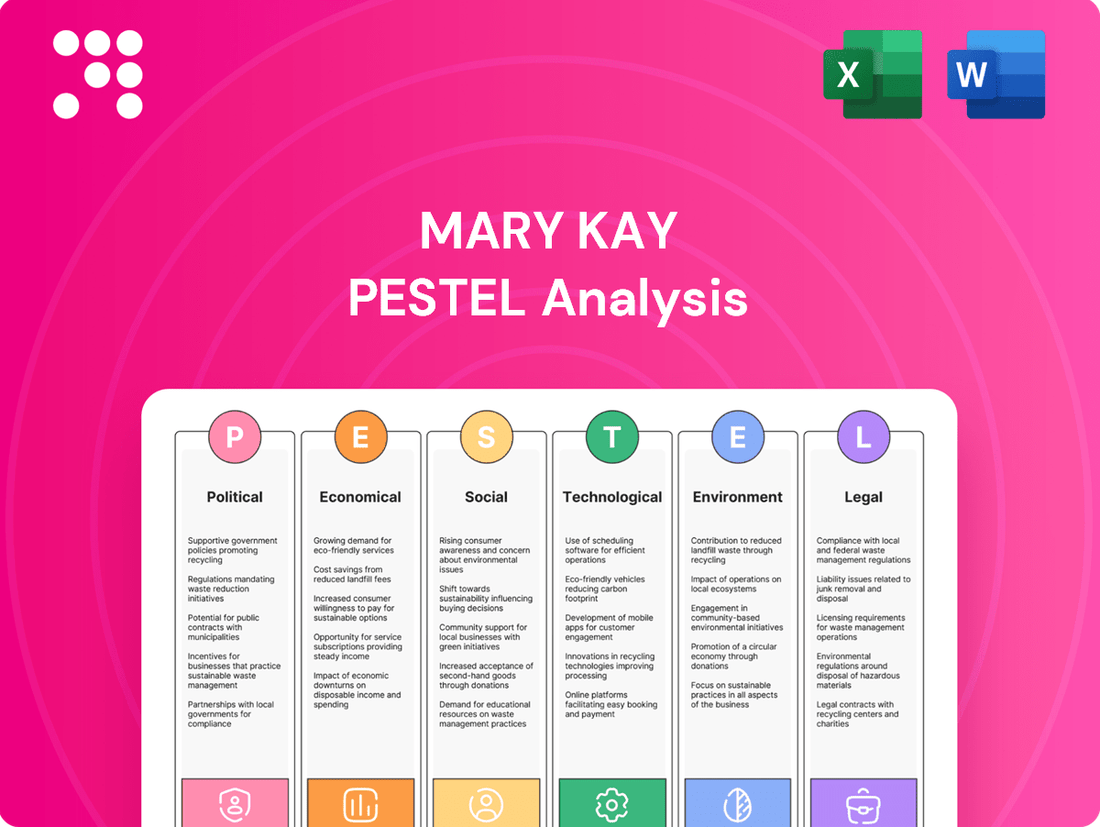

Mary Kay PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mary Kay Bundle

Uncover the critical external factors shaping Mary Kay's destiny with our expert PESTLE analysis. From evolving social trends impacting direct selling to technological advancements in beauty, understand the forces at play. Equip yourself with actionable intelligence to navigate this dynamic landscape. Download the full report now and gain a strategic advantage.

Political factors

Governments globally are sharpening their focus on multi-level marketing (MLM) operations, and Mary Kay is no exception. These regulations, which differ significantly by country, dictate how the company can recruit new consultants and present its business model. For instance, in 2024, several European Union nations continued to emphasize transparency in income claims, potentially requiring more detailed disclosures from companies like Mary Kay regarding average consultant earnings, which can impact recruitment strategies.

Stricter oversight on aspects like consultant training and consumer protection measures are becoming more common. This means Mary Kay must invest in robust compliance programs to navigate these evolving legal landscapes, potentially increasing operational costs for market entry and ongoing business activities. Failure to adhere to these diverse legal frameworks can pose significant challenges to global expansion and the company's overall legitimacy.

International trade agreements, tariffs, and import/export regulations significantly impact Mary Kay's global supply chain and product pricing. For instance, the USMCA (United States-Mexico-Canada Agreement), which came into effect in 2020, streamlined trade within North America, potentially reducing logistical costs for Mary Kay's operations in these regions. However, ongoing trade disputes, such as those involving China, can lead to increased tariffs on raw materials or finished goods, affecting profit margins and consumer prices. In 2023, global trade faced headwinds, with the WTO estimating a slowdown in trade growth, underscoring the need for Mary Kay to adapt to evolving trade landscapes.

