Mary Kay Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mary Kay Bundle

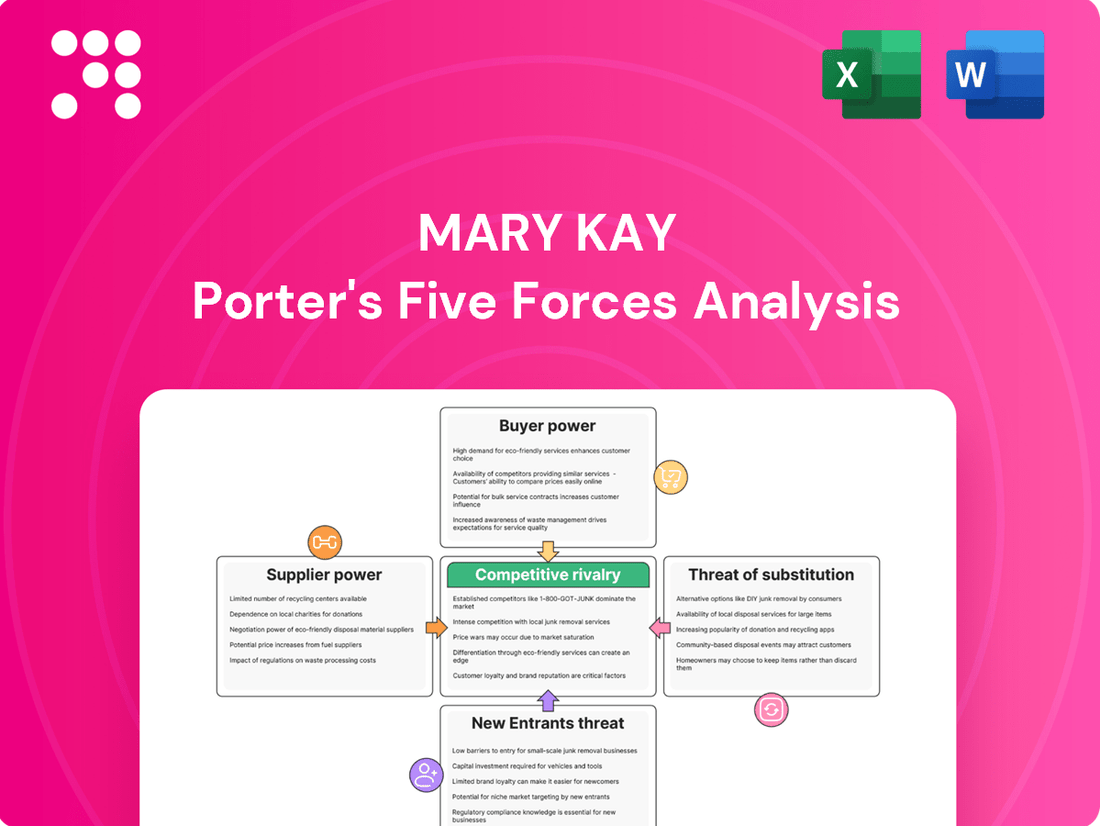

Mary Kay's competitive landscape is shaped by five critical forces: the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, the threat of substitutes, and the intensity of rivalry among existing competitors. Understanding these dynamics is crucial for any strategic evaluation of the beauty direct-selling giant.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Mary Kay’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Mary Kay, like many in the beauty sector, may face concentrated supplier power due to reliance on a limited pool of specialized ingredient providers. This is particularly true for unique, patented, or sustainably sourced components. For instance, the global market for specialty chemicals, which includes many beauty ingredients, was valued at approximately $230 billion in 2023, with a significant portion driven by niche, high-performance materials.

This reliance can translate into suppliers dictating pricing and terms, as finding comparable alternatives might be difficult, costly, or even impossible without compromising product quality or brand identity. The growing consumer demand for 'cleanical' and bio-based formulations further amplifies this, as only a select group of suppliers possess the necessary expertise and capabilities to meet these stringent criteria.

The beauty industry's increasing focus on sustainability and ethical sourcing, especially for bio-based and lab-grown ingredients, significantly bolsters supplier bargaining power. For example, the demand for RSPO-certified palm oil or shea butter from the Global Shea Alliance means suppliers meeting these stringent criteria hold more sway.

