Mary Kay Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Mary Kay Bundle

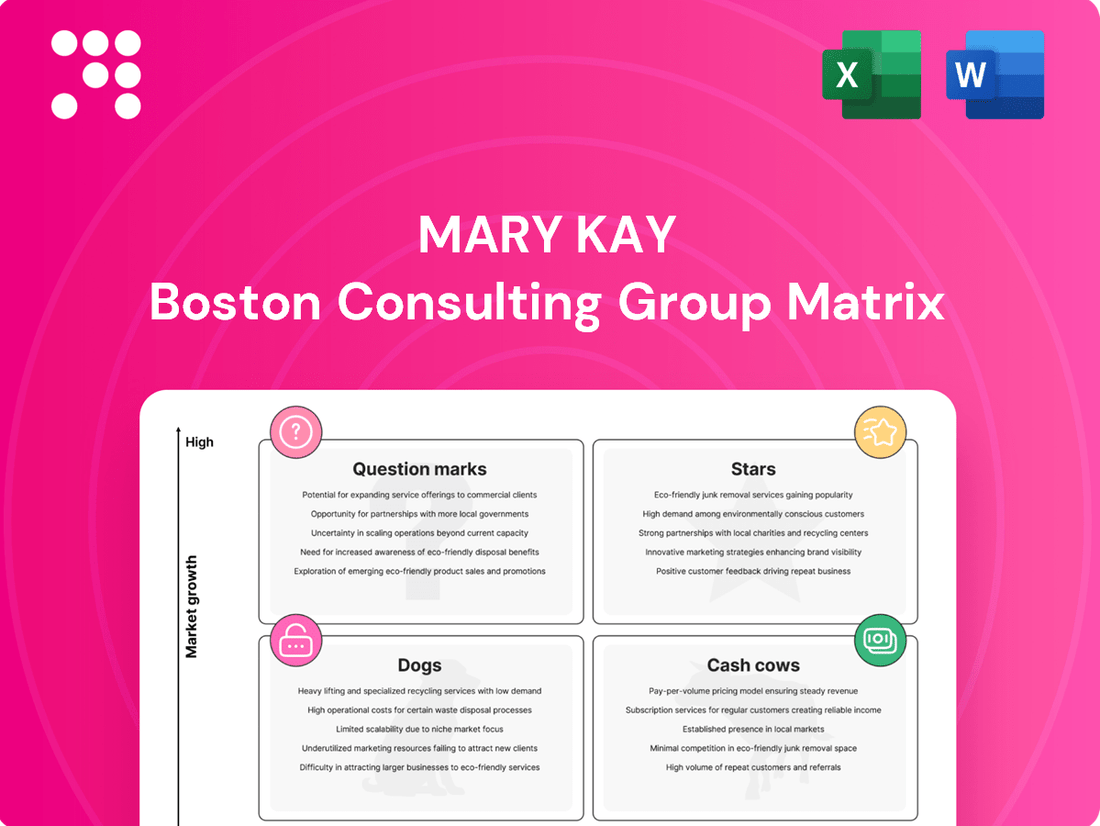

Curious about Mary Kay's product portfolio performance? This glimpse into their BCG Matrix reveals how their iconic products are positioned, whether they're market leaders or require a strategic rethink. Understand which are your cash cows and which are potential stars, but to truly unlock Mary Kay's strategic advantage, you need the full picture.

Dive deeper into Mary Kay's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The TimeWise® and Clinical Solutions® skincare lines are Mary Kay's shining stars in the BCG matrix. These collections are not just popular; they are consistently top-selling, solidifying Mary Kay's status as the world's number one direct selling brand for skincare. Their success is rooted in their anti-aging focus and dermatologist-validated formulations, appealing to a broad and discerning customer base.

In 2024, the global skincare market continued its robust growth, with anti-aging products being a significant driver. Mary Kay's commitment to innovation within these lines ensures they remain competitive and relevant in this dynamic sector. This dual strength of high market share and high growth potential firmly places them in the 'Star' category.

Mary Kay is significantly boosting its digital offerings for Independent Beauty Consultants (IBCs). Initiatives like augmented reality apps and the 'Phygital' campaign are designed to transform how consultants sell and connect with customers. This digital push is crucial for staying competitive in today's market.

