Latam Airlines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Latam Airlines Bundle

Latam Airlines operates within a dynamic environment shaped by political stability, economic fluctuations, and evolving social attitudes towards travel. Understanding these external forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis dives deep into these factors, offering actionable insights.

Gain a competitive edge by leveraging our expertly crafted PESTLE Analysis for Latam Airlines. Discover how political shifts, economic downturns, technological advancements, and environmental concerns are impacting its operations and future growth. Download the full report now to unlock critical intelligence for your strategic decisions.

Political factors

Government policies significantly shape LATAM Airlines' operations. For instance, in 2024, several Latin American countries are reviewing or implementing new bilateral air service agreements, which directly affect route approvals and capacity. These policy shifts, such as potential changes in foreign ownership rules in some markets, could influence LATAM's strategic partnerships and investment plans.

Regulatory stability is crucial for LATAM's long-term planning. In 2024, the airline is navigating evolving environmental regulations across its key operating regions, impacting fleet modernization and fuel efficiency strategies. Uncertainty in areas like carbon emissions reporting or sustainable aviation fuel mandates can lead to increased operational costs and necessitate adjustments to capital expenditure.

Political stability and geopolitical dynamics across the Latin American countries where LATAM operates are paramount. Unrest, shifts in government leadership, or even regional conflicts can significantly impact travel demand, compromise operational safety, and introduce abrupt policy changes that directly affect the airline sector.

As the largest airline group in Latin America, LATAM's extensive network makes it especially vulnerable to these geopolitical fluctuations. For instance, in 2024, several Latin American nations experienced significant political transitions, such as presidential elections in Argentina and Uruguay, which can lead to policy uncertainty for businesses like LATAM.

International trade agreements significantly influence LATAM Airlines' operational landscape. For instance, the renegotiation of air service agreements between countries can alter traffic rights, impacting routes and frequencies. The stability of alliances, such as LATAM's past joint ventures with airlines like Delta and American Airlines, is crucial for market access and competitive positioning, affecting everything from codesharing to fare structures.

Government Support and Subsidies

Government support, such as subsidies and tax incentives, plays a crucial role in shaping the aviation industry's landscape. For LATAM Airlines, understanding the extent of such support provided to its competitors is vital for maintaining a competitive edge. For instance, during 2023, various Latin American governments continued to offer varying levels of support to their national carriers, impacting operational costs and market access.

The impact of government intervention can create an uneven playing field, influencing pricing strategies and route development. While LATAM Airlines successfully navigated its restructuring, emerging with a more efficient cost base, the presence of government-backed subsidies for other airlines can alter market dynamics. Staying informed about these policy shifts is a continuous necessity for strategic planning.

- Government Support: Varying levels of state aid and incentives are provided to national airlines across Latin America, influencing competitive positioning.

- Tax Incentives: Favorable tax regimes in certain countries can reduce operating expenses for airlines, creating cost advantages.

- Financial Aid: Direct financial assistance or loan guarantees from governments can bolster the financial health of carriers, impacting their ability to invest and expand.

- Uneven Playing Field: Subsidized competitors may offer lower fares or invest more aggressively in fleet modernization, posing a challenge to unsubsidized airlines like LATAM.

Bilateral Air Service Agreements

Bilateral Air Service Agreements (BASAs) are foundational to LATAM Airlines' international operations, dictating where and how often it can fly. Renegotiations or new agreements can significantly alter market access, impacting LATAM's strategic planning and financial performance.

For instance, a favorable BASA could unlock lucrative routes, while a restrictive one might limit expansion. LATAM's ability to secure and leverage these agreements is crucial for optimizing its extensive network, which spans multiple continents.

- Route Expansion: Favorable BASAs allow LATAM to add new international destinations, increasing revenue potential.

- Frequency Adjustments: Agreements determine the number of flights an airline can operate on a given route, affecting capacity and pricing.

- Market Access: BASAs are key to LATAM's strategy for penetrating and growing its presence in markets across North America, Europe, and Oceania.

Political stability remains a critical factor for LATAM Airlines, influencing operational continuity and investor confidence across its key South American markets. In 2024, several countries within its operational sphere are undergoing significant political transitions, including presidential elections and potential shifts in regulatory frameworks, which could impact aviation policies and foreign investment rules.

Government policies directly shape LATAM's route network and operational costs, with ongoing reviews of bilateral air service agreements in 2024 potentially altering traffic rights and market access. Furthermore, evolving environmental regulations, such as those concerning sustainable aviation fuels, require strategic adaptation and can influence fleet modernization investments.

Geopolitical tensions and regional stability are paramount, as demonstrated by past disruptions affecting travel demand and operational safety. For instance, political developments in 2024 across nations like Brazil and Chile, key hubs for LATAM, necessitate continuous monitoring for any impact on air travel and business operations.