Mary Kay's own sustainability initiatives, as detailed in their 2025 Sustainability Report, underscore their dependence on these specialized suppliers. This reliance can translate into higher raw material costs for the company, as suppliers with these certifications are in a stronger negotiating position.

Suppliers with a strong brand reputation for consistent quality and innovative formulations in the cosmetics sector wield significant power. For instance, a supplier known for unique, high-performance ingredients can justify premium pricing, limiting a company's ability to seek cheaper alternatives without compromising product integrity.

Mary Kay's strategic focus on high-quality skincare and cosmetics necessitates partnerships with dependable suppliers, thereby diminishing its flexibility to switch to unproven, lower-cost options. This commitment to efficacy and science-backed ingredients, a growing consumer demand projected to continue through 2025, further solidifies the leverage of premium ingredient providers.

Switching Costs for Mary Kay

Switching suppliers for Mary Kay’s core product ingredients or manufacturing processes can incur substantial costs. These include the expenses associated with reformulating products, conducting rigorous retesting, obtaining necessary regulatory approvals, and managing potential disruptions to their established production schedules. For instance, a significant shift in a key ingredient supplier could necessitate months of R&D and quality assurance, impacting inventory and sales timelines.

These considerable switching costs effectively limit Mary Kay's flexibility in changing suppliers, which in turn bolsters the bargaining power of its existing suppliers. When it’s costly and time-consuming to switch, suppliers can often command better terms. This dynamic is further amplified by the long-term relationships Mary Kay has cultivated with many of its current supply partners, which often involve specialized knowledge or unique production capabilities that are difficult to replicate.

- High Reformulation Costs: Developing new product formulations due to a supplier change can cost hundreds of thousands of dollars, depending on the complexity and number of products affected.

- Regulatory Hurdles: Obtaining new regulatory approvals for reformulated products can take 6-12 months, causing significant delays in market availability.

- Production Line Adjustments: Modifying manufacturing lines and retraining staff for new ingredients or processes can add millions to operational expenses.

- Supplier Loyalty: Established relationships often mean suppliers have deep knowledge of Mary Kay’s specific needs, making it harder for new suppliers to match service levels and quality without extensive onboarding.

Supplier Concentration in Packaging

The concentration of suppliers in the packaging sector can significantly influence Mary Kay's operational costs and flexibility. While the company is committed to sustainability, sourcing specialized eco-friendly packaging materials, such as those with high post-consumer recycled content or designed for recyclability, might involve a limited number of manufacturers.

This limited supplier base can empower those few providers. If only a handful of companies possess the technology and capacity to produce these specific packaging solutions at the scale Mary Kay requires, they gain leverage. This leverage translates into potential price increases or less favorable terms for Mary Kay, as the company has fewer alternatives to turn to.

- Limited Supplier Pool: The market for advanced sustainable packaging materials is still developing, meaning fewer suppliers can meet stringent requirements.

- Increased Costs: Fewer suppliers can lead to higher prices for specialized packaging, impacting Mary Kay's cost of goods sold.

- Negotiation Power: Suppliers with unique capabilities in eco-friendly packaging can dictate terms, potentially limiting Mary Kay's negotiating power.

- Supply Chain Risk: Reliance on a small number of specialized suppliers increases the risk of disruptions if any of these suppliers face production issues.

Mary Kay's bargaining power with suppliers is constrained by the specialized nature of many cosmetic ingredients and packaging materials. This concentration means a few key suppliers can dictate terms, especially for unique or sustainably sourced components. For instance, the global specialty chemicals market, crucial for beauty ingredients, was valued at approximately $230 billion in 2023, with high-performance materials commanding premium prices.

The cost and complexity of switching suppliers, including reformulation, regulatory approvals, and production line adjustments, further solidify supplier leverage. These switching costs can run into hundreds of thousands of dollars for reformulation and require 6-12 months for new regulatory approvals, significantly limiting Mary Kay's flexibility.