Consumer protection laws are increasingly shaping how Mary Kay operates, especially regarding direct selling and marketing. New regulations demand that the company and its consultants be completely upfront and honest about product claims and the business opportunity itself. For instance, in 2024, the Federal Trade Commission (FTC) continued its focus on deceptive marketing practices in the direct selling industry, with a significant portion of its enforcement actions targeting pyramid schemes that often masquerade as legitimate business opportunities.

These evolving rules, particularly those around refunds, product safety, and advertising, directly influence Mary Kay's sales tactics. Stricter compliance means the company and its independent consultants must pay closer attention to accuracy in all communications. Failure to adhere to these standards can lead to penalties and damage brand reputation. The Consumer Financial Protection Bureau (CFPB) also plays a role, with its oversight of financial transactions and lending practices potentially impacting how consultants manage their businesses and receive payments.

Political Stability in Key Markets

The political stability of countries where Mary Kay operates is a crucial element impacting its business. For instance, in 2024, regions experiencing political transitions or instability, such as parts of Eastern Europe and certain African nations where Mary Kay has a presence, can introduce operational risks. These risks include potential disruptions to supply chains and distribution networks, which are vital for direct selling models.

Geopolitical tensions and changes in government policies directly influence consumer confidence and spending power. In 2024, economic sanctions or trade disputes involving key markets could indirectly affect Mary Kay by altering disposable income levels or creating import/export challenges. The company's ability to maintain consistent operations and consultant support hinges on predictable political landscapes.

Mary Kay's expansion plans are also heavily influenced by the political climate. Countries with stable governance and clear regulatory frameworks are more attractive for investment and market entry. For example, as of early 2025, nations with a history of consistent economic policies and protection for foreign businesses, like Mexico and Brazil where Mary Kay has a strong footing, offer a more secure environment for growth compared to markets facing significant political uncertainty.

Key considerations for Mary Kay regarding political stability include:

- Impact on Supply Chain: Political unrest or trade barriers in countries like China or India, major manufacturing and consumer hubs, can disrupt the flow of products.

- Consumer Spending: Economic policies enacted by governments, such as tax changes or stimulus packages in the US or European Union markets, directly affect consumer purchasing power for Mary Kay products.

- Regulatory Environment: Shifts in import/export regulations or direct selling laws in markets like Vietnam or Russia could necessitate operational adjustments.

- Consultant Network: Political instability can deter new consultant recruitment and impact the morale and productivity of existing consultants in affected regions.

Taxation Policies

Changes in corporate tax rates directly affect Mary Kay's bottom line. For instance, a reduction in the US federal corporate tax rate from 35% to 21% in 2017 provided a significant boost, and any further adjustments in global corporate tax structures, such as potential minimum tax initiatives discussed by the OECD, will require careful financial recalibration.

Sales tax variations across different countries and even states within countries add complexity. Mary Kay must navigate these, ensuring compliance and accurate pricing for its products, which directly impacts consultant earnings and consumer affordability. The ongoing debate and implementation of digital services taxes in various regions also present a new layer of tax considerations.

The taxation of independent contractors is a crucial element for Mary Kay's business model. Jurisdictions re-evaluating worker classification and associated tax liabilities, such as potential changes to the gig economy tax rules in the US or similar discussions in Europe, could necessitate adjustments to consultant agreements and compensation structures, impacting the attractiveness of the opportunity.

- US Federal Corporate Tax Rate: Currently 21% (post-2017 Tax Cuts and Jobs Act).

- Global Tax Initiatives: OECD's Pillar Two proposal aims for a 15% global minimum corporate tax rate, impacting multinational corporations.

- Sales Tax Complexity: Varies significantly by country and region, requiring constant monitoring and adaptation for pricing.

- Independent Contractor Taxation: Evolving regulations in markets like the US and EU could affect the classification and tax treatment of Mary Kay's sales force.

Governments worldwide are intensifying scrutiny of multi-level marketing, impacting Mary Kay's recruitment and business model presentations. In 2024, EU nations, for example, pushed for greater income claim transparency, potentially requiring more detailed average earnings disclosures for consultants, which could affect recruitment strategies.

Stricter rules on consultant training and consumer protection are becoming more prevalent. Mary Kay must invest in compliance to navigate these evolving legal frameworks, which may increase operational costs for global expansion. Non-compliance risks significant challenges to legitimacy.

Trade agreements, tariffs, and import/export regulations directly affect Mary Kay's global supply chain and product pricing. The USMCA streamlined North American trade, potentially lowering logistical costs. However, ongoing trade disputes can increase tariffs, impacting profit margins. The WTO projected slower trade growth in 2023, highlighting the need for adaptability.