What is included in the product

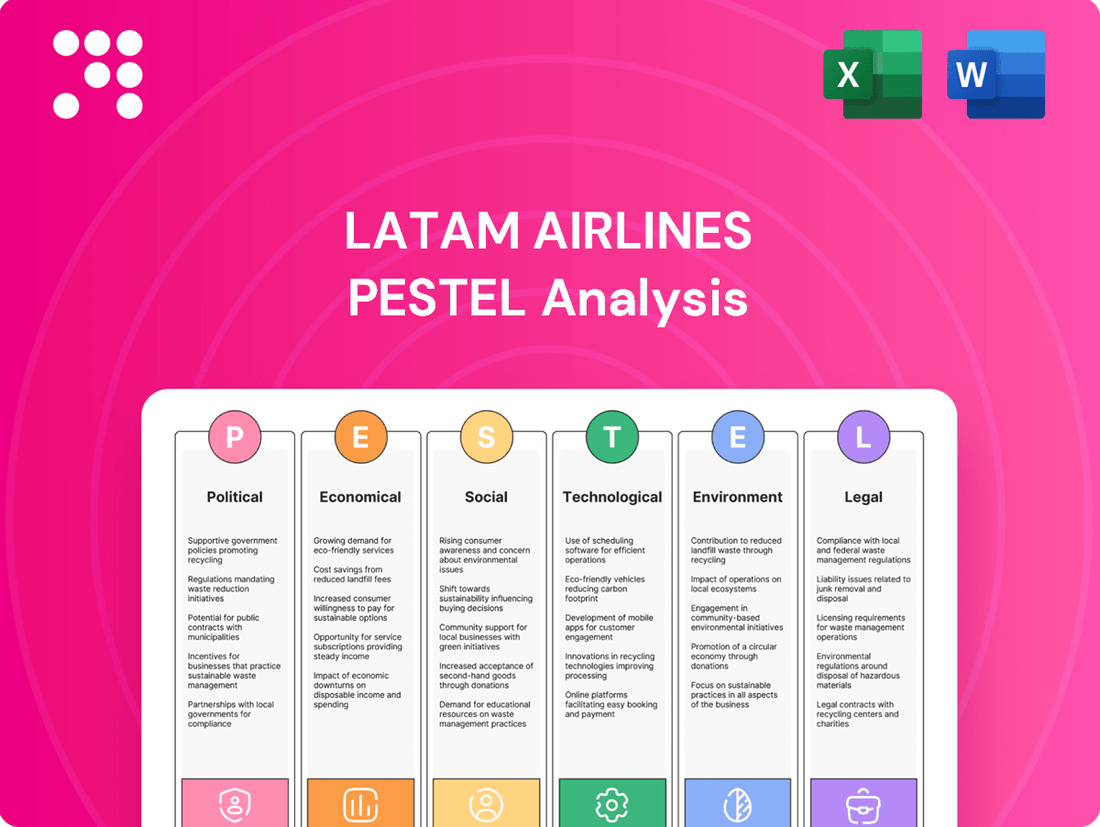

This PESTLE analysis for Latam Airlines examines the critical external forces shaping its operational landscape, from government policies and economic fluctuations to social trends, technological advancements, environmental concerns, and legal frameworks.

It provides a comprehensive overview of the macro-environmental factors that present both challenges and strategic opportunities for Latam Airlines' growth and sustainability in the Latin American aviation market.

A clear, actionable summary of Latam Airlines' PESTLE analysis, highlighting key external factors that can be strategically leveraged to mitigate operational risks and unlock new market opportunities.

Economic factors

Latin America's economic trajectory significantly influences LATAM Airlines' performance. For instance, the region's GDP growth, projected to average around 2.5% for 2024 and potentially reaching 2.7% in 2025 according to IMF forecasts, directly impacts consumer spending power and the propensity to travel. Higher GDP per capita, which saw an average increase across several key economies in 2023, translates to greater disposable income available for leisure and business trips.

The expansion of the middle class across countries like Brazil, Mexico, and Colombia is a key driver for air travel demand. This demographic shift, with millions entering middle-income brackets, fuels a stronger appetite for both domestic and international flights. LATAM Airlines itself has projected robust operational and financial growth for 2025, building on positive results and strategic efficiency improvements implemented in 2023 and 2024.

LATAM Airlines faces significant challenges from currency fluctuations and inflation. For instance, in early 2024, several Latin American currencies, like the Argentine Peso and Brazilian Real, experienced considerable depreciation against the US Dollar. This volatility directly impacts LATAM's operating costs, as essential expenses such as aircraft fuel and spare parts are frequently priced in USD.