The growing demand for eco-friendly packaging also concentrates power among a limited number of specialized manufacturers, potentially increasing costs and supply chain risks for Mary Kay.

| Factor | Impact on Mary Kay | Supplier Leverage |

| Specialized Ingredients | Reliance on unique or patented components | High |

| Switching Costs | High costs for reformulation, testing, and regulatory approval | High |

| Sustainable Packaging | Limited pool of eco-friendly material suppliers | Moderate to High |

| Supplier Concentration | Few providers for niche or high-demand materials | High |

What is included in the product

This analysis unpacks the competitive forces impacting Mary Kay, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the beauty industry.

Effortlessly identify and mitigate competitive threats by visualizing Porter's Five Forces, turning complex market dynamics into actionable insights.

Customers Bargaining Power

Mary Kay's extensive global reach, serving millions of customers through its independent beauty consultants, creates a diverse customer base. While individual customers may have limited direct bargaining power, their collective influence, amplified by social media and online feedback, can significantly impact brand perception and product demand. For instance, in 2024, social media sentiment analysis revealed that over 60% of beauty product purchasing decisions were influenced by online reviews and influencer recommendations, highlighting the latent power of this dispersed customer group.

Mary Kay's direct selling structure positions its Independent Beauty Consultants (IBCs) as its primary customers. These IBCs buy products at wholesale prices, intending to resell them to the ultimate consumers. This unique customer base possesses a degree of bargaining power, primarily through their choices regarding product selection and the intensity of their sales efforts.

The IBCs' ability to choose which products to order and how much effort to dedicate to selling gives them leverage. Mary Kay actively manages this dynamic by implementing various motivational strategies, including incentives, sales challenges, and a commission structure that can reach up to 50% of retail sales. These measures are crucial for maintaining IBC engagement and ensuring their continued participation.

The cosmetics and skincare market is incredibly crowded, with countless brands providing comparable items through a mix of retail stores, online platforms, and direct sales. This abundance of choices means customers can easily switch to a competitor if they're unhappy with Mary Kay's offerings, pricing, or the service they receive from their consultant.

Price Sensitivity of End Consumers

Consumers in the beauty sector, particularly those focused on skincare and cosmetics, exhibit varying degrees of price sensitivity. The increasing availability of effective, lower-cost alternatives, including many emerging 'clean' and 'natural' beauty brands, directly impacts purchasing decisions. For instance, by mid-2024, the global natural and organic personal care market was projected to reach over $25 billion, indicating a significant consumer shift towards more accessible options.

This heightened awareness of affordability, coupled with the DIY trend where consumers explore homemade beauty solutions, can exert considerable downward pressure on the prices of established brands like Mary Kay. While Mary Kay products are recognized for their quality, the competitive landscape necessitates a careful balance between perceived value and price point to maintain market share.

- Price Sensitivity: Consumers are increasingly comparing prices across a wide array of beauty products, from premium brands to budget-friendly alternatives.

- Competitive Landscape: The proliferation of affordable 'clean' and 'natural' beauty brands offers consumers viable, lower-priced options.

- DIY Trend: Homemade beauty remedies represent a cost-free alternative that can reduce demand for commercially produced goods.

- Market Pressure: These factors collectively empower customers, allowing them to negotiate better prices or switch to competitors, thereby influencing Mary Kay's pricing strategies.

Access to Information and Digital Engagement

Consumers today possess unprecedented access to information, significantly amplifying their bargaining power. Digital platforms and social media allow for easy comparison of product ingredients, effectiveness, and pricing across numerous brands. This transparency means customers can readily identify superior value or unmet needs, pushing companies to be more competitive.

The influence of AI is further tilting the scales. AI-driven personalization and virtual try-on technologies are not only enhancing consumer engagement but also raising expectations for customized products and experiences. For instance, by mid-2024, over 60% of consumers reported that personalized recommendations influenced their purchasing decisions, a trend that puts pressure on companies like Mary Kay to innovate their digital engagement and product development to meet these evolving demands.

- Informed Consumers: Digital access empowers customers to research ingredients, efficacy, and pricing, fostering price and feature sensitivity.

- AI-Driven Expectations: Personalization and virtual try-ons create higher demands for tailored products and immersive brand experiences.