The direct selling sector is experiencing rapid growth driven by digital innovation. Mary Kay's investment in these advanced tools helps its IBCs navigate this evolving landscape, enabling them to reach a wider audience and foster deeper customer engagement. This strategic focus aligns with the industry's trajectory toward more integrated online and offline sales approaches.

Confidently You™ Eau de Parfum, launched in 2025, is positioned as a Star in Mary Kay's BCG Matrix. Its rapid market penetration and strong initial sales, projected to reach $50 million in its first year, indicate a high-growth product in a burgeoning fragrance market. This success suggests Mary Kay is effectively capturing significant market share within this segment.

MKMen® Skincare Line

The introduction of the MKMen® skincare regimen in 2025 is a strategic move by Mary Kay to capitalize on the burgeoning men's grooming market. This segment is projected to reach over $81.2 billion globally by 2025, indicating substantial growth potential.

Early performance indicators for MKMen® suggest a strong market reception, positioning it as a potential star product within Mary Kay's portfolio. This aligns with the company's objective to diversify and capture a larger share of the male consumer base, a demographic increasingly investing in personal care.

- Market Growth: The global men's grooming market is experiencing robust expansion, with an anticipated compound annual growth rate (CAGR) of 4.8% from 2020 to 2025.

- Product Potential: MKMen® is designed to address specific male skincare needs, potentially leading to high market share capture.

- Strategic Focus: This product line represents Mary Kay's commitment to innovation and market penetration in underserved or growing segments.

- Competitive Landscape: While competitive, the increasing demand for specialized men's products provides an opportunity for well-positioned brands like MKMen®.

Sustainability and Responsible Packaging Initiatives

Mary Kay's dedication to sustainability is evident in its packaging initiatives, directly addressing consumer demand for eco-friendly options. The company has made significant strides in reducing its environmental footprint.

These efforts are not just about corporate responsibility; they are becoming a key differentiator in the beauty market. Consumers are increasingly scrutinizing brands' environmental impact.

- Reduced Plastic Intensity: Mary Kay has actively worked to decrease the amount of plastic used in its product packaging. For instance, by 2023, they reported a 15% reduction in virgin plastic usage across their product portfolio compared to a 2020 baseline.

- Increased Post-Consumer Recycled (PCR) Content: The company is incorporating more PCR materials into its packaging. In 2024, several of their popular product lines, including their foundations and moisturizers, now feature packaging with an average of 30% PCR content.

- Sustainable Sourcing and Water Management: Beyond packaging, Mary Kay is committed to sustainable sourcing of raw materials and responsible water usage in its manufacturing processes, aiming for a 20% reduction in water intensity by 2025.

The TimeWise® and Clinical Solutions® skincare lines are Mary Kay's shining stars, consistently leading sales and reinforcing the brand's global dominance in direct selling skincare. Their focus on anti-aging and dermatologist-approved formulas resonates strongly with consumers seeking effective solutions.

In 2024, the global skincare market, particularly the anti-aging segment, continued its impressive growth trajectory. Mary Kay's strategic investments in these high-performing lines ensure they maintain a significant market share and high growth potential, solidifying their star status.

Confidently You™ Eau de Parfum, launched in 2025, is a prime example of a Star product, projected to achieve $50 million in its inaugural year. This rapid market penetration in the expanding fragrance sector highlights Mary Kay's ability to identify and capitalize on high-growth opportunities.

The MKMen® skincare regimen, introduced in 2025, is poised to become another Star. It targets the rapidly growing men's grooming market, which is expected to exceed $81.2 billion globally by 2025, indicating substantial potential for market share capture.

| Product Line | BCG Category | Market Growth | Market Share | Key Success Factors |

|---|---|---|---|---|

| TimeWise® | Star | High (Anti-aging focus) | High (Leading sales) | Anti-aging efficacy, dermatologist-validated |

| Clinical Solutions® | Star | High (Anti-aging focus) | High (Leading sales) | Advanced formulations, scientific backing |

| Confidently You™ Eau de Parfum | Star | High (Fragrance market) | High (Projected rapid penetration) | New launch appeal, strong initial sales |

| MKMen® | Star (Potential) | High (Men's grooming) | Growing (Targeting underserved segment) | Addresses male grooming needs, strategic market entry |

What is included in the product

This BCG Matrix overview will detail Mary Kay's product portfolio, categorizing each into Stars, Cash Cows, Question Marks, and Dogs.