Inflationary pressures further compound these issues. In 2023, countries like Argentina saw inflation rates exceeding 200%, which can erode consumer purchasing power and potentially dampen demand for international travel. Conversely, a depreciating local currency can make LATAM's tickets more expensive for foreign tourists, affecting international passenger volumes. Managing this foreign exchange risk is therefore a crucial financial strategy for the airline group.

Jet fuel is a major expense for LATAM Airlines, and its price is closely tied to global oil prices. When oil prices rise, LATAM's operating costs increase, directly impacting its bottom line, even with fuel efficiency measures.

For 2025, the International Air Transport Association (IATA) anticipates a favorable environment with lower fuel prices benefiting the airline industry. However, persistent supply chain issues could still introduce volatility and unexpected cost increases for carriers like LATAM.

Tourism Trends and Passenger Demand

The resurgence of tourism is a major catalyst for LATAM Airlines. Both domestic travel within Latin American countries and international arrivals are seeing significant upticks, directly fueling passenger demand. For instance, in 2023, international tourist arrivals to Latin America and the Caribbean reached 115% of pre-pandemic levels, signaling a robust recovery.

LATAM is strategically positioned to capitalize on this growth. Expansion of flight routes, particularly in key markets like Mexico, Brazil, and Argentina, is crucial. Brazil, a core market for LATAM, saw a notable increase in air travel, with domestic passenger traffic in early 2024 showing a strong recovery compared to 2023 figures.

These positive tourism trends translate directly into increased passenger volume for LATAM. The airline’s capacity growth is intrinsically linked to the ability to serve a rising number of travelers. This demand surge is supported by factors like increased disposable income in certain segments and a desire for travel post-pandemic.

- Domestic Tourism Growth: Brazil, a key market, experienced a significant rebound in domestic air travel, with passenger numbers in Q1 2024 exceeding pre-pandemic benchmarks.

- International Arrivals: Latin America and the Caribbean as a region welcomed approximately 60 million international visitors in 2023, a substantial increase from previous years.

- Route Expansion: LATAM has focused on bolstering its presence in high-demand corridors, such as routes connecting major South American cities with North America and Europe.

- Capacity Increase: The airline's fleet modernization and expansion plans are directly aligned with anticipating and accommodating the projected rise in passenger demand through 2025.

Competitive Landscape and Market Dynamics

The competitive landscape in Latin America is intensifying, with low-cost carriers (LCCs) like Viva Air and Sky Airline continuing to expand, challenging traditional carriers. This dynamic forces established airlines, including LATAM, to refine pricing strategies and aggressively pursue market share. Potential airline consolidation, a recurring theme in the region, could further reshape competitive dynamics.

LATAM Airlines, having successfully navigated its restructuring process, is emerging with a more robust cost structure. This, combined with its broad product offerings, from premium to economy, provides a significant advantage against competitors. For instance, in 2024, LATAM reported a strong operational performance, with its passenger load factor reaching 85.1% in the first quarter, demonstrating its ability to fill seats effectively amidst this competitive pressure.

- Increased LCC Penetration: Low-cost carriers captured an estimated 30-35% of the domestic Latin American market share in 2023, impacting fare structures.

- LATAM's Cost Efficiency: LATAM achieved a cost per available seat mile (CASM) reduction of approximately 5% in early 2024 compared to its pre-restructuring levels.

- Product Diversification: LATAM offers a tiered service model, catering to a wider customer base than many LCCs.

- Market Share Resilience: Despite competitive pressures, LATAM maintained a leading position in key South American markets throughout 2024.

Economic factors significantly shape LATAM Airlines' operational environment. The region's GDP growth, projected around 2.5% for 2024 and 2.7% for 2025, directly influences consumer spending on travel. Rising middle-class populations across key markets like Brazil and Mexico are increasing demand for both domestic and international flights, a trend LATAM is positioned to capture with its route expansions and capacity increases.

Currency volatility and inflation present ongoing challenges, with several Latin American currencies depreciating against the US Dollar in early 2024. This impacts operating costs, particularly for fuel and parts priced in USD, while high inflation in countries like Argentina can reduce disposable income and travel demand.

| Economic Indicator | 2023 (Actual/Estimate) | 2024 (Projection) | 2025 (Projection) |

|---|---|---|---|

| Latin America GDP Growth | ~2.3% | ~2.5% | ~2.7% |

| International Tourist Arrivals (LATAM & Caribbean) | 115% of pre-pandemic levels | Further growth expected | Continued growth |

| LATAM Airlines Load Factor (Q1 2024) | 85.1% | N/A | N/A |

Preview the Actual Deliverable

Latam Airlines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Latam Airlines delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the critical external forces shaping the airline's strategy and future growth.