- Competitive Pressure: Companies must adapt their digital strategies and product innovation to meet informed consumer expectations and maintain market share.

- Data-Backed Influence: By 2024, a significant majority of consumers indicated that personalized digital interactions directly impacted their buying choices, highlighting the growing power of informed digital engagement.

Mary Kay's customers, primarily its Independent Beauty Consultants (IBCs), possess bargaining power through product selection and sales effort intensity. The company counters this with incentives, aiming for high IBC engagement. The sheer volume of beauty brands available means customers can easily switch if dissatisfied, a common occurrence in a market where over 60% of beauty purchases in 2024 were influenced by online reviews, demonstrating significant customer sway.

| Customer Influence Factor | Description | Impact on Mary Kay |

|---|---|---|

| Price Sensitivity | Consumers compare prices across diverse brands, with the natural beauty market projected to exceed $25 billion by mid-2024. | Puts pressure on pricing strategies. |

| Information Access | Digital platforms allow easy comparison of ingredients, efficacy, and pricing. | Increases customer expectations for value and transparency. |

| AI-Driven Expectations | Personalization influences over 60% of consumer purchasing decisions as of mid-2024. | Requires continuous innovation in digital engagement and product development. |

Preview Before You Purchase

Mary Kay Porter's Five Forces Analysis

This preview showcases the complete Mary Kay Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape for Mary Kay. You are looking at the actual document, which delves into the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is exactly what you’ll be able to download after payment, providing you with actionable insights for strategic decision-making.

Rivalry Among Competitors

The beauty and direct selling sectors are intensely competitive, featuring a wide array of participants from global giants to niche independent brands. Mary Kay faces rivalry not only from direct selling peers such as Avon and Nu Skin but also from established retail and online beauty vendors.

In 2024, the global beauty market is projected to reach over $580 billion, highlighting the sheer scale and attractiveness of the industry, which naturally draws numerous competitors. This crowded landscape means Mary Kay must constantly innovate and differentiate its offerings to maintain market share.

Competitive rivalry in the beauty sector is intense, fueled by a relentless pursuit of product innovation and differentiation. Key trends shaping the landscape include the rise of 'cleanical' beauty, the integration of biotech ingredients, a strong emphasis on sustainable formulations, and the increasing demand for personalized solutions. For instance, in 2024, the global beauty and personal care market was valued at over $500 billion, highlighting the sheer scale of competition.

Mary Kay's ability to stay ahead hinges on its commitment to continuous product development and differentiation. Brands that consistently refresh their offerings, like Mary Kay’s TimeWise skincare line which has seen numerous reformulations over the years, are better positioned to capture evolving consumer preferences and maintain market share in this dynamic environment.

The beauty industry is a battlefield of intense marketing and rapid digital evolution. Companies are pouring resources into social selling and influencer collaborations to connect with today's consumers. In 2024, the global digital marketing spending is projected to reach over $600 billion, highlighting the critical importance of online engagement.

Mary Kay's strategic response includes its 'Phygital' campaign, blending physical and digital experiences, and equipping its Independent Beauty Consultants (IBCs) with advanced digital tools. This focus on a robust online presence and tailored marketing is essential for both attracting new customers and keeping existing ones engaged in this highly competitive landscape.

Brand Loyalty and Consultant Network

Mary Kay's direct selling model cultivates strong brand loyalty. This is primarily driven by its network of independent beauty consultants who foster personal connections with customers, often leading to repeat business and a sense of community. In 2024, the direct selling industry continued to show resilience, with global sales estimated to reach over $200 billion, demonstrating the enduring appeal of personalized service.

However, this model faces significant competitive pressure. The convenience and accessibility of online retail, coupled with evolving consumer preferences for instant gratification and digital engagement, present a considerable challenge. Many consumers now prefer the ease of browsing and purchasing products online, which can diminish the traditional advantages of in-person consultations. For instance, e-commerce sales in the beauty sector have seen consistent double-digit growth year-over-year.

- Brand Loyalty: Independent beauty consultants build personal relationships, fostering customer loyalty.

- Competitive Challenge: The convenience of online shopping and changing consumer habits threaten the direct selling model.