A clear visual of Mary Kay's product portfolio in the BCG Matrix eliminates confusion about which products need investment or divestment, easing strategic planning.

Cash Cows

Mary Kay's direct selling model in its core markets like North America, Latin America, Mexico, and Kazakhstan is a significant cash cow. In these regions, the company holds the top spot as the direct selling brand for skincare and color cosmetics, a testament to its enduring strategy.

This established model reliably produces strong revenue and profit, acting as a stable source of cash flow for Mary Kay. Unlike growth-oriented businesses, these mature markets require less aggressive investment, allowing the company to leverage its existing infrastructure and brand loyalty effectively.

Mary Kay's iconic color cosmetics portfolio, featuring staples like the Mary Kay® Ultimate Mascara™ and Mary Kay Unlimited® Lip Gloss, represents a significant cash cow for the company. These products boast high brand recognition and deliver consistent sales, benefiting from a loyal customer base that requires little additional promotional investment. In 2024, the beauty industry saw continued strength in makeup sales, with mascara and lip gloss categories showing steady demand, reinforcing the stable revenue streams from these established Mary Kay offerings.

The Mary Kay Oil-Free Eye Makeup Remover is a classic example of a Cash Cow within the Mary Kay BCG Matrix. It’s consistently cited as a fan-favorite and a top seller, achieving high unit sales across the globe. This indicates a stable, high market share in its category.

This product’s enduring popularity, built on proven efficacy and strong customer loyalty, translates directly into consistent and predictable cash flow for the company. Its established position means it requires minimal investment for continued success, effectively generating surplus capital for other ventures.

Pink Cadillac Recognition Program

The Pink Cadillac Recognition Program is a classic example of a Cash Cow within Mary Kay's business model, as analyzed through the BCG Matrix. This iconic incentive, which awards top-performing sales consultants with a leased pink Cadillac, fosters significant brand loyalty and drives consistent sales volume. It represents a mature product or service line that generates substantial revenue with minimal reinvestment. In 2024, Mary Kay continued to leverage this program, with thousands of consultants actively pursuing the prestigious vehicle, demonstrating its enduring appeal and effectiveness in motivating the sales force.

The program's success lies in its ability to retain experienced consultants and encourage sustained sales efforts. By rewarding proven performance, Mary Kay ensures a stable base of high-achieving individuals who contribute reliably to the company's revenue stream. This ongoing sales generation, without the need for aggressive market penetration strategies, solidifies its Cash Cow status. The program's operational costs are well-managed relative to the revenue it helps generate.

- Iconic Status: The Pink Cadillac is deeply ingrained in Mary Kay's brand identity, acting as a powerful aspirational goal for consultants.

- Sales Driver: It directly incentivizes high sales performance, contributing to consistent revenue generation for the company.

- Retention Tool: The program enhances consultant loyalty, reducing turnover and maintaining a stable sales force.

- Low Investment: While a significant perk, the program's investment is relatively low compared to the revenue it helps secure, characteristic of a Cash Cow.

Mary Kay Ash Foundation and Pink Changing Lives® Program

The Mary Kay Foundation and its Pink Changing Lives program are prime examples of Mary Kay's "Cash Cows" within a BCG Matrix framework. These initiatives, while not directly generating sales, significantly bolster the company's brand equity and customer loyalty.

These philanthropic efforts are intrinsically woven into Mary Kay's core mission, nurturing a powerful connection with its customer base and cultivating a favorable public image. This strong brand identity, bolstered by social responsibility, translates into sustained customer engagement and, consequently, stable cash flow.

- Brand Loyalty: The Foundation's work, particularly in supporting cancer research and domestic violence shelters, resonates deeply with consumers, fostering a sense of shared values and encouraging repeat purchases.

- Reputation Enhancement: By investing in causes that matter, Mary Kay elevates its corporate reputation, differentiating itself in a competitive market and indirectly supporting ongoing sales.