Sociological factors

Consumer travel preferences are shifting significantly across Latin America. There's a growing appetite for personalized journeys, with travelers actively seeking out unique cultural immersion and shorter, more frequent trips, often referred to as micro-journeys. This trend directly impacts LATAM Airlines' strategy, pushing them to develop more tailored service packages and routes that cater to these evolving desires.

The demand for sustainable and eco-friendly travel options is also on the rise. Travelers are more conscious of their environmental impact, influencing their choices of airlines and destinations. LATAM's commitment to sustainability initiatives, such as fleet modernization and carbon offsetting programs, becomes a crucial differentiator in attracting this segment of the market. For instance, by 2024, LATAM aims to reduce its emissions intensity by 15% compared to 2019 levels.

Furthermore, flexibility in booking and travel arrangements is paramount for many Latin American consumers. The desire for adaptable plans, including easy changes and cancellations, shapes expectations for airline services. LATAM's ability to offer transparent and user-friendly flexible booking policies can significantly enhance customer loyalty and attract new passengers in a competitive landscape.

Demographic shifts are significantly reshaping the travel landscape. Generation Z, now a substantial economic force, is increasingly prioritizing experiences and sustainable travel options, influencing airline offerings and marketing. In 2024, this cohort is expected to spend billions on travel globally, a trend LATAM must leverage.

Urbanization across Latin America is also a critical demographic trend. As more people move to cities, demand for both domestic and international air travel for business and leisure is likely to grow. For example, by 2025, over 80% of Latin America’s population is projected to reside in urban areas, creating concentrated travel hubs and demand centers that LATAM can strategically target.

Public perception of health and safety in air travel remains a significant factor influencing passenger confidence and travel patterns, especially in the wake of the pandemic. Airlines like LATAM must continue to prioritize and communicate robust hygiene protocols.

While safety perceptions are generally strong across key Latin American destinations, sustained demand hinges on maintaining high standards. For instance, passenger surveys in 2024 indicated that over 70% of travelers in Brazil and Chile considered airline cleanliness a top priority when booking flights.

Cultural Influences on Travel

Cultural norms significantly shape travel demand in Latin America. The strong emphasis on visiting family and friends, especially during public holidays and significant life events, is a primary driver for domestic and regional air travel. For instance, during the 2023-2024 holiday season, LATAM Airlines reported a substantial increase in passenger numbers, particularly on routes connecting major cities with more rural or suburban areas, reflecting this cultural imperative.

Celebrations of public holidays and festivals also create distinct travel peaks. Many Latin American countries have vibrant cultural calendars, leading to surges in travel as people move to participate in or celebrate these events. LATAM can capitalize on this by offering specialized packages or promotions tied to popular festivals like Carnival in Brazil or Inti Raymi in Peru.

Furthermore, the growing desire for cultural immersion is influencing travel choices. Travelers are increasingly seeking authentic experiences, exploring local traditions, cuisine, and historical sites. This trend presents an opportunity for LATAM to highlight destinations known for their rich cultural heritage and to partner with local tourism providers to offer curated experiences that appeal to this segment.

- Family Reunions: Travel patterns are heavily influenced by the cultural importance placed on visiting relatives, particularly during holidays.

- Public Holidays: Major public holidays trigger significant travel demand as people move to celebrate with loved ones or experience cultural festivities.

- Cultural Tourism: A rising interest in authentic experiences and local traditions drives demand for travel to destinations offering rich cultural immersion.

- Brand Resonance: By aligning marketing and route planning with these cultural drivers, LATAM can foster stronger connections with its customer base.

Labor Relations and Workforce Dynamics

LATAM Airlines' operational efficiency hinges significantly on robust labor relations and the availability of skilled personnel, especially in critical areas like aircraft maintenance and piloting. The aviation sector in Latin America faces a dynamic labor landscape, with ongoing negotiations and agreements shaping workforce dynamics. For instance, in 2024, the International Air Transport Association (IATA) highlighted a growing global shortage of qualified aviation technicians, a trend that also impacts LATAM's operational continuity and cost management.

Staffing challenges, including attracting and retaining top talent amidst intense competition from other airlines and related industries, can directly influence LATAM's service quality and overall cost structure. The airline must navigate these complexities to ensure a stable and proficient workforce. For example, reports from early 2025 indicate that pilot training backlogs, a consequence of post-pandemic recovery and increased demand, are contributing to higher recruitment and training expenses for major carriers in the region.

- Skilled Labor Availability: Critical roles in aviation manufacturing and maintenance require specialized expertise, impacting LATAM's ability to maintain its fleet efficiently.

- Labor Relations: Strong, collaborative relationships with unions and employees are essential for smooth operations and mitigating potential disruptions.