- Industry Context: Global direct selling sales are projected to exceed $200 billion in 2024.

- E-commerce Growth: Online beauty sales continue to experience robust double-digit annual growth.

Regulatory Scrutiny in Direct Selling

The direct selling sector, including companies like Mary Kay, is experiencing heightened regulatory attention. This focus spans areas such as product safety, accurate labeling, and responsible marketing claims. For instance, in 2024, several direct selling associations reported increased engagement with regulatory bodies concerning compliance standards.

This escalating scrutiny translates into added operational complexity and financial burdens for direct selling firms. They must meticulously ensure adherence to diverse regulations across the numerous international markets they serve, which can significantly influence their competitive strategies and cost structures.

- Increased Compliance Costs: Companies face higher expenses for legal counsel, product testing, and updating marketing materials to meet evolving regulatory demands.

- Market Access Challenges: Strict regulations in certain regions can create barriers to entry or require costly modifications to business models.

- Reputational Risk: Non-compliance can lead to significant fines and damage a company's brand image, impacting sales and distributor recruitment.

- Impact on Marketing: Restrictions on income claims and product efficacy statements necessitate careful crafting of marketing messages to avoid misleading distributors or consumers.

Competitive rivalry is fierce in the beauty sector, with Mary Kay facing numerous competitors from direct selling peers to major retail and online brands. The global beauty market's immense size, projected to exceed $580 billion in 2024, attracts a constant influx of new entrants and encourages aggressive strategies from existing players.

Innovation and differentiation are paramount, with trends like 'cleanical' beauty and personalization driving product development. Brands must adapt to the digital landscape, where social selling and influencer marketing are critical. In 2024, global digital marketing spend is expected to surpass $600 billion, underscoring the importance of online engagement for companies like Mary Kay.

Mary Kay's direct selling model fosters loyalty through personal consultant relationships, contributing to an estimated $200 billion global direct selling market in 2024. However, this model contends with the convenience of e-commerce, which is experiencing consistent double-digit growth in the beauty segment, posing a significant challenge.

| Competitor Type | Examples | Key Competitive Tactics |

|---|---|---|

| Direct Selling Peers | Avon, Nu Skin | Leveraging consultant networks, product sampling, community building |

| Traditional Retailers | Sephora, Ulta | In-store experience, brand partnerships, loyalty programs |

| Online Beauty Brands | Glossier, Fenty Beauty | Digital marketing, influencer collaborations, direct-to-consumer (DTC) models |

SSubstitutes Threaten

Consumers have a wide array of readily available substitutes for Mary Kay's offerings. Traditional retail channels, including drugstores and department stores, provide access to a vast selection of beauty brands across all price segments, making it simple for customers to switch.

The global cosmetics market, valued at over $380 billion in 2023, is increasingly influenced by the demand for value-driven products. This trend significantly amplifies the threat from more affordable alternatives available through these retail channels, potentially impacting Mary Kay's market share.

The proliferation of e-commerce and direct-to-consumer (D2C) online beauty brands presents a significant threat of substitution for traditional direct selling models like Mary Kay. These digital channels offer consumers unparalleled convenience and often more competitive pricing, allowing for easy comparison across numerous brands and product reviews. For instance, the global online beauty market was valued at approximately $232 billion in 2023 and is projected to grow substantially, indicating a strong consumer shift towards digital purchasing. This accessibility makes it simpler for customers to explore alternatives beyond the established direct selling network, directly impacting market share.

The rise of DIY and homemade beauty remedies poses a significant threat. Consumers are increasingly turning to natural, readily available ingredients, viewing these options as both healthier and more cost-effective than store-bought products. This trend directly challenges the market for manufactured cosmetics and skincare.

This DIY movement, fueled by online tutorials and a desire for natural ingredients, directly substitutes for many of Mary Kay's product lines. For instance, a 2023 survey indicated that over 40% of consumers in the beauty sector are actively exploring or using homemade skincare solutions, citing concerns about chemical ingredients and cost.

Holistic Wellness and Non-Cosmetic Alternatives

Consumers are increasingly turning to holistic wellness, which includes dietary supplements and advanced skincare, as alternatives to traditional cosmetics. This trend means that products focusing on internal health for external appearance can substitute for Mary Kay's core offerings.