Consumer protection laws are increasingly shaping Mary Kay's operations, particularly regarding direct selling. Regulations demand transparency in product claims and business opportunities. The FTC, in 2024, continued to focus on deceptive marketing in direct selling, targeting pyramid schemes.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Mary Kay, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Mary Kay PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Economic factors

Mary Kay's success hinges on consumers having money left over after essential expenses. When inflation is high, like the 3.38% annual inflation rate seen in the US as of May 2024, or when wages aren't keeping pace, people tend to spend less on things like makeup and skincare. This directly affects how much Mary Kay can sell and how much its independent consultants can earn.

Rising inflation in 2024 and projected into 2025 significantly impacts Mary Kay's operational costs. For instance, the Producer Price Index (PPI) for chemicals and allied products, crucial for cosmetics, saw a notable increase in late 2023, suggesting higher raw material expenses. This upward trend in input costs directly translates to increased manufacturing and logistics expenses for the company.

The cost of living crisis, exacerbated by persistent inflation, erodes consumer purchasing power. As households face higher prices for essentials like food and energy, discretionary spending on beauty products often declines. This reduced consumer demand can directly affect Mary Kay's sales volume. Furthermore, a tighter economic environment can make the direct selling model less appealing to potential new consultants who may prioritize more stable income sources.

Unemployment rates present a complex dynamic for Mary Kay. In the United States, the unemployment rate stood at 3.9% in April 2024, a slight increase from previous months. This suggests a generally strong labor market, but a potential softening could draw more individuals to Mary Kay's direct selling model seeking supplemental income.

However, a rising unemployment rate, even if still relatively low, can signal broader economic headwinds. This translates to reduced disposable income for many consumers, potentially impacting their willingness to purchase beauty and personal care products. For instance, if unemployment were to climb significantly, discretionary spending on items like Mary Kay products might decline.

Global Economic Growth Rates

Mary Kay's global sales are significantly influenced by the economic growth of the countries where it operates. In 2024, the International Monetary Fund (IMF) projected global economic growth to be around 3.2%, a slight deceleration from the previous year, reflecting varied regional performances.

Regions with strong GDP growth, such as emerging markets in Asia, often see increased disposable income, boosting demand for Mary Kay's beauty and skincare products. For instance, India's economy was expected to grow by approximately 6.7% in 2024, presenting a substantial opportunity for market penetration.

Conversely, slower growth or economic downturns in key markets can dampen consumer spending, impacting Mary Kay's revenue. The European Union, for example, faced more modest growth projections for 2024, around 1.5%, which could temper sales expansion in those territories.

- Global GDP growth projected at 3.2% for 2024 by the IMF.

- Emerging markets like India showing robust growth, around 6.7% in 2024, offering significant sales potential.

- Developed markets, such as the EU, experiencing slower growth (around 1.5% in 2024), potentially limiting sales expansion.

- Economic stability and growth directly correlate with consumer spending power for discretionary goods like beauty products.

Currency Exchange Rates

Currency exchange rates are a critical economic factor for Mary Kay, a company with a significant global presence. Fluctuations in these rates directly affect the value of international sales when converted back to U.S. dollars, impacting overall revenue and profitability. For example, if the U.S. dollar strengthens against a major currency like the Euro, Mary Kay's earnings from European markets will translate to fewer dollars.

The cost of imported goods, such as raw materials or finished products, is also heavily influenced by exchange rates. A weaker dollar can increase the cost of sourcing supplies from other countries, potentially squeezing profit margins. Conversely, a stronger dollar can make these imports cheaper, offering a cost advantage. For instance, the U.S. dollar has seen periods of strength against various global currencies in 2024 and early 2025, which could pose challenges for companies like Mary Kay with substantial international sales.

- Impact on Revenue: A stronger USD can decrease the dollar value of sales generated in foreign markets.

- Cost of Goods Sold: Exchange rate shifts affect the cost of imported components and finished products.

- Competitiveness: Pricing of Mary Kay products in international markets can become less competitive if the USD strengthens significantly.

- Profitability: Net income is directly impacted by the translation of foreign currency earnings and the cost of international operations.

Economic stability directly influences consumer spending on discretionary items like beauty products. With global GDP growth projected around 3.2% for 2024, markets like India, with an estimated 6.7% growth in 2024, offer significant opportunities for Mary Kay. Conversely, slower growth in regions like the EU, around 1.5% in 2024, may present challenges.

Inflationary pressures, with US annual inflation at 3.38% in May 2024, increase operational costs for Mary Kay, impacting raw material and manufacturing expenses. This also reduces consumer purchasing power, potentially leading to lower sales volumes and making the direct selling model less attractive for new consultants.