- Talent Competition: The airline industry faces fierce competition for skilled professionals, potentially driving up labor costs and affecting service delivery.

- Workforce Dynamics: Evolving labor laws and workforce expectations in Latin American countries influence employment practices and operational strategies for LATAM.

Cultural norms significantly shape travel demand in Latin America, with a strong emphasis on visiting family and friends, especially during holidays, driving domestic and regional air travel. Public holidays and festivals also create distinct travel peaks, as people move to celebrate events, presenting opportunities for specialized packages. The growing desire for cultural immersion is influencing travel choices, with travelers seeking authentic experiences and local traditions, which LATAM can leverage by highlighting culturally rich destinations.

Technological factors

LATAM Airlines is significantly benefiting from the integration of new-generation aircraft like the Boeing 787 Dreamliner. These advanced planes are substantially more fuel-efficient, directly reducing operational expenses for the airline. For instance, the 787 can offer fuel savings of up to 20% compared to older models, a crucial advantage in the competitive airline industry.

This technological upgrade not only boosts efficiency but also enhances the passenger experience through improved cabin comfort and quieter flights. By investing in a modern fleet, LATAM is positioning itself for greater sustainability and cost-effectiveness in its operations through 2024 and beyond.

LATAM Airlines is actively embracing digital transformation, pouring resources into technologies like biometrics for smoother check-ins and augmented reality to improve the passenger journey. These investments aim to create a more seamless and engaging travel experience.

The airline is also leveraging Artificial Intelligence (AI) across its operations. AI is being used to refine flight path planning, proactively identify aircraft maintenance requirements before issues arise, and tailor services to individual passenger preferences, all contributing to greater efficiency and happier customers.

LATAM Airlines is investing heavily in enhancing its in-flight connectivity and entertainment systems, recognizing their importance in the modern travel landscape. This includes deploying advanced satellite technology to offer high-speed Wi-Fi across its long-haul wide-body aircraft.

These upgrades are designed to deliver a seamless and personalized passenger experience, allowing travelers to stay connected and entertained throughout their journeys. The airline's commitment to this technological advancement reflects a broader industry trend where robust onboard Wi-Fi is becoming a key differentiator in attracting and retaining customers.

Cybersecurity and Data Protection

As LATAM Airlines navigates deeper digital transformation, cybersecurity and data protection are paramount. Protecting passenger data and critical operational systems from sophisticated cyber threats is no longer optional; it's fundamental to maintaining customer trust and ensuring seamless flight operations. The airline must invest heavily in safeguarding sensitive personal information and the integrity of its complex network.

The increasing reliance on digital platforms for bookings, operations, and customer engagement amplifies the risk of cyberattacks. For instance, the global aviation industry experienced a significant uptick in cyber incidents in recent years. A 2024 report indicated that over 60% of aviation organizations faced at least one major cyberattack in the preceding 12 months, often targeting customer databases. This underscores the necessity for LATAM to implement advanced threat detection and response systems.

- Enhanced Data Encryption: Implementing state-of-the-art encryption for all passenger data, both in transit and at rest, to prevent unauthorized access.

- Regular Security Audits: Conducting frequent, rigorous security audits and penetration testing to identify and remediate vulnerabilities across all IT infrastructure.

- Employee Training: Providing comprehensive and ongoing cybersecurity awareness training for all employees to mitigate risks associated with phishing and social engineering tactics.

- Incident Response Planning: Developing and regularly testing robust incident response plans to ensure swift and effective mitigation in the event of a data breach or cyberattack.

Sustainable Aviation Technologies (SAF)

The aviation sector is increasingly focused on Sustainable Aviation Fuels (SAFs) as a key technology for reducing its environmental impact. While currently more expensive than traditional jet fuel, SAFs offer a significant pathway to decarbonization. The International Air Transport Association (IATA) aims for a 20% reduction in net aviation CO2 emissions by 2030, with SAFs expected to contribute substantially to this target. LATAM Airlines, like other major carriers, is exploring SAF adoption to meet its own ambitious sustainability objectives.

The development and scaling of SAF production are ongoing technological challenges. Current SAF production costs are estimated to be two to five times higher than conventional jet fuel, creating an economic hurdle for widespread adoption. However, advancements in feedstock processing and production efficiency are expected to lower these costs over time. For instance, by 2023, global SAF production capacity was around 1.5 billion liters annually, a figure projected to grow significantly as investments in new facilities increase.

LATAM's strategic consideration of SAFs aligns with global trends and regulatory pressures. The airline industry recognizes that SAFs are crucial for achieving long-term net-zero emission goals. As technology matures and production scales up, SAFs will become a more viable and essential component of LATAM's operational strategy, supporting its commitment to a more sustainable future in air travel.

- SAF production costs: Currently 2-5 times higher than conventional jet fuel.