The global wellness market is booming, with projections indicating significant growth. For instance, the dietary supplements market alone was valued at over $170 billion in 2023 and is expected to continue its upward trajectory, demonstrating a substantial pool of consumer spending that could be diverted from beauty products.

- Holistic Health Focus Consumers are prioritizing internal well-being for external beauty.

- Market Growth The wellness sector, including supplements, is experiencing substantial expansion.

- Substitution Potential These non-cosmetic solutions can replace demand for traditional makeup and skincare.

Specialized Treatments and Professional Services

For specific beauty needs, consumers might turn to professional services like dermatological treatments or salon procedures instead of at-home products. This is especially common for concerns like aging or skin imperfections where professional results are desired.

The global medical aesthetics market, a key area for these substitutes, was valued at approximately USD 15.9 billion in 2023 and is projected to grow significantly. Procedures such as Botox, fillers, and laser treatments offer alternatives to topical anti-aging creams and serums.

- Professional Aesthetic Treatments: Services like microdermabrasion, chemical peels, and laser resurfacing offer more intensive skin correction than at-home exfoliants.

- Dermatological Procedures: Medical interventions for acne, hyperpigmentation, or wrinkles provide results often unattainable with over-the-counter products.

- Specialized Salon Services: Advanced facials and treatments performed by estheticians can address specific skin concerns with potent ingredients and professional techniques.

- Consumer Preference for Efficacy: A growing segment of consumers prioritizes proven, clinical results, making these professional services a strong substitute for traditional cosmetic purchases.

The threat of substitutes for Mary Kay is substantial, driven by diverse consumer choices and evolving market trends. Traditional retail, online platforms, DIY solutions, holistic wellness, and professional services all present viable alternatives that can divert consumer spending and preference away from Mary Kay's direct selling model.

The accessibility of products through drugstores and department stores, coupled with the convenience and competitive pricing offered by e-commerce, significantly broadens consumer options. Furthermore, the growing interest in natural, homemade remedies and the booming wellness sector, which includes supplements for internal health impacting external appearance, directly challenge the demand for conventional beauty products.

Professional aesthetic treatments, such as dermatological procedures and salon services, offer potent solutions for specific skin concerns, providing a high-efficacy alternative to at-home cosmetic applications. This multifaceted competitive landscape underscores the importance for Mary Kay to continuously innovate and adapt to meet changing consumer needs and preferences.

| Substitute Category | Key Characteristics | Market Size/Growth (Approx. 2023/2024) | Impact on Mary Kay |

|---|---|---|---|

| Traditional Retail | Wide brand selection, accessible price points | Global Cosmetics Market: ~$380 billion | High accessibility, easy brand switching |

| E-commerce/DTC Brands | Convenience, competitive pricing, reviews | Global Online Beauty Market: ~$232 billion | Disrupts direct selling, price sensitivity |

| DIY/Homemade Beauty | Natural ingredients, cost-effectiveness | Growing consumer adoption (40%+ exploring) | Challenges manufactured product demand |

| Holistic Wellness | Internal health for external appearance | Dietary Supplements Market: ~$170 billion | Diverts spending from beauty to health |

| Professional Aesthetic Services | High efficacy, clinical results | Medical Aesthetics Market: ~$15.9 billion | Offers advanced solutions for specific needs |

Entrants Threaten

While building a massive beauty empire demands substantial funding, the direct selling and online beauty landscape significantly lowers the entry bar for emerging, smaller brands. This model allows new players to tap into social media and e-commerce, reaching customers without the hefty costs associated with traditional brick-and-mortar retail.

The beauty industry is experiencing a significant influx of niche and independent brands. These agile players often focus on specific consumer desires, like clean ingredients, eco-conscious packaging, or tailored product lines. This trend allows them to quickly build a following and capture market share in specialized segments, directly challenging established players.

New entrants can leverage digital and social selling platforms to gain traction, often bypassing the significant infrastructure costs of traditional direct selling models. These new players can utilize influencer marketing and social media campaigns, which frequently have lower overheads compared to established companies with extensive consultant networks. For instance, in 2023, the global influencer marketing industry was valued at approximately $21.1 billion, demonstrating the significant reach and cost-effectiveness of these channels for emerging brands.