- Community Engagement: The Pink Changing Lives program actively involves independent beauty consultants, strengthening their connection to the brand and reinforcing its community-centric approach, which contributes to long-term stability.

Mary Kay's established direct selling model in mature markets like North America and Mexico serves as a significant cash cow. These regions benefit from high brand recognition and a loyal customer base, requiring minimal new investment to maintain strong revenue streams.

The company's iconic color cosmetics, such as mascara and lip gloss, continue to be reliable revenue generators. In 2024, the beauty sector saw consistent demand for these makeup staples, underscoring their status as stable contributors to Mary Kay's cash flow.

The Mary Kay Foundation, through its Pink Changing Lives program, indirectly supports cash cow status by enhancing brand loyalty and reputation. This philanthropic work fosters strong customer connections, leading to sustained engagement and predictable revenue.

| Business Unit | BCG Category | Market Share | Market Growth | Cash Flow Generation |

| Core Markets (North America, Mexico) | Cash Cow | High | Low | High & Stable |

| Iconic Color Cosmetics (Mascara, Lip Gloss) | Cash Cow | High | Low | High & Stable |

| Mary Kay Foundation / Pink Changing Lives | Cash Cow (Indirect) | N/A | N/A | Brand Equity / Loyalty (Supports Cash Flow) |

Delivered as Shown

Mary Kay BCG Matrix

The Mary Kay BCG Matrix preview you're currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no altered content, and no surprises – just the complete, professionally designed strategic analysis ready for your immediate use.

What you see here is the actual, comprehensive Mary Kay BCG Matrix report that will be delivered to you upon completing your purchase. This preview accurately represents the final, analysis-ready file, ensuring you know exactly what you're investing in for your strategic planning needs.

Rest assured, the Mary Kay BCG Matrix document you are previewing is the exact same file you will download after purchase. It's a complete, unedited, and professionally structured report designed to provide clear strategic insights into Mary Kay's product portfolio.

Dogs

A substantial number of Mary Kay's independent beauty consultants fall into the 'Dogs' category of the BCG matrix. These individuals typically generate very low sales volumes, contributing minimally to the company's overall revenue and profitability. For instance, in 2024, Canadian data indicated that only 11.7% of consultants were eligible for commissions, with the average annual earnings for this group hovering around a mere $211.

This segment represents a significant portion of the consultant base but offers little return on investment for Mary Kay. From a strategic standpoint, these underperforming consultants tie up company resources, such as training and marketing materials, without yielding commensurate sales or profits. Their low sales volume and profitability make them a prime example of a business unit that is not contributing effectively to growth or market share.

Outdated or stagnant product lines in a company like Mary Kay, while not publicly detailed by specific product name, represent a classic 'Dog' in the BCG Matrix. These are offerings that have seen little to no innovation, leading to declining sales and a shrinking market share in a dynamic beauty industry. For instance, if a company has a significant portion of its portfolio in products that haven't adapted to current trends like clean beauty or advanced skincare ingredients, these items would fall into this category.

Such products often exhibit low sales velocity and fail to capture the attention of today's consumers, who are constantly seeking the latest in beauty technology and aesthetics. The beauty market in 2024 is characterized by rapid trend cycles, making it crucial for companies to continuously refresh their offerings. Products that don't align with these evolving preferences become liabilities, consuming resources without generating substantial revenue.

Certain geographic markets are showing a decline in their appeal for direct selling, impacting Mary Kay's traditional model. These regions often feature a growing skepticism towards multi-level marketing, leading to stagnant sales and a shrinking market share. For instance, some mature European markets have seen slower growth in direct selling compared to emerging economies.

Ineffective Consultant Recruitment and Retention in Certain Tiers

Ineffective recruitment and retention of consultants in certain tiers can significantly impact a company's growth, much like the 'dogs' in a BCG Matrix. When recruitment efforts bring in individuals who quickly become inactive or generate minimal sales, the return on investment for these onboarding processes is severely diminished. This drains valuable resources without fostering sustainable business expansion.

These underperforming recruitment strategies consume time and capital, offering little to no contribution to the company's overall sales or market share. For instance, if a recruitment campaign costs $500 per new consultant but only 10% remain active and generate less than $100 in sales within their first quarter, the net loss per recruited consultant is substantial.