- IATA’s 2030 CO2 reduction target: 20% net reduction, with SAFs playing a key role.

- Global SAF production capacity (2023): Approximately 1.5 billion liters annually.

- Technological focus: Advancements in feedstock processing and production efficiency are critical for cost reduction.

LATAM Airlines is enhancing its operational efficiency and passenger experience through significant technological investments. The airline is integrating new-generation aircraft like the Boeing 787 Dreamliner, which offers up to 20% fuel savings compared to older models. This focus on a modern fleet directly reduces operational costs and improves sustainability.

Digital transformation is a key priority, with LATAM implementing biometrics for smoother check-ins and augmented reality to enrich the passenger journey. Artificial Intelligence (AI) is also being leveraged for optimized flight planning, predictive maintenance, and personalized customer services, aiming for greater efficiency and customer satisfaction.

Connectivity is being boosted with advanced satellite technology for high-speed in-flight Wi-Fi, a critical factor in customer retention. However, this digital reliance necessitates robust cybersecurity measures. A 2024 industry report highlighted that over 60% of aviation organizations faced significant cyberattacks, underscoring LATAM's need for advanced data protection and threat response systems.

Sustainable Aviation Fuels (SAFs) are another technological focus, crucial for reducing environmental impact. Despite current production costs being 2-5 times higher than conventional jet fuel, SAFs are vital for achieving industry decarbonization goals, such as IATA's 2030 target for a 20% CO2 reduction. Global SAF production capacity reached approximately 1.5 billion liters in 2023, with ongoing advancements expected to lower costs.

Legal factors

LATAM Airlines operates under a stringent framework of international and national aviation safety regulations, including those set by the International Civil Aviation Organization (ICAO) and national authorities like Brazil's ANAC and Chile's DGAC. Strict adherence is non-negotiable, impacting everything from aircraft maintenance to pilot training protocols. For instance, in 2023, the aviation industry globally saw a continued focus on enhancing safety management systems, with airlines investing heavily in technology and training to meet these evolving standards.

Consumer protection laws are a significant legal factor for LATAM Airlines, particularly concerning passenger rights. These regulations dictate how airlines must handle issues like flight delays, cancellations, and lost baggage, often mandating specific compensation or refund policies. For instance, in Brazil, the National Civil Aviation Agency (ANAC) has stringent rules, and in 2023, ANAC reported over 10,000 passenger complaints related to flight disruptions, highlighting the operational impact of these legal frameworks.

Compliance with these diverse consumer protection frameworks across Latin America is crucial for LATAM's reputation and financial health. Failure to adhere to regulations regarding refunds, compensation for service failures, and transparent baggage handling can lead to substantial fines and damage customer loyalty. The airline must navigate varying legal landscapes, ensuring its policies align with local consumer advocacy and legal precedents, which are constantly evolving to protect travelers.

LATAM Airlines operates within a complex web of labor laws across its various South American and international destinations. These regulations dictate minimum wages, standard working hours, and overtime pay, directly impacting the airline's payroll expenses. For instance, in Brazil, a key market, the average hourly wage for flight attendants can fluctuate based on experience and union agreements, influencing operational costs.

Navigating diverse union relations is a critical legal factor. Collective bargaining agreements in countries like Chile and Colombia can significantly influence employment conditions, including benefits, scheduling, and job security. These agreements often require extensive negotiation and can lead to potential disruptions if not managed effectively, as seen in past labor disputes within the industry that have impacted flight schedules and financial performance.

Employment conditions, such as safety standards, training requirements, and termination procedures, are also heavily regulated. LATAM must ensure compliance with national aviation authorities' mandates regarding pilot and crew qualifications, which are stringent and regularly updated. Failure to adhere to these employment regulations can result in hefty fines, operational suspensions, and reputational damage, underscoring the importance of robust legal compliance in human resource management.

Anti-Trust and Competition Laws

Anti-trust and competition laws are crucial for LATAM Airlines, shaping its market interactions and growth. These regulations oversee how LATAM can expand, merge with or acquire other entities, and form strategic alliances like joint ventures. For instance, a proposed merger or significant route-sharing agreement would likely face scrutiny from competition authorities in the countries where LATAM operates, ensuring fair play and preventing monopolistic practices.

These laws directly impact LATAM's ability to enhance connectivity and competitiveness. By ensuring fair market practices, regulators can prevent dominant airlines from unfairly disadvantaging smaller competitors or consumers. This regulatory environment means LATAM must carefully plan any strategic moves that could alter the competitive landscape, such as expanding its network through acquisitions or forming new partnerships. For example, in 2023, the Chilean National Economic Prosecutor's Office (FNE) reviewed LATAM's alliance with Delta Air Lines, focusing on potential impacts on competition within the Chilean aviation market.