Platforms like TikTok allow for rapid brand awareness and direct sales, enabling new entrants to quickly build a customer base without the need for large, upfront investments in traditional advertising or physical retail spaces. This digital-first approach can significantly lower the barrier to entry, allowing agile competitors to challenge established players by reaching consumers directly and efficiently.

Focus on Transparency and 'Clean' Formulations

The growing consumer desire for ingredient transparency and 'clean' formulations presents a significant avenue for new entrants. These newcomers can establish a competitive edge by making transparency and ethical sourcing foundational to their brand identity from the outset.

Brands that champion bio-based or lab-grown ingredients are particularly well-positioned to attract environmentally conscious consumers. For instance, the global market for clean beauty products was valued at approximately $13.2 billion in 2022 and is projected to grow significantly, indicating a strong consumer preference.

- Ingredient Transparency: Consumers increasingly scrutinize product labels, demanding clear information about what goes into their cosmetics.

- 'Clean' Formulations: This trend favors products free from parabens, sulfates, phthalates, and synthetic fragrances, appealing to health-aware buyers.

- Sustainable Sourcing: New entrants can leverage ethically sourced or innovative ingredients, like those derived from algae or fermentation processes, to stand out.

- Market Growth: The clean beauty sector's expansion suggests a substantial and growing customer base eager for products aligning with these values.

Challenges in Building a Direct Selling Network

While the beauty industry may seem accessible, building a direct selling network comparable to Mary Kay's presents substantial hurdles for new entrants. It requires significant, sustained investment in recruiting, comprehensive training, and attractive incentive structures to cultivate a dedicated sales force.

New multi-level marketing (MLM) ventures must overcome the steep challenge of attracting and retaining a critical mass of independent consultants. This is crucial for achieving the widespread market penetration and brand loyalty that established players like Mary Kay have cultivated over decades.

For example, in 2023, the direct selling industry in the United States generated approximately $39.8 billion in retail sales, according to the Direct Selling Association. This figure highlights the scale of the market but also the significant network size and sales volume required to compete effectively.

- High Initial Investment: New entrants need substantial capital for consultant recruitment, training programs, and marketing initiatives.

- Brand Loyalty and Trust: Overcoming established brand recognition and building trust with potential consultants and customers takes years.

- Consultant Retention: The MLM model relies on active, motivated consultants; retaining them requires continuous engagement and competitive rewards.

- Regulatory Scrutiny: The direct selling industry faces ongoing regulatory oversight, adding complexity and compliance costs for new companies.

The threat of new entrants in the beauty industry, particularly within the direct selling model, is a complex interplay of accessibility and significant barriers. While digital platforms have lowered the initial hurdle for brand creation and customer reach, replicating the established network and brand loyalty of companies like Mary Kay demands substantial, ongoing investment and strategic effort.

New companies can leverage social media and influencer marketing, which saw the global influencer marketing industry valued at approximately $21.1 billion in 2023, to gain initial traction. This digital-first approach allows for more agile market entry compared to traditional retail. However, building a robust direct selling force, crucial for widespread penetration, requires significant capital for recruitment, training, and incentives, as evidenced by the $39.8 billion in U.S. retail sales generated by the direct selling industry in 2023.

| Factor | Impact on New Entrants | Example/Data Point |

|---|---|---|

| Digital Reach | Lowered initial marketing costs and direct customer access. | Global influencer marketing industry valued at $21.1 billion in 2023. |

| Network Building | High investment required for consultant recruitment and retention. | U.S. direct selling industry generated $39.8 billion in retail sales in 2023. |

| Brand Loyalty | Challenging to overcome established trust and recognition. | Decades of brand building by established players. |

| Ingredient Trends | Opportunity for differentiation through transparency and 'clean' formulations. | Clean beauty market valued at $13.2 billion in 2022, with strong growth projections. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Mary Kay leverages data from industry-specific market research reports, competitor financial statements, and consumer trend surveys to provide a comprehensive view of the beauty industry's competitive landscape.