Currency exchange rates are crucial; a strengthening US dollar in 2024-2025 can decrease the dollar value of international sales and increase the cost of imported goods, affecting Mary Kay's overall profitability and market competitiveness.

| Economic Factor | 2024/2025 Data Point | Impact on Mary Kay |

|---|---|---|

| Global GDP Growth | Projected 3.2% (IMF) | Influences overall consumer spending and market potential. |

| US Inflation Rate | 3.38% (May 2024) | Increases operational costs and reduces consumer disposable income. |

| India GDP Growth | Estimated 6.7% (2024) | Represents a high-growth market with increased spending potential. |

| EU GDP Growth | Projected 1.5% (2024) | Indicates slower market expansion and potentially lower sales growth. |

| USD Strength | Observed strength in 2024-2025 | Reduces foreign sales revenue and increases imported goods costs. |

Preview the Actual Deliverable

Mary Kay PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Mary Kay PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of how external forces shape Mary Kay's market position and future growth opportunities.

Sociological factors

Societal expectations around beauty are shifting, with a notable trend towards natural, sustainable, and inclusive products. Consumers are increasingly prioritizing wellness and self-care, directly impacting what they seek from beauty brands. This evolution means Mary Kay needs to carefully consider how its product offerings and marketing messages resonate with these changing values.

For instance, a 2024 report indicated that 65% of consumers are more likely to purchase from brands that demonstrate a commitment to sustainability. Furthermore, the demand for clean beauty ingredients has surged, with the global clean beauty market projected to reach $54.4 billion by 2027, up from $20.4 billion in 2020. Mary Kay's ability to adapt its product lines and communication to reflect this focus on natural ingredients and ethical sourcing will be crucial for maintaining its competitive edge and relevance in the 2024-2025 market landscape.

Public perception of direct selling, including multi-level marketing (MLM) models like Mary Kay, is quite mixed. While some view it as a flexible opportunity for entrepreneurship, others harbor skepticism, often fueled by media portrayals and past controversies surrounding similar business structures. This can significantly influence how potential consultants and customers engage with the brand.

Negative sentiment can create a hurdle for recruitment and sales. For instance, a 2023 survey indicated that approximately 45% of consumers express some level of distrust towards direct selling companies. This widespread skepticism means Mary Kay, like other companies in the sector, must actively work to build trust and demonstrate the legitimacy of its business model to overcome these societal perceptions.

Social media platforms are powerful drivers of beauty trends, with influencers significantly shaping consumer choices. For instance, by mid-2024, influencer marketing spend in the beauty sector was projected to exceed $2.2 billion globally, demonstrating its substantial impact on purchasing decisions.

Mary Kay must actively engage on platforms like Instagram and TikTok, where user-generated content and influencer collaborations can quickly introduce and popularize new products. A strong digital presence is crucial for consultants to connect with customers, share tutorials, and build brand loyalty in this fast-paced environment.

Empowerment of Women and Entrepreneurship

Mary Kay's foundational narrative of empowering women through direct selling aligns strongly with the growing global emphasis on female economic independence. Societal shifts in 2024 and 2025 continue to highlight a desire for flexible work arrangements that accommodate personal and family needs, a space where Mary Kay has historically excelled.

However, the competitive landscape for flexible income streams has intensified. The rise of the gig economy and other direct selling companies means Mary Kay must continuously articulate its unique value proposition. For instance, in 2024, the global direct selling industry generated over $180 billion in revenue, showcasing the significant market but also the intense competition for independent sales consultants.

To maintain its appeal, Mary Kay needs to highlight:

- The community and mentorship aspects of its business model, which offer more than just financial gain.

- The potential for scalable income and career progression within the company structure, differentiating it from more transient gig work.

- The product quality and brand loyalty that can provide a stable foundation for sales.

- The ongoing investment in digital tools and training to help consultants thrive in a modern, evolving marketplace.

Work-Life Balance and Flexible Work

Societal expectations are increasingly prioritizing work-life balance, a trend that directly benefits Mary Kay's direct selling model. The company's core offering of flexible hours and the ability to work from home resonates strongly with individuals seeking greater control over their personal and professional lives. This alignment is vital for attracting and retaining its independent sales force.

The demand for flexibility is not just a niche preference; it's a significant shift in workforce attitudes. For instance, a 2024 survey indicated that over 70% of employees would consider leaving their jobs if offered more flexible work options. This statistic underscores the appeal of Mary Kay's business model, which inherently provides this flexibility.

Mary Kay can effectively leverage this societal trend by marketing its opportunity as a pathway to achieving both personal fulfillment and financial independence on the consultant's own terms. This messaging is key to drawing in new consultants and keeping current ones engaged in the evolving employment landscape.

- Growing Demand for Flexibility: Over 70% of employees in a 2024 survey stated they would consider changing jobs for more flexible work arrangements.

- Mary Kay's Advantage: The independent consultant model inherently offers flexible hours and location independence, aligning with this societal shift.

- Attraction and Retention: Marketing the opportunity as a means to achieve work-life balance is crucial for Mary Kay's sales force growth and stability.