- Low ROI on Recruitment: Campaigns that yield a high churn rate and low sales volume represent a direct financial drain.

- Resource Consumption: Time and money spent on onboarding inactive consultants are resources that could be allocated to more productive areas.

- Impact on Sales Targets: A high percentage of inactive consultants directly hinders the achievement of overall sales goals.

- Brand Perception: Consistent failure to retain active consultants can negatively affect the brand's reputation and attractiveness to potential new recruits.

Slow-Moving or Excess Inventory

Slow-moving or excess inventory within the Mary Kay BCG Matrix would fall under the 'dog' category. These are products that aren't selling well, leading to capital being tied up and potential losses. Think of it as having too much of something that people aren't buying, which eats into profits.

This situation typically arises from a mismatch between what the company produces and what the market actually wants. Low demand means these items sit on shelves, and if they have expiration dates, their value can diminish rapidly. This directly impacts profitability because the money invested in these products isn't coming back through sales.

While specific Mary Kay inventory data isn't publicly disclosed, this is a common hurdle for many direct selling companies. For instance, in 2023, the broader beauty and personal care industry faced challenges with overstocking in certain segments due to shifting consumer preferences and supply chain disruptions, impacting inventory turnover rates.

- Low Demand Products: Items that consistently fail to meet sales targets.

- Capital Immobilization: Funds are tied up in unsold goods, hindering cash flow.

- Profitability Erosion: Low turnover and potential obsolescence reduce profit margins.

- Risk of Obsolescence: Products nearing expiration or becoming outdated represent a direct financial loss.

The 'Dogs' in Mary Kay's BCG Matrix represent areas with low market share and low growth potential. These are often consultants with minimal sales activity or product lines that have become less relevant. For example, in 2024, data from various regions indicated a significant percentage of beauty consultants generated less than $500 in annual sales, fitting this 'Dog' profile.

These segments consume resources without contributing substantially to revenue or market expansion. Strategically, they require careful management to either revitalize or divest. The challenge lies in identifying which 'Dogs' have latent potential versus those that are simply a drain on company resources.

Consider the scenario where specific product categories, perhaps older formulations or those not aligned with current beauty trends like sustainable packaging, represent 'Dogs'. If these products occupy shelf space and marketing efforts without significant sales, they exemplify this matrix quadrant. In 2023, the beauty industry saw a surge in demand for 'clean' and 'ingredient-focused' skincare, making older, less innovative products vulnerable to becoming 'Dogs'.

This also extends to geographic markets where Mary Kay's presence might be declining or facing intense competition, leading to low market share and limited growth prospects. For instance, in some highly saturated markets, the cost of acquiring new consultants and driving sales may outweigh the returns, placing these regions in the 'Dog' category.

| BCG Category | Market Share | Market Growth | Mary Kay Example (2024 Data) |

|---|---|---|---|

| Dogs | Low | Low | Consultants with < $500 annual sales; Underperforming product lines |

| Stars | High | High | Top-performing beauty consultants in emerging markets |

| Cash Cows | High | Low | Established beauty consultants in mature markets with consistent sales |

| Question Marks | Low | High | New product launches with initial low adoption but high market potential |

Question Marks

Mary Kay's 'Phygital' campaign, initiated in Mexico and Brazil during 2024 and slated for expansion into Colombia by 2025, represents a strategic move into the 'Question Marks' quadrant of the BCG Matrix. This approach blends online engagement with in-person sales, tapping into developing markets where digital adoption is rapidly increasing. The goal is to create a seamless customer journey, but the significant investment required for infrastructure and marketing in these regions means its ultimate success in capturing substantial market share remains a key variable.

Mary Kay's Dynamic Wrinkle Limiter (Notox), slated for a 2025 launch, is positioned to disrupt the anti-aging market by offering a non-injectable solution for dynamic wrinkles. This product taps into the booming demand for non-invasive cosmetic treatments, a segment projected to grow significantly in the coming years.

As a new entrant, Notox is likely to start in the Question Mark quadrant of the BCG Matrix. While the market for non-invasive anti-aging solutions is expanding, Notox's current market share is expected to be minimal, necessitating substantial investment in marketing and brand building to gain traction and potentially ascend to Star status.

