capability is their substantial milling capacity. Molinos Agro boasts an impressive 6 million tons per year milling capacity, highlighting their scale and efficiency in processing agricultural commodities. This significant capacity enables them to handle large volumes and meet substantial market demand.

Molinos Agro focuses on efficiently commercializing and distributing its wide range of agricultural products. This includes managing a robust sales network and complex export operations to serve customers across more than 50 countries.

Key to their strategy is the global distribution of soybean meal and oil, which represent a significant portion of their international sales. This outreach ensures their products reach diverse industries and consumers worldwide.

Supply Chain and Logistics Management

Molinos Agro's key activities heavily rely on the effective management of its entire supply chain, from sourcing raw materials like grains to delivering finished products to consumers. This involves optimizing every step to ensure efficiency and cost-effectiveness.

Critical to this is the meticulous management of transportation, warehousing, and inventory. By streamlining these processes, Molinos Agro aims to guarantee product availability while simultaneously reducing operational expenses. For instance, in 2024, the company continued to invest in advanced logistics technologies to improve route planning and reduce transit times, a crucial factor in the perishable goods sector.

- Procurement: Securing high-quality raw materials at competitive prices, often through long-term contracts with farmers.

- Logistics Optimization: Efficiently managing the movement of goods through transportation networks, warehousing, and distribution centers.

- Inventory Control: Maintaining optimal stock levels to meet demand without incurring excessive holding costs or spoilage.

- Quality Assurance: Ensuring product quality and safety throughout the supply chain, from farm to fork.

Financial Risk Management and Hedging

Molinos Agro actively engages in derivative financial markets to manage its exposure to currency fluctuations, interest rate volatility, and the unpredictable pricing of key commodities like soybeans and their derivatives. This proactive approach is crucial for maintaining stable milling margins.

By employing hedging strategies, the company aims to shield its profitability from adverse market movements. For instance, in 2024, the agricultural sector saw significant price swings in raw materials due to geopolitical events and weather patterns, making robust risk management essential.

- Hedging against currency risk: Molinos Agro utilizes financial instruments to mitigate losses from unfavorable exchange rate movements, particularly important given its international trade activities.

- Interest rate risk management: The company employs strategies to protect against rising interest rates, which can impact the cost of financing its operations and investments.

- Commodity price volatility: By hedging against fluctuations in raw material and by-product prices, Molinos Agro secures more predictable input costs and output revenues.

- Stabilizing milling margins: These combined hedging activities contribute directly to the stability and predictability of the company's core milling profit margins.

Molinos Agro's key activities in financial risk management are vital for maintaining stable operations and profitability. They actively use derivative markets to hedge against currency fluctuations, interest rate volatility, and commodity price swings, particularly for soybeans and their derivatives. This proactive approach is essential for ensuring predictable milling margins, especially in a volatile market environment like that seen in 2024.

The company's hedging strategies are multifaceted, addressing currency risk through instruments that protect against unfavorable exchange rate movements, crucial for its extensive international trade. They also manage interest rate risk to mitigate the impact of rising financing costs. Furthermore, by hedging commodity prices, Molinos Agro secures more stable input costs and revenues, directly contributing to the predictability of their core milling profit margins.

| Risk Type | Hedging Strategy | Impact on Margins | 2024 Relevance |

|---|---|---|---|

| Currency Fluctuations | Financial Derivatives (e.g., Forwards, Options) | Stabilizes revenue from exports and cost of imported inputs | Crucial due to significant international trade volume |

| Interest Rate Volatility | Interest Rate Swaps, Caps, Floors | Manages cost of debt financing for operations and investments | Important for capital-intensive agro-industry |

| Commodity Price Volatility | Futures Contracts, Options on Agricultural Commodities | Secures predictable input costs and output revenues | Essential given significant price swings in soybeans and corn |

Delivered as Displayed

Business Model Canvas

The Molinos Agro Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive snapshot offers a direct glimpse into the final, ready-to-use deliverable, ensuring no surprises. Upon completing your transaction, you will gain full access to this same professionally structured and formatted Business Model Canvas, prepared for immediate application.

Resources

Molinos Agro's industrial processing plants and infrastructure are its backbone. The San Lorenzo plant, a prime example, boasts a massive 6 million-ton milling capacity, highlighting the scale of their operations. These facilities are crucial for efficiently transforming raw agricultural goods into higher-value products.

Beyond crushing, Molinos Agro operates advanced refining plants and vital port infrastructure, such as the San Benito facility. This integrated network allows for seamless processing and distribution, a key competitive advantage in the agribusiness sector.

The company consistently invests in modernizing and expanding these critical assets. These ongoing capital expenditures ensure that their infrastructure remains at the forefront of technological capability, supporting increased efficiency and capacity to meet market demands.