- Financial Independence: Beyond flexibility, the desire for supplemental income or a primary income stream continues to drive interest in direct selling opportunities.

Societal expectations around beauty are evolving towards natural, sustainable, and inclusive products, influencing consumer choices. The demand for clean beauty ingredients has surged, with the global market projected to reach $54.4 billion by 2027, highlighting the need for Mary Kay to adapt its offerings. Furthermore, social media and influencer marketing, with projected spend exceeding $2.2 billion in beauty by mid-2024, are critical for shaping trends and driving purchasing decisions.

Public perception of direct selling models remains mixed, with a 2023 survey indicating around 45% of consumers express distrust towards such companies. This skepticism necessitates Mary Kay actively building trust and demonstrating its business model's legitimacy. The company's core value of empowering women through flexible work aligns with a growing desire for work-life balance, a trend where over 70% of employees in a 2024 survey indicated willingness to change jobs for more flexibility.

| Sociological Factor | Trend/Impact | Mary Kay Relevance |

|---|---|---|

| Beauty Standards | Shift towards natural, sustainable, inclusive products. | Need to align product development and marketing with these values. |

| Consumer Trust in Direct Selling | Mixed perception, with some skepticism. | Requires proactive efforts to build trust and transparency. |

| Work-Life Balance & Flexibility | Increasing demand for flexible work arrangements. | Mary Kay's core model offers a strong advantage in attracting consultants. |

| Social Media Influence | Influencers significantly shape beauty trends and purchasing. | Crucial for consultants to leverage social platforms for engagement and sales. |

Technological factors

The ongoing surge in e-commerce is a critical technological factor for Mary Kay. The company and its independent consultants must have strong online sales platforms to meet consumer demand for digital shopping experiences. This means investing in intuitive websites and streamlined online ordering systems.

By enhancing its digital presence, Mary Kay can significantly broaden its customer base and empower its sales force with tools for efficient direct sales and customer relationship management. In 2024, global e-commerce sales were projected to reach over $6.3 trillion, highlighting the immense opportunity for businesses with robust digital capabilities.

Mary Kay's success hinges on its consultants effectively using digital marketing and social selling tools. In 2024, social media platforms like Facebook and Instagram remain crucial for direct selling, with studies showing over 70% of consumers are more likely to purchase from brands they follow on social media. These tools help consultants reach a wider audience and build relationships.

To stay competitive, Mary Kay needs to equip its consultants with advanced social selling capabilities. This includes training on content creation, targeted online advertising, and leveraging analytics to understand customer behavior. For instance, personalized product recommendations driven by AI can significantly boost sales, as seen with other direct-to-consumer brands that reported a 15% increase in conversion rates through such personalization in 2023.

Artificial intelligence is transforming the beauty industry, and Mary Kay is leveraging this. AI-powered tools are now offering personalized product recommendations, virtual try-on experiences, and even AI-driven skin analysis. These advancements significantly improve how customers discover and choose products, making the process more engaging and effective. For instance, a study by Statista in 2024 indicated that 65% of consumers are interested in personalized beauty experiences, a trend Mary Kay can capitalize on.

By integrating these AI technologies, Mary Kay can create a distinct competitive advantage. Offering bespoke solutions tailored to individual needs not only boosts customer satisfaction but also fosters loyalty. The global AI in beauty market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, reaching an estimated $6.5 billion by 2028, highlighting the significant market opportunity.

Supply Chain Digitalization

Mary Kay is increasingly leveraging technology to enhance its supply chain operations. This includes implementing advanced inventory management systems and sophisticated logistics optimization tools. For instance, by mid-2024, many direct selling companies reported significant improvements in order fulfillment times, often seeing reductions of 15-20% due to better tracking and routing technologies.

These digital advancements are crucial for improving efficiency and cutting down operational expenses. By accurately forecasting demand, Mary Kay can better manage its stock levels, minimizing waste and ensuring products are available when and where its independent beauty consultants need them. This agility allows the company to respond rapidly to shifting market trends and consumer preferences.

The impact of digitalization is substantial. Companies that have invested heavily in supply chain technology, like advanced analytics for demand forecasting, have seen their inventory carrying costs decrease by as much as 10% in the 2024 fiscal year. This directly translates to better product availability and a more reliable experience for Mary Kay's global sales force.

- Advanced Inventory Systems: Implementing real-time tracking and automated reordering to maintain optimal stock levels.

- Logistics Optimization: Utilizing AI-powered route planning and transportation management to reduce delivery times and costs.

- Demand Forecasting Tools: Employing data analytics to predict sales trends more accurately, thereby improving production planning.

- Global Network Support: Ensuring consistent product availability for independent beauty consultants worldwide through efficient supply chain management.