Key considerations for LATAM under these laws include:

- Merger and Acquisition Scrutiny: LATAM's potential acquisitions or mergers, like its previous restructuring and alliance with Delta, are subject to approval by competition authorities in multiple jurisdictions.

- Joint Venture Regulations: Agreements for joint ventures or strategic alliances, such as those with other airlines to share routes or code-share agreements, must comply with competition rules to avoid market distortion.

- Market Dominance: Authorities monitor LATAM's market share and pricing strategies to prevent abuse of dominant positions, especially on key routes where it holds a significant presence.

- Consumer Protection: Regulations aim to ensure that competition laws ultimately benefit consumers through fair pricing, better service options, and increased choice, which LATAM must consider in its strategic planning.

Data Privacy Regulations

With the growing reliance on digital platforms for booking and managing travel, LATAM Airlines must navigate an evolving landscape of data privacy regulations across Latin America. These laws, often drawing parallels to the European Union's General Data Protection Regulation (GDPR), impose strict obligations on how passenger data is collected, processed, and stored. Failure to comply can result in significant penalties, impacting IT investments and customer trust.

LATAM's commitment to protecting sensitive passenger information is a legal imperative. This includes ensuring the security of personal data against breaches and maintaining transparency in data handling practices. For instance, Brazil's LGPD (Lei Geral de Proteção de Dados), enacted in 2020, sets a benchmark for data protection, requiring explicit consent for data usage and granting individuals rights over their information, directly influencing LATAM's operational procedures and customer interaction strategies.

- Compliance with LGPD in Brazil: LATAM must adhere to stringent rules regarding consent, data access, and breach notification, impacting its customer data management systems.

- GDPR-like laws in other LATAM countries: As more nations in the region adopt similar privacy frameworks, LATAM faces a complex web of regulations requiring consistent data protection standards.

- Impact on IT infrastructure: Significant investment is needed to update IT systems to ensure secure data processing and meet the legal requirements for data privacy.

- Customer trust and data security: Demonstrating robust data protection is crucial for maintaining passenger confidence and avoiding reputational damage from data breaches.

LATAM Airlines must navigate a complex web of international and national aviation regulations, prioritizing safety and operational compliance. For instance, in 2023, global aviation safety standards continued to emphasize enhanced safety management systems, prompting airlines like LATAM to invest in advanced technology and rigorous training programs to meet these evolving requirements.

Consumer protection laws significantly impact LATAM, dictating how it handles flight disruptions and baggage issues, often requiring specific compensation. In 2023, Brazil's ANAC reported over 10,000 passenger complaints related to flight issues, underscoring the operational and financial implications of these regulations.

Labor laws across its operational regions are critical, affecting wages, working hours, and employee benefits, thus influencing payroll costs. Collective bargaining agreements, particularly in key markets like Chile and Colombia, can shape employment conditions and require careful negotiation to avoid operational disruptions.

Anti-trust and competition laws scrutinize LATAM's strategic moves, such as mergers or alliances, to ensure fair market practices. For example, the Chilean National Economic Prosecutor's Office (FNE) reviewed LATAM's alliance with Delta in 2023, focusing on potential impacts on market competition.

Environmental factors

The intensifying global concern over climate change and the aviation sector's commitment to lowering carbon emissions are profoundly influencing LATAM Airlines' operational strategies. These environmental pressures necessitate significant investment in more fuel-efficient aircraft and sustainable aviation fuels.

LATAM has proactively responded by establishing ambitious sustainability goals. These include a commitment to reach net-zero emissions by 2050 and a substantial 50% reduction in domestic emissions by the year 2030, demonstrating a clear strategic direction in addressing environmental accountability.

The availability, cost, and widespread adoption of Sustainable Aviation Fuel (SAF) are pivotal environmental considerations for LATAM Airlines. Meeting ambitious decarbonization targets hinges on LATAM's capacity to integrate SAF into its flight operations, a goal currently hampered by significant challenges.

Currently, SAF production costs remain considerably higher than conventional jet fuel, creating an economic hurdle for widespread adoption. For instance, SAF can be 2-5 times more expensive. Furthermore, the global supply of SAF is still limited, with production capacity needing substantial expansion to meet the growing demand from airlines like LATAM.

LATAM Airlines is actively embracing circular economy principles as a core environmental strategy. A key focus is the reduction of waste, with significant strides made in eliminating single-use plastics across its operations.

By the end of 2023, LATAM reported successfully eliminating 97% of single-use plastics, a substantial achievement demonstrating their commitment. Furthermore, the airline has implemented robust waste recycling programs on domestic flights, aiming to divert as much material as possible from landfills.