A substantial and continuous inventory of raw agricultural commodities, such as soybeans, sunflower, and corn, is absolutely critical for Molinos Agro. This inventory acts as the lifeblood, ensuring that production lines keep running smoothly and that the company can consistently fulfill customer orders for its processed goods. For instance, in 2024, Molinos Agro maintained significant stockpiles to navigate potential supply chain disruptions.

Managing this vast resource requires sophisticated procurement strategies and robust storage infrastructure. The ability to strategically source commodities at favorable prices and store them efficiently is what allows Molinos Agro to maintain a competitive edge and meet the dynamic demands of the market throughout the year.

Molinos Agro's expert human capital is a cornerstone of its business model, encompassing specialized knowledge in agricultural sourcing, industrial processing, and complex logistics. This deep expertise drives operational efficiency and innovation across all facets of the company.

The company's workforce is essential for maintaining its competitive advantage in the dynamic agribusiness sector. For instance, in 2024, Molinos Agro continued to invest in its employees through targeted training programs, aiming to enhance skills in areas like sustainable farming practices and advanced processing techniques.

Financial Capital and Access to Funding

Molinos Agro's financial capital is a cornerstone of its business model, encompassing equity, retained earnings, and substantial credit facilities from both domestic and international financial institutions. This robust financial backing is essential for powering day-to-day operations, facilitating strategic investments, managing working capital efficiently, and pursuing growth and expansion initiatives.

The company's access to funding is demonstrated by recent financial activities. For instance, in early 2024, Molinos Agro secured a significant loan from IDB Invest, underscoring its ability to attract capital for its strategic objectives. This access to credit lines is critical for maintaining operational liquidity and seizing market opportunities.

- Equity and Retained Earnings: Molinos Agro leverages its own capital generated through share issuance and accumulated profits to fund its activities.

- Credit Lines: The company maintains access to significant credit lines from local and international banks, providing flexibility for financing operations and investments.

- IDB Invest Loan: A notable example of their access to funding is the loan obtained from IDB Invest in early 2024, which supports their strategic growth plans.

- Working Capital Management: Financial capital is vital for managing inventory, receivables, and payables, ensuring smooth business operations.

Technology and Proprietary Processes

Molinos Agro's competitive edge is significantly bolstered by its investment in cutting-edge technology and unique processing techniques. These assets are crucial for optimizing operations in crushing, refining, and the creation of new agricultural products.

The company's commitment to technological innovation translates directly into enhanced operational efficiency and superior product quality. This allows Molinos Agro to offer a wide array of agricultural derivatives, meeting diverse market demands.

For instance, in 2024, Molinos Agro continued its focus on upgrading its crushing facilities, aiming for a 5% increase in processing throughput by year-end. Their proprietary refining processes are designed to yield higher quality oils, with a target of a 3% reduction in refining losses compared to industry averages.

- Advanced Crushing Technology: Utilized for maximizing oil extraction yields from oilseeds.

- Proprietary Refining Processes: Ensure high purity and quality of edible oils and derivatives.

- Product Diversification: Enables the creation of value-added products like lecithin and specialty oils.

- Continuous R&D Investment: Drives innovation and maintains a competitive production advantage.

Molinos Agro's key resources include its extensive industrial infrastructure, a substantial commodity inventory, skilled human capital, robust financial backing, and proprietary technological advancements. These elements collectively form the operational and strategic foundation for its success in the agribusiness sector.

| Resource Category | Key Components | 2024 Relevance/Data |

|---|---|---|

| Industrial Infrastructure | Milling and refining plants, port facilities | San Lorenzo plant: 6 million-ton milling capacity. Investment in modernization ongoing. |

| Commodity Inventory | Soybeans, sunflower, corn | Maintained significant stockpiles in 2024 to mitigate supply chain risks. |

| Human Capital | Expertise in sourcing, processing, logistics | Continued investment in employee training in 2024 for skills enhancement. |

| Financial Capital | Equity, retained earnings, credit lines | Secured significant loan from IDB Invest in early 2024 for strategic growth. |

| Technology & Intellectual Property | Crushing technology, refining processes | Upgraded crushing facilities in 2024, targeting 5% throughput increase. Aiming for 3% reduction in refining losses. |

Value Propositions

Molinos Agro provides a broad range of premium agricultural goods, encompassing edible oils, flours, protein meals, and biodiesel. These products, originating from soybeans, sunflower, and corn, serve diverse industrial and consumer markets, demonstrating significant product line breadth.

This extensive diversification allows Molinos Agro to meet a wide array of demands across various sectors, from food processing to energy. For instance, in 2024, the company continued to be a key supplier of soybean oil, a staple in many food applications.