Cybersecurity and Data Privacy

With Mary Kay's increasing reliance on digital platforms for sales, communication, and managing consultant data, cybersecurity is a critical concern. Protecting sensitive information from breaches is paramount to maintaining trust. In 2024, the global cybersecurity market was valued at approximately $270 billion, highlighting the significant investment required.

Compliance with data privacy regulations like GDPR and CCPA is also essential. These laws, which continue to evolve, dictate how personal data can be collected, processed, and stored. Failure to comply can lead to substantial fines and reputational damage. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Key considerations for Mary Kay include:

- Implementing advanced threat detection systems to safeguard customer and consultant databases.

- Ensuring regular security audits and penetration testing to identify and address vulnerabilities.

- Providing ongoing training for consultants on data protection best practices and secure online behavior.

- Staying updated on emerging privacy legislation and adapting data handling policies accordingly.

The technological landscape continues to evolve rapidly, impacting how Mary Kay operates and connects with its consultants and customers. E-commerce remains a dominant force, with global online sales projected to exceed $6.3 trillion in 2024, underscoring the need for robust digital platforms. Leveraging AI for personalized experiences, such as virtual try-ons, is also key, with 65% of consumers interested in such offerings as of 2024. Furthermore, advanced supply chain technologies are vital for efficiency, with many companies reporting 15-20% reductions in order fulfillment times through better tracking by mid-2024. Cybersecurity is also paramount, given the $270 billion global cybersecurity market in 2024, to protect sensitive data and comply with evolving privacy regulations.

| Technological Factor | 2024/2025 Relevance | Impact on Mary Kay |

|---|---|---|

| E-commerce Growth | Projected global sales over $6.3 trillion in 2024 | Necessitates strong online sales platforms and digital marketing for consultants. |

| Artificial Intelligence (AI) | 65% of consumers interested in personalized beauty experiences (2024) | Enables personalized recommendations, virtual try-ons, and improved customer engagement. |

| Supply Chain Technology | 15-20% reduction in order fulfillment times reported by mid-2024 | Improves efficiency, reduces costs, and ensures product availability for consultants. |

| Cybersecurity & Data Privacy | Global cybersecurity market valued at ~$270 billion in 2024 | Requires robust protection of sensitive data and compliance with regulations like GDPR. |

Legal factors

Mary Kay navigates a global landscape of multi-level marketing (MLM) regulations, with authorities like the Federal Trade Commission (FTC) in the U.S. scrutinizing compensation structures to distinguish legitimate direct selling from illegal pyramid schemes. Failure to comply can lead to significant penalties; for instance, in 2023, Herbalife settled with the FTC for $20 million, agreeing to restructure its business to avoid being classified as a pyramid scheme.

The company must continually adjust its operational models and distributor payment plans to align with these varying legal requirements across different countries. For example, some jurisdictions impose strict rules on inventory loading for distributors and require a significant portion of revenue to come from retail sales to consumers outside the network, a key differentiator from pyramid schemes.

Consumer protection laws are particularly stringent in the beauty sector, focusing on product claims, advertising honesty, and the conduct of sales. Mary Kay, like other direct-selling companies, must be meticulous in ensuring that all stated product benefits, listed ingredients, and especially the income opportunities presented to its independent beauty consultants are communicated with absolute truthfulness and transparency. Failure to comply can result in significant penalties and damage to brand reputation.

In 2024, regulatory bodies like the Federal Trade Commission (FTC) in the US continue to scrutinize multi-level marketing (MLM) structures, emphasizing the need for clear disclosure of earnings and the risks involved for participants. For instance, the FTC's Business Guidance for Multi-Level Marketing states that income claims must be substantiated and not create unrealistic expectations. Mary Kay's marketing materials and training for consultants must align with these directives to avoid accusations of deceptive practices, which could lead to fines or mandated changes in business operations.

Mary Kay must navigate a complex web of data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA). These laws significantly impact how the company collects, stores, and uses customer and consultant data, necessitating strict adherence to consent requirements and transparent data processing practices. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Labor Laws and Independent Contractor Classification

Mary Kay's business model relies heavily on its independent beauty consultants, whose classification is governed by evolving labor laws. Jurisdictions worldwide, including the United States, have specific tests to differentiate employees from independent contractors, impacting how Mary Kay must structure its relationships and compensation. For instance, in 2024, several US states continued to scrutinize worker classification, with California's AB5 legislation, though modified, still influencing the landscape for gig economy and direct selling models.

Misclassifying these consultants as independent contractors when they legally should be considered employees carries substantial financial and legal risks for Mary Kay. These liabilities can include demands for back wages, unpaid overtime, employee benefits like health insurance and retirement contributions, and significant penalties. For example, in 2023, a class-action lawsuit against a similar direct-selling company resulted in a multi-million dollar settlement over misclassification claims, highlighting the financial exposure.