Noise Pollution Regulations

LATAM Airlines, like all carriers, must navigate increasingly stringent noise pollution regulations, particularly in densely populated areas. These rules directly influence fleet modernization decisions, pushing for quieter, newer aircraft. For instance, the International Civil Aviation Organization (ICAO) Committee on Aviation Environmental Protection (CAEP) continues to refine noise standards, with ongoing discussions around potential updates to Chapter 14 of Annex 16, which could impact aircraft operations in the near future.

Compliance is not just a legal necessity but a critical factor for maintaining community relations and avoiding costly operational disruptions. Airports globally are implementing stricter noise abatement procedures, which can affect flight schedules and routing. For example, London Heathrow Airport, a key hub for many international carriers, has specific noise preferential runway systems and night-flight restrictions that airlines must adhere to, impacting flight timings and passenger convenience.

- Fleet Modernization: LATAM's investment in newer aircraft like the Airbus A320neo family, which are significantly quieter than older models, is a direct response to noise regulations. These new engines can reduce noise footprints by up to 50% compared to previous generations.

- Operational Adjustments: Airlines must adapt flight paths and landing/takeoff procedures to minimize noise impact on surrounding communities, potentially leading to longer flight times or altered arrival/departure slots.

- Community Engagement: Proactive engagement with communities near major airports is vital to address noise concerns and maintain the social license to operate, a factor that can influence regulatory decisions and public perception.

Biodiversity Protection and Ecosystem Preservation

LATAM Airlines, operating across South America, recognizes the critical need to protect the region's exceptional biodiversity. This commitment is not just about environmental responsibility but also about safeguarding the natural heritage that attracts tourism, a key sector for many of its destinations.

The airline actively participates in partnerships with environmental organizations to support ecosystem preservation. For example, LATAM has supported initiatives focused on protecting the Amazon rainforest and other vital biomes. These efforts often involve reforestation projects, wildlife conservation programs, and community engagement to promote sustainable practices.

In 2024, LATAM continued its focus on sustainability, with a reported 4.5% reduction in CO2 emissions per passenger-kilometer compared to 2023 levels, demonstrating progress in operational efficiency that indirectly benefits ecosystem preservation by reducing environmental impact. The company's environmental strategy includes specific targets for biodiversity protection.

- Partnerships: LATAM collaborates with NGOs like Conservation International and local conservation groups to implement on-the-ground projects.

- Ecosystem Focus: Key areas of focus include the Amazon, the Andes, and coastal marine ecosystems, all of which are crucial for global biodiversity.

- Initiatives: Programs involve supporting ecotourism, reducing single-use plastics on flights, and investing in sustainable aviation fuel research.

- Impact: These efforts aim to mitigate the environmental footprint of air travel while actively contributing to the preservation of sensitive natural areas.

Environmental factors significantly shape LATAM Airlines' strategy, pushing for reduced emissions and sustainable practices. The airline is committed to net-zero emissions by 2050, with a target of a 50% reduction in domestic emissions by 2030, reflecting a proactive approach to climate change. This involves substantial investment in fuel-efficient aircraft and the integration of Sustainable Aviation Fuel (SAF), though SAF's higher cost and limited supply present ongoing challenges.

LATAM is also focused on waste reduction, having achieved a 97% elimination of single-use plastics by the end of 2023 and implementing robust recycling programs. Furthermore, stricter noise pollution regulations are influencing fleet modernization, driving the adoption of quieter aircraft technologies. The airline's commitment extends to biodiversity protection through partnerships and initiatives aimed at preserving vital ecosystems across South America.

| Environmental Factor | LATAM's Response/Data | Key Challenges/Considerations |

|---|---|---|

| Climate Change & Emissions | Net-zero by 2050 target; 50% domestic emissions reduction by 2030. 4.5% CO2 reduction per passenger-km in 2024 vs. 2023. | High cost and limited supply of SAF (2-5x more expensive than conventional fuel). |

| Waste Management | 97% elimination of single-use plastics by end of 2023. Waste recycling programs on domestic flights. | Scaling recycling infrastructure and ensuring consistent implementation across all operations. |

| Noise Pollution | Investment in quieter aircraft (e.g., Airbus A320neo family, up to 50% noise reduction). | Adherence to evolving ICAO noise standards and airport-specific noise abatement procedures. |

| Biodiversity Protection | Partnerships with NGOs (e.g., Conservation International) for ecosystem preservation. Focus on Amazon, Andes, coastal areas. | Balancing operational needs with conservation efforts; ensuring sustainable tourism impacts. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for LATAM Airlines is built on a robust foundation of data from official government agencies across Latin America, international financial institutions like the IMF and World Bank, and leading aviation industry reports. This ensures comprehensive coverage of political stability, economic trends, regulatory changes, and technological advancements impacting the region.