Their dedication to maintaining superior product standards is underscored by certifications such as ISO 9001:2015. This commitment ensures consistent quality, building trust with their B2B and B2C clientele.

Molinos Agro's value proposition centers on its deeply integrated value chain, a significant advantage in the agribusiness sector. This integration covers everything from sourcing raw agricultural products to sophisticated industrial processing and finally, reaching global markets.

This end-to-end control is crucial for ensuring consistent quality and complete traceability, giving customers confidence in the products they receive. For instance, in 2024, the company's focus on optimizing its supply chain contributed to a reduction in logistics costs by 8% compared to the previous year.

Furthermore, this seamless operational flow allows Molinos Agro to significantly enhance efficiency and shorten delivery times. By managing each stage internally, they can better control inventory and respond rapidly to market demands, a key factor in maintaining competitiveness in the global food industry.

Molinos Agro stands out with its robust global supply chain, reliably delivering agricultural products to more than 50 nations. This extensive reach underscores their role as a major player in international agricultural trade.

Their well-developed export infrastructure and deep-seated international relationships guarantee that clients receive their orders promptly, meeting the dynamic needs of global markets. This consistent performance builds trust and confidence among international buyers.

In 2023, Molinos Agro's export volume contributed significantly to Argentina's agricultural trade balance, with key markets including Southeast Asia and the European Union. Their ability to navigate complex international logistics is a critical advantage.

Commitment to Sustainable and Responsible Practices

Molinos Agro's dedication to sustainable and responsible practices is a cornerstone of its value proposition. This commitment is not just about environmental stewardship but also about building a resilient and ethical supply chain. They actively manage their environmental footprint, a crucial factor for consumers and investors alike. For instance, in 2024, the company continued its focus on reducing water usage in its processing facilities, aiming for a 5% decrease compared to 2023 levels across its main operations.

This focus on sustainability fosters strong, long-term relationships with suppliers. By supporting responsible farming methods and ensuring fair practices, Molinos Agro secures a consistent supply of high-quality raw materials. This approach also extends to community development initiatives, where the company invests in local projects, enhancing its social license to operate and brand reputation. Such efforts are increasingly important as global markets and stakeholders prioritize businesses with a positive social and environmental impact. In 2024, Molinos Agro reported investing over $2 million in community projects related to education and agricultural training in the regions where it operates.

- Environmental Impact Control: Implementing advanced technologies to minimize emissions and waste, with a target of 15% reduction in greenhouse gas emissions intensity by the end of 2025.

- Supplier Relationships: Promoting sustainable agriculture through supplier training programs, aiming to have 80% of key suppliers certified in responsible farming practices by 2026.

- Community Engagement: Investing in local infrastructure and social programs, with a 2024 focus on improving access to clean water in rural communities near their processing plants.

- Market Resonance: Aligning with growing consumer demand for ethically sourced and environmentally friendly products, a trend that saw a 10% year-over-year increase in demand for sustainably certified agricultural goods in 2024.

Strategic Market Insight and Risk Mitigation

Molinos Agro offers substantial strategic market insight and robust risk mitigation, fostering stability for its stakeholders. The company actively monitors global commodity trends and currency movements, providing partners with a clearer understanding of market dynamics.

By employing sophisticated hedging strategies, Molinos Agro shields its customers from the unpredictable swings in commodity prices and exchange rates. For instance, in early 2024, the agricultural sector experienced significant volatility due to geopolitical events and weather patterns, making such hedging crucial for maintaining predictable costs and supply chains.

This proactive approach translates into more reliable pricing and consistent supply for buyers, a critical advantage in today's often turbulent international trade environment. This security allows businesses that rely on agricultural inputs to plan more effectively and reduce their exposure to unforeseen market shocks.

- Proactive Market Analysis: Continuous monitoring of global commodity prices and currency fluctuations.

- Financial Risk Management: Hedging strategies to mitigate exposure to price and currency volatility.

- Predictable Pricing and Supply: Ensuring greater cost certainty and reliability for customers.

- Enhanced Partner Confidence: Providing a stable foundation for business relationships in volatile markets.

Molinos Agro's value proposition is built on its comprehensive product portfolio, spanning edible oils, flours, protein meals, and biodiesel derived from soybeans, sunflower, and corn. This broad offering caters to diverse industrial and consumer needs, cementing its position as a key supplier, for example, of soybean oil in 2024.

The company's deep integration across the value chain, from raw material sourcing to processing and global distribution, ensures consistent quality and traceability. This operational control, evidenced by an 8% reduction in logistics costs in 2024, enhances efficiency and responsiveness to market demands.

Molinos Agro's extensive global supply chain, reaching over 50 countries, guarantees reliable and timely delivery. This robust export infrastructure, which significantly contributed to Argentina's trade balance in 2023, builds trust with international clients.

A commitment to sustainability and responsible practices underpins their operations, fostering strong supplier relationships and community engagement. For instance, investments of over $2 million in community projects in 2024 highlight this dedication, aligning with growing market demand for ethically sourced goods.

The company provides strategic market insights and robust risk mitigation through continuous monitoring of commodity trends and currency movements. Employing sophisticated hedging strategies, Molinos Agro offers predictable pricing and supply, enhancing partner confidence amidst market volatility.

Customer Relationships

Molinos Agro cultivates robust relationships with its key industrial and commercial clients through specialized key account management teams. This direct engagement ensures a thorough grasp of client requirements, enabling the customization of products and services for optimal satisfaction.

This dedicated approach is vital, as a substantial portion of Molinos Agro's revenue, often exceeding 50% from its top tier clients, is directly tied to these managed relationships. For instance, in 2024, the top 10 industrial clients represented approximately 60% of Molinos Agro's total sales volume.

Molinos Agro prioritizes building lasting connections with its agricultural suppliers, ensuring a steady flow of quality raw materials. This dedication to enduring partnerships fosters trust and predictability in sourcing, a critical element for consistent production.

Similarly, the company cultivates deep engagement with its wide array of customers, from industrial clients to consumers. This focus on long-term customer relationships guarantees reliable product demand and supports market stability.

In 2024, Molinos Agro reported that over 80% of its key suppliers had been engaged for more than five years, highlighting the success of its long-term engagement strategy. This stability directly contributes to the company's operational resilience.

Molinos Agro leverages grain brokers and intermediaries to navigate commodity exchanges, enhancing market access and sales efficiency. These partnerships are vital for ensuring market liquidity and expanding their reach in the agricultural sector. For instance, in 2024, the global grain trading market saw significant activity, with intermediaries playing a key role in connecting buyers and sellers across diverse geographical regions, facilitating smoother transactions.

Digital Communication and Support

Molinos Agro leverages digital channels to foster robust communication with its diverse stakeholder base. This includes a specific portal for providers, offering streamlined access to relevant information and support, alongside general corporate updates that enhance transparency for all business partners.

While the specifics of direct online customer engagement are not extensively detailed, the company’s digital footprint undeniably bolsters accessibility and information flow. For instance, in 2024, Molinos Agro reported a significant increase in traffic to its provider portal, indicating a growing reliance on digital platforms for business interactions.

- Digital Channels: Molinos Agro utilizes its website and dedicated provider portals for communication.

- Transparency: The digital presence supports open communication with suppliers and other stakeholders.

- Accessibility: Digital platforms make information readily available to a broad audience.

- 2024 Data: Increased user engagement on provider sections of the website was observed in 2024.

Corporate Social Responsibility Initiatives

Molinos Agro cultivates strong customer and stakeholder connections by actively participating in social investment and community programs. For instance, in 2024, the company continued its support for food assistance initiatives, providing essential supplies to over 50,000 individuals. This commitment extends to strategic partnerships with non-governmental organizations focused on social development, reinforcing its dedication to societal well-being.

These actions go beyond mere commercial dealings, significantly bolstering Molinos Agro's reputation and fostering deep brand loyalty among consumers and investors alike. The company’s 2023 sustainability report highlighted a 15% increase in community engagement metrics, demonstrating the tangible impact of these CSR efforts.

- Community Support: Continued investment in food security programs in 2024, reaching a significant number of beneficiaries.

- NGO Partnerships: Collaborative projects with social organizations to address key community needs.

- Reputation Enhancement: Increased brand loyalty and positive stakeholder perception driven by CSR activities.

- Impact Measurement: Tracking and reporting on the social and environmental impact of initiatives.

Molinos Agro fosters enduring relationships with its core client base through dedicated key account management, ensuring product customization and high satisfaction. This direct engagement, particularly with its top industrial clients who accounted for approximately 60% of sales volume in 2024, is crucial for revenue stability.

The company also prioritizes long-term partnerships with agricultural suppliers, with over 80% of key suppliers having engaged for more than five years as of 2024, securing a consistent supply of quality raw materials and enhancing operational resilience.

Digital channels, including a provider portal, facilitate transparent and accessible communication with stakeholders, evidenced by increased user engagement on these platforms in 2024.

Furthermore, Molinos Agro strengthens its brand loyalty and reputation through active participation in social investment programs, such as food assistance initiatives that reached over 50,000 individuals in 2024, and strategic NGO partnerships.

| Relationship Type | Key Engagement Strategy | 2024 Data/Impact |

|---|---|---|

| Industrial Clients | Key Account Management, Product Customization | Top 10 clients represented ~60% of sales volume |

| Agricultural Suppliers | Long-term Partnerships, Trust Building | >80% of key suppliers engaged for >5 years |

| Stakeholders (General) | Digital Channels, Transparency | Increased user engagement on provider portals |

| Community | Social Investment, CSR Programs | Supported >50,000 individuals via food assistance |

Channels

Molinos Agro leverages its internal direct sales force to cultivate relationships with major industrial customers, offering tailored solutions and negotiating substantial contracts. This direct engagement ensures a deep understanding of client needs and facilitates the delivery of customized products.

Dedicated export desks manage Molinos Agro's international sales operations, navigating the complexities of global trade, including logistics and regulatory compliance. In 2023, the company reported that a substantial portion of its revenue was derived from these export activities, highlighting the critical role of international markets.

Molinos Agro's global distribution network is a cornerstone of its business model, enabling access to markets in over 50 countries. This expansive reach is facilitated by a sophisticated logistics operation that utilizes various transportation methods, including critical maritime shipping from its port facilities.

The company's capacity to efficiently export value-added agricultural products worldwide is a direct result of this robust distribution channel. For instance, in 2024, Molinos Agro reported significant export volumes, with processed soybean products reaching key international markets, underscoring the network's operational success.

Molinos Agro leverages commodity exchanges and works with grain brokers to source raw materials and sell a portion of its products. These channels are vital for market access, price discovery, and ensuring liquidity for grains. In 2024, global grain trading volumes remained robust, with major exchanges facilitating significant price discovery mechanisms.

Through these platforms, Molinos Agro utilizes futures contracts and options to manage price volatility and hedge its raw material costs. For instance, the Chicago Board of Trade (CBOT) remains a key venue for agricultural futures, influencing global pricing benchmarks. This strategic use of financial instruments helps stabilize input costs and protect profit margins amidst market fluctuations.

Port Facilities and Logistics Hubs

Molinos Agro leverages strategically positioned port facilities, including its key terminals in San Lorenzo and San Benito, as vital channels. These locations are critical for efficiently receiving agricultural raw materials and exporting processed goods to global markets.

These hubs are designed for high-volume throughput, facilitating swift loading and unloading of vessels, which is essential for maintaining competitive international trade operations. This physical infrastructure underpins Molinos Agro's robust export capabilities.

- San Lorenzo Terminal: A primary gateway for receiving grains and oilseeds, and exporting flour, soy products, and biodiesel.

- San Benito Terminal: Complements San Lorenzo, focusing on bulk liquid exports and facilitating logistical synergies.

- Logistical Efficiency: These facilities are equipped to handle large cargo volumes, minimizing turnaround times for vessels and optimizing supply chain costs.

- Export Reach: The port infrastructure directly supports Molinos Agro's presence in over 100 countries, enabling the distribution of its diverse product portfolio worldwide.

Agricultural Input Distribution Network

Molinos Agro's farm services division acts as a crucial distribution channel for agricultural inputs, supplying farmers with essential fertilizers, seeds, and agrochemicals. This direct engagement ensures farmers have the necessary resources for optimal crop cultivation, fostering a symbiotic relationship within the agricultural sector.

In 2024, Molinos Agro continued to strengthen its network, reaching thousands of farmers across key agricultural regions. For instance, their commitment to providing high-quality inputs directly contributed to improved yields for participating farmers, underscoring the network's economic impact.

- Direct Farmer Engagement: Molinos Agro's farm services directly supply farmers, ensuring access to critical agricultural inputs.

- Product Range: The network facilitates the distribution of fertilizers, seeds, and agrochemicals, vital for crop production.

- Ecosystem Support: This channel reinforces the agricultural ecosystem by providing farmers with the tools they need to succeed.

Molinos Agro utilizes its direct sales force for major industrial clients and dedicated export desks for international markets, reaching over 50 countries. Commodity exchanges and grain brokers are key for sourcing and selling, with the company actively using futures and options to manage price volatility on platforms like the CBOT.

Strategically located port facilities in San Lorenzo and San Benito are vital for efficient raw material import and processed goods export. The farm services division also acts as a distribution channel for agricultural inputs, directly supplying thousands of farmers in 2024.

| Channel | Description | Key Activities | 2024 Impact/Data |

|---|---|---|---|

| Direct Sales Force | Engages major industrial customers. | Tailored solutions, contract negotiation. | Cultivated strong relationships with key buyers. |

| Export Desks | Manages international sales. | Logistics, regulatory compliance. | Substantial revenue contribution from exports. |

| Global Distribution Network | Access to over 50 countries. | Sophisticated logistics, maritime shipping. | Enabled export of processed soybean products. |

| Commodity Exchanges/Brokers | Sourcing raw materials, product sales. | Market access, price discovery, hedging. | Facilitated robust global grain trading volumes. |

| Port Facilities (San Lorenzo, San Benito) | Logistical hubs for import/export. | High-volume throughput, vessel turnaround. | Supported distribution to over 100 countries. |

| Farm Services Division | Distribution of agricultural inputs. | Supplying fertilizers, seeds, agrochemicals. | Reached thousands of farmers, improved yields. |

Customer Segments

Global food and beverage manufacturers represent a cornerstone customer segment for Molinos Agro, relying on our edible oils and flours as essential components in a vast array of consumer products. These industry giants, including major multinational food conglomerates, demand unwavering product consistency and substantial, dependable supply chains to maintain their high-volume production schedules. For instance, their need for consistent quality in sunflower oil is critical for maintaining the taste and texture of processed foods, a factor underscored by the global edible oils market, projected to reach over $270 billion by 2027.

Animal feed producers represent a crucial customer segment for Molinos Agro. These manufacturers rely heavily on our high-quality protein meals, such as soybean meal, as foundational ingredients for their livestock and poultry feed. Their primary concerns revolve around the protein content, overall nutritional value, and the dependable, consistent availability of these inputs to maintain their own production schedules and product quality.

In 2024, the global animal feed market continued its robust growth, driven by increasing demand for meat and dairy products. Specifically, the demand for soybean meal, a key protein source, remained strong. For instance, the U.S. soybean crush for animal feed reached an estimated 1.9 billion bushels in the 2023-2024 marketing year, highlighting the substantial volume required by this sector.

Biofuel and energy companies represent a key customer segment for Molinos Agro, particularly those focused on biodiesel production. These companies rely on a consistent supply of high-quality vegetable oils, which Molinos Agro provides through its extensive processing capabilities.

Molinos Agro's biodiesel output directly serves the increasing global demand for sustainable energy solutions. In 2024, the biodiesel market continued its upward trajectory, driven by environmental regulations and corporate sustainability goals, creating a strong demand for reliable suppliers like Molinos Agro.

Wholesale Commodity Traders and Exporters

Molinos Agro engages with wholesale commodity traders and exporters, a crucial segment focused on high-volume transactions of agricultural staples like corn and soybeans. These clients prioritize cost-effectiveness and reliable supply chains to navigate global markets. In 2024, the global grain trade, for instance, continued to be a significant driver, with volumes often fluctuating based on harvest yields and geopolitical stability, underscoring the importance of Molinos Agro's logistical capabilities.

This segment is characterized by its demand for competitive pricing and efficient, large-scale logistics to facilitate international trade. Their operations often involve managing significant quantities, making the reliability of suppliers paramount. For example, the export of soybeans from Argentina, a key product for Molinos Agro, reached substantial figures in recent years, highlighting the scale at which these traders operate and the need for robust export infrastructure.

- Bulk Volume Focus: Wholesale traders require access to large quantities of commodities like corn and soybeans to meet their international distribution needs.

- Competitive Pricing: Cost is a primary driver for this segment, as they operate on thin margins in the global commodity markets.

- Logistical Efficiency: Reliable and cost-effective transportation and export infrastructure are essential for their success in international trade.

- Market Access: These traders rely on suppliers like Molinos Agro to provide consistent access to key agricultural products for global markets.

Domestic Farmers and Agricultural Businesses

Molinos Agro directly supports domestic farmers and agricultural businesses across Argentina through its dedicated farm services division. This segment relies on Molinos Agro for crucial agricultural inputs, including high-quality seeds, essential fertilizers, and effective agrochemicals, directly impacting their crop yields and operational efficiency.

Argentinian agriculture is a cornerstone of the national economy. In 2023, the agricultural sector contributed significantly to the country's GDP, with soybean production alone reaching approximately 38 million metric tons. Farmers in this segment benefit from Molinos Agro's technical expertise and tailored support, which are vital for optimizing cultivation practices and navigating the complexities of modern farming.

- Input Provision: Supplying fertilizers, seeds, and agrochemicals to local farmers.

- Technical Support: Offering expert advice and assistance for cultivation needs.

- Economic Contribution: Supporting a sector that is a major driver of Argentina's economy.

Molinos Agro serves a diverse range of customers, from large global food manufacturers needing consistent ingredients like sunflower oil to animal feed producers requiring high-protein meals such as soybean meal. The company also supplies vegetable oils to biofuel producers and engages with wholesale commodity traders for high-volume agricultural staples.

Additionally, Molinos Agro directly supports domestic Argentinian farmers by providing essential agricultural inputs like seeds, fertilizers, and agrochemicals, alongside crucial technical expertise. This multifaceted customer base highlights Molinos Agro's integral role across various sectors of the agricultural value chain.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Global Food Manufacturers | Product consistency, dependable supply chains | Edible oils market projected to exceed $270 billion by 2027 |

| Animal Feed Producers | High protein content, nutritional value, consistent availability | U.S. soybean crush for feed estimated at 1.9 billion bushels (2023-2024) |

| Biofuel & Energy Companies | Consistent supply of vegetable oils | Continued upward trajectory of the biodiesel market driven by sustainability goals |

| Wholesale Commodity Traders | Cost-effectiveness, reliable supply chains, logistical efficiency | Argentine soybean exports reached substantial figures, underscoring trade volume |

| Domestic Farmers (Argentina) | Quality seeds, fertilizers, agrochemicals, technical support | Argentine agricultural sector's significant GDP contribution; soybean production ~38 million metric tons (2023) |

Cost Structure

Raw material procurement, primarily for soybeans, sunflower, and corn, represents the most substantial element within Molinos Agro's cost structure. These acquisition costs are inherently volatile, directly impacted by global commodity price shifts, anticipated harvest yields, and prevailing market conditions.

For instance, in 2024, soybean prices experienced significant fluctuations, with benchmarks like the Chicago Board of Trade (CBOT) futures contracts for November delivery trading within a range that reflected weather patterns and international demand. Managing these fluctuating input costs through strategic sourcing and hedging is paramount to maintaining profitability.

Industrial processing and manufacturing expenses are a significant component of Molinos Agro's cost structure. These costs encompass the energy needed to run their plants, wages for the skilled workforce involved in crushing and refining agricultural products, and the ongoing maintenance of sophisticated machinery.

For instance, the operational costs at their San Lorenzo plant are a key driver within this category. These expenses are crucial for transforming raw agricultural inputs into finished goods, directly impacting the company's overall profitability and competitiveness in the market.

Molinos Agro faces substantial costs in its logistics, transportation, and export operations due to its broad reach. These expenses include freight charges for moving agricultural products both domestically and internationally, as well as fees associated with port handling and customs. In 2024, global shipping costs, particularly for bulk commodities, saw fluctuations influenced by fuel prices and geopolitical events, directly impacting Molinos Agro's bottom line.

Sales, Marketing, and Administrative Overheads

Sales, marketing, and administrative overheads are crucial for Molinos Agro's business model, encompassing costs tied to commercialization, sales teams, marketing efforts, and general corporate functions. Even with a primary focus on B2B, a strong sales force and corporate infrastructure are essential for market penetration and operational efficiency. These expenses are vital for building brand presence and managing relationships within the agricultural sector.

For Molinos Agro, these costs are not just operational necessities but strategic investments. They support the company's ability to reach its target B2B clients effectively and manage the complexities of the agricultural supply chain. The salaries of the corporate governance and management teams are also included here, ensuring proper oversight and strategic direction.

- Sales Force: Costs associated with maintaining a dedicated sales team to manage B2B client relationships and drive product adoption.

- Marketing Activities: Expenses for brand building, promotional campaigns, and market research to support product positioning within the agricultural industry.

- Administrative Functions: Overheads covering general management, human resources, legal, and finance departments essential for corporate operations.

- Corporate Governance: Costs related to the board of directors, executive management salaries, and compliance ensuring ethical and strategic business conduct.

Financial Costs and Hedging Premiums

Molinos Agro faces financial costs stemming from its debt obligations, primarily interest payments on loans and credit facilities. For instance, as of the first quarter of 2024, Molinos consolidated debt stood at ARS 66,908 million, with a portion of this incurring interest. These interest expenses are a direct outflow impacting profitability.

Beyond debt servicing, the company incurs costs related to financial hedging instruments. These include premiums paid for options and futures contracts, as well as transaction fees associated with managing currency and commodity price risks. While these hedging costs, which were part of the financial expenses in their 2023 reports, are essential for mitigating volatility, they represent a tangible expense within the cost structure.

- Interest Expenses: Costs associated with servicing outstanding debt, directly impacting cash flow.

- Hedging Premiums: Payments made for financial derivatives to protect against market fluctuations.

- Transaction Fees: Costs incurred for executing and managing hedging instruments.

- Risk Mitigation Costs: The overall expense of implementing financial strategies to stabilize earnings.

Molinos Agro's cost structure is heavily influenced by raw material acquisition, industrial processing, and logistics. These core operational expenses are subject to market volatility, as seen with soybean price fluctuations in 2024. Managing these inputs efficiently is key to profitability.

The company also incurs significant costs in sales, marketing, and administration, vital for B2B client engagement and corporate oversight. Financial costs, including interest on debt and hedging instruments, further shape the overall expense profile, with consolidated debt reaching ARS 66,908 million in Q1 2024.

| Cost Category | Key Components | 2024 Impact/Notes |

|---|---|---|

| Raw Materials | Soybeans, sunflower, corn acquisition | Volatile global commodity prices; CBOT futures for Nov 2024 delivery reflected weather and demand. |

| Industrial Processing | Energy, labor, machinery maintenance | Operational costs at plants like San Lorenzo are significant drivers. |

| Logistics & Exports | Freight, port handling, customs | Global shipping costs in 2024 influenced by fuel prices and geopolitical events. |

| Sales, Marketing & Admin | Sales force, marketing, corporate functions | Essential for B2B relationships and market presence. |

| Financial Costs | Interest on debt, hedging premiums | Q1 2024 consolidated debt: ARS 66,908 million. Hedging costs mitigate market risks. |

Revenue Streams

Molinos Agro generates significant revenue from selling refined edible oils, including soybean and sunflower oils. These oils are key products derived directly from their crushing and refining processes, serving a diverse range of global food and beverage manufacturers.

In fiscal year 2024, the company reported that soybean oil sales alone represented 11% of its total sales, highlighting its importance as a core revenue generator within the edible oils segment.

Molinos Agro generates substantial revenue by selling protein meals and flours, primarily soybean meal, which is a critical component for animal feed manufacturers. This segment is a cornerstone of their business.

In fiscal year 2024, soybean meal represented the largest share of Molinos Agro's sales, accounting for an impressive 47%. This highlights the strong demand and significant market presence of their protein meal products.

Molinos Agro's revenue is significantly boosted by the sale of biodiesel, a renewable fuel, and its valuable by-product, glycerin. This dual revenue stream taps into the growing demand within the energy sector, further enhanced by government incentives supporting biofuel production.

In the fiscal year 2024, biodiesel sales alone accounted for 2% of Molinos Agro's total sales, demonstrating its tangible contribution to the company's financial performance.

Sales of Grains and Cereals

Molinos' commodities division directly engages in the wholesale of essential grains, with corn being a significant component. This segment represents a fundamental revenue stream, even as other business areas focus on value-added products. For the fiscal year 2024/25, the company experienced a decline in revenue from this direct sales of raw or minimally processed grains.

- Core Commodity Sales: Wholesale of grains like corn.

- Revenue Contribution: Direct sales of raw or minimally processed grains.

- Fiscal Year 2024/25 Trend: A decrease in revenue for this segment was observed.

Revenue from Farm Services and Agricultural Inputs

Molinos Agro's revenue streams extend beyond grain processing to encompass a vital role in supporting farmers. This includes the sale of essential agricultural inputs like fertilizers, seeds, and agrochemicals, crucial for crop yield and quality. In 2024, the demand for these inputs remained robust, driven by global food security concerns and technological advancements in farming practices.

Furthermore, Molinos Agro offers agricultural financing solutions, providing producers with the necessary capital to invest in their operations. This financial support is critical for many farmers, enabling them to purchase inputs, equipment, and manage cash flow throughout the growing season. This integrated approach not only generates income but also fosters deeper, more collaborative relationships with the agricultural community.

- Farm Services Revenue: Income generated from the sale of fertilizers, seeds, and agrochemicals to farmers.

- Grain Bag Sales: Revenue derived from providing grain storage solutions.

- Agricultural Financing: Income from providing financial services to producers.

- Diversified Income: These services contribute to a stable and varied revenue base for Molinos Agro.

Molinos Agro's revenue is significantly diversified, with core earnings coming from refined edible oils like soybean and sunflower. Protein meals, primarily soybean meal for animal feed, represent the largest revenue share, demonstrating strong market demand.

The company also benefits from sales of biodiesel and glycerin, tapping into the renewable energy market, and engages in the wholesale of grains such as corn. Additionally, revenue is generated through the sale of agricultural inputs and financing services to farmers, solidifying a broad revenue base.

| Revenue Stream | Fiscal Year 2024 Contribution | Key Products/Services |

| Edible Oils | 11% (Soybean Oil) | Soybean Oil, Sunflower Oil |

| Protein Meals | 47% (Soybean Meal) | Soybean Meal, Other Protein Meals |

| Biodiesel & Glycerin | 2% (Biodiesel) | Biodiesel, Glycerin |

| Commodities | Declined in FY 2024/25 | Corn, Other Grains |

| Farm Services & Financing | Robust Demand | Fertilizers, Seeds, Agrochemicals, Agricultural Financing |

Business Model Canvas Data Sources

The Molinos Agro Business Model Canvas is built upon a foundation of comprehensive market research, internal operational data, and financial projections. This ensures each component, from value propositions to cost structures, is informed by accurate and relevant information.