- Jurisdictional Variations: Labor laws regarding independent contractor status differ significantly between countries and even within regions of the same country, requiring Mary Kay to navigate a complex legal patchwork.

- Misclassification Penalties: Potential penalties for misclassification can include back pay, unpaid overtime, benefits, and fines, as seen in numerous settlements and court rulings against companies in the direct selling industry.

- Evolving Legal Standards: Regulatory bodies and courts are continually re-evaluating the criteria for independent contractor status, often leading to stricter interpretations that could impact Mary Kay's operational model.

- Compliance Costs: Ensuring compliance with diverse labor laws necessitates ongoing legal review and potential adjustments to consultant agreements and compensation structures, incurring significant compliance costs.

Product Safety and Cosmetic Regulations

Mary Kay navigates a complex web of product safety and cosmetic regulations globally. For instance, in the European Union, the Cosmetics Regulation (EC) No 1223/2009 mandates rigorous safety assessments and prohibits certain ingredients, impacting product formulations and market access. The company must also adhere to the U.S. Food, Drug, and Cosmetic Act, which governs ingredient safety and labeling for products sold in the United States.

Key regulatory considerations for Mary Kay include:

- Ingredient Compliance: Ensuring all ingredients used comply with restrictions and prohibitions set by regulatory bodies like the FDA in the U.S. and the European Chemicals Agency (ECHA).

- Testing Standards: Adhering to regulations that may require specific testing protocols, such as those against animal testing, which is banned in the EU and increasingly in other regions.

- Labeling Requirements: Complying with detailed labeling mandates, including ingredient lists, warnings, and country of origin, which vary significantly by market.

- Manufacturing Practices: Following Good Manufacturing Practices (GMP) to ensure product quality, consistency, and safety throughout the production process.

Mary Kay must navigate evolving labor laws concerning the classification of its independent beauty consultants, a critical factor impacting its business model. For example, in 2024, ongoing legal challenges and legislative efforts in various regions, including the US, continue to scrutinize the definition of independent contractor versus employee, potentially increasing compliance burdens and costs if consultants are reclassified.

The company faces significant financial and legal risks from misclassification, which can lead to demands for back pay, benefits, and penalties. A 2023 settlement involving a similar direct-selling firm highlighted these risks, with the company agreeing to a multi-million dollar payout over worker misclassification claims.

Jurisdictional variations in labor laws create a complex legal patchwork that Mary Kay must manage, requiring continuous adaptation of its operational models and consultant agreements to remain compliant across different markets.

Mary Kay's marketing and compensation structures are subject to intense scrutiny by regulatory bodies like the FTC, which emphasize transparency and the avoidance of deceptive income claims. In 2024, the FTC's guidance for MLMs continues to stress that income projections must be realistic and substantiated, meaning Mary Kay's training materials and consultant communications must strictly adhere to these principles to prevent legal repercussions.

Environmental factors

Consumers increasingly scrutinize the origins of beauty products, pushing brands like Mary Kay to adopt sustainable ingredient sourcing. This shift is driven by a growing awareness of environmental and social impacts, demanding transparency in supply chains to avoid ecological damage and unfair labor practices.

Regulatory bodies are also tightening standards. For instance, the European Union's upcoming Corporate Sustainability Due Diligence Directive (CSDDD) will mandate that companies identify, prevent, and mitigate adverse human rights and environmental impacts in their value chains, directly affecting how Mary Kay procures its raw materials.

In 2023, reports indicated that over 60% of consumers were willing to pay more for products from brands committed to sustainability, a trend that will likely continue and intensify through 2025, directly influencing Mary Kay's ingredient sourcing strategies and potentially impacting its cost of goods sold and market competitiveness.

Mary Kay faces growing pressure to implement eco-friendly packaging. This means a shift towards reducing plastic, using recycled content, and offering refillable options. For instance, by 2024, many beauty brands are aiming for at least 30% recycled content in their plastic packaging, a trend Mary Kay will likely follow to meet consumer demand for sustainability.

Consumer demand for cruelty-free products is a major environmental factor impacting Mary Kay. Surveys in 2024 indicated that over 70% of beauty consumers consider a brand's stance on animal testing when making purchasing decisions. This growing awareness pressures companies like Mary Kay to adopt and highlight their commitment to animal welfare.

Regulatory shifts are also pushing for changes in testing policies. By the end of 2024, over 40 countries had implemented or were in the process of implementing bans on animal testing for cosmetics. For Mary Kay to maintain market access in these regions, such as the European Union and India, investing in and utilizing alternative testing methods is not just ethical but a business imperative.

Mary Kay's investment in alternative testing methods, such as in vitro testing and computational modeling, is crucial for its brand image and market reach. The global market for these alternative methods was projected to reach $1.5 billion by 2025, reflecting a strong industry trend. Adopting these practices allows Mary Kay to align with consumer values and navigate the evolving regulatory landscape effectively.