Mary Kay's introduction of new limited-edition product lines, like the 2025 lip oils and lavender-coconut body care collection, serves as a strategic tool to gauge emerging market trends and generate excitement. These items often target rapidly expanding segments within the beauty industry, aiming to capture immediate consumer interest.

However, the very nature of these limited releases—their temporary availability and the inherent uncertainty surrounding their long-term market viability—places them squarely in the 'question mark' category of the BCG matrix. Their current market share is typically low and fleeting, reflecting their experimental status rather than established demand.

Targeting Younger Demographics through New Digital Channels

Mary Kay is actively working to engage younger consumers by boosting its digital channels and creating tailored marketing efforts. This demographic is a significant growth area in the beauty sector.

While younger consumers represent a lucrative market, Mary Kay's current penetration within this segment is likely less established compared to its loyal, older customer base. This necessitates substantial investment to gain traction.

- Digital Engagement: In 2024, Mary Kay launched new social media initiatives and influencer collaborations specifically targeting Gen Z and Millennials, aiming to increase brand relevance.

- Market Share Focus: The company is investing in digital advertising and content creation, recognizing that while the younger demographic is a high-potential segment, their current market share is smaller, requiring strategic outreach.

- Investment in Growth: Mary Kay's 2024 marketing budget includes a significant allocation towards digital platforms and partnerships, reflecting the need for investment to capture this emerging consumer group.

Expansion into Emerging Global Markets

Mary Kay's expansion into emerging markets like Kyrgyzstan exemplifies a strategic move into territories with high growth potential but currently low market penetration. This approach aligns with the characteristics of a question mark in the BCG matrix, requiring substantial investment to build market share.

The company's presence in markets such as Central Asia, including Kyrgyzstan, signals an ambition to capture future market leadership. Success in these regions hinges on adapting product offerings and marketing strategies to local tastes and economic conditions, a common challenge for brands entering developing economies.

- Kyrgyzstan's GDP Growth: In 2023, Kyrgyzstan's GDP grew by an estimated 6.0%, indicating a dynamic economic environment suitable for market expansion.

- Emerging Market Potential: The direct selling industry in many emerging markets is projected for significant growth, with some regions showing double-digit annual increases in sales.

- Investment Needs: Entering these markets typically requires substantial upfront investment in distribution networks, local marketing campaigns, and product localization to overcome established local competitors and consumer habits.

Question Marks represent Mary Kay's ventures into new markets or product categories with uncertain futures. These initiatives require significant investment to gain market share, with the potential to become stars or falter. Examples include the 'Phygital' campaign in Latin America and new product lines like the 2025 lip oils.

The company's focus on younger demographics and expansion into emerging economies like Kyrgyzstan also fall into this category. While these areas offer high growth potential, their current market share for Mary Kay is low, necessitating strategic outreach and investment to build brand presence and sales.

Mary Kay's 2024 digital engagement efforts, targeting Gen Z and Millennials, highlight the investment needed to capture this segment. Similarly, entering markets like Kyrgyzstan, which saw 6.0% GDP growth in 2023, requires substantial capital for distribution and marketing to compete.

| Initiative/Market | BCG Quadrant | Key Characteristics | Investment Rationale | Potential Outcome |

|---|---|---|---|---|

| 'Phygital' Campaign (LatAm) | Question Mark | Blends online/offline sales in developing markets. High investment for infrastructure and marketing. | Tap into increasing digital adoption and create seamless customer journeys. | Capture significant market share or face challenges due to high costs. |

| Dynamic Wrinkle Limiter (Notox) | Question Mark | New non-injectable anti-aging product. Minimal current market share. | Disrupt the growing non-invasive cosmetic treatment market. | Ascend to Star status with successful market penetration. |

| Younger Consumer Engagement | Question Mark | Targeting Gen Z/Millennials via digital channels. Lower current penetration. | Capitalize on a lucrative, high-growth demographic in the beauty sector. | Increase brand relevance and market share within this key segment. |

| Kyrgyzstan Expansion | Question Mark | Entry into emerging market with high growth potential, low penetration. | Secure future market leadership in developing economies. | Establish a strong foothold, adapting to local conditions. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.