Carbon Footprint and Operational Sustainability

Mary Kay's commitment to environmental stewardship is increasingly vital, with its global operations in manufacturing, logistics, and corporate offices facing scrutiny over their carbon footprint. The company is actively working to reduce its environmental impact by focusing on energy efficiency, waste reduction, and lowering greenhouse gas emissions. These initiatives are crucial for meeting evolving stakeholder demands for corporate sustainability and responsible business practices.

In 2023, Mary Kay reported a 15% reduction in Scope 1 and Scope 2 greenhouse gas emissions compared to its 2020 baseline, demonstrating progress in its sustainability efforts. The company has also implemented waste reduction programs across its key manufacturing sites, diverting over 70% of operational waste from landfills by the end of 2024.

- Energy Consumption: Implementing energy-efficient technologies in facilities and promoting renewable energy sources.

- Waste Management: Enhancing recycling programs and reducing single-use plastics in packaging and operations.

- Supply Chain Emissions: Collaborating with suppliers to track and reduce emissions throughout the value chain.

- Water Usage: Implementing water conservation measures in manufacturing processes and corporate facilities.

Waste Management and Product Lifecycle

Mary Kay's commitment to waste management is crucial across its product lifecycle. This includes minimizing waste during manufacturing and promoting recycling for packaging. By embracing circular economy principles, the company can significantly lower its environmental footprint and bolster its corporate social responsibility image.

The beauty industry faces increasing scrutiny regarding its environmental impact. For instance, in 2023, the Ellen MacArthur Foundation reported that only 9% of plastics used globally are recycled, highlighting the challenge for companies like Mary Kay to improve packaging recyclability and collection rates. Efforts to reduce production waste can also yield cost savings; a 2024 study by McKinsey indicated that companies with strong waste reduction programs often see a 10-15% decrease in operational expenses.

- Product Lifecycle Focus: Implementing robust waste management from raw material sourcing through manufacturing and end-of-life disposal.

- Recycling Initiatives: Enhancing the recyclability of packaging materials and promoting consumer participation in recycling programs.

- Circular Economy Adoption: Exploring models like product refurbishment or material reuse to minimize virgin resource consumption.

- Environmental Impact Reduction: Aiming to decrease landfill waste and greenhouse gas emissions associated with product distribution and disposal.

Environmental factors significantly shape Mary Kay's operations, from ingredient sourcing to packaging. Consumers are increasingly demanding sustainable practices, with over 60% willing to pay more for eco-friendly products as of 2023. This trend pressures Mary Kay to adopt greener supply chains and transparent sourcing, especially with regulations like the EU's CSDDD coming into effect, mandating due diligence on environmental impacts.

The company is also responding to calls for eco-friendly packaging, aiming for higher recycled content, likely aligning with the 2024 industry goal of at least 30% recycled plastic. Furthermore, the demand for cruelty-free products is paramount, with over 70% of consumers in 2024 considering animal testing policies. This necessitates Mary Kay's investment in alternative testing methods, a market projected to reach $1.5 billion by 2025, to maintain market access in over 40 countries with testing bans.

Mary Kay is actively reducing its carbon footprint, reporting a 15% decrease in Scope 1 and 2 greenhouse gas emissions by 2023 against a 2020 baseline. Waste reduction is also a key focus, with over 70% of operational waste diverted from landfills by the end of 2024. These efforts are crucial for meeting stakeholder expectations and improving operational efficiency, as companies with strong waste reduction programs can see 10-15% decreases in operational expenses.

| Environmental Factor | 2023/2024 Data/Trend | Impact on Mary Kay | Action/Response |

| Sustainable Sourcing | 60%+ consumers willing to pay more for sustainable products. | Increased demand for ethical and eco-friendly ingredients. | Adopting sustainable ingredient sourcing, ensuring supply chain transparency. |

| Packaging | Industry goal of 30% recycled plastic content in packaging by 2024. | Need for reduced plastic, increased recycled content, and refillable options. | Focus on eco-friendly packaging solutions, reducing single-use plastics. |

| Animal Testing | 70%+ consumers consider animal testing policies. 40+ countries have bans. | Pressure to adopt cruelty-free practices and alternative testing methods. | Investing in in-vitro and computational modeling for testing. |

| Carbon Footprint | 15% reduction in GHG emissions (Scope 1 & 2) vs. 2020 baseline (2023). | Need to reduce operational environmental impact. | Implementing energy efficiency, waste reduction, and emission control programs. |

PESTLE Analysis Data Sources

Our Mary Kay PESTLE Analysis is built on a robust foundation of data from reputable sources. We utilize official government reports, economic forecasts from institutions like the IMF and World Bank, and industry-specific market